Professional Documents

Culture Documents

ACCT 1026 Lesson 4 Posting and Summarizing

Uploaded by

Roshane Deil PascualOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT 1026 Lesson 4 Posting and Summarizing

Uploaded by

Roshane Deil PascualCopyright:

Available Formats

UNIVERSITY OF SAINT LOUIS

Tuguegarao City

SCHOOL OF ACCOUNTANCY, BUSINESS and HOSPITALITY

First Semester

Academic Year 2021-2022

ONLINE LEARNING MODULE

ACCT 1026- Financial Accounting and Reporting

Lesson 4: Posting of Transactions and Preparation of Trial Balance

REMINDERS:

Lessons will be uploaded every Monday, and submission of assessments will be every Friday of the

week.

Comply with all requirements (written outputs, projects/performance tasks examinations and the like.)

Turn in learning tasks on time to avoid backlogs.

For this week, the following shall be your guide for the different lessons and tasks that you need to

accomplish. Be patient, read them carefully before proceeding to the tasks expected of you.

Date Topics Activities or Tasks

Sept 6 I. Posting to the ledger Read Lessons from books and handouts

Sept 7 A. Posting of Transactions Online discussion

Sept 8 B. Preparation of the Unadjusted Trial Accomplish the drills and exercises

Balance

Sept 9 Submission of Assessments

Sept 10 Participate in the scheduled Quiz

Learning At the end of this module, you are expected to :

Outcomes: 1. Describe the General Ledger and understand what purpose it serves.

2. Post entries from the general journal to the general ledger

3. Prepare and explain the use of a trial balance

4. Perform steps in locating errors

LEARNING CONTENT

Are you burnout? Mainly because of COVID and secondly, your assessments? Read the quotes below . . .

again and again, if you are.

Yes, the right frame of mind is called right A T T I T U D E, all caps for emphasis. If you are not yet

inspired, read the story of David and Goliath in the holy Bible. . . .. Believe you can, and you can!!!.

https://tr.pinterest.com/pin/209487820148840392/

ACCT 1026 – Financial Accounting and Reporting | 1

WARNING: No part of this E-module or LMS contentcan be reproduced or transported or shared

to others without permission from the University of Saint Louis. Unauthorized use of the

materials, other than personal learning use, will be penalized. Please be guided accordingly.

Let us continue our study of the accounting cycle.

Steps in the Accounting Cycle:

1. Identifying and Analyzing – finished

2. Recording or Journalizing - finished

3. Posting to the Ledger –It is done by transferring the data in the Journal to the General Ledger for

classification.

4. Preparing the Unadjusted Trial Balance –It aims to periodically test the equality of the total debits

and total credits in the general ledger. Normally, this is done at the end of each month.

Posting to the General Ledger

General Ledger (GL) is the book of final entry while the Journal is the book of original entry.

The best way to explain the purpose of the general ledger is through a diagram:

http://www.leoisaac.com/fin/fin049.htm

Explaining the purpose of the General Ledger is perhaps a difficult task. One reason is because in this age

of computers and information technology, the General Ledger does not any longer have an easily identifiable

physical form. Most large companies have their own system that will post transactions daily to the Journal

then to the General Ledger and from the Ledger to the Subsidiary Ledgers. And all the Accountant has to do

is print a daily report, perform reconciliation of balances between the General Ledger and Subsidiary Accounts

and maintain a permanent file of these reports.

ACCT 1026 – Financial Accounting and Reporting | 2

WARNING: No part of this E-module or LMS contentcan be reproduced or transported or shared

to others without permission from the University of Saint Louis. Unauthorized use of the

materials, other than personal learning use, will be penalized. Please be guided accordingly.

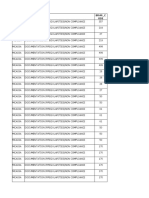

For companies that are still using the manual system, the standard format of the general ledger for Cash is

shown below:

http://www.leoisaac.com/fin/fin049.htm

There are three columns for recording money - Debit, Credit and Balance. There is one page in the General

Ledger for each Account, and typically the number of Accounts will be many, depending on the Chart of

Accounts.

The manual process of posting involves transferring the date, debit and credit totals of accounts from the

General Journal to the G/L. A recorded journal entry is copied to its specific account in the GL.

Purpose: To classify the effects of business transactions according to the five (5) elements of financial

statements: Assets, Liabilities, Owner’s Equity, Income and Expense. This will greatly help the accountant

to prepare the financial statements in an orderly and timely manner.

For classroom discussion, we will be using the informal form of the G/L which is the T-account.

https://www.wallstreetmojo.com/t-accounts/

Example:

ACCT 1026 – Financial Accounting and Reporting | 3

WARNING: No part of this E-module or LMS contentcan be reproduced or transported or shared

to others without permission from the University of Saint Louis. Unauthorized use of the

materials, other than personal learning use, will be penalized. Please be guided accordingly.

On January 02, 2020, Pedro Penduco started his locksmith business investing cash of P10,000.

Journal Entry:

DATE ACCOUNT TITLE DEBIT CREDIT

Jan 02, 2020 Cash P10,000

P. Penduco, Capital P10,000

GENERAL Ledger

CASH P. PENDUCO, CAPITAL

Dr. Cr. Dr. Cr.

2-Jan 10,000.00 10,000.00 2-Jan

Ending

Bal. 10,000.00 10,000.00 Ending Balance

Proceed to the Drill 1 portion of the module

The Trial Balance

https://slideplayer.com/slide/4507456/

Some Important Notes:

Correct results of posting depend to a great extent on the correctness of the entries in the general

journal

Errors in journalizing should be avoided as much as possible because any error in the journal entries

such as wrong amounts or wrong accounts debited and credited will lead to wrong results of posting

Proceed to Drill 2 of the module.

ACCT 1026 – Financial Accounting and Reporting | 4

WARNING: No part of this E-module or LMS contentcan be reproduced or transported or shared

to others without permission from the University of Saint Louis. Unauthorized use of the

materials, other than personal learning use, will be penalized. Please be guided accordingly.

Trial Balance out of balance if the total debits and total credits are not equal. This is a positive proof of the

existence of one or more errors.

The chief causes of errors are:

1. Posting an item to the wrong side of the account

2. A mistake in copying when transferring a balance from the ledger account to the trial balance.

3. Omission of the posting of either a debit or credit entry in the journal.

4. Posting the same item twice

5. Wrong addition or subtraction in finding the balance of an account.

Location of Errors

The following guides may help in the prompt location of errors:

A difference of P0.01, P0.10, P1, P100, etc. suggests that an error has been made in addition or

subtraction

A difference of 9 or a multiple of 9 indicates transposition, that is, the order of the figures is

reversed. For example, 25 is written as 52 or 38 is written as 83.

A difference divisible by 2 indicates an error in posting to the wrong side of the account or entering

the account balance in the wrong column of the trial balance.

A difference divisible by 9 or 99 indicates a slide or misplacement of a decimal point. For example,

P50 is written as P5.00.

Tip: If the trial balance is out of balance, a good plan to locate the error/s is to check the work

from the trial balance to the journal entries rather than from the journal entries to the trial balance.

Your thoughts!

If what is posted to the General Ledger is the record of the same transaction in the journal, why is

maintenance of the General Ledger still necessary? Don’t you think it is duplicative, time

consuming and boring?

ACCT 1026 – Financial Accounting and Reporting | 5

WARNING: No part of this E-module or LMS contentcan be reproduced or transported or shared

to others without permission from the University of Saint Louis. Unauthorized use of the

materials, other than personal learning use, will be penalized. Please be guided accordingly.

REFERENCES

Textbooks

1. Ballada, W. (2019). Basic Financial Accounting and Reporting. Manila: DomDane Publishers.

2. Cabrera, E.(2017) Fundamentals of Accounting Volume I, GIC Enterprises & Co., Inc., Manila

3. Millan, Z. V. (2020). Financial Accounting and Reporting (Fundamentals). Baguio City: Bandolin

Enterprise.

4. Valencia, E. and Roxas, G. (2017), Basic Accounting, Valencia Educational Supply

5. Valix, C. and Peralta, J. (2018). Financial Accounting Volume I GIC Enterprises & Co., Inc., Manila

Electronic Resource:

1. Accounting Basic https://www.accountingcoach.com/accounting-basics/explanation

2. Basic Accounting. https://www.bizfilings.com/toolkit/research-topics/finance/basic-accounting/the-

accounting-system-and-accounting-basics

3. Basic accounting and bookkeeping lessons, http://www.moneyinstructor.com/accounting.asp

4. Financial Accounting. https://www.accountingcoach.com/financial-accounting/explanation

5. Accounting Tutorials for Beginners. https://www.guru99.com/accounting.html

6. https://corporatefinanceinstitute.com/resources/knowledge/accounting/accounting-equation/

7. https://bobsteelecpa.com/accounting-equation-account-types-and-the-double-entry-accounting-

equation/

8. https://www.bookstime.com/what-is-the-accounting-equation

9. https://www.accountingcoach.com/blog/expanded-accounting-equation

10. https://accounting-simplified.com/equity.html

11. https://www.investopedia.com/

12. https://courses.lumenlearning.com/sac-finaccounting/chapter/the-basic-accounting-equation/

Assessment/Evaluation: Answers to this page is to be written in a separate sheet of paper.

DRILL 1: JOURNALIZING AND POSTING

The following were the transactions of Entity A during the period:

Date Transactions

Jan. 8 Services worth ₱150,000 were rendered for cash.

Jan. 9 Services worth ₱200,000 were rendered on account.

Jan. 10 Cash amounting to ₱25,000 was disbursed for advertising expense.

Jan. 11 Accounts receivable of ₱180,000 was collected.

Jan. 12 The owner made a temporary withdrawal of ₱10,000 cash from the business.

Requirements:

a. Provide the journal entries.

b. Post the journal entries to the ledger then determine the ending balances of the accounts. Use ledger

accounts for this purpose. Arrange the accounts in this order: Assets, Liabilities, Equity, Income and

Expenses.

ACCT 1026 – Financial Accounting and Reporting | 6

WARNING: No part of this E-module or LMS contentcan be reproduced or transported or shared

to others without permission from the University of Saint Louis. Unauthorized use of the

materials, other than personal learning use, will be penalized. Please be guided accordingly.

DRILL 2: JOURNALIZING, POSTING AND UNADJUSTED TRIAL BALANCE

Entity A started operation on January 1, 20x1. The following were the transactions during the first week of

operations:

Jan. Transactions

1 The owner provided ₱600,000 cash as initial investment to the business.

2 The business acquired a building for ₱400,000 cash.

3 The business acquired office equipment for ₱100,000 cash.

4 The business purchased supplies for ₱20,000 cash. The business uses a prepaid asset

account.

5 The business rendered services worth ₱150,000 on cash basis.

6 The business rendered services worth ₱100,000 on account.

7 The business paid ₱25,000 salaries expense.

Requirements:

a. Provide the journal entries.

b. Post the journal entries to the ledger. Arrange you’re the accounts in this order: Assets, Liabilities, Equity,

Income and Expenses.

c. Prepare the unadjusted trial balance.

ACCT 1026 – Financial Accounting and Reporting | 7

WARNING: No part of this E-module or LMS contentcan be reproduced or transported or shared

to others without permission from the University of Saint Louis. Unauthorized use of the

materials, other than personal learning use, will be penalized. Please be guided accordingly.

You might also like

- Steps Academics Can Take Now to Protect and Grow Their PortfoliosFrom EverandSteps Academics Can Take Now to Protect and Grow Their PortfoliosNo ratings yet

- ACCT 1026 Lesson 3 Transaction Analysis and RecordingDocument10 pagesACCT 1026 Lesson 3 Transaction Analysis and RecordingRoshane Deil PascualNo ratings yet

- Tle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2Document14 pagesTle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2johnklientantiguaNo ratings yet

- ACCT 1026 Lesson 7Document11 pagesACCT 1026 Lesson 7Yzmael Klyde BorjaNo ratings yet

- Lesson Proper & Learning Activities: Accounting CycleDocument4 pagesLesson Proper & Learning Activities: Accounting CycleHazel Joy UgatesNo ratings yet

- ACCT 1026 Lesson 7Document10 pagesACCT 1026 Lesson 7ChjxksjsgskNo ratings yet

- BUS120 Unit Outline 2021T2Document11 pagesBUS120 Unit Outline 2021T2cloudella byrdeNo ratings yet

- Quarter 1Week6Modu: Let's Talk Accounting Cycle in BusinessDocument26 pagesQuarter 1Week6Modu: Let's Talk Accounting Cycle in BusinessTaj MahalNo ratings yet

- ACCT 1026 Lesson 4 PDFDocument5 pagesACCT 1026 Lesson 4 PDFAnnie RapanutNo ratings yet

- ACC 203 Main Course (R.B. Jat)Document196 pagesACC 203 Main Course (R.B. Jat)Rolfu Bambido Looken100% (1)

- Financial Accounting and Reporting - SLK - 03Document24 pagesFinancial Accounting and Reporting - SLK - 03Its Nico & SandyNo ratings yet

- Accounting Cycle Assignment HelpDocument6 pagesAccounting Cycle Assignment Helpfpxmfxvlf100% (1)

- Financial Accounting and Reporting Learning ModulesDocument126 pagesFinancial Accounting and Reporting Learning ModulesLovelyn Joy Solutan100% (2)

- COURSE PACK - ACCTG 1&2 Lesson 5.1Document10 pagesCOURSE PACK - ACCTG 1&2 Lesson 5.1Victoria Quebral CarumbaNo ratings yet

- Grade 9 Accounting Syllabus Overview 2020-2021Document5 pagesGrade 9 Accounting Syllabus Overview 2020-2021Kelvin CalvinNo ratings yet

- Syllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021Document10 pagesSyllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021SYED HUSSAINNo ratings yet

- Week 3 - The Conceptual Framework For Financial ReportingDocument4 pagesWeek 3 - The Conceptual Framework For Financial ReportingRoshane Deil PascualNo ratings yet

- Las Fabm1 Q4 W2Document31 pagesLas Fabm1 Q4 W2nahatdoganNo ratings yet

- 001 2012 4 eDocument365 pages001 2012 4 eShiran Mahadeo100% (1)

- AP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSDocument40 pagesAP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSBebie Joy Urbano100% (1)

- 04 Completing The Accounting Cycle PDFDocument39 pages04 Completing The Accounting Cycle PDFcyics TabNo ratings yet

- Accounting I Syllabus: Instructor's Name and Contact InformationDocument6 pagesAccounting I Syllabus: Instructor's Name and Contact InformationDino DizonNo ratings yet

- Acct 4Document5 pagesAcct 4Annie RapanutNo ratings yet

- Accounting Fundamentals BookletDocument113 pagesAccounting Fundamentals BookletAnsha Guness100% (1)

- Fac 1502Document365 pagesFac 1502Thuthukani100% (1)

- 2022 - FMGT2152 Course OutlineDocument3 pages2022 - FMGT2152 Course OutlineKCNo ratings yet

- Week 4 - Objective of The General Purpose Financial Reporting and Qualitative CharacteresticsDocument8 pagesWeek 4 - Objective of The General Purpose Financial Reporting and Qualitative CharacteresticsRoshane Deil PascualNo ratings yet

- Assignment 1 StudentDocument3 pagesAssignment 1 StudentAssagNo ratings yet

- Learning Packet (FABM1)Document14 pagesLearning Packet (FABM1)Judy Anne RamirezNo ratings yet

- Unit 1-5Document337 pagesUnit 1-5Aditya VashisthNo ratings yet

- ACN101MDocument377 pagesACN101MTobelaNcube100% (2)

- Fabm1 Quarter3 Module 8 Week 8 Week 9Document19 pagesFabm1 Quarter3 Module 8 Week 8 Week 9Princess Nicole EsioNo ratings yet

- Ignou Eco - 2 Solved Assignment 218-19Document34 pagesIgnou Eco - 2 Solved Assignment 218-19NEW THINK CLASSESNo ratings yet

- Tutorial Letter 101/3/2024: Financial Accounting ReportingDocument15 pagesTutorial Letter 101/3/2024: Financial Accounting Reportingtleggat69No ratings yet

- Fabm1 Quarter3 Module 8 Week 8 Week 9Document19 pagesFabm1 Quarter3 Module 8 Week 8 Week 9Princess Nicole EsioNo ratings yet

- CML 102 Foundations of Accounting (Notes)Document170 pagesCML 102 Foundations of Accounting (Notes)Wesley100% (2)

- AF101 Course Outline s1 2024Document11 pagesAF101 Course Outline s1 2024Maciu TuilevukaNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Second QuarterDocument26 pagesFundamentals of Accountancy, Business and Management 1: Second QuarterELIANNE VY100% (1)

- Tutorial Letter 101/3/2024: Elementary Financial Accounting ReportingDocument14 pagesTutorial Letter 101/3/2024: Elementary Financial Accounting Reportingsindisiwemtetwa540No ratings yet

- Acct101 - Charmayne HighfieldDocument5 pagesAcct101 - Charmayne Highfieldrachel.mack.2022No ratings yet

- Learning: Fundamentals of Accounting, Business and Management 1Document13 pagesLearning: Fundamentals of Accounting, Business and Management 1MTECH ASIANo ratings yet

- ACC111 Course CompactDocument2 pagesACC111 Course CompactKehindeNo ratings yet

- Elv Baa3733 LP010 V1Document5 pagesElv Baa3733 LP010 V1SAKHILAH A/P ARIVALAGANNo ratings yet

- Full Download Pfin 6th Edition Billingsley Solutions ManualDocument35 pagesFull Download Pfin 6th Edition Billingsley Solutions Manualc3miabutler100% (41)

- ACCT5001-01 Fall2020Document6 pagesACCT5001-01 Fall2020Claire ZhangNo ratings yet

- Homework w2Document7 pagesHomework w2ergjnv85100% (2)

- Module Template FIN 327 (Financial Analysis and Reporting)Document20 pagesModule Template FIN 327 (Financial Analysis and Reporting)Normae AnnNo ratings yet

- Nothing To Be Computed. I Will B E Sending The Set of Transaction (Problems) Next WeekDocument12 pagesNothing To Be Computed. I Will B E Sending The Set of Transaction (Problems) Next WeekShiela EspirituNo ratings yet

- Module 4 Packet: AE 111 - Financial Accounting & ReportingDocument28 pagesModule 4 Packet: AE 111 - Financial Accounting & ReportingHelloNo ratings yet

- Intermediate Accountig AkuntansiDocument46 pagesIntermediate Accountig AkuntansiRika LerianiNo ratings yet

- Accounting Grade 11 / Year 12: Course OutlineDocument3 pagesAccounting Grade 11 / Year 12: Course OutlineTommyTheNerdyNo ratings yet

- ACCTG131-CourseGuide First Semester Ay2022-2023 Version 1Document6 pagesACCTG131-CourseGuide First Semester Ay2022-2023 Version 1Klarissemay MontallanaNo ratings yet

- COURSE PACK - ACCTG 1&2 Lesson 2Document8 pagesCOURSE PACK - ACCTG 1&2 Lesson 2RITCHEL JOHN ARELLANONo ratings yet

- Book-Keeping and Accounts Level 2 April 2012Document22 pagesBook-Keeping and Accounts Level 2 April 2012Cary LeeNo ratings yet

- Prep M51C R1601 W01.note.gDocument56 pagesPrep M51C R1601 W01.note.galghazalianNo ratings yet

- Diploma in Accounting Program BUSI 293 I PDFDocument10 pagesDiploma in Accounting Program BUSI 293 I PDFSheena MachinjiriNo ratings yet

- ACCT2010 L10 L11 L12 Syllabus 2015Document4 pagesACCT2010 L10 L11 L12 Syllabus 2015jasNo ratings yet

- Inshan New Acct1002 Course Guide Students Semester 2 2011 12 v1 (1) .Doc RevisedDocument18 pagesInshan New Acct1002 Course Guide Students Semester 2 2011 12 v1 (1) .Doc RevisedSunita RamkobairNo ratings yet

- ACCT2542 Corporate Financial Reporting and Analysis S2 2015 Part A (Updated On Page 17)Document21 pagesACCT2542 Corporate Financial Reporting and Analysis S2 2015 Part A (Updated On Page 17)Bob CaterwallNo ratings yet

- Unit II Study GuideDocument4 pagesUnit II Study GuideVirginia TownzenNo ratings yet

- Week 3 - The Conceptual Framework For Financial ReportingDocument4 pagesWeek 3 - The Conceptual Framework For Financial ReportingRoshane Deil PascualNo ratings yet

- CFAS Week 14 Accounting For DividendsDocument7 pagesCFAS Week 14 Accounting For DividendsRoshane Deil PascualNo ratings yet

- Week-1 Midterms MotivationDocument15 pagesWeek-1 Midterms MotivationRoshane Deil PascualNo ratings yet

- Normal DistributionDocument13 pagesNormal DistributionRoshane Deil PascualNo ratings yet

- ACCT 1033 - Topic 2Document14 pagesACCT 1033 - Topic 2Roshane Deil PascualNo ratings yet

- ACCT1033 - Week 5 Accounting For Cost FlowDocument10 pagesACCT1033 - Week 5 Accounting For Cost FlowRoshane Deil PascualNo ratings yet

- RZAL 1013 Module 5Document20 pagesRZAL 1013 Module 5Roshane Deil PascualNo ratings yet

- MGMT-1033-Capital-Budgeting FinalDocument4 pagesMGMT-1033-Capital-Budgeting FinalRoshane Deil PascualNo ratings yet

- Kinds of ObligationsDocument35 pagesKinds of ObligationsRoshane Deil PascualNo ratings yet

- Fabm 2: Quarter 4 - Module 1 Bank Reconciliation StatementDocument15 pagesFabm 2: Quarter 4 - Module 1 Bank Reconciliation StatementFlordilyn Dichon83% (6)

- e-StatementBRImo 716901009766537 Oct2023 20231019 110239Document1 pagee-StatementBRImo 716901009766537 Oct2023 20231019 110239yenimaisya9No ratings yet

- Account Statement: 01/10/2020 - 31/10/2020 Fxpro Global Markets LTDDocument3 pagesAccount Statement: 01/10/2020 - 31/10/2020 Fxpro Global Markets LTDKarren SVNo ratings yet

- 12345Document17 pages12345xjammer0% (3)

- Concurrent Review Data - May 2021Document1,069 pagesConcurrent Review Data - May 2021Tamilmani SubramaniyanNo ratings yet

- Compiled Notes I NegoDocument16 pagesCompiled Notes I NegoDeanne ViNo ratings yet

- Partnership OperationDocument52 pagesPartnership OperationMark Reyes100% (1)

- Functional Analysis of Digital PaymentDocument57 pagesFunctional Analysis of Digital PaymentSejal MehrotraNo ratings yet

- MA0028Document2 pagesMA0028Tenzin KunchokNo ratings yet

- 2023 TIC Financial StatementsDocument6 pages2023 TIC Financial StatementsEduardoNo ratings yet

- Excel Week 5Document14 pagesExcel Week 5Eco FacileNo ratings yet

- Services Quality Analysis in SBI BankDocument110 pagesServices Quality Analysis in SBI Bankvinodksrini007100% (4)

- Quiz 1 - 5Document4 pagesQuiz 1 - 5Yong RenNo ratings yet

- Standard Bank: Miss. Nthabiseng Rebecca LetabolaDocument9 pagesStandard Bank: Miss. Nthabiseng Rebecca LetabolaMpho100% (1)

- Why Co-Operative Banks Fail in IndiaDocument22 pagesWhy Co-Operative Banks Fail in IndiaRohit YadavNo ratings yet

- Comprehensive Exercises On Equity InvestmentquestionaireDocument4 pagesComprehensive Exercises On Equity InvestmentquestionaireLilian LagrimasNo ratings yet

- Akuntansi 1Document1 pageAkuntansi 1Bintang FitriNo ratings yet

- Paytm CaseDocument9 pagesPaytm CaseSHREY BAZARINo ratings yet

- Chapter 14 - SolutionsDocument17 pagesChapter 14 - SolutionsHolly EntwistleNo ratings yet

- AR18 - Financial Statements and Independent Auditor ReportDocument57 pagesAR18 - Financial Statements and Independent Auditor ReportKira LimNo ratings yet

- Summer Internship Project ReportDocument66 pagesSummer Internship Project ReportPrakhar Agarwal100% (1)

- 4AC1 01R Que 20190511 PDFDocument20 pages4AC1 01R Que 20190511 PDFAbrar ChowdhuryNo ratings yet

- Clavax Power - TAR - 2023 - Provisional - 10.09Document7 pagesClavax Power - TAR - 2023 - Provisional - 10.09Naresh nath MallickNo ratings yet

- Malik Asad Pervez's Internship Report On Askari Commercial Bank LimitedDocument43 pagesMalik Asad Pervez's Internship Report On Askari Commercial Bank LimitedMalik Asad Pervez100% (1)

- Reimbursement 1 1Document5 pagesReimbursement 1 1Sneha JoseNo ratings yet

- FVSC Signed Audited Accounts 20 - 21Document35 pagesFVSC Signed Audited Accounts 20 - 21Forth Valley Sensory CentreNo ratings yet

- Cbe Ac STMT RPDocument1 pageCbe Ac STMT RPBayechNo ratings yet

- CURRENT ISSUES IN ACCOUNTING Assignment 1Document4 pagesCURRENT ISSUES IN ACCOUNTING Assignment 1Fungai MajuriraNo ratings yet

- Overview of Hedge Funds PERACDocument21 pagesOverview of Hedge Funds PERACNirmal PatidarNo ratings yet

- Module - Principless of Accounting IDocument205 pagesModule - Principless of Accounting Iወሬ ነጋሪ- oduu himaaNo ratings yet