Professional Documents

Culture Documents

Nitin Itr

Uploaded by

Nitin TayadeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nitin Itr

Uploaded by

Nitin TayadeCopyright:

Available Formats

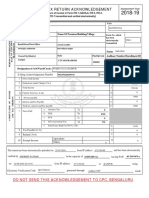

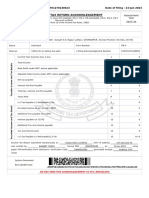

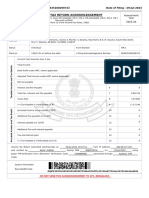

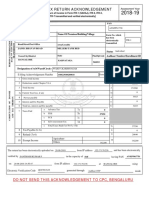

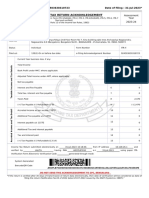

Acknowledgement Number:416358740100723 Date of filing : 10-Jul-2023*

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment

[Where the data of the Return of Income in Form ITR-1(SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 Year

filed and verified]

(Please see Rule 12 of the Income-tax Rules, 1962) 2023-24

PAN BJPPT2024N

Name NITIN VIJAY TAYADE

Address 404, ganaraj residency , ambika nagar, AKOLA, 19-Maharashtra, 91-INDIA, 444001

Status Individual Form Number ITR-1

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 416358740100723

Current Year business loss, if any 1 0

Total Income 2 2,40,000

Taxable Income and Tax Details

Book Profit under MAT, where applicable 3 0

Adjusted Total Income under AMT, where applicable 4 0

Net tax payable 5 0

Interest and Fee Payable 6 0

Total tax, interest and Fee payable 7 0

Taxes Paid 8 0

(+) Tax Payable /(-) Refundable (7-8) 9 0

Accreted Income and Tax Detail

Accreted Income as per section 115TD 10 0

Additional Tax payable u/s 115TD 11 0

Interest payable u/s 115TE 12 0

Additional Tax and interest payable 13 0

Tax and interest paid 14 0

(+) Tax Payable /(-) Refundable (13-14) 15 0

Income Tax Return submitted electronically on 10-Jul-2023 21:51:29 from IP address 157.33.101.235

and verified by NITIN VIJAY TAYADE having PAN BJPPT2024N on 10-Jul-2023

using paper ITR-Verification Form /Electronic Verification Code 7UAE6J7T1I generated through Aadhaar

OTP mode

System Generated

Barcode/QR Code

BJPPT2024N014163587401007233c391fbf2916bec94244d43183fdaf8f0a771b82

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

*If the return is verified after 30 days of transmission of return data electronically, then date of verification will be considered as date of

filing the return (Notification No.05 of 2022 dated 29-07-2022 issued by the DGIT (Systems), CBDT).”

You might also like

- ITR-3 Ackn AY 2021-22Document1 pageITR-3 Ackn AY 2021-22amit debnathNo ratings yet

- PDF 464995310271221Document1 pagePDF 464995310271221Drsex DrsexNo ratings yet

- PundlinkDocument1 pagePundlinkSHAIKH IBRAHIMNo ratings yet

- Ack 137988180310723Document1 pageAck 137988180310723Lakesh kumar padhyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearPrateek GuptaNo ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- ACK138389790080523Document1 pageACK138389790080523Vishal GoyalNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearAEN TRACKNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearWILLOFDREAMNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Ranjit 23-24Document1 pageRanjit 23-24Radha SureshNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearTitiksha JoshiNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAryan KulhariNo ratings yet

- PDF 387693400310722Document1 pagePDF 387693400310722kumar kishanNo ratings yet

- Ashok ITR 2022-23Document1 pageAshok ITR 2022-23SHIFAZ SULAIMANNo ratings yet

- F MUp 0 FRQs T3 XJK 7 KDocument5 pagesF MUp 0 FRQs T3 XJK 7 KArchanaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearsumitNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearP N rajuNo ratings yet

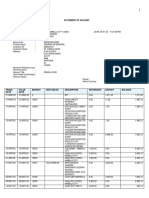

- Statement of Account: State Bank of IndiaDocument6 pagesStatement of Account: State Bank of IndiavikiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDirector GGINo ratings yet

- Kotak Mahindra Bank LTD: Full and Final SettlementDocument2 pagesKotak Mahindra Bank LTD: Full and Final SettlementvasssssssSNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmit DuttaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusunilchampNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment Yeartejeswararao ronankiNo ratings yet

- Itr 2023 2024Document1 pageItr 2023 2024Deepak ThangamaniNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearpawan kumar raiNo ratings yet

- ACK859248570300723Document1 pageACK859248570300723Manas Ranjan DalaiNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearMurugadassNo ratings yet

- Rutansh Itr 2022-23Document1 pageRutansh Itr 2022-23Rutansh JagtapNo ratings yet

- PDF 628846520240522Document1 pagePDF 628846520240522Narayana Rao GanapathyNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- PDF 829435100290723Document1 pagePDF 829435100290723Nilay KumarNo ratings yet

- Full and Final Settlement Statement of January 2021 Associate InformationDocument1 pageFull and Final Settlement Statement of January 2021 Associate InformationB BhaskarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmiya Ranjan PaniNo ratings yet

- DILBAGH SINGH ITR 2023-2024 - UnlockedDocument1 pageDILBAGH SINGH ITR 2023-2024 - UnlockedmohitNo ratings yet

- Ponugoti Manga Itr 2022Document4 pagesPonugoti Manga Itr 2022Neduri Kalyan SrinivasNo ratings yet

- Itr Acknowledgement 2020Document1 pageItr Acknowledgement 2020AJAY KUMAR JAISWALNo ratings yet

- PDF 382787590310722Document1 pagePDF 382787590310722Techwiser services and engineeringNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023HeetNo ratings yet

- Pay Slip - 1421107 - Apr-22Document1 pagePay Slip - 1421107 - Apr-22Sachin ChadhaNo ratings yet

- Salary Slip June2020Document1 pageSalary Slip June2020rehan siddiquiNo ratings yet

- PDF 776152000311221Document1 pagePDF 776152000311221NandhakumarNo ratings yet

- ACK158216300200523Document1 pageACK158216300200523Ritu RajNo ratings yet

- Itr Ack PDFDocument1 pageItr Ack PDFPixel computerNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSiyad KvNo ratings yet

- PDF 808478730140722Document1 pagePDF 808478730140722Vishakha BhureNo ratings yet

- Al Hikam DetailsDocument11 pagesAl Hikam DetailsArif Hussain ShaikhNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearsubhash mandwalNo ratings yet

- Ack - AY 2022-23 MeenaDocument1 pageAck - AY 2022-23 Meenakdsss pNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep NegiNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRajagopal ArunachalamNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023bluetrans expressNo ratings yet

- PDF 309648880270623Document1 pagePDF 309648880270623Vinay PatelNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- PDF 404118660090723Document1 pagePDF 404118660090723arjunbasfore84No ratings yet

- Genet Tadesse - A Small Business Borrower in EthiopiaDocument2 pagesGenet Tadesse - A Small Business Borrower in EthiopiaWedpPepeNo ratings yet

- Review Questions: by Kailashinie ThiranagamaDocument9 pagesReview Questions: by Kailashinie ThiranagamarkailashinieNo ratings yet

- Doing Business in BrazilDocument164 pagesDoing Business in BrazilVarupNo ratings yet

- Islamic Banking: Financial Institutions and Markets Final ProjectDocument27 pagesIslamic Banking: Financial Institutions and Markets Final ProjectNaina Azfar GondalNo ratings yet

- Mergent Residences Sample ComputationDocument1 pageMergent Residences Sample Computationrx5426.homerouterNo ratings yet

- Certificado Inshur SH - 2Document1 pageCertificado Inshur SH - 2ukmagicoNo ratings yet

- CA51024 - Quiz 2 (Solutions)Document6 pagesCA51024 - Quiz 2 (Solutions)The Brain Dump PHNo ratings yet

- Special Lecture Handouts in TaxationDocument24 pagesSpecial Lecture Handouts in TaxationTep DomingoNo ratings yet

- PT Zalia Cash Receipts JournalDocument8 pagesPT Zalia Cash Receipts Journalsovia deviNo ratings yet

- Groups 7 Changes in Group StructureDocument10 pagesGroups 7 Changes in Group StructureSharmaine Rivera MiguelNo ratings yet

- Summary - Rule 68 71Document32 pagesSummary - Rule 68 71Allana NacinoNo ratings yet

- Project Report Strategic Management Ssegic ManagementDocument23 pagesProject Report Strategic Management Ssegic ManagementMansi MeenaNo ratings yet

- Signature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Document36 pagesSignature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Ganesh PrasadNo ratings yet

- Opportunity Cost in Finance and AccountingDocument8 pagesOpportunity Cost in Finance and AccountingMary Grace GonzalesNo ratings yet

- Trent's Mortgage & Finance BrokingDocument10 pagesTrent's Mortgage & Finance BrokingTrent FetahNo ratings yet

- 1 - 1 Identifying Business TransactionsDocument5 pages1 - 1 Identifying Business TransactionsChristian Oliveros100% (1)

- History of Insu-Wps OfficeDocument2 pagesHistory of Insu-Wps OfficeSIDHARTH TiwariNo ratings yet

- Internship ReportDocument33 pagesInternship ReportPriyanka A SNo ratings yet

- Answers To End of Chapter QuestionsDocument59 pagesAnswers To End of Chapter QuestionsBruce_scribed90% (10)

- 14TH Annual Report: Year Ended - 3 (. O3.2Oo9Document19 pages14TH Annual Report: Year Ended - 3 (. O3.2Oo9ravalmunjNo ratings yet

- 06 MaterialityDocument2 pages06 MaterialityMan Cheng100% (1)

- CH 21 TBDocument18 pagesCH 21 TBJessica Garcia100% (1)

- ATC List 2017 Updated 5517Document47 pagesATC List 2017 Updated 5517Varinder AnandNo ratings yet

- Ja TinderDocument6 pagesJa TinderHitlisted VasuNo ratings yet

- ARTI Annual Report 2019 PDFDocument139 pagesARTI Annual Report 2019 PDFS Gevanry SagalaNo ratings yet

- Satia Industry Training Report.Document57 pagesSatia Industry Training Report.Deep zaildarNo ratings yet

- ProfitMart DEMATDocument24 pagesProfitMart DEMATProfit CircleNo ratings yet

- Asset Management PlanDocument49 pagesAsset Management PlanAndar WIdya PermanaNo ratings yet

- Draft AnswerDocument5 pagesDraft Answeraalawi00No ratings yet

- Affirm Buy Now Pay Later Case StudyDocument9 pagesAffirm Buy Now Pay Later Case StudyTrader CatNo ratings yet