Professional Documents

Culture Documents

AK Audit of Receivables ACP103

Uploaded by

km dummieCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AK Audit of Receivables ACP103

Uploaded by

km dummieCopyright:

Available Formats

Solutions: Audit of Receivables AP - 06 - ACCTG 100c - (Second Semester 2012-2013)

Problem I

1 Inventory 92,000

A/R 92,000

2 Sales 40,000

A/R 40,000

3 Cash 124,000

A/R 124,000

2 Balance before adjustments 2,020,000

AJE 1 (92,000)

AJE 2 (40,000)

AJE 3 (124,000)

Adjusted balance 1,764,000

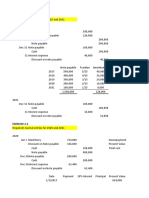

Problem II

1 NR from sale of division 4,500,000

Less: Payment on May 1, 2012 (1,500,000)

Installment due on May 1, 2013 (1,500,000) 1,500,000

NR from officers due 12/31/14 1,200,000

NR from sale of patent due April 1, 2014

Present value of note on April 1, 2012 (P400K x 0.797) 318,800

Amortization April 1 to December 31, 2012 (P318,800 x 12% x 9/12) 28,692 347,492

NR from sale of land 280,000

Installment due on July 1, 2013 90,250

Interest (P280K x 11%) (30,800) 59,450 220,550

TOTAL B 3,268,042

2 Note receivable from sale of division 1,500,000

Note receivable from sale of land 59,450

TOTAL D 1,559,450

3 Note receivable from sale of division

From May 1 to December 31, 2012 (P3M x 9% x 8/12) 180,000

Note receivable from sale of land

From July 1 to December 31, 2012 (P280K x 11% 6/12) 15,400

TOTAL A 195,400

4 Note receivable from sale of division

From January 1 to April 30, 2012 (P4.5M x 9% x 4/12) 135,000

From May 1 to December 31, 2012 (P3M x 9% x 8/12) 180,000 315,000

Note receivable from officer (P1.2M x 8%) 96,000

Note receivable from sale of patent (Number 1) 28,692

Note receivable from sale of land (Number 3) 15,400

TOTAL A 455,092

5 Unamortized discount, April 1, 2012 (P400,000 - P318,800) 81,200

Amortization, April 1 to December 31, 2012 (Number 1) (28,692)

TOTAL D 52,508

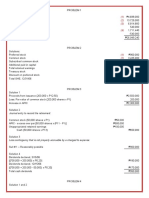

Problem III

1 A Allowance for doubtful accounts, Janury 1, 2012 300,000

Provisions during the year 150,000

Writeoff during the year (187,500)

Recovery of writeoff 50,000

Balance before aging 312,500

Required allowance 200,000

Overallowance 112,500

Doubtful accounts expense (P150,000 - P112,500) 37,500

B Accounts receivable, December 31, 2012 2,375,000

Allowance for Doubtful accounts (200,000)

Net realizable value 2,175,000

C Equal to overallowance 112,500

D Allowance for Doubtful Accounts 112,500

Doubtful Accounts Expense 112,500

2 A Base on provision during the year. 150,000

B Allowance for doubtful accounts, Janury 1, 2012 300,000

Provisions during the year 150,000

Writeoff during the year (187,500)

Recovery of writeoff 50,000

Allowance for doubtful accounts, December 31, 2012 312,500

3 A Required allowance (8% x P2,375,000) 190,000

Allowance for doubtful accounts, Janury 1, 2012 300,000

Provisions during the year 150,000

Writeoff during the year (187,500)

Recovery of writeoff 50,000 312,500

Over allowance 122,500

Provisions during the year 150,000

Over allowance 122,500

Doubtful accounts expense during the year 27,500

Problem IV

Net Debit Adjusted Required

1 Balance Adjustment Balance Rate Allowance

60 days and under 258,513 258,513 1% 2,585

61 - 90 days 204,735 7,260 211,995 3% 6,360

91 - 120 days 59,886 (4,110) 55,776 6% 3,347

Over 120 days 35,466 (6,300) 29,166 25% 7,292

558,600 (3,150) 555,450 1. B 19,583

2. B

3 Allowance, January 1, 2012 13,125

Writeoff, November 30 (4,110)

Additional writeoff (6,300)

Balance before any provision 2,715

Required balance per aging 19,583

Doubtful accounts expense for 2012 B 16,868

4 Provision during the year 27,930

Doubtful accounts expense for the year 16,868

Credit adjustment 11,062

Debit adjustment for correction of error in recording writeoff (4,110)

Net credit adjustment A 6,952

Problem V

1 Total 0 - 30 31 - 60 61 - 90 91 - 120 Over 120

AAA 140,720 56,000 84,720

BBB 83,680 48,000 35,680

CCC 122,400 80,000 42,400

DDD 180,560 92,560 88,000

EEE 126,400 126,400

FFF 69,600 69,600

TOTAL 723,360 262,400 177,280 130,400 117,600 35,680

Percentage 1% 1.50% 3% 10% 50%

C 38,795 2,624 2,659 3,912 11,760 17,840

2 Doubtful accounts expense 24,795

Allowance for Doubtful accounts 24,795

You might also like

- Accounting PracticeDocument24 pagesAccounting PracticeLloydNo ratings yet

- Mark Scheme (Results) January 2012: GCE Accounting (6001) Paper 01Document21 pagesMark Scheme (Results) January 2012: GCE Accounting (6001) Paper 01hisakofelixNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- BudgetDocument7 pagesBudgetvasanthgurusamynsNo ratings yet

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocument6 pagesACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleNo ratings yet

- GE 01.FCAB - .L Solution JUNE 2020 ExamDocument5 pagesGE 01.FCAB - .L Solution JUNE 2020 ExamTameemmahmud rokibNo ratings yet

- MQ2 Answer KeyDocument8 pagesMQ2 Answer KeyAldric Jayson TaclanNo ratings yet

- Unit 3: Answers To ActivitiesDocument10 pagesUnit 3: Answers To ActivitiesJaved MushtaqNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- 9706 s12 Ms 22 PDFDocument6 pages9706 s12 Ms 22 PDFmarryNo ratings yet

- Financial Accounting N 6 Test MG 2nd Semester 2017Document8 pagesFinancial Accounting N 6 Test MG 2nd Semester 2017professional accountantsNo ratings yet

- Chapter 8 - Notes Payable and Debt Restructuring: Problem 8-7Document3 pagesChapter 8 - Notes Payable and Debt Restructuring: Problem 8-7Pau LaguertaNo ratings yet

- CPAR - AP Solutions 1st PB-BATCH 91Document5 pagesCPAR - AP Solutions 1st PB-BATCH 91Allyson VillalobosNo ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- Practice Set 5 Financial Statements of Sole ProprietorshipsDocument3 pagesPractice Set 5 Financial Statements of Sole ProprietorshipsBritney PetersNo ratings yet

- Mark Scheme (Results) January 2018Document34 pagesMark Scheme (Results) January 2018Samin AhmedNo ratings yet

- ACG211E Test 1 Suggested SolutionDocument5 pagesACG211E Test 1 Suggested Solutionsphesihlemkhize1204No ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerDocument9 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerChantelle IsaksNo ratings yet

- ABC Chap 9 SolmanDocument11 pagesABC Chap 9 SolmanKimberly ToraldeNo ratings yet

- Auditing Problems SOLUTION v.1 - 2018Document12 pagesAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloNo ratings yet

- Suggested Solutions June 2006Document11 pagesSuggested Solutions June 2006kalowekamoNo ratings yet

- Module 2 Answer Key On Property Plant and EquipmentDocument7 pagesModule 2 Answer Key On Property Plant and EquipmentLoven BoadoNo ratings yet

- Summer ExamDocument17 pagesSummer Examoliverchukwudi97No ratings yet

- PPE1&2Document3 pagesPPE1&2Kailah CalinogNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Problems On Total IncomeDocument12 pagesProblems On Total IncomedipakNo ratings yet

- Journal Entry To Record The RetirementDocument2 pagesJournal Entry To Record The RetirementMoses John SarteNo ratings yet

- Ans Jan 2018 Far410Document8 pagesAns Jan 2018 Far4102022478048No ratings yet

- GR 11 Accounting P1 (English) November 2022 Possible AnswersDocument9 pagesGR 11 Accounting P1 (English) November 2022 Possible Answersphafane2020No ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document12 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Shane KimNo ratings yet

- WAC11 01 MSC 20190307 PDFDocument33 pagesWAC11 01 MSC 20190307 PDFTharushi DiyanaNo ratings yet

- Viii - Audit of Equity PROBLEM NO. 1 - Equity Components SolutionDocument22 pagesViii - Audit of Equity PROBLEM NO. 1 - Equity Components SolutionKirstine DelegenciaNo ratings yet

- Grade 10 Provincial Exam Accounting p1 AnswersDocument7 pagesGrade 10 Provincial Exam Accounting p1 AnswershobyanevisionNo ratings yet

- GR10 Accounting Practice Exam Memorandum November Paper 1Document7 pagesGR10 Accounting Practice Exam Memorandum November Paper 1morukakgothatso5No ratings yet

- Part 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalDocument8 pagesPart 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalAUDITOR97No ratings yet

- Intermediate Accounting Volume III 2012 Edition Suggested AnswersDocument3 pagesIntermediate Accounting Volume III 2012 Edition Suggested AnswersEuphoriaNo ratings yet

- Financial Accounting 2022 NeHu Question PaperDocument7 pagesFinancial Accounting 2022 NeHu Question PaperSuraj BoseNo ratings yet

- Test 3 Memo Tax621sDocument2 pagesTest 3 Memo Tax621sMartha EeluNo ratings yet

- Auditing Problem SolutionsDocument13 pagesAuditing Problem SolutionsjhobsNo ratings yet

- Cpa Review School of The PhilippinesDocument6 pagesCpa Review School of The PhilippinesMarwin AceNo ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- Exercise (11) : Answer: A. Net Profit RM1,793 B. RM63,340Document3 pagesExercise (11) : Answer: A. Net Profit RM1,793 B. RM63,340S1X 32 許詠棋 KohYongKeeNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersProto Proffesor TshumaNo ratings yet

- Departmental Accounts PDFDocument10 pagesDepartmental Accounts PDFMINTU SARAFNo ratings yet

- AC3202 WK2 Exercises SolutionsDocument11 pagesAC3202 WK2 Exercises SolutionsLong LongNo ratings yet

- Book-Keeping and Accounts Level 2/series 2-2009Document13 pagesBook-Keeping and Accounts Level 2/series 2-2009Hein Linn Kyaw60% (10)

- 2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersDocument8 pages2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersChantelle IsaksNo ratings yet

- 1-1hkg 2002 Dec ADocument8 pages1-1hkg 2002 Dec AWing Yan KatieNo ratings yet

- Tutorial Letter 201/1/2017: Distinctive Financial ReportingDocument8 pagesTutorial Letter 201/1/2017: Distinctive Financial ReportingItumeleng KekanaNo ratings yet

- Kunci - Menyusun Lap. Keuangan - P1Document15 pagesKunci - Menyusun Lap. Keuangan - P1Arief Budi SetiawanNo ratings yet

- Ia3 FinalsDocument4 pagesIa3 FinalsGeraldine MayoNo ratings yet

- Financial Accounting and Reporting - JA - 2022 - Suggested AnswersDocument8 pagesFinancial Accounting and Reporting - JA - 2022 - Suggested AnswersMonira afrozNo ratings yet

- Faf Tutorial 3Document11 pagesFaf Tutorial 3ThomasNo ratings yet

- Acinac Problem 5Document5 pagesAcinac Problem 5Angelo Gian CoNo ratings yet

- Investment Accounts-Master Mind Answers PDFDocument7 pagesInvestment Accounts-Master Mind Answers PDFRam IyerNo ratings yet

- AlphaIndicator TANC 20230212Document11 pagesAlphaIndicator TANC 20230212Zhi_Ming_Cheah_8136No ratings yet

- CH - 04 Dissolution of Partnership FirmDocument10 pagesCH - 04 Dissolution of Partnership FirmMahathi AmudhanNo ratings yet

- High Yield Covenants - Merrill Lynch - Oct 2005Document21 pagesHigh Yield Covenants - Merrill Lynch - Oct 2005fi5hyNo ratings yet

- AnswerDocument13 pagesAnswerEhab M. Abdel HadyNo ratings yet

- General Journal 1 PERIODICDocument14 pagesGeneral Journal 1 PERIODICHana SantiagoNo ratings yet

- Review Accounting NotesDocument9 pagesReview Accounting NotesJasin LujayaNo ratings yet

- Afar 3Document2 pagesAfar 3Eric Kevin LecarosNo ratings yet

- 2 - Who Uses Financial Reports and For What Purpose Evidence From Capital ProvidersDocument26 pages2 - Who Uses Financial Reports and For What Purpose Evidence From Capital ProvidersLaurenz MeyerNo ratings yet

- CA Final SFM - New Scheme - Dawn 2022 - Merger & AcquisitionsDocument23 pagesCA Final SFM - New Scheme - Dawn 2022 - Merger & Acquisitionsideasthat worthNo ratings yet

- tài chính doanh nghiệpDocument44 pagestài chính doanh nghiệptieuma712No ratings yet

- Notes in Business Laws and RegulationsDocument10 pagesNotes in Business Laws and RegulationsZie TanNo ratings yet

- Estatement Chase MayDocument6 pagesEstatement Chase MayAtta ur RehmanNo ratings yet

- Corp. AccountingDocument214 pagesCorp. Accountingayxan0013No ratings yet

- HW On Receivables CDocument5 pagesHW On Receivables CAmjad Rian MangondatoNo ratings yet

- BW SuiteDocument8 pagesBW Suiteramadaniansyah3No ratings yet

- Tech Tune Pvt. Ltd. BalancesDocument3 pagesTech Tune Pvt. Ltd. BalancesHEMAL SHAHNo ratings yet

- Company Detailed Report-Pakistan Aluminium Beverage Cans LimitedDocument17 pagesCompany Detailed Report-Pakistan Aluminium Beverage Cans LimitedAbdullah UmerNo ratings yet

- CMA II 2016 Study Materials CMA Part 2 MDocument37 pagesCMA II 2016 Study Materials CMA Part 2 MJohn Xaver PerrielNo ratings yet

- Project Report Format in ExcelDocument14 pagesProject Report Format in ExcelProcurement ASCLNo ratings yet

- Ôn GK PT BCTCDocument6 pagesÔn GK PT BCTCdoryNo ratings yet

- VIMA 2.0 Model Venture Capital LexiconDocument8 pagesVIMA 2.0 Model Venture Capital LexiconRaushan AljufriNo ratings yet

- Intermediate AccountingDocument12 pagesIntermediate AccountingpolxrixNo ratings yet

- IntroductionDocument11 pagesIntroductionGokul BansalNo ratings yet

- KTrade Technicals - Daily (30-Oct-2023)Document4 pagesKTrade Technicals - Daily (30-Oct-2023)mirzaNo ratings yet

- CT DUFf SDX9 NPQEd CDocument10 pagesCT DUFf SDX9 NPQEd C19ME094 S.Suresh KumarNo ratings yet

- Financial Management Test 1 - DistanceDocument2 pagesFinancial Management Test 1 - DistancePdoneeverNo ratings yet

- Bab1 Trial Balance MYOBDocument1 pageBab1 Trial Balance MYOB14 - LUSI FITRIANINo ratings yet

- Chapter 2 Meeting of Board and Its PowersDocument29 pagesChapter 2 Meeting of Board and Its Powershbansal058No ratings yet

- 8 As 21 Consolidated Financial StatementsDocument26 pages8 As 21 Consolidated Financial StatementssmartshivenduNo ratings yet

- Chapter 3 Cost of CapitalDocument15 pagesChapter 3 Cost of Capitalfirst breakNo ratings yet