0% found this document useful (0 votes)

105 views31 pagesUnderstanding Prepayments and Adjusting Entries

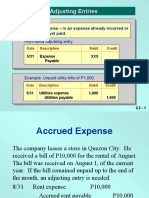

The document discusses various adjusting journal entries for prepayments, deferrals, accrued expenses, accrued income, bad debts, and depreciation expense. Examples are provided for each with computations and journal entries.

Uploaded by

Jae LucienCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

105 views31 pagesUnderstanding Prepayments and Adjusting Entries

The document discusses various adjusting journal entries for prepayments, deferrals, accrued expenses, accrued income, bad debts, and depreciation expense. Examples are provided for each with computations and journal entries.

Uploaded by

Jae LucienCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd