Professional Documents

Culture Documents

Simple Tax Return Client Information and Instuctions - Tagged

Simple Tax Return Client Information and Instuctions - Tagged

Uploaded by

Jahra MusgraveOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Simple Tax Return Client Information and Instuctions - Tagged

Simple Tax Return Client Information and Instuctions - Tagged

Uploaded by

Jahra MusgraveCopyright:

Available Formats

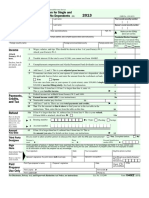

Federal Income Tax I – Simple Tax Return

Information and Instructions

One of your tax clients, Jane Doe recommended her cousin, Martin Doe to your firm. Martin generally

prepares his tax returns himself, however, this year he decided he would like to hire a trusted tax

accountant. Since he trusts his cousin, he has hired you as his tax accountant for the year. His

pertinent information is as follows:

Personal Information

Martin Doe (SS# 103-59-2009) is a College Advisor. His date of birth is January 11, 1970. His home

address is 611 Main Street, New Rochelle, NY 10801. His email address is martindoe@gmail.com.

His telephone number is 718-766-9211.

Income Information

1) He is employed by Monroe College. His W-2 showed that his salary for the year amounted to

$44,134.11 (this is reported on Form 1040 page 1, Line 1). Federal tax withheld was

$6,754.99. (This is reported on Form 1040 page 2, Lines 25a and 25d).

2) He earned interest income from JP Morgan Chase during the year of $428. (This is reported

on Form 1040 page 1, Line 2b, and Part I of Schedule B).

3) He received dividend income from ABC Corporation during the year of $733. (This is reported

on Form 1040 page 1, Line 3a and 3b, and Part II of Schedule B).

Other information

4) Martin is not married and has no dependents.

5) He does not contribute to the Presidential Election Campaign Fund.

6) Martin has no deductions for adjusted gross income.

Instructions: Prepare Martin’s current year Tax Return (Form 1040) and determine whether

he has a net balance due or a refund.

You might also like

- Electronic Filing Instructions For Your 2020 Federal Tax ReturnDocument21 pagesElectronic Filing Instructions For Your 2020 Federal Tax Returntraceybaker80% (5)

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Document2 pagesJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- US Social Security Form (Ssa-7050) : Wage Earnings CorrectionDocument4 pagesUS Social Security Form (Ssa-7050) : Wage Earnings CorrectionMax PowerNo ratings yet

- Electronic Filing Instructions For Your 2020 Federal Tax ReturnDocument38 pagesElectronic Filing Instructions For Your 2020 Federal Tax ReturnPeter LaFontaine100% (3)

- W 2Document3 pagesW 2lysprr33% (3)

- PDF W2Document1 pagePDF W2John LittlefairNo ratings yet

- W2 2010Document2 pagesW2 2010Rick Nunns100% (2)

- Form 4852Document1 pageForm 4852Dawn Simpson100% (1)

- Electronic Filing Instructions For Your 2020 Federal Tax ReturnDocument16 pagesElectronic Filing Instructions For Your 2020 Federal Tax Returnann laijas57% (7)

- YAMIDocument12 pagesYAMIStephany PolancoNo ratings yet

- Tax FormsDocument2 pagesTax FormsBridget May Cruz100% (1)

- File by Mail Instructions For Your 2019 Federal Tax ReturnDocument4 pagesFile by Mail Instructions For Your 2019 Federal Tax ReturnAndrew Wilkes100% (1)

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- Beginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Document34 pagesBeginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Nancy GuerraNo ratings yet

- TGDocument2 pagesTGpr995No ratings yet

- F 4852Document2 pagesF 4852GoodinespressurewashingNo ratings yet

- F 4852Document2 pagesF 4852IRSNo ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- Us W-2 2015 PDFDocument7 pagesUs W-2 2015 PDFkevsNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- 2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFDocument2 pages2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFLISA VOLPENo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- Profile Assignment 1-2021Document2 pagesProfile Assignment 1-2021Sumaya AhmedNo ratings yet

- Tax Form MentorshipDocument3 pagesTax Form Mentorshipapi-601011369No ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormJennifer LeetNo ratings yet

- CpaDocument17 pagesCpaKeti AnevskiNo ratings yet

- ViewPrintRequest AspxDocument3 pagesViewPrintRequest AspxDragana MijajlovicNo ratings yet

- CT 3911Document1 pageCT 3911Kizito MarowaNo ratings yet

- Tax Flyer LevinDocument1 pageTax Flyer LevinStephen LevinNo ratings yet

- SCHEDULE IN-112 Vermont Tax Adjustments and CreditsDocument3 pagesSCHEDULE IN-112 Vermont Tax Adjustments and Creditsjim deeznutzNo ratings yet

- Ontario TD1Document2 pagesOntario TD1Diego Gallo MacínNo ratings yet

- Rose Hudson Workbook Case StudyDocument6 pagesRose Hudson Workbook Case StudyMary O'KeeffeNo ratings yet

- Connecticut W-4 Form Explains Codes For Withholding RatesDocument4 pagesConnecticut W-4 Form Explains Codes For Withholding RatesestannardNo ratings yet

- TAX - PCS - Foreign Trusts From United States PerspectiveDocument3 pagesTAX - PCS - Foreign Trusts From United States Perspectivee1chin0No ratings yet

- ACC 330 Final Project Two Tax Planning Template - 2020Document3 pagesACC 330 Final Project Two Tax Planning Template - 2020BREANNA JOHNSONNo ratings yet

- W9Document1 pageW9chris2077No ratings yet

- 2019 British Columbia Personal Tax Credits Return: Country of Permanent ResidenceDocument2 pages2019 British Columbia Personal Tax Credits Return: Country of Permanent Residencekittu513No ratings yet

- Whistleblower ComplaintDocument7 pagesWhistleblower ComplaintThe FederalistNo ratings yet

- LVD App PY22 1Document7 pagesLVD App PY22 1Billy McNo ratings yet

- Instructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesDocument3 pagesInstructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesIRSNo ratings yet

- Tax Quiz 2Document5 pagesTax Quiz 2Garcia Alizsandra L.No ratings yet

- 01 Seep 1Document19 pages01 Seep 1van phanNo ratings yet

- FederalDocument24 pagesFederalNeil NitinNo ratings yet

- ISSO New York State Tax Information SessionDocument91 pagesISSO New York State Tax Information SessionShuoshuo HanNo ratings yet

- United States of America v. George PeltzDocument10 pagesUnited States of America v. George PeltzWHYY NewsNo ratings yet

- US Internal Revenue Service: p967 - 1997Document5 pagesUS Internal Revenue Service: p967 - 1997IRSNo ratings yet

- US Internal Revenue Service: p967 - 2001Document6 pagesUS Internal Revenue Service: p967 - 2001IRSNo ratings yet

- Tax Time InfoDocument4 pagesTax Time InfoNews 12 New JerseyNo ratings yet

- Lynden Company Has The Following Balances in Its General LedgerDocument1 pageLynden Company Has The Following Balances in Its General Ledgertrilocksp SinghNo ratings yet

- Payroll Accounting 2015 1st Edition Landin Test Bank 1Document106 pagesPayroll Accounting 2015 1st Edition Landin Test Bank 1dorothy100% (47)

- The Following Data Relates To Maryann's Prior Year IncomeDocument2 pagesThe Following Data Relates To Maryann's Prior Year IncomeRahulNo ratings yet

- UI Online - Doc - 20210110165828Document2 pagesUI Online - Doc - 20210110165828Mark ThomasNo ratings yet

- ECWANDC Funding - Vendor W9 FormDocument1 pageECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilNo ratings yet

- F1040ez PDFDocument2 pagesF1040ez PDFjc75aNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument2 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employermuhammad mudassarNo ratings yet

- 2010 Application For Extension of Time To File Form IT-9Document2 pages2010 Application For Extension of Time To File Form IT-9Tyler RoachNo ratings yet