Professional Documents

Culture Documents

0 - 1098 Mortgage Interest 2022 - 01122023 - 162111

Uploaded by

Osvaldo CalderonUACJ0 ratings0% found this document useful (0 votes)

27 views1 pageOriginal Title

0539982_0_1098 Mortgage Interest 2022_01122023_162111 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views1 page0 - 1098 Mortgage Interest 2022 - 01122023 - 162111

Uploaded by

Osvaldo CalderonUACJCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

OSVALDO CALDERON GARCIA

2400 TEXAS AVE

EL PASO, TX, 79901

Instructions for Payer/Borrower

Box 2. Shows the outstanding principal on the mortgage as of January 1 of the calendar year.If

A person (including a financial institution, a governmental unit, and a cooperative the mortgage originated in the calendar year, shows the mortgage principal as of the date of

housing corporation) who is engaged in a trade or business and, in the course of origination. If the recipient/lender acquired the loan in the calendar year, shows the mortgage

such trade or business, received from you at least $600 of mortgage interest

principal as of the date of acquisition.

(including certain points) on any one mortgage in the calendar year must furnish this

statement to you. Box 3. Shows the date of the mortgage origination.

If you received this statement as the payer of record on a mortgage on which Box 4. Do not deduct this amount. It is a refund (or credit) for overpayment(s)

there are other borrowers, furnish each of the other borrowers with information about of interest you made in a prior year or years. If you itemized deductions in the year(s) you paid the

the proper distribution of amounts reported on this form. Each borrower is entitled to interest, you may have to include part or all of the box 4 amount on the “Other income” line of

deduct only the amount he or she paid and points paid by the seller that represent your calendar year Schedule 1 (Form 1040). No adjustment to your prior year(s) tax return(s) is

his or her share of the amount allowable as a deduction. Each borrower may have to necessary. For more information, see Pub. 936 and Itemized Deduction Recoveries in Pub. 525.

include in income a share of any amount reported in box 4.

If your mortgage payments were subsidized by a government agency, you may not Box 5. If an amount is reported in this box, it may qualify to be treated as deductible mortgage

be able to deduct the amount of the subsidy. See the instructions for Schedule A, C, interest. See the calendar year Schedule A (Form 1040) instructions and Pub. 936.

or E (Form 1040 or 1040-SR) for how to report the mortgage interest. Also, for more

information, see Pub. 936 and Pub. 535. Box 6. Not all points are reportable to you. Box 6 shows points you or the seller paid this year for

the purchase of your principal residence that are required to be reported to you. Generally, these

Payer's/Borrower's taxpayer identification number (TIN). For your protection, this points are fully deductible in the year paid, but you must subtract seller-paid points from the basis

form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). of your residence. Other points not reported in box 6 may also be deductible. See Pub. 936 to

However, the issuer has reported your complete TIN to the IRS. figure the amount you can deduct.

Account number. May show an account or other unique number the lender has

assigned to distinguish your account. Box 7. If the address of the property securing the mortgage is the same as the payer's/borrower's,

Box 1. Shows the mortgage interest received by the recipient/lender during the year. either the box has been checked, or box 8 has been completed.

This amount includes interest on any obligation secured by real property, including a

mortgage, home equity loan, or line of credit. This amount does not include points, Box 8. Shows the address or description of the property securing the mortgage.

government subsidy payments, or seller payments on a “buydown” mortgage. Such Box 9. If more than one property secures the loan, shows the number of properties securing the

amounts are deductible by you only in certain circumstances.

mortgage. If only one property secures the loan, this box may be blank.

If you prepaid interest in the calendar year that accrued in full by

▲

!

CAUTION

January 15, of the subsequent year, this prepaid interest may be

included in box 1. However, you cannot deduct the prepaid amount in

the calendar year paid even though it may be included in box 1.

Box 10. The interest recipient may use this box to give you other information, such as real

estate taxes or insurance paid from escrow.

Box 11. If the recipient/lender acquired the mortgage in the calendar year, shows the date of acquisition.

Future developments. For the latest information about developments related to

If you hold a mortgage credit certificate and can claim the mortgage interest Form 1098 and its instructions, such as legislation enacted after they were published, go to

credit, see Form 8396. If the interest was paid on a mortgage, home equity loan, www.irs.gov/Form1098.

or line of credit secured by a qualified residence, you can only deduct the interest

paid on acquisition indebtedness, and you may be subject to a deduction Free File. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online federal tax

preparation, e-filing, and direct deposit or payment options.

limitation.

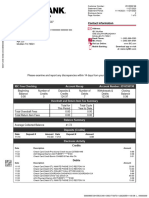

CORRECTED (if checked)

RECIPIENT’S/LENDER’S name, street address, city or town, state or *Caution: The amount shown may OMB No. 1545-1380

province, country, ZIP or foreign postal code, and telephone no. not be fully deductible by you.

Limits based on the loan amount Mortgage

21st Mortgage Corporation

and the cost and value of the

secured property may apply. Also,

you may only deduct interest to the

2022 Interest

P.O Box 477

extent it was incurred by you,

actually paid by you, and not

Statement

reimbursed by another person. Form 1098

Knoxville, TN 37901

1 Mortgage interest received from payer(s)/borrower(s)*

Copy B

$ 9602.29 For Payer/

RECIPIENT’S/LENDER’S TIN PAYER’S/BORROWER’S TIN 2 Outstanding mortgage 3 Mortgage origination date Borrower

principal

$ 150655.81 01/27/2022 The information in boxes 1

76-0478830 XXX-XX-9373 4 Refund of overpaid through 9 and 11 is

5 Mortgage insurance

interest premiums important tax information

and is being furnished to the

PAYER’S/BORROWER’S name $ 0.00 $ 0.00 IRS. If you are required to

6 Points paid on purchase of principal residence file a return, a negligence

OSVALDO CALDERON GARCIA penalty or other sanction

$ 4359.03 may be imposed on you if

Street address (including apt. no.) 7 If address of property securing mortgage is the same the IRS determines that an

as PAYER’S/BORROWER’S address, the box is checked, or underpayment of tax results

2400 TEXAS AVE because you overstated a

the address or description is entered in box 8.

deduction for this mortgage

interest or for these points,

City or town, state or province, country, and ZIP or foreign postal code 8 Address or description of property securing mortgage (see reported in boxes 1 and 6; or

instructions) because you didn’t report

EL PASO, TX, 79901 the refund of interest (box 4);

3140 WICHITA PLACE ANTHONY, or because you claimed a

9 Number of properties securing the 10 Other nondeductible item.

mortgage

NM 88021

11 Mortgage acquisition

date

Account number (see instructions)

539982 0

Form 1098 (Keep for your records) www.irs.gov/Form1098 Department of the Treasury - Internal Revenue Service

You might also like

- Request for Taxpayer ID FormDocument4 pagesRequest for Taxpayer ID FormMichael RamirezNo ratings yet

- LG FFDocument1 pageLG FFfeem743No ratings yet

- PUA 1099G tax form summaryDocument1 pagePUA 1099G tax form summaryClifton WilsonNo ratings yet

- 2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)Document42 pages2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)jpeppard100% (4)

- Paula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Document2 pagesPaula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Natural Beauty LaserNo ratings yet

- Direct Loan Disclosure DetailsDocument3 pagesDirect Loan Disclosure DetailsNathan BurrisNo ratings yet

- 2016 Merrill Taxes PDFDocument8 pages2016 Merrill Taxes PDFholymolyNo ratings yet

- Advia Credit Union 2Document1 pageAdvia Credit Union 2kathyNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- Sample Format of Individual Income Tax Return y A 2017 2018Document3 pagesSample Format of Individual Income Tax Return y A 2017 2018Chathuranga LSISNo ratings yet

- Leave Certification Requirements: Page 1 of 14Document14 pagesLeave Certification Requirements: Page 1 of 14Anonymous zEf2TWiHgWNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Tax ReturnDocument26 pagesTax ReturnjoshuaharaldNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocument3 pagesTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNo ratings yet

- Individual Tax CalculationDocument11 pagesIndividual Tax CalculationSunil ChelladuraiNo ratings yet

- Captura de Pantalla T 2023-05-28 A La(s) 22.18.24Document69 pagesCaptura de Pantalla T 2023-05-28 A La(s) 22.18.24rozaj519No ratings yet

- Individuals Tax Return - US 2016Document2 pagesIndividuals Tax Return - US 2016Yousef M. AqelNo ratings yet

- DocumentDocument1 pageDocumentMulletHawkSunshyneBrownNo ratings yet

- 2013 AgriSafe 990Document28 pages2013 AgriSafe 990AgriSafeNo ratings yet

- Tax Return 2023Document2 pagesTax Return 2023jacksonleah313No ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- CertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245Document1 pageCertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245c phelpsNo ratings yet

- Webull Tax DocumentDocument10 pagesWebull Tax DocumentHimer VerdeNo ratings yet

- Student loan interest statementDocument2 pagesStudent loan interest statementMaikeru ShogunnateMusa MNo ratings yet

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusfelix angomasNo ratings yet

- Request For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429Document2 pagesRequest For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429DrmookieNo ratings yet

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- Chase Mortgage Finance Trust 2007-S6 ProspectusDocument214 pagesChase Mortgage Finance Trust 2007-S6 ProspectusBrenda ReedNo ratings yet

- 2016 1040 Individual Tax Return Engagement LetterDocument11 pages2016 1040 Individual Tax Return Engagement LettersarahvillalonNo ratings yet

- 1099-G unemployment benefitsDocument1 page1099-G unemployment benefitsKristine McVeighNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarNo ratings yet

- Cash FlowDocument1 pageCash Flowpawan_019No ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- 2022 Individual Tax Organizer FillableDocument6 pages2022 Individual Tax Organizer FillableTham DangNo ratings yet

- 2023_TaxReturnDocument27 pages2023_TaxReturnLuiNo ratings yet

- 2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917Document2 pages2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917BindhuNo ratings yet

- Think Computer Foundation 2009 Tax ReturnDocument10 pagesThink Computer Foundation 2009 Tax ReturnTaxManNo ratings yet

- 2018 Form I Individual Income Tax Return 2017Document20 pages2018 Form I Individual Income Tax Return 2017KSeegurNo ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- 2021 TaxReturnDocument9 pages2021 TaxReturnTerry ParkerNo ratings yet

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- Loan Guidelines Us BankDocument12 pagesLoan Guidelines Us BankcraigscNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- Form990 2021 1661373681961Document58 pagesForm990 2021 1661373681961Jeremy Joseph EhlingerNo ratings yet

- 34 Wihh 504331 H 0714320240524151104202Document3 pages34 Wihh 504331 H 0714320240524151104202jamelmhunt22No ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- 2021 - TaxReturn 2pagessignedDocument3 pages2021 - TaxReturn 2pagessignedDedrick RiversNo ratings yet

- Gene Locke Tax Return, 2006Document25 pagesGene Locke Tax Return, 2006Lee Ann O'NealNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitNo ratings yet

- ECDC 2009 Tax ReturnDocument27 pagesECDC 2009 Tax ReturnNC Policy WatchNo ratings yet

- Investment Declaration Form - FY 2022-23Document7 pagesInvestment Declaration Form - FY 2022-23varaprasadNo ratings yet

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Document4 pagesCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezNo ratings yet

- Instructions For Payer/Borrower: Important Tax Return Document EnclosedDocument4 pagesInstructions For Payer/Borrower: Important Tax Return Document EnclosedJenine FordNo ratings yet

- TaxStatement 2024Document3 pagesTaxStatement 202425268magdaNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website. The Official Printed Version of This IRS Form IsDocument6 pagesAttention:: Not File Copy A Downloaded From This Website. The Official Printed Version of This IRS Form IsBenne James50% (2)

- 2000 Tank CompDocument4 pages2000 Tank CompOsvaldo CalderonUACJNo ratings yet

- Drilling Your Water Well121114Document2 pagesDrilling Your Water Well121114Osvaldo CalderonUACJNo ratings yet

- Cirona-6300 IFUDocument4 pagesCirona-6300 IFUOsvaldo CalderonUACJNo ratings yet

- CID Foundation Only PermitDocument1 pageCID Foundation Only PermitOsvaldo CalderonUACJNo ratings yet

- XXXXXXXXXX0009 20240128150640302188 UnlockedDocument6 pagesXXXXXXXXXX0009 20240128150640302188 Unlockedr6540073No ratings yet

- MalobaDocument1 pageMalobaenyonyoziNo ratings yet

- Mortgage and Its Types: Pallavi Chopra Omama Iqbal Shubham Agarwal Anurat Singh Mohit Sharma Vinay VermaDocument11 pagesMortgage and Its Types: Pallavi Chopra Omama Iqbal Shubham Agarwal Anurat Singh Mohit Sharma Vinay VermaSomesh SiddharthNo ratings yet

- Operative Accounts Deposit Accounts Loan Accounts All AccountsDocument2 pagesOperative Accounts Deposit Accounts Loan Accounts All AccountsGamer Ji100% (1)

- Zo BX12 T VXL5 JCZW 9Document7 pagesZo BX12 T VXL5 JCZW 9SwapnilSharmaNo ratings yet

- Time Value of Money Excel 2Document9 pagesTime Value of Money Excel 2Siraj ShaikhNo ratings yet

- Finance Written AssignmentDocument4 pagesFinance Written Assignmentapi-30241034250% (2)

- Bank Reconciliation Statement 2023Document30 pagesBank Reconciliation Statement 2023jsy claudeNo ratings yet

- HDFC 1701773336742Document8 pagesHDFC 1701773336742gangwarsuresh971753pNo ratings yet

- Module 2 - Bank ReconciliationDocument21 pagesModule 2 - Bank ReconciliationJennalyn S. GanalonNo ratings yet

- Trieu BuiDocument77 pagesTrieu BuiNam CaoNo ratings yet

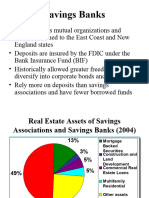

- Savings BanksDocument7 pagesSavings BanksLara KhanNo ratings yet

- Account Statement SummaryDocument11 pagesAccount Statement SummarysudharshanNo ratings yet

- Ibiciro Tugenderaho Mu Gutanga Serivisi Guhera Taliki 4 Gashyantare 2022Document1 pageIbiciro Tugenderaho Mu Gutanga Serivisi Guhera Taliki 4 Gashyantare 2022paul KAGABONo ratings yet

- D Websites COWWW4 Wwwcache V 1708 751 48080794 PanoramaDocument3 pagesD Websites COWWW4 Wwwcache V 1708 751 48080794 Panorama252908No ratings yet

- 2nd Periodical Test MATH11Document2 pages2nd Periodical Test MATH11Jubeth L. EspirituNo ratings yet

- Northen Region Water Board Salary SlipsDocument41 pagesNorthen Region Water Board Salary SlipsWjz WjzNo ratings yet

- U S Banking System 3rd Edition Center For Financial Training Test BankDocument9 pagesU S Banking System 3rd Edition Center For Financial Training Test Bankdylantamxrnt100% (23)

- Statement XXXXXX0676 2023 08 15Document6 pagesStatement XXXXXX0676 2023 08 15garrettloehrNo ratings yet

- MBBsavings - 164017 212412 - 2022 09 30 PDFDocument6 pagesMBBsavings - 164017 212412 - 2022 09 30 PDFAdeela fazlinNo ratings yet

- ShruthiDocument6 pagesShruthiSanjay LeoNo ratings yet

- Indwdhi 20220831Document7 pagesIndwdhi 20220831nor nurul maisitahNo ratings yet

- Customer Inquiry Report 7Document6 pagesCustomer Inquiry Report 7Rom RoyenNo ratings yet

- Test Bank For Personal Finance 4th Edition MaduraDocument18 pagesTest Bank For Personal Finance 4th Edition Madurathomasburgessptrsoigxdk100% (22)

- Account Statement: Penyata AkaunDocument3 pagesAccount Statement: Penyata AkaunSue Ah SueNo ratings yet

- Axis Bank - 123456763542 - Sample Statement - cc319740Document5 pagesAxis Bank - 123456763542 - Sample Statement - cc319740Seemab LatifNo ratings yet

- Sbi Fy 2021 - 22Document2 pagesSbi Fy 2021 - 22Y. Sreekanth reddyNo ratings yet

- Nacer - Debache 01Document9 pagesNacer - Debache 01joeNo ratings yet

- Mohammad Avisena - Week 6 - Storing My Savings - Student Worksheet (Classworks)Document4 pagesMohammad Avisena - Week 6 - Storing My Savings - Student Worksheet (Classworks)Avisena AzisNo ratings yet

- Discover Statement 20230726 7744Document6 pagesDiscover Statement 20230726 7744tyger ndaNo ratings yet