Professional Documents

Culture Documents

Exemption Under 54B Agri Land

Exemption Under 54B Agri Land

Uploaded by

HSMagisterial TjrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exemption Under 54B Agri Land

Exemption Under 54B Agri Land

Uploaded by

HSMagisterial TjrCopyright:

Available Formats

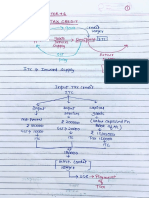

EXEMPTION TO CAPITAL GAINS ON TRANSFER OF

AGRICULTURAL LAND

Introduction

A farmer wants to shift his agricultural land for certain reason and hence he sold his old

agricultural land and from the sale proceeds he purchased another agricultural land. In

this case the objective of the seller was not to earn income by sale of old land but was to

shift to another land. If in this case, the seller was liable to pay income-tax on capital

gains arising on sale of old land, then it would be a hardship on him.

Section 54B gives relief from such a hardship. Section 54B gives relief to a taxpayer who

sells his agricultural land and from the sale proceeds he acquires another agricultural

land. The detailed provisions in this regard are discussed in this part.

Basic conditions

Following conditions should be satisfied to claim the benefit of section 54B.

The benefit of section 54B is available only to an individual or a HUF

The asset transferred should be agricultural land. The land may be a long-term

capital asset or short-term capital asset.

The agricultural land should be used by the individual or his parents for

agricultural purpose at least for a period of two years immediately preceding the

date of transfer. In case of HUF the land should be used by any member of HUF.

Within a period of two years from the date of transfer of old land the taxpayer

should acquire another agricultural land. In case of compulsory acquisition the

period of acquisition of new agricultural land will be determined from the date of

receipt of compensation. However, as per section 10(37), no capital gain would be

chargeable to tax in case of an individual or HUF if agricultural land is

compulsorily acquired under any law and the consideration of which is approved

by the Central Government or RBI and received on or after 01-04-2004.

Illustration

Mr. Raja purchased an agricultural land in April, 2011. Since the date of purchase, the

land was being used for agricultural purpose. The land was sold in July, 2016 for Rs.

8,40,000. Capital gain arising on sale of land amounted to Rs. 1,00,000. Can he claim the

benefit of section 54B by purchasing another agricultural land?

**

Exemption under section 54B can be claimed in respect of capital gains arising on

transfer of capital asset, being agricultural land (may be long-term or short-term).

This benefit is available only to an individual or a HUF. The land should be used for

agricultural purpose at least for two years. In this case, all the conditions of section 54B

were satisfied and, hence, Mr. Raja can claim the benefit of section 54B by purchasing

[As amended by Finance Act, 2016]

another agricultural land within the time-limit specified under section 54B.

Illustration

Mr. Kamal purchased an agricultural land in April, 2013. Since the date of purchase, the

land was being used for agricultural purpose. The land was sold in May, 2016 for Rs.

18,40,000. Capital gain arising on sale of land amounted to Rs. 2,00,000. Can he claim

the benefit of section 54B by purchasing another agricultural land?

**

Exemption under section 54B can be claimed in respect of capital gains arising on

transfer of capital asset, being agricultural land (may be long-term or short-term). This

benefit is available only to an individual or HUF.

The land should be used for agricultural purpose for at least two years. In this case, all the

conditions of section 54B are satisfied and, hence, Mr. Kamal can claim the benefit of

section 54B by purchasing another agricultural land within the time-limit specified under

section 54B.

Illustration

Raja HUF purchased an agricultural land in June, 2013. Since the date of purchase, the

land was being used for agricultural purpose. The land was sold in July, 2016 for Rs.

28,40,000. Capital gain arising on sale of land amounted to Rs. 8,00,000. Can the HUF

claim the benefit of section 54B by purchasing another agricultural land?

**

Exemption under section 54B can be claimed in respect of capital gains arising on

transfer of capital asset, being agricultural land (may be long-term or short-term). This

benefit is available only to an individual or HUF. The land should be used for agricultural

purpose for at least two years. In this case all the conditions of section 54B are satisfied

and, hence, Raja HUF can claim the benefit of section 54B by purchasing another

agricultural land within the time-limit specified under section 54B.

Illustration

Mr. Kumar purchased gold in April, 2011 and sold the same in July, 2016 for Rs.

8,40,000. Capital gain arising on sale of gold amounted to Rs. 1,00,000. Can he claim the

benefit of section 54B by purchasing agricultural land from the capital gain of Rs.

1,00,000?

**

Exemption under section 54B can be claimed in respect of capital gains arising on

transfer of a capital asset, being agricultural land (may be long-term or short-term). In

this case the capital asset is gold, i.e., other than agricultural land and, hence, the benefit

of section 54B is not available.

[As amended by Finance Act, 2016]

Amount of exemption

Exemption under section 54B will be lower of the following:

Amount of capital gains arising on transfer of agricultural land; or

Investment in new agricultural land [including the amount deposited in Capital

Gains Deposit Account Scheme (discussed later)].

Illustration

Mr. Raja purchased an agricultural land in April, 2011. Since the date of purchase, the

land was being used for agricultural purpose.

The land was sold in July, 2016 for Rs. 8,40,000. Capital gain arising on sale of land

amounted to Rs. 1,00,000. Out of the sale proceeds of old land, he purchased another

agricultural land for Rs. 3,00,000 (purchased in August, 2016). What will be the amount

of exemption under section 54B which can be claimed by Mr. Raja?

**

Exemption under section 54B can be claimed in respect of capital gains arising on

transfer of capital asset, being agricultural land. Exemption under section 54B will be

lower of following :

Amount of capital gains arising on transfer of agricultural land; or

Investment in new agricultural land

Considering the above provisions, the exemption in this case will be lower of the

following amount :

Amount of capital gain arising on transfer of agricultural land, i.e., Rs. 1,00,000

or

Amount of investment in new agricultural land, i.e., Rs. 3,00,000

Thus, exemption will be Rs. 1,00,000. Taxable capital gain will come to Nil (entire gain

will be exempt).

Illustration

Mr. Kaushal purchased an agricultural land in April, 2011. Since the date of purchase, the

land was being used for agricultural purpose. The land was sold in July, 2016 for Rs.

18,40,000. Capital gain arising on sale of land amounted to Rs. 4,00,000. Out of the sale

proceeds of old land, he purchased another agricultural land for Rs. 3,00,000 (in August,

2016). What will be the amount of exemption under section 54B which can be claimed by

Mr. Kaushal?

**

Exemption under section 54B can be claimed in respect of capital gains arising on

transfer of capital asset, being agricultural land. Exemption under section 54B will be

lower of following :

Amount of capital gains arising on transfer of agricultural land, or

[As amended by Finance Act, 2016]

Investment in new agricultural land

Considering the above provisions, the exemption in this case will be lower of the

following amount :

Amount of capital gain arising on transfer of agricultural land, i.e., Rs. 4,00,000

or

Amount of investment in new agricultural land, i.e., Rs. 3,00,000

Thus, exemption will be Rs. 3,00,000. Taxable capital gain will come to Rs. 1,00,000

(i.e., Rs. 4,00,000 less Rs. 3,00,000).

Consequences if the new land is transferred

Exemption under section 54B is available in respect of rollover of capital gains arising on

transfer of agricultural land into another agricultural land. However, to keep a check on

misutilisation of this benefit a restriction is inserted in section 54B. The restriction is in

the form of prohibition of sale of the new agricultural land.

If a taxpayer purchases new agricultural land to claim exemption under section 54B and

subsequently he transfers the new agricultural land within a period of 3 years from the

date of its acquisition, than the benefit granted under section 54B will be withdrawn. The

ultimate impact of the restriction is as follows:

The restriction will be attracted if, after claiming exemption under section 54B,

the new agricultural land is sold within a period of 3 years from the date of its

purchase.

If the agricultural land is sold within a period of 3 years from the date of its

purchase, then at the time of computation of capital gain arising on transfer of the

new land, the amount of capital gain claimed as exemption under section 54B will

be deducted from the cost of acquisition of the new agricultural land.

Illustration

Mr. Rajat sold his agricultural land in April, 2015 for Rs. 25,20,000. Since past 10 years

the land was used for agricultural purpose. Long-term capital gain arising on transfer of

the land amounted to Rs. 8,40,000. In December, 2015 he purchased another agricultural

land worth Rs. 10,00,000. The new land was, however, sold in April, 2016 for Rs.

12,00,000. What will be amount of taxable capital gains in the hands of Mr. Rajat for the

financial years 2015-16 and 2016-17?

**

Computation of capital gains for the financial year 2015-16

Particulars Rs.

Long-term capital gain arising on transfer of old land 8,40,000

Less: Exemption under section 54B (*) 8,40,000

Taxable Long-Term Capital Gains Nil

[As amended by Finance Act, 2016]

(*) Exemption under section 54B will be lower of following :

Amount of capital gains arising on transfer of agricultural land, or

Investment in new agricultural land

Considering the above provisions, the exemption in this case will be lower of the

following amount :

Amount of capital gain arising on transfer of agricultural land, i.e., Rs. 8,40,000

or

Amount of investment in new agricultural land, i.e., Rs. 10,00,000

Thus, exemption will be Rs. 8,40,000.

Computation of capital gains for the year 2016-17

If a taxpayer purchases another agricultural land and claims exemption under section 54B

and subsequently he transfers the new agricultural land within a period of 3 years from

the date of its acquisition, than the benefit granted earlier under section 54B will be

withdrawn. The computation in this case will be as follows :

Particulars Rs.

Full value of consideration (i.e., Sales value of new agricultural 12,00,000

land)

Less: Expenditure incurred wholly and exclusively in connection Nil

with transfer of capital asset (e.g., brokerage, etc.).

Net sale consideration 12,00,000

Less: Cost of acquisition (*) 1,60,000

Short- term capital gains on sale of new agricultural land 10,40,000

(*) If the agricultural land is sold before a period of 3 years from the date of its purchase,

then at the time of computation of capital gain arising on transfer of the new agricultural

land, the amount of capital gain claimed as exempt under section 54B will be deducted

from the cost of acquisition of the new agricultural land. Applying this provisions the

cost of acquisition of new land will be computed as follows :

Particulars Rs.

Cost of acquisition of new land 10,00,000

Less: Exemption claimed earlier under section 54B 8,40,000

Cost of new land to be used while computing capital gain 1,60,000

[As amended by Finance Act, 2016]

Illustration

Mr. Aakash sold his agricultural land in April, 2015 for Rs. 25,20,000. Since past 10

years the land was used for agricultural purpose. Long-term capital gain arising on

transfer of the land amounted to Rs. 8,40,000. In December, 2015 he purchased another

agricultural land worth Rs. 5,00,000.

The new land was sold in April, 2016 for Rs. 12,00,000. What will be amount of taxable

capital gains in the hands of Mr. Aakash for the financial years 2015-16 and 2016-17?

Computation of capital gains for the financial year 2015-16

Particulars Rs.

Long-term capital gain arising on transfer of old land 8,40,000

Less: Exemption under section 54B (*) 5,00,000

Taxable Long-Term Capital Gains 3,40,000

(*) Exemption under section 54B will be lower of following :

Amount of capital gains arising on transfer of agricultural land; or

Investment in new agricultural land

Considering the above provisions, the exemption in this case will be lower of the

following amount :

Amount of capital gain arising on transfer of agricultural land, i.e., Rs. 8,40,000

or

Amount of investment in new agricultural land, i.e., Rs. 5,00,000

Thus, exemption will be Rs. 5,00,000.

Computation of capital gains for the financial year 2016-17

If a taxpayer purchases agricultural land and claims exemption under section 54B and

subsequently transfers the new agricultural land within a period of 3 years from the date

of its acquisition, than the benefit granted earlier under section 54B will be withdrawn.

The computation in this case will be as follows :

Particulars Rs.

Full value of consideration (i.e., Sales value of new land) 12,00,000

Less: Expenditure incurred wholly and exclusively in connection Nil

with transfer of capital asset (e.g., brokerage, etc.).

Net sale consideration 12,00,000

[As amended by Finance Act, 2016]

Less: Cost of acquisition (*) Nil

Short-term capital gains on sale of new agricultural land 12,00,000

(*) If the new land is sold before a period of 3 years from the date of its purchase, then at

the time of computation of capital gain arising on transfer of the new land, the amount of

capital gain claimed as exempt under section 54B will be deducted from the cost of

acquisition of the new land. Applying this provision, the cost of acquisition of new land

will be computed as follows :

Particulars Rs.

Cost of acquisition of new land 5,00,000

Less: Exemption claimed earlier under section 54B 5,00,000

Cost of new land to be used while computing capital gain Nil

Capital Gain Deposit Account Scheme

To claim exemption under section 54B, the taxpayer should purchase another agricultural

land within a period of two years from the date of transfer of old land.

If till the date of filing the return of income the capital gain arising on transfer of the old

land is not utilised (in whole or in part) for purchase of another agricultural land, then the

benefit of exemption can be availed by depositing the unutilised amount in Capital Gains

Deposit Account Scheme in any branch of public sector bank, in accordance with Capital

Gains Deposit Accounts Scheme, 1988 (hereafter referred as Capital Gains Account

Scheme). The new land can be purchased by withdrawing the amount from the said

account within the specified time-limit of 2 years.

Illustration

Mr. Raj had purchased an agricultural land in April, 2012. Since the day of its purchase,

the land was being used for agricultural purpose. This land was sold on 25th August,

2016 for Rs. 8,40,000. Capital gain arising on sale of land amounted to Rs. 2,00,000. He

wants to claim exemption under section 54B. By what time he should purchase another

agricultural land?

**

To claim exemption under section 54B, the taxpayer should purchase another agricultural

land within a period of two years from the date of transfer of old land. In this case the old

land was transferred on 25th August, 2016, hence, he has to purchase another land within

a period of 2 years from 25th August, 2016 i.e. on or before 24th August, 2018.

[As amended by Finance Act, 2016]

The old land was transferred in the year 2016-17 and the due date of filing the return of

income of the year 2016-17 is 31st July 2017. If Mr. Raj cannot purchase another land by

31st July, 2017, then he has to deposit Rs. 2,00,000 in Capital Gains Account Scheme.

By depositing Rs. 2,00,000 in the Capital Gains Account Scheme he can claim exemption

of Rs. 2,00,000 under section 54B. However, merely depositing in the Capital Gains

Account Scheme would not be sufficient. After deposit in the scheme he has to utilise this

fund to purchase new agricultural land within the specified period of 2 years i.e. on or

before 24th August, 2018.

Illustration

Mr. Raj had purchased an agricultural land in April, 2012. Since the day of its purchase,

the land was being used for agricultural purpose. This land was sold on 25th August,

2016 for Rs. 18,40,000. Capital gain arising on sale of land amounted to Rs. 4,00,000. He

could not purchase another agricultural land by 31st July, 2017, however, in July, 2017

he deposited Rs. 4,00,000 in Capital Gains Account Scheme. Will he be entitled to claim

any exemption under section 54B?

**

To claim exemption under section 54B, the taxpayer should purchase another agricultural

land within a period of two years from the date of transfer of old land. In this case the old

land was transferred on 25th August, 2017, hence, he has to purchase another land within

a period of 2 years from 25th August, 2016, i.e., on or before 24th August, 2018.

The old land was transferred in the year 2016-17 and the due date of filing the return of

income of the year 2016-17 is 31st July 2017. If Mr. Raj cannot purchase another land by

31st July, 2017, then he has to deposit Rs. 4,00,000 in Capital Gains Account Scheme.

By depositing Rs. 4,00,000 in the Capital Gains Account Scheme he can claim exemption

of Rs. 4,00,000 under section 54B. In this case he has deposited Rs. 4,00,000 in the

Capital Gains Account Scheme and, hence, he can claim exemption of Rs. 4,00,000 under

section 54B.

However, merely depositing in the Capital Gains Account Scheme would not be

sufficient. After deposit in the scheme he has to utilise this fund to purchased new

agricultural land within the specified period of 2 years, i.e., on or before 24th August,

2018.

Illustration

Mr. Kamal had purchased an agricultural land in April, 2012. Since the day of its

purchase, the land was being used for agricultural purpose. This land was sold on 25th

August, 2016 for Rs. 18,40,000. Capital gain arising on sale of land amounted to Rs.

4,00,000. He could not purchase another agricultural land by 31st July, 2017, however, in

July, 2017 he deposited Rs. 3,00,000 in Capital Gains Account Scheme. Will he be

entitled to claim any exemption under section 54B?

**

[As amended by Finance Act, 2016]

To claim exemption under section 54B, the taxpayer should purchase another agricultural

land within a period of two years from the date of transfer of old land. In this case the old

land was transferred on 25th August, 2016, hence, he has to purchase another land within

a period of 2 years from the date of transfer.

The old land was transferred in the year 2016-17 and the due date of filing the return of

income of the year 2016-17 is 31st July 2017. If Mr. Kamal cannot purchase another land

by 31st July 2017, then he has to deposit Rs. 4,00,000 in Capital Gains Account Scheme.

By depositing Rs. 4,00,000 in the Capital Gains Account Scheme he can claim exemption

of Rs. 4,00,000 under section 54B. In this case, he has deposited Rs. 3,00,000 in the

Capital Gains Account Scheme and, hence, he can claim exemption of Rs. 3,00,000 under

section 54B.

However, merely depositing in the Capital Gains Account Scheme would not be

sufficient. After deposit in the scheme he has to utilise this fund to purchased new

agricultural land within the specified period of 2 years.

Non-utilisation of amount deposited in Capital Gain Deposit Account Scheme

If the amount deposited in the Capital Gains Account Scheme in respect of which the

taxpayer has claimed exemption is not utilised within the specified period for purchase of

another agricultural land, then the unutilised amount (for which exemption is claimed)

will be taxed as income by way of long-term capital gains or short-term capital gain

(depending upon the nature of original capital gain) for the previous year in which the

specified period of 2 years gets over.

Illustration

Mr. Ramlal had purchased an agricultural land in April, 2012. Since the day of purchase

the land was used for agricultural purpose. The land was sold on 25th August, 2016 for

Rs. 25,20,000. Capital gain arising on sale of land amounted to Rs. 5,00,000.

He could not purchase another agricultural land by 31st July, 2017, however, in July,

2017 he deposited Rs. 5,00,000 in Capital Gains Account Scheme. He did not purchase

any agricultural land till 24th August, 2018. Will he be entitled to claim any exemption

under section 54B? If yes, can the exemption granted be revoked subsequently?

**

To claim exemption under section 54B, the taxpayer should purchase another agricultural

land within a period of two years from the date of transfer of old land. In this case, the

old land was transferred on 25th August, 2016, hence, he has to purchase another land

within a period of 2 years from 25th August, 2016, i.e., on or before24th August, 2018.

The old land was transferred in the year 2016-17 and the due date of filing the return of

income of the year 2016-17 is 31st July 2017. If Mr. Ramlal cannot purchase another

agricultural land by 31st July 2017, then he has to deposit Rs. 5,00,000 in Capital Gains

Account Scheme.

[As amended by Finance Act, 2016]

By depositing Rs. 5,00,000 in the Capital Gains Account Scheme he can claim exemption

of Rs. 5,00,000 under section 54B. In this case he has deposited Rs. 5,00,000 in the

Capital Gains Account Scheme and, hence, he can claim exemption of Rs. 5,00,000 under

section 54B. In other words, exemption under section 54B for the year 2016-17 will be

Rs. 5,00,000.

He has to utilise the funds deposited in the scheme to purchase another agricultural land

within the specified period of 2 years. If he does not purchase the land within a period of

2 years, then the amount (for which exemption is claimed) will be taxed as income by

way of long-term capital gains or short-term capital gain (depending upon the nature of

the original capital gain) for the previous year in which the specified period of 2 years

gets over.

In this case the period of 2 years gets over on 24th August, 2018. Mr. Ramlal has not

purchased any agricultural land till 24th August, 2018, hence, the exemption of Rs.

5,00,000 allowed in the year 2016-17 will be revoked and will be taxed as income by way

of long-term capital gains for the year 2018-19.

Illustration

Mr. Khushal had purchased an agricultural land in April, 2012. Since the day of purchase

the land was used for agricultural purpose. The land was sold on 25th August, 2016 for

Rs. 25,20,000. Capital gain arising on sale of land amounted to Rs. 5,00,000.

He could not purchase another agricultural land by 31st July, 2017, however, in July,

2017 he deposited Rs. 5,00,000 in Capital Gains Account Scheme. In January, 2018 he

withdrew Rs. 4,00,000 from the Capital Gains Account Scheme and purchased

agricultural land. Thereafter, he did not purchase any agricultural land till 24th August,

2018. Will he be entitled to claim any exemption under section 54B? If yes, will the

exemption granted be revoked subsequently?

**

To claim exemption under section 54B, the taxpayer should purchase another agricultural

land within a period of two years from the date of transfer of old land. In this case the old

land was transferred on 25th August, 2016, hence, he has to purchase another land within

a period of 2 years from the date of transfer, i.e., on or before24th August, 2018.

The old land was transferred in the year 2016-17 and the due date of filing the return of

income of the year 2016-17 is 31st July 2017. If Mr. Kuhshal cannot purchase another

agricultural land by 31st July, 2017, then he has to deposit Rs. 5,00,000 in Capital Gains

Account Scheme. By depositing Rs. 5,00,000 in the Capital Gains Account Scheme he

can claim exemption of Rs. 5,00,000 under section 54B.

In this case he has deposited Rs. 5,00,000 in the Capital Gains Account Scheme and,

hence, he can claim exemption of Rs. 5,00,000 under section 54B. In other words,

exemption under section 54B for the year 2016-17 will be Rs. 5,00,000.

He has to utilise the amount deposited in the scheme (i.e., Rs. 5,00,000) to purchase

agricultural land within the specified period of 2 years. If he does not purchase the

[As amended by Finance Act, 2016]

agricultural land within a period of 2 years, then the unutilised amount will be taxed as

income by way of long-term capital gains or short-term capital gain (depending upon the

nature of original capital gain) for the previous year in which the specified period of 2

years expires.

In this case the period of 2 years expires on 24th August, 2018. Hence, Mr. Khushal has

to purchase a land for Rs. 5,00,000upto 24th August, 2018, He has purchased agricultural

land worth Rs. 4,00,000 in January, 2018 and he has not utilized the remaining portion to

purchase any agricultural land till 24thAugust, 2018.Thus, the unutilised amount of Rs.

1,00,000 will be taxed as income by way of long-term capital gains of the year of expiry

of the specified period, i.e., 2018-19.

Illustration

Mr. Raju had purchased an agricultural land in April, 2012. Since the day of purchase the

land was used for agricultural purpose. This land was sold on 25th August, 2016 for Rs.

18,40,000. Capital gain arising on sale of land amounted to Rs. 3,00,000. He could not

purchase another agricultural land by 31st July, 2017, however, in July, 2017 he

deposited Rs. 5,00,000 in Capital Gains Account Scheme. He did not purchase any

agricultural land till 24th August, 2018. Will he be entitled to claim any exemption under

section 54B? If yes, will the exemption granted be revoked?

**

To claim exemption under section 54B, the taxpayer should purchase another agricultural

land within a period of two years from the date of transfer of old land. In this case the old

land was transferred on 25th August, 2016, hence, he has to purchase another land within

a period of 2 years from the date of transfer , i.e., on or before 24th August, 2018.

The old land was transferred in the year 2016-17 and the due date of filing the return of

income of the year 2016-17 is 31st July, 2017. If Mr. Raju cannot purchase another

agricultural land by 31st July, 2017, then he has to deposit Rs. 3,00,000 in Capital Gains

Account Scheme. By depositing Rs. 3,00,000 in the Capital Gains Account Scheme he

can claim exemption of Rs. 3,00,000 under section 54B. In this case, he has deposited

more amount, i.e., Rs. 5,00,000 in the Capital Gains Account Scheme, however, he will

be entitled to claim exemption only of Rs. 3,00,000. In other words, exemption under

section 54B for the year 2016-17 will be Rs. 3,00,000.

He has to utilise the funds deposited in the scheme to purchase another agricultural land

within the specified period of 2 years. If he does not purchase another agricultural land

within a period of 2 years, then the amount (for which exemption is claimed) will be

taxed as income by way of long-term capital gains or short-term capital gain (depending

upon the nature of original capital gain) for the previous year in which the specified

period of 2 years gets over.

In this case, the period of 2 years gets over on 24th August, 2018. Mr. Raju has not

purchased any agricultural land till 24th August, 2018, hence, the exemption of Rs.

3,00,000 allowed in the year 2016-17 will be revoked and will be taxed as income by way

of long-term capital gains for the year 2018-19.

[As amended by Finance Act, 2016]

Illustration

Mr. Vipul had purchased an agricultural land in April, 2012. Since the day of purchase

the land was used for agricultural purpose. This land was sold on 25th August, 2016 for

Rs. 28,40,000. Capital gain arising on sale of land amounted to Rs. 6,00,000. He could

not purchase another agricultural land by 31st July, 2017, however, in July, 2017 he

deposited Rs. 6,00,000 in Capital Gains Account Scheme. In March, 2018 he withdrew

Rs. 6,00,000 from the scheme and purchased a car from the said amount. Will he be

entitled to claim any exemption under section 54B? If yes, will the exemption granted be

revoked subsequently?

**

To claim exemption under section 54B, the taxpayer should purchase another agricultural

land within a period of two years from the date of transfer of old land. In this case the old

land was transferred on 25th August, 2016, hence, he has to purchase another land within

a period of 2 years from the date of transfer, i.e., on or before 24th August, 2018.

The old land was transferred in the year 2016-17 and the due date of filing the return of

income of the year 2016-17 is 31st July, 2017. If Mr. Vipul cannot purchase another

agricultural land by 31st July, 2017, then he has to deposit Rs. 6,00,000 in Capital Gains

Account Scheme. By depositing Rs. 6,00,000 in the Capital Gains Account Scheme he

can claim exemption of Rs. 6,00,000 under section 54B. In this case he has deposited Rs.

6,00,000 in the Capital Gains Account Scheme and, hence, will be entitled to claim

exemption only of Rs. 6,00,000. In other words, exemption under section 54B for the

year 2016-17 will be Rs. 6,00,000.

He has to utilise the funds deposited in the scheme to purchase another agricultural land

within the specified period of 2 years. The amount withdrawn from the scheme should be

used to purchase of agricultural land. If the amount withdrawn from the scheme is used

for any other purpose then it will be charged to tax as income by way of long-term capital

gain or short-term capital gain (depending upon the nature of original capital gain) of the

year of withdrawal.

In this case Mr. Vipul has withdrawn Rs. 6,00,000 from the scheme. Thus, he should

purchase agricultural land worth Rs. 6,00,000 in the year of withdrawal. However, he had

utilised the said amount to purchase a car and, hence, Rs. 6,00,000 will be charged to tax

as income by way of long-term capital gains of the year of withdrawal, i.e., year 2017-18.

[As amended by Finance Act, 2016]

MCQ ON EXEMPTION TO CAPITAL GAINS ON TRANSFER OF

AGRICULTURAL LAND

Q1. Section ______ gives relief to a taxpayer who sells his agricultural land and from the

sale proceeds he acquires another agricultural land.

(a) 54 (b) 54B

(c) 54EC (d) 54F

Correct answer : (b)

Justification of correct answer :

Section 54B gives relief to a taxpayer who sells his agricultural land and acquires another

agricultural land from the sale proceeds.

Thus, option (b) is the correct option.

Q2.The benefit of section 54B is available to all the persons except to an individual and a

HUF.

(a) True (b) False

Correct answer : (b)

Justification of correct answer :

The benefit of section 54B is available only to an individual or a HUF.

Thus, the statement given in the question is false and hence, option (b) is the correct

option.

Q3.To avail the benefit of section 54B, the assets transferred should be _______.

(a) A residential house property (b) A non-agricultural land

(c) An agricultural land (d) Bonds of National Highways Authority

of India

Correct answer : (c)

Justification of correct answer :

To avail the benefit of section 54B, the assets transferred should be an agricultural land.

Thus, option (c) is the correct option.

Q4.The agricultural land should be used by the individual or his parents for agricultural

purpose at least for a period of ______ immediately preceding the date of transfer.

(a) 2 years (b) 5 years

(c) 7 years (d) 10 years

Correct answer : (a)

Justification of correct answer :

The agricultural land should be used by the individual or his parents for agricultural

purpose at least for a period of two years immediately preceding the date of transfer.

Thus, option (a) is the correct option.

Q5.To avail the benefit of section 54B, the taxpayer should acquire another agricultural

landwithin a period of 3 years from the date of transfer of old agricultural land.

[As amended by Finance Act, 2016]

(a) True (b) False

Correct answer : (b)

Justification of correct answer :

To avail the benefit of section 54B, the taxpayer should acquire another agricultural land

within aperiod of two years from the date of transfer of old agricultural land.

Thus, the statement given in the question is false and hence, option (b) is the correct

option.

Q6.Exemption under section 54B will be lower of the following :

Amount of capital gains arising on transfer of agricultural land; or

Investment in new agricultural land [including the amount deposited in Capital

Gains Deposit Account Scheme]

(a)True (b) False

Correct answer : (a)

Justification of correct answer :

Exemption under section 54B will be lower of the following :

Amount of capital gains arising on transfer of agricultural land; or

Investment in new agricultural land [including the amount deposited in Capital

Gains Deposit Account Scheme]

Thus, the statement given in the question is true and hence, option (a) is the correct

option.

Q7.If a taxpayer purchases new agricultural land to claim exemption under section 54B

and subsequently he transfers the new agricultural land within a period of

__________from the date of its acquisition, than the benefit granted under section 54B

will be withdrawn.

(a) 3 years (b) 5 years

(c) 10 years (d) 12 years

Correct answer : (a)

Justification of correct answer :

If a taxpayer purchases new agricultural land to claim exemption under section 54B and

subsequently he transfers the new agricultural land within a period of 3 years from the

date of its acquisition, then the benefit granted under section 54B will be withdrawn.

Thus, option (a) is the correct option.

Q8.If till the date of filing the return of income, the capital gain arising on transfer of the

old land is not utilised (in whole or in part) for purchase of another agricultural land, then

the benefit of exemption can be availed by depositing the unutilised amount in

______________ in any branch of public sector bank.

(a) Current account (b) Saving account

(c) Capital Gains Deposit Account Scheme (d) Loan account

[As amended by Finance Act, 2016]

Correct answer : (c)

Justification of correct answer :

If till the date of filing the return of income, the capital gain arising on transfer of the old

land is not utilised (in whole or in part) for purchase of another agricultural land, then the

benefit of exemption can be availed by depositing the unutilised amount in Capital Gains

Deposit Account Scheme in any branch of public sector bank, in accordance with Capital

Gains Deposit Accounts Scheme, 1988 (hereafter referred as Capital Gains Account

Scheme).

Thus, option (c) is the correct option.

Q9.After the expiry of specified period of 2 years, the unutilised amount remained in the

Capital Gains Account Schemewill be taxed as income by way of long-term capital gains

or short-term capital gains (depending upon the nature of original capital gain) for the

previous year in which the specified period of 2 years gets over.

(a) True (b) False

Correct answer : (a)

Justification of correct answer :

After the expiry of specified period of 2 years, the unutilised amount remained in the

Capital Gains Account Schemewill be taxed as income by way of long-term capital gains

or short-term capital gains (depending upon the nature of original capital gain) for the

previous year in which the specified period of 2 years gets over.

Thus, the statement given in the question is true and hence, option (a) is the correct

option.

[As amended by Finance Act, 2016]

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Final Accounts of Banking Companies Problems and SolutionsDocument27 pagesFinal Accounts of Banking Companies Problems and Solutionsmy Vinay96% (57)

- Senior Citizen Investment PortfolioDocument5 pagesSenior Citizen Investment Portfoliovishwa shah50% (2)

- Mini-Case 3: Crosswell International and BrazilDocument4 pagesMini-Case 3: Crosswell International and BrazilAbdullah IsseNo ratings yet

- Smart Entry TypesDocument15 pagesSmart Entry TypeshubbyjoseNo ratings yet

- India's Top 10 Financial Scam: By-Mahendra ChoudharyDocument17 pagesIndia's Top 10 Financial Scam: By-Mahendra Choudharytest1217No ratings yet

- 6 FEOD AND DFSU ReportDocument45 pages6 FEOD AND DFSU ReportOsama HussainNo ratings yet

- International Finance Midterm TopicsDocument13 pagesInternational Finance Midterm TopicsAnisa TasnimNo ratings yet

- Noreen Ali Case Study SolutionDocument5 pagesNoreen Ali Case Study SolutionChintu WatwaniNo ratings yet

- The Loan Granting & Recovering Problems of Commercial Banks in BangladeshDocument22 pagesThe Loan Granting & Recovering Problems of Commercial Banks in BangladeshHossain Anirban Momin100% (1)

- Inflation AccountingDocument18 pagesInflation AccountingDivya Elizabeth Babu100% (1)

- The Institution of Engineers (India) : (For Member Technologist Applicants)Document8 pagesThe Institution of Engineers (India) : (For Member Technologist Applicants)dipinnediyaparambathNo ratings yet

- Cash Flow StatementDocument18 pagesCash Flow StatementSriram BastolaNo ratings yet

- Handbook of English 1 (STIER) - 1Document7 pagesHandbook of English 1 (STIER) - 1Sarah AnggrainiNo ratings yet

- Domestic and Foreign CapitalDocument26 pagesDomestic and Foreign CapitalJaved StylesNo ratings yet

- Testlet 1Document18 pagesTestlet 1jojojepNo ratings yet

- Study Schedule For December-2012 ExamDocument3 pagesStudy Schedule For December-2012 ExamRoha KhanNo ratings yet

- AFAR Preboards MergedDocument112 pagesAFAR Preboards Mergedpajarillagavincent15No ratings yet

- Group 6 Exercises 05022021 TTH ClassDocument8 pagesGroup 6 Exercises 05022021 TTH ClassShara Monique RolunaNo ratings yet

- CH 6 ITC GSTDocument23 pagesCH 6 ITC GSTHARSHIT DHANWANINo ratings yet

- Macro Final 2019Document124 pagesMacro Final 2019Sabiha SaeedNo ratings yet

- Analysis of Bank Mandiri's Health Level Based On Risk Profile, Good Corporate Governance, Earnings and Capital (Rgec)Document8 pagesAnalysis of Bank Mandiri's Health Level Based On Risk Profile, Good Corporate Governance, Earnings and Capital (Rgec)index PubNo ratings yet

- Plant, Assets, Natural Resources and Intangible AssetsDocument19 pagesPlant, Assets, Natural Resources and Intangible AssetsMonica SusiloNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceReema KhatiNo ratings yet

- Epayment Form - NewDocument3 pagesEpayment Form - NewVirender SainiNo ratings yet

- Infrastructure FinanceDocument7 pagesInfrastructure FinanceKaran VasheeNo ratings yet

- Develop and Use Saving PlanDocument55 pagesDevelop and Use Saving PlanAshenafi AbdurkadirNo ratings yet

- Computing Ledgers and The Political Ontology of The BlockchainDocument15 pagesComputing Ledgers and The Political Ontology of The BlockchainthebusstopworldNo ratings yet

- Till Date Banking of MayDocument11 pagesTill Date Banking of MayLoan LoanNo ratings yet

- Minutes Course Meeting ECON046Document4 pagesMinutes Course Meeting ECON046OSHI JOHRINo ratings yet

- Syllabus Mathematics of InvestmentDocument4 pagesSyllabus Mathematics of InvestmentAngel Omlas100% (1)