Professional Documents

Culture Documents

Managing Withholding Taxesfor Brazil

Uploaded by

Luiz A M V BarraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managing Withholding Taxesfor Brazil

Uploaded by

Luiz A M V BarraCopyright:

Available Formats

Managing Withholding Taxes for

ERP CLOUD

Brazil

Table of Contents

1. Purpose of the Document ....................................................................................................................2

2. Assumptions and Prerequisites ............................................................................................................2

3. Withholding Tax Structure for Brazil ....................................................................................................2

4. Withholding Tax Processing for Brazil ..................................................................................................3

A) Withholding Tax Calculation: Calculation Point = Invoice ............................................................4

B) Withholding Tax Calculation: Calculation Point = Payment .........................................................6

5. Withholding Tax Scenarios for Brazil....................................................................................................9

A) Supplier Types ...............................................................................................................................9

B) Period Based Threshold Computations ......................................................................................15

C) Deductions ..................................................................................................................................17

D) Tax Amount Withheld by Other Companies ...............................................................................23

E) Prepayments ...............................................................................................................................24

F) Withholding on Transaction Tax .................................................................................................25

1. Purpose of the Document

This document describes how to manage withholding taxes for Brazil using Oracle ERP Cloud. A sample

configuration is explained with examples of typical withholding tax scenarios in Brazil.

The following withholding taxes are discussed:

• IRRF_PF: Federal withholding tax that is applicable for services provided by persons

• IRRF_PJ: Federal withholding tax that is applicable for services provided by companies

• INSS_PF: Social security withholding tax that is applicable for services provided by persons

• INSS_PJ: Social security withholding tax that is applicable for services provided by companies

• PIS/COFINS/CSLL: Federal contribution withholding tax that is applicable for services provided by

companies

• ISS - City (municipal) withholding tax that is applicable for services provided by companies and persons

2. Assumptions and Prerequisites

The following prerequisites are required before you can set up withholding taxes for Brazil:

1. Cloud Security

Assign the predefined Tax Manager job role to the user. For more information on predefined job roles,

see the Oracle Applications Cloud Security Reference for Common Features guide at

http://docs.oracle.com.

2. Enterprise Structure

Model your enterprise to meet your legal and management objectives. For more information on

configuring enterprise structures, see the Using Rapid Implementation Spreadsheets chapter in the

Oracle Financials Cloud Getting Started with Your Implementation guide at http://docs.oracle.com.

3. Common Setups for Payables and Payments

For more information on implementing Oracle Financials Cloud, see the Oracle Financials Cloud Getting

Started with Your Implementation guide at http://docs.oracle.com.

Note: You must set up Configuration Owner Tax Options in Oracle Fusion Tax for Payables events such as

prepayment invoices and standard invoices to enable withholding tax calculation.

3. Withholding Tax Structure for Brazil

The sample withholding tax configuration for Brazil is provided using the Rapid Implementation (RI) sheets (Tax

Configuration Workbook). You can use these spreadsheets to upload withholding tax setups to Oracle ERP

Cloud.

Note: This is a sample setup. The actual configuration may vary based on your requirements. Make the

necessary modifications to the RI sheets before uploading them.

2 | MANAGING WITHHOLDING TAXES FOR BRAZIL

For more information on implementing withholding tax, see the Define Withholding Tax Configuration section in

the Tax Configuration chapter of the Oracle Financials Cloud Implementing Tax guide at http://docs.oracle.com.

4. Withholding Tax Processing for Brazil

In Brazil, withholding taxes are levied on services rendered by persons or companies at the time of recording an

invoice, or at the time of making an invoice payment.

With Oracle ERP Cloud, you can process withholding tax either at invoice validation or invoice payment. The

processing is based on the configuration at the Configuration Owner Tax Options level and the Tax level, which

control the withholding tax calculation at the invoice or payment event.

At Configuration Owner Tax Options Level

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Configuration Owner Tax Options.

4. Search for Event Class Processing Controls.

5. For the Prepayment Invoices and Standard Invoices event classes, set the Calculation Point to Both.

At Tax Level

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Taxes > Controls and Defaults > Calculation Point.

4. Set the Calculation Point to Invoice or Payment.

3 | MANAGING WITHHOLDING TAXES FOR BRAZIL

A) Withholding Tax Calculation: Calculation Point = Invoice

Example

A supplier provides services to an organization based in Sao Paulo (SP) and issues invoices to that company. The

payables clerk enters an invoice with the following transaction line in Payables and validates the invoice.

Payables Transaction Line

Line Type Product Type Amount

1 Item Service 2000 BRL

At invoice validation, the following tax determination processes run for all the withholding taxes with a tax

calculation point of Invoice:

Tax Determination Processes

Order Process Name Activities Included Components Used Result

1. Determine Identify the Configuration options for the Applicable regime =

Applicable Tax applicable tax withholding tax regime <User-defined

Regimes regimes withholding tax

regime>

2. Determine Place Identify the Based on the location Tax jurisdiction =

of Supply and Tax jurisdiction and place (Country) of the transaction Brazil

Jurisdiction of supply

3. Determine Tax Consider the taxes Tax Applicability Rules Applicable tax = INSS

Applicability based on the tax Tax conditions – _PF

applicability rule for 1. Bill-From Party’s

each tax Registration Status =

Registered

2. Product Type = Services

3. Party Fiscal Classification

Supplier = Person

4. Determine Tax Determine the party INSS_PF Definition > Tax Rule Bill-from party

Registration type to derive the tax Defaults > Tax Registration

registration for each

applicable tax

5. Determine Tax Consider the tax User-defined tax status = Standard

Status statuses of applicable Standard

taxes

INSS_PF rule defaults >

Indirect defaults > Tax Status

= Standard

4 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Order Process Name Activities Included Components Used Result

6. Determine Tax Consider the tax Tax Rate Rules Applicable tax rate

Rate rates of each =11%

applicable tax status

of each applicable tax

7. Determine Determine the Standard Taxable Basis Taxable basis = Line

Taxable Basis taxable basis on Formula = STANDARD_TB amount of 2000 BRL

which the tax rate for

each tax is applied

8. Calculate Taxes Identify the tax Standard Tax Calculation Taxable basis * tax

calculation formula Formula = STANDARD_TC rate = 2000 *11%

and calculate the -220 BRL

taxes

Withholding Tax Line

After the tax determination process completes, Oracle ERP Cloud inserts invoice lines for the Tax type, i.e., one

line for each applicable withholding tax. In this example, there is one tax line for INSS_PF Tax.

Tax Tax Regime Tax Tax Tax Tax Tax

Line Name Status Jurisdiction Rate Amount

1 <User-defined withholding tax INSS_PF Standard Brazil 11% -220 BRL

regime>

After the withholding tax line is added, the distributions for transaction and withholding tax lines are generated.

Line Account Class Distribution Type Amount

1 Item Expense Item 2000.00

2 Withholding Tax Withholding Tax -220.00

Total 1780.00 BRL

After the accounting successfully completes, the following accounting lines are generated for the invoice:

Account Class Account Type Debit Credit

Item Expense Expense 2000.00

Liability Liability 220.00

Liability Liability 2000.00

Withholding Tax Liability 220.00

Total 2220.00 2220.00

5 | MANAGING WITHHOLDING TAXES FOR BRAZIL

B) Withholding Tax Calculation: Calculation Point = Payment

Assume the invoice is paid in Oracle Fusion Payments.

At invoice payment, the following tax determination processes run for all the withholding taxes with a tax

calculation point of Payment:

Tax Determination Processes

Order Process Activities Components Used Result

Name Included

1. Determine Identify the Configuration Applicable regime = <User-defined

Applicable applicable tax options for the withholding tax regime>

Tax Regimes regimes withholding tax

regime

2. Determine Identify the Direct defaults from Tax jurisdiction = Brazil

Place of jurisdiction the tax definition

Supply and and place of

Tax supply

Jurisdiction

3. Determine Consider the Tax Applicability Applicable tax = IRRF_PF

Tax taxes based Rules

Applicability on the tax Tax conditions –

applicability 1. Bill-From Party’s

rule for each Registration

tax Status =

Registered

2. Product Type =

Services

3. Party Fiscal

Classification

Supplier = Person

4. Determine Determine the IRRF_PF definition > Bill-from party

Tax party type to Tax Rule Defaults >

Registration derive the tax Tax Registration

registration

for each

applicable tax

5. Determine Consider the User-defined tax Standard

Tax Status tax statuses of status Standard

applicable

taxes IRRF_PF rule defaults

> Indirect Defaults >

Tax Status = Standard

6 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Order Process Activities Components Used Result

Name Included

6. Determine Consider the Tax Rate Rules Applicable tax rates based on ranges:

Tax Rate tax rates of

the applicable

tax status

7. Determine Determine the Standard Taxable Taxable Basis = Line Amount of 2000 BRL

Taxable Basis taxable basis Basis Formula =

on which the STANDARD_TB

tax rate for

each tax is

applied

8. Calculate Identify the Standard Tax Taxable Basis * Tax Rate as per ranges:

Taxes tax calculation Calculation Formula For 1499.15 BRL, it is 0

formula and = STANDARD_TC For next 500.85 BRL, it is 37.56

calculate taxes

Withholding Tax Line

After the tax determination process completes, Oracle ERP Cloud inserts tax lines at the summary level, i.e., one

line for each applicable tax. In this example, there is one tax line for IRRF_PF Tax.

Tax Line Tax Regime Tax Name Tax Status Tax Effective Tax Tax Amount

Jurisdiction Rate

1 <User-defined withholding IRRF_PF Standard Brazil 1.878% -37.56 BRL

tax regime>

After the accounting successfully completes, the following accounting lines are generated for payment:

Account Class Account Type Debit Credit

Liability Liability 1780.00

Cash Clearing Liability 1742.44

Withholding Tax Liability 37.56

Total 1780.00 1780.00 BRL

7 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Withholding Tax Invoices

Oracle ERP Cloud generates withholding tax authority invoices to remit withheld taxes to the tax authorities

based on your configuration.

Note: You must define the tax authority as a supplier in Payables.

To configure tax authorities:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Taxes.

4. Search for a specific tax.

5. Click the Tax Authorities tab.

6. Enter the following values:

Attribute Value Comments

Collecting Tax <your tax authority> Withholding tax authority defined as a supplier in

Authority Payables.

Business Unit <your business unit> Business unit that creates the withholding tax invoices.

Collecting Tax <your tax authority site> Supplier site defined in Payables.

Authority Site

After the invoice validation runs the tax determination process and it successfully completes, Payables

automatically creates the invoice for the INSS_PF tax authority for 220 BRL.

Distributions for tax invoice 1 for the INSS_PF tax authority:

Line Account Class Distribution Type Amount

1 Item Expense Item 220.00

Total 220.00 BRL

After the accounting successfully completes, Payables create the following accounting lines for the invoice:

Account Class Account Type Debit Credit

Item Expense Liability 220.00

Liability Liability 220.00

Total 220.00 220.00

After the invoice payment runs the tax determination process and it successfully completes, Payables

automatically creates the invoice for the IRRF_PF tax authority for 37.56 BRL.

Distributions for tax invoice 2 for the IRRF_PF tax authority:

Line Account Class Distribution Type Amount

1 Item Expense Item 37.56

Total 37.56 BRL

8 | MANAGING WITHHOLDING TAXES FOR BRAZIL

After the accounting successfully completes, Payables creates the following accounting lines for the invoice:

Account Class Account Type Debit Credit

Item Expense Liability 37.56

Liability Liability 37.56

Total 37.56 37.56

You can pay these two invoices in Payments within the stipulated time given by the tax authority (INSS_PF and

IRRF_PF) similar to supplier invoices.

5. Withholding Tax Scenarios for Brazil

A) Supplier Types

In Brazil, withholding tax applicability varies based on the supplier type.

• IRRF_PF is a federal withholding tax that is applicable only on services provided by persons.

• IRRF_PJ is a federal withholding tax that is applicable only on services provided by companies.

• INSS_PF is a withholding tax that is applicable on certain services provided by persons.

• INNS_PJ is a withholding tax that is applicable on certain services provided by companies.

Note: In the procure to pay cycle for Payables, invoice withholding tax applicability varies based on the supplier

type.

9 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Create Classification Category

Create a classification category to create a party fiscal classification that classifies parties such as customers or

suppliers.

For example, you may want to classify parties according to tax handling requirements such as end consumer,

distributor, non-profit organization, and so on. Create a new classification category and create two classification

codes: one for person and one for company.

To create a classification category:

1. Sign in as an Implementation Consultant.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Classification Categories.

4. Click Add.

5. Enter the following values to create a classification category:

Attribute Value Comments

Classification Category BR_SUPPLIER_TYPE Enter a user-defined value to meet your

requirements.

Classification Category Meaning BR_SUPPLIER_TYPE Enter a user-defined value to meet your

requirements.

Classification Category Brazil Supplier Enter a user-defined value to meet your

Description Type requirements.

Allow Parent Code Assignment Enabled

Allow Multiple Class Code Enabled

Assignment

6. Enter the following values to create an entity assignment:

Attribute Value Comments

Table Name HZ_PARTIES Assign newly created category to TCA parties.

Where WHERE PARTY_TYPE = Enter the newly created category, which is the

Clause ‘ORGANIZATION’ party type.

Create Classification Codes

To create classification codes:

1. Click Create Classification Codes on the Classification Categories page.

2. For data source, select Party Classification Hierarchy.

3. Click Next.

4. Enter the following values:

Attribute Value Comments

Classification Code COMPANY Classification code for the company.

Classification Code Meaning Supplier as Company

Classification Code Description Supplier as Company

Classification Code PERSON Classification code for the person.

10 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Attribute Value Comments

Classification Code Meaning Supplier as Person

Classification Code Description Supplier as Person

Classification Generation Hierarchy

To create a classification generation hierarchy:

1. Navigate: Tools > Scheduled Processes > Schedule New Process.

2. Run the Classification Hierarchy Generation ESS program with the following parameters:

Attribute Value Comments

Classification BR_SUPPLIER_TYPE Use the classification category created in the preceding

Category steps.

Flattening Method Incremental

Flattening

Create Party Fiscal Classification

To create a party fiscal classification:

1. Sign in as an Implementation Consultant.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Party Fiscal Classification.

4. Click Add.

5. Enter the following values:

Attribute Value Comments

Party Classification BR_SUPPLIER_TYPE Assign the TCA category in the previous section. This

links TCA category and party fiscal classification.

Number of Levels 1 This classifies the supplier as a person and company.

There is no further classification so one level is

sufficient.

Type Code BR_SUPPLIER_TYPE Enter a user-defined value to meet your requirements.

Type Name BR_SUPPLIER_TYPE Enter a user-defined value to meet your requirements.

Start Date 01/01/01 Date from which the party fiscal classification type

codes are effective.

Related fiscal classification codes appear as Fiscal Classification Codes such as PERSON, COMPANY, and so on.

Assign regimes that use this classification for tax rules.

11 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Assign Party Fiscal Classification to Supplier

A third party tax profile includes main and default tax information such as tax registration, tax exemptions, and

party fiscal classifications.

To assign a party fiscal classification to a supplier:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Party Tax Profiles.

4. Search for the party to which you will assign the classification.

5. Click the Classifications tab.

6. Click Add.

7. Enter the following values to assign a party fiscal classification to the supplier:

Attribute Value Comments

Fiscal Classification Type BR_SUPPLIER_TYPE Assign the party fiscal classification type code created in

Code the previous section.

Fiscal Classification Type BR_SUPPLIER_TYPE Automatically defaults based on the fiscal classification

Name type code value.

Fiscal Classification Code PERSON Select the applicable supplier type person/company.

Fiscal Classification Supplier as Automatically defaults based on the fiscal classification

Name PERSON code value.

Party fiscal classifications classify suppliers as a person or company for tax determination. A tax determining

factor can be a geographical location, party fiscal classification (Supplier Type), product fiscal classification

(Product Type), and so on. A tax determining factor is an attribute that contributes to the outcome of a tax

determination process. Tax determining factors are categorized into logical groupings called tax determining

factor classes. Each tax determining factor class contains determining factor names that constitute the

contents of the class. The following table explains the tax determining factor details required to map the

given scenario:

Attribute Value Comments

Tax Determining Party Fiscal This factor class allows party fiscal classification to be

Factor Class Classification used as a tax determining factor to create tax rules.

Tax Determining BR_SUPPLIER_TYPE The newly created party fiscal classification classifies

Factor Name suppliers as a person or company.

12 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Create Tax Determining Factor Set

To create a tax determining factor set:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Tax Determining Factor Set.

4. Click Add.

5. Enter the following values:

Create Tax Condition Set

To create a tax condition set:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Tax Condition Set.

4. Click Add.

5. Enter the following values:

13 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Create Tax Applicability Rule

To create a tax applicability rule:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Tax Rules.

4. Select the Tax Applicability Rules rule type.

5. Click Add.

6. Enter the following values:

14 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Note: Codes mentioned in the preceding table are for demonstration purposes only. Users can create their own

codes.

With the preceding setup, Oracle ERP Cloud derives the supplier type person or company during the tax

determination process based on the supplier chosen in the invoice workbench, and applies withholding tax.

B) Period Based Threshold Computations

A period based threshold has a minimum and/or maximum tax amount that can be applied for a definite period

as stipulated by the tax authority. In Brazil, the threshold amounts are applicable during withholding tax

calculation. Thresholds can apply at different levels. Certain withholding taxes such as PIS, COFINS, and CSLL

have a minimum taxable base amount. Other withholding taxes have minimum or maximum withholding

amounts that must be compared with the final calculated withholding amount. For example, INSS_PF

withholding tax applies to services provided by a person to a company. The maximum INSS_PF tax amount to

withhold for a month is 406.09 BRL.

Oracle ERP Cloud provides support for thresholds and schedule-based tax calculation for withholding taxes.

Thresholds are an integral part of withholding tax calculation and are normally defined by tax authorities at

individual tax levels, which are supported in Oracle ERP Cloud. You can define thresholds based on period or

document level, taxable amount, and tax amount level. Thresholds can be also be defined on the Manage Taxes

page and the Manage Jurisdictions page.

Configure Thresholds

To configure Thresholds:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Taxes.

4. Search for INSS_PF Tax.

5. Configure Thresholds in the Threshold Controls tab of INSS_PF Tax.

6. Enter the following values:

15 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Attribute Value Comments

Threshold Buckets All Threshold applicability set to accommodate tax withheld by

Level all the customers of the supplier in the month.

Threshold Basis Period Period based threshold is required for this example.

Withholding Tax Used Defined INSS_PF threshold is applicable for a month.

Calendar Calendar

Threshold Type Tax Amount

Minimum Value - No minimum threshold value for INSS_PF.

Maximum Value 406.09 Maximum threshold value for INSS_PF is 406.09 BRL.

This tax configuration sets the total INSS_PF withheld amount to not exceed 406.09 in a month.

Example

The supplier as a person provides services to a company and invoices for the services rendered during the

month. A clerk enters and validates the following three invoices in Payables.

First Payables Invoice Transaction Line

Invoice Date Invoice Number Product Type Amount

04/28/17 501 Service 3000.00

Total 3000.00 BRL

Tax Determination Process

The INSS_PF standard rate of 11% is applied on the line amount and the withholding tax amount is 330 BRL. The

tax amount bucket is 330 BRL.

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Tax Rate Tax Amount

1 <User-defined INSS_PF Standard Brazil 11% -330.00 BRL

withholding tax regime>

The clerk enters and validates the second invoice for the same supplier for the same period.

Second Payables Invoice Transaction Line

Invoice Date Invoice Number Product Type Amount

04/28/17 502 Service 2000.00

Total 2000.00 BRL

16 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Tax Determination Process

The INSS_PF standard rate of 11% is applied on the line amount and the withholding tax amount is 220 BRL. The

tax amount bucket is 330 BRL after validation of the first invoice, and the remaining balance is 76.09 BRL (based

on 406.09-330.00). The following tax line is created for 76.09 BRL, the remaining balance in the tax amount

bucket.

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Tax Rate Tax Amount

1 <User-defined INSS_PF Standard Brazil 3.804% -76.09 BRL

withholding tax regime>

The clerk enters and validates the third invoice for the same supplier for the same period.

Third Payables Invoice Transaction Line

Invoice Date Invoice Number Product Type Amount

04/29/17 503 Service 3000.00

Total 3000.00 BRL

Tax Determination Process

The INSS_PF standard rate of 11% is applied on the line amount and the withholding tax amount is 330 BRL. The

tax amount bucket is now 406.09 BRL, which is the maximum withholding amount, and there is no remaining

balance. As such, there won’t be any additional withholding tax for this invoice and subsequent invoices.

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Tax Rate Tax Amount

1 <User-defined INSS_PF Standard Brazil 0 0.00 BRL

withholding tax regime>

C) Deductions

In Brazil, dependent deductions are applicable during the withholding tax calculation for a supplier as a person

providing services. A deduction reduces the taxable base amount during the withholding tax calculation process.

The following deductions are applied to the IRRF_PF taxable basis:

1. Deductions for Dependents:

Number of dependents is multiplied by the fixed amount specified by tax authorities.

17 | MANAGING WITHHOLDING TAXES FOR BRAZIL

For example, if the supplier has three dependents, 3 * 150.69 BRL = BRL 452.07 is deducted from the

IRRF_PF withholding taxable basis.

2. Deductions for Alimony:

Amount paid in the previous month is deducted from the IRRF_PF withholding taxable basis.

3. Deductions for Social Security Contributions:

Amount paid in the previous month is deducted from the IRRF_PF withholding taxable basis.

Configure Dependent Deductions

Set up deductions for dependents by configuring the deduction amount per dependent at the tax level.

To create a dependent deduction:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Taxes.

4. Search for IRRF_PF Tax.

5. Click the Tax Deductions tab and add a row.

6. Enter the following values:

Attribute Value Comments

Fixed Deduction per 150.69 In Brazil, the deduction amount per dependent is fixed by law which

dependent varies from year to year. This setup is configured at the tax level.

Effective Start Date 01/01/17 Date from which the deductions are effective.

18 | MANAGING WITHHOLDING TAXES FOR BRAZIL

After configuring the deduction amount per dependent at the tax level, specify the number of dependents that

the supplier as a person has on the Third Party Tax Profile page.

Configure Number of Dependents

To configure Number of Dependents:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Party Tax Profiles.

4. Search for Third Party Tax Profile for an existing party or create a new one.

5. Click the Withholding Tax Deductions tab and add a row.

6. Enter the following values :

Attribute Value Comments

Tax Regime Code <User-defined withholding tax

regime>

Tax IRRF_PF

Deduction Type Number of Dependents

Number of 3 Number of dependents provided by

Dependents the supplier.

Start Date 04/01/17 Date from which the deductions are

effective.

Example

The supplier as a person provides services and invoices for the services rendered during the month to a

company. This supplier has three dependents. The clerk enters this invoice, validates and approves the invoice,

then makes a payment in Payables.

Payables Invoice Transaction Line

Invoice Date Invoice Number Product Type Amount

05/01/17 700 Service 2600.00

Total 2600.00 BRL

Tax Determination Process

In Brazil, IRRF_PF tax is calculated at the time of payment per the following table:

IRRF_PF Tax Computation

Total invoice amount 2600 BRL

Number of dependents 3

Fixed deduction amount per dependent 150.69 BRL

IRRF_PF taxable basis 2600- (3*150.69) = 2147.93 BRL

IRRF_PF tax amount as per rate schedule 48.65 BRL

19 | MANAGING WITHHOLDING TAXES FOR BRAZIL

IRRF_PF Tax Computation

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Effective Tax

Tax Rate Amount

1 <User-defined withholding IRRF_PF Standard Brazil 2.265% -48.65 BRL

tax regime>

Configure Alimony Deductions

Set up the deduction for alimony paid by supplier in the previous month by configuring the deduction amount

for the Third Party Tax Profile.

To configure alimony deductions:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Party Tax Profiles.

4. Search for Third Party Tax Profile for an existing party or create a new one.

5. Click the Withholding Tax Deductions tab and add a row.

6. Enter the following values:

Attribute Value Comments

Tax Regime Code <User-defined withholding tax regime>

Tax IRRF_PF

Deduction Type Alimony Amount

Deduction Amount 500 Alimony amount provided by the

supplier.

Start Date 04/01/17 Date from which the deductions are

effective.

Example

The supplier as a person provides services and invoices for the services rendered during the month to a

company. This supplier has provided the previous month’s alimony amount paid to the company. The clerk has

recorded this amount in the Party Tax Profile. The clerk enters this supplier invoice, validates and approves the

invoice, then makes a payment in Payables.

20 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Payables Invoice Transaction Line

Invoice Date Invoice Number Product Type Amount

05/07/17 800 Service 3000

Total 3000.00 BRL

Tax Determination Process

In Brazil, IRRF_PF tax is calculated at the time of payment per the following table:

IRRF_PF Tax Computation

Total invoice amount 3000 BRL

Alimony paid amount provided by supplier 500

IRRF_PF taxable basis 3000- 500 = 2500 BRL

IRRF_PF tax amount as per rate schedule 94.05 BRL

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Effective Tax Amount

Tax Rate

1 <User-defined IRRF_PF Standard Brazil 3.762% -94.05 BRL

withholding tax regime>

Configure Social Security Contribution Deduction

Set up the deductions for social security contributions paid in the previous month by configuring the deduction

amount for the Third Party Tax Profile.

To configure the social security contribution deduction:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Party Tax Profiles.

4. Search for Third Party Tax Profile for an existing party or create a new one.

5. Click the Withholding Tax Deductions tab and add a row.

6. Enter the following values:

Attribute Value Comments

Tax Regime Code <User-defined Withholding Tax

Regime>

21 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Attribute Value Comments

Tax IRRF_PF

Deduction Type Social Security Contribution

Deduction 300 Social contribution amount provided by the

Amount supplier.

Start Date 04/01/17 Date from which the deductions are

effective.

Example

The supplier as a person provides services and invoices for the services rendered during the month to a

company. This supplier has provided the previous month’s social security contribution amount paid to the

company. The clerk has recorded this amount in the Third Party Tax Profile. The clerk enters this supplier

invoice, validates and approves the invoice, then makes a payment in Payables.

Payables Invoice Transaction Line

Invoice Date Invoice Number Product Type Amount

05/20/17 900 Service 2500

Total 2500.00 BRL

Tax Determination Process

In Brazil, IRRF_PF tax is calculated at the time of payment per the following formula:

IRRF_PF taxable basis = Total amount – Social security contribution deduction

IRRF_PF Tax Computation

Total invoice amount 2500 BRL

Social security contribution deduction 300

IRRF_PF taxable basis 2500- 300 = 2200 BRL

IRRF_PF tax amount as per rate schedule 52.56 BRL

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Effective Tax Amount

Tax Rate

1 <User-defined IRRF_PF Standard Brazil 2.389% -52.56 BRL

withholding tax regime>

22 | MANAGING WITHHOLDING TAXES FOR BRAZIL

D) Tax Amount Withheld by Other Companies

To calculate INSS_PF tax for a supplier as a person who provides services to more than one company, the tax

withheld in a month by all the customers of the supplier must be considered. INSS_PF tax is tax on the invoice

gross amount after accounting for the total tax withheld by all the customers of the supplier in the current

month. A supplier must report all the withheld tax deducted in the month to the buyer, so the buyer can use this

information for calculating the withholding tax.

Oracle ERP Cloud can record the tax withheld in a month by all the customers of the supplier and processes the

withholding tax calculations accordingly. When entering an invoice in Payables, you can enter the tax amount

withheld by earlier companies in the Additional Information tab of the Withheld Tax Amount attribute. You can

also configure threshold buckets level to All to accommodate tax withheld by all the customers of the supplier in

the month.

Configure Thresholds

To configure Thresholds:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Taxes.

4. Search for INSS_PF Tax.

5. Configure Thresholds in the Threshold Controls tab of INSS_PF Tax.

6. Enter the following values:

Attribute Value Comments

Threshold Buckets All Threshold applicability set to accommodate tax withheld by

Level all the customers of the supplier in the month.

Threshold Basis Period Period based threshold is required for this example.

Withholding Tax Used Defined INSS_PF threshold is applicable for a month.

Calendar Calendar

Threshold Type Tax Amount

Minimum Value - No minimum threshold value for INSS_PF.

Maximum Value 406.09 Maximum threshold value for INSS_PF is 406.09 BRL.

Example

The supplier as a person provides services to XYZ Inc. and has earlier provided services to ABC Inc. The tax

withheld by ABC Inc. is 200 BRL for the same period. The XYZ Inc. clerk enters the invoice and the ABC Inc.

withheld tax amount of 200 BRL (in the Invoice Additional Information tab of the Withheld Tax Amount

attribute) and validates the invoice.

Payables Invoice Transaction Line

Invoice Date Invoice Number Product Type Amount Withheld Tax Amount

(Additional Information Tab)

05/01/17 877 Service 2000.00 200.00 BRL

Total 2000.00 BRL

23 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Tax Determination Process

INSS_PF Tax Computation

Total invoice amount 2000 BRL

INSS_PF tax amount (2000*11%) = 220 BRL

Tax amount retained by earlier companies 200.00 BRL

INSS_PF tax on the invoice is restricted to the 406.09-200.00 = 206.09 BRL

Maximum threshold limit 406.09

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Tax Rate Tax

Amount

1 <User-defined withholding INSS_PF Standard Brazil 10.304% -206.09

tax regime> BRL

E) Prepayments

According to Brazil tax legislation, any advance payment to a supplier for the services not yet rendered is subject

to withholding tax. IRRF_PJ withholding tax is applicable on prepayments to suppliers as a company.

Withholding tax on a standard invoice considers the tax amount already withheld on respective prepayments to

avoid double withholding taxes.

Use Oracle ERP Cloud to withhold taxes on supplier prepayments. If a prepayment is applied to an invoice

before invoice validation, Payables creates withholding tax distributions only for the unapplied invoice amount.

Example

For the supplier as a company, IRRF_PJ withholding tax is applicable on an advance payment. A clerk enters and

validate a prepayment invoice with the following transaction line in Payables.

Payables Prepayment Invoice Transaction Line

Invoice Date Invoice Number Product Type Product Category Amount

05/10/17 CA1009 Service Security Services 5000.00

Total 5000.00 BRL

Tax Determination Process

At prepayment invoice validation, the tax determination process calculates the following withholding amount:

IRRF_PJ Tax Computation

Total invoice amount 5000 BRL

IRRF_PJ tax amount 5000*1.5% =75.00 BRL

24 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Tax Rate Tax Amount

1 <User-defined withholding IRRF_PJ Standard Brazil 1.5% -75.00 BRL

tax regime>

The clerk enters a standard invoice, applies the prepayment before validation, and validates the standard

invoice in Payables.

Payables Standard Invoice with Prepayment Transaction Lines

Type Invoice Date Invoice Number Product Type Product Category Amount

Item 05/11/17 CA1010 Service Security Services 6000

Prepayment 05/10/17 CA1009 Service Security Services -5000

Unapplied amount 1000.00 BRL

Tax Determination Process

At standard invoice validation, the tax determination process calculates the following withholding tax amount

on the invoice after deducting the tax amount already withheld on prepayment:

IRRF_PJ Tax Computation

Invoice unapplied amount 1000 BRL

IRRF_PJ tax amount 1000*1.5% =15.00 BRL

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Tax Rate Tax Amount

1 <User-defined withholding IRRF_PJ Standard Brazil 1.5% -15.00 BRL

tax regime>

F) Withholding on Transaction Tax

ISS is the tax on services and must be paid to the municipalities. This tax is withheld from the transaction tax on

the supplier invoice.

Set up withholding tax on transaction tax using tax configuration and tax rules. You must configure two tax

configurations: one for processing transaction tax and one for processing withholding tax.

For more information on managing transaction taxes for Brazil, see the Quick Reference for Oracle ERP Cloud

Documentation for Brazil (2329725.1) on My Oracle Support at https://support.oracle.com.

25 | MANAGING WITHHOLDING TAXES FOR BRAZIL

At Configuration Owner Tax Options Level

To process transaction taxes for ISS withholding tax:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Configuration Owner Tax Options.

4. Search for Event Class Processing Controls.

5. For the Prepayment Invoices and Standard Invoices event classes, enable Process Transaction Taxes.

At Tax Level

To configure the calculation point for ISS withholding tax:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Taxes.

4. Search for ISS Tax.

5. Search for Controls and Defaults > Calculation Point.

6. Set the Calculation Point to Invoice.

The calculation point can be set to Invoice or Payment. Since ISS tax calculation is based on invoice, select

Invoice.

In the Direct Defaults section for the ISS tax, the Tax Applicability field defaults to Not Applicable.

Since ISS withholding tax is based on transaction tax, the applicability rules for ISS withholding must be defined

based on the transaction tax.

Create Tax Determining Factor Set

To create a tax determining factor set:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Tax Determining Factor Set.

4. Click Add.

5. Enter the following values:

26 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Create Tax Condition Set

To create a tax condition set:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Tax Condition Set.

4. Click Add.

5. Enter the following values:

Create Tax Applicability Rule

To create a tax applicability rule:

1. Sign in as a Tax Manager.

2. Click Navigator > Setup and Maintenance.

3. Search for Manage Tax Rules.

4. Select the Tax Applicability Rules rule type.

5. Click Add.

6. Enter the following values:

27 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Example

A supplier based in Sao Paulo provides services to a company in Sao Paulo for 10000 BRL. The following invoice

is entered in Payables:

Payables Invoice Transaction Line

Invoice Date Invoice Number Product Type Amount Bill To Ship To

05/01/17 300 Service 10000.00 Sao Paulo Sao Paulo

Total 10000.00 BRL

After entering the invoice, it is validated.

Tax Determination Process

< User-Defined ISS Transaction Tax > Transaction Tax Computation

Total invoice amount 10000 BRL

< User-defined ISS transaction tax > (10000*10%) = 1000 BRL

< User-defined ISS Withholding Tax> Withholding Tax Computation

<User-defined ISS transaction tax > 1000 BRL

< User-defined ISS withholding tax > (1000*2%) = 20 BRL

Transaction Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Tax Rate Tax Amount

1 <User-defined Brazil < User-defined ISS Standard Brazil 10.00% 1000.00 BRL

transaction tax transaction tax >

regime>

Withholding Tax Line

After the tax determination process successfully completes, the following tax line is created:

Tax Line Tax Regime Tax Name Tax Status Tax Jurisdiction Tax Rate Tax Amount

1 <User-defined < User-defined ISS Standard Brazil 2% -20.00 BRL

withholding tax withholding tax >

regime>

28 | MANAGING WITHHOLDING TAXES FOR BRAZIL

Oracle Corporation, World Headquarters Worldwide Inquiries

500 Oracle Parkway Phone: +1.650.506.7000

Redwood Shores, CA 94065, USA Fax: +1.650.506.7200

CONNECT WITH US

blogs.oracle.com/oracle

Copyright © 2017, Oracle and/or its affiliates. All rights reserved. This document is provided for information purposes only, and the contents hereof

are subject to change without notice. This document is not warranted to be error-free, nor subject to any other warranties or conditions, whether

facebook.com/oracle expressed orally or implied in law, including implied warranties and conditions of merchantability or fitness for a particular purpose. We specifically

disclaim any liability with respect to this document, and no contractual obligations are formed either directly or indirectly by this document. This

twitter.com/oracle document may not be reproduced or transmitted in any form or by any means, electronic or mechanical, for any purpose, without our prior written

permission.

oracle.com Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their respective owners.

Intel and Intel Xeon are trademarks or registered trademarks of Intel Corporation. All SPARC trademarks are used under license and are trademarks

or registered trademarks of SPARC International, Inc. AMD, Opteron, the AMD logo, and the AMD Opteron logo are trademarks or registered

trademarks of Advanced Micro Devices. UNIX is a registered trademark of The Open Group. 1117

You might also like

- Basic Tax Setups in E-Business Tax: Case Study - 1Document22 pagesBasic Tax Setups in E-Business Tax: Case Study - 1jabar aliNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 5-Day Self-Love Challenge - Big Life JournalDocument16 pages5-Day Self-Love Challenge - Big Life Journalmatias apecenaNo ratings yet

- Baixar A Guide To The Project Management Body of Knowledge (PMBOK® Guide) - Seventh Edition and The Standard For Project Management (ENGLISH) PDF GrátDocument2 pagesBaixar A Guide To The Project Management Body of Knowledge (PMBOK® Guide) - Seventh Edition and The Standard For Project Management (ENGLISH) PDF Gráteduelis0% (17)

- E-Business Tax - Setup With ExampleDocument36 pagesE-Business Tax - Setup With ExampleReddy SreeNo ratings yet

- ERP Tax Setup OverviewDocument59 pagesERP Tax Setup Overviewprasadv19806273100% (1)

- OFI GST O2C Tax Defaultation Functional DocumentDocument59 pagesOFI GST O2C Tax Defaultation Functional DocumentdurairajNo ratings yet

- How To Setup Expert Tax Rules On EBTaxDocument5 pagesHow To Setup Expert Tax Rules On EBTaxnaveencbe1016No ratings yet

- BCOM - BCOM Accounting 3Document322 pagesBCOM - BCOM Accounting 3Ntokozo Siphiwo Collin DlaminiNo ratings yet

- Oracle-Fusion-Tax - Analysis PDFDocument43 pagesOracle-Fusion-Tax - Analysis PDFRaveen Kumar100% (1)

- R12 EtaxDocument66 pagesR12 Etaxsatya_raya8022No ratings yet

- Oracle EB TAXDocument61 pagesOracle EB TAXAli IqbalNo ratings yet

- Withholding Tax BestDocument14 pagesWithholding Tax Bestsoumya singhNo ratings yet

- Oilfield Review January 1993Document59 pagesOilfield Review January 1993Andres PalladinoNo ratings yet

- GST SettlementDocument32 pagesGST SettlementSrinivas KovvurNo ratings yet

- AP Integration With E TAXDocument23 pagesAP Integration With E TAXTejeshwar KumarNo ratings yet

- Forensic Ballistics Reviewer - ScribdDocument589 pagesForensic Ballistics Reviewer - ScribdMelcon S. Lapina96% (25)

- Br100 e BtaxDocument43 pagesBr100 e BtaxunnikallikattuNo ratings yet

- SAP - IMG Configuration of Indonesia Withholding TaxDocument5 pagesSAP - IMG Configuration of Indonesia Withholding TaxGhosh2100% (1)

- Enable Tax To Calculate On Invoices Originating in Oracle R12 ProjectsDocument23 pagesEnable Tax To Calculate On Invoices Originating in Oracle R12 ProjectsVenugopalcaNo ratings yet

- Oracle Ebs Tax User GuideDocument35 pagesOracle Ebs Tax User GuideMuthumariappan21No ratings yet

- Managing Transaction Taxesfor BrazilDocument31 pagesManaging Transaction Taxesfor BrazilLuiz A M V BarraNo ratings yet

- Ebixtax Day 3 - Lesson 7 Issue 1.0Document50 pagesEbixtax Day 3 - Lesson 7 Issue 1.0Roel Antonio PascualNo ratings yet

- Introduction To Goods and Services Tax Compliance in Oracle ERP Cloud Internal Ref GSTDocument37 pagesIntroduction To Goods and Services Tax Compliance in Oracle ERP Cloud Internal Ref GSTdchussain17No ratings yet

- Israel EssayDocument30 pagesIsrael Essaysudhirpatil15No ratings yet

- Tax Does Not Calculate in R12 E-Business Tax (EBTAX)Document4 pagesTax Does Not Calculate in R12 E-Business Tax (EBTAX)msalahscribdNo ratings yet

- Vat Reporting For France Topical EssayDocument17 pagesVat Reporting For France Topical EssayMiguel FelicioNo ratings yet

- EBS Group Tax1604480.1Document19 pagesEBS Group Tax1604480.1sreenivasNo ratings yet

- How To Setup A Group Tax in R12 E-Business Tax (EBTax) (Doc ID 1604480.1)Document18 pagesHow To Setup A Group Tax in R12 E-Business Tax (EBTax) (Doc ID 1604480.1)Lo JenniferNo ratings yet

- Beyonics ERP Configuration Workbook Tax PRODDocument185 pagesBeyonics ERP Configuration Workbook Tax PRODsureshNo ratings yet

- Document 549697.1 Ebs No Calcula Tax en APDocument6 pagesDocument 549697.1 Ebs No Calcula Tax en APMariaPaola Pacheco AraujoNo ratings yet

- TDS Config in SAPDocument31 pagesTDS Config in SAPvaishaliak2008No ratings yet

- OFI GST Functional TDS Configuration Phase2Document26 pagesOFI GST Functional TDS Configuration Phase2rajkumarNo ratings yet

- Accounting in A Nutshell 4: Deferred TaxesDocument3 pagesAccounting in A Nutshell 4: Deferred TaxesBusiness Expert PressNo ratings yet

- Sap Cin-MM Customizing For Tax Procedure - Taxinn: Hide TOCDocument7 pagesSap Cin-MM Customizing For Tax Procedure - Taxinn: Hide TOCsreekumarNo ratings yet

- Vat Reporting For Spain Topical EssayDocument34 pagesVat Reporting For Spain Topical EssayMiguel FelicioNo ratings yet

- Taxes - Customizing (SAP Lib..Document2 pagesTaxes - Customizing (SAP Lib..dj2781No ratings yet

- Ebixtax Day 2 - Lesson 3 Issue 1.0Document28 pagesEbixtax Day 2 - Lesson 3 Issue 1.0Roel Antonio PascualNo ratings yet

- EDU3EDCYDocument27 pagesEDU3EDCYMurali K PanchangamNo ratings yet

- Korea LocalizationDocument9 pagesKorea Localizationabhijeet_yadkikarNo ratings yet

- How To Lower Your TaxesDocument2 pagesHow To Lower Your TaxesPhia CustodioNo ratings yet

- Basic Tax Setups in E-Business Tax: Case Study - 1Document24 pagesBasic Tax Setups in E-Business Tax: Case Study - 1ved.prakash.mehtaNo ratings yet

- Tds NotesDocument15 pagesTds NotesnaysarNo ratings yet

- CIN 02 DetailsDocument80 pagesCIN 02 DetailsBiranchi MishraNo ratings yet

- EB Tax For PakistanDocument31 pagesEB Tax For Pakistanhamzaali227004No ratings yet

- GST Functional TDS Configuration Phase2Document26 pagesGST Functional TDS Configuration Phase2Venkata Ramana50% (4)

- Ebiz TaxDocument2 pagesEbiz TaxArchana RaghuNo ratings yet

- Ind AS 12Document37 pagesInd AS 12Amal P TomyNo ratings yet

- TAX LAW and ADMINISTRATIONDocument11 pagesTAX LAW and ADMINISTRATIONReStyleNo ratings yet

- Income Taxes Far Reviwer NotesDocument15 pagesIncome Taxes Far Reviwer Notesabb.reviewersNo ratings yet

- TDS OnlineDocument17 pagesTDS OnlineRupang ShahNo ratings yet

- Equity Program FAQDocument14 pagesEquity Program FAQNikhil SinghalNo ratings yet

- 1 Income TaxesDocument95 pages1 Income TaxesJoven LorenzoNo ratings yet

- SAP S4 HANA FINANACE - Withholding TaxDocument17 pagesSAP S4 HANA FINANACE - Withholding Taxlakshmipathy naraNo ratings yet

- Activate Country Version India For Specific Fiscal Years: ActivitiesDocument32 pagesActivate Country Version India For Specific Fiscal Years: ActivitiesSiva KumarrNo ratings yet

- CIN Step by StepDocument32 pagesCIN Step by StepBalakrishna GovinduNo ratings yet

- OFI GST ISupplier Functional DocumentDocument27 pagesOFI GST ISupplier Functional Documentsubhani1211No ratings yet

- BR100 Oracle Ebiz Tax Setup Pre-RequisitesDocument4 pagesBR100 Oracle Ebiz Tax Setup Pre-RequisitesPrasad RajashekarNo ratings yet

- Tax Israel Train The TrainerDocument98 pagesTax Israel Train The TrainerI GNo ratings yet

- Part 1: Oracle E-Business Tax Basic Tax ConfigurationDocument29 pagesPart 1: Oracle E-Business Tax Basic Tax ConfigurationMaheshNo ratings yet

- Class 11 Accountancy 2023-24 Notes Chapter 2 Theory Base of Accounting - RemovedDocument13 pagesClass 11 Accountancy 2023-24 Notes Chapter 2 Theory Base of Accounting - RemovedROHIT PAREEKNo ratings yet

- Unit A Administrative FrameworkDocument14 pagesUnit A Administrative Frameworklloyd madanhireNo ratings yet

- Perilaku Masyarakat Terhadap Kesehatan Lingkungan (Studi Di Pantai Desa Ketong Kecamatan Balaesang Tanjung Kabupaten Donggala)Document11 pagesPerilaku Masyarakat Terhadap Kesehatan Lingkungan (Studi Di Pantai Desa Ketong Kecamatan Balaesang Tanjung Kabupaten Donggala)Ali BaktiNo ratings yet

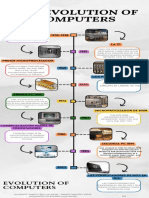

- Infografia Línea Del Tiempo Historia de La Computadoras en InglesDocument1 pageInfografia Línea Del Tiempo Historia de La Computadoras en InglesGEORGEGAMER MCNo ratings yet

- Entrepreneurial Skills-II: in This Chapter..Document34 pagesEntrepreneurial Skills-II: in This Chapter..TECH-A -TRONICSNo ratings yet

- LAB 7: Functions: Student Name: Nathaneal Anak Biat Student ID: EP01081100 Section:02ADocument9 pagesLAB 7: Functions: Student Name: Nathaneal Anak Biat Student ID: EP01081100 Section:02AWilfredNo ratings yet

- Schengen Visa Application 2021-11-26Document5 pagesSchengen Visa Application 2021-11-26Edivaldo NehoneNo ratings yet

- Java DL 2023Document16 pagesJava DL 2023Sktr BhanuNo ratings yet

- Oracle Audit Vault and Database FirewallDocument16 pagesOracle Audit Vault and Database FirewallRofiq AhmedNo ratings yet

- Temperature Control Systems: Product Reference Guide For Truck and Trailer ApplicationsDocument40 pagesTemperature Control Systems: Product Reference Guide For Truck and Trailer ApplicationsSaMos AdRiianNo ratings yet

- Oracle Database 12c: Administration Workshop Student Guide Volume 2 D78846GC10 - sg2Document374 pagesOracle Database 12c: Administration Workshop Student Guide Volume 2 D78846GC10 - sg2Nelson NelsonNo ratings yet

- Solaris 10 Installation Guide: Basic InstallationsDocument58 pagesSolaris 10 Installation Guide: Basic InstallationsHakim HamzaouiNo ratings yet

- JKIT - Dialog SAP Revamp Phase II As-Is Proposal V2.0Document10 pagesJKIT - Dialog SAP Revamp Phase II As-Is Proposal V2.0Hathim MalickNo ratings yet

- 4150 70-37-3 Requirement AnalysisDocument71 pages4150 70-37-3 Requirement AnalysisSreenath SreeNo ratings yet

- An Inflection Point For The Data-Driven Enterprise: Pulse SurveyDocument20 pagesAn Inflection Point For The Data-Driven Enterprise: Pulse SurveyAndy BaneNo ratings yet

- AN1009: Driving MOSFET and IGBT Switches Using The Si828x: Key FeaturesDocument22 pagesAN1009: Driving MOSFET and IGBT Switches Using The Si828x: Key FeaturesNikolas AugustoNo ratings yet

- Advantages and Disadvantages of Distance LearningDocument2 pagesAdvantages and Disadvantages of Distance LearningШвидка Вікторія ТарасівнаNo ratings yet

- B-0018-1-Al Khayal Gen. Cont. (Hordi Block) (Comp. Strength)Document1 pageB-0018-1-Al Khayal Gen. Cont. (Hordi Block) (Comp. Strength)Matrix LaboratoryNo ratings yet

- Blue Ocean Strategy Book ReviewDocument3 pagesBlue Ocean Strategy Book ReviewVibhav bhatnagarNo ratings yet

- MSMQ Service Failing To StartDocument2 pagesMSMQ Service Failing To Startann_scribdNo ratings yet

- TÜV Rheinland Academy: 2021 Professional Training Schedule - Virtual ClassroomDocument3 pagesTÜV Rheinland Academy: 2021 Professional Training Schedule - Virtual ClassroomAaron ValdezNo ratings yet

- Cambridge International AS and A Level Economics Coursebook CD ROMDocument5 pagesCambridge International AS and A Level Economics Coursebook CD ROMNana Budu Kofi HAYFORDNo ratings yet

- Decision Support For Blockchain PlatformDocument20 pagesDecision Support For Blockchain PlatformgianniNo ratings yet

- Omkar Shende: Education SkillsDocument1 pageOmkar Shende: Education Skillseema yoNo ratings yet

- Comprehensive Comparison of 99 Efficient Totem-Pole PFC With Fixed PWM or Variable TCM Switching FrequencyDocument8 pagesComprehensive Comparison of 99 Efficient Totem-Pole PFC With Fixed PWM or Variable TCM Switching FrequencyMuhammad Arsalan FarooqNo ratings yet

- Biochips: Submitted byDocument17 pagesBiochips: Submitted byCharina Marie CaduaNo ratings yet

- M.Tech PSADocument17 pagesM.Tech PSASwathi AllipilliNo ratings yet

- Cerebrum - Product Sheet + Protocol List V2.2Document10 pagesCerebrum - Product Sheet + Protocol List V2.2Tony PerezNo ratings yet