Professional Documents

Culture Documents

Cpay - Testing Procedures and Production Implementation - v1.0.7

Uploaded by

TvingosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cpay - Testing Procedures and Production Implementation - v1.0.7

Uploaded by

TvingosCopyright:

Available Formats

Authorisation Department

cPay – Testing Procedures And

Production Implementation

cPay Testing Procedures And Production Implementation v1.0.7 Page 1 of 12

Authorisation Department

Document History

Release Author Version Comment

Date

14.05.2014 Filomena Pljakovska 1.0 Initial version

Asprovska

Marin Gugovski

Dalibor Peshovski

Ana Gjorgjieska

15.12.2014 Marin Gugovski 1.0.1 Modified procedure for changing production

checksum password; added additional

payment status

12.02.2016 Dalibor Peshovski 1.0.2 Additional information for redirect code

25.02.2016 Dalibor Peshovski 1.0.3 Additional comments added

04.01.2017 Dalibor Peshovski 1.0.4 Moved Notifications to Basic Doc

08.03.2017 Marin Gugovski 1.0.5 Moved notes to Basic Doc

27.06.2017 Marin Gugovski 1.0.6 Added test for EXPIRED payment, added

confirmation from merchant for TLS 1.2,

added statuses Authorized and Completed

authorization.

05.11.2018 Marin Gugovski 1.0.7 Changed terminology “checksum password”

to “checksum authentication key”; corrected

explanation for status “New”, "In 3D Secure

authentication", "3D Secure authenticated",

Added statuses: Blocked, Blocked By Card

Limits, System reversal, deleted case 9,

deleted notes for test cases 5,6

cPay Testing Procedures And Production Implementation v1.0.7 Page 2 of 12

Authorisation Department

Contents

GENERAL ......................................................................................................................................................... 4

PAYMENT PROCESS .................................................................................................................................. 5

CPAY MERCHANT LOGIN ........................................................................................................................... 5

PAYMENTS STATUS ................................................................................................................................... 5

REDIRECT CODE ........................................................................................................................................ 6

REPORTS FROM MERCHANT MODULE ................................................................................................... 6

TEST PAYMENTS ........................................................................................................................................ 7

CHANGING TO PRODUCTION CHECKSUM AUTHENTICATION KEY…….. ......................................... 10

COMMUNICATION WITH CASYS ............................................................................................................. 11

cPay Testing Procedures And Production Implementation v1.0.7 Page 3 of 12

Authorisation Department

General

This document contains information required for merchant integration on CaSys’ cPay payment system. The

document describes all steps that should be completed during testing period and production implementation.

Transaction is initiated by the customer/buyer, on the web site of the merchant. The customer/buyer selects

from the offered goods and services and fills the basket. All data that describe the merchant, payment and the

customer/buyer are collected on the merchant’s web site. The data related with card that will be used in the

payment process, are collected on cPay payment system, to which the customer/buyer is redirected from the

merchant web site.

The data collected on the merchant’s web site are transferred on cPay payment system within the redirect

code. The following data should be transferred:

- Total amount (without decimal separators and last two digits must always be 00 e.g. xxxx00)

- Amount currency (payment currency on cPay payment system is Macedonian Denar – MKD)

- Payment details 1 (filled by the buyer or merchant)

- Payment details 2 (unique identifier of the transactions in the merchant’s system)

- Merchant name and merchant identifier

- URL on which merchant receives information for the outcome of the transaction

Except these data, there is optional information such as customer/buyer name, address, postal code,

country, phone number, e-mail that can be transferred within redirect code. Additional information also can be

sent, original amount and original currency, but these are used by cPay only for informational purposes.

For security reasons of online shopping, information for the merchant’s web site hosting must be known to

CaSys, along with the addresses from which it can access, firewall usage etc.

When the customer completes shopping process and decides to pay, with pressing pay (checkout/buy)

button on merchant’s web site, he is redirected on cPay payment system.

Data of the card used in payment process, are entered on each transaction by the customer/buyer.

Card/cardholder authentication is achieved with CVC2/CVV2 and 3D security authentication (if the card is

enrolled in 3D authentication model which depends from the Issuer).

When the payment process is finished, the customer/buyer is redirected back to the merchant’s web site

where he receives information about the status of the financial transaction and the outcome of the payment.

The following picture is an illustration of the shopping process described previously.

3D secure authentication through MC/VISA network

(MasterCard Secure Code (MSCS)/Verified by VISA (VBV)

2. Cardholder Authentication 3. MSCS/VBV Authentication response

through MC/VISA network (If authentication is passed, continue

with step 4, otherwise, go to step 6)

1. The buyer is redirected

Merchant to cPay Payment System

cPay Payment System

WEB site 6. The buyer is redirected

back to merchant site and is

informed for payment status

5. Authorisation response 4. Transaction is submitted for authorisation

Casys’s host/Bank’s host/MasterCard/VISA Authorization

cPay Testing Procedures And Production Implementation v1.0.7 Page 4 of 12

Authorisation Department

Payment Process

The payment process can be performed as:

- One step payment – the cardholder account is debited immediately.

- Two step payment – first, preauthorization transaction is performed and amount of the payment is

reserved from the cardholder’s account. Later, when the merchant is sure that the product/service can

be delivered, preauthorization completion transaction is performed.

cPay Merchant LOGIN

When merchant is defined in cPay payment system, Merchant USER and Merchant PASSWORD are sent

to contact person’s e-mail address specified in the definition form sent by the Bank.

Merchant can use received Merchant USER and PASSWORD to login on cPay payment system, merchant

menu, on which merchant have access on the following:

- Payments – Listing of payments performed on merchant’s e-shop

- Merchant (User) profile – Listing of user data and option for changing the password

- Redirect code – Downloading the redirect code template

- Transaction reports – Reports for all successful payments on merchant’s e-shop

Payments Status

Explanation follows of the transactions status that can appear on cPay merchant module:

- Успешна/Sent

Successful transaction, successfully processed transaction.

- Одбиена/Rejected

Unsuccessful transaction, rejected by the card issuer or cPay

- Authorized

Successful pre-authorization transaction, the amount is reserved from cardholder account.

- Completed authorization

- Successful completion of previous pre-authorization transaction. Completion amount is debited from

cardholder account.

- Нарачка во процес/New

Pending transaction, transaction that is not yet confirmed by the client, it is temporary status. Later, this

status will be change to one of the final statuses (if no action is taken by the client this status will be

change to Expired)

- Откажана/Canceled

Unsuccessful transaction, transaction that is canceled by the client

- Blocked

Unsuccessful transaction, blocked because of set black/white list for the merchant

- Blocked by Card Limits

Unsuccessful transaction, blocked because of set limit for amount/number of transactions in defined

period.

cPay Testing Procedures And Production Implementation v1.0.7 Page 5 of 12

Authorisation Department

- System Reversal

Unsuccessful transaction, the transaction is not successfully processed in authorization and cPay

system generates reversal.

- Во 3D Secure автентикација/In 3D Secure authentication

Pending transaction, the client is redirected to the bank ACS site for verification of the 3D Secure

code/password, it is temporary status. Later, after appropriate action by the client, this status will be

change to one of the final statuses. If the client do not take any action or closes the browser without

entering the 3D Secure code, this status will be change to Expired

- 3D Secure автентицирана/3D Secure authenticated

Pending transaction, the client has successful entered the 3D Secure code and has passed 3D

authentication, it is temporary status. Later, this status will be change to one of the final statuses. If the

client closes the browser after entering the 3D Secure code, this status is changed to Expired.

- 3D Secure автентикацијата е неуспешна/3D Secure authentication failed

Unsuccessful transaction, the client has entered an incorrect 3D Secure code and has failed 3D Secure

authentication.

- Рефундирана/Refunded

Refunded successful transaction, a successful transaction was refunded by the bank on a request from

the merchant.

- Expired

Unsuccessful transaction. All transactions that are not completed on cPay will have this status, as

explain above (previous statuses: New, In 3D authentication, 3D secure authenticated)

Redirect Code

The HTML redirect code is example/template of how and which fields need to be send in the cPay redirect

in order to perform an online transaction. In this template the merchant can find the fields PayToMerchant,

MerchantName and AmountCurrency, these fields are dedicated to the merchant and must be send as they are

for all transactions.

- Redirect code is downloaded from cPay payment system, merchant menu.

- The redirect code is provided only as an example of the redirect form that the merchant ecommerce

application should generate for each transaction and if any of the fields are modified manually, it will not

work.

- The payment implementation in the merchant web site is developers’ solution and can be done in any

programming language (PHP, ASP.NET, JavaScript…). E-commerce web site developers are the only

ones who know their own programming code, therefore, it is really up to them to create a module that

works with their own software code. However, where ever possible cPay technicians will always assist.

- If the developer is using CMS (VirtueMart (Joomla), Prestashop, Magento, OpenCart…), the PLUGIN,

which will be compatible with the cPay interface, should be made by the developer. We do not have and

cannot provide any PLUGIN for this purpose, it is developers’ solution.

Reports From Merchant Module

The merchant can download reports for successful transactions from the merchant module of cPay, tab

“ИЗВЕШТАЈ ЗА ТРАНСАКЦИИ” (“REPORT TRXIDS”). The report file can be downloaded in several formats

(.txt, .csv, .xls, .xml)

An example of one record in .txt format follows:

277254,0010012800,46929,,24.04.2012 14:23:20,245,MKD,Sent

cPay Testing Procedures And Production Implementation v1.0.7 Page 6 of 12

Authorisation Department

The explanation about fields in the record is listed in the following table:

Field Lenght Description

cPayRefID 6 - 10 Transaction Identification in cPay.

Sequence Number 10 Control number that the POS terminal generates for

each transaction.

Details 2 max 100 Transaction Identification in the merchant system

(Order Id).

Details 3 max 100 Not used. Always will be empty.

Transaction DateTime 16 Date and time of the transaction.

Format is: DD.MM.YYYY HH:MM:SS

(24.04.2012 14:23:20)

Amount 1 - 12 Transaction amount.

Currency 3 Transaction currency (MKD).

Status 4-23 Transaction Status (always will be “sent”, “authorized”

or “completed authorisation”, since in the reports are

shown only successful transactions).

Test Payments

Test payments should be created with correct checksum. For the checksum creation, as explained in

merchant integration specification, checksum authentication key is needed. Initially, for the test purposes

authentication key is TEST_PASS and maximum amount for a transaction is 10 denars. After testing is

successfully completed, i.e. all tests are performed and all notifications sent from cPay payment system are

received by the merchant, checksum authentication key is changed (procedure for checksum authentication key

management is explained later in this document) and transaction amount limitation is removed.

In order to check accuracy of the created checksum, payment request from the merchant web site should

be sent to the following test URL:

https://www.cpay.com.mk/Client/page/default.aspx?xml_id=/mk-MK/.TestLoginToPay/

This test page is used only for checking the accuracy of the calculated checksum.

After correct creation of the checksum (the test page doesn’t show an error), the merchant should:

- Create payment of 1 Denar

- Use one of the PaymentURL addresses listed in the merchant integration specification

- Perform test payment transactions.

1. For one step payments, the following payment transactions should be performed for test purposes:

- Case 1: Successful transaction - the cardholder’s account is debited. All notifications, explained in next

chapter, should be sent to the merchant.

- Case 2: Unsuccessful transaction - the cardholder’s account is not debited (e.g. wrong expiration date or

CVC2/CVV2 of the card is entered). All notifications, explained in next chapter, should be sent to the

merchant.

- Case 3: Cancelled transaction - the data of the payment card are entered, the button Продолжи/ Continue

is pressed, but on the next step, the buyer has cancelled the payment, button Откажи/Cancel is pressed.

All notifications, explained in next chapter, should be sent to the merchant. For this test also include string

with international special characters (e.g. string “Тёст Strîñğ” In the parameter Details 1) to make sure that

cPay Testing Procedures And Production Implementation v1.0.7 Page 7 of 12

Authorisation Department

the length of these characters and the checksum are correctly calculated. Length of each character should

be count 1.

- Case 4: Expired transaction - the data of the payment card are entered, the button Продолжи/Continue

is pressed, but on the next step, the buyer has performed no action and transaction has time out. In this

case email notification for unsuccessful transaction and push notification to FAIL URL will be sent to

merchant after 30 minutes.

Also, the following tests, where merchant will not receive all notifications, should be performed (The merchant

should be aware for these situations that might occur in production):

- Case 5: Successful transaction – the browser should be close immediately after confirming the payment in

last step (for less than 1 second e.g. only one tab in the browser, where payment will be performed, is

opened; and after confirmation immediately close the browser with ALT+F4), the cardholder’s account is

debited. In this case the merchant will not receive notification via buyer’s browser but will receive only email

confirmation (with subject “order status”) and push notifications, both initiated 15 minutes after the payment.

- Case 6: Successful transaction – the browser should be close immediately after confirming the payment in

last step (for less than 1 second e.g. only one tab in the browser, where payment will be performed, is

opened; and after confirmation immediately close the browser with ALT+F4), the cardholder’s account is

debited. In this case the merchant will not receive notification via buyer’s browser and push notifications,

but will receive only email confirmation (with subject “order status”) 15 minutes after the payment.

Additionally, the merchant will receive and email for unsuccessful delivery of push notifications (with subject

“failed merchant notifications”). For this case there is need of assistance from CaSys’ support team.

- Case 7: Successful transaction – the cardholder’s account is debited. In this case the merchant will not

receive the push notifications but only notifications via buyer’s browser and email confirmation (with subject

“order status”). Additionally, the merchant will receive and email for unsuccessful delivery of push

notifications (with subject “failed merchant notifications”). For this case there is need of assistance from

CaSys’ support team.

2. For two steps payments, the following payment transactions should be performed for test purposes:

- Case 1: Successful transaction – the preauthorization amount is reserved from the cardholder’s account.

All notifications, explained in next chapter, should be sent to the merchant. After that, preauthorization

completion should be performed by the merchant, which debits the reserved amount from the cardholder’s

account.

- Case 2: Unsuccessful transaction – the amount is not reserved from the cardholder’s account (e.g. wrong

expiration date or CVC2/CVV2 of the card is entered). All notifications, explained in next chapter, should

be sent to the merchant.

- Case 3: Cancelled transaction (the data of the payment card are entered, the button Продолжи/ Continue

is pressed, but on the next step, the buyer has cancelled the payment, button Откажи/Cancel is pressed).

All notifications, explained in next chapter, should be sent to the merchant. For this test also include string

with international special characters (e.g string “Тёст Strîñğ” In the parameter Details 1) to make sure that

the length of these characters and the checksum are correctly calculated. Length of each character should

be count 1.

- Case 4: Expired transaction - the data of the payment card are entered, the button Продолжи/Continue

is pressed, but on the next step, the buyer has performed no action and transaction has time out. In this

case email notification for unsuccessful transaction and push notification to FAIL URL will be sent to

merchant after 30 minutes.

cPay Testing Procedures And Production Implementation v1.0.7 Page 8 of 12

Authorisation Department

Also, the following tests, where merchant will not receive all notifications, should be performed (The merchant

should be aware for these situations that might occur in production):

- Case 5: Successful transaction – the browser should be close immediately after confirming the payment in

last step (for less than 1 second e.g. only one tab in the browser, where payment will be performed, is

opened; and after confirmation immediately close the browser with ALT+F4), the preauthorization amount

is reserved from the cardholder’s account. In this case the merchant will not receive notification via buyer’s

browser but will receive only email confirmation (with subject “order status”) and push notifications; both

initiated 15 minutes after the payment. After that, preauthorization completion should be performed by the

merchant, which debits the reserved amount from the cardholder’s account.

- Case 6: Successful transaction – the browser should be close immediately after confirming the payment in

last step (for less than 1 second e.g. only one tab in the browser, where payment will be performed, is

opened; and after confirmation immediately close the browser with ALT+F4), the preauthorization amount

is reserved from the cardholder’s account. In this case the merchant will not receive notification via buyer’s

browser and push notifications, but will receive only email confirmation (with subject “order status”) 15

minutes after the payment. Additionally, the merchant will receive and email for unsuccessful delivery of

push notifications (with subject “failed merchant notifications”). For this case there is need of assistance

from CaSys’ support team. After that, preauthorization completion should be performed by the merchant,

which debits the reserved amount from the cardholder’s account. For this case there is need of assistance

from CaSys’ support team.

- Case 7: Successful transaction – the preauthorization amount is reserved from the cardholder’s account.

In this case the merchant will not receive the push notifications but only notifications via buyer’s browser

and email confirmation (with subject “order status”). Additionally, the merchant will receive and email for

unsuccessful deliver of push notifications (with subject “failed merchant notifications”). For this case there

is need of assistance from CaSys’ support team. After that, preauthorization completion should be

performed by the merchant, which debits the reserved amount from the cardholder’s account. For this case

there is need of assistance from CaSys’ support team.

At the end, for one step and two step payments, email confirmation should be send by the merchant:

- Case 8: The merchant must confirm through email that whole unit amount will be used in the redirect code

(the last two digits of parameter AmountToPay must always be 00 e.g. xxxx00).

The email should be with subject:

English - cPay_MERCHANT NAME_Confirmation about AmountToPay/TLS 1.2_Date

Macedonian - cPay_IME NA TRGOVECOT_Potvrda za AmountToPay/TLS 1.2_Datum

Please note that all test payments are performed in production mode.

For all test cases the HTTP Referer parameter should be present with valid value.

If during testing the merchant faces with screen with information “System error”, it should contact CaSys’

support team in order problem to be resolved.

Note 1: For two steps payment, with preauthorization and completion, if the merchant cannot deliver the

product/service after successful preauthorization, release of the reserved clients’ funds should be performed

(cancelation of the preauthorization). The easiest way is to perform completion on 1 denar, which will debit the

client account for 1 denar, and release the remaining amount of the cardholders account. In this case the

merchant should inform the Bank about these preauthorization/completion transactions. It is recommended the

acquiring Bank to inform the issuer Bank about this cancelation.

cPay Testing Procedures And Production Implementation v1.0.7 Page 9 of 12

Authorisation Department

Note 2: All transaction performed on amount greater than 10 denars before changing the checksum

authentication key will be declined.

The obligation for test conduction is on the merchant. When all test transactions are performed, the merchant

should inform CaSys’ support team in order analysis to be performed, for successfulness of performed test

payments and notification delivery.

Changing To Production CheckSum Authentication Key

In order to start working in production mode, the merchant should inform CaSys’ support team that the tests

are finished and all test transactions are performed.

If transactions are not successfully processed in CaSys’ system (i.e. the notifications are not successfully

delivered to the merchant), additional correction by the merchant should be performed according provided

instruction, and tests should be repeated.

After CaSys’ confirmation of successful transactions processing in the system, and successful delivery of

all notifications to the merchant, the checksum authentication key must be change.

The productive checksum authentication key is defined by Casys and sent only to merchant email. Subject

of the email message will be:

cPay_MERCHANT NAME_Changing the checksum authentication key_Date – if the e-mail communication

is conducted on other than Macedonian language

cPay_IME NA TRGOVECOT_Promena na CheckSum Avtentikaciski Kluch_Datum – if the e-mail

communication is conducted on Macedonian language

The following rules must be followed:

1. CheckSum authentication key (which must be sent only by Casys representative) must be in zip file; the zip

file should be password protected.

2. The password of the zip file is sent only to merchant email address, in another email, replying on the previous

sent mail for changing the checksum authentication key.

3. The changing of the checksum authentication key is performed in the merchant system. To confirm that the

changes made in both systems are correct, the merchant should perform at least one successful redirect to

cPay Payment system, and inform about successful redirect to ecommerce@casys.com.mk.

4. CaSys informs the merchant and the Bank representative that the checksum authentication key is successfully

changed.

Without changing to production checksum authentication key, the merchant cannot implement its e-shop in

production mode. Changing of the checksum authentication key is performed in working days in period from

08:30-15:30.

cPay Testing Procedures And Production Implementation v1.0.7 Page 10 of 12

Authorisation Department

Communication With CaSys

During the implementation and testing, the merchant should use only e-mail communication with CaSys’

support team. This way all involved parties will be informed about the activities, problems and the progress of

the implementation. Please, do not use phone communication.

During implementation, for communication with CaSys’ support team please use the following e-mail

address ecommerce@casys.com.mk. In each request/e-mail please include representative person from the

bank with which the merchant has agreement (email address of the representative person of the bank is not

included when changing the checksum authentication key).

Note: After the implementation is finished, and checksum authentication key is changed i.e. production

mode has started, the complete communication is carried out by the bank.

For e-mail communications with CaSys’ support team please follow the rules for e-mail subject create

classified by topic (the subject is listed in both English and Macedonian language, depending of the email

language conversation):

- Problem with code implementation –

English - cPay_MERCHANT NAME_Problem with code implementation_Date

Macedonian - cPay_IME NA TRGOVECOT_Problem vo implementacija na kodot_Datum

- Requesting for test cases results –

English - cPay_MERCHANT NAME_Test cases results_Date

Macedonian - cPay_IME NA TRGOVECOT_Rezultati od testovite_Datum

Note: the merchant should provide info about cPayRefID for each performed test. For example, Case1:

710201, Case2: 710202, Case3: 710203 etc.

- Push messages or email notifications are not delivered –

English - cPay_MERCHANT NAME_Undelivered push messages or email notifications_Date

Macedonian - cPay_IME NA TRGOVECOT_Neisprateni push poraki ili e-mail notifikacii_Datum

- Changing the simple site settings –

English - cPay_MERCHANT NAME_simple_site settings_Date

Macedonian - cPay_MERCHANT NAME_simple_strana nagoduvanje_Datum

- Changing the checksum authentication key –

English - cPay_MERCHANT NAME_Changing the checksum authentication key_Date

Macedonian - cPay_IME NA TRGOVECOT_Promena na CheckSum Avtentikaciski Kluch_Datum

- Reissue of the password for the user profile of the merchant –

English - cPay_MERCHANT NAME_Reissue of merchants’ user profile password_Date

Macedonian - cPay_IME NA TRGOVECOT_Reizdavanje na lozinka za korisnicki profil na trgovec_Datum

cPay Testing Procedures And Production Implementation v1.0.7 Page 11 of 12

Authorisation Department

- Creation of additional user profil (email should be send only by representative of the Bank)

English - cPay_MERCHANT NAME_Creation of additional user profil_Date

Macedonian - cPay_IME NA TRGOVECOT_Kreiranje na dopolnitelni korisnicki profil_Datum

- If the problem is not listed in above examples –

English - cPay_MERCHANT NAME_Question_Date

Macedonian - cPay_IME NA TRGOVECOT_Prasanje_Datum

Please follow the above rules in order your requests to be processed on time.

cPay Testing Procedures And Production Implementation v1.0.7 Page 12 of 12

You might also like

- Bankart Uputstvo Za Integraciju, ENGDocument31 pagesBankart Uputstvo Za Integraciju, ENGPetar ĐuričkovićNo ratings yet

- Documentatie TestareDocument8 pagesDocumentatie TestareClaudiu ClauNo ratings yet

- BPE 3.0 Service Creditcards.1.06Document12 pagesBPE 3.0 Service Creditcards.1.06rainashwetaNo ratings yet

- White Paper - All About Ecommerce and Payment GatewaysDocument8 pagesWhite Paper - All About Ecommerce and Payment GatewaysschoginiNo ratings yet

- Sci 1 10 Final Uptodate 2Document21 pagesSci 1 10 Final Uptodate 2im reNo ratings yet

- API-NeoGatewayReferenceGuide v2.1 wISPDocument47 pagesAPI-NeoGatewayReferenceGuide v2.1 wISPjuan pablo lopezNo ratings yet

- Payment ProcessDocument2 pagesPayment ProcessMudit KothariNo ratings yet

- End Customer FlowDocument2 pagesEnd Customer FlowMudit KothariNo ratings yet

- Confessions of A BankerDocument59 pagesConfessions of A Bankeremanuelselfmade01No ratings yet

- Payments in Order Management in R12 (Doc ID 1164613.1) : Applies ToDocument33 pagesPayments in Order Management in R12 (Doc ID 1164613.1) : Applies ToManoj100% (1)

- Eselectplus PHP Ig-MpiDocument15 pagesEselectplus PHP Ig-MpiMuhammad AzeemNo ratings yet

- Payment Gateway TestingDocument15 pagesPayment Gateway TestingavinashrocksNo ratings yet

- NAPASMerchantIntegrationSpecification 2.2Document32 pagesNAPASMerchantIntegrationSpecification 2.2Nam Nguyễn ThànhNo ratings yet

- Credit Card ProcessingDocument21 pagesCredit Card Processingtushar20010% (1)

- B47 CRAC Generation 1692598986Document37 pagesB47 CRAC Generation 1692598986AEE Design MCFNo ratings yet

- CommWeb - Payment Client Integration GuideDocument133 pagesCommWeb - Payment Client Integration GuideNiño Francisco AlamoNo ratings yet

- Kuickpay Hosted Checkout V4Document7 pagesKuickpay Hosted Checkout V4Aumair MalikNo ratings yet

- Redirection Manual Ver 1.1.3 enDocument72 pagesRedirection Manual Ver 1.1.3 enGiorgos GrivokostopoulosNo ratings yet

- 8 Credit Card System OOADDocument29 pages8 Credit Card System OOADMahesh WaraNo ratings yet

- Network Merchants (NMI) Integration Resources: Direct Post API DocumentationDocument11 pagesNetwork Merchants (NMI) Integration Resources: Direct Post API DocumentationParag SankheNo ratings yet

- Internet - Authentication - Procedure - Guide - Barclays 3DSDocument54 pagesInternet - Authentication - Procedure - Guide - Barclays 3DSbenNo ratings yet

- Cyber Cash: Vivek BirlaDocument21 pagesCyber Cash: Vivek Birlavivek.birlaNo ratings yet

- Myvirtual UserguideDocument60 pagesMyvirtual UserguidePhillip OdendaalNo ratings yet

- Credit Card System OOADDocument27 pagesCredit Card System OOADArun Kumar63% (8)

- Sage Pay SERVERProtocoland Integration GuidelinesDocument52 pagesSage Pay SERVERProtocoland Integration GuidelinesspamanjeNo ratings yet

- Unit-4.4-Payment GatewaysDocument8 pagesUnit-4.4-Payment GatewaysShivam SinghNo ratings yet

- E CommerceDocument7 pagesE CommerceNimya RoyNo ratings yet

- Payment Gateway vs. Payment Processor - What Are The DifferencesDocument6 pagesPayment Gateway vs. Payment Processor - What Are The DifferencesCarlos JesenaNo ratings yet

- Payscape: Integration ResourcesDocument11 pagesPayscape: Integration Resourcesapi-27548001No ratings yet

- 3D Secure 3Document30 pages3D Secure 3kominminNo ratings yet

- ACHQ ECheckPaymentAPI Merchants v2.0.1Document19 pagesACHQ ECheckPaymentAPI Merchants v2.0.1Urbano BallesterosNo ratings yet

- API-GatewayTokenService - v6.4 - BAC - TranslatedDocument26 pagesAPI-GatewayTokenService - v6.4 - BAC - TranslatedMuhammad AsfandyarNo ratings yet

- Invoice Approval Process and Chart of Authority - SAP BlogsDocument32 pagesInvoice Approval Process and Chart of Authority - SAP BlogsSiva NarendraNo ratings yet

- Sage Pay Shared ProtocolsDocument32 pagesSage Pay Shared ProtocolsAlex WilkesNo ratings yet

- How Credit Card Transaction Processing Works - Steps, Fees & ParticipantsDocument15 pagesHow Credit Card Transaction Processing Works - Steps, Fees & ParticipantsSeanSean ParkNo ratings yet

- In This Use Cases ExampleDocument2 pagesIn This Use Cases ExampleNeelima ReddyNo ratings yet

- Resentation ON Online Payment Gateway SystemDocument25 pagesResentation ON Online Payment Gateway SystemvincentNo ratings yet

- Design A Payment GatewayDocument8 pagesDesign A Payment GatewayRaghuram PeddibhotlaNo ratings yet

- Cpay Merchant Integration Specification v2.9Document21 pagesCpay Merchant Integration Specification v2.9Sasho JovevskiNo ratings yet

- Dragonpay PS APIDocument23 pagesDragonpay PS APIwhittakersharoNo ratings yet

- E-Commerce Banking R&D 2 TO PPDocument10 pagesE-Commerce Banking R&D 2 TO PPaspany loisNo ratings yet

- UML DiagramDocument29 pagesUML DiagramDIVAGARRAJANo ratings yet

- Chapter 2 - Cash TransferDocument62 pagesChapter 2 - Cash TransferMa. Eliza CerveraNo ratings yet

- Chase Mobile Payments SDK 1 2 0Document43 pagesChase Mobile Payments SDK 1 2 0Amit Kumar ShindeNo ratings yet

- UCO Bank User Management & WireframeDocument14 pagesUCO Bank User Management & WireframeAnweshan DharaNo ratings yet

- Electronic Payment Systems-FinalDocument105 pagesElectronic Payment Systems-Finaldileepvk1978No ratings yet

- Payment Gateway Original DataDocument6 pagesPayment Gateway Original DataAshrithaNo ratings yet

- Uml Diagrams-Bank ManagementDocument30 pagesUml Diagrams-Bank Managementshakir54490% (70)

- Unit III EpsDocument45 pagesUnit III Epsaditi pandeyNo ratings yet

- Software Requirements SpecificationDocument5 pagesSoftware Requirements SpecificationArjun RajNo ratings yet

- Bank Management: Use Case ModelingDocument30 pagesBank Management: Use Case ModelingMuralidharNo ratings yet

- IPAYMU Commercial Offering MerchantDocument8 pagesIPAYMU Commercial Offering MerchantHimanshu NagpalNo ratings yet

- Payment ResponseDocument34 pagesPayment ResponseDebdoot PalNo ratings yet

- 3DS EMV Migration StepsDocument4 pages3DS EMV Migration Stepssemanikoytu semanikoytuNo ratings yet

- Darie Mobile Banking BRDDocument6 pagesDarie Mobile Banking BRDuniteddesyibel2018No ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Oracle PeopleSoft Enterprise Financial Management 9.1 ImplementationFrom EverandOracle PeopleSoft Enterprise Financial Management 9.1 ImplementationNo ratings yet

- To Find Out More: Chat ScriptDocument6 pagesTo Find Out More: Chat ScriptGraciella De GuzmanNo ratings yet

- Private Commercial BanksDocument7 pagesPrivate Commercial Banksjakia sultanaNo ratings yet

- E Business Strategy Chaffey 2Document24 pagesE Business Strategy Chaffey 2diyanaNo ratings yet

- Specialized Fields and Branches of AccountingDocument2 pagesSpecialized Fields and Branches of AccountingElla Simone100% (2)

- Ana González Formoso Ana Parrilla GonzálezDocument5 pagesAna González Formoso Ana Parrilla GonzálezanaNo ratings yet

- 27-Full Manuscript-489-1-10-20220328Document7 pages27-Full Manuscript-489-1-10-20220328TychiqueNo ratings yet

- Soal Asis Pert 2 - Jordy - PA1Document1 pageSoal Asis Pert 2 - Jordy - PA1Jordy TangNo ratings yet

- Intelligent Transportation SystemDocument11 pagesIntelligent Transportation SystemCollins omondi onyangoNo ratings yet

- Telemedicine According To WHO, Telemedicine Is Defined Advantages of Telemedicine Model of Telehealth SystemDocument2 pagesTelemedicine According To WHO, Telemedicine Is Defined Advantages of Telemedicine Model of Telehealth SystemAmanda ScarletNo ratings yet

- Chapter 10 AnsDocument8 pagesChapter 10 AnsDave Manalo50% (2)

- Lecture No 9Document26 pagesLecture No 9Hamza AliNo ratings yet

- Work Experience Watiga & Co. (S) Pte LTD: IgnatiusDocument3 pagesWork Experience Watiga & Co. (S) Pte LTD: IgnatiusankiosaNo ratings yet

- ICI PakistanDocument29 pagesICI PakistanMuhammad Hassaan Ali100% (4)

- Cash Collection Systems: 2005 by Thomson Learning, IncDocument13 pagesCash Collection Systems: 2005 by Thomson Learning, IncuuuuufffffNo ratings yet

- Accounting For Merchandising OperationsDocument58 pagesAccounting For Merchandising OperationsSalvie Perez UtanaNo ratings yet

- Course Group 2012-14 1562-1645Document7 pagesCourse Group 2012-14 1562-1645AgenttZeeroOutsiderNo ratings yet

- 1-15 A12060 HMO Manual PDFDocument460 pages1-15 A12060 HMO Manual PDFsyunamiNo ratings yet

- Inventory ManagementDocument18 pagesInventory ManagementAmolnanavareNo ratings yet

- Daddy Nicc1292021Document1 pageDaddy Nicc1292021Katherine VerceluzNo ratings yet

- Plan Vouchers 01 03 2023Document1 pagePlan Vouchers 01 03 2023Ayesha KovuriNo ratings yet

- Of The Institute of Chartered Accountants of India, New DelhiDocument2 pagesOf The Institute of Chartered Accountants of India, New DelhiMahesh KumarNo ratings yet

- Statement: FUJIFILM Business Innovation Asia Pacific Pte. LTDDocument1 pageStatement: FUJIFILM Business Innovation Asia Pacific Pte. LTDHarvest MoonNo ratings yet

- Heritage Institute of Technology, Kolkata: (Brief SRS - 10, Design Solution - 30) Plus Viva (Already Conducted) - 20)Document9 pagesHeritage Institute of Technology, Kolkata: (Brief SRS - 10, Design Solution - 30) Plus Viva (Already Conducted) - 20)Devil HunterNo ratings yet

- Complaint Detail 23109230073779Document2 pagesComplaint Detail 23109230073779Ankit DubeyNo ratings yet

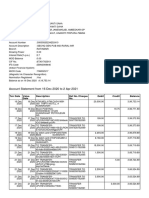

- Account Statement From 16 Dec 2020 To 2 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 16 Dec 2020 To 2 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSuhan SahaNo ratings yet

- PNB MetLife Endowment Savings Plan Plus-Policy Doc - tcm47-58256-v0Document52 pagesPNB MetLife Endowment Savings Plan Plus-Policy Doc - tcm47-58256-v0Amit GuptaNo ratings yet

- Directives Unified Directives 2075 NewDocument453 pagesDirectives Unified Directives 2075 Newbijayr100% (2)

- Applications of ICT in BankingDocument10 pagesApplications of ICT in Bankingboss_7amoudNo ratings yet

- 23 Office AccountsDocument9 pages23 Office AccountsNguyenNo ratings yet

- Tourism Answers PDFDocument41 pagesTourism Answers PDFĐạt VươngNo ratings yet