Professional Documents

Culture Documents

15 May Accounts Test

Uploaded by

Prashantu MerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

15 May Accounts Test

Uploaded by

Prashantu MerCopyright:

Available Formats

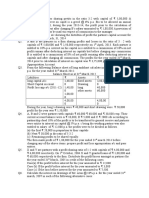

Q1 and Q2 – 3 marks each, Q3 – 4 marks Time : 45 minutes

Q1. Kavita, Meenakshi and Gauri are partners doing a paper business in Ludhiana. After the accounts of

partnership have been drawn up and closed, it was discovered that for the years ending 31st March 2013

and 2014, Interest on capital has been allowed to partners @ 6% p. a. although there is no provision for

interest on capital in the partnership deed. Their fixed capitals were 2,00,000; 1,60,000 and 1,20,000

respectively. During the last two years they had shared the profits as under:

Ratio Year

3:2:1 31 March 2014

5:3:2 31 March 2013

You are required to give necessary adjusting entry on April 1, 2014.

Q2. X and Y are partnership sharing profits and losses in the ratio 2 : 1. They decided to admit Z, their

manager as partner giving him 1/5 th share in profit. Z while a manager, was receiving a salary of 25,000

per annum plus a commission of 10% of the net profit after charging salary and commission.

It was also agreed that any excess amount which Z receives as partner (over his salary and commission)

will be borne by X. Profit for the year 3,22,000 before payment of salary and commission. Prepare Profit

and Loss Appropriation Account.

Q3. X, Y, and Z are partners sharing profits and losses in the ratio 7 : 5 : 4. Their balance sheet as at 31 st

March, 2022 stood as follows :

Liabilities Amount Assets Amount

Capital Accounts : Sundry Assets 6,00,000

X 2,00,000

Y 1,50,000

Z 1,20,000 4,70,000

General Reserve 75,000

Profit and Loss A/c 15,000

Creditors 40,000

6,00,000 6,00,000

st

Partners decided that with effect from (w.e.f.) 1 April, 2022, they will share profits and losses in the ratio

3 : 2 : 1. For this reason goodwill of the firm was valued at 1,50,000. The partners do not want to record

the goodwill and also do not want to distribute the general reserve and profits.

Pass the necessary journal entry and prepare new balance sheet.

You might also like

- Marketing and Sales ManualDocument17 pagesMarketing and Sales ManualWendimagen Meshesha Fanta89% (9)

- Wipro Offer LetterDocument14 pagesWipro Offer Letterkeerthana s0% (1)

- Social Media Marketing Secrets 2020 3 Books in 1 B088QN6CFRDocument324 pagesSocial Media Marketing Secrets 2020 3 Books in 1 B088QN6CFRmusfiq100% (1)

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Indian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursDocument5 pagesIndian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursRitaNo ratings yet

- AccountancyDocument18 pagesAccountancyMeena DhimanNo ratings yet

- Partnership Fundamentals 2Document6 pagesPartnership Fundamentals 2sainimanish170gmailcNo ratings yet

- 28 07 2023 - 344571Document4 pages28 07 2023 - 344571Boda TanviNo ratings yet

- Change in Profit Sharing Ratio QuestionsDocument3 pagesChange in Profit Sharing Ratio QuestionsTechnology worldNo ratings yet

- Partnership Mock Exam GuideDocument4 pagesPartnership Mock Exam GuideCleo Meguel AbogadoNo ratings yet

- Class 12Document33 pagesClass 12vaibhav dangiNo ratings yet

- Class XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Document3 pagesClass XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Lester Williams100% (1)

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- Partnership and Non-For-Profit OrganisationsDocument4 pagesPartnership and Non-For-Profit OrganisationsJoshi DrcpNo ratings yet

- 12 Accounts Half YearlyDocument5 pages12 Accounts Half YearlyRahul MajumdarNo ratings yet

- class 12th Accountancy Set ADocument6 pagesclass 12th Accountancy Set AjashanjeetNo ratings yet

- GCL Retirement & Death Practice Paper 1Document2 pagesGCL Retirement & Death Practice Paper 1Ananya BhargavaNo ratings yet

- FUNDAMENTAL OF PARTNERSHIP Class 12Document1 pageFUNDAMENTAL OF PARTNERSHIP Class 12Varun HurriaNo ratings yet

- Assignment Accountancy Class 12 PartnershipDocument4 pagesAssignment Accountancy Class 12 PartnershipVarun HurriaNo ratings yet

- Class 12th Accountancy Set BDocument6 pagesClass 12th Accountancy Set BjashanjeetNo ratings yet

- Assessement Test 5 - Partnership Accounts & Goodwill - Docx - 1660529707799Document2 pagesAssessement Test 5 - Partnership Accounts & Goodwill - Docx - 1660529707799Shreya PushkarnaNo ratings yet

- Saint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Document3 pagesSaint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Abhishek SharmaNo ratings yet

- Asm1 25560Document12 pagesAsm1 25560shivanshu11o3o6No ratings yet

- XII Accounts Test With SolutionDocument12 pagesXII Accounts Test With SolutionKritika Mahalwal100% (1)

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- AccountsDocument22 pagesAccountsRakesh AryaNo ratings yet

- Chapter - Partnership Accounts If There Is No Partnership DeedDocument8 pagesChapter - Partnership Accounts If There Is No Partnership DeedVijayasri KumaravelNo ratings yet

- Cheque in Profit Sharing RatioDocument3 pagesCheque in Profit Sharing Ratioxjnk6fwfvhNo ratings yet

- Introduction To Partnership AccountsDocument20 pagesIntroduction To Partnership Accountsanon_672065362100% (1)

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- 1,60,000. C Is Admitted and New Profit Sharing Ratio Is Agreed at 6: 9Document6 pages1,60,000. C Is Admitted and New Profit Sharing Ratio Is Agreed at 6: 9Indra Kumar TiwariNo ratings yet

- Change in Profit RatioDocument10 pagesChange in Profit RatioHansika SahuNo ratings yet

- Retirement and Death (Revision) PDFDocument7 pagesRetirement and Death (Revision) PDFBHUMIKA JAINNo ratings yet

- Question Bank Accountancy (055) Class XiiDocument5 pagesQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNo ratings yet

- Wa0041.Document8 pagesWa0041.Pieck AckermannNo ratings yet

- Wa0011.Document6 pagesWa0011.Pieck AckermannNo ratings yet

- 12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationDocument3 pages12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationHari SharmaNo ratings yet

- Xii Acc WorksheetssDocument55 pagesXii Acc WorksheetssUnknown patelNo ratings yet

- Xii Acc Worksheetss-1-29Document29 pagesXii Acc Worksheetss-1-29Unknown patelNo ratings yet

- Accountancy Sample Paper Grade 12Document9 pagesAccountancy Sample Paper Grade 12priya longaniNo ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- 12 Accounts 2020 21 Practice Paper 3Document9 pages12 Accounts 2020 21 Practice Paper 3Vijey RamalingamNo ratings yet

- Practice Paper 2Document1 pagePractice Paper 2s99749649No ratings yet

- XII ACC 1st Online Pre-Board Exam QP 2020-21Document11 pagesXII ACC 1st Online Pre-Board Exam QP 2020-21Melvin CristoNo ratings yet

- 9 Partnership Question 21Document11 pages9 Partnership Question 21kautiNo ratings yet

- Accountancy Pre Board 2Document5 pagesAccountancy Pre Board 2Akshit kumar 10 pinkNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- 11 Sample PaperDocument40 pages11 Sample Papergaming loverNo ratings yet

- Paper For Term-1 2020-21 For Accountancy Xii PDFDocument11 pagesPaper For Term-1 2020-21 For Accountancy Xii PDFPrashil AgrawalNo ratings yet

- Cbse Questions Change in PSRDocument4 pagesCbse Questions Change in PSRDeepanshu kaushikNo ratings yet

- Fixed and Flucuating Capital AccountDocument3 pagesFixed and Flucuating Capital AccountArun AroraNo ratings yet

- 1 TEST, 2020-21 Class: Xii AccountancyDocument1 page1 TEST, 2020-21 Class: Xii AccountancyKul DeepNo ratings yet

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- Assessement Test 6 - Change of PSR - Docx - 1661182024584Document2 pagesAssessement Test 6 - Change of PSR - Docx - 1661182024584Shreya PushkarnaNo ratings yet

- RETIREMENT WORK SHEET SOLUTIONS FOR ACCOUNTANCY GRADE 12Document5 pagesRETIREMENT WORK SHEET SOLUTIONS FOR ACCOUNTANCY GRADE 12priya longaniNo ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Asm 25560Document9 pagesAsm 25560shivanshu11o3o6No ratings yet

- 12 Accountancy Accounting For Partnership Firms Fundamentals Impq 3Document5 pages12 Accountancy Accounting For Partnership Firms Fundamentals Impq 3Adam ZakriNo ratings yet

- Half Yearly Examination (2015 - 16) Class - XII General InstructionsDocument5 pagesHalf Yearly Examination (2015 - 16) Class - XII General Instructionsmarudev nathawatNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Istiqlal Ramadhan Rasyid - 11180820000040 - Latihan Soal AKM 1Ch.5Document3 pagesIstiqlal Ramadhan Rasyid - 11180820000040 - Latihan Soal AKM 1Ch.5Istiqlal RamadhanNo ratings yet

- Company Profile Law Firm Getri, Fatahul & Co. English VersionDocument9 pagesCompany Profile Law Firm Getri, Fatahul & Co. English VersionArip IDNo ratings yet

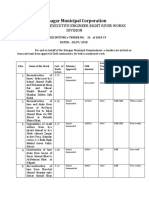

- Srinagar Municipal Corporation: Office of The Executive Engineer Right River Works DivisionDocument7 pagesSrinagar Municipal Corporation: Office of The Executive Engineer Right River Works DivisionBeigh Umair ZahoorNo ratings yet

- Noakhali Gold Foods Limited: Project CostDocument19 pagesNoakhali Gold Foods Limited: Project Costaktaruzzaman bethuNo ratings yet

- Cips November 2014 Examination TimetableDocument1 pageCips November 2014 Examination TimetableajayikayodeNo ratings yet

- Sap Press Catalog 2008 SpringDocument32 pagesSap Press Catalog 2008 Springmehul_sap100% (1)

- BuddDocument34 pagesBuddPeishi Ong50% (2)

- Domino's Pizza SWOT AnalysisDocument17 pagesDomino's Pizza SWOT AnalysisNora FahsyaNo ratings yet

- INSTRUCTIONS: Write Your Final Answer in The Answer Sheet. NO ERASURES ALLOWEDDocument18 pagesINSTRUCTIONS: Write Your Final Answer in The Answer Sheet. NO ERASURES ALLOWEDSandra Mae CabuenasNo ratings yet

- Fringe Benefits AnswersDocument5 pagesFringe Benefits AnswersJonnah Grace SimpalNo ratings yet

- Marketing Practices by FMCG Companies For Rural Market: Institute of Business Management C.S.J.M University KanpurDocument80 pagesMarketing Practices by FMCG Companies For Rural Market: Institute of Business Management C.S.J.M University KanpurDeepak YadavNo ratings yet

- Adani's Holistic Approach for India's FutureDocument26 pagesAdani's Holistic Approach for India's FutureRow Arya'nNo ratings yet

- Affordable Lawn Care Financial StatementsDocument8 pagesAffordable Lawn Care Financial StatementsTabish TabishNo ratings yet

- FB - Solution Readiness Dashboard - L2 - SP06Document34 pagesFB - Solution Readiness Dashboard - L2 - SP06Alison MartinsNo ratings yet

- The Management of Organizational JusticeDocument16 pagesThe Management of Organizational Justicelucianafresoli9589No ratings yet

- Analyzing Financial Performance with Profit & Loss and Balance SheetsDocument27 pagesAnalyzing Financial Performance with Profit & Loss and Balance SheetssheeluNo ratings yet

- Ingersoll Rand Sec B Group 1Document8 pagesIngersoll Rand Sec B Group 1biakNo ratings yet

- 8th Mode of FinancingDocument30 pages8th Mode of FinancingYaseen IqbalNo ratings yet

- Banking Reforms in IndiaDocument6 pagesBanking Reforms in IndiaChaitanya Athyala0% (1)

- Everyday EthicsDocument2 pagesEveryday EthicsJess HollNo ratings yet

- ACLC College Tacloban Marketing PrinciplesDocument70 pagesACLC College Tacloban Marketing PrinciplesSherwin HidalgoNo ratings yet

- Unit 3-Strategy Formulation and Strategic Choices: Group MemberDocument12 pagesUnit 3-Strategy Formulation and Strategic Choices: Group MemberBaken D DhungyelNo ratings yet

- Business Model and Sustainability AnalysisDocument11 pagesBusiness Model and Sustainability AnalysisAseem GargNo ratings yet

- Riding The VUCA Wave (Indian Management, Nov 2017)Document5 pagesRiding The VUCA Wave (Indian Management, Nov 2017)Suhayl AbidiNo ratings yet

- Motivation QuizDocument3 pagesMotivation QuizBEEHA afzelNo ratings yet

- Introduction To PaintsDocument43 pagesIntroduction To Paintstwinklechoksi100% (1)

- Cloud Operations PlaybookDocument127 pagesCloud Operations PlaybookSantosh Kumar100% (1)