Professional Documents

Culture Documents

Private Placement Program Using Brazil LTN As Collatera

Private Placement Program Using Brazil LTN As Collatera

Uploaded by

Baphil ProjectsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Private Placement Program Using Brazil LTN As Collatera

Private Placement Program Using Brazil LTN As Collatera

Uploaded by

Baphil ProjectsCopyright:

Available Formats

PRIVATE PLACEMENT PROGRAM USING BRAZIL LTN AS COLLATERAL.

General: Traders use Brazil LTNs as collaterals in Private Placement Programs. The LTN may be:

a) Repactuated, under control of Bacen and blocked by Bacen in favor of the Trader’s custodial bank (less used now as Bacen

is unreliable). b) Deposited on a bank (securities account) outside Brazil, or deposited in a bank outside Brazil (in a vault)

with the bank issuing a SKR. c) Loaded on EC, then blocked on EC.

Currently, there are in the world only 3 Platforms able to trade large quantities of LTNs, backed by International Financial

Institutions. These Platforms have working arrangements with top banks and don't need Swift MT542 from Brazil. The

bonds are deposited in these prime banks only, with an SKR issued under Owner's name.

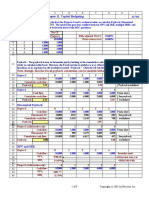

MAIN TRANSACTION TERMS Trader takes groups of 10 LTN H and takes one LTN Z only, as minimum quantities.

Regarding other series, groups of a minimum of 5 units are expected, to be confirmed by Trader upon request. Trader will

indicate in which bank the Investor needs to deposit the LTN. The associated costs are not at the Investor’s expense. There

are no initial costs to go to trade, such as Swift issuance costs or Euroclear loading costs, to be paid upfront by the Owners

(this is often a real barrier for the Owners). Trader’s Program is a 40 week long Program only. Estimated earnings (Net to the

Investor, before facilitator’s commissions) are as follows:

LTN Series Cruzeiros Monetized Estimated Current PU $B Net Earnings Net Earnings

(CR) Face Face Value Current PU (USD) Per Week $B Program

Value USD (B) (R) (40W) $B

H 1.2 1.7 4 1.1 0,35 14.0

K 2.4 3.5 8 2.3 TBC TBC

M 5 7.2 16.7 4.8 TBC TBC

R 7 10.1 23.3 6.7 TBC TBC

Z 10 14.4 33.3 9.6 1,25 50,0

Trade earnings are paid weekly or monthly.

Commissions to facilitators are of 10% of the Investor’s earnings as above. Advances: After the PPP agreement has been

signed, the owner –upon his request-can take an upfront cash payment, usually of 2% of the LOC level, withheld from the

LOC.

Transaction procedures A) Owner submits full, fresh, KYC plus the full legal (paper) documentation of one LTN (plus the

list of the bonds numbers + copy of the 10 GRU certificates including payment receipt), together with signed genealogy/FPA.

KYC does not need to be notarized.

B) GRU certificates and taxes payment certificates must have a residual validity of a minimum of 3 months at the time the

Owner’s KYC is submitted. The ATAF certificate must also be valid.

C) Following the Trader initial Due Diligence and Trader/Owner CC, the LTN will be deposited in a top Bank to be indicated

by the Trader [Necessarily outside Brazil]. A bank SKR under the name of the Owner.

D) Trader will have these LLTN loaded on Euroclear.

E) The bank will block the instrument (the SKR) in favor of the Trader’s custodial bank.

F) Upon blocking confirmation, Trader’s Bank raises the Line Of Credit (LOC).

G) Trade starts the following week.

H) At the end of the 40 week program, the bonds SKR is unblocked. The owner keeps the ownership of these bonds or may

extend the process of trading over the following year(s).

You might also like

- Wiley - Practice Exam 1 With SolutionsDocument10 pagesWiley - Practice Exam 1 With SolutionsIvan Bliminse80% (5)

- Barangay Manual Vol. 2Document29 pagesBarangay Manual Vol. 2anon_361714853100% (1)

- Export Finance From Banks: IMI, Kolkata 2018Document15 pagesExport Finance From Banks: IMI, Kolkata 2018Vishal SinghNo ratings yet

- Part 1. Worksheet For Chapter 11, Capital BudgetingDocument9 pagesPart 1. Worksheet For Chapter 11, Capital BudgetingIndrama PurbaNo ratings yet

- North East University Bangladesh Assignment OnDocument9 pagesNorth East University Bangladesh Assignment OnSahriar EmonNo ratings yet

- MT GoxDocument16 pagesMT GoxForkLogNo ratings yet

- Bachelor'S Degree Programme TR) : Term-End Examination June, 2010Document6 pagesBachelor'S Degree Programme TR) : Term-End Examination June, 2010Sougata ChattopadhyayNo ratings yet

- CCP402Document30 pagesCCP402api-3849444No ratings yet

- Annexure I Standardised Format For LCDocument5 pagesAnnexure I Standardised Format For LCNishit MarvaniaNo ratings yet

- International Trade Course 3Document34 pagesInternational Trade Course 3Sudershan ThaibaNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Chapter 4 SolutionDocument104 pagesChapter 4 SolutionJames Clear0% (1)

- ISDA Section 08 Rate Sets and SettlementsDocument21 pagesISDA Section 08 Rate Sets and Settlementsswinki3No ratings yet

- Treatment Report: Well: KTC1Document4 pagesTreatment Report: Well: KTC1jose perozoNo ratings yet

- Ifrs 16 SimulationDocument7 pagesIfrs 16 SimulationSuryadi100% (1)

- $REM7Y4GDocument41 pages$REM7Y4GGilbert Ü LimNo ratings yet

- Accountancy - Additional Questions MARKING SCHEMEDocument15 pagesAccountancy - Additional Questions MARKING SCHEMEseema chadhaNo ratings yet

- Usance LC Accounting IllustrationDocument4 pagesUsance LC Accounting Illustrationkillerj911No ratings yet

- Solution Manual For Financial AccountingDocument53 pagesSolution Manual For Financial AccountingPhương ĐinhNo ratings yet

- Cash Balance Per Bank Versus Per BookDocument6 pagesCash Balance Per Bank Versus Per BookSyrill CayetanoNo ratings yet

- Libor Forward RatesDocument17 pagesLibor Forward RatesKofikoduahNo ratings yet

- Investment Decision Rule For ItDocument2 pagesInvestment Decision Rule For ItIzzahIkramIllahiNo ratings yet

- LD - Pd-Technical Specification DocumentDocument16 pagesLD - Pd-Technical Specification DocumentRavi ShankarNo ratings yet

- Corporate Finance: Class Notes 9Document21 pagesCorporate Finance: Class Notes 9Sakshi VermaNo ratings yet

- Contrato de Compra Venta de BitcoinsDocument9 pagesContrato de Compra Venta de BitcoinsRicardo Pedraza100% (1)

- International Financial Management 7Th Edition Eun Solutions Manual Full Chapter PDFDocument37 pagesInternational Financial Management 7Th Edition Eun Solutions Manual Full Chapter PDFDeniseWadeoecb100% (10)

- Answers To Warm-Up Exercises: AnswerDocument21 pagesAnswers To Warm-Up Exercises: AnswerMeyzla Ativa HuslikNo ratings yet

- June Grade 10 PDFDocument7 pagesJune Grade 10 PDFBasetsana MakuaNo ratings yet

- Bachelor'S Degree Programme Term-End Examination December, 2012 Elective Course: Commerce Eco-14: Accountancy-IiDocument8 pagesBachelor'S Degree Programme Term-End Examination December, 2012 Elective Course: Commerce Eco-14: Accountancy-IiRohit GhuseNo ratings yet

- International Financial Management Eun 7th Edition Solutions ManualDocument16 pagesInternational Financial Management Eun 7th Edition Solutions ManualJessicaJohnsonqfzm100% (50)

- 11-Guipos2020 Part2-Observations and RecommDocument67 pages11-Guipos2020 Part2-Observations and RecommKurt Fuentes CajetaNo ratings yet

- Internal ReconsrtuctionDocument33 pagesInternal ReconsrtuctionRenuNo ratings yet

- Financial Accounting - B, Com Sem I NEP 2022 PDFDocument6 pagesFinancial Accounting - B, Com Sem I NEP 2022 PDF『SHREYAS NAIDU』No ratings yet

- 1.7M BTC JPMORGAN T089 MT103 (International) or Wire USA OctDocument14 pages1.7M BTC JPMORGAN T089 MT103 (International) or Wire USA OctJose Lahoz100% (1)

- International Financial Management 7th Edition Eun Solutions ManualDocument16 pagesInternational Financial Management 7th Edition Eun Solutions Manualaprilhillwoijndycsf100% (26)

- Tax RevDocument8 pagesTax RevmayNo ratings yet

- Accounting Principles: The Recording ProcessDocument51 pagesAccounting Principles: The Recording ProcessMd. Saadman Sakib 2115420660No ratings yet

- Appendix 10.1 Certificate of Inward Remittance (Cir) of Foreign Exchange No. Ccyy-Nnnnnn-BbbbbbbbbbbDocument4 pagesAppendix 10.1 Certificate of Inward Remittance (Cir) of Foreign Exchange No. Ccyy-Nnnnnn-BbbbbbbbbbbRalph AcobaNo ratings yet

- Partnership DissolutionDocument8 pagesPartnership DissolutionEmmanNo ratings yet

- AP14e ch03 Solutions ManualDocument5 pagesAP14e ch03 Solutions Manual22004079No ratings yet

- Government Accountancy and Financial Management Information SystemDocument86 pagesGovernment Accountancy and Financial Management Information SystemJessie MendozaNo ratings yet

- Liquidity Monitoring Framework-Liquidity Monitoring FrameworkDocument6 pagesLiquidity Monitoring Framework-Liquidity Monitoring Frameworkbinodkhatri202No ratings yet

- Lecture 2Document43 pagesLecture 2Arju LubnaNo ratings yet

- RMC No. 124-2020Document6 pagesRMC No. 124-2020Raine Buenaventura-Eleazar100% (2)

- Survey of Accounting 1St Edition Kimmel Solutions Manual Full Chapter PDFDocument77 pagesSurvey of Accounting 1St Edition Kimmel Solutions Manual Full Chapter PDFzanewilliamhzkbr100% (7)

- Basel 3 LiquidityDocument22 pagesBasel 3 Liquiditytuananh6990No ratings yet

- 1.7M BTC JPMORGAN T089 MT103 (International) or Wire USA December 6 2018Document14 pages1.7M BTC JPMORGAN T089 MT103 (International) or Wire USA December 6 2018Jose Lahoz100% (1)

- Reserve Bank of IndiaDocument11 pagesReserve Bank of Indiaprateek17000No ratings yet

- CAIIB ABFM Module B Mini Marathon 2Document21 pagesCAIIB ABFM Module B Mini Marathon 2Nandagopal KannanNo ratings yet

- Mold-Masters Luxembourg Holdings S.À R.L.Document46 pagesMold-Masters Luxembourg Holdings S.À R.L.Daniel HrbáčNo ratings yet

- Chapter 10 Management of Translation Exposure Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument18 pagesChapter 10 Management of Translation Exposure Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsOyeleye TofunmiNo ratings yet

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument24 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualBillyBishoptpyc100% (51)

- Bangko: SentralDocument15 pagesBangko: SentralJun MiralNo ratings yet

- Load Value No. of InstlDocument12 pagesLoad Value No. of Instlsanjeev chawlaNo ratings yet

- 8-5 BTC ESCROW - AS EditsDocument16 pages8-5 BTC ESCROW - AS EditsThomas Dye100% (1)

- Accounting Principles: The Recording ProcessDocument51 pagesAccounting Principles: The Recording ProcessS. M. Fahmidunnabi 2035150660No ratings yet

- Brazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsFrom EverandBrazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsNo ratings yet

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet