Professional Documents

Culture Documents

Burgos Executive Summary 2013

Uploaded by

Shmily MendozaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Burgos Executive Summary 2013

Uploaded by

Shmily MendozaCopyright:

Available Formats

EXECUTIVE SUMMARY

INTRODUCTION

The Municipality of Burgos was previously a part of Benguet. In 1920, the

boundary line between La Union and Benguet was modified, hence, Burgos, known as

Disdis, was reverted to La Union

Like any local government units, the municipality enjoys total autonomy in the

management of its own affairs in conformity with the development thrusts of the national

government.

FINANCIAL HIGHLIGHTS

The agency’s financial condition and result of operations for calendar year 2013

compared with that of preceding year are as follows:

CY 2013 CY 2012

Total Assets P60,023,380.13 P65, 004,617.40

Total Liabilities 11,142,272.30 18,243,270.23

Residual Equity 48,881,107.83 46,761,347.17

Sources and application of funds are as follows:

CY 2013 CY 2012

Allotment P53,978,113.61 58,968,736.68

Obligations 32,587,340.26 41,804,690.05

Balance 21,390,773.25 17,640,046.63

OPERATIONAL HIGHLIGHTS

As part of its functions, the municipality had undertaken in 2013 projects,

programs and activities designed to develop its localities and improve its facilities. The

major accomplishments of the municipality during the year herein presented vis-à-vis the

corresponding plans and targets to highlight this report.

Program/Project/Activity Target Accomplishment

Construction of Slope Protections- P4,500,000.00 10 100%

Improvement of Farm to Market Roads- P5,025,00.00 12 100%

Construction/Improvement of Hanging Bridges- P950,000 4 100%

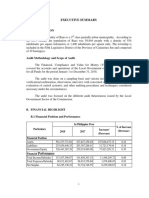

The municipality had realized a total income of 38,794,711.31, which is

2,896,265.06 less than the income of 41,690,976.37 in 2012. On the other hand, total

expenditures for the same year amounting to 37,102,412.43 is less than last year’s

expenditures of 42,760,130.84 or by 13%

SCOPE OF AUDIT

A financial and compliance audit was conducted on the accounts and operational

activities of the Municipality of Burgos, La Union for the calendar year ended December

31, 2013.It was focused on the different audit thrusts/areas enumerated by COA

Unnumbered Memorandum dated July 17, 2013.

The audit was done on sampling basis and used various audit techniques like

confirmation, observation, interview, evaluation of control system/s, and other auditing

procedures and techniques necessary under the circumstances.

AUDITOR’S OPINION ON THE FINANCIAL STATEMENTS

We rendered a qualified opinion on the financial statements of the municipality

because the validity and accuracy of the balance of the Accounts Payable amounting to P

P1, 011,532.60, which had been outstanding for more than two years, could not be

ascertained. The inadequacy of records did not allow us to apply other alternative

procedures to satisfy ourselves as to the validity and accuracy of the account.

SIGNIFICANTCOMMENTS AND RECOMMENDATIONS

Discussed herewith are some of the audit findings:

1. Accounts Payable totaling P1,011,532.60 which has been outstanding for more than

90 days were not supported by valid claims casting doubt on the reliability of

accounts.

We have recommended the Municipal Accountant-Designate to document all

payable accounts which has been outstanding for more than two years and against

which no actual claim has been filed or not covered with valid contracts.

2. Collections were not promptly deposited with authorized depository bank within the

prescribed period, contrary to Section 32 of NGAS Manual Volume l, thus, exposing

the funds to possible loss, misuse or misappropriation.

We have recommended the Municipal Treasurer that all deposits be made intact with

the authorized depository bank within the prescribed period pursuant to Section 32, of

NGAS for LGUS Manual Volume I.

STATUS OF IMPLEMENTATION OF PRIOR YEARS’ AUDIT

RECOMMENDATIONS

Out of seven (7) recommendations embodied in the previous Annual Audit Reports

from 2010 to 2012, two (2) were fully implemented and five (5) were partially

implemented.

You might also like

- Coping With Institutional Order Flow Zicklin School of Business Financial Markets SeriesDocument208 pagesCoping With Institutional Order Flow Zicklin School of Business Financial Markets SeriesRavi Varakala100% (5)

- Flora Executive Summary 2013Document3 pagesFlora Executive Summary 2013Drei GoNo ratings yet

- Calanasan Executive Summary 2013Document3 pagesCalanasan Executive Summary 2013Drei GoNo ratings yet

- Iligan City Executive Summary 2016Document11 pagesIligan City Executive Summary 2016crizeljane.enayudaNo ratings yet

- Bindoy Executive Summary 2013Document11 pagesBindoy Executive Summary 2013fenty girlNo ratings yet

- Cabatuan Executive Summary 2012Document7 pagesCabatuan Executive Summary 2012Steve RodriguezNo ratings yet

- Executive Summary A. Agency ProfileDocument4 pagesExecutive Summary A. Agency ProfileRomeo MalanaNo ratings yet

- TacurongCity2012 Audit ReportDocument101 pagesTacurongCity2012 Audit ReportWarren Wyndell DP SarsagatNo ratings yet

- TacurongCity2012 COA Audit ReportDocument101 pagesTacurongCity2012 COA Audit ReportPrateik RyukiNo ratings yet

- Josefina Executive Summary 2017Document8 pagesJosefina Executive Summary 2017Virgo Philip Wasil ButconNo ratings yet

- Tax Revenue: Executive Summary Highlights of Financial OperationsDocument3 pagesTax Revenue: Executive Summary Highlights of Financial OperationsJaniceNo ratings yet

- Mga Tao Sa KapehanDocument4 pagesMga Tao Sa KapehanJoshua Lavega AbrinaNo ratings yet

- Dolores Executive Summary 2013Document6 pagesDolores Executive Summary 2013Lyrics DistrictNo ratings yet

- Las Pinas City Executive Summary 2022Document8 pagesLas Pinas City Executive Summary 2022markaljons.aldea1229No ratings yet

- Roxas Isabela ES2016Document4 pagesRoxas Isabela ES2016J JaNo ratings yet

- A. Highlights of Financial Operation: Executive SummaryDocument3 pagesA. Highlights of Financial Operation: Executive SummaryQueng QuintinitaNo ratings yet

- SamarProv ES2012Document9 pagesSamarProv ES2012J JaNo ratings yet

- 03-OrmocCity2018 Executive SummaryDocument6 pages03-OrmocCity2018 Executive Summarysandra bolokNo ratings yet

- Republic of The Philippines Commission On Audit: Honorable Jose Mario J. PahangDocument41 pagesRepublic of The Philippines Commission On Audit: Honorable Jose Mario J. PahangRoronoa ZoroNo ratings yet

- Indang Cavite ES2019nhaulingDocument5 pagesIndang Cavite ES2019nhaulingMS NIQUEENo ratings yet

- San Juan City Executive Summary 2022Document7 pagesSan Juan City Executive Summary 2022MAYON NAGANo ratings yet

- Bacarra IN ES2015Document7 pagesBacarra IN ES2015Chelcee Ulnagan CacalNo ratings yet

- Catarman Executive Summary 2017Document6 pagesCatarman Executive Summary 2017Jeanine IlaganNo ratings yet

- Executive Summary: A. Introduction The AgencyDocument5 pagesExecutive Summary: A. Introduction The Agencysandra bolokNo ratings yet

- Santa Maria Executive Summary 2013Document4 pagesSanta Maria Executive Summary 2013kaixuxu2No ratings yet

- Tangub City Executive Summary 2019Document4 pagesTangub City Executive Summary 2019jhannrjcesarNo ratings yet

- Uyugan Executive Summary 2013Document5 pagesUyugan Executive Summary 2013arlyne velayoNo ratings yet

- NewBataan CV ES2013Document9 pagesNewBataan CV ES2013Joergen Mae MicabaloNo ratings yet

- Macrohon Executive Summary 2013Document7 pagesMacrohon Executive Summary 2013rominadulfo4bNo ratings yet

- Aurora Executive Summary 2012Document7 pagesAurora Executive Summary 2012Mary Joy Sedenio LopezNo ratings yet

- Rizal Executive Summary 2015Document4 pagesRizal Executive Summary 2015Sittie RahmaNo ratings yet

- Banga Executive Summary 2018 PDFDocument5 pagesBanga Executive Summary 2018 PDFMohammadNo ratings yet

- Executive Summary: Highlights of OperationsDocument6 pagesExecutive Summary: Highlights of OperationsJaniceNo ratings yet

- Talibon Executive Summary 2019Document4 pagesTalibon Executive Summary 2019AbigailNo ratings yet

- Luba Abra ES2014Document5 pagesLuba Abra ES2014J JaNo ratings yet

- Agency Background: Executive Summary A. IntroductionDocument4 pagesAgency Background: Executive Summary A. IntroductionRObelyn Alwod BOta-angNo ratings yet

- Bayombong Executive Summary 2021Document8 pagesBayombong Executive Summary 2021Aika KimNo ratings yet

- Kalayaan Executive Summary 2014Document6 pagesKalayaan Executive Summary 2014Aira Kathrina PerezNo ratings yet

- Tigbauan Executive Summary 2020Document8 pagesTigbauan Executive Summary 2020cpa126235No ratings yet

- Camarines Sur Executive Summary 2013Document10 pagesCamarines Sur Executive Summary 2013Frannie PastorNo ratings yet

- Mati City Executive Summary 2014Document6 pagesMati City Executive Summary 2014Heart Trixie Tacder SalvaNo ratings yet

- A. Introduction: Executive SummaryDocument4 pagesA. Introduction: Executive Summarysandra bolokNo ratings yet

- 2010 Mandaue City Purchase OrderDocument146 pages2010 Mandaue City Purchase OrderjhaNo ratings yet

- 02-Loboc2012 Executive SummaryDocument9 pages02-Loboc2012 Executive SummaryMiss_AccountantNo ratings yet

- Surallah Executive Summary 2020Document5 pagesSurallah Executive Summary 2020Kynard PatrickNo ratings yet

- Executive Summary: A. IntroductionDocument5 pagesExecutive Summary: A. Introductionsandra bolokNo ratings yet

- Naguilian Executive Summary 2021Document5 pagesNaguilian Executive Summary 2021Willie FabroaNo ratings yet

- Executive Summary: A. IntroductionDocument6 pagesExecutive Summary: A. IntroductionMarcoNo ratings yet

- 03-Estancia2022 Executive SummaryDocument4 pages03-Estancia2022 Executive SummaryEi Mi SanNo ratings yet

- 03-DBM2017 Executive SummaryDocument5 pages03-DBM2017 Executive SummarybolNo ratings yet

- Pangasinan Executive Summary 2013Document4 pagesPangasinan Executive Summary 2013luibrilNo ratings yet

- Tudela Executive Summary 2017Document5 pagesTudela Executive Summary 2017Sittie Fatma ReporsNo ratings yet

- Polomolok2017 Audit ReportDocument142 pagesPolomolok2017 Audit ReportShmily MendozaNo ratings yet

- BaguioCity2017 Audit ReportDocument184 pagesBaguioCity2017 Audit ReportrainNo ratings yet

- Catarman Executive Summary 2019Document7 pagesCatarman Executive Summary 2019Jeanine IlaganNo ratings yet

- Santo Nino Executive Summary 2017Document6 pagesSanto Nino Executive Summary 2017Meranie FrancisqueteNo ratings yet

- Malay Executive Summary 2017Document7 pagesMalay Executive Summary 2017RM Rea RebNo ratings yet

- Neda Es2013Document8 pagesNeda Es2013Benedict AlvarezNo ratings yet

- Santa Ignacia Executive Summary 2017Document6 pagesSanta Ignacia Executive Summary 2017Reyna YlenaNo ratings yet

- 01 TC2018 Audit Report ADocument114 pages01 TC2018 Audit Report AJerwin Cases TiamsonNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- Pledge, REM, Antichresis DigestsDocument43 pagesPledge, REM, Antichresis DigestsAnonymous fnlSh4KHIgNo ratings yet

- Heller - Sues - GT Heller V Greenberg TraurigDocument45 pagesHeller - Sues - GT Heller V Greenberg TraurigRandy PotterNo ratings yet

- A Reaction PaperDocument6 pagesA Reaction PaperRedelyn Guingab Balisong100% (2)

- AE - Teamcenter Issue Management and CAPA PDFDocument3 pagesAE - Teamcenter Issue Management and CAPA PDFsudheerNo ratings yet

- Module 12. Worksheet - Hypothesis TestingDocument3 pagesModule 12. Worksheet - Hypothesis TestingShauryaNo ratings yet

- Revionics - White.paper. (Software As A Service A Retailers)Document7 pagesRevionics - White.paper. (Software As A Service A Retailers)Souvik_DasNo ratings yet

- Design & Build Toyo Batangas WH Evaluation SUMMARYDocument1 pageDesign & Build Toyo Batangas WH Evaluation SUMMARYvina clarisse OsiasNo ratings yet

- The Input Tools Require Strategists To Quantify Subjectivity During Early Stages of The Strategy-Formulation ProcessDocument24 pagesThe Input Tools Require Strategists To Quantify Subjectivity During Early Stages of The Strategy-Formulation ProcessHannah Ruth M. GarpaNo ratings yet

- Part & Process Audit: Summary: General Supplier InformationDocument20 pagesPart & Process Audit: Summary: General Supplier InformationNeumar Neumann100% (1)

- Company Profile of Tradexcel Graphics LTDDocument19 pagesCompany Profile of Tradexcel Graphics LTDDewan ShuvoNo ratings yet

- CH3Document4 pagesCH3Chang Chun-MinNo ratings yet

- English 8 - Q3 - Las 1 RTP PDFDocument4 pagesEnglish 8 - Q3 - Las 1 RTP PDFKim Elyssa SalamatNo ratings yet

- SAP ISR Course ContentDocument1 pageSAP ISR Course ContentSandeep SharmaaNo ratings yet

- Project On Max Life InsuranseDocument48 pagesProject On Max Life InsuranseSumit PatelNo ratings yet

- G12 ABM Marketing Lesson 1 (Part 1)Document10 pagesG12 ABM Marketing Lesson 1 (Part 1)Leo SuingNo ratings yet

- 1st Quarterly Exam Questions - TLE 9Document28 pages1st Quarterly Exam Questions - TLE 9Ronald Maxilom AtibagosNo ratings yet

- Lessons 1 and 2 Review IBM Coursera TestDocument6 pagesLessons 1 and 2 Review IBM Coursera TestNueNo ratings yet

- Od-2017 Ed.1.7Document28 pagesOd-2017 Ed.1.7Tung Nguyen AnhNo ratings yet

- Cultural Norms, Fair & Lovely & Advertising FinalDocument24 pagesCultural Norms, Fair & Lovely & Advertising FinalChirag Bhuva100% (2)

- New 7 QC ToolsDocument106 pagesNew 7 QC ToolsRajesh SahasrabuddheNo ratings yet

- Virata V Wee To DigestDocument29 pagesVirata V Wee To Digestanime loveNo ratings yet

- Customer SQ - Satisfaction - LoyaltyDocument15 pagesCustomer SQ - Satisfaction - LoyaltyjessiephamNo ratings yet

- Strategic Management Nokia Case AnalysisDocument10 pagesStrategic Management Nokia Case Analysisbtamilarasan88100% (1)

- GADocument72 pagesGABang OchimNo ratings yet

- Xxxxacca Kısa ÖzzetttDocument193 pagesXxxxacca Kısa ÖzzetttkazimkorogluNo ratings yet

- Credit Card ConfigurationDocument5 pagesCredit Card ConfigurationdaeyongNo ratings yet

- Capstone Wharton Foundations BusinessDocument43 pagesCapstone Wharton Foundations BusinessRahul Nair80% (5)

- Coin Sort ReportDocument40 pagesCoin Sort ReportvishnuNo ratings yet

- Post Acquisition (HR Issues)Document16 pagesPost Acquisition (HR Issues)Bharat AggarwalNo ratings yet