Professional Documents

Culture Documents

Sudama Set Up - Check List

Sudama Set Up - Check List

Uploaded by

Atul KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sudama Set Up - Check List

Sudama Set Up - Check List

Uploaded by

Atul KumarCopyright:

Available Formats

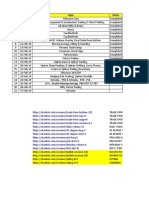

SUDAMA SET UP - EXPIRY DAY ONLY

Perameters to be

Sr. No.

Checked Actions

Sharp Movement on Only on Expiry day with Expectation of Sharp Movement in Either

1

Expiry Day Direction

2 Capital To Be Deployed Only 10% of Weekly Profit to be used to avoid Capital Loss/ Wipe Out.

Trend Watching Time -

Till 12:30 PM Observe MACD on hourly and 15 Min. to check the trend /

3 To check trend

direction. Best if both are alligned but day trend must be in 15 Min.TF

(Up/Down)

Observation Time Wave - 5 Minutes & Tide - 15 Minute & Ripplle-1

4

Frames after 12.30 PM Minute.

Look for the Bullish / Bearish Weapon & ideltify Weapon candle.

Identify Weapon for

5 TLBO/TLBD or any other chart pattern must. Check DOW Theory.

Entry

Candle Challenging BB

Check Ungli Setup - BBC, RSI Below 40/ Above 60, ADX above 15 -

6 Ungali Setup

(Amar Akbar Anthony) Ungali shape formation as well

Generally 11/-to 21/- Premium (Max. 30/-)

7 Option Premiums

Not to Trade above 30/- Premium

Special Attantion about Before Entry check Option Premiums - Doubled from Low of the Day -

8

Option Premiums (Means -Premium uptrend Starts)

Open Interest (OI) Ol to be checked on Put Side(TMG) - For Bearish and Call Side(TMG) -

9

Status For Bullish

10 H.V. Daily Time Frame - High and 15 Min. Time Frame - low are better.

Trade Entry (Generally

11 Enter the Trade with Buy PE (Bearish) / CE (Bullish) Next 1 or 2 OTM

12.30 PM onwards)

12 Trailling Stop Loss 5 EMA indicatior in 1 Min. Option Chart and observe.

Define the Entry & Stop Loss as per Weapon Candle

Stop Ioss addition as

13 Put Stop Loss in Option chart at Below of

per Entry

the Lowest of the Day

One Minute Candle

14 Monitor one minute time frame chart closely

Wave

15 Trade Exit Exit the Trade in 2.30 PM~03:00 PM

If Bullish Engulf comes on One Minute chart and Eat the Weapon candle, then

16 In Case of Stop Loss Hit

take the stop loss and exit the trade immediately with no hope of reversel

You might also like

- Banknifty 3 30 FormulaTrading Strategy 1699629081727Document1 pageBanknifty 3 30 FormulaTrading Strategy 1699629081727samidh Morari0% (1)

- Pre Webinar Presentation-13th OctoberDocument11 pagesPre Webinar Presentation-13th OctoberVinod100% (3)

- Mastering Options Trading: by Mentor - Ravi ChandiramaniDocument120 pagesMastering Options Trading: by Mentor - Ravi ChandiramanivivekNo ratings yet

- Lesson 8 Stock Day Trading System: Gap Up News Scalp (GUNS)Document61 pagesLesson 8 Stock Day Trading System: Gap Up News Scalp (GUNS)sesilya 14No ratings yet

- NKMen 13 90 Arbitration Hidden Secret of Indian Index and How ToDocument21 pagesNKMen 13 90 Arbitration Hidden Secret of Indian Index and How ToMohammed Asif Ali RizvanNo ratings yet

- Booming Bulls 15M StrategyDocument5 pagesBooming Bulls 15M StrategySharma comp50% (2)

- BTST & STBT Strategy - by Nse & MCX Arena 1Document3 pagesBTST & STBT Strategy - by Nse & MCX Arena 1देवेंद्र विश्राम परब0% (2)

- Aka Intraday 2 Day WebinarDocument37 pagesAka Intraday 2 Day WebinarSuraj DhawaleNo ratings yet

- 01 Screener by KGSDocument11 pages01 Screener by KGSDineshNo ratings yet

- PROMOTIONDocument4 pagesPROMOTIONHarryNo ratings yet

- Banknifty StrategyDocument35 pagesBanknifty StrategySumeet LudhwaniNo ratings yet

- 15 Minutes Gap StrategyDocument3 pages15 Minutes Gap StrategyAkshay Harekar50% (4)

- Santosh BabaDocument137 pagesSantosh BabaAkshi KarthikeyanNo ratings yet

- Fib Retracement ToolDocument9 pagesFib Retracement ToolSharma compNo ratings yet

- Trading Plan EnglishDocument3 pagesTrading Plan Englishهادی جهانیNo ratings yet

- Intraday GVK StocksDocument9 pagesIntraday GVK Stockssri sriNo ratings yet

- Bank Nifty: Daily StrategyDocument25 pagesBank Nifty: Daily Strategyalistair7682No ratings yet

- Anand Rathi PDFDocument44 pagesAnand Rathi PDFChristianStefan100% (1)

- Create Scan Old Candlestick P&F Realtime & Alerts WatchlistsDocument5 pagesCreate Scan Old Candlestick P&F Realtime & Alerts WatchlistsSushobhan DasNo ratings yet

- DD and Account Size - Madan KumarDocument4 pagesDD and Account Size - Madan KumarIMaths PowaiNo ratings yet

- Workshop Booklet To Send BhumkarDocument11 pagesWorkshop Booklet To Send BhumkarLatnekar V100% (2)

- Two Candle Theory - High Probability TradesDocument11 pagesTwo Candle Theory - High Probability Tradessohan100% (3)

- Chart Analysis: by Sunny JainDocument26 pagesChart Analysis: by Sunny JainShubh mangalNo ratings yet

- 30 Min Flow With All The New RulesDocument8 pages30 Min Flow With All The New Rulesswapnil koreNo ratings yet

- Bank Nifty Weekly-Wednesday Option Trading FormulaDocument4 pagesBank Nifty Weekly-Wednesday Option Trading FormulamkranthikumarmcaNo ratings yet

- 5 6167880689858379820Document31 pages5 6167880689858379820Siva Prakash50% (2)

- 1 Crore StrategyDocument14 pages1 Crore StrategyAmandeep SinghNo ratings yet

- 5 EMA StrategyDocument8 pages5 EMA Strategydesignfordummy100% (1)

- Intraday Strategy Using CPR Suresh Kumar047Document13 pagesIntraday Strategy Using CPR Suresh Kumar047KkrkumarNo ratings yet

- Options Mentorship - Day 1Document49 pagesOptions Mentorship - Day 1Unesh JughsNo ratings yet

- Daily TF 15 Mins Weekly 15 Mins TF 1D Monthly. TF 1D Yearly TF 1 WDocument4 pagesDaily TF 15 Mins Weekly 15 Mins TF 1D Monthly. TF 1D Yearly TF 1 WSumit GuptaNo ratings yet

- OHL StrategyDocument5 pagesOHL Strategyrekha patilNo ratings yet

- BNF Option Trading On ExpiryDocument35 pagesBNF Option Trading On ExpirySwastik TiwariNo ratings yet

- UntitledDocument19 pagesUntitledDeepak Raj100% (1)

- Shruti Trader MindsetDocument21 pagesShruti Trader MindsetRoomaNo ratings yet

- VWAPDocument8 pagesVWAPKarthick Annamalai50% (2)

- Day 3 IntradayDocument21 pagesDay 3 IntradayNishant100% (1)

- #CPR Is An Indicator Thread by Ymehta Nov 19, 21 From Rattibha 1Document19 pages#CPR Is An Indicator Thread by Ymehta Nov 19, 21 From Rattibha 1Muhammad MehdiNo ratings yet

- 50-Sma Strategy PDFDocument1 page50-Sma Strategy PDFfixemiNo ratings yet

- Stock Selection For CPR BY KGSDocument1 pageStock Selection For CPR BY KGSvvpvarunNo ratings yet

- I3t3 Mega Webinar Ed9 - BrochureDocument27 pagesI3t3 Mega Webinar Ed9 - BrochureTraders GurukulNo ratings yet

- CRUDEOIL INTRADAY STRATEGY - Swapnaja SharmaDocument268 pagesCRUDEOIL INTRADAY STRATEGY - Swapnaja Sharmaআম্লান দত্তNo ratings yet

- Mindfluential Trading (Session 3)Document44 pagesMindfluential Trading (Session 3)Jaichandran Rajendran100% (2)

- Ambush Trades - Bank Nifty-1Document23 pagesAmbush Trades - Bank Nifty-1harish2005No ratings yet

- 27 Aug Risk Management Theory NotesDocument5 pages27 Aug Risk Management Theory NotesChitranjan SharmaNo ratings yet

- Use This To Buy: Chips & Hava Calculator by NK Stocktalk Option Spot Strike Price LTP Chips HavaDocument1 pageUse This To Buy: Chips & Hava Calculator by NK Stocktalk Option Spot Strike Price LTP Chips HavamgrreddyNo ratings yet

- Gap Trading IntradayDocument2 pagesGap Trading IntradayAbhinav KumarNo ratings yet

- Camarilla and Fibonacci Pivots LevelsDocument5 pagesCamarilla and Fibonacci Pivots LevelsNayan PatelNo ratings yet

- Intraday Trading Strategies For Expanding WealthDocument15 pagesIntraday Trading Strategies For Expanding WealthPam G.100% (2)

- BB Trap - For Premium Chartink UsersDocument8 pagesBB Trap - For Premium Chartink Usersheera lal thakur100% (2)

- Scanner LinkDocument2 pagesScanner LinkMohammad Aamir PerwaizNo ratings yet

- Hit and Run: - Number7Document31 pagesHit and Run: - Number7Siva PrakashNo ratings yet

- Batch 10 ExcelDocument139 pagesBatch 10 ExcelRajeshKancharla100% (1)

- Price Action Madness, Part 3 - 2-22-17Document64 pagesPrice Action Madness, Part 3 - 2-22-17kalelenikhlNo ratings yet

- Hilega Milega ConceptsDocument8 pagesHilega Milega ConceptsManan AgarwalNo ratings yet

- Raj OptionDocument9 pagesRaj OptionPearlboy Muthuselvan N100% (1)

- Pivots: This Image Has Been Resized. Click This Bar To View The Full Image. The Original Image Is Sized 806x331Document28 pagesPivots: This Image Has Been Resized. Click This Bar To View The Full Image. The Original Image Is Sized 806x331livermoreNo ratings yet