Professional Documents

Culture Documents

Conclusion For Q2

Conclusion For Q2

Uploaded by

Barney KwikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Conclusion For Q2

Conclusion For Q2

Uploaded by

Barney KwikCopyright:

Available Formats

Conclusion

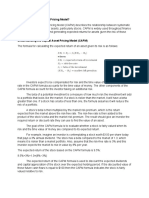

In a nutshell, the capital asset pricing model (CAPM) is a model that connects a security's systematic

risk to the projected return on that investment. Systematic risk, also known as market risk or non-

diversifiable risk, is a component of overall risk produced by market conditions that influence all

businesses and is beyond any company's or entity's control. Inflation, political turmoil, conflict,

currency value fluctuations, and so on are examples of market forces. Even with a well-diversified

portfolio, systemic risk cannot be eliminated, and all assets are subject to it.

The sensitivity or responsiveness of a stock's return to the overall market return is evaluated by beta,

which is the sensitivity or responsiveness of the stock's return to the overall market return. Stocks

with a beta larger than 1 are highly sensitive to the market and, as a result, have a higher market

covariance. They grow faster than the other equities in a bull market. In a bad market, however, they

also fall quicker. As a result, they are dangerous. Because investors need to be rewarded for the

degree of risk they are taking, the expected return for these companies would be greater. Stocks with a

beta of less than one, on the other hand, are regarded as less volatile. As a result, the expected returns

on these equities are often smaller.

For the research, Apple (AAPL), Tesla (TSLA), Amazon (AMZN), and Netflix, Inc. (NFLX) are the

four US-listed equities that we have chosen. The betas for each listed stock are 1.22, 1.89, 1.16, and

0.71 respectively and the expected returns are 16.57%, 25.63%, 15.75%, and 9.67% respectively.

From the betas itself, we can see that Netflix, Inc. has the smallest beta and the beta is less than 1,

which means the stock is less risky and less volatile, but it generates a lower expected return. While

the other 3 companies, have betas greater than 1, indicating that they are risky stocks with higher

volatility but generate higher expected returns compared to Netflix, Inc. If we equally weighted the

portfolio for these 4 companies, the portfolio beta also greater than 1 which is 1.245 with an expected

return of 16.9%. From these findings, we can conclude that when the stocks are combined into a

portfolio, the risk remains significant because the beta is greater than 1. Although it will increase their

overall portfolio risk, it will give them the possibility to generate more money.

You might also like

- Chapter 11 Investments BKM Solutions 9eDocument10 pagesChapter 11 Investments BKM Solutions 9enpiper29No ratings yet

- Chapter - 8Document14 pagesChapter - 8Huzaifa Malik100% (1)

- ACF 602/622 Coursework: Group 53Document13 pagesACF 602/622 Coursework: Group 53Shihab HasanNo ratings yet

- CapmDocument7 pagesCapmVaishali ShuklaNo ratings yet

- Yukta Jhala Tybaf 16Document5 pagesYukta Jhala Tybaf 16Sameer ChoudharyNo ratings yet

- Capital Asset Pricing ModelDocument4 pagesCapital Asset Pricing ModelGeorge Ayesa Sembereka Jr.No ratings yet

- CapmDocument3 pagesCapmTalha SiddiquiNo ratings yet

- Earnings Per Share-ProDocument3 pagesEarnings Per Share-ProVibhorBajpaiNo ratings yet

- Mauldin With Monti ErDocument10 pagesMauldin With Monti ErJUDS1234567No ratings yet

- 03.risk and Return IIIDocument6 pages03.risk and Return IIIMaithri Vidana KariyakaranageNo ratings yet

- Capital Asset Pricing ModelDocument6 pagesCapital Asset Pricing ModelSadaf AmirNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelSameer ChoudharyNo ratings yet

- Haugen BakerDocument39 pagesHaugen Bakerjared46No ratings yet

- BKM CH 11 Answers W CFADocument10 pagesBKM CH 11 Answers W CFAlevajunk80% (5)

- SHARPE SINGLE INDEX MODEL - HarryDocument12 pagesSHARPE SINGLE INDEX MODEL - HarryEguanuku Harry EfeNo ratings yet

- Financial Risk Management Reducing Systematic RiskDocument9 pagesFinancial Risk Management Reducing Systematic RiskXxx vidios Hot videos Xnxx videos Sexy videosNo ratings yet

- What Is The Capital Asset Pricing Model?Document4 pagesWhat Is The Capital Asset Pricing Model?Klester Kim Sauro ZitaNo ratings yet

- Group 4 Stock CaseDocument3 pagesGroup 4 Stock Caseapi-578941689No ratings yet

- Who Is William F. Sharpe?Document35 pagesWho Is William F. Sharpe?Games destroyerNo ratings yet

- Investments Chapter 7Document7 pagesInvestments Chapter 7b00812473No ratings yet

- Investment Management in An Evolving and Volatile World Lesson 1: What Kind of Investors Are You?Document17 pagesInvestment Management in An Evolving and Volatile World Lesson 1: What Kind of Investors Are You?Andrianarivelo Mihoby Safidy 1820352No ratings yet

- Chapte 10 Capital MarketDocument5 pagesChapte 10 Capital MarketRonaliza MallariNo ratings yet

- EMH Corporate FinanceDocument38 pagesEMH Corporate FinanceIsma NizamNo ratings yet

- Magic Formula Investing HKDocument46 pagesMagic Formula Investing HKMeester KewpieNo ratings yet

- A Rate of Return (Ror) IsDocument2 pagesA Rate of Return (Ror) IsAxam KhanNo ratings yet

- The Relevant Risk of A StockDocument2 pagesThe Relevant Risk of A StockMisbahNo ratings yet

- Systematic Risk Principle 1Document4 pagesSystematic Risk Principle 1Mutisya JeffreyNo ratings yet

- CAPMDocument8 pagesCAPMshadehdavNo ratings yet

- Theory CoC and WACCDocument9 pagesTheory CoC and WACCMisky1673No ratings yet

- Capm-Apt Notes 2021Document4 pagesCapm-Apt Notes 2021hardik jainNo ratings yet

- Topic Risk and ReturnDocument5 pagesTopic Risk and ReturnVic CinoNo ratings yet

- vvJialinYu 1nov2011Document41 pagesvvJialinYu 1nov2011Srinu BonuNo ratings yet

- 4.risk and Return LessonDocument8 pages4.risk and Return LessonSabarni ChatterjeeNo ratings yet

- Capital Asset Pricing ModelDocument17 pagesCapital Asset Pricing ModelChrisna Joyce MisaNo ratings yet

- What Does Capital Asset Pricing Model - CAPM Mean?Document6 pagesWhat Does Capital Asset Pricing Model - CAPM Mean?nagendraMBANo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelVrinda TayadeNo ratings yet

- Alpha Beta Gamma FinanceDocument15 pagesAlpha Beta Gamma FinanceKrishna RaiNo ratings yet

- Learning To Play Offense and Defense: Combining Value and Momentum From The Bottom Up, and The Top DownDocument10 pagesLearning To Play Offense and Defense: Combining Value and Momentum From The Bottom Up, and The Top Downmosqi100% (1)

- Dynamic Risk ParityDocument18 pagesDynamic Risk ParityRohit ChandraNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelRajvi SampatNo ratings yet

- Econ 132 Midterm 2 Book StuffDocument3 pagesEcon 132 Midterm 2 Book StuffThomas NgoNo ratings yet

- Arbitrage Pricing TheoryDocument2 pagesArbitrage Pricing TheoryMrDj Khan100% (1)

- Driving Innovation at A Mature FirmDocument17 pagesDriving Innovation at A Mature FirmSaniyaMirzaNo ratings yet

- SSRN Id1919226Document27 pagesSSRN Id1919226nloucaNo ratings yet

- Alpha - Beta1Document29 pagesAlpha - Beta1tejaspatel07No ratings yet

- Introduction of The Concepts Analyzed Beta: A RF A M RFDocument4 pagesIntroduction of The Concepts Analyzed Beta: A RF A M RFsagun0% (1)

- Five Financial RatiosDocument3 pagesFive Financial RatiosJoel FrankNo ratings yet

- Strategic RiskDocument18 pagesStrategic RiskJonisha JonesNo ratings yet

- What Does Modern Portfolio TheoryDocument5 pagesWhat Does Modern Portfolio TheoryIlangeeranNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Capital Asset Pricing ModelDocument6 pagesAssignment of Security Analysis & Portfolio Management On Capital Asset Pricing ModelShubhamNo ratings yet

- Security Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskDocument4 pagesSecurity Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskEdwin HauwertNo ratings yet

- The Facts and Fictions of The Securities IndustryDocument289 pagesThe Facts and Fictions of The Securities IndustryzadanliranNo ratings yet

- MAPM-WPS OfficeDocument9 pagesMAPM-WPS Officepuja bhatNo ratings yet

- Dissecting The Returns On Deep Value InvestingDocument41 pagesDissecting The Returns On Deep Value Investingsilverarrow66No ratings yet

- Comparison of The RatiosDocument3 pagesComparison of The RatiosChristopher KipsangNo ratings yet

- Capital Market TheoryDocument25 pagesCapital Market Theoryiqra sarfarazNo ratings yet

- Capital Asset Pricing Model: Make smart investment decisions to build a strong portfolioFrom EverandCapital Asset Pricing Model: Make smart investment decisions to build a strong portfolioRating: 4.5 out of 5 stars4.5/5 (3)