Professional Documents

Culture Documents

1066-Addendum - Modification To Who Can Invest Provisions of The SID-March 28, 2022 - 0

Uploaded by

Jai Shree Ambe EnterprisesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1066-Addendum - Modification To Who Can Invest Provisions of The SID-March 28, 2022 - 0

Uploaded by

Jai Shree Ambe EnterprisesCopyright:

Available Formats

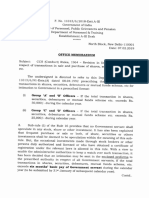

HDFC Asset Management Company Limited

A Joint Venture with abrdn Investment Management Limited

CIN: L65991MH1999PLC123027

Regd. Office: HDFC House, 2nd Floor, H.T. Parekh Marg, 165-166, Backbay Reclamation, Churchgate, Mumbai - 400020.

Phone: 022 66316333 • Toll Free Nos: 1800-3010-6767 / 1800-419-7676 • Fax: 022 22821144

• e-mail: hello@hdfcfund.com • Visit us at: www.hdfcfund.com

ADDENDUM TO THE SCHEME INFORMATION DOCUMENT(S) / KEY INFORMATION

MEMORANDUM(S) OF SCHEMES AND STATEMENT OF ADDITIONAL INFORMATION OF HDFC

MUTUAL FUND

Modification in ‘Who can invest’ provisions

It has been decided to permit registration of systematic transactions by US persons who are NRIs /

PIOs when physically present in India.

Accordingly, point no. 1 (a) under the para titled “Who cannot invest”, in the Scheme Information

Documents (“SIDs”), Key Information Memorandum(s) (KIMs) and Statement of Additional

Information (“SAI”) of HDFC Mutual Fund (“the Fund”) stand modified as under with effect from April

1, 2022.

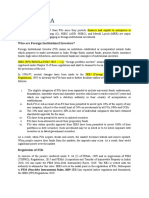

Provision Existing Proposed

Who can Who cannot invest? Who cannot invest?

Invest The aforementioned persons/entities as The aforementioned persons/entities as

specified under section "Who Can specified under section "Who Can

Invest?" shall not be eligible to invest in Invest?" shall not be eligible to invest in

the Scheme, if such persons/entities are: the Scheme, if such persons/entities are:

1. United States Person (U.S. person*) 1. United States Person (U.S. person*)

as defined under the extant laws of the as defined under the extant laws of the

United States of America, except the United States of America, except the

following: following:

a. NRIs/PIOs may invest/transact, in a. NRIs/PIOs may invest/transact, in

the Scheme, when present in India, as the Scheme, when present in India, as

lump sum subscription, redemption lump sum subscription, redemption

and/or switch transaction (other than and/or switch transaction, Registration

systematic transactions) only through of systematic transactions only

physical form and upon submission of through physical form and upon

such additional documents/undertakings, submission of such additional

etc., as may be stipulated by AMC/ documents/undertakings, etc., as may be

Trustee from time to time and subject to stipulated by AMC/ Trustee from time to

compliance with all applicable laws and time and subject to compliance with all

regulations prior to investing in the applicable laws and regulations prior to

Scheme. investing in the Scheme.

All other terms & conditions of the Schemes will remain unchanged.

This addendum shall form an integral part of the SIDs / KIMs of the Schemes and SAI of the Fund as

amended from time to time.

This Addendum is dated March 28, 2022.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME

RELATED DOCUMENTS CAREFULLY.

You might also like

- Serejp3-50 3Document95 pagesSerejp3-50 3pedabushcraft100% (1)

- 78 - Aspen Dental Motion To Dismiss Decision and Order - Cause No.v3:12-Cv-1565 US District Court Syracuse NYDocument27 pages78 - Aspen Dental Motion To Dismiss Decision and Order - Cause No.v3:12-Cv-1565 US District Court Syracuse NYDentist The MenaceNo ratings yet

- Answer Paper-1 MBL2Document7 pagesAnswer Paper-1 MBL2Matin Ahmad KhanNo ratings yet

- Addendum To Contract of LeaseDocument4 pagesAddendum To Contract of LeaseLowell MadrilenoNo ratings yet

- Facts:: VALENTIN CAMACHO v. CIR, GR No. L-1505, 1948-05-12Document2 pagesFacts:: VALENTIN CAMACHO v. CIR, GR No. L-1505, 1948-05-12Yash ManinNo ratings yet

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- Privatisation of Airports in IndiaDocument21 pagesPrivatisation of Airports in IndiaprincechennaiNo ratings yet

- Fire Safety Inspection Certificate: Fsic No. RDocument2 pagesFire Safety Inspection Certificate: Fsic No. RChristine Pauline100% (1)

- Birdys 800020069Document2 pagesBirdys 800020069alatfshekh5123No ratings yet

- PDF 1 20190207153559208uhjc1Document4 pagesPDF 1 20190207153559208uhjc1dgpmNo ratings yet

- Form2a LTFSNCD1Document46 pagesForm2a LTFSNCD1abhishekNo ratings yet

- FiiDocument9 pagesFiiRohan SinghNo ratings yet

- PDF 3. Investec - PPM (August 12 2021)Document197 pagesPDF 3. Investec - PPM (August 12 2021)AJNo ratings yet

- FDI Circular 01 2014Document119 pagesFDI Circular 01 2014rubal0468No ratings yet

- Consumer LawDocument84 pagesConsumer LawRao Varun YadavNo ratings yet

- Auto LineDocument256 pagesAuto LineVedha SathishNo ratings yet

- Supplement EBCL Dec 2023Document162 pagesSupplement EBCL Dec 2023Kunal GuptaNo ratings yet

- CX Renewables Solar Bond Offer 6mDocument55 pagesCX Renewables Solar Bond Offer 6mAnonymous pEfXMJ8QNo ratings yet

- 202052918455afpl Im 29052020Document100 pages202052918455afpl Im 29052020pratishthit mittalNo ratings yet

- Page From SR 5 Infra Disclosure DocumentDocument1 pagePage From SR 5 Infra Disclosure DocumentkartiksharmainspireNo ratings yet

- REC TAx Free Bond Application FormDocument8 pagesREC TAx Free Bond Application FormPrajna CapitalNo ratings yet

- Foreign Exchange ManagementDocument4 pagesForeign Exchange Managementmithilesh tabhaneNo ratings yet

- Fii Report - Docx SandeepDocument23 pagesFii Report - Docx Sandeepaadishjain007No ratings yet

- HUDCO Tax Free Bonds - Shelf ProspectusDocument282 pagesHUDCO Tax Free Bonds - Shelf ProspectusSachin ShirwalkarNo ratings yet

- SEBI (Listing Obligations Disclosure Requirements Regulations) 2015 - HIGHLIGHTS & ANALYSISDocument15 pagesSEBI (Listing Obligations Disclosure Requirements Regulations) 2015 - HIGHLIGHTS & ANALYSISBhavik GalaNo ratings yet

- Bcas S C Fema: Tudy Ircle Meeting On Answers To Questions Raised in The MeetingDocument4 pagesBcas S C Fema: Tudy Ircle Meeting On Answers To Questions Raised in The MeetingTaxpert mukeshNo ratings yet

- Origin of Investment in IndiaDocument8 pagesOrigin of Investment in IndiaD Attitude KidNo ratings yet

- Corporate Compliance Calendar October 2023Document24 pagesCorporate Compliance Calendar October 2023Sreenivasan KorappathNo ratings yet

- Mannapuram Application Form DetailsTNCDocument47 pagesMannapuram Application Form DetailsTNCTejas Pradyuman JoshiNo ratings yet

- Sbi Funds Management Private LimtedDocument48 pagesSbi Funds Management Private LimtedAkash ParabNo ratings yet

- Background Material-FDI in Financial ServicesDocument22 pagesBackground Material-FDI in Financial ServicesDinesh GodhaniNo ratings yet

- POLICY FDI - Circular - 01 - 2013 PDFDocument120 pagesPOLICY FDI - Circular - 01 - 2013 PDFArasan ArasanNo ratings yet

- Group IV FMRDocument14 pagesGroup IV FMRkanak kathuriaNo ratings yet

- Faqs View: SearchDocument17 pagesFaqs View: Searchmeenakshi56No ratings yet

- Participatory NotesDocument3 pagesParticipatory NotesAmit KumarNo ratings yet

- SSE Checklist - For - Registration - 02.05.2023Document3 pagesSSE Checklist - For - Registration - 02.05.2023Anuj Kumar SinghNo ratings yet

- Foreign Investments in India 177Document23 pagesForeign Investments in India 177rohitbansal111No ratings yet

- Banka Bioloo Limited: U90001AP2012PLC082811Document35 pagesBanka Bioloo Limited: U90001AP2012PLC082811goyalneerajNo ratings yet

- Uti-Leadership Equity Fund ODDocument68 pagesUti-Leadership Equity Fund ODSurbhi JoshiNo ratings yet

- Kyc RBI Circular On CKYC25Feb2016Document57 pagesKyc RBI Circular On CKYC25Feb2016aditya_bb_sharmaNo ratings yet

- Appendix 18: A.18.1 Launching A GDR IssueDocument15 pagesAppendix 18: A.18.1 Launching A GDR IssuePrasad NambiarNo ratings yet

- FDI and Regulatory FrameworkDocument7 pagesFDI and Regulatory FrameworkBHUVI KUMARINo ratings yet

- Sebi Investment LimitDocument2 pagesSebi Investment LimitJoydeep NtNo ratings yet

- Ishan 800001258 PDFDocument2 pagesIshan 800001258 PDFSaahil ShahNo ratings yet

- New EbclDocument16 pagesNew EbclA0913KHUSHI RUNGTANo ratings yet

- Regulatory Environment For Fii in IndiaDocument7 pagesRegulatory Environment For Fii in IndiaDivya BansalNo ratings yet

- Ireda - Tax Free Bonds: Issue DetailsDocument4 pagesIreda - Tax Free Bonds: Issue Detailsapi-255983286No ratings yet

- GfrybDocument34 pagesGfrybSamir BuddheNo ratings yet

- FII Flows Could Increase in Spells, Says RBI: The Securities and Exchange Board of India DataDocument11 pagesFII Flows Could Increase in Spells, Says RBI: The Securities and Exchange Board of India DataPooja MaanNo ratings yet

- Shine GIDDocument37 pagesShine GIDSubscriptionNo ratings yet

- Instructions For Completing The Application FormDocument2 pagesInstructions For Completing The Application FormRanjan G HegdeNo ratings yet

- Alternate Investment FundsDocument5 pagesAlternate Investment FundsJhansi DevarasettyNo ratings yet

- Fii in IndiaDocument4 pagesFii in IndiaSalman MSDNo ratings yet

- Impact of Foreign Institutional Investment On Stock MarketDocument15 pagesImpact of Foreign Institutional Investment On Stock MarketVivek SahNo ratings yet

- Investment of SurplusDocument7 pagesInvestment of SurplusHarsh JainNo ratings yet

- Prospectus Wise IncomeDocument203 pagesProspectus Wise IncomesmulyuzNo ratings yet

- Foreign Exchange Management ActDocument21 pagesForeign Exchange Management ActManish RamnaniNo ratings yet

- Frequently Asked Questions: Liberalised Remittance SchemeDocument9 pagesFrequently Asked Questions: Liberalised Remittance SchemeGlen F. PreiraNo ratings yet

- Corporate Professionals-Highlights of FDI-10.04.2010Document8 pagesCorporate Professionals-Highlights of FDI-10.04.2010nids25No ratings yet

- Updates SMAIT June 2016Document11 pagesUpdates SMAIT June 2016Harsh SharmaNo ratings yet

- G Sec ActDocument9 pagesG Sec Actuhyr ujdgbNo ratings yet

- Cgraphics 800016361Document2 pagesCgraphics 800016361ruchikedia05No ratings yet

- CA Final Law Amendments - Nov 2022Document10 pagesCA Final Law Amendments - Nov 2022Rohit KumarNo ratings yet

- MFS Homework Day 3Document3 pagesMFS Homework Day 3Kshitij SinghNo ratings yet

- CAF Nov'23 Paper 4 AmendmentDocument19 pagesCAF Nov'23 Paper 4 AmendmentSiddhi GNo ratings yet

- Bitong v. CADocument36 pagesBitong v. CAReemNo ratings yet

- Review of Strategic PlanningDocument11 pagesReview of Strategic PlanningSimon DzokotoNo ratings yet

- Trafic Police ChalanDocument2 pagesTrafic Police Chalanajay yadav21No ratings yet

- 3 Domiciano Aguas V Conrado de LeonDocument6 pages3 Domiciano Aguas V Conrado de LeonMarioneMaeThiamNo ratings yet

- Inter-Relation Between Article. 301 and Article. 19 (1) (G)Document5 pagesInter-Relation Between Article. 301 and Article. 19 (1) (G)Ashay VermaNo ratings yet

- An Ordinance Amending Section 94, Article Iv of Ordinance No. 241, S - 1993, Otherwise Known As The Pasay City Revenue CodeDocument2 pagesAn Ordinance Amending Section 94, Article Iv of Ordinance No. 241, S - 1993, Otherwise Known As The Pasay City Revenue CodeAnaiah HoneyNo ratings yet

- The Chamber of Customs BrokersDocument3 pagesThe Chamber of Customs Brokerscalagosronpaul.b20.1375No ratings yet

- Lanuza v. Court of Appeals20210423-12-Hm3quoDocument11 pagesLanuza v. Court of Appeals20210423-12-Hm3quoMegan AglauaNo ratings yet

- 169163-2014-RCBC Capital Corp. v. BDO Unibank Inc.Document3 pages169163-2014-RCBC Capital Corp. v. BDO Unibank Inc.jrNo ratings yet

- Akshit Respondant 21Document33 pagesAkshit Respondant 21AkshitNo ratings yet

- Topa-Chapter 3 - Transfer of Immovable PropertyDocument15 pagesTopa-Chapter 3 - Transfer of Immovable PropertyRupeshPandyaNo ratings yet

- Nowak v. Tak How, 1st Cir. (1996)Document81 pagesNowak v. Tak How, 1st Cir. (1996)Scribd Government DocsNo ratings yet

- CH 18 Update 0810Document3 pagesCH 18 Update 0810Edwin OlooNo ratings yet

- Dy Teban Trading Inc. v. Dy, Et. Al.Document29 pagesDy Teban Trading Inc. v. Dy, Et. Al.citizenNo ratings yet

- Balbin Vs Register of DeedsDocument2 pagesBalbin Vs Register of Deedsecinue guirreisaNo ratings yet

- San Diego Regional Vice Chair 10.23.17Document17 pagesSan Diego Regional Vice Chair 10.23.17Vincent WetzelNo ratings yet

- 203 CHAMBER OF FILIPINO RETAILERS vs. VILLEGAS PDFDocument1 page203 CHAMBER OF FILIPINO RETAILERS vs. VILLEGAS PDFErvin Franz Mayor CuevillasNo ratings yet

- Marzalado Vs People (Article 11-12, RPC)Document44 pagesMarzalado Vs People (Article 11-12, RPC)Rich Lopez AlmarioNo ratings yet

- Citizen Charter-Ministry of Tribal AffairsDocument14 pagesCitizen Charter-Ministry of Tribal AffairsitsmohanecomNo ratings yet

- A Foreigner Acquiring Land in TanzaniaDocument3 pagesA Foreigner Acquiring Land in TanzaniaMarbaby SolisNo ratings yet

- Assignment 2.1: The 2016 Bangladesh Bank HackDocument8 pagesAssignment 2.1: The 2016 Bangladesh Bank Hackapi-651266391No ratings yet

- Letter To Chiefs - MPTC Test IntegrityDocument2 pagesLetter To Chiefs - MPTC Test IntegrityWBZ Webstaff100% (1)

- Appellant Side Memorial FINALDocument24 pagesAppellant Side Memorial FINALisha jainNo ratings yet

- Pioneer Urban Land and Vs Govindan Raghavan On 2 April 2019Document22 pagesPioneer Urban Land and Vs Govindan Raghavan On 2 April 2019bookmarkbuddy365No ratings yet