Professional Documents

Culture Documents

38741rr No. 3-2008 - Annex C

Uploaded by

Awala AmagicOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

38741rr No. 3-2008 - Annex C

Uploaded by

Awala AmagicCopyright:

Available Formats

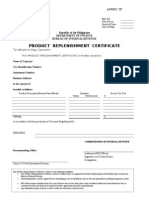

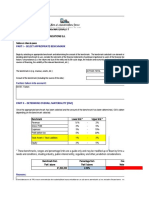

ANNEX “C”

BIR Form No. ______

PRDM No. :

Date :

Republic of the Philippines

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

PRODUCT REPLENISHMENT DEBIT MEMO

Large Taxpayers Service – Excise Group

2/F, Rm. 216 A & B, BIR National Office

Diliman, Quezon City

Attention : Head Revenue Executive Assistant

LTS- Excise Group

Sir/Madam:

We have authorized the debit of product replenishment on excisable articles pursuant to Revenue

Regulations No. _________ in relation to Section ___ of the National Internal Revenue Code, detailed as

follows:

Product Description/Brand Name/Model Quantity Excise Tax Due

Volume Unit of measure P

TOTAL P

COMPANY NAME :

TIN

Assessment No.

Volume/Amount of product replenishment

tax debit

Amount available as of date of utilization :

Amount of product replenishment tax debit :

Balance as of date :

REFERENCE:

PRC No. :

Date Issued :

Date revalidated :

Original Amount :

No. and date of last PRDM issued :

Purpose :

RecommendingApproval: Approved:

Division Chief Head Revenue Executive Assistant

LT- Field Operations Division Large Taxpayers Service – Excise Group

Note:

This PRDM is valid within thirty (30) calendar days from issuance hereof and subject to liquidation within forty five (45)

calendar days upon transmittal. Any erasure shall render this PRDM invalid. Furthermore, this PRDM is being issued

against the subject PRC on the basis of the remaining balance of the said PRC as evidenced by the entries, if any, posted at

the subject PRC’s dorsal portion. Final acceptance of this PRDM for product replenishment shall, however, be based on the

PRC’s actual creditable balance as verified by the accepting office.

You might also like

- Macroeconomics 6th Edition Williamson Solutions ManualDocument14 pagesMacroeconomics 6th Edition Williamson Solutions Manualregattabump0dt100% (30)

- BPLO Taguig Mayor's Permit ApplicationDocument2 pagesBPLO Taguig Mayor's Permit Applicationgille abajar50% (4)

- Business School ADA University ECON 6100 Economics For Managers Instructor: Dr. Jeyhun Mammadov Student: Exam Duration: 18:45-21:30Document5 pagesBusiness School ADA University ECON 6100 Economics For Managers Instructor: Dr. Jeyhun Mammadov Student: Exam Duration: 18:45-21:30Ramil AliyevNo ratings yet

- Product Replenishment Debit Memo: BIR Form No.Document2 pagesProduct Replenishment Debit Memo: BIR Form No.Jon JamoraNo ratings yet

- RR No. 3-2008 - Annex BDocument2 pagesRR No. 3-2008 - Annex BJon JamoraNo ratings yet

- LCIF - Schedules - PAGES 6 TO 11Document7 pagesLCIF - Schedules - PAGES 6 TO 11April VillanuevaNo ratings yet

- Appendix 40 - Report of Supplies and Materials IssuedDocument2 pagesAppendix 40 - Report of Supplies and Materials IssuedIvy Michelle HabagatNo ratings yet

- Rmo No 76-10 Annex CDocument1 pageRmo No 76-10 Annex CGil Pino100% (1)

- Municipality of Guipos: Republic of The Philippines Province of Zamboanga de SurDocument21 pagesMunicipality of Guipos: Republic of The Philippines Province of Zamboanga de SurMelvinson Loui Polenzo SarcaugaNo ratings yet

- Form - Application For Business PermitDocument2 pagesForm - Application For Business Permitcamilo martalNo ratings yet

- New Forms (Conso)Document78 pagesNew Forms (Conso)Angeli Lou Joven VillanuevaNo ratings yet

- Final ADC Business Facilitation Fund FormDocument3 pagesFinal ADC Business Facilitation Fund FormRobert OtienoNo ratings yet

- SD-SCD-QF72B PCIMS Account Registration Form For PS Applicants - PS - 01302019Document1 pageSD-SCD-QF72B PCIMS Account Registration Form For PS Applicants - PS - 01302019Chiekoi PasaoaNo ratings yet

- Power Build PVT Limited: Invoice Cum Delivery ChallanDocument1 pagePower Build PVT Limited: Invoice Cum Delivery ChallanSandip PatelNo ratings yet

- Accounting Forms Per GAM With InstructionsDocument74 pagesAccounting Forms Per GAM With Instructionsdemi demzkyNo ratings yet

- Buslaw3 VATDocument58 pagesBuslaw3 VATVan TisbeNo ratings yet

- Purchase Request FormDocument18 pagesPurchase Request FormJunNo ratings yet

- July Apr TaresDocument6 pagesJuly Apr TaresAngela Maniego MendozaNo ratings yet

- Quotation FormDocument5 pagesQuotation FormAnita QueNo ratings yet

- LARGE Inventory Slides 2019Document80 pagesLARGE Inventory Slides 2019Clyde G. CairelNo ratings yet

- Bids and Awards Committee: Request For Quotation (RFQ) To All Eligible SuppliersDocument1 pageBids and Awards Committee: Request For Quotation (RFQ) To All Eligible SuppliersJunNo ratings yet

- ACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyDocument4 pagesACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyJoel RazNo ratings yet

- Application Form For Business Permit Office of The City Mayor Business Permit & Licensing DivisionDocument2 pagesApplication Form For Business Permit Office of The City Mayor Business Permit & Licensing Divisionvivian deocampoNo ratings yet

- Application Form Business Permit UnifiedDocument2 pagesApplication Form Business Permit UnifiedNameless DevelopmentNo ratings yet

- Agency Procurement Request: Please Check ( ) Appropriate Box On Action Requested On The Item/S Listed BelowDocument2 pagesAgency Procurement Request: Please Check ( ) Appropriate Box On Action Requested On The Item/S Listed BelowBrianSantiagoNo ratings yet

- Application Form Business PermitDocument4 pagesApplication Form Business PermitJanine LagutanNo ratings yet

- 2cycles DCPR FormatDocument5 pages2cycles DCPR FormatLibertad-Butuan MultibikesNo ratings yet

- ACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyDocument4 pagesACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyErlene CompraNo ratings yet

- New Post Qua Report GoodsDocument3 pagesNew Post Qua Report GoodsChrisAlmerRamosNo ratings yet

- Office of The Accountant General Sindh: Vendor Creation FormDocument1 pageOffice of The Accountant General Sindh: Vendor Creation FormKashif Ad0% (1)

- Appendix 40 - RSMIDocument1 pageAppendix 40 - RSMIJohn Jade JaymeNo ratings yet

- ACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyDocument4 pagesACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public Accountancyhannah100% (1)

- ACD-BOA-07 App Form Acc of Indiv Partner of Firm - Partnership 092923Document2 pagesACD-BOA-07 App Form Acc of Indiv Partner of Firm - Partnership 092923rhed curaNo ratings yet

- Vendor Creation Form AGSindhDocument1 pageVendor Creation Form AGSindhShoaibzaheer MemonNo ratings yet

- Form Permintaan ATK & SPARE PART: No Nama Barang Jumlah KeteranganDocument10 pagesForm Permintaan ATK & SPARE PART: No Nama Barang Jumlah KeteranganAldi MahmudNo ratings yet

- Pinamungajan Business PermitDocument2 pagesPinamungajan Business PermitHannah PanaresNo ratings yet

- LCFS - Schedules - PAGES 8 TO 15Document10 pagesLCFS - Schedules - PAGES 8 TO 15Florida DelinaNo ratings yet

- Annex B BOA FORM INDIVIDUAL PARTNERSHIP 1 PDFDocument3 pagesAnnex B BOA FORM INDIVIDUAL PARTNERSHIP 1 PDFJun Guerzon PaneloNo ratings yet

- RSC Cis Forms 2019Document7 pagesRSC Cis Forms 2019John EncarnacionNo ratings yet

- CKDJ and ADADJ Per GAM With InstructionsDocument9 pagesCKDJ and ADADJ Per GAM With Instructionsdemi demzkyNo ratings yet

- RFQ Lot 1 With Tech Specs SGDDocument10 pagesRFQ Lot 1 With Tech Specs SGDROSE MAE PAWAYNo ratings yet

- Power Build PVT Limited: Invoice Cum Delivery ChallanDocument1 pagePower Build PVT Limited: Invoice Cum Delivery ChallanSandip PatelNo ratings yet

- Pol M Salazar 2 20221011 170410494 PDFDocument7 pagesPol M Salazar 2 20221011 170410494 PDFdsNo ratings yet

- BLGF PPT On Coaches Training On The Enhanced BPLS (Revised)Document62 pagesBLGF PPT On Coaches Training On The Enhanced BPLS (Revised)DILG Manolo FortichNo ratings yet

- Copy - Nos For Recipient: Bill From Beckman Coulter India Private LimitedDocument2 pagesCopy - Nos For Recipient: Bill From Beckman Coulter India Private LimitedrahulrsinghNo ratings yet

- Report of Supplies and Materials IssuedDocument3 pagesReport of Supplies and Materials IssuedJonas AsoyNo ratings yet

- COC Checklist FormDocument2 pagesCOC Checklist Formfuel station0% (1)

- BIR Form 1702-RTDocument4 pagesBIR Form 1702-RTAljohn Sechico BacolodNo ratings yet

- Application Form For Business Permit New Renewal and Retirement 1Document4 pagesApplication Form For Business Permit New Renewal and Retirement 1Amiel GuintoNo ratings yet

- Payment Request Non&PO Based (Form. FIN-006) - RevisedDocument1 pagePayment Request Non&PO Based (Form. FIN-006) - RevisedSuryanto KimNo ratings yet

- Inventory Custodian Slip FormDocument1 pageInventory Custodian Slip FormErikajane IgnacioNo ratings yet

- City of Taguig: Business Permit Application FormDocument2 pagesCity of Taguig: Business Permit Application Formjane calipayNo ratings yet

- App 4Document4 pagesApp 4alex almarioNo ratings yet

- NSI Form - 25 - 10 - 2021Document2 pagesNSI Form - 25 - 10 - 2021sizeninhleko8No ratings yet

- Faqs On BNPL Process in Csi V3.0Document17 pagesFaqs On BNPL Process in Csi V3.0Jt.CCA ChhattisgarhNo ratings yet

- Procurement FormsDocument22 pagesProcurement FormsILECO UNONo ratings yet

- Unified Business Application FormDocument2 pagesUnified Business Application FormKahlila-Keon Morabor-EstorninosNo ratings yet

- Face Form For UnfpaDocument3 pagesFace Form For UnfpaChe Chi AwondoNo ratings yet

- Application For Permit To OperateDocument2 pagesApplication For Permit To Operategarthraymundo123No ratings yet

- 42385rr No. 13-2008 - Annexes A-B, E-JDocument18 pages42385rr No. 13-2008 - Annexes A-B, E-JAwala AmagicNo ratings yet

- Reit Annex DDocument1 pageReit Annex DAwala AmagicNo ratings yet

- 42385rr No.13-2008 - Annex DDocument2 pages42385rr No.13-2008 - Annex DAwala AmagicNo ratings yet

- 38646rr No. 2-2008 - Annex A-1Document3 pages38646rr No. 2-2008 - Annex A-1Awala AmagicNo ratings yet

- 37626RR No. 13-2007 - Annex ADocument1 page37626RR No. 13-2007 - Annex AAwala AmagicNo ratings yet

- RMC No. 73-2022 Annex ADocument1 pageRMC No. 73-2022 Annex AAwala AmagicNo ratings yet

- RMC No. 3-2022 Annex A 2Document2 pagesRMC No. 3-2022 Annex A 2Awala AmagicNo ratings yet

- RMC No. 14-2023Document1 pageRMC No. 14-2023Awala AmagicNo ratings yet

- RMC No. 73-2022 Annex DDocument1 pageRMC No. 73-2022 Annex DAwala AmagicNo ratings yet

- RMC No. 73-2022 Annex CDocument2 pagesRMC No. 73-2022 Annex CAwala AmagicNo ratings yet

- RMC No. 26-2023 AttachmentDocument3 pagesRMC No. 26-2023 AttachmentAwala AmagicNo ratings yet

- RMC No. 64-2023Document5 pagesRMC No. 64-2023Awala AmagicNo ratings yet

- RMC No. 15-2023Document1 pageRMC No. 15-2023Awala AmagicNo ratings yet

- 27744rmc No. 01-2006Document1 page27744rmc No. 01-2006Awala AmagicNo ratings yet

- RMC No. 76-2023Document2 pagesRMC No. 76-2023Awala AmagicNo ratings yet

- 27860rmc No. 04-2006 - Annex A - Page 2Document1 page27860rmc No. 04-2006 - Annex A - Page 2Awala AmagicNo ratings yet

- RMC No. 67-2023Document2 pagesRMC No. 67-2023Awala AmagicNo ratings yet

- 5200rmc 1-2002Document1 page5200rmc 1-2002Awala AmagicNo ratings yet

- 32762rmc No. 76-2006Document2 pages32762rmc No. 76-2006Awala AmagicNo ratings yet

- 5185rmc 3 2002Document1 page5185rmc 3 2002Awala AmagicNo ratings yet

- 5189rmc 2-2002Document1 page5189rmc 2-2002Awala AmagicNo ratings yet

- 27772rmc No. 02-2006Document1 page27772rmc No. 02-2006Awala AmagicNo ratings yet

- 5163rmc 7-2002Document1 page5163rmc 7-2002Awala AmagicNo ratings yet

- 5181rmc4 2002Document1 page5181rmc4 2002Awala AmagicNo ratings yet

- An Experimental Investigation in Paver Blocks by Replacing Sand With Manufacturing Sand and Its Strength ComparisonDocument13 pagesAn Experimental Investigation in Paver Blocks by Replacing Sand With Manufacturing Sand and Its Strength ComparisonPratik WANKHEDENo ratings yet

- FPB 22.03 - Steam Turbines and Axial Turbo Expanders Observation of Hexavalent Chromium On Equipment During OutagesDocument5 pagesFPB 22.03 - Steam Turbines and Axial Turbo Expanders Observation of Hexavalent Chromium On Equipment During Outageswaqar ahmadNo ratings yet

- Disconnected Defaulters Web July-19Document62 pagesDisconnected Defaulters Web July-19shyam143225No ratings yet

- AC 203 Final Exam Review WorksheetDocument6 pagesAC 203 Final Exam Review WorksheetLương Thế CườngNo ratings yet

- Micro & Macro Economics:: ObjectivesDocument8 pagesMicro & Macro Economics:: ObjectivesGod BoyNo ratings yet

- Traffic Impact Analysis of Urban Construction Projects Based On Traffic SimulationDocument5 pagesTraffic Impact Analysis of Urban Construction Projects Based On Traffic SimulationSasi KumarNo ratings yet

- Al Brooks Advanced CourseDocument5 pagesAl Brooks Advanced CourseAlaa AhbaliNo ratings yet

- Corgi Queen PatternDocument4 pagesCorgi Queen PatternTasheenaNo ratings yet

- Top South Dakota Business Tax DelinquentsDocument13 pagesTop South Dakota Business Tax DelinquentsDelinquencyReport.comNo ratings yet

- Department of Education: Individual Workweek Accomplishment ReportDocument6 pagesDepartment of Education: Individual Workweek Accomplishment ReportJay Ann Lausing-TuvillaNo ratings yet

- Catalog Disco D P HardwareDocument10 pagesCatalog Disco D P HardwareBillNo ratings yet

- BCBP - ILOILO - Financial Report - SEP - 2021Document164 pagesBCBP - ILOILO - Financial Report - SEP - 2021Angelo ManlangitNo ratings yet

- Prajwal TradesDocument392 pagesPrajwal TradesSaheb ChakrobortyNo ratings yet

- Real Estate Economics in PakistanDocument3 pagesReal Estate Economics in PakistanAli AkhtarNo ratings yet

- Excerpt of Introduction To Political Economy, Lecture Notes by Daron Acemoglu (PoliticalDocument34 pagesExcerpt of Introduction To Political Economy, Lecture Notes by Daron Acemoglu (PoliticalKaren PerezNo ratings yet

- ENT300 BUSINESS PLAN Latest - Doc (Ref)Document61 pagesENT300 BUSINESS PLAN Latest - Doc (Ref)Nor HakimNo ratings yet

- Ap 2Document8 pagesAp 2Louiejane LapinigNo ratings yet

- Engineering Economic Analysis Homework SolutionsDocument6 pagesEngineering Economic Analysis Homework Solutionsafnojbsgnxzaed100% (3)

- Capital Budgeting Notes (MBA FA - 2023)Document10 pagesCapital Budgeting Notes (MBA FA - 2023)kavyaNo ratings yet

- Merchandising Accounting Cycle-Rev1 - 1Document33 pagesMerchandising Accounting Cycle-Rev1 - 1Hendra Setiyawan100% (4)

- Sprinkler Pressure Gauge LF PGXDocument1 pageSprinkler Pressure Gauge LF PGXAwais MumtazNo ratings yet

- 600 - Materiality AvayaDocument19 pages600 - Materiality AvayaBrayan Nicolás Martínez RomeroNo ratings yet

- Product Roadmap Template LightDocument8 pagesProduct Roadmap Template LightDaniel MachadoNo ratings yet

- Business PlanDocument3 pagesBusiness PlanPenninah MainaNo ratings yet

- KCSE 2008 Agriculture P1 EDocument5 pagesKCSE 2008 Agriculture P1 EUrex ZNo ratings yet

- Means of AccessDocument10 pagesMeans of Accessajay dalalNo ratings yet

- Credit Crunch Student WorksheetDocument3 pagesCredit Crunch Student WorksheetstephNo ratings yet

- NeelofaDocument3 pagesNeelofaNur Syahirah binti Mohd IdrisNo ratings yet