Professional Documents

Culture Documents

Completing The Accounting Cycle - Merchandising Yt

Uploaded by

Google UserOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Completing The Accounting Cycle - Merchandising Yt

Uploaded by

Google UserCopyright:

Available Formats

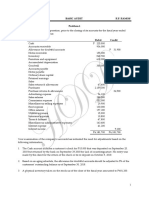

Trial Balance – Reversing Entries

The bookkeeper of Rossle Ong’s Toyland presented the following ledger accounts and their balances as of June 30, 2021

the end of fiscal period:

Cash in bank 487,288 Ong, Capital ???????

Advertising expense 9,000 Cash on Hand 75,200

Accounts Payable 54,000 Office Salaries Expense 33,400

Accum. Depr. – Store Furn. & Fix. 500 Sales 783,200

Accounts Receivable 112,000 Notes Receivable 4,800

Rent Expense 96,800 Taxes Expense 12,000

Purchase Discount 2,000 Freight In 6,000

Sales Discount 2,880 Ong, Withdrawals 30,000

Interest Expense 600 Unearned Commission 2,400

Interest Income 3,000 SSS Premiums Expense 6,424

Philhealth Premiums Expense 1,200 Withholding Taxes Payable 490

Purchases 242,000 Prepaid Store Insurance, 7/1/20 6,300

Allowance for bad debts 4,000 Sales return and allowances 5,020

Merchandise Inventory, 7/1/20 89,500 Store Furniture and Fixtures 16,000

Notes Payable – 5 yrs. 180,000 Electricity Expense 42,400

Purchase returns and allowances 3,000 Sales salaries expense 60,000

Office Furniture and Fixtures 15,000 Accum. Depr. – Off. Furn. & Fix. 900

SSS Premiums Payable 522 Pag-Ibig Premiums Expense 2,400

Philhealth Premiums Payable 100 Pag-Ibig Premiums Payable 200

Miscellaneous Income 2,000 Freight Out 1,500

Building 500,000 Land 250,000

Accum. Depr. – Building 25,000 Bank Service Charge 1,750

Gain on sale of investment 2,500 Loss on fire 14,000

Water Expense 2,500 Communication Expense 700

Representation Expense 2,000 Loss on flood 3,000

Additional data needed for adjustments:

a. Increase in allowance for doubtful accounts to 5% of receivable

b. The notes received from the customer consists of:

I. 30-day, 10% note for 4,000 dated June 10, 2021

II. 60-day 8%, 800 note dated June 5, 2021

c. The business has paid on January 1, 2020 insurance premium for two-year policy effective on that date

d. The store furniture and fixtures are depreciated over a useful life of 5 years. Of those on hand as of June 30, 6,000

were acquired on March 1, 2021.

e. The office furniture and fixtures are to be depreciated at a rate of 20% per annum

f. The building has a 50,000 salvage value and is to be depreciated at a rate of 15% per annum

g. Sales salaries of 550 has accrued as of June 30

h. On May 1, 2021, the business paid for a three month advertising contract for 9,000

i. The notes payable dated October 1, 2020 has a 18% interest for which no interest has yet been paid

j. The business received a commission of 2,400 but only one-third of this has been earned by the company

k. Merchandise unsold, per physical count of June 30, 2021, amounted to three-fourth of the beginning inventory

Additional Information for preparation of comprehensive income statement follows:

1. The building was occupied 20% store, 80% administration

2. The employer’s contribution for mandated benefits are allocated based on office and sales salaries

3. Electricity, water and communication is allocated on 4:3 basis for selling and administrative expenses respectively

Required:

1. Trial Balance

2. Adjusting Entries 5. Closing Entries

3. Prepare a worksheet 6. Post-Closing Trial Balance

4. Financial Statements 7. Reversing Entries

You might also like

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- Merchandising Activity - 11.23.2021 Act110-FarDocument2 pagesMerchandising Activity - 11.23.2021 Act110-FarRhadzmae OmalNo ratings yet

- Merchandising - Adjusting To Reversing Entries - UpdatedDocument36 pagesMerchandising - Adjusting To Reversing Entries - Updatedhello hayaNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- Capital and Revenue TransactionsDocument7 pagesCapital and Revenue Transactionscarolm790No ratings yet

- Financial Statements With Notes To FsDocument2 pagesFinancial Statements With Notes To Fsdimpy dNo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- Cielo Corp accounting adjustmentsDocument3 pagesCielo Corp accounting adjustmentsCarina Mae Valdez ValenciaNo ratings yet

- Accounting Fundamentals - Practice Worksheet SolutionsDocument11 pagesAccounting Fundamentals - Practice Worksheet SolutionsMeet PatelNo ratings yet

- Quiz - 2 - BAAB1014 - (Sept2022) AnswerDocument8 pagesQuiz - 2 - BAAB1014 - (Sept2022) AnswerTheresa AnneNo ratings yet

- 2017 S2 (final) (尊孔)Document5 pages2017 S2 (final) (尊孔)Khor Xing TienNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- Adjustments To Financial Statements Tutorial No: 13Document6 pagesAdjustments To Financial Statements Tutorial No: 13me myselfNo ratings yet

- MC 2 - A201 - QuestionDocument6 pagesMC 2 - A201 - Questionlim qsNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- Comprehensive Problem 2 SolutionDocument14 pagesComprehensive Problem 2 SolutionRJ 1No ratings yet

- Ia3 Quiz 3Document5 pagesIa3 Quiz 3Magdaraog LutzNo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- FS to RECEIVABLE - Petty Cash, Accounts Receivable, Shareholders' EquityDocument31 pagesFS to RECEIVABLE - Petty Cash, Accounts Receivable, Shareholders' EquityWillen Christia M. MadulidNo ratings yet

- Quizzer - Financial Accounting ProcessDocument8 pagesQuizzer - Financial Accounting ProcessLuisitoNo ratings yet

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- Error in Recording & Posting: Fabm 2Document17 pagesError in Recording & Posting: Fabm 2Earl Hyannis Elauria0% (1)

- Quiz - Single EntryDocument2 pagesQuiz - Single EntryGloria BeltranNo ratings yet

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- Merchandising Accounting (Erlinda See Chua)Document1 pageMerchandising Accounting (Erlinda See Chua)Shaira Nicole VasquezNo ratings yet

- Fa Atd 2 ExamDocument5 pagesFa Atd 2 ExamNelsonMoseMNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- MM Company Adjusted Trial BalanceDocument22 pagesMM Company Adjusted Trial BalanceKianJohnCentenoTurico100% (2)

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- Exhibit 7. Revenue and Expense RecognitionDocument6 pagesExhibit 7. Revenue and Expense RecognitionЭниЭ.No ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- BKNC3 - Activity 1 - Review ExamDocument3 pagesBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- ACC2002L Financial Management Question PackDocument67 pagesACC2002L Financial Management Question PackAhamed NabeelNo ratings yet

- Problem 1: The Accounts of Marissa Babilonia Health Store Selected From The December 31, 2019 TrialDocument2 pagesProblem 1: The Accounts of Marissa Babilonia Health Store Selected From The December 31, 2019 TrialKimberly G. EtangNo ratings yet

- CAT 2 Urgent DBM EveningDocument3 pagesCAT 2 Urgent DBM EveningCollins WandatiNo ratings yet

- Activity - Cash Flow AnalysiDocument1 pageActivity - Cash Flow AnalysiJessica AningatNo ratings yet

- Ans Mini Case 2 - A171 - LecturerDocument14 pagesAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- Particulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRDocument9 pagesParticulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRasdfNo ratings yet

- Cash ExampleDocument1 pageCash ExampleFRANCIS IAN ALBARACIN IINo ratings yet

- Problem 1Document3 pagesProblem 1karthikeyan01No ratings yet

- Income Tax Revision QuestionsDocument13 pagesIncome Tax Revision QuestionsMbeiza MariamNo ratings yet

- Worksheet 5 NMIMSDocument4 pagesWorksheet 5 NMIMSvipulNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Conceptual Activity 1 Journal FinalDocument2 pagesConceptual Activity 1 Journal FinalJhazreel BiasuraNo ratings yet

- University of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Document3 pagesUniversity of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Justine JaymaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessFrom EverandJ.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessNo ratings yet