0% found this document useful (0 votes)

1K views5 pagesCredit Bureau Report Sample

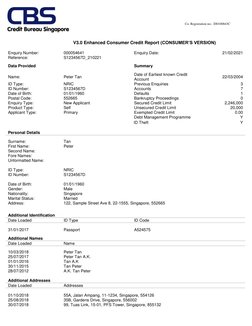

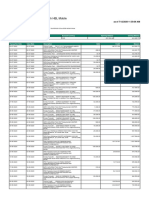

1) Peter Tan has 7 credit accounts and 1 default reported. He has a history of credit enquiries and is currently on a debt management program due to identity theft.

2) Key details include a Nric of S1234567D, date of birth of 01/01/1960, and current address of 122 Sample Street Ave 8, Singapore 552665.

3) His credit report shows accounts with Banks A and B, including an HDB loan, credit cards, personal loans, and mortgage. The total secured credit limit is $2,246,000 and unsecured is $20,000.

Uploaded by

Indra ChanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views5 pagesCredit Bureau Report Sample

1) Peter Tan has 7 credit accounts and 1 default reported. He has a history of credit enquiries and is currently on a debt management program due to identity theft.

2) Key details include a Nric of S1234567D, date of birth of 01/01/1960, and current address of 122 Sample Street Ave 8, Singapore 552665.

3) His credit report shows accounts with Banks A and B, including an HDB loan, credit cards, personal loans, and mortgage. The total secured credit limit is $2,246,000 and unsecured is $20,000.

Uploaded by

Indra ChanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

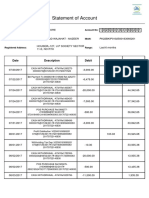

- Consumer Credit Information

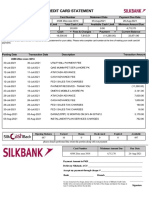

- Account Status and History

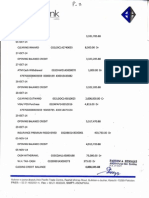

- Bureau Score Explanation

- Narratives and Outstanding Balances

- Aggregated Monthly Instalments