Professional Documents

Culture Documents

Joborder Annex A1 Dhdgsfadskjfjkajgriuewyhfjandlasfjhjadsfbsjfk

Uploaded by

vivianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joborder Annex A1 Dhdgsfadskjfjkajgriuewyhfjandlasfjhjadsfbsjfk

Uploaded by

vivianCopyright:

Available Formats

Joborder Annex A1 - dhdgsfadskjfjkaJGRIUEWYHFJANDL;

ASFJHJADSFBSJFK

Accountancy (Partido State University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Vivian Estella (estellavivian27@gmail.com)

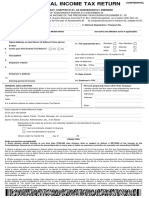

ANNEX <A1=

INCOME PAYEE’S SWORN DECLARATION OF GROSS RECEIPTS/SALES

(For Self-Employed and/or Engaged in the Practice of Profession with Lone Income Payor)

I, , , of legal age, single/ married to

(Name) (Citizenship)

permanently residing at

(Name of Spouse)

with

(Address)

Taxpayer Identification Number (TIN) , after having been duly sworn in accordance with

law hereby depose and state:

1. That I derived my income only from

(business/professional) (Name of Lone Payor)

with Taxpayer Identification Number and business address at

2. That for the current year , my gross receipts will not exceed Two Hundred Fifty Thousand Pesos (₱250,000.00) and

that I am registered as a non-VAT taxpayer; that whatever is the amount of income received, I will comply with the

requirement to file my Income Tax Return on the prescribed due date. For this purpose, I opt to avail of either one of the

following:

Graduated Income Tax Rates under Section 24(A)(2)(a) of the Tax Code, as amended, based on the taxable

income. With this selection, I acknowledge that I am subject to 0% income tax, thus, not subject to

creditable withholding tax; subject to percentage tax, if applicable, and will file the required percentage tax

returns or subject to withholding percentage tax, in case of government money payments.

Eight Percent (8%) income tax rate under Section 24(A)(2)(b) of the Tax Code, as amended, based on

gross receipts/sales and other non-operating income - with this selection, I understand that this is in lieu of

the graduated income tax rates and the Percentage Tax under Section 116 of the Tax Code, as amended;

thus, no withholding tax shall be made;

3. That based on my selection above, if my gross sales/receipts and other non-operating income exceeds ₱250,000.00 but not over

₱3,000,000.00, my afore-stated lone income payor shall automatically withhold the prescribed rate of withholding tax:

a. In case of Graduated Income Tax Rates, I acknowledge that aside from income tax, I am subject to

business tax (Percentage Tax, if applicable) and creditable withholding of income in excess of

P250,000.00, and business tax withholding, if any, are applicable on the entire income payment; OR

b. In case of Eight Percent (8%) income tax rate, I acknowledge that I am only subject to income tax and

thus, to the creditable withholding income tax in excess of P250,000.00;

4. That I duly execute this SWORN DECLARATION in compliance with the requirement prescribed under Section of

Revenue Regulations No. ;

5. That I declare, under the penalties of perjury, that this declaration has been made in good faith, and to the best of my

knowledge and belief to be true and correct.

IN WITNESS WHEREOF, I have hereunto set my hand this day of , 20 at , Philippines

Signature over Printed Name of Individual Taxpayer

SUBSCRIBED AND SWORN to before me this day of , 20 in

. Applicant exhibited to me his/her issued at on .

(Government Issued ID and No.)

NOTARY PUBLIC

Doc. No.:

Page No.:

Book No.:

Series of

Affix ₱30.00

Documentary Stamp

Tax

(To be filled-out by the withholding agent/lone payor)

Date Received: Received by:

(MM-DD-YYYY-00001)

Signature over Printed Name of the Withholding Agent/Payor or Authorized Officer

Designation/Position of Authorized Officer

Name of Withholding Agent/Lone Payor

Downloaded by Vivian Estella (estellavivian27@gmail.com)

You might also like

- Sworn Declaration FormDocument1 pageSworn Declaration FormAnawin FamadicoNo ratings yet

- Bir Form Pro FormaDocument3 pagesBir Form Pro Formasamcoronel925No ratings yet

- Income Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2Document1 pageIncome Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2Records Section67% (3)

- Annex (A1)Document1 pageAnnex (A1)Jana Jonathan0% (1)

- Sworn Declaration Annex B-1Document4 pagesSworn Declaration Annex B-1Sebastian Orlann TojongNo ratings yet

- Sworn Declaration Annex B-2Document4 pagesSworn Declaration Annex B-2Theresa Redler100% (1)

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument4 pagesIncome Payee'S Sworn Declaration of Gross Receipts/SalesLeslie Darwin DumasNo ratings yet

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument2 pagesIncome Payee'S Sworn Declaration of Gross Receipts/SalesHanabishi RekkaNo ratings yet

- RMC No. 8-2024 - Annex ADocument1 pageRMC No. 8-2024 - Annex AAnostasia NemusNo ratings yet

- Cos Jo Annex A1 Sample-TemplateDocument1 pageCos Jo Annex A1 Sample-TemplateGamy Glazyle100% (1)

- Gen Bir Annex B2Document1 pageGen Bir Annex B2ArgielJedTabalBorrasNo ratings yet

- 2307 Creditable Tax Withheld at SourceDocument6 pages2307 Creditable Tax Withheld at SourceBarangay BugasNo ratings yet

- Annex B-2Document1 pageAnnex B-2Von Virchel VallesNo ratings yet

- RMC No. 8-2024 Annex A TemplateDocument2 pagesRMC No. 8-2024 Annex A TemplateELLIE JAMES PLACIONo ratings yet

- SD PDFDocument2 pagesSD PDFdummyanne27No ratings yet

- Annex B-2 Guide, Instructions and Blank Copy: (Lone Income Payor)Document4 pagesAnnex B-2 Guide, Instructions and Blank Copy: (Lone Income Payor)Kristel Anne Liwag100% (2)

- 2307 BirDocument3 pages2307 BirPFMPC SecretaryNo ratings yet

- IIT - Fillable From Word PDFDocument4 pagesIIT - Fillable From Word PDFRussell ChaseNo ratings yet

- RoamDocument2 pagesRoamdivine mercyNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Patricia Irene PanganNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaszairah jean baquilarNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- Golden Angel Knights 2306 SecsDocument1 pageGolden Angel Knights 2306 SecsJay-r Dela Cruz CubangbangNo ratings yet

- 01-Uptown ServicesDocument2 pages01-Uptown ServicesMarina ButlayNo ratings yet

- 2307 FORM - WITHHOLDING 2021 - VanDocument46 pages2307 FORM - WITHHOLDING 2021 - VanHraid MundNo ratings yet

- Agent CorpDocument1 pageAgent CorpMa Joyce ImperialNo ratings yet

- 2307 Jan - Feb 2020Document4 pages2307 Jan - Feb 2020Marvin CeledioNo ratings yet

- RC ColaDocument2 pagesRC ColaMi MiNo ratings yet

- 2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFDocument11 pages2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFpearlanncasem12No ratings yet

- Sworn Bank FileDocument1 pageSworn Bank FileRalf Anton RamosNo ratings yet

- Chapter5TrustandEstate Exerciseslumbera LalusinDocument12 pagesChapter5TrustandEstate Exerciseslumbera Lalusinjay-r Gutierrez100% (1)

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Document4 pagesAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagNo ratings yet

- Form 2307Document2 pagesForm 2307Dino Garzon OcinoNo ratings yet

- BIR2306 LUELCO Santa CeciliaDocument18 pagesBIR2306 LUELCO Santa CeciliaMaria RinaNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document1 pageCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)dorieNo ratings yet

- Triple L Food Corp 2306 - JollibeeDocument1 pageTriple L Food Corp 2306 - JollibeeclarikaNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasRonaldo CatindigNo ratings yet

- PMR 2307Document1 pagePMR 2307Rheddy RaymundoNo ratings yet

- 2307 Thedeleons Co LTDDocument2 pages2307 Thedeleons Co LTDRACHEL DAMALERIONo ratings yet

- 2307 Creditable Tax Withheld at SourceDocument8 pages2307 Creditable Tax Withheld at SourceBarangay BugasNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument36 pagesCertificate of Creditable Tax Withheld at SourceProbinsyana KoNo ratings yet

- Skyreign Travel & Tours Corp. - 03312021Document1 pageSkyreign Travel & Tours Corp. - 03312021Lhynette JoseNo ratings yet

- 1601 C CompensationDocument2 pages1601 C Compensationjon_cpaNo ratings yet

- Bartle Beyl, Inc - Kfc. 2306Document2 pagesBartle Beyl, Inc - Kfc. 2306clarikaNo ratings yet

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document2 pagesCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)RapRalph GalagalaNo ratings yet

- Form B-2 Sworn Declaration (1) .DocxXDocument1 pageForm B-2 Sworn Declaration (1) .DocxXsernakeisharaeNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- 2307Document3 pages2307JUCONS ConstructionNo ratings yet

- Certificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseDocument4 pagesCertificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseMay MayNo ratings yet

- Sample 2307Document4 pagesSample 2307kaysNo ratings yet

- Annex B-1:: Guide On Filling Up The DocumentDocument9 pagesAnnex B-1:: Guide On Filling Up The DocumentGrace UrbanoNo ratings yet

- Income Payee's Sworn Declaration of Gross Receipts or SalesDocument1 pageIncome Payee's Sworn Declaration of Gross Receipts or SalesApril Lynn Ursal-BelciñaNo ratings yet

- 1601-EQ Guide January 2019 ENCS RevDocument1 page1601-EQ Guide January 2019 ENCS RevErika OrellanoNo ratings yet

- Serv Central 2307 November 2023Document1 pageServ Central 2307 November 2023andrea.begulbuilderscorpNo ratings yet

- BT 211 Module 05 1Document12 pagesBT 211 Module 05 1Franz PampolinaNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Analyn DomingoNo ratings yet

- Certificate of Final Tax Withheld at Source: 004 053 294 000 Barangay CentroDocument5 pagesCertificate of Final Tax Withheld at Source: 004 053 294 000 Barangay CentroHa HakdogNo ratings yet

- Certificate of Final Tax Withheld at Source: 004 053 294 000 Barangay CentroDocument5 pagesCertificate of Final Tax Withheld at Source: 004 053 294 000 Barangay CentroHa HakdogNo ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet