Professional Documents

Culture Documents

GSRT 11

GSRT 11

Uploaded by

rekha kumari0 ratings0% found this document useful (0 votes)

10 views1 pageThe document contains sales transaction data from various states in India including the type of transaction, place, sales tax rate, taxable value, and GSTIN for each transaction. A total of 24 transactions are listed with sales amounts ranging from Rs. 0 to Rs. 2645.72 and tax rates of 0.05, 0.18 across various states in India.

Original Description:

cvdsav

Original Title

gsrt11

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains sales transaction data from various states in India including the type of transaction, place, sales tax rate, taxable value, and GSTIN for each transaction. A total of 24 transactions are listed with sales amounts ranging from Rs. 0 to Rs. 2645.72 and tax rates of 0.05, 0.18 across various states in India.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageGSRT 11

GSRT 11

Uploaded by

rekha kumariThe document contains sales transaction data from various states in India including the type of transaction, place, sales tax rate, taxable value, and GSTIN for each transaction. A total of 24 transactions are listed with sales amounts ranging from Rs. 0 to Rs. 2645.72 and tax rates of 0.05, 0.18 across various states in India.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

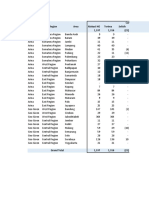

Type Place Of S Rate Applicable Taxable VaCess AmouE-Commerce GSTIN

E 21-Odisha 0.18 1584.75 0 10AAICA3918J1C8

E 29-Karnata 0.18 3217.8 0 10AAICA3918J1C8

E 23-Madhya 0.18 422.88 0 10AAICA3918J1C8

E 09-Uttar P 0.05 0 0 10AAICA3918J1C8

E 07-Delhi 0.05 1044.76 0 10AAICA3918J1C8

E 36-Telanga 0.18 0 0 10AAICA3918J1C8

E 08-Rajasth 0.18 423.73 0 10AAICA3918J1C8

E 06-Haryan 0.05 284.76 0 10AAICA3918J1C8

E 07-Delhi 0.18 1100 0 10AAICA3918J1C8

E 09-Uttar P 0.18 -211.02 0 10AAICA3918J1C8

E 06-Haryan 0.18 422.88 0 10AAICA3918J1C8

E 18-Assam 0.18 423.73 0 10AAICA3918J1C8

E 10-Bihar 0.05 949.52 0 10AAICA3918J1C8

E 29-Karnata 0.05 1329.52 0 10AAICA3918J1C8

E 36-Telanga 0.05 380 0 10AAICA3918J1C8

E 33-Tamil N 0.18 1945.76 0 10AAICA3918J1C8

E 27-Mahara 0.05 854.28 0 10AAICA3918J1C8

E 10-Bihar 0.18 2645.72 0 10AAICA3918J1C8

E 19-West Be 0.18 422.04 0 10AAICA3918J1C8

E 27-Mahara 0.18 253.39 0 10AAICA3918J1C8

E 20-Jharkha 0.05 380 0 10AAICA3918J1C8

E 20-Jharkha 0.18 972.03 0 10AAICA3918J1C8

E 37-Andhra 0.18 423.73 0 10AAICA3918J1C8

E 24-Gujarat 0.18 1268.64 0 10AAICA3918J1C8

You might also like

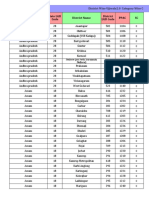

- University Institutions of National Importance Sl. No. States/Uts Research Institutions Arts, Science & Commerce Colleges Deemed UniversityDocument24 pagesUniversity Institutions of National Importance Sl. No. States/Uts Research Institutions Arts, Science & Commerce Colleges Deemed UniversityJatin TamgadgeNo ratings yet

- B2B 042023 09abepg1126a1zg GSTR2B 14052023Document12 pagesB2B 042023 09abepg1126a1zg GSTR2B 14052023Raja GuptaNo ratings yet

- List of Registered Recyclers of Used Lead Acid Batteries & Lead Wastes /scrapsDocument40 pagesList of Registered Recyclers of Used Lead Acid Batteries & Lead Wastes /scrapsRohit SoniNo ratings yet

- Political Party Wise Deposit ForfeitedDocument1 pagePolitical Party Wise Deposit Forfeitedeepoch587No ratings yet

- Pipeline TariffDocument7 pagesPipeline TariffRaihan Fuad100% (1)

- B2B 082022 09aqaps1668n1z7 GSTR2B 06102022Document7 pagesB2B 082022 09aqaps1668n1z7 GSTR2B 06102022birpal singhNo ratings yet

- AU1856Document2 pagesAU1856Rohit KiranNo ratings yet

- Political Party Wise Deposit ForefeitedDocument2 pagesPolitical Party Wise Deposit ForefeitedAniket MahaleNo ratings yet

- Baraiyarhat-Lifting Card TopsheetDocument2 pagesBaraiyarhat-Lifting Card TopsheetashikNo ratings yet

- Table 3A.3 - 2Document1 pageTable 3A.3 - 2PadmeshBadkarNo ratings yet

- GST InvoiceDocument6 pagesGST InvoiceChamundi MNo ratings yet

- TABLE 3A.2 (Ii) SLL Crimes Against Women (Crime Head-Wise & State/UT-wise) - 2019 (Continued)Document1 pageTABLE 3A.2 (Ii) SLL Crimes Against Women (Crime Head-Wise & State/UT-wise) - 2019 (Continued)aditi ranaNo ratings yet

- AST gstr2 Return SummaryDocument49 pagesAST gstr2 Return SummaryushaprakashNo ratings yet

- State and System-Wise Number of AYUSH Hospitals With Their Bed Strength in India As On 1st April 2007.odsDocument4 pagesState and System-Wise Number of AYUSH Hospitals With Their Bed Strength in India As On 1st April 2007.odsUttej RaoNo ratings yet

- State Wise Installed Capacity As On 30.06.2019Document2 pagesState Wise Installed Capacity As On 30.06.2019Bhom Singh NokhaNo ratings yet

- Daily Tracking Implementasi POSM & Gimmick 161221 NasionalDocument17 pagesDaily Tracking Implementasi POSM & Gimmick 161221 Nasional314 Riska PrimayantiNo ratings yet

- Merit-Cum-Means Scholarship Scheme For Minority CommunitiesDocument3 pagesMerit-Cum-Means Scholarship Scheme For Minority Communitiesswamijyoti100% (7)

- Circle Wise Break Up of Vacancies-JTODocument3 pagesCircle Wise Break Up of Vacancies-JTOpiksyNo ratings yet

- Statement Showing Sanctioned Strength, Working Strength and Vacancies of Judges in The Supreme Court of India and The High Courts (As On 01.01.2020)Document1 pageStatement Showing Sanctioned Strength, Working Strength and Vacancies of Judges in The Supreme Court of India and The High Courts (As On 01.01.2020)vishnuNo ratings yet

- MEI - GST Enrolment-Annexure ADocument1 pageMEI - GST Enrolment-Annexure AUday PatelNo ratings yet

- B2B 042023 09bippj9015e1z2 GSTR2B 14052023Document14 pagesB2B 042023 09bippj9015e1z2 GSTR2B 14052023Raja GuptaNo ratings yet

- BPCL Registration DetailsDocument1 pageBPCL Registration DetailsPraveen Kumar DubeyNo ratings yet

- 02 December PDFDocument3 pages02 December PDFNadun MaleeshaNo ratings yet

- Mechanics CircularDocument6 pagesMechanics CircularsrinivasNo ratings yet

- Component (Product 5) Lenght Width Thick Colour GrainDocument14 pagesComponent (Product 5) Lenght Width Thick Colour GrainarjunNo ratings yet

- Vacancy 1.08.2020Document1 pageVacancy 1.08.2020Samarth AgarwalNo ratings yet

- Gstin NumberDocument1 pageGstin NumberSatendra SharmaNo ratings yet

- Ioqm2021 Region Wise CuttoffsDocument1 pageIoqm2021 Region Wise CuttoffsAyush JhaNo ratings yet

- India ConstitutenciesDocument1,286 pagesIndia Constitutenciesநாராயணன் / Narain100% (1)

- Above 180 (GTR Than 10 Lakhs) 'NPA Stock Vs Resolution - 7.12.22Document112 pagesAbove 180 (GTR Than 10 Lakhs) 'NPA Stock Vs Resolution - 7.12.22sai narenNo ratings yet

- Emis Pd-Pontren Sulsel 2022Document1 pageEmis Pd-Pontren Sulsel 2022Asisten KuNo ratings yet

- Estoque Saida Diario - Raquel DiasDocument2 pagesEstoque Saida Diario - Raquel DiasEvan SilvaNo ratings yet

- District Wise&Categry Wise Conn Installed Ujjwala 2 ReportDocument108 pagesDistrict Wise&Categry Wise Conn Installed Ujjwala 2 ReportA JNo ratings yet

- Quad RingDocument2 pagesQuad RingAntonio Rivera VillavicencioNo ratings yet

- Rajkot Depot - ZC927C - SMPL Vadinar Route - 3 - 1Document4 pagesRajkot Depot - ZC927C - SMPL Vadinar Route - 3 - 1Ajay SinghNo ratings yet

- April 2016 DieselDocument7 pagesApril 2016 DieselaradhyaprateekNo ratings yet

- Allocation of Funds (Disbursement)Document1 pageAllocation of Funds (Disbursement)Shashikant MeenaNo ratings yet

- Tentative Vacancies For CT (GD) 2022 09022023Document7 pagesTentative Vacancies For CT (GD) 2022 09022023Vikas KardamNo ratings yet

- 3 4 CS PDFDocument2 pages3 4 CS PDFChutiya ChutiyaNo ratings yet

- Table 3a.2Document16 pagesTable 3a.2Dhandhan231No ratings yet

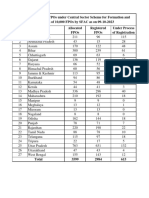

- State Wise Details of FPOs Under Central Sector Scheme For Formation and Promotion of 10,000 FPOs by SFAC As On 09-10-2023Document1 pageState Wise Details of FPOs Under Central Sector Scheme For Formation and Promotion of 10,000 FPOs by SFAC As On 09-10-2023Pranav BhatNo ratings yet

- Gstin ListDocument1 pageGstin Listbabaloo sharmaNo ratings yet

- B-School: Total Approved InstitutesDocument2 pagesB-School: Total Approved InstitutesHari SreyasNo ratings yet

- R18OCT21Document6 pagesR18OCT21ameenhaajNo ratings yet

- Financial ManagementDocument11 pagesFinancial ManagementTinatini BakashviliNo ratings yet

- 100 Cells FeatureDocument9 pages100 Cells FeatureAnonymous DUua3A5No ratings yet

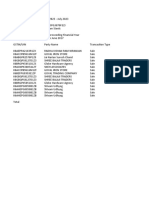

- GSTR1 Report - 07 - 23 - To - 07 - 23Document45 pagesGSTR1 Report - 07 - 23 - To - 07 - 23akshayNo ratings yet

- DC0998 2Document2 pagesDC0998 2BMSNo ratings yet

- Rajya Sabha Unstarred Question No. 2358 Initiatives For Promotion of Renewable Energy SourcesDocument2 pagesRajya Sabha Unstarred Question No. 2358 Initiatives For Promotion of Renewable Energy SourcesdsoNo ratings yet

- LT05 L1TP 173033 20110910 20200820 02 T1 VerDocument54 pagesLT05 L1TP 173033 20110910 20200820 02 T1 Vermerve1099No ratings yet

- Account Statement 779003724418032023Document2 pagesAccount Statement 779003724418032023NIKKI CHAUHANNo ratings yet

- R18NOV21Document6 pagesR18NOV21ameenhaajNo ratings yet

- Vehicleusagereport 9557Document4 pagesVehicleusagereport 9557tchikaysonNo ratings yet

- Moody Diagram (Plot of Colebrook's Correlation) : Fully Rough Flow - Complete Turbulence Transition ZoneDocument1 pageMoody Diagram (Plot of Colebrook's Correlation) : Fully Rough Flow - Complete Turbulence Transition ZoneCorrecaminos ZuñigaNo ratings yet

- UntitledDocument72 pagesUntitledVIKRAMNo ratings yet

- Annexure 1 - eOBC - 18 03 2021 CompressedDocument79 pagesAnnexure 1 - eOBC - 18 03 2021 CompressedRKKhatriNo ratings yet

- December Bill 2023Document3 pagesDecember Bill 2023shubhamNo ratings yet

- CRIME Against ChildrenDocument4 pagesCRIME Against Childrenfarhat khanNo ratings yet

- LoadingDocument2 pagesLoadingNikhil NagpalNo ratings yet