0% found this document useful (0 votes)

110 views4 pagesHST Notes

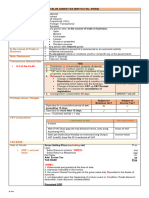

The document discusses key aspects of the Harmonized Sales Tax (HST) implemented in Ontario, Canada. It outlines that the HST replaced the GST and PST as a value-added tax charged on most goods and services. Businesses with over $30,000 in annual sales must register and charge HST on sales, while being able to recover HST paid to suppliers. Accounting for HST involves maintaining HST payable and recoverable accounts, and remitting the difference (either payment or refund claim) to the Canada Revenue Agency within one month of a reporting period.

Uploaded by

Drippy SnowflakeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

110 views4 pagesHST Notes

The document discusses key aspects of the Harmonized Sales Tax (HST) implemented in Ontario, Canada. It outlines that the HST replaced the GST and PST as a value-added tax charged on most goods and services. Businesses with over $30,000 in annual sales must register and charge HST on sales, while being able to recover HST paid to suppliers. Accounting for HST involves maintaining HST payable and recoverable accounts, and remitting the difference (either payment or refund claim) to the Canada Revenue Agency within one month of a reporting period.

Uploaded by

Drippy SnowflakeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd