Professional Documents

Culture Documents

Bba 3 Sem Company Accounts 18053 Dec 2017

Bba 3 Sem Company Accounts 18053 Dec 2017

Uploaded by

Mohd Harish0 ratings0% found this document useful (0 votes)

6 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesBba 3 Sem Company Accounts 18053 Dec 2017

Bba 3 Sem Company Accounts 18053 Dec 2017

Uploaded by

Mohd HarishCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

uroa'épmisnsao-anniay/'sdy

bitps://www.cesustudy.com

N

(201217)

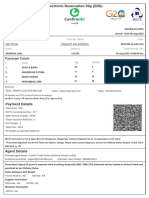

B.B.A.-III Sem.

18053

B. B. A. Examination, Dec. 2017

‘COMPANY ACCOUNTS

(BBA-305)

(New)

Tne : Three Hours)

[Maximum Marks: 75

Note: Attempt questions from all Sections as per

instructions.

Section-A,

(Very Short Answer Questions)

‘Attempt all the five questions. Each question carries

3 marks. Very short answer is required not exceeding

75 words. 35215

What is Government liquidator?

‘Whatis preference share?

‘What do you understand by reconstruction of a

company?

hutps://www-cesustudy.com

nsoo:amrey sda

‘woo'Apn

uroa'épmisnsao-anniay/'sdy

18083,

bitps://www.cesustudy.com

Define a subsidiary company.

‘What particulars ate to bs given roganting sundry

debtors inthe Balance Sheet of Company.

Section-B

(Shore Answer Questions)

‘Attecnpt any two questions out ofthe following three

‘questions. Each question carries 7% marks. Short

answers required notexceeding 200 words. 714215

Give the differentkinds of debentures,

‘What do you understand by liquidation of company.

‘A company purchased assets of the Book value

‘© 9.90,000 from another company, It was agreed

that the puschase consideration be paid by issuing

11%, Debentures of ¥ 100 each, Assume debentures

have been issued (i) at par (i) at premiom of 10%

and (i) at discount of 10%, Give oecetsary journal

‘entries inthe books of purchasing compy.

Sectioa-C

(Detatted Answer Questions)

Attempt any chree questions out of the following five

‘questions. Each question carries 15 marks. Answer is

required indetai, ISd=45

hutps://www-cesustudy.com

‘woo'€pmisnsoo:anmaysdaiy

uroa'épmisnsao-anniay/'sdy

10,

5

18083

bitps://www.cesustudy.com

@

Give a specimen form of Balance sheet of acompany

asperSchedule-Ulof Companies Act, 2013.

What is divisible profit ” What various provisions

have been made in Companies Act regarding disaibution

of dividend 7 Can the dividend be paid out of

(a) Reservesand (b) Capital profits. Explain.

‘What accounting entries are rade in the books of

Amalgamating company and Amalgamated

company?

Dabur India Ltd. issued a prospectus inviting

pplications for 1,200 shares of ® 10 each at

premium of € 2 pershare payable as follows

(@) onapplicaion €2, (0) onallotment ¥ 5

(©) onfissteall €3and(4) onsecondcall® 2

Applications were received for 1,800 shares end

allotment made pro rata tothe applicants of 14,000,

shares. Money overpaid on applications was

employedon sccountof sums duconallotment.

XK, towhom 240 shares were alloted, uted to pay the

AHlotment money and on his subsequent failure ta pay

the frat cal his shares were forfeited.

hutps://www-cesustudy.com

‘woo'€pmisnsoo:anmaysdaiy

uroa'épmisnsao-anniay/'sdy

‘bttps://www.cesustudy.com

Rama, who was allotted 360 shares, thite to pay the

‘wo calls and ber shares were forfeited after the

second all :

OF the shares forfeited 480 shares were sold to Kini

‘credited as fully paid for © 9 per shave, the whole K's

‘shares being included. Show jeumal and Cash: Boole

the Balance Sheet,

A company has 600,000 10% debentures

outstanding on {st Jan, 2016 on that date Debenture

Redemption Fund stood at © 5,00,000 represcated by

T 5,90,000,6% (2021) loan ofthe U.P. Government

‘The annual installment added 10 the Debenture

Redemption Funds € 64600,

(On 31st December, 2016 the Balance of Bank Account

(after interest on investment) had been received was

156,400. On that date the investments were sold

183% net and the debentures were paid off,

‘Show the necessary Ledger Accounts for 2016,

190834

hutps://www-cesustudy.com

‘woo'€pmisnsoo:anmaysdaiy

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter-05 (Natural Vegetation and Wildlife)Document13 pagesChapter-05 (Natural Vegetation and Wildlife)Mohd HarishNo ratings yet

- Research FileDocument50 pagesResearch FileMohd HarishNo ratings yet

- Ticket TK365664423B26Document2 pagesTicket TK365664423B26Mohd HarishNo ratings yet

- Comparatives Study On Mango Drinks inDocument2 pagesComparatives Study On Mango Drinks inMohd HarishNo ratings yet

- AcknowledgementDocument2 pagesAcknowledgementMohd HarishNo ratings yet

- Comparatives Study On Mango Drinks inDocument2 pagesComparatives Study On Mango Drinks inMohd HarishNo ratings yet

- De Clac RationDocument1 pageDe Clac RationMohd HarishNo ratings yet