Professional Documents

Culture Documents

Introduction and Indemnity

Uploaded by

dee dee0 ratings0% found this document useful (0 votes)

8 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesIntroduction and Indemnity

Uploaded by

dee deeCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

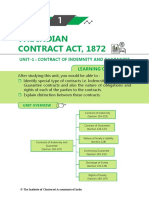

Specific Contracts

General Principles of Contract - (Sections 1 to 75)

Specific Contracts - (Sections 124 to 238)

Specific Contracts - (Sections 124 to 238)

Sections 76 to 123 have been repealed and are now embodied in “Sale of Goods Act,1930”

Sections 239 to 266 have been repealed and are now embodied in the “Indian Partnership Act”

Chapter VIII-Sections 124 to 147 Indemnity and Guarantee

Chapter IX-Sections 148 to 181 Bailment and Pledge

Chapter X- Sections 182 to 238 Agency

Indemnity and Guarantee

Contract of Indemnity - Secs 124 and 125

Section-124: “Contract of Indemnity” defined: A contract by which one party promises to save the other

from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person,

is called a “contract of indemnity”.

Ex: A contracts to Indemnify B against the consequences of any proceedings which C may take against B

in respect of a certain sum of Rs200. This is a contract of Indemnity.

The person who promises to make good the loss is called the “Indemnifier” (Promisor)

The person whose loss is to be made good is called the “Indemnified” or “Indemnity Holder” (Promisee)

Ex: A and B go into a shop, B says “Let him (A) have the goods, I will see you paid”, to the shopkeeper.

The contract is one of Indemnity.

A contract of indemnity is a class of contingent contract.

Nature of contract of Indemnity

The definition covers indemnity for loss caused by human agency only. It does not deal with those

classes of cases where the indemnity arises from loss caused by events or accidents which do not or may

not depend upon the conduct of the promisor or any other person, or by reason of liability incurred by

something done by the promisee at the request of the promisor.

Gajanan Moreshwar V Moreshwar Madan, AIR1942, Bom303

Cases where loss arises from an act done at the request of the promisor are also outside the scope of

Section 124.

Such cases are properly covered under Section 223 of the Act, which provides for indemnity between

agent and his principal.

Situations like those in Admson V Jarvis(1827)4

Where cattle were sold by the plaintiff auctioneer under the directions of the defendant not being the

owner of the livestock are outside the scope of Section 124.

The expression “Contract of Indemnity” has been used in section 124 in a narrow sense. The general law

relating to contracts of indemnity is much wider. For example, a contract of fire insurance is a contract

of indemnity though not covered by section 124.

State of Orissa V United India Insurance Co.Ltd., AIR 1997 SC2671

1

Scope of contract of Indemnity:

Nature of indemnity is not restricted to the narrow sense of the expression as defined in section 124. It

is discussed in a wider sense wherein the term “indemnity” is said to mean recompense for any loss or

liability which a person has incurred. Such a duty may arise from an agreement or otherwise i.e., besides

a contract it may result from “the relation of the parties” or by “statute”.

For example a right of indemnity may arise between a principal and agent, an employer and employee

or in favour of a trustee under a trust fund.

Insurance indemnity: Almost all insurances other than life and personal accident insurance are contracts

of indemnity. The insurer’s promise to indemnify is an absolute one. A suit can be filed immediately

upon failure of performance, irrespective of actual loss. If the indemnity holder incurred liability and

that liability was absolute, he would be entitled call upon the indemnifier to save him from that liability

by paying it off.

New India Assurance Co Ltd V State Trading Corporation of India., AIR 2007

Vehicle insured for Rs1,00,000, it was stolen and became a total loss, the insurer not permitted to say

that his liability was only up to market value of the vehicle.

Vishan Narain V Oriental Insurance Co. Ltd, AIR2002 Del336

Other illustrations are service bonds executed by the employees to serve the master for a particular

period or persons claiming payment of money or delivery of goods on indemnity bonds having lost the

original documents of title.

Rights of Indemnity-holder: Sec 125

1. All damages which he may be compelled to pay in any suit in respect of any matter to which the

promise of indemnity applies.

2. All costs which he may be compelled to pay in such suits if, in bringing or defending it.

3. All sums which he may have paid under the terms of any compromise of any such suit.

Commencement of liability of indemnifier:

When does the indemnifier become liable to pay or when is the indemnity-holder entitled to recover his

indemnity?

The original English rule was that indemnity was payable only after the indemnity-holder had suffered

actual loss by paying off the claim. The maxim of law was: “you must be damnified before you can claim

to be indemnified”.

But the law is now different. The process of transaction is well- explained in Gajanan Moreshwar

Parelkar V Moreshwar Madan Mantri, AIR1942 Bom 302: It is true that under the English common law

no action could be maintained until the actual loss had been incurred. It was very soon realized that an

indemnity might be worth very little indeed if the indemnified could not enforce his indemnity till he had

actually paid the loss. If a suit was filed against him he had actually to wait till a judgment was

pronounced and it was only after he had satisfied the judgment that he could sue on his indemnity. It is

clear that this might under certain circumstances throw an intolerable burden upon the indemnity-

holder. He might not be in a position to satisfy the judgment and yet he could not avail himself of his

indemnity till he had done so. Therefore, the court of equity held that if his liability had become

absolute then he was entitled either to get the indemnifier to pay off the claim or to pay into court

sufficient money which would constitute a fund for paying off the claim whenever it was made.

You might also like

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- law of special contractDocument7 pageslaw of special contractKanishkaNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Unit-I NotesDocument19 pagesUnit-I NotesAnilNo ratings yet

- Contract of Indemnity and Guarantee (Article 3)Document12 pagesContract of Indemnity and Guarantee (Article 3)Mandira PrakashNo ratings yet

- Contract - II FinalDocument244 pagesContract - II FinalakashNo ratings yet

- Contract of IndemnityDocument3 pagesContract of IndemnityNarendra DevNo ratings yet

- Contract of Indemnity and Guarantee (Article 3)Document11 pagesContract of Indemnity and Guarantee (Article 3)Mandira PrakashNo ratings yet

- LLM - Iv Semester Law of Contract - Ii: Study MaterialDocument20 pagesLLM - Iv Semester Law of Contract - Ii: Study MaterialSuman sharmaNo ratings yet

- IndemnityDocument20 pagesIndemnityShubham SarkarNo ratings yet

- Contract of IndemnityDocument10 pagesContract of Indemnitydvkreddy 4499No ratings yet

- Wa0005.Document65 pagesWa0005.Harsh RawatNo ratings yet

- Contract of IndemnityDocument7 pagesContract of Indemnitybhavitha birdalaNo ratings yet

- Contract of Indemnity Meaning, Definition and RightsDocument6 pagesContract of Indemnity Meaning, Definition and RightsBoobalan RNo ratings yet

- Special ContractsDocument9 pagesSpecial ContractsAPURVA RANJANNo ratings yet

- Contract of Indemnity and GuaranteeDocument8 pagesContract of Indemnity and GuaranteeSiddhant MathurNo ratings yet

- Contract IndemnityDocument3 pagesContract Indemnitysudhir.kochhar3530No ratings yet

- INDEMNITY GUARANTEE BAILMENT PLEDGE AGENCY SALE OF GOODSDocument17 pagesINDEMNITY GUARANTEE BAILMENT PLEDGE AGENCY SALE OF GOODSsimplejimrossNo ratings yet

- Contract of IndemnityDocument32 pagesContract of Indemnityshubham agarwalNo ratings yet

- Specific Contract Full Modules - 231122 - 205555Document131 pagesSpecific Contract Full Modules - 231122 - 205555jovithajoby48No ratings yet

- Contracts of Indemnity and GuaranteeDocument19 pagesContracts of Indemnity and GuaranteeUrvi MishraNo ratings yet

- Indemnity and guarantee explainedDocument11 pagesIndemnity and guarantee explainedAdyashaNo ratings yet

- Contract of Indemnity defined under Indian Contract Act 1872Document8 pagesContract of Indemnity defined under Indian Contract Act 1872Gaurav JindalNo ratings yet

- The Indian Contract Act, 1872: Unit-1: Contract of Indemnity and GuaranteeDocument28 pagesThe Indian Contract Act, 1872: Unit-1: Contract of Indemnity and Guaranteesamartha umbareNo ratings yet

- Contract of IndemnityDocument12 pagesContract of IndemnityKhushi KothariNo ratings yet

- Contract of Indemnity GuideDocument10 pagesContract of Indemnity GuideYash SinghNo ratings yet

- Indemnity and GuaranteeDocument20 pagesIndemnity and GuaranteeShrey ApoorvNo ratings yet

- 1.unit 1.contract of Indemnity and GuaranteeDocument28 pages1.unit 1.contract of Indemnity and GuaranteeKarthik100% (1)

- Indemnity Under Contract Law 1872Document17 pagesIndemnity Under Contract Law 1872মৌন গোলদারNo ratings yet

- (1.1) ICA Indemnity & GuaranteeDocument28 pages(1.1) ICA Indemnity & GuaranteeYash RankaNo ratings yet

- CONTRACTS OF INDEMNITYDocument11 pagesCONTRACTS OF INDEMNITYMandira PrakashNo ratings yet

- Contract of IndemnityDocument17 pagesContract of IndemnityNiraj PandeyNo ratings yet

- Contract of Indemnity ExplainedDocument31 pagesContract of Indemnity ExplainedRajat SharmaNo ratings yet

- Contract Assignment FinalDocument6 pagesContract Assignment FinalYadav AnkitaNo ratings yet

- Contract ExamDocument73 pagesContract ExamplannernarNo ratings yet

- Law ProjectDocument8 pagesLaw ProjectShaiviNo ratings yet

- Amulya Contract NotesDocument109 pagesAmulya Contract NotesMadhu NNo ratings yet

- Contract of Indemnity Rights and LiabilitiesDocument39 pagesContract of Indemnity Rights and LiabilitiesAnkit JindalNo ratings yet

- Aligarh Muslim University: Submitted To: Prof. Javaid Talib SBDocument21 pagesAligarh Muslim University: Submitted To: Prof. Javaid Talib SBMohammad Faisal TariqNo ratings yet

- Law of Contract Ii: Contracts of Indemnity - Sections 124-125 of The Indian Contract Act, 1872Document8 pagesLaw of Contract Ii: Contracts of Indemnity - Sections 124-125 of The Indian Contract Act, 1872Manisha PawarNo ratings yet

- contract of indemnityDocument9 pagescontract of indemnityjhanvi tayalNo ratings yet

- Notes ContractDocument50 pagesNotes ContractS S PNo ratings yet

- Contract of IndemnityDocument2 pagesContract of IndemnityPradnyanjali GhadigaonkarNo ratings yet

- Contract QADocument30 pagesContract QAsanampreet virkNo ratings yet

- Contract II Unit 2Document27 pagesContract II Unit 2Sadaf ShabbirNo ratings yet

- Contract of IndemnityDocument11 pagesContract of IndemnityAishwarya KrishnaKumarNo ratings yet

- Indemnity & Guarantee PDFDocument55 pagesIndemnity & Guarantee PDFKomal SandhuNo ratings yet

- Contract 2Document33 pagesContract 2RubikaNo ratings yet

- Contract 2Document58 pagesContract 2yeshwanthgowda2002No ratings yet

- Contract 2Document28 pagesContract 2yeshwanthgowda2002No ratings yet

- Contracts of Indemnity and Guarantee ComparedDocument20 pagesContracts of Indemnity and Guarantee ComparedAqib khanNo ratings yet

- Contract IiDocument19 pagesContract IioxcelestialxoNo ratings yet

- GST On Corporate Guarantees: Address: JD-2C, 2nd Floor, Pitampura, Delhi 110034Document20 pagesGST On Corporate Guarantees: Address: JD-2C, 2nd Floor, Pitampura, Delhi 110034Mohit NandalNo ratings yet

- Mod 1Document28 pagesMod 1me tanzeemNo ratings yet

- The Phrase Indemnity MeansDocument9 pagesThe Phrase Indemnity MeansArushiNo ratings yet

- 74586bos60476 FND p2 Nset cp2 U7Document24 pages74586bos60476 FND p2 Nset cp2 U7Shivam SinghNo ratings yet

- Sbaa1206 Business Law Unit 2 NotesDocument34 pagesSbaa1206 Business Law Unit 2 NotesBharathi 3280No ratings yet

- Need For Indemnity in Commercial ContractsDocument13 pagesNeed For Indemnity in Commercial ContractsUdit KapoorNo ratings yet

- Need For Indemnity in Commercial ContractsDocument13 pagesNeed For Indemnity in Commercial ContractsUdit KapoorNo ratings yet

- KSLU Contract II Reading MaterialDocument245 pagesKSLU Contract II Reading MaterialMG MaheshBabu0% (1)

- Module 3, Unit 5Document7 pagesModule 3, Unit 5Sarah CampilanNo ratings yet

- Major Assignment 2 3Document6 pagesMajor Assignment 2 3api-707703889No ratings yet

- Hacking - Reconnaissance Reference SheetDocument1 pageHacking - Reconnaissance Reference SheetMigue FriasNo ratings yet

- Sahara and Satyam ScamDocument13 pagesSahara and Satyam ScamJannavi SinghaNo ratings yet

- Bank Company ActDocument16 pagesBank Company Actmd nazirul islam100% (2)

- SantaremDocument2 pagesSantaremYopaj Ob neonNo ratings yet

- Strategic Financial Management (SFM) Notes & Ebook - Second Year Sem 3Document296 pagesStrategic Financial Management (SFM) Notes & Ebook - Second Year Sem 3Rituraj RanjanNo ratings yet

- Brainy kl8 Short Tests Unit 5 Lesson 5Document1 pageBrainy kl8 Short Tests Unit 5 Lesson 5wb4sqbrnd2No ratings yet

- Extension of CPC validity applicationDocument3 pagesExtension of CPC validity applicationNickoFalconNo ratings yet

- Surah Zalzala Dream Tafseer NotesDocument19 pagesSurah Zalzala Dream Tafseer NotesAbu Ammar AsrafNo ratings yet

- Now You Can: Music in Your LifeDocument1 pageNow You Can: Music in Your LifeDiana Carolina Figueroa MendezNo ratings yet

- BISE MultanDocument617 pagesBISE MultanZubair NadeemNo ratings yet

- Mohamuud Mohamed Abdi 57Document3 pagesMohamuud Mohamed Abdi 57AbdullahNo ratings yet

- So Ping Bun's Warehouse Occupancy DisputeDocument4 pagesSo Ping Bun's Warehouse Occupancy DisputeVincent BernardoNo ratings yet

- Electrical Engineering Portal - Com Substation Fire ProtectionDocument4 pagesElectrical Engineering Portal - Com Substation Fire ProtectionJaeman ParkNo ratings yet

- 3 Factors That Contribute To Gender Inequality in The ClassroomDocument3 pages3 Factors That Contribute To Gender Inequality in The ClassroomGemma LynNo ratings yet

- David Vs ArroyoDocument2 pagesDavid Vs ArroyoAjpadateNo ratings yet

- Department of Education: Answer Sheet ProvidedDocument3 pagesDepartment of Education: Answer Sheet ProvidedFlomarie AlferezNo ratings yet

- 4.4.1.2 Packet Tracer - Configure IP ACLs To Mitigate Attacks - InstructorDocument7 pages4.4.1.2 Packet Tracer - Configure IP ACLs To Mitigate Attacks - Instructorrafael8214No ratings yet

- Instant Download Communicate 14th Edition Verderber Test Bank PDF Full ChapterDocument32 pagesInstant Download Communicate 14th Edition Verderber Test Bank PDF Full ChapterCarolineAvilaijke100% (10)

- CHAPTER 2 AnalysisDocument7 pagesCHAPTER 2 AnalysisJv Seberias100% (1)

- Finland's Top-Ranking Education SystemDocument6 pagesFinland's Top-Ranking Education Systemmcrb_19100% (2)

- Infopack Yffj YeDocument16 pagesInfopack Yffj Yeapi-544978856No ratings yet

- Notification No.54/2021 - Customs (N.T.) : Schedule-IDocument3 pagesNotification No.54/2021 - Customs (N.T.) : Schedule-Ianil nayakanahattiNo ratings yet

- Capstone Project 1: Product BacklogDocument11 pagesCapstone Project 1: Product BacklogHoàng Văn HiếuNo ratings yet

- Flaws in India's Coal Allocation ProcessDocument12 pagesFlaws in India's Coal Allocation ProcessBhaveen JoshiNo ratings yet

- All Hands Naval Bulletin - Nov 1942Document56 pagesAll Hands Naval Bulletin - Nov 1942CAP History Library0% (1)

- IMICS Graduate Handbook 2014Document31 pagesIMICS Graduate Handbook 2014greenglassNo ratings yet

- A Disaster Recovery Plan PDFDocument12 pagesA Disaster Recovery Plan PDFtekebaNo ratings yet

- ILNAS-EN 17141:2020: Cleanrooms and Associated Controlled Environments - Biocontamination ControlDocument9 pagesILNAS-EN 17141:2020: Cleanrooms and Associated Controlled Environments - Biocontamination ControlBLUEPRINT Integrated Engineering Services0% (1)