Professional Documents

Culture Documents

Forms of Ownership

Uploaded by

ElisonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forms of Ownership

Uploaded by

ElisonCopyright:

Available Formats

Forms of ownership:

Sole Trader Partnership Close Corporation Private Company Personal Liability Public Company State Owned Non-Profit Co-Operation

Company Company Company

Name of the ‘Cooperative Limited’

Name of Name ends with (Pty) Must end with the Name ends with Ltd Name ends with the

No requirements No requirements Must end with “CC” company must end must appear at the end

business Ltd letters INC or Limited letters SOC Ltd

with NPC / NPO of its name

3 or more directors

Owner of 1-unlimited 1-unlimited 1-unlimited With or without Minimum 5 members

One person 2-20 partners 1-10 members and 1 or more

business shareholders shareholders shareholders members required

shareholders

Owned by the

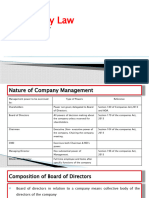

Board consists of at

Partners share government

least 3 directors and

Can make quick responsibilities Board of directors Shareholders vote for Members own and

Members share can be well managed

Management decision without and they are all Director Director appointed by the most competent manage the business

responsibility as it requires a

consulting others involved in shareholders directors and they together

minimum of 3 of

decision-making are appointed to

more directors

manage the company

Transfer of the Raises capital by More shareholders

Expansion is No limit to the To create mutual benefits

Easy to control interest of a No limit to the number issuing shares to the Raises capital by may join the

possible because number of for the members and

Capacity because it is a member must be of shareholders, it can public and borrowing issuing shares to the company, as they

more partners join shareholders, it can allow the members to

small business approved by all lead to expansion capital by issuing a public contribute positively

partnership lead to expansion work tighter as a team

other members debenture to society

Register with the

No legal

Register with the Register of Register with the

formalities to start, Audit of financial In the MOI it must be

No legal and Register of Companies by Register of Must draw up a

Legal only written statements / stated that it is a Register with Registrar of

administrative Companies by setting setting MOI Companies by setting Memorandum of

requirements partnership regular annual company with Co-Operatives

formalities Memorandum of Prospectus issued Memorandum of Incorporation

agreement is general meetings personal liability

Incorporation to public to raise Incorporation

required

capital

Partners have Shareholders have

Members have

unlimited liability limited liability.

limited liability, The business as a The business as a

and are jointly and Directors are liable

Liability Unlimited liability unless the CC has legal person (limited Unlimited liability legal person (limited Limited liability Limited liability

separately liable for any loss

6 months or longer liability) liability)

for the debts of the experienced by the

than ten members

personality company

Not a legal entity, Legal personality and are

Legal No legal

all in personal Legal personality Legal personality Legal personality Legal personality Legal personality Legal personality allowed to own land and

Personality personality

capacity open bank accounts

Continuity No continuity No continuity Unlimited continuity Unlimited continuity Unlimited continuity Unlimited continuity Unlimited continuity Unlimited continuity Unlimited continuity

Submit application at Register with the

Paperwork to Partnership Founding

Trading license Register with CIPC Register with CIPC Register with CIPC Register with CIPC a provincial social Registrar of

complete Agreement Statement

development office Cooperatives Societies

Partners

Owner (borrowed Members Shares sold privately Shares sold privately Shares sold publicly Access to long-term Limited to the number of

Capital contribute or Funded by donations

or own) contribute to shareholders to shareholders to shareholders capital members

borrow

Shareholders receive

Shareholders receive Profit must be used

According to In proportion to the a dividend in

a dividend in Shareholders Profits are shared in for the primary Shared equally amongst

Profit sharing Owner partnership interest of the proportion to the

proportion to the receive a dividend the form of dividends purpose of the members

agreement member of the CC number of shares

number of shares held company

held

Partners taxed on Business taxed on On the profits of the On the profits of the Tax on profits of the Pay tac on the profits Taxed as a legal entity

Tax on profits plus

part of their profit profits business and business and declared business and of the business and Granted tax-exempt and the income of the

Taxes income tax on

plus personal Members taxed on declared dividends of dividends of declared dividends declared dividends of status company is separate to

personal income

income salary shareholders shareholders of shareholders shareholders that of the members

Sole Trader Partnership Close Corporation Private Company Personal Liability Public Company State Owned Non-Profit Co-Operation

Company Company Company

A It is very easy to The cost of forming a Any change in the It is easy to raise It is easy to raise It is open to the Profits may be used to The company is a Access to resources and

D form. partnership is not CC will have no capital because there capital because there public. finance other state legal personality. funding

V The owner will expensive and it is effect on the CC and are many are many Anyone can invest in departments The is continuity. Decision making is by a

A very easy to form. it can continue to shareholders. shareholders. a public company, Donors receive tax

receive all profits. Offer essential services group

N More capital is exist. The private company The private company regardless of the deductions.

T The owner can available to run or The CC is a legal is a legal entity. is a legal entity. amount of money. which may not be Each member has an

A manage the expand the business. entity. The shareholders will Shareholders can join It is easy to raise offered by the private equal share in the

G business as they The workload can be The members not be responsible for or leave the company capital by issuing sector business.

E wish. spread among the cannot be held its debts. without being affected. shares to the public. Prices are kept Can appoint its own

S It is easy to partners. Partners responsible for the Shareholders can Shareholders may reasonable/Create management.

maintain personal can share their debts of the join or leave the freely sell their sound competition with Members have limited

knowledge or skills. business, company without shares.

contact with your the private sector to liability

The success of the being affected.

customers business does not lie make services The decisions are

because the with one person. affordable to more democratic and fair

business is small. citizens. Members are motivated

Quick decision- Wasteful duplication of because they are working

making. services is eliminated for themselves

Planning can be Can gain extra capital by

coordinated through asking its members to buy

central control. shares.

Generates income to Have continuity of

finance social existence

programmes. Resources of many people

Jobs are created for all are pooled together to

skills levels. achieve common

objectives

Profits are shared equally

amongst members.

D If the owner Limited life – a Every member is an Private companies Cannot be listed on It is very costly to May result to poor Not allowed to pay Decisions are often difficult

I becomes ill or partnership ends with agent for the CC, cannot be listed the JSE. form a Public management as bonuses to members. to reach and time

S dies, the business the death, retirement they can act on its companies. Complex Company. government is not Must keep financial consuming.

A will come to an or insolvency of any behalf and can Complex establishment There is hardly any always as efficient as and accounting

Difficult to grow.

D end. of the partners. participate in its establishment process. personal contact the private sector. records.

V The owner might Unlimited liability – management. process. Can only rely on between the Inefficiency due to the Very few promotion

A find it difficult to the partners are An irresponsible Can only rely on capital contributed by shareholders and the size of the business positions for staff.

N raise enough liable in the personal member can cause capital contributed by shareholders. customers. Often rely on It can be difficult to get a

T capital to run or capacity for any loss to the CC. shareholders. Unlimited liability. Complex government subsidies loan because their main

A expand the debts of the It the business establishment A lack of incentive for objective is not always to

G business. partnership. wants to expand, it process. employees to perform if make a profit.

E Because the Each partner acts as can run into Certain information there is no absence of

The success of

S owner is the only an agent for the problems because must be published other motivator such as

one responsible business. of the restriction of under the law. productivity bonuses. cooperatives depends on

for the business, The partnership is members. Government can lose the support of the

they will have to bound by the actions It is only allowed to money through the members.

work long hours. of the partners. have 10 members. business. Shares are not freely

If the business is Decisions must be Banks require a Losses must be met by transferable

insolvent, the approved by all financial audit for the tax payer. All members have one

owner will be partners. loans. Shares are not freely

vote regardless of the

responsible for all tradable making it

the debts. difficult to raise capital. number of shares held.

There is no SOC must follow strict

continuity and no regulations for

legal entity. operations to raise

capital.

Financial statements

must be audited.

You might also like

- Forms of Business OrganizationsDocument18 pagesForms of Business OrganizationsHannah jaz BautistaNo ratings yet

- ERH BusinessEntityComparisonTableDocument1 pageERH BusinessEntityComparisonTableEliss CainNo ratings yet

- Item Sole Partnership Corporation Cooperative: ProprietorshipDocument4 pagesItem Sole Partnership Corporation Cooperative: ProprietorshipLeilalyn Nicolas50% (2)

- Forms of Business OrganizationDocument1 pageForms of Business OrganizationLanz William MacuhaNo ratings yet

- Basis of Difference Company Limited Liability PartnershipDocument4 pagesBasis of Difference Company Limited Liability PartnershipBalraj AnandNo ratings yet

- Sole Proprietor Vs LLP Vs General Partnership Vs Company in MalaysiaDocument4 pagesSole Proprietor Vs LLP Vs General Partnership Vs Company in MalaysiaJonathan TengNo ratings yet

- Information of CompaniesDocument11 pagesInformation of CompaniesAli AliNo ratings yet

- Types of Business MatrixDocument4 pagesTypes of Business MatrixAhsan AliNo ratings yet

- Introduction To Company LawDocument14 pagesIntroduction To Company LawGYANESHWAR MALHOTRANo ratings yet

- Different Types of BusinessDocument1 pageDifferent Types of BusinessThu An LêNo ratings yet

- Malaysia BizDocument3 pagesMalaysia BizElizabeth NelsonNo ratings yet

- Limited Personal LiabilityDocument9 pagesLimited Personal LiabilityrosyNo ratings yet

- AccformatDocument2 pagesAccformatJade PallenNo ratings yet

- Management of CompanyDocument19 pagesManagement of Companyalmighty.thor786No ratings yet

- Client Name: Ratish Radhakrishnan Write-Up: Comparison Between Private Limited Company and LimitedDocument6 pagesClient Name: Ratish Radhakrishnan Write-Up: Comparison Between Private Limited Company and LimitedCloxan India Pvt LtdNo ratings yet

- Business FormsDocument1 pageBusiness FormskhanyamadonselaNo ratings yet

- ACC 113 - CH 12Document33 pagesACC 113 - CH 12ahmed.alaradi88No ratings yet

- Accounting For PartnershipsDocument58 pagesAccounting For PartnershipsAmy MurphyNo ratings yet

- Advanced Accounting Chapter 9 2020Document67 pagesAdvanced Accounting Chapter 9 2020Uzzaam HaiderNo ratings yet

- Law Last Minute Revision NotesDocument17 pagesLaw Last Minute Revision Notesrajesh venkatNo ratings yet

- IU - Legal Forms of Business - Private EnterpriseDocument8 pagesIU - Legal Forms of Business - Private EnterpriseQuỳnh DungNo ratings yet

- Forms or Types of Business VentureDocument18 pagesForms or Types of Business VentureTalia JeonNo ratings yet

- Accounting For PartnershipsDocument37 pagesAccounting For PartnershipsTsigereda MulugetaNo ratings yet

- Companies Act, 2013: Legal Aspects of Business Prof. Mehek KapoorDocument15 pagesCompanies Act, 2013: Legal Aspects of Business Prof. Mehek KapoorAman jaiNo ratings yet

- Partnership Act 1932 DefinitionDocument4 pagesPartnership Act 1932 DefinitionSuptoNo ratings yet

- Organizational PlanDocument23 pagesOrganizational PlanYacir HussainNo ratings yet

- Partnership Act 1932Document5 pagesPartnership Act 1932Erfan KhanNo ratings yet

- Comparison of of Legal Forms of BusinessDocument2 pagesComparison of of Legal Forms of BusinessCHARLES KEVIN MINANo ratings yet

- Accounting For Partnerships: Powerd By: Ma7moud Sala7 Mob:0104118340 E-MailDocument33 pagesAccounting For Partnerships: Powerd By: Ma7moud Sala7 Mob:0104118340 E-MailhaithomaNo ratings yet

- Sole Proprietor Vs LLP Vs General Partnership Vs CompanyDocument7 pagesSole Proprietor Vs LLP Vs General Partnership Vs CompanyElizabeth NelsonNo ratings yet

- Lesson 2 Tidalgo, Edure C.Document3 pagesLesson 2 Tidalgo, Edure C.MikeNo ratings yet

- Partnership CompaniesDocument8 pagesPartnership Companiesduyanh.vinunihanoiNo ratings yet

- Paul Hype Page & CoDocument39 pagesPaul Hype Page & CoArunKumarNo ratings yet

- Limited Liability PartnershipDocument19 pagesLimited Liability PartnershipMariam munirahNo ratings yet

- 3.1 Sole Proprietorship 3.1.1 DefinitionDocument14 pages3.1 Sole Proprietorship 3.1.1 DefinitionHalinh TranNo ratings yet

- Tutorial 4 - LE TRAN KHANH PHUONGDocument3 pagesTutorial 4 - LE TRAN KHANH PHUONGPhương Lê Trần KhánhNo ratings yet

- Assignment-01 BUS101Document4 pagesAssignment-01 BUS101Amit HasanNo ratings yet

- Company and PartnershipDocument1 pageCompany and PartnershiprahulNo ratings yet

- Transform Idea Into VisionDocument26 pagesTransform Idea Into VisionANGELO RABUAYANNo ratings yet

- Entity ComparisonDocument3 pagesEntity Comparisoncthunder_1No ratings yet

- CompriseDocument12 pagesCompriseAnwesha PandaNo ratings yet

- Weeks 10 Chapter 5. General Provisions (Republic Act No. 11232)Document6 pagesWeeks 10 Chapter 5. General Provisions (Republic Act No. 11232)Jean Paula SequiñoNo ratings yet

- PARCOR-SIMILARITIESDocument2 pagesPARCOR-SIMILARITIESHoney Lizette SunthornNo ratings yet

- Session 17 - 24Document19 pagesSession 17 - 24PreranaNo ratings yet

- Alzona - STRATAX OE - Choosing An EntityDocument4 pagesAlzona - STRATAX OE - Choosing An EntityJames Ryan AlzonaNo ratings yet

- Partnership Act Notes Fast Track FinalDocument14 pagesPartnership Act Notes Fast Track Finalsamsfib420No ratings yet

- Partnership Formation and OperationDocument47 pagesPartnership Formation and Operationlou-924No ratings yet

- Armaan Agarwal 2223110 .Document2 pagesArmaan Agarwal 2223110 .Armaan AgarwalNo ratings yet

- Comparison Between Business EntitiesDocument1 pageComparison Between Business EntitiessuhanaNo ratings yet

- Sole Proprietorship Partnership Corporation CooperativesDocument1 pageSole Proprietorship Partnership Corporation Cooperativesnayeonar bunnyNo ratings yet

- BA50-UNIT I-LAP-PERFORMANCE TASK 1 - Tumamao-Rheyalhane-C.Document2 pagesBA50-UNIT I-LAP-PERFORMANCE TASK 1 - Tumamao-Rheyalhane-C.rheyalhane tumamaoNo ratings yet

- ML 292 Topic 1 - Lecture 1 - SlidesDocument16 pagesML 292 Topic 1 - Lecture 1 - Slidestpotera8No ratings yet

- CG 2Document28 pagesCG 2Puneet MalhotraNo ratings yet

- DeAsra - Company Formation ChecklistDocument8 pagesDeAsra - Company Formation ChecklistArun JainNo ratings yet

- 2223 BLP ws16 Ce01 GuideDocument18 pages2223 BLP ws16 Ce01 GuideZuniNo ratings yet

- Ch3Accounting For PartnershipDocument39 pagesCh3Accounting For Partnershipz62m2h2x6hNo ratings yet

- Comparison of The Features of Different Types of Business OrganizationsDocument2 pagesComparison of The Features of Different Types of Business Organizationsgavin adrianNo ratings yet

- Business Structure TableDocument1 pageBusiness Structure TableLuke AlbertsonNo ratings yet

- Corporate Finance: A Beginner's Guide: Investment series, #1From EverandCorporate Finance: A Beginner's Guide: Investment series, #1No ratings yet

- Legal docs for Dubai FZ-LLCDocument2 pagesLegal docs for Dubai FZ-LLCShamim ZaidiNo ratings yet

- Tan Vs SycipDocument15 pagesTan Vs SycippyulovincentNo ratings yet

- Application For Registration Information Update/Correction/CancellationDocument3 pagesApplication For Registration Information Update/Correction/CancellationSJC ITRNo ratings yet

- Revival of Corporate Existence - ChecklistDocument6 pagesRevival of Corporate Existence - ChecklistClaire LoqueroNo ratings yet

- Marketing Analytics Meaning, Benefits & DisadvantagesDocument46 pagesMarketing Analytics Meaning, Benefits & DisadvantagesAnuj SinghNo ratings yet

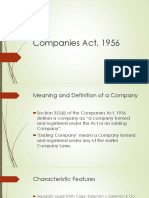

- Companies Act, 1956Document20 pagesCompanies Act, 1956Munira VohraNo ratings yet

- A Comparison Between Batas Pambansa Bilang 68Document66 pagesA Comparison Between Batas Pambansa Bilang 68Elson Talotalo0% (1)

- Promotion of A CompanyDocument4 pagesPromotion of A CompanyTaiyabaNo ratings yet

- ACC3024 Advanced Taxation Lecture 2 PDFDocument12 pagesACC3024 Advanced Taxation Lecture 2 PDFShaark LamNo ratings yet

- Study Notes 11 CH2Document23 pagesStudy Notes 11 CH2Saurav NegiNo ratings yet

- Business Law and Regulations - CorporationDocument15 pagesBusiness Law and Regulations - CorporationMargie RosetNo ratings yet

- Compapy Act 5moduleDocument21 pagesCompapy Act 5moduleBasappaSarkarNo ratings yet

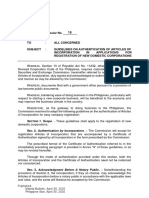

- S 1. Scope. - These Guidelines Shall Apply To The Registration of NewDocument3 pagesS 1. Scope. - These Guidelines Shall Apply To The Registration of NewCzarina Danielle EsequeNo ratings yet

- Process Flow v2Document12 pagesProcess Flow v2Katrizia FauniNo ratings yet

- Outline On Articles of IncorporationDocument4 pagesOutline On Articles of IncorporationkaiaceegeesNo ratings yet

- MICHIE ON BANKS AND BANKING Vol IDocument946 pagesMICHIE ON BANKS AND BANKING Vol Icoriedee100% (2)

- VAT - Getting Started GuideDocument6 pagesVAT - Getting Started GuideBlueLake InvestmentNo ratings yet

- Module 2 - Revised Corp Code - IncorporationDocument14 pagesModule 2 - Revised Corp Code - IncorporationLorraine BlanciaNo ratings yet

- Schedule of Tax Payment-Iloilo City TreasurerDocument4 pagesSchedule of Tax Payment-Iloilo City TreasurerJorge ParkerNo ratings yet

- CKC - Minutes of Joint SHBOD - AOI AmendmentDocument3 pagesCKC - Minutes of Joint SHBOD - AOI Amendmentcanadian kitchenNo ratings yet

- Revised Corporation Code NotesDocument36 pagesRevised Corporation Code NotesWinna Yu OroncilloNo ratings yet

- 777 Ace Entertainment Corporate DocumentsDocument18 pages777 Ace Entertainment Corporate DocumentsRegi PonferradaNo ratings yet

- Articles of Incorporation: Article I NameDocument3 pagesArticles of Incorporation: Article I NameReynee Shaira Lamprea MatulacNo ratings yet

- BL2 Module 2 Topics 5-8Document17 pagesBL2 Module 2 Topics 5-8Vinsmoke KaidoNo ratings yet

- Corp - Riano Midterm ReviewerDocument19 pagesCorp - Riano Midterm ReviewerPatrice De CastroNo ratings yet

- Corpo QuamtoDocument38 pagesCorpo QuamtomichelleNo ratings yet

- NOTES I Dissolution of Corp.Document4 pagesNOTES I Dissolution of Corp.Melissa Kayla ManiulitNo ratings yet

- Acctg1205 - Chapter 6Document28 pagesAcctg1205 - Chapter 6Elj Grace BaronNo ratings yet

- Corporations - Answers To Diagnostic ExerciseseDocument31 pagesCorporations - Answers To Diagnostic ExerciseseBrent LigsayNo ratings yet

- RCC Title IIDocument19 pagesRCC Title IITanya Mia PerezNo ratings yet