Professional Documents

Culture Documents

The Bisleri Acquisition-1

Uploaded by

AbcdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Bisleri Acquisition-1

Uploaded by

AbcdCopyright:

Available Formats

The Bisleri acquisition

Throughout history, mergers and acquisitions have taken place not only to deal with economic and

financial crises, but also to achieve greater profits and stability. During the past few years due to

increase in competition, as a result of globalization and other economic reforms. India has witnessed a

drastic growth in mergers and acquisitions. The most recent example, doing the rounds in all social

circles is the envisaged Bisleri international acquisition by tata consumer products limited. Moreover if

this contract were to materialize it would be the biggest acquisition in the FMCG space in india till now.

Now before I delve deep into this topic, delineating it and becoming too verbose. I would like to provide

the reader with the meaning of the word acquisition. In layman’s language it is a strategic decision

which involves consolidation of two or more business entities into one entity for reasons such as

diversification and growth.

Now the key perplexing question which arises is how will this potential acquisition benefit TPCL and as

a consequence its effect on the FMCG sector of india? Firstly if this deal is sealed the bisleri brand

name shall open a spectrum of new avenues in the beverage sector for TPCL, in turn making it a leader

in the bottled water segment. Elaborating more on the intricacies of this acquisition. TPCL is in

discussions to buy a majority stake in packaged water major Bisleri International for Rs 6,000 crore-Rs

7,000 crore. As part of the overall deal, it is expected that the current management of bisleri would

continue for two years following the closing of the transaction. As far as the implications of this deal on

competing players are concerned, the proposed deal is likely to have a considerable impact. Also if this

acquisition takes place in the market, the other players in the industry shall likely engage in a bidding

war for remaining targets, which shall result in overvalued transactions. Furthermore, when two robust

players in the market join forces, such as in the case of TPCL and Bisleri ,the competitiveness of the

market automatically tenses up. Which shall consequently lead to reduction in the prices because of the

consolidation in market, and higher productivity. Moreover on the macro level, the prices of similar

products should reduce given the increased variety to benefit the consumers. However, as a result of

this acquisition, the smaller companies may be forced to exit the market owing to cutthroat

competition. The effect of the proposed combination would result in a bigger space for the Indian retail

sector not only limited to packaged mineral water segment. Furthermore, with more than 5,000 delivery

trucks and over 4,500 distributors’ network, Tata will be getting higher volume and a 30 percent share of

the organised market, and value-add to its existing brands. Therefore the logic behind the proposed

acquisition is clear, cost synergies and cross-selling of Tata’s water brands to Bisleri . Conclusively

resulting in cost savings and effectiveness for the merged entity.

When all is said and done, The proposed transaction would indeed constitute a marriage of two iconic

brands that evoke trust in the consumers. It is estimated that revenue of the TCPL will be increased by

10-15 percent in the subsequent years, which will reflect on its share prices. In a word, this is ‘once in a

decade’ deal, and will have multiplier effects on the overall Indian retail industry.

You might also like

- Tata - Bisleri DealDocument4 pagesTata - Bisleri DealAkash AgarwalNo ratings yet

- FMCG Industry: Porter AnalysisDocument4 pagesFMCG Industry: Porter AnalysisRohanMohapatraNo ratings yet

- Coke Vs Pepsi, 2001Document35 pagesCoke Vs Pepsi, 2001alaa_mehsen100% (3)

- General Strategy Assg - 1Document3 pagesGeneral Strategy Assg - 1Sunny M.No ratings yet

- Case Analysis Coke Pepsi5Document7 pagesCase Analysis Coke Pepsi5Ajinkya RautNo ratings yet

- Cola Wars Continue Coke and Pepsi in 2010 - Answers To QuestionsDocument5 pagesCola Wars Continue Coke and Pepsi in 2010 - Answers To Questions123102725% (4)

- FMCG Sector AnalysisDocument7 pagesFMCG Sector AnalysisKrutika AbitkarNo ratings yet

- Semester 1 Coca Cola Case AnalysisDocument4 pagesSemester 1 Coca Cola Case AnalysisRosa Langhammer WardNo ratings yet

- Emotional Intelligence Questionnaire-LAL1Document1 pageEmotional Intelligence Questionnaire-LAL1CourtNo ratings yet

- Mid Term AnswerDocument6 pagesMid Term AnswerSherif Ahmed Maher67% (3)

- Research ReportDocument71 pagesResearch ReportVedikaNo ratings yet

- Merger and Acquisition of HDFC and CbopDocument24 pagesMerger and Acquisition of HDFC and CbopARUN KUMAR SAINI69% (13)

- Getting More Out of Indian Oil & Gas Retail Sector: Dhanish Ahsen, Sebin K. Joseph, Vaisakh K. VDocument8 pagesGetting More Out of Indian Oil & Gas Retail Sector: Dhanish Ahsen, Sebin K. Joseph, Vaisakh K. VMunish KohliNo ratings yet

- Flipkart Myntra Case Study Assignment 2 PDFDocument13 pagesFlipkart Myntra Case Study Assignment 2 PDFJeetuSri100% (4)

- Cola Wars Memo PDFDocument2 pagesCola Wars Memo PDFLavanyaNo ratings yet

- EcoN2305 Merger and AcuisationDocument9 pagesEcoN2305 Merger and Acuisationnaorin akterNo ratings yet

- Report On Summer Placement Project (2010 - 2012 Batch) : ResearchDocument4 pagesReport On Summer Placement Project (2010 - 2012 Batch) : ResearchPrerna GillNo ratings yet

- Strategic Analysis of Bisleri (Part 2)Document34 pagesStrategic Analysis of Bisleri (Part 2)sarangpethe100% (5)

- Profitability For Soft Drinks - Michael Porter's Five Force Model - Top Grade Papers - Academic AssignmentDocument10 pagesProfitability For Soft Drinks - Michael Porter's Five Force Model - Top Grade Papers - Academic AssignmentTop Grade Papers100% (1)

- FMCG Sector AnalysisDocument5 pagesFMCG Sector Analysislisa moh100% (2)

- Why India's Stock Markets Are Decoupled From The Economic RealityDocument4 pagesWhy India's Stock Markets Are Decoupled From The Economic RealityPiyush PoddarNo ratings yet

- Lubricant Market in IndiaDocument8 pagesLubricant Market in IndiaManthan Gattani100% (2)

- Mergers and Acquisition ProjectDocument21 pagesMergers and Acquisition ProjectNivedita Kotian100% (1)

- Cola Wars Continue: Coke and Pepsi in 2010Document5 pagesCola Wars Continue: Coke and Pepsi in 2010MYNo ratings yet

- Challenges Faced by CompaniesDocument11 pagesChallenges Faced by CompaniesdhwaniNo ratings yet

- Issues in Opening Indian Goods MarketDocument6 pagesIssues in Opening Indian Goods MarketJahanwi SinghNo ratings yet

- Coca-Cola Case StudyDocument8 pagesCoca-Cola Case StudyDiogo GomesNo ratings yet

- International Business 1116744Document9 pagesInternational Business 1116744Ravi KumawatNo ratings yet

- Cola WarsDocument4 pagesCola WarsMayur Suresh IwanateNo ratings yet

- Competative Study Between Coke vs. PepsiDocument95 pagesCompetative Study Between Coke vs. Pepsisalil2509No ratings yet

- Niharika IDPDocument8 pagesNiharika IDPsamNo ratings yet

- Economic and Political WeeklyDocument3 pagesEconomic and Political WeeklyKamalDeep SidhuNo ratings yet

- Q4 20 HCM Investment Letter FINALDocument11 pagesQ4 20 HCM Investment Letter FINALKan ZhouNo ratings yet

- India M&A Study Analyzes Trends Across SectorsDocument15 pagesIndia M&A Study Analyzes Trends Across SectorsemkaysubhaNo ratings yet

- Structure Analysis of Alcoholic Beverage IndustryDocument13 pagesStructure Analysis of Alcoholic Beverage IndustrySubhajit RoyNo ratings yet

- Mains July 2020Document69 pagesMains July 2020kela vinesNo ratings yet

- Haiqa Malik Microeconomics 2019-Bba-027Document10 pagesHaiqa Malik Microeconomics 2019-Bba-027haiqa malikNo ratings yet

- Besanco Odgovori-Harvard CaseDocument227 pagesBesanco Odgovori-Harvard CaseŠpela DrinovecNo ratings yet

- FinMan ProjectDocument4 pagesFinMan ProjectAkash SwainNo ratings yet

- Five forces analysis explains soft drink industry profitabilityDocument1 pageFive forces analysis explains soft drink industry profitabilityJoyal ThomasNo ratings yet

- Business Environment BBA LLB 2021Document7 pagesBusiness Environment BBA LLB 2021Amshul BhatiaNo ratings yet

- Vertical Integration in MediaDocument15 pagesVertical Integration in MediaArthi GaddipatiNo ratings yet

- FDI in Multi Brand Retail: Will The Cash Infusion Derail The Colossal Retail Structure?Document5 pagesFDI in Multi Brand Retail: Will The Cash Infusion Derail The Colossal Retail Structure?Harsh GagraniNo ratings yet

- Consumer Preference and Brand Loyalty Study on Prestige Kitchen AppliancesDocument40 pagesConsumer Preference and Brand Loyalty Study on Prestige Kitchen AppliancesDivakar BNo ratings yet

- Channel Conflict-Lubricant Markets-Petroleum IndustryDocument12 pagesChannel Conflict-Lubricant Markets-Petroleum IndustryNikhil100% (1)

- Cola Wars - Five ForcesDocument5 pagesCola Wars - Five ForcesBrian ParkNo ratings yet

- The Indian Lubricant Market - Survival of The SlickestDocument3 pagesThe Indian Lubricant Market - Survival of The SlickestajakbbNo ratings yet

- Cola Wars Continue: Coke and Pepsi in 2010Document2 pagesCola Wars Continue: Coke and Pepsi in 2010tj100% (1)

- Customer Satisfaction Bajaj Automobiles Sachin 3La18Mba12: August 2019Document61 pagesCustomer Satisfaction Bajaj Automobiles Sachin 3La18Mba12: August 2019NEHA KAMALNo ratings yet

- Subhojit Ghosh FinalDocument37 pagesSubhojit Ghosh FinalPriyanka SheeNo ratings yet

- Integrated Marketing Communications: BM023-3-3-IMKTC Individual AssignmentDocument14 pagesIntegrated Marketing Communications: BM023-3-3-IMKTC Individual Assignment啊浩No ratings yet

- SM ProjectDocument15 pagesSM ProjectRohit J SaraiyaNo ratings yet

- ProjectDocument68 pagesProjectharpreet kaurNo ratings yet

- Business Development Strategy for the Upstream Oil and Gas IndustryFrom EverandBusiness Development Strategy for the Upstream Oil and Gas IndustryRating: 5 out of 5 stars5/5 (1)

- Quality Enhancement in Voluntary Carbon Markets: Opening up for MainstreamFrom EverandQuality Enhancement in Voluntary Carbon Markets: Opening up for MainstreamNo ratings yet

- Building Manufacturing Competitiveness: The TOC WayFrom EverandBuilding Manufacturing Competitiveness: The TOC WayRating: 3 out of 5 stars3/5 (1)

- ICT BlocksDocument16 pagesICT Blocksnextlink80No ratings yet

- FMAI - Ch04 - Stock MarketDocument105 pagesFMAI - Ch04 - Stock Marketngoc duongNo ratings yet

- 3 Hidden Secrets of The Moving AverageDocument23 pages3 Hidden Secrets of The Moving AverageBaru 94No ratings yet

- Unpaid Unclaimed Dividend IEPF-1 (2)Document138 pagesUnpaid Unclaimed Dividend IEPF-1 (2)raghavNo ratings yet

- MARKETINGDocument16 pagesMARKETINGFarrukhsgNo ratings yet

- Legesse Business Plan 2022Document21 pagesLegesse Business Plan 2022penna belew100% (1)

- Union Bank Stock Statement FormatDocument2 pagesUnion Bank Stock Statement Formatberrysautolko82% (11)

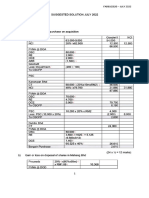

- July 22 Far620Document8 pagesJuly 22 Far620FARAH ZAFIRAH ISHAMNo ratings yet

- Joint ArrangementsDocument22 pagesJoint ArrangementsJhoanNo ratings yet

- Bpi Pera FaqDocument7 pagesBpi Pera FaqHana DumpayanNo ratings yet

- Sahand Lali Cover Letter DynamoDocument1 pageSahand Lali Cover Letter DynamoSahand LaliNo ratings yet

- PFRS 10 - Consolidate FSDocument11 pagesPFRS 10 - Consolidate FSHannah TaduranNo ratings yet

- CH 26Document33 pagesCH 26Rafid Al Abid SpondonNo ratings yet

- KV sqp1 EconomicsDocument33 pagesKV sqp1 Economicsyazhinirekha4444No ratings yet

- Introduction To Air Transport Economics From Theory To Applications - Bijan Vasigh, Ken Fleming, Thomas Tacker - 2019 - 3ra Edición-5-8Document4 pagesIntroduction To Air Transport Economics From Theory To Applications - Bijan Vasigh, Ken Fleming, Thomas Tacker - 2019 - 3ra Edición-5-8FernandoNo ratings yet

- by Nitin SinghDocument6 pagesby Nitin SinghAditi GhaiNo ratings yet

- Sale ChannelsDocument4 pagesSale ChannelsThùy DươngNo ratings yet

- Sanet ST BarronsFebruary272023Document52 pagesSanet ST BarronsFebruary272023Carlos Rodolfo SinibaldiNo ratings yet

- Financial Analysis of A Business PlanDocument11 pagesFinancial Analysis of A Business PlanOm KummarNo ratings yet

- International Financial Management Chapter 5Document12 pagesInternational Financial Management Chapter 51954032027cucNo ratings yet

- Final Exam - Mathematics of FinanceDocument10 pagesFinal Exam - Mathematics of FinanceRuffa Mae ParaderoNo ratings yet

- The Data and Analytics Edge in Corporate and Commercial BankingDocument7 pagesThe Data and Analytics Edge in Corporate and Commercial Bankinghamza saghirNo ratings yet

- Mastering Options Trading: by Mentor - Ravi ChandiramaniDocument120 pagesMastering Options Trading: by Mentor - Ravi ChandiramanivivekNo ratings yet

- Latest Intern ReportDocument26 pagesLatest Intern ReportParveshNo ratings yet

- Learning Activity Sheet q2w1-2Document4 pagesLearning Activity Sheet q2w1-2Mark Anthony Bell BacangNo ratings yet

- For Students - Interpretation of FS - Ratio Analysis - Example, ExercisesDocument10 pagesFor Students - Interpretation of FS - Ratio Analysis - Example, ExercisesdimniousNo ratings yet

- Public Debt Management PrinciplesDocument17 pagesPublic Debt Management PrinciplesbghNo ratings yet

- 3.1 Slide Life Insurance Benefit - Part 1Document15 pages3.1 Slide Life Insurance Benefit - Part 1caramel latteNo ratings yet

- Financial Performance Analysis of Kotak Mahindra BankDocument60 pagesFinancial Performance Analysis of Kotak Mahindra Bankvaibhav pachputeNo ratings yet

- Difference Between Traditional Marketing and Modern MarketingDocument4 pagesDifference Between Traditional Marketing and Modern Marketingvedant punjNo ratings yet