Professional Documents

Culture Documents

Acts 210 General Insurance Theory

Acts 210 General Insurance Theory

Uploaded by

Jos Mwongs0 ratings0% found this document useful (0 votes)

6 views1 pageThis document contains an exam for a Bachelor of Science in Actuarial Science course at Kabarak University. The exam has 5 questions testing knowledge of general insurance theory. Question 1 covers characteristics of quality data, circumstances for risk declination, and types of motor vehicle policies. Question 2 differentiates underwriters and covers health insurance obligations. Question 3 describes marine insurance features and problems in premium calculation. Question 4 explains insurance ratios and components of individual ratings. Question 5 covers circumstances for reserves calculation and the reserving process.

Original Description:

general insurance theory

Original Title

ACTS 210 GENERAL INSURANCE THEORY

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains an exam for a Bachelor of Science in Actuarial Science course at Kabarak University. The exam has 5 questions testing knowledge of general insurance theory. Question 1 covers characteristics of quality data, circumstances for risk declination, and types of motor vehicle policies. Question 2 differentiates underwriters and covers health insurance obligations. Question 3 describes marine insurance features and problems in premium calculation. Question 4 explains insurance ratios and components of individual ratings. Question 5 covers circumstances for reserves calculation and the reserving process.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageActs 210 General Insurance Theory

Acts 210 General Insurance Theory

Uploaded by

Jos MwongsThis document contains an exam for a Bachelor of Science in Actuarial Science course at Kabarak University. The exam has 5 questions testing knowledge of general insurance theory. Question 1 covers characteristics of quality data, circumstances for risk declination, and types of motor vehicle policies. Question 2 differentiates underwriters and covers health insurance obligations. Question 3 describes marine insurance features and problems in premium calculation. Question 4 explains insurance ratios and components of individual ratings. Question 5 covers circumstances for reserves calculation and the reserving process.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

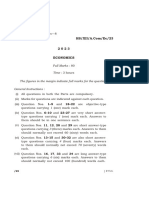

KABARAK UNIVERSITY

BACHELOR OF SCIENCE IN ACTUARIAL SCIENCE

ACTS 210 GENERAL INSURANCE THEORY

EXAM, APRIL, 2019

QUESTION ONE ( 30 MARKS)

(a)Outline five essential characteristics of good quality data ( 10 marks)

(a)Explain five circumstances under which a risk be declined by insurers ( 10 marks)

(b) Explain three types of insurance policies that can be issued to motor vehicle owners ( 6 marks)

(c)Distinguish between premium risk and claim risk ( 4 marks)

QUESTION TWO ( 20 MARKS)

(a) Differentiate these underwriters

(i) Property and casualty underwriters ( 2 marks)

(ii) Personal line and commercial lines underwriters ( 2 marks)

(b) Explain five forms of the individual insured person's obligations in health insurances ( 10 marks)

(c) Describe the limitations and exclusions in personal accidents ( 6 marks)

QUESTION THREE ( 20 MARKS)

(a) Describe five features of Marine Insurance in Kenya ( 10 marks)

(b) Explain three basic problems in premium calculation ( 5 marks)

(c) Outline five factors considered in property insurance underwriting ( 5 marks)

QUESTION FOUR (20 MARKS)

(a) Explain the following insurance ratios and show how each is calculated

(i) Frequency ( 2 marks)

(ii)Severity ( 2 marks)

(iii) Pure premium ( 2 marks)

(iv) Average premium ( 2 marks)

(v) Loss ratio ( 2 marks)

(b) Rates for most insurance are determined by a class rating or individual rating. Explain the

two components of individual rating ( 10 marks)

QUESTION FIVE ( 20 MARKS)

(a) Explain five circumstances that necessitates calculating reserves ( 10 marks)

(b) Describe five steps in reserving ( 10 marks)

Page 1 of 1

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- POB Revision Questions 2Document6 pagesPOB Revision Questions 2Khalil Weir100% (1)

- Economics - Paper 02Document7 pagesEconomics - Paper 02lal100% (1)

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- CSEC Economics June 2012 P2Document5 pagesCSEC Economics June 2012 P2Sachin BahadoorsinghNo ratings yet

- CSEC Question Paper May-June 2016 P-2Document5 pagesCSEC Question Paper May-June 2016 P-2amelia de matasNo ratings yet

- BlackRock's Guide to Fixed-Income Risk ManagementFrom EverandBlackRock's Guide to Fixed-Income Risk ManagementBennett W. GolubNo ratings yet

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- CSEC Economics June 2013 P2Document5 pagesCSEC Economics June 2013 P2Sachin BahadoorsinghNo ratings yet

- 11562-Sample Marine Insurance ExamDocument2 pages11562-Sample Marine Insurance ExamThanh Trúc NguyễnNo ratings yet

- HBC 2109 Insurance and Risk ManagementDocument2 pagesHBC 2109 Insurance and Risk Managementcollostero6No ratings yet

- Bci 210 Principles of Insurance and Risk ManagementDocument2 pagesBci 210 Principles of Insurance and Risk ManagementCaleb MuseNo ratings yet

- CS Pre-Board-2 PAPER (GRD 10) Set-1Document4 pagesCS Pre-Board-2 PAPER (GRD 10) Set-1shreyanshpagariya3No ratings yet

- BMS 101 Principles of InsuranceDocument2 pagesBMS 101 Principles of Insurancemarywacera2005No ratings yet

- HCB 0207 Insurance and Risk ManagementDocument3 pagesHCB 0207 Insurance and Risk Managementcollostero6No ratings yet

- HCB 0207 Insurance Ad Risk ManagementDocument2 pagesHCB 0207 Insurance Ad Risk Managementcollostero6No ratings yet

- MN5207 Acounting and Financial Management 2019Document10 pagesMN5207 Acounting and Financial Management 2019Vimuth Chanaka PereraNo ratings yet

- FN1024 ZB - 2019Document7 pagesFN1024 ZB - 2019Ha PhuongNo ratings yet

- 06 - Test 6 Mission 80+Document4 pages06 - Test 6 Mission 80+Safal BhandariNo ratings yet

- Iv-Semester Online Examinations MBA405F-Financial ServicesDocument5 pagesIv-Semester Online Examinations MBA405F-Financial ServicesNaga Mani MeruguNo ratings yet

- MTH222R: Foundations of Asset Pricing ModelsDocument7 pagesMTH222R: Foundations of Asset Pricing ModelsSuwandi LieNo ratings yet

- AEB301-Financial Management-27JAN2022Document3 pagesAEB301-Financial Management-27JAN2022MIRUGI STEPHEN GACHIRINo ratings yet

- HBC 2109-HPS 2304Document2 pagesHBC 2109-HPS 2304123 321No ratings yet

- Waec Econs Theory Ques 11 15Document24 pagesWaec Econs Theory Ques 11 15timothyNo ratings yet

- Assignment For 2024 Semester 1Document2 pagesAssignment For 2024 Semester 1nchimunyaclement5No ratings yet

- Introduction To Economics and Finance: The Institute of Chartered Accountants of PakistanDocument2 pagesIntroduction To Economics and Finance: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- Exam Questions (Economics)Document19 pagesExam Questions (Economics)Langson phiriNo ratings yet

- Economics 1Document4 pagesEconomics 1omaryhamis2023No ratings yet

- POB Revision Questions (Paper 2)Document4 pagesPOB Revision Questions (Paper 2)Khalil WeirNo ratings yet

- Bbs37 Emi Exam PaperDocument9 pagesBbs37 Emi Exam Paperyulinliu9988No ratings yet

- Multiple Choice ProblemsDocument11 pagesMultiple Choice ProblemsZillur RahmanNo ratings yet

- R2.TAXM - .L Question CMA June 2021 Exam.Document7 pagesR2.TAXM - .L Question CMA June 2021 Exam.Pavel DhakaNo ratings yet

- Rnis College of Financial Planning - 15 Mock-Test - Module-IVDocument10 pagesRnis College of Financial Planning - 15 Mock-Test - Module-IVAbhilash ParakhNo ratings yet

- Uganda Advanced Certificate of Education: Economics Paper 1 3 Hours Instructions To CandidatesDocument2 pagesUganda Advanced Certificate of Education: Economics Paper 1 3 Hours Instructions To CandidatesJohn DoeNo ratings yet

- Business ServicesDocument8 pagesBusiness Services9227aryansajsNo ratings yet

- EconomicsDocument157 pagesEconomicsportableawesomeNo ratings yet

- BBA Insurance Management 2022Document4 pagesBBA Insurance Management 2022Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- PB Xii Economics 2023-24Document7 pagesPB Xii Economics 2023-24nhag720207No ratings yet

- SAC 603 Exam 19 - 20Document5 pagesSAC 603 Exam 19 - 20Martin Kasuku100% (1)

- Cbleecpu 12Document8 pagesCbleecpu 12Pubg GokrNo ratings yet

- Risk Management Assignment Feb 2023Document10 pagesRisk Management Assignment Feb 2023ashrinNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument42 pagesThis Paper Is Not To Be Removed From The Examination HallsmilkshakezNo ratings yet

- Introduction To Economics and FinanceDocument2 pagesIntroduction To Economics and FinanceBablooNo ratings yet

- Practicepaper 3 Class XIIEconomics EMDocument6 pagesPracticepaper 3 Class XIIEconomics EMAvnish kumarNo ratings yet

- Calculation of Systematic RiskDocument2 pagesCalculation of Systematic RiskAmitesh KumarNo ratings yet

- AICPA TSE L1 Certification Exam 16th Dec 2022 DescDocument9 pagesAICPA TSE L1 Certification Exam 16th Dec 2022 DescMilind GuptaNo ratings yet

- CT6 QP 0416Document6 pagesCT6 QP 0416Shubham JainNo ratings yet

- International Trade Finance November 2014Document5 pagesInternational Trade Finance November 2014Basilio MaliwangaNo ratings yet

- 25 - HS XII AComEc 23Document8 pages25 - HS XII AComEc 23lasagna2134No ratings yet

- MicroeconomicsDocument3 pagesMicroeconomicschelseaNo ratings yet

- Introduction To Economics and FinanceDocument4 pagesIntroduction To Economics and FinanceShaheer MalikNo ratings yet

- Board Question Paper EconomicsDocument18 pagesBoard Question Paper Economics9137373282abcdNo ratings yet

- Topper 110 2 509 Economics Applications Question Up202306301439 1688116169 6495Document10 pagesTopper 110 2 509 Economics Applications Question Up202306301439 1688116169 6495abhimanyou076No ratings yet

- 103 Ecn (Eng)Document6 pages103 Ecn (Eng)crisgk1234No ratings yet

- EC Sample Paper 16 UnsolvedDocument7 pagesEC Sample Paper 16 UnsolvedMilan TomarNo ratings yet

- SQP 20 Sets EconomicsDocument160 pagesSQP 20 Sets Economicsmanav18102006No ratings yet

- Eco Set B XiiDocument7 pagesEco Set B XiicarefulamitNo ratings yet

- CAF 2 Past PapersDocument110 pagesCAF 2 Past PapersAaraiz Hassan BtNo ratings yet

- Icse 2024 Specimen 641 EcoDocument7 pagesIcse 2024 Specimen 641 EcoShweta SamantNo ratings yet

- Pre Board Eco Class 12Document3 pagesPre Board Eco Class 12Kusum VijaywargiyaNo ratings yet