Professional Documents

Culture Documents

8 MCQ - Overview of Risk-Based Audit Process

Uploaded by

Raisa Lidasan0 ratings0% found this document useful (0 votes)

109 views1 pageThis document provides an overview of the risk-based audit process and includes multiple choice questions about auditing. It discusses the inherent limitations of an audit, the responsibilities of management and auditors, obtaining sufficient audit evidence, documentation requirements, and factors that create demand for external audit services. The document emphasizes that auditors are responsible for obtaining sufficient appropriate audit evidence through designed audit procedures and maintaining technical knowledge of accounting, auditing standards, industries and developing computer skills.

Original Description:

Chapter 8 MCQ Auditing and Assurance

Original Title

8 MCQ_OVERVIEW OF RISK-BASED AUDIT PROCESS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of the risk-based audit process and includes multiple choice questions about auditing. It discusses the inherent limitations of an audit, the responsibilities of management and auditors, obtaining sufficient audit evidence, documentation requirements, and factors that create demand for external audit services. The document emphasizes that auditors are responsible for obtaining sufficient appropriate audit evidence through designed audit procedures and maintaining technical knowledge of accounting, auditing standards, industries and developing computer skills.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

109 views1 page8 MCQ - Overview of Risk-Based Audit Process

Uploaded by

Raisa LidasanThis document provides an overview of the risk-based audit process and includes multiple choice questions about auditing. It discusses the inherent limitations of an audit, the responsibilities of management and auditors, obtaining sufficient audit evidence, documentation requirements, and factors that create demand for external audit services. The document emphasizes that auditors are responsible for obtaining sufficient appropriate audit evidence through designed audit procedures and maintaining technical knowledge of accounting, auditing standards, industries and developing computer skills.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

CHAPTER 8: OVERVIEW OF RISK-BASED AUDIT PROCESS

BBBDDADBBBBDDD

Multiple Choice Questions

1. Which of the following is included as part of the principles governing an audit?

b. An audit has inherent limitations such that auditor cannot provide absolute assurance about whether the

financial statements are free of misstatement.

2. Which of the following statements is true about the audit opinion formulation process?

b. The audit opinion formulation process is based on the premise that management has responsibility to

prepare the financial statements and maintain internal control over financial reporting.

3. Which of the following activities is not part of the activities within the audit opinion formulation process?

b. The auditor determines the appropriate nonaudit consulting services to provide to the client.

4. Which of the following is not one of the management assertions?

1. Completeness

2. Existence

3. Rights and obligations

d.They are all management assertions.

5. Which management assertion addresses whether the components of the financial statements are properly

classified, described, and disclosed?

d. Presentation and disclosure

6. Which of the following is a true statement regarding audit evidence and audit procedures?

a. The auditor has a responsibility to design and perform audit procedures to obtain sufficient appropriate

audit evidence.

7. Which of the following items should be included in audit documentation?

1. Procedures performed

2. Audit evidence examined

3. Conclusions reached with respect to relevant financial statement assertions

d.All of the above should be included

8. Which of the following statements is a false statement regarding audit documentation?

b.The only purpose of audit documentation is to provide evidence that the audit was planned and performed

in accordance with auditing standards.

9. Which of the following procedures is least likely to be performed during the final phase of the audit opinion

formulation process?

b. Performance of preliminary analytical review procedures.

10. Which of the following factors does not create a demand for external audit services?

b.Requirement of PICPA.

11. Which of the following expectations can users of the audit report reasonably expect with regards to the audited

financial statements?

b.The financial statements are presented fairly according to the substance of PFRS.

12. Which of the following parties are involved in preparing and auditing financial statements?

d. External auditor

13. Which of the following are the responsibilities of the external auditor in auditing financial statements?

1. Maintaining internal controls and preparing financial reports

2. Providing internal assurance on internal control and financial reports

3. Providing internal oversight of the reporting process

d.None of the above.

14. In terms of technical knowledge and expertise, which of the following should external auditors do?

1. Understand accounting and auditing authoritative literature.

2. Develop industry and client-specific knowledge.

3. Develop and apply computer skills

d.All of the above.

You might also like

- Activity - Overview To FS Audit & Risk-Based AuditDocument3 pagesActivity - Overview To FS Audit & Risk-Based AuditGia Sarah Barillo BandolaNo ratings yet

- Activity - Overview To FS Audit & Risk-Based AuditDocument3 pagesActivity - Overview To FS Audit & Risk-Based AuditDolorNo ratings yet

- Overview of AuditingDocument7 pagesOverview of Auditingharley_quinn11No ratings yet

- PSA 100 - Framework of Assurance EngagementsDocument6 pagesPSA 100 - Framework of Assurance EngagementsDaren Dame Jodi RentasidaNo ratings yet

- Auditing Theory SalosagcolDocument4 pagesAuditing Theory SalosagcolYuki CrossNo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersLeonard Cañamo100% (1)

- Auditing Theory MCQs by Salosagcol With AnswersDocument31 pagesAuditing Theory MCQs by Salosagcol With AnswersYeovil Pansacala79% (62)

- Introduction To Assurance and Non Assurance - MULTIPLE CHOICES QUESTIONSDocument8 pagesIntroduction To Assurance and Non Assurance - MULTIPLE CHOICES QUESTIONSReynan E. BolisayNo ratings yet

- Acctg 14 Final ExamDocument8 pagesAcctg 14 Final ExamErineNo ratings yet

- AT Quizzer 4 - Profl ResponsibilitiesDocument15 pagesAT Quizzer 4 - Profl Responsibilitieslyndon delfinNo ratings yet

- At Quizzer 3 - (Profl Responsibilities) FEU MakatiDocument15 pagesAt Quizzer 3 - (Profl Responsibilities) FEU Makatiiyah100% (1)

- Auditing Theory Mcqs by Salosagcol With AnswersDocument50 pagesAuditing Theory Mcqs by Salosagcol With AnswersAnthony Koko CarlobosNo ratings yet

- Ethical Obligations and Decision Making in Accounting Text and Cases 2nd Edition Mintz Test BankDocument41 pagesEthical Obligations and Decision Making in Accounting Text and Cases 2nd Edition Mintz Test Bankhungden8pne100% (30)

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersCharilyn RemigioNo ratings yet

- Audit TheoryDocument17 pagesAudit TheoryFrancis Martin100% (2)

- Aud ThEORY 2nd PreboardDocument11 pagesAud ThEORY 2nd PreboardJeric TorionNo ratings yet

- MCQ - Auditing - PL PDFDocument31 pagesMCQ - Auditing - PL PDFWesley Smith73% (44)

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Aud ThEORY - 2nd PreboardDocument11 pagesAud ThEORY - 2nd PreboardKim Cristian MaañoNo ratings yet

- Audit TheoDocument6 pagesAudit TheoVillapando GemaNo ratings yet

- Feu - MakatiDocument15 pagesFeu - MakatiRica RegorisNo ratings yet

- DocxDocument30 pagesDocxrandomlungs121223No ratings yet

- Acp 102 FTDocument7 pagesAcp 102 FTLyca SorianoNo ratings yet

- Audtheo Part 2Document2 pagesAudtheo Part 2MichNo ratings yet

- MCQ - Intro To AuditDocument13 pagesMCQ - Intro To Auditemc2_mcv74% (27)

- Lebanese Association of Certified Public Accountants - Audit February Exam 2020 Extra SessionDocument8 pagesLebanese Association of Certified Public Accountants - Audit February Exam 2020 Extra Sessionjifri syamNo ratings yet

- Auditing Theory - 2Document11 pagesAuditing Theory - 2Kageyama HinataNo ratings yet

- 2024-04-15T112315.301Document3 pages2024-04-15T112315.301Donny EmanuelNo ratings yet

- Chapter7 QuizzerDocument5 pagesChapter7 Quizzermisonim.eNo ratings yet

- All ExamsDocument135 pagesAll Examsfaith050883% (6)

- Assignment 1 in Auditing TheoryDocument6 pagesAssignment 1 in Auditing TheoryfgfsgsrgrgNo ratings yet

- Module 1 Auditing ConceptsDocument21 pagesModule 1 Auditing ConceptsDura LexNo ratings yet

- MCQ Comprehensive ActivityDocument13 pagesMCQ Comprehensive ActivityMicaela MarimlaNo ratings yet

- JHLKHNDocument114 pagesJHLKHNgladsNo ratings yet

- Chapter 6 MC Bank For Opportunity-Student VersionDocument8 pagesChapter 6 MC Bank For Opportunity-Student VersionLivia WangNo ratings yet

- Audtheo Part 3Document3 pagesAudtheo Part 3MichNo ratings yet

- Auditing Reviewer 3Document3 pagesAuditing Reviewer 3Sheena ClataNo ratings yet

- Auditing TheoryDocument10 pagesAuditing TheoryAnna Mae SanchezNo ratings yet

- Aud Module 1-5Document23 pagesAud Module 1-5yaanvinaNo ratings yet

- Mod 1 Auditing ConceptsDocument17 pagesMod 1 Auditing ConceptsDavid DavidNo ratings yet

- AT 2nd Monthly AssessmentDocument4 pagesAT 2nd Monthly AssessmentreymarkgalasinaoNo ratings yet

- Q1 - Q4 - Prelim Exam ACC5111 - Auditing and Assurance PrinciplesDocument81 pagesQ1 - Q4 - Prelim Exam ACC5111 - Auditing and Assurance Principlesartemis100% (1)

- DocDocument13 pagesDocMequen Chille QuemadoNo ratings yet

- Auditing Merged IA - AFRIYIE YAW ADDAEDocument33 pagesAuditing Merged IA - AFRIYIE YAW ADDAElehbhronephilipNo ratings yet

- CPA ReviewerDocument8 pagesCPA ReviewerSer Crz JyNo ratings yet

- Auditing TheoryDocument5 pagesAuditing Theoryblackphoenix303No ratings yet

- Questionnaires in Assurance EngagementsDocument25 pagesQuestionnaires in Assurance EngagementsRandy ManzanoNo ratings yet

- Department of Accountancy: Page - 1Document18 pagesDepartment of Accountancy: Page - 1Noro0% (1)

- Aud 310 Test 3 and Memo 2018Document12 pagesAud 310 Test 3 and Memo 2018Shilongo OliviaNo ratings yet

- Auditing Theory Final ReviewerDocument17 pagesAuditing Theory Final ReviewerYmmalen MadeloNo ratings yet

- Audit December 2017 EngDocument17 pagesAudit December 2017 EngNthabiseng ButsanaNo ratings yet

- Audit Assessment True or False and MCQ - CompressDocument8 pagesAudit Assessment True or False and MCQ - CompressHazel BawasantaNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Audit Engagement Strategy (Driving Audit Value, Vol. III): The Best Practice Strategy Guide for Maximising the Added Value of the Internal Audit EngagementsFrom EverandAudit Engagement Strategy (Driving Audit Value, Vol. III): The Best Practice Strategy Guide for Maximising the Added Value of the Internal Audit EngagementsNo ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- CMA CGM - Consolidated Financial Statements - December 2018 - SignedDocument82 pagesCMA CGM - Consolidated Financial Statements - December 2018 - SignedSanchit RathiNo ratings yet

- Assets Misappropriation in The Malaysian Public AnDocument5 pagesAssets Misappropriation in The Malaysian Public AnRamadona SimbolonNo ratings yet

- Chap 3 Audit PlanningDocument12 pagesChap 3 Audit PlanningYitera SisayNo ratings yet

- 2019 AC3093 Main PDFDocument32 pages2019 AC3093 Main PDFJoe LagalaNo ratings yet

- Guide On Cooperative Audit PDFDocument25 pagesGuide On Cooperative Audit PDFNichole DouglasNo ratings yet

- Company AuditDocument30 pagesCompany AuditChutmaarika GoteNo ratings yet

- Wiley Part 2 Domain 2Document36 pagesWiley Part 2 Domain 2Rajeshwari MgNo ratings yet

- Chapter 13 - AUDIT PRINCIPLESDocument38 pagesChapter 13 - AUDIT PRINCIPLESdipikamalpani1402No ratings yet

- A - 4 Ch01 Internal Control Objectives, Principles, ModelsDocument31 pagesA - 4 Ch01 Internal Control Objectives, Principles, ModelsBlacky PinkyNo ratings yet

- Village Development Committee - Capacity Assessment ToolDocument36 pagesVillage Development Committee - Capacity Assessment ToolDejan Šešlija100% (2)

- Aaa Examiner's Report March June 2022Document20 pagesAaa Examiner's Report March June 2022Busch LearningNo ratings yet

- Branch AuditDocument88 pagesBranch AudithiralmojidraNo ratings yet

- Cag Report On Local Governance in Kerala 2004 - 2005Document132 pagesCag Report On Local Governance in Kerala 2004 - 2005K RajasekharanNo ratings yet

- Audit and Internal ReviewDocument5 pagesAudit and Internal Reviewisaac animNo ratings yet

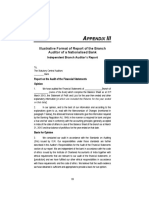

- Illustrative Branch Audit Report FormatDocument5 pagesIllustrative Branch Audit Report FormatCA K Vijay SrinivasNo ratings yet

- Sip ReportDocument114 pagesSip Reportprincy chauhanNo ratings yet

- Audit Reports: Statements Is Contained in TheDocument10 pagesAudit Reports: Statements Is Contained in TheElaine Joyce GarciaNo ratings yet

- Internal ISO Auditor TrainingDocument46 pagesInternal ISO Auditor TrainingCharles Bill Eldredge100% (2)

- Company Auditor's ReportDocument11 pagesCompany Auditor's ReportVinayak SaxenaNo ratings yet

- Audit Report Disclaimer of OpinionDocument6 pagesAudit Report Disclaimer of OpinionMariam MohamedNo ratings yet

- Article-The Inter Branch Adjustments - Time Bomb Inside Bank Balance SheetsDocument18 pagesArticle-The Inter Branch Adjustments - Time Bomb Inside Bank Balance SheetsRijesh RNNo ratings yet

- AUD-1stPB 10.22Document14 pagesAUD-1stPB 10.22Harold Dan AcebedoNo ratings yet

- MGMT Audit Report WritingDocument28 pagesMGMT Audit Report WritingAndrei IulianNo ratings yet

- Sa 510Document14 pagesSa 510Narasimha Akash100% (1)

- Impact Code of Ethics To IaDocument25 pagesImpact Code of Ethics To Iahafizie07No ratings yet

- Audit and Internal ReviewDocument6 pagesAudit and Internal ReviewkhengmaiNo ratings yet

- Isago Q5iams Auditee Manual Ed2 Sep 10Document31 pagesIsago Q5iams Auditee Manual Ed2 Sep 10Hatem Ibrahim100% (1)

- Chapter 17 ReportsDocument42 pagesChapter 17 ReportsArizal Zul LathiifNo ratings yet

- CPA Review: Excel Professional Services IncDocument100 pagesCPA Review: Excel Professional Services IncMmNo ratings yet

- Day 5 PresentationDocument3 pagesDay 5 PresentationIftekhar-Ul- IslamNo ratings yet