Professional Documents

Culture Documents

Dec 2019

Uploaded by

Anjana TimalsinaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dec 2019

Uploaded by

Anjana TimalsinaCopyright:

Available Formats

Suggested Answer Paper Group I

Paper 1: Advanced Financial Reporting

Attempt all questions. Working notes should form part of the answers.

1. AK Ltd., operates in Nepal and has investments in two other companies. The draft

statements of financial position of all three companies as at 31st Ashadh 2076 are as

follows:

Rs. In million

Assets: AK Ltd. BK Ltd. TK Ltd.

Non – current assets

Property plant and equipment 1,440 1,100 1,300

Investments in subsidiaries

BK Ltd. 1,250

TK Ltd. 310 1,270

Financial assets 320 21 141

Total non-current assets 3,320 2,391 1,441

Current assets 895 681 150

Total assets 4,215 3,072 1,591

Equity and liabilities:

Share capital 1,750 1,210 800

Retained earnings 1,240 930 350

Other components of equity 125 80 95

Total equity 3,115 2,220 1,245

Non-current liabilities 985 765 150

Current liabilities 115 87 196

Total liabilities 1,100 852 346

Total equity and liabilities 4,215 3,072 1,591

Additional Information:

a) On 1st Shrawan 2074, AK Ltd. acquired 14% of the equity interest of TK Ltd. for a cash

consideration of Rs. 260 million and BK Ltd. acquired 70% of the equity interest of TK

Ltd. for a cash consideration of Rs. 1,270 million. At 1st Shrawan 2074, the identifiable

net assets of TK Ltd. had a fair value of Rs. 990 million, retained earnings were Rs.

190 million and other components of equity were Rs. 52 million. At 1st Shrawan 2075,

the identifiable net assets of TK Ltd. had a fair value of Rs. 1,150 million, retained

earnings were Rs. 240 million and other components of equity were Rs. 70 million. The

excess in fair value is due to revaluation of non-depreciable land which has not been

accounted for and not changed till the reporting date. The fair value of the 14% holding

of AK Ltd. in TK Ltd., which was classified as fair value through profit or loss, was Rs.

280 million at 32nd Ashad 2075 and Rs. 310 million at 31st Ashadh 2076. However, the

fair value of BK Ltd’s interest in TK Ltd. had not changed since acquisition.

b) On 1st Shrawan 2075, AK Ltd. acquired 60% of the equity interests of BK Ltd. The cost

of investment comprised cash consideration of Rs. 1,250 million. On 1st Shrawan 2075,

the fair value of the identifiable net assets acquired was Rs. 1,950 million and retained

earnings of BK Ltd. were Rs. 650 million and other component of equity were Rs. 55

million. The excess in fair value is due to revaluation of non-depreciable land which

has not been accounted for and not changed till the reporting date. It is the group’s

© The Institute of Chartered Accountants of Nepal 4

Suggested Answer Paper Group I

policy to measure the non-controlling interest at acquisition at its proportionate share

of the fair value of the subsidiary’s net assets.

c) Goodwill of BK Ltd. and TK Ltd. were tested for impairment at 31st Ashadh 2076 and

found that there was no impairment relating to TK Ltd. However, the goodwill of BK

Ltd. was fully impaired by the reporting date.

d) On 1st Shrawan 2074, AK Ltd. acquired office accommodation at a cost of Rs. 90 million

with a 30 year estimated useful life. During the year, the property market in the area

slumped and the fair value of the accommodation fell to Rs. 75 million at 32nd Ashadh

2075 and this was reflected in the financial statements. However, the market

unexpectedly recovered quickly due to the announcement of major government

investment in the area’s transport infrastructure. On 31st Ashadh 2076, the professional

valuer advised AK Ltd. that the office accommodation should now be valued at Rs. 105

million. AK Ltd. has charged depreciation for the year but has not taken into account

of the upward valuation of the office accommodation. AK Ltd. uses the revaluation

model and records any valuation change when advised to do so.

e) AK Ltd. has announced two major restructuring plans during the year. The first plan

is to reduce its capacity by closure of some of its smaller factories, which have already

been identified. This will lead to the redundancy of 500 employees, who have all

individually been selected and communicated to. The costs of this plan are Rs. 9 million

in redundancy costs, Rs. 5 million in retraining costs and Rs. 5 million in lease

termination costs. The second plan is to re-organize the finance and information

technology department over a one-year period but it does not commence until two

years’ time. The plan will result in 20% of finance staff losing their jobs during the

restructuring. The costs of this plan are Rs. 10 million in redundancy costs, Rs. 6

million in retraining costs and Rs. 7 million in equipment lease termination costs. There

are no entries made in the financial statements for the above plans.

f) The following information relates to the group pension plan of AK Ltd.:

Rs. In million

1st Shrawan 31st Ashadh

2075 2076

Fair value of plan assets 28 29

Actuarial value of defined benefit obligation 30 35

The contributions for the period received by the fund were Rs. 2 million and the

employee benefits paid in the year amounted to Rs. 3 million. The discount rate to be

used in any calculation is 5%. The current service cost for the period based on

actuarial calculations is Rs. 1 million. The above figures have not been taken into

account for the year ended 31st Ashadh 2076 except for the contributions paid which

have been entered in cash and the defined benefit obligation.

Required: (20 marks)

Prepare the group consolidated statement of financial position of AK Ltd. as at 31st

Ashadh 2076 with the notes of any of the issues dealt in the question.

Answer:

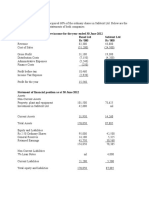

AK Ltd.

Consolidated statement of financial position

© The Institute of Chartered Accountants of Nepal 5

Suggested Answer Paper Group I

as at 31 Ashadh 2076

Assets: Rs. Million

Non-current assets:

Property, plant and equipment [1,440 + 1,100 + 1,300 + 35 + 40 (W.N 2) +

32.6 (W.N 6)] 3,947.6

Goodwill (W3) 398

Financial assets (320 + 21 + 141) 482

4,827.6

Current assets (895 + 681 + 150) 1,726

Total assets 6,553.6

Equity and liabilities

Share Capital 1,750

Retained earnings (W5) 1,356.1

Other components of equity (W5) 170.1

3,276.2

Non-controlling interest (W4) 959.4

Total Equity 4,235.6

Total non-current liabilities [985 + 765 + 150 + 6 (W.N 8)] 1,906

Current liabilities [115 + 87 + 196 + 14 (W.N 7)] 412

Total liabilities 2,318

Total Equity and Liabilities 6,553.6

Workings:

W-1: Group structure

The group effective interest in TK Ltd is:

Direct interest 14%

Indirect interest or effective interest (60% X 70%) 42%

Group effective interest 56%

The NCI interest in TK Ltd. is therefore (100% - 56%) 44%

100%

Consolidation of BK Ltd.

Group 60%

NCI (100% - 60%) 40%

100%

The acquisition date of TK Ltd. is 1st Shrawan 2075 as this is when AK Ltd. gains control

over BK Ltd. and therefore indirect control over TK Ltd.

W-2: Net assets

Rs. In million

Post-

BK Ltd Acquisition date Reporting date

Acquisition

Share capital 1,210 1,210 -

Other components 55 80 25

Retained earnings 650 930 280

© The Institute of Chartered Accountants of Nepal 6

Suggested Answer Paper Group I

Fair value adjustment – Land

(balancing figure) 35 35 -

1,950 2,255 305

TK Ltd

Share capital 800 800 -

Other components 70 95 25

Retained earnings 240 350 110

Fair value adjustment – Land

(balancing figure) 40 40 -

1,150 1,285 135

Therefore, the post-acquisition profits of BK Ltd. is Rs. 305 million (Rs. 2,255 – Rs. 1,950)

and that of TK Ltd. is Rs. 135 million (Rs. 1,285 – 1,150).

W-3: Goodwill

The cost of TK Ltd. has three elements: the cost of the direct holding, the cost of the indirect

holding and the indirect holding adjustments.

BK Ltd.

Rs. Million

Fair value of consideration 1,250

NCI at acquisition (40% X Rs. 1,950) 780

Fair value of identifiable net assets acquired (W2) (1,950)

Goodwill at acquisition 80

Impairment 2075/76 (80)

Goodwill at reporting date (fully

impaired -

Alternative:

BK Ltd.

Rs. Million

Fair value of consideration 1,250

Group share of Fair value of identifiable net assets acquired (60% X 1,950) (1,170)

Goodwill at acquisition 80

Impairment (80)

Goodwill at reporting date -

TK Ltd.

Rs. Million

Fair value of consideration:

Direct holding (Fair value at date control obtained) 280

Indirect holding 1,270

indirect holding adjustment (40% X Rs. 1,270 million) (508)

NCI at acquisition (44% X Rs. 1,150 million) 506

Less fair value of identifiable net assets (W2) (1,150)

© The Institute of Chartered Accountants of Nepal 7

Suggested Answer Paper Group I

Goodwill at reporting date 398

AK investment in TK Ltd. was held at Rs. 310 million at the reporting date. Therefore, the

fair value increase of Rs. 30 million (Rs. 310 – Rs. 280) that has arisen since the date that

control was achieved must be removed from the consolidated statements. Retained

earnings must also be reduced by Rs. 30 million.

Alternative:

TK Ltd.

Rs. Million

Fair value of purchase consideration:

Direct holding 280

Indirect holding (60% X 1,270) 762

1,042

Less Group's share of fair value of identifiable net assets (56% X1,150) (644)

Goodwill at reporting date 398

Alternative:

TK Ltd.

Rs. Million

Fair value of purchase consideration:

Direct holding 280

Indirect holding (60% X 1,270) 762

NCI at acquisition (44% X Rs. 1,150) 506

Less fair value of identifiable net assets (W2) (1,150)

Goodwill at reporting date 398

W-4: Non-controlling interest

Rs. Million

NCI in BK Ltd. at acquisition (40% X Rs. 1,950) 780

Add: NCI % of post-acquisition net assets (40% X (Rs. 2,255 million -

Rs. 1,950 million)) 122

Indirect holding adjustment (40% X Rs. 1,270 million) (508)

NCI in TK Ltd. at acquisition 506

NCI in post-acquisition net assets (44% X (Rs. 1,285 - Rs.

1,150) 59.4

959.4

Alternative:

Rs. Million

NCI in BK Ltd's net assets at reporting date (40% X Rs. 2,255) 902

NCI in TK Ltd's net assets at reporting date (44% X Rs. 1,285) 565.4

NCI's share of investment in BK (40% X Rs.

1,270) (508)

959.4

W - 5: Retained earnings

Rs. Million

© The Institute of Chartered Accountants of Nepal 8

Suggested Answer Paper Group I

AK Ltd 1,240

BK Ltd.: 60% X (Rs. 930 million - Rs. 650 million

(W2)) 168

TK Ltd: 56% X (Rs. 350 million - Rs. 240 million

(W2)) 61.6

Gain on TK Ltd's investment (W3) (30)

Impairment of goodwill (W3) (80)

Reversal of impairment loss (W6) 11.6

Restructuring provision (W7) (14)

Pension plan (W8) (1.1)

1,356.10

Other components of equity

Rs. Million

AK Ltd. 125

BK Ltd.: 60% X (Rs. 80 million - Rs. 55 million (W2)) 15

TK Ltd: 56% X (Rs. 95 million - Rs. 70 million (W2)) 14

Revaluation gain (W6) 21

Pension plan re-measurement (W8) (4.9)

170.1

W - 6: The office

Rs. Million

Cost of office building (1.4.2074) 90

Depreciation (90/30 years) (2074/75) (3)

Carrying amount(32.03.2075) 87

Revaluation loss - Profit or loss (balancing figure) (12)

Fair value at 32nd Ashadh 2075 75

Depreciation (75/29 years) (2075/76) (2.6)

Carrying amount (31.03.2076) 72.4

Revaluation surplus – OCI (balancing figure) 32.6

Fair value at 31st Ashadh 2076 105

If no revaluation reserve exists for an item of PPE then a downwards revaluation is

recognized in the statement of profit or loss.

Some of this reversal can be recognized in profit or loss, but this is capped at the amount

needed to increase the asset to the value it would have been had no impairment occurred.

If no impairment had occurred, the asset would have been held at Rs. 84 million (Rs. 90

million – (2 X Rs. 3)). Therefore, the gain recorded in profit or loss is Rs 11.6 million (Rs.

84 million – 72.4 million). The remainder of the gain is recognized in other comprehensive

income.

The entries will be:

Dr property, plant and equipment Rs. 32.6 million

Cr profit or loss Rs. 11.6 million

Cr other comprehensive income Rs. 21 million

© The Institute of Chartered Accountants of Nepal 9

Suggested Answer Paper Group I

W – 7: provision for restructuring

Only those costs that result directly from and are necessarily entailed by a restructuring

may be included in a restructuring provision. This includes costs such as employee

redundancy costs or lease termination costs. Expenses that relate to ongoing activities, such

as relocation and retraining, are excluded.

With regard to the service reduction, a provision should be recognized for the redundancy

and lease termination costs of Rs. 14 million. The sites and details of the redundancy costs

have been identified.

In contrast, AK Ltd. should not recognize a provision for the finance and IT department’s

re-organisation. The re-organisation is not due to start for two years. Stakeholders outside

are unlikely to have a valid expectation that management is committed to the re-

organisation as the time frame allows significant opportunities for management to change

the details of the plan or even to decide not to proceed with it. In addition, the degree of

identification of the staff to lose their jobs is not sufficiently detailed to support the

recognizing of a redundancy provision.

W-8: pension plan

In order to calculate the re-measurement component, reconcile the opening and closing net

pension deficit. The re-measurement component is accounted for in other comprehensive

income.

The liability recognized in the financial statements will be Rs. 6 million (that is, Rs. 35

million – Rs. 29 million)

Rs. Million

Net obligation at 1st Shrawan 2075 (Rs. 30 million - Rs. 28

million) 2

Net interest component (Rs. 2 million X 5%) 0.1

Contributions (2)

Service cost component 1

Re-measurement loss (balancing figure) (4.9)

Net obligation at 31st Ashadh 2076 (35 - 29) 6

The service cost component and net interest component will be charged to profit or loss

(Rs. 1.1 million) and the re-measurement loss to Other Comprehensive Income (Rs. 4.9

million). There will be no adjustment for the contributions, which have already been taken

into account.

2.

a) DD Ltd. availed a lease. The terms of the lease are as under:

i) Lease period is 3 years, in the beginning of the year 2075/76, for equipment costing

Rs. 1,000,000 and has an expected useful life of 5 years.

ii) The fair market value is also Rs. 1,000,000.

iii) The property reverts back to the lessor on termination of the lease.

© The Institute of Chartered Accountants of Nepal 10

Suggested Answer Paper Group I

iv) The unguaranteed residual value is estimated at Rs. 100,000 at the end of the year

2077/78.

v) Three equal annual payments are made at the end of each year.

Consider IRR of 10% and the present value of annuity of Re. 1 due at the end of 3rd

year at 10% is Rs. 2.4868 and PV of 3rd year is 0.7513.

Required: (4+2+2+2=10 marks)

i) Calculate annual lease payment and state whether the lease constitute finance

lease.

ii) Calculate total unearned finance income and show Journal entries for recording

the lease instalments.

b) The following information is supplied to you by Sagarmatha Ltd.:

Amount (Rs.)

Equity Shares (Face value Rs. 10) 580,000

12% Preference Shares (Face value Rs. 10) 150,000

10% Debentures (Face value Rs. 10) 500,000

Term Debt (taken at 15%) 200,000

Financial Leverage 1.2

Securities Premium A/c 50,000

General Reserve 20,000

Statutory Reserve 60,000

Income Tax Rate 30%

The industry to which Sagarmatha Ltd. belongs to has a practice of paying at least 15%

dividend to its shareholders. The ordinary shares are quoted at a premium of 400%,

preference shares at Rs. 25 and debentures at a discount of 20%.

Required: (4+4+2=10 marks)

Calculate Economic Value Added (EVA) and Market Value Added (MVA) statements

of the company and also explain the reasons for the difference, if any between the two.

Answer:

a)

i) Computation of annual lease payment to the lessor

Rs.

Cost of equipment 1,000,000

Unguaranteed residual value 100,000

PV of residual value after third year @10% (100,000 x 75,130

0.7513)

Fair value to be recovered from lease payments 924,870

(1,000,000 - 75,130)

PV of annuity for three years is 2.4868

Annual lease payments = 924,870/2.4868 371,912

© The Institute of Chartered Accountants of Nepal 11

Suggested Answer Paper Group I

The PV of lease payment i.e. Rs. 924,870 equivalent to 92.48% of the fair value.

As the present value of minimum lease payments substantially covers the initial fair

value of the leased asset and lease term covers the major part of the life of asset, it

constitutes a finance lease.

ii) Computation of Unearned finance income

Rs.

Total lease payments (Rs. 371,912 x 3) 1,115,736

Add: Unguaranteed residual value 100,000

Gross investment in the lease 1,215,736

Less: PV of investment (Rs. 75,130 +924,870) (1,000,000)

Total Unearned finance income 215,735

Journal Entry

Assets under Lease A/C Dr. Rs. 10 Lakh

To Lease Payable A/C Rs. 10 Lakh

b)

Economic Value Added (EVA) statement

Amount(Rs.)

Profit after tax (W.N 1) 280,000

Add: interest (net of tax) (80,000 x 0.70) 56,000

Return to providers of fund 336,000

Less: cost of capital (W.N 3) (171,450)

Economic value added (EVA) 164,550

Market Value Added (MVA) statement

Amount Amount

(Rs.) (Rs.)

Equity share capital (market value) (58,000 x 10 x 500%) 2,900,000

Preference share capital (15,000x25) 375,000

Debentures (50,000 x 10x80%) 400,000

Current market value of firm 3,675,000

Less: Equity share capital 580,000

Preference share capital 150,000

Debentures 500,000

Long term loan 200,000

Securities premium 50,000

General reserve 20,000

Statutory reserve 60,000 (1,560,000)

Market value added (MVA) 2,115,000

The MVA of Rs. 2,115,000 is the difference between the current market value of

Sagarmatha Ltd. and the capital contributed by the fund providers. While EVA

measures current earning efficiency of the company, MVA takes into consideration the

© The Institute of Chartered Accountants of Nepal 12

Suggested Answer Paper Group I

EVA from not only the assets in place but also from the future projects/activities of the

company. The difference between MVA and EVA thus represents the value attributed

to the future potential for the company and may change from time to time based on

market sentiments. In short the MVA is the net present value of all future EVAs.

Working Notes:

1. Calculation of net profit after interest and tax

Interest on debentures (500,000 x 10%) 50,000

Interest on long term debt (200,000 x 15%) 30,000

Total interest 80,000

Financial leverage = 1.2 = PBIT / (PBIT – Interest)

PBIT 480,000

Less: Interest (80,000)

Profit after interest before tax 400,000

Less : 30% tax (120,000)

Profit after interest and tax 280,000

2. Calculation of weighted average cost of capital (WACC)

Amount Amount Weight Cost % WACC %

Equity shareholders fund

Equity shares 580,000

Security premium 50,000

General reserve 20,000 650,000 0.43 15 6.45

Preference share 150,000 0.10 12 1.20

Debentures 500,000 0.33 7* 2.31

Long term debt 200,000 0.14 10.5* 1.47

1500,000 11.43

*Rate of interest has been calculated net of tax.

3. Cost of capital = capital employed X WACC%

= 1500,000 x 11.43%

= 171,450

3.

a) The capital structure of XYZ Ltd. on 31st Ashadh 2076 was as follows:

Equity share capital (Rs. 100 each) (Rs.) 1,800,000

12% preference capital (Rs. 100 each) (Rs.) 500,000

12% secured debentures (Rs.) 500,000

Reserves (Rs.) 500,000

Profit earned before interest and taxes during the year(Rs.) 720,000

Tax rate 25%

Normal rate of return on equity shares of the industry 15%

© The Institute of Chartered Accountants of Nepal 13

Suggested Answer Paper Group I

Subject to;

i) The profit after tax covers fixed interest and fixed dividend at least 4 times.

ii) The debt equity ratio is at least 2.

iii) Yield on shares is calculated at 60% of distributed profits and 10% of

undistributed profits.

The company has been paying regularly an equity dividend of 15%

The risk premium of dividend is generally assumed at 1%.

Required: (10 marks)

Find out the value of equity shares of the company as on 31st Ashadh 2076.

b) Bashu Kshitiz Ltd. acquired a block making machine on 1st Shrawan 2075. The cost of

the machine amounting to Rs. 1,340,000.00 was derived by Finance Office of the

company as follows:

Particulars Amount in '000 Rs.

Purchase Price 1,005.00

Installation Cost 234.50

Performance Deposit 67.00

Delivery Cost 33.50

Total cost 1,340.00

Following additional information are relevant in relation to cost of machine above:

i) The purchase price is before taking into account trade discount of 8%.

ii) Installation was done by employees of machine supplier and Bashu Kshitiz Ltd. Rs.

87,100.00 of the installation cost included above relates to what the machine

supplier paid to Bashu Kshitiz Ltd. for assisting in installation by workers of Bashu

Kshitiz Ltd. The company did not pay its employees any additional amount for being

involved in installing the new machine.

iii) Performance deposit relates to a two year maintenance service to be provided by

the supplier. It was paid on 1st Shrawan 2075. It is refundable if no works are

carried out on the machine. No maintenance works were provided by supplier in

the period to Ashadh end 2076.

iv) Delivery cost is simply an estimate of what it would have been charged by machine

supplier to deliver the machine. The machine was however delivered free of charge

as it was on promotion.

The machine qualified for an immediate government grant equal to 10% of its initial

cost calculated as per NAS 16 on a specific condition that it should remain in use over

its useful life. The grant was received by Bashu Kshitiz Ltd. on 1st Kartik 2075, the date

on which the machine was ready for its intended use. The company estimates that

depreciation on the machine at an annual rate of 20% on Straight Line Method (SLM)

basis with estimate of nil scrap value would be in compliant with the applicable

reporting standards. Also the company is considering a policy of using deferred income

to account for government grants.

© The Institute of Chartered Accountants of Nepal 14

Suggested Answer Paper Group I

Required: (10 marks)

Line items to be presented in the financial statements of Bashu Kshitiz Ltd. for the year

ended Ashadh 31, 2076. The calculation should be supported by adequate reasons.

Answer:

a)

Value of equity share = [Actual Yield / Expected Yield] X paid up value of share

= [9.92/15] X 100 = Rs. 66.13

Working Notes:

1) Calculation of profit after tax (PAT) and retained earnings: Rs.

A. Profit before interest & tax (PBIT) 720,000

B. Less: Debenture interest (Rs. 500,000 x 12%) (60,000)

C. Profit before tax 660,000

D. Less: Tax 25% (165,000)

E. Profit after tax (PAT) 495,000

F. Less: Preference Dividend (Rs. 500,000 x 12%) (60,000)

G. Less: Equity Dividend (Rs. 1,800,000 x 15%) (270,000)

Retained Earnings 165,000

2) Interest and fixed dividend coverage = (PAT + debenture interest)

Debenture interest + Pref. Dividend

= (495,000 + 60,000)

(60,000 + 60,000)

= 4.625 times

3) Debt Equity Ratio = Debentures

(Pref. Share capital + Equity share capital + Reserves)

= 500,000

(500,000 + 1,800,000 + 500,000)

= 0.179 (the ratio is less than the prescribed ratio)

4) Calculation of Yield of Equity shares

Yield on equity shares is calculated at 60% of distributed profit and 10% of

undistributed profit

60% of distributed profit (60% of Rs. 270,000) 162,000

© The Institute of Chartered Accountants of Nepal 15

Suggested Answer Paper Group I

10% of undistributed profit (10% of Rs. 165,000) 16,500

178,500

Yields on equity shares = [Yield on shares / Equity share capital] x 100

= [178,500 / 1800,000] x 100 = 9.92%

5) Calculation of expected yield on equity shares

Normal rate of return 15%

Add: Risk premium for low interest and

fixed dividend coverage (4.625 > 4) 0%

Add: Risk Premium for debt equity ratio (not required) 0%

Expected yield 15%

b)

The question deals with three items i.e. PPE, Government Grant and Prepayment. The

amount to be reported for these line items of FS are:

Line Item Amount in 000 Remarks

Non- current Assets

Property, Plant & Equipment 911.20 WN 1

Prepayment 67 N6

Current -Liability 21.44 WN2

Non- Current Liability 69.68 WN2

Income

Grant Income 16.08 WN2

Expenses

Depreciation 160.80 WN1

W. N. 1

Calculation of Carrying Amount of Machine

Purchase price 1,005.00

Trade discount @ 8% (N 1) (80.40)

Net purchase price 924.60

Installation cost (N2) 147.40

Total Initial Cost 1,072.00

Depreciation 9 Months @ 20% (N3) (160.80)

Carrying value 911.20

W. N. 2

Government grant

Government grant received (1072 x 10%) 107.20

© The Institute of Chartered Accountants of Nepal 16

Suggested Answer Paper Group I

Grant recognized as income (16.08)

Balance as on 31.3.2076 91.12

Current liability (N4) (91.12/5) 21.44 F

Non -Current Liability (N5) 69.68

N1: Trade discount not included in cost of machine as per NAS 16

N2: based on what was incurred by Basu Kshitiz Ltd. Rs. 87,100 paid to company by

the supplier for helping in installing the machine shall be set off with actual interest

cost.

N3: Proportionate depreciation for nine months.

N4: Current portion of grant i.e. income of next 12 months

N5: Non-current portion of grant, beyond 12 months.

N6: Amount paid for performance deposit of Rs. 67,000 should be treated as

prepayment in statement of financial position as at Ashadh end 2076 under non-current

assets. An amount equal to the value of repair works provided by the supplier should

be expensed to the statement of profit or loss and an equal amount transferred from the

amount. No amount is to be transferred to the statement of profit or loss nor expensed

for the year ended Ashadh end 2076 as no repair works were done by the supplier on

the machine.

4. Write short notes on the following: (5×3=15 marks)

a) Challenges faced by BFI undergoing NFRS implementation

b) Corporate Governance Reporting

c) The significance of the earnings per share (EPS) figure to the analysis of company

performance based on NAS 33.

d) Types of Hedging Relationship

e) Operating Segment

Answer:

a) Challenges faced by BFI undergoing NFRS implementation:

1. Technical Challenges:

a. Impairment of financial assets:

b. Fair value measurement criteria for assets and liabilities

c. Consolidation of financial statements

d. Disclosures requirement

e. Income recognition

2. Other Challenges:

© The Institute of Chartered Accountants of Nepal 17

Suggested Answer Paper Group I

a. Amendment to existing legal framework and policies

b. Shortage of trained and experienced resources

c. Complexity in financial reporting

d. Increased initial cost

e. Measurement of business performance

3. Change Management

b) Corporate governance involves balancing the interests of the stakeholders in a company

– these include its shareholders, management, customers, suppliers, financiers,

government and the community. Corporate governance provides the framework for

attaining a company‘s objectives and encompasses practically every sphere of

management, from action plans and internal controls to performance measurement and

corporate disclosure. Most companies strive to have a high level of corporate

governance. These days, it is not enough for a company to merely be profitable; it also

needs to demonstrate good corporate citizenship through environmental awareness,

ethical behavior and sound corporate governance practices. Good corporate governance

requires a joint effort of the promoters who need to be more transparent, responsible

and socially accountable; the shareholders who must actively participate in their

corporate affairs to help prevent any fraudulent and insider practices and; the regulatory

authority that should effectively enforce rules and regulations in order to protect the

rights of all stakeholders and create favorable environment to enhance good corporate

governance culture.

c) Significance of Earnings per Share (EPS)

• EPS gives a way to measure a company’s profits relative to the number of shares

in issue. It is argued that as owners hold equity shares, it is more relevant to them

to know how much profit each share has earned than to know the overall profit

figure.

• EPS feeds into the price / earnings ratio, one of the most important stock market

measures of value. This gives an estimate of the number of years it would take for

an investment in an equity share to return itself in earnings terms, assuming current

performance continues into the future.

• It is essential that such an important measure of performance have clear guidelines

regarding its calculation. NAS 33 Earnings per Share gives us a standardised

method of calculating both earnings, and the number of shares.

• Many investors feel that other measures are more appropriate, and that the NAS 33

definition of EPS is too conservative. NAS 33 allows alternative measures of EPS

to be published, as long as the NAS 33 figure gets equal or greater prominence.

• There is a danger in relying on a single measure of performance, as no single

measure can encapsulate all aspects of an entity’s performance.

• Also, there is a danger that EPS may be seen by unsophisticated investors as a

definite exact number, when in reality it is subject to all the accounting estimates

and judgments that are necessary in preparing a set of financial statements.

• Despite these fears, it is generally agreed that NAS 33 gives a very fair method of

calculating EPS, and that the consistency it offers is of value to the investor and

analyst.

© The Institute of Chartered Accountants of Nepal 18

Suggested Answer Paper Group I

d) Types of Hedging Relationship:

There are three types of hedge accounting: fair value hedges, cash flow hedges

and hedges of the net investment in a foreign operation.

1. Fair Value Hedges:

The risk being hedged in a fair value hedge is a change in the fair value of an

asset or a liability. For examples, changes in fair value may arise through changes

in interest rates (for fixed-rate loans), foreign exchange rates, equity prices or

commodity prices.

2. Cash Flows Hedges

The risk being hedged in a cash flow hedge is the exposure to variability in cash

flows that is attributable to a particular risk and could affect the income statement.

Volatility in future cash flows will result from changes in interest rates, exchange

rates, equity prices or commodity prices.

3. Hedges of net investment in a foreign operation

An entity may have overseas subsidiaries, associates, joint ventures or branches

(‘foreign operations’). It may hedge the currency risk associated with the

translation of the net assets of these foreign operations into the group’s currency

e) NFRS defines an operating segment as a component of an entity;

(i) That engages in business activities from which it may earn revenues and incur

expenses (including revenues and expenses relating to transactions with other

components of the same entity)

(ii) Whose operating results are reviewed regularly by the entity’s chief operating

decision maker to make decisions about resources to be allocated to the segment and

assess its performance and

(iii) For which discrete financial information is available.

It also sets out various disclosure requirement for operating segments.

5.

a) What are the pillars of Public Expenditure and Financial Accountability (PEFA) and

how does its assessment help in strengthening Public Finance Management (PFM)

system of a country? (3.5+3.5=7 marks)

b) X Ltd. acquired a Safa Tempo business on 1st Shrawan 2075 for Rs. 4,600,000. The

values of the assets of the business at that date based on net selling prices were as

follows:

Rs. '000

Tempo 2,400

Intangible Assets (license of tempo) 600

Trade receivable 200

Cash 1,000

Trade payable (400)

3,800

© The Institute of Chartered Accountants of Nepal 19

Suggested Answer Paper Group I

On 1st Bhadra 2075, the tempo company had four of its tempos stolen. The net selling

value of four tempos was Rs. 600,000 and because of non-disclosure of certain risks to

the insurance company, the tempos were uninsured. As a result of this event, X Ltd.

wishes to recognize an impairment loss of Rs. 900,000 (inclusive of the loss of the stolen

tempos) due to the decline in the value in use of the cash generating unit, that is the

tempo business. On 1st Ashwin 2075 a rival tempo company commenced business in the

same area. It is anticipated that the business revenue of X ltd. will be reduced by 25%

leading to a decline in the present value in use of the business which is calculated at

Rs 3,000,000. The net selling value of the tempo license has fallen to Rs. 500,000 as a

result of the rival tempo operator. The net selling value of the other assets have

remained the same as at 1st Shrawan 2075 throughout the period.

Required:

Describe how X Ltd. should treat the above impairment of assets in its financial

statements as at 1st Bhadra 2075 and 1st Ashwin 2075. (4+4=8 marks)

Answer:

a) PEFA Pillars

PEFA identifies seven pillars of performance in an open and orderly PFM system that

are essential to achieving desired fiscal and budgeting outcomes. The pillars are as

follows:

1. Budget reliability

2. Transparency of public finance

3. Management of assets and liabilities

4. Policy based fiscal strategy and budgeting

5. predictability and control in budget execution

6. Accounting and reporting

7. External scrutiny and audit

Within these 7 broad areas marked by these pillars, PEFA defines 31 specific indicators

that focus on key measurable aspects of the PFM system. PEFA uses the results of the

individual indicator calculations, which are based on available evidence, to provide an

integrated assessment of PFM system against the 7 pillars of PFM performance. It then

assesses the likely impact of PFM performance levels on the three desired budgetary

outcomes, viz, aggregate fiscal discipline, strategic allocation of resources and efficient

service delivery.

b)

At 1st Bhadra 2075

1/4/2075 Impairment 1/5/2075

loss

Rs '000 Rs '000 Rs '000

Goodwill (4,600 - 3,800) 800 (300) 500

(balancing

Intangible assets 600 figure) 600

© The Institute of Chartered Accountants of Nepal 20

Suggested Answer Paper Group I

Tempos 2,400 (600) 1,800

Net assets (TR+ Cash-TP) 800 - 800

4,600 (900) 3,700

An impairment loss is recognized for the stolen vehicles. The balance of Rs 300,000 is

allocated to goodwill in the cash generating unit.

At 1st Ashwin 2075

1/5/2075 Impairment 1/6/2075

loss

Rs. '000 Rs. '000 Rs. '000

Goodwill 500 (500)

Intangible assets 600 (100) 500

Tempos 1,800 - 1,800

Net Assets 800 - 800

3,700 (600) 3,100

A further impairment loss of Rs. 600,000 (Goodwill 500 due to full in net business

revenue + 100 decline in license) is recognized. The recoverable amount falls to the

higher of net selling price (3,700- 600) or value in use (3,000). There is no indication

that other tangible assets are impaired. The loss is applied initially to the intangible

assets and then to goodwill.

6.

a) Brat Ltd. incorporated in Nepal purchased 6,000 kg of materials on 1st Ashadh 2075

to use in their production process.

The supplier is located in China where the currency is Yuan. The goods cost 300,000

Yuan and have not been paid at the year end. The relevant exchange rates are:

1st Ashadh Re. 1 = 0.05 Yuan

32nd Ashadh Re. 1 = 0.056 Yuan

Required: (3+2=5 marks)

How this transaction will be included in the financial statements of 32nd Ashadh 2075.

Also, identify the functional currency and presentation currency of Brat Ltd.

b) Progressive Ltd. operates a defined benefit pension plan for its employees. At 1st

Shrawan 2075 the fair value of the pension plan assets was Rs. 8,200,000 and the

present value of the pension plan liabilities was Rs. 8,500,000. The Actuary estimated

that, the service cost for the year to 31st Ashadh 2076 was Rs. 2,100,000. The pension

plan paid Rs. 500,000 to retired members and Progressive Ltd. paid Rs. 1,900,000 in

contributions to the pension plan in the year to 31st Ashadh 2076. The Actuary

estimated that, the relevant discount rate for the year to 31st Ashadh 2076 was 6%.

On 31st Ashadh 2076, Progressive Ltd announced improvements to the benefits offered

by the pension plan to all of its members. The Actuary estimated that, the past service

cost associated with these improvements was Rs. 2 million. At 31st Ashadh 2076 the

fair value of the pension plan assets was Rs. 10,200,000 and the present value of the

pension plan liabilities (including the past service costs) was Rs. 12,500,000.

© The Institute of Chartered Accountants of Nepal 21

Suggested Answer Paper Group I

Required: (3+2=5 marks)

In accordance with NAS 19 Employee Benefits:

i) Calculate the net actuarial gain or loss that will be included in Progressive Ltd.’s

other comprehensive income for the year ended 31st Ashadh 2076.

ii) Calculate the net pension asset or liability that will be included in Progressive

Ltd.’s statement of financial position as at 31st Ashadh 2076.

Answer:

a) Brat Ltd. should recognise the purchase of goods at the exchange rate in place at the

date of the transaction.

Therefore:

300,000 Yuan/0.05 = Rs. 6,000,000

Purchases A/c Dr. Rs. 6,000,000

Trade payables A/c Cr. Rs. 6,000,000

At the year end, the supplier has not been paid, so the liability is still outstanding. It

must be translated at the closing rate at the year end and any exchange gains or losses

recognised in the statement of profit or loss.

The liability at 32nd Ashadh 2075 is:

300,000 Yuan/0.056 = Rs. 5,357,143

It has decreased and Brat must recognise an exchange gain of Rs. 642,857 as:

Trade payables A/c Dr. Rs. 642,857

To OCI Cr. Rs. 642,857

Functional currency is the currency of the primary economic environment in which the

entity operates. In Brat Ltd.’s. case, it operates in Rs. which is the functional currency.

The presentation currency is the currency in which the financial statements are

presented. Brat Ltd. may well prepare financial statements in their functional currency

(Rs.).

b) Pension plan of Progressive Ltd.

i) Actuarial gains and losses:

FV of plan PV of plan

assets liabilities

Rs 000 Rs. 000

Opening balance (1.4.2075) 8,200 8,500

Service cost (2075/76) 2,100

Interest cost (6% x opening balances) 492 510

Benefits paid (500) (500)

Contributions 1,900

© The Institute of Chartered Accountants of Nepal 22

Suggested Answer Paper Group I

Past service cost 2,000

Total 10,092 12,610

Actuarial gain on plan assets (balancing fig) 108

Actuarial gain on plan liabilities (balancing fig) (110)

Closing Balance 10,200 12,500

The net actuarial gain in OCI is NRs. 218,000 for the year.

ii)

Statement of financial position: NRs. 000

Present value of pension plan liabilities at 31st Ashadh 2076 (12,500)

Fair value of pension plan assets at 31st Ashadh 2076 10,200

Net pension liability (2,300)

© The Institute of Chartered Accountants of Nepal 23

You might also like

- ICAN 1 ConsolidationDocument29 pagesICAN 1 ConsolidationAnjana TimalsinaNo ratings yet

- Suggested Answer Paper CAP III Dec 2019Document142 pagesSuggested Answer Paper CAP III Dec 2019Roshan PanditNo ratings yet

- Suggested Answer Paper CAP III Dec 2019Document146 pagesSuggested Answer Paper CAP III Dec 2019Ankit Jung RayamajhiNo ratings yet

- Suggested CAP III Group I June 2023Document66 pagesSuggested CAP III Group I June 2023ranjanNo ratings yet

- 1 CAP-III SA Group-I June2022 FinalDocument83 pages1 CAP-III SA Group-I June2022 Finalsubash pandeyNo ratings yet

- ACCT 451 Advanced Accounting Trial ExamDocument4 pagesACCT 451 Advanced Accounting Trial ExamPrince-SimonJohnMwanzaNo ratings yet

- C1 Free Problem Solving (May 2021) - Set 5Document8 pagesC1 Free Problem Solving (May 2021) - Set 5JMwaipNo ratings yet

- Advanced Financial Accounting Group A SolutionDocument6 pagesAdvanced Financial Accounting Group A SolutionNajmul IslamNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIHooriaNo ratings yet

- C1 Free Problem Solving Session Nov 2019 - Set 5Document6 pagesC1 Free Problem Solving Session Nov 2019 - Set 5JMwaipNo ratings yet

- PDF 03Document5 pagesPDF 03Hiruni LakshaniNo ratings yet

- Paper - 1: Financial Reporting: AssetsDocument43 pagesPaper - 1: Financial Reporting: AssetsTisha AggarwalNo ratings yet

- CA23 Financial Reporting and AnalysisDocument5 pagesCA23 Financial Reporting and AnalysisjoanNo ratings yet

- Advanced Accounting & Financial Reporting: The Professionals' Academy of CommerceDocument8 pagesAdvanced Accounting & Financial Reporting: The Professionals' Academy of CommerceRamzan Ali0% (1)

- Advanced Accounting QN August 2018 Group AssignmentDocument9 pagesAdvanced Accounting QN August 2018 Group AssignmentGift MoyoNo ratings yet

- Mock - Question v1Document5 pagesMock - Question v1Dawood ZahidNo ratings yet

- Advanced Accounting and Financial ReportingDocument6 pagesAdvanced Accounting and Financial ReportingAhmed Raza MirNo ratings yet

- E-14 AFR - ICAP Past PaperDocument4 pagesE-14 AFR - ICAP Past PaperSheharyar HasanNo ratings yet

- AFR 2 End of Semester Examination 2022-2023Document10 pagesAFR 2 End of Semester Examination 2022-2023Sebastian MlingwaNo ratings yet

- CAP-III SA Group-I Dec2021 FinalDocument79 pagesCAP-III SA Group-I Dec2021 FinalSanjay AryalNo ratings yet

- US GAAP - Financials Dec'2021Document50 pagesUS GAAP - Financials Dec'2021ashokdb2kNo ratings yet

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet

- FR (New) A MTP Final Apr 2021Document16 pagesFR (New) A MTP Final Apr 2021ritz meshNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Audit of Shareholder's EquityDocument4 pagesAudit of Shareholder's EquityRosalie Colarte LangbayNo ratings yet

- 2016 December Financial Reporting L1 PDFDocument158 pages2016 December Financial Reporting L1 PDFDixie Cheelo100% (1)

- CFAP 1 AFR Winter 2022Document5 pagesCFAP 1 AFR Winter 2022Ali HaiderNo ratings yet

- FR 1 QDocument17 pagesFR 1 QG INo ratings yet

- 2023 Grade 12 Controlled Test 1 QPDocument5 pages2023 Grade 12 Controlled Test 1 QPannabellabloom282007No ratings yet

- Dec 2021Document23 pagesDec 2021Anjana TimalsinaNo ratings yet

- Questions - ConsolidatedDocument8 pagesQuestions - ConsolidatedMo HachimNo ratings yet

- Bos 24780 CP 5Document114 pagesBos 24780 CP 5NmNo ratings yet

- MSA 1 Winter2021Document16 pagesMSA 1 Winter2021RSM PakistanNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- Answer All Questions in Part A. Answer Only Three Questions in Part BDocument16 pagesAnswer All Questions in Part A. Answer Only Three Questions in Part BHazim BadrinNo ratings yet

- FR Last 4 MTPDocument98 pagesFR Last 4 MTPSHIVSHANKER AGARWALNo ratings yet

- 71465exam57501 p1Document32 pages71465exam57501 p1ManaliNo ratings yet

- FR Suggested July 2021Document38 pagesFR Suggested July 2021Rahul NandurkarNo ratings yet

- Audit of Shareholder's EquityDocument6 pagesAudit of Shareholder's EquityRosalie Colarte LangbayNo ratings yet

- Complex and Disposal of Sub (4416)Document5 pagesComplex and Disposal of Sub (4416)Ahmad vlogsNo ratings yet

- Suggested December 2022 CAP III Group IDocument67 pagesSuggested December 2022 CAP III Group Isubash pandeyNo ratings yet

- Complex and Disposal of Sub (4416)Document5 pagesComplex and Disposal of Sub (4416)zeeshan sikandarNo ratings yet

- QUESTION 1 - Preferance Shares Intragroup Tranaction Investment in AssociateDocument14 pagesQUESTION 1 - Preferance Shares Intragroup Tranaction Investment in Associatedineomokoena327No ratings yet

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaNo ratings yet

- Institute of Rural Management Anand: 1. Non-Current AssetsDocument5 pagesInstitute of Rural Management Anand: 1. Non-Current AssetsDharampreet SinghNo ratings yet

- 7948final Adv Acc Nov05Document16 pages7948final Adv Acc Nov05Kushan MistryNo ratings yet

- Revision Test Paper CAP III June 2020Document233 pagesRevision Test Paper CAP III June 2020Roshan PanditNo ratings yet

- Strategic Business Reporting - International (SBR - Int)Document8 pagesStrategic Business Reporting - International (SBR - Int)Karan KumarNo ratings yet

- F3 Practice Questions Consolidation.Document9 pagesF3 Practice Questions Consolidation.Nikesh KunwarNo ratings yet

- FAC 320 Test 1 2022F With MemoDocument10 pagesFAC 320 Test 1 2022F With MemoNolan TitusNo ratings yet

- Mid AFA-II 2020Document2 pagesMid AFA-II 2020CRAZY SportsNo ratings yet

- Answer All Questions: Age ofDocument17 pagesAnswer All Questions: Age ofBich Ngoc DangNo ratings yet

- Aafr Updated Past PapersDocument491 pagesAafr Updated Past PapersSummama Ahmad LodhraNo ratings yet

- IAS 19 Employee BenefitsDocument4 pagesIAS 19 Employee BenefitsAhmad vlogsNo ratings yet

- PST AFR 2015 2023Document111 pagesPST AFR 2015 2023PhilipNo ratings yet

- HD Book 5Document4 pagesHD Book 5humphrey daimonNo ratings yet

- CORPORATE REPORTING - MA-2022 - QuestionDocument7 pagesCORPORATE REPORTING - MA-2022 - Questionswarna dasNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Spice Jet - RATIODocument35 pagesSpice Jet - RATIOankurNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Jainism in Odisha Chapter 1Document13 pagesJainism in Odisha Chapter 1Bikash DandasenaNo ratings yet

- Chapter 1 Concept of Entrepreneurship - Meaning, Elements, EDDocument23 pagesChapter 1 Concept of Entrepreneurship - Meaning, Elements, EDPrincess Galicia Tres ReyesNo ratings yet

- Patterns in Stock Prices PIVOTE Jesse LivermoreDocument7 pagesPatterns in Stock Prices PIVOTE Jesse Livermorekuky6549369No ratings yet

- 13 Mbfi - at - 191104 PDFDocument2 pages13 Mbfi - at - 191104 PDFAkshayNo ratings yet

- SEAL AR 2020 (Final) (Resize)Document130 pagesSEAL AR 2020 (Final) (Resize)BenjaminNo ratings yet

- Course OL TaxationDocument3 pagesCourse OL TaxationSayed Mukhtar HedayatNo ratings yet

- DN No 710 H K SERVICES - MANDYADocument3 pagesDN No 710 H K SERVICES - MANDYAGangaraju T CNo ratings yet

- Vinayak Pandla Nbs (Bank of Baroda)Document19 pagesVinayak Pandla Nbs (Bank of Baroda)Vinayak PandlaNo ratings yet

- Internship Report On Capital Structure of Islamic Bank LimitedDocument47 pagesInternship Report On Capital Structure of Islamic Bank LimitedFahimNo ratings yet

- Michael E. PorterDocument21 pagesMichael E. PorterAnshikaNo ratings yet

- AF304 Major Assignment DraftDocument25 pagesAF304 Major Assignment DraftShilpa KumarNo ratings yet

- Financial Maths Test 2020Document6 pagesFinancial Maths Test 2020Liem HuynhNo ratings yet

- Provisional Certificate H402HHL0713483Document1 pageProvisional Certificate H402HHL0713483sivavm4No ratings yet

- Peter Drucker: Father of Post-War Management ThinkingDocument12 pagesPeter Drucker: Father of Post-War Management Thinkingamit chavaria100% (1)

- Tadiwa Dhaka Section 1: Availability of Materials For Chrome PlantDocument11 pagesTadiwa Dhaka Section 1: Availability of Materials For Chrome PlantTadiwa DhakaNo ratings yet

- Ch183 Process Cost Systemsdocx PDF FreeDocument52 pagesCh183 Process Cost Systemsdocx PDF FreeROLANDO II EVANGELISTANo ratings yet

- Share-Federal Income TaxDocument78 pagesShare-Federal Income TaxHenryNo ratings yet

- FNSACC513 Rattanawadee PholsanDocument29 pagesFNSACC513 Rattanawadee PholsanChaleamkwan NatungkhumNo ratings yet

- Wallstreetjournal 20230104Document28 pagesWallstreetjournal 20230104カンマックスNo ratings yet

- Time Value of MoneyDocument21 pagesTime Value of MoneyKadita MageNo ratings yet

- BS FormatDocument12 pagesBS Formatsudershan90% (1)

- Fidelity InvestmentsDocument1 pageFidelity InvestmentsJack Carroll (Attorney Jack B. Carroll)No ratings yet

- Who Owns Offshore Real Estate? Evidence From DubaiDocument46 pagesWho Owns Offshore Real Estate? Evidence From Dubaiatlatszo100% (1)

- Revised Booking - Confirmation - EBKG06645778Document4 pagesRevised Booking - Confirmation - EBKG06645778Ribeiro Eugenio SardenhaNo ratings yet

- The Impact of Microfinance On Poverty Alleviation: The Case of PakistanDocument22 pagesThe Impact of Microfinance On Poverty Alleviation: The Case of PakistanShah WazirNo ratings yet

- Evidencia 3: Ensayo "Free Trade Agreement (FTA) : Advantages and Disadvantages"Document4 pagesEvidencia 3: Ensayo "Free Trade Agreement (FTA) : Advantages and Disadvantages"jesus david franco barriosNo ratings yet

- CF Unit 2 Solutions 09-01-2022Document22 pagesCF Unit 2 Solutions 09-01-2022SuganyaNo ratings yet

- Chapter 5: Intercompany Profit Transactions - Inventories: Advanced AccountingDocument39 pagesChapter 5: Intercompany Profit Transactions - Inventories: Advanced AccountingRifqa Aulia NabylaNo ratings yet

- 1.0 DefinitionDocument43 pages1.0 DefinitionfloraNo ratings yet

- Situational AnalysisDocument9 pagesSituational AnalysisPratyaksh JainNo ratings yet