Professional Documents

Culture Documents

2023-07-31-AUSS - OL-BuySellSignals Resea-Austevollafood Sinks 14 in 2023-103225804

Uploaded by

César Eliazar Romero AlvarezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023-07-31-AUSS - OL-BuySellSignals Resea-Austevollafood Sinks 14 in 2023-103225804

Uploaded by

César Eliazar Romero AlvarezCopyright:

Available Formats

Norway Edition Monday, July 31, 2023

Austevollafood (AUSS) down 14% in 2023 NOK76.15

Austevollafood sinks 14% in 2023

Austevoll Seafood ASA's stock price sunk NOK12.30 (or 13.9%) In this Report:

year-to-date (YTD) in 2023 to close at NOK76.15. Highlights: (Click tab for direct access) Page

Compared with the Oslobors Benchmark Index which has risen DATA & ARCHIVE DOWNLOAD CENTER 1

4.7% YTD, this is a relative price change of -18.6% for The Past Quarter

Austevollafood shareholders. Financials 3

Press Releases and Corporate Wire 4

Austevollafood is Norway's 5th largest Food Products company

Bearish Signals 7

by market cap.

Ongoing Bearish Parameters 7

Average daily volume of 208,292 shares so far in 2023 was 0.9 Bullish Signals 12

times the average daily volume in 2022. Ongoing Bullish Parameters 15

Corporate Profile 19

Fig 1: Primary Exchange and Other Financials FY 2022 19

Listings: Trading Currency and Dividend 21

Volume Top Management and Board of Directors 21

Financials as Reported FY 2022, Past 7 Years 22

Curren ADV Peer Comparison & Ranking of AUSS 25

Exchange Ticker Last Vol % of Total

cy T Currency Synopsis: Norwegian Krone (NOK) 29

Oslobors AUSS NOK 76.15 254,4 96.0 OTHER LISTINGS AND STOCK IDENTIFIERS 30

39 Historical Perspective 30

Frankfurt Z85 EUR 6.74 1,326 4.0 Credit Rating Summary: NORWAY 31

Total 100.00 Index 31

Glossary 33

1 NOK [Norwegian Krone]= 0.089 EUR Note also:

ADVT= Avg. Daily Volume of Trading; VI= Volume Index (1 is avg)

Section Headers and Figures are mapped as Bookmarks in the PDF menu

(left, top)

Fig 2: Activities Last Updated: Wednesday, July 05, 2023

Austevoll Seafood group is a significant player in pelagic fishery,

fishmeal/oil production, processing of fish for human

consumption, sale of fish products and salmon farming. It is

Norway's 5th largest Food products company by market

capitalisation.

DATA & ARCHIVE DOWNLOAD CENTER

AUSS: EXCEL TABLES ARE AVAILABLE TO EXPORT DATA:

• PRICE VOLUME - 5-YEAR HISTORY

• FINANCIALS - 7-YEAR HISTORY [INCLUDING FY 2022]

• PEER COMPARISON - STOCK IN FOOD PRODUCTS SECTOR AND STOCK IN INDICES

AUSS: LINKS IN HTML TO FURTHER INFORMATION:

• NEWS ARCHIVES - AUSS PAST 3 YEARS IN HTML

• PRICE VOLUME CHARTS IN HTML

• USD vs NOK EXCHANGE RATE CHARTS IN HTML

www.BuySellSignals.com . . @selltipsdotcom Index and Glossary at end of this Report.

Norway Edition Monday, July 31, 2023

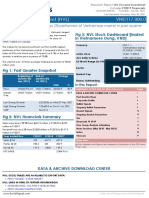

Fig 3: AUSTEVOLLAFOOD (AUSS) Stock Dashboard [traded in Norwegian

Krone, NOK] End-of-Day

Exchange NORWEGIAN [Oslobors]

Currency 1.000 USD = 10.2 Norwegian Krone

(NOK)

Jul 31, 2023 NOK76.15

EPS (FY2022) NOK12.34

AUSS P/E Stock 6.2; Sector 13.9

AUSS Dividend Yield % (TTM) Stock 7.2; Sector 4.6

DPS (past 12 months) NOK6

EPS Growth (FY2022 vs FY2021) 25.7%

Ave Daily Volume 241,348 shares

52-Week Price Range 61.94 - 116.15

Sector Food Products

Market Cap NOK15 billion [US$2 billion]

Shares Outstanding 202,717,374

AUSS in Indices OBSFX SEAFOOD NR, OBSFX SEAFOOD

PR [of 9 stocks]

PVNOK1000 (1 yr) NOK722

PVUS$1000 (1 yr) US$692*

*If You Invested $1,000 in Austevollafood a year ago, This is How Much You Would Have Today: $692. USD1000 would have bought

NOK9,660 for 86.4 shares (@the then price of 111.81) worth NOK722 @76.15 today. Dividends reinvested are worth $40.

Fig 4: Past Quarter Snapshot

Beginning of Quarter (28 End-of Quarter (31 Jul, 2023) Change

Apr, 2023)

NOK %

Price NOK94.46 NOK76.15 -17.18 -18.4

Market Cap NOK1.9 billion NOK1.5 billion -393.8 million -18.4

P/E 14.0 6.2

Dividend Yield % 4.5 7.2

Low During Quarter 70.95 on Mon 10 Jul, 2023

High During Quarter 95.41 on Tue 02 May, 2023

VWP 82.6

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 2

Norway Edition Monday, July 31, 2023

Fig 5: LONG-TERM FUNDAMENTAL RANKING: 4 OUT OF 5 [5 is best]

Austevollafood is ranked number 5 out of 13 listed food products

companies in the Norway with a market capitalization of

NOK15.4 billion ($1.5 billion).

In the food products companies it has the 3rd highest total

assets and 2nd highest revenues.

Within its sector it has a relatively low P/E of 6.2, low P/E/G of 0.24

and low Price/Sales of 0.5.

It has a strong relative ROE of 15.2% and ROA of 8.9%. Finally, its

earnings growth in the past 12 months has been a comparatively

high 25.7%.

Stocks are scored on a set of parameters reflecting fundamental

analytical tools involving valuation, size and financial

performance. They are ranked according to the average values

of those parameters. The highest ranking is 5 and the lowest

ranking is 1.

The Past Quarter: Financials

Fig 6: AUSS Financials Summary: EPS up 25.7% to NOK12.34 in FY2022 [ y.e.

31 Dec 2022]

Net profit was up 25.6% from $195.8 million in FY2021 to $245.9 million in FY2022.

Earnings Per Share (EPS) was up 25.7% from NOK9.82 in FY2021 to NOK12.34 in FY2022.

Year ended Dec FY2022 FY2021 FY2020

Sales ($ B) 3.1 2.6 2.2

Pretax ($ M) 536.1 432.2 101.5

Net ($ M) 245.9 195.8 48.8

EPS (NOK) 12.34 9.82 4.55

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Source: Annual/Quarterly Report Page 3

Norway Edition Monday, July 31, 2023

The Past Quarter: Press Releases and Corporate Wire

Fig 7: Press Releases and Corporate Wire

May 25: Austevollafood: Ex dividend NOK 5.50 today

The shares in Austevoll Seafood ASA will be quoted ex-dividend NOK 5.50 per share as of today, 26 May 2023.

This information is subject to the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

Source: Oslo Bors

May 25: Ordinary General Meeting held in Austevoll Seafood ASA

The Ordinary General Meeting of the shareholders of Austevoll Seafood ASA was held at 10:00 hours today, 25 May 2023. All items

were resolved in accordance with the Boards Calling Notice and the Nomination Committee's recommendations.

The General Meeting approved to distribute a dividend of NOK 5.50 per share. The dividend will be paid on 9 June 2023 and shall

be paid to the shareholders who are registered shareholders of Austevoll Seafood ASA as of 25 May 2023.

The shares in Austevoll Seafood ASA will be quoted ex-dividend from 26 May 2023.

Please see attached translated copy of the minutes of the Ordinary General Meeting in Austevoll Seafood ASA 25 May 2023.

This information is subject of the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

Source: Oslo Bors

May 04: Notice of Ordinary General Meeting of Austevoll Seafood ASA

Please find attached the Notice of Ordinary General Meeting of Austevoll Seafood ASA. The Ordinary General Meeting will be held

on Thursday 25 May 2023 at 10.00 a.m. CET as a digital meeting.

The Notice will be posted electronically or by mail to all shareholders. Notice of General Shareholders' Meeting and related

documents are also available at www.auss.no The Annual Report 2022 was published 28 April 2023 and is available on the

company's web site www.auss.no

This information is subject to the disclosure requirements pursuant to Section 5-12 of the Norwegian Securities Trading Act.

Source: Oslo Bors

May 10: Austevollafood : Chairman's Statement

DEAR STAKEHOLDERS

Over time Austevoll Seafood ASA (AUSS) has focused on building a strong organisation, ensuring that all participants in our group of

companies (Group) have organisations well prepared to solve challenges and difficult and changing conditions. Following

challenging years in 2020 and 2021 with many restrictions related to the covid 19 pandemic, restrictions were lifted during the first

quarter of 2022. Special situations call for extraordinary efforts and put organisations to the test and we are proud of the effort, the

flexibility and adaptability that our employees have shown during the challenging pandemic years.

2022 was a record year for the Group with an EBITDA in excess of NOK 6.8 billion including 50% of Pelagia. 70% of our result came

from our salmon and whitefish activity in Leroy Seafood Group ASA (LSG), and 30 % came from the remaining pelagic activity in the

Group achieving for the first time an EBITDA in excess of NOK 2 billion. We are pleased with the financial performance of all our

pelagic activities in both South America and the North Atlantic.

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 4

Norway Edition Monday, July 31, 2023

In 2022, the salmon industry harvest volumes decreased by 1% to approx. 2.86 million tonnes, compared with 2.89 million tonnes in

2021. Harvest volumes in Norway decreased by 2.6%, and the average spot prices for 2022 were up 38.5% (NOK 79 per kg)

compared with 2021 prices (NOK 57 per kg). LSG earnings were stronger than in 2021. However, LSG experienced a setback in terms

of volumes harvested. From a harvest volume of 187,000 tonnes in 2021, LSG's harvest volume of salmon and trout fell 6%, to 175,000

tonnes, in 2022. While LSG was able to reduce fish mortality in 2021 compared to 2020, this trend was reversed in 2022. Several

projects and actions have been implemented to reduce mortality, increase growth speed, and reach LSG's targeted harvest

volume of 205,000 tonnes in 2025.

For whitefish, the total volume caught was 71,700 tonnes in 2022 which is on par with 71,500 tonnes in 2021.

May 10: Austevollafood : Outlook

OUTLOOK

Atlantic salmon and trout, and whitefish LSG works to develop an efficient and sustainable value chain for seafood. This not only

provides cost-efficient solutions, but also quality, availability, a high level of service, traceability and competitive climaterelated and

environmental solutions.

The Group is not satisfied with the development in growth in the farming operations in the second half of 2022, and a raft of

measures have been implemented throughout the segment's value chain. These measures are expected gradually to generate

positive effects. At the same time, cost inflation for input factors will continue to manifest itself in 2023. Release from stock costs for

the present year are therefore expected to be higher than in 2022. For its consolidated operations, LSG currently estimates a harvest

volume of around 175,000 tonnes in 2023. The Group's share from the joint venture is forecast to be approx. 18,500 tonnes. LSG's total

harvest volume in 2023 is expected to be in the region of 193,500 tonnes.

The cod quota is down 15% and the haddock quota up 8% compared to 2022. For saithe caught north of 62 degrees, the quota has

been increased by 11%, while the quota for saithe in the North Sea is up 19%. The quotas for other species such as redfish and

Greenland halibut are unchanged from 2022.

Investments - leading to good, full-year jobs - in downstream entities in recent years, including in a new industrial facility for Leroy

Midt, a new factory in Stamsund and new factories in Spain, the Netherlands and Italy, are expected to make a positive

contribution going forward. Political risk for LSG's value chain has increased, but the Group has a clear ambition to grow operating

profit in this segment in the years ahead. This risk was laid bare on 28 September 2022 when the Norwegian government and Ministry

of Finance tabled their resource rent proposal, which is detrimental to the industry.

June 06: Austevoll Seafood ASA: Bond Mandate Announcement and Fixed Income Investor Calls

Austevoll Seafood ASA, rated BBB- (stable) by Nordic Credit Rating, has mandated Pareto Securities AS and Nordea Bank Abp, filial i

Norge as Joint Lead Managers, to arrange a series of fixed income virtual investor meetings. One or more NOK-denominated senior

unsecured bond issues with expected tenors of 5-7 years, with preference for longer dated tenors, may follow, subject to inter alia

market conditions.

Source: Oslo Bors

May 31: Austevoll Seafood ASA assigned an investment grade rating from Nordic Credit Rating

Nordic Credit Rating ("NCR") has on June 1st 2023 assigned an "BBB-" long term issuer credit rating on Austevoll Seafood ASA ("AUSS")

with a "stable outlook".

The full report is available at https://nordiccreditrating.com/issuer/austevoll-seafood-asa

The credit rating confirms the Group and parent company's financial position and underpins continued continuity in financing at

competitive terms.

Source: Oslo Bors

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 5

Norway Edition Monday, July 31, 2023

May 15: Financial report Q1 2023

Group operating revenue in Q1 2023 totalled NOK 8,002 million, compared with NOK 6,565 million in Q1 2022, an increase of 22%.

The growth in revenue comes from the farming companies and is driven by strong prices as well as by the weak Norwegian krone.

Operating EBIT in Q1 2023 was NOK 1,249 million, against NOK 1,132 million in Q1 2022. Inflation over the past year means higher

prices for the Group's products but also for virtually all input factors, impacting costs. The operating EBIT margin for Q1 2023 was 16%,

compared with 17% in Q1 2022. The growth in earnings comes from the farming companies as well as the joint ventures and

associates.

Norskott Havbruk AS and Pelagia Holding AS are joint ventures and the two largest associates. Income from associates before fair

value adjustment related to biological assets in Q1 2023 totalled NOK 75 million (Q1 2022: NOK 59 million). The equivalent figure

including fair value adjustment of biological assets was NOK 66 million (Q1 2022: NOK 129 million). Pelagia has continued its positive

development and improved its Q1 results compared with Q1 2022. Cost focus/rationalisation, growth and good sales volumes for

finished products combined with higher prices realised for fishmeal, protein concentrate and fish oil all contributed to the earnings

improvement. However, Norskott's earnings continued to be affected by the challenging biological situation in the second half of

2022. The Group's joint ventures and associates have generated good results over time, are significant enterprises in their segments

and represent substantial values for Austevoll Seafood ASA. Please refer to note 5 for more detailed information on associates.

Operating profit after fair value adjustment of biological assets and income from joint ventures and associates totalled NOK 1,679

million in Q1 2023 (Q1 2022: NOK 1,383 million).

Fair value adjustment related to biological assets was NOK 460 million.

May 08: Austevollafood: Invitation to presentation of results for Q1 2023

Austevoll Seafood ASA will present its results for Q1 2023 on 16 May 2023 at 09:00 a.m. CET at Hoyres Hus Konferanse &

Selskapslokaler, Emil Stang, Stortingsgata 20, Oslo.

The presentation will be held in Norwegian followed by a Q&A session. You may alternatively follow the Norwegian presentation

and submit questions through a live broadcast available on www.auss.no.

The quarterly report and presentation will be published at 07:00 a.m. CET.

A recording of the presentation in English will be available from 12:00 p.m. CET on www.auss.no.

The presentation will be held by CEO Arne Mogster and CFO Britt Kathrine Drivenes.

This information is subject to the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

Source: Oslo Bors

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 6

Norway Edition Monday, July 31, 2023

Bearish Signals

Fig 8: Rank in the bottom 21% by Price Performance in the Norwegian

market

Description Value Rank

Rel Strength 6 mo 22 In Bottom 21%

Downtrend

Beta < 1 combined with price fall. The Beta of the stock is 0.6.

Price/Moving Average Price of 0.93 and negative MACD:

• The Price/MAP 200 for Austevollafood is 0.93. Being less than 1 is a bearish indicator. It is lower than the Price/MAP 200 for the

Oslobors Benchmark Index of 1.03, a second bearish indicator. The stock is trading below both its MAPs and the 50-day MAP of

NOK79.01 is lower than the 200-day MAP of NOK82.29, a third bearish indicator. The 200-day MAP has decreased to NOK82.29,

a fourth bearish indicator.

• The Moving Average Convergence Divergence (MACD) indicator of 12-day Exponential Moving Average (EMA) of 74.55 minus

the 26-day EMA of 74.99 is negative, suggesting a bearish signal.

Trailing Relative Strength (6 months) at 22 percentile:

• The stock has a 6-month relative strength of 22 in the Norwegian market of 318 stocks and 1 preference stock indicating it is

trailing 78% of the market.

Other Bearish Signals

• Total Liabilities/EBITDA of 5.4 is more than 5, this compares unfavourably with the Joseph Piotroski benchmark of 5.

Overbought/Bearish Signals

• The stock is overbought according to the Williams % R indicator of -16.5, suggesting the price is close to its 14-day high of

NOK77.05.

Ongoing Bearish Parameters

Fig 9: Rank in the bottom 24% by Growth in the Norwegian market

Description Value Rank

EPS Growth % 25.7 In Bottom 24%

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 7

Norway Edition Monday, July 31, 2023

Fig 10: Present Value of NOK1000 Invested in the Past [3 Mo, 1 Yr]; The

Worst Periods with PVNOK1000 < 866

PVNOK1,000 3 mo ago 1 yr ago

AUSS.OB NOK865 NOK722

Food Products sector NOK867 NOK13,947

Oslobors Benchmark Index NOK1,052 NOK993

Fig 11: The Worst Periods [3 Mo, 1 Yr] with Price Change % < -18.3

1-Year price change of -31.9% for Austevollafood underperformed the change of -0.7% in the Oslobors Benchmark Index for a

relative price change of -31.2%.

Price Change % Quarter Year

Austevollafood -18.4 -31.9

Food Products sector -13.3 1,294.7

Oslobors Benchmark Index 3 -0.7

Fig 12: Moving Annual Return of -27.0% in the past year

Moving Annual Return was -27.0% in the past year. Based on a Quotes from Legends: Annual Return

dynamic start date of 5 years ago, the real rate of return has

averaged 4%. The Moving Annual Return has been negative in 3

out of 5 years.

Dividen Capital Annual

Close %

AUSS ds Gain / Return

(NOK) Yield

(NOK) (Loss) % %

Jul 31 76.15 5.5 (31.9) 4.9 (27.0)

1 Yr ago 111.81 4.5 8.6 4.4 13.0

2 Yrs ago 102.95 3.5 47.2 5 52.2

3 Yrs ago 69.92 2.5 (13.1) 3.1 (10.0)

4 Yrs ago 80.47 3.5 (11.9) 3.8 (8.0)

Close 5 years ago NOK91.31

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 8

Norway Edition Monday, July 31, 2023

Fig 13: Annualised Period-based Total Shareholder Returns [TSR %]: The

Worst Period with TSR < -27.7%

TSR % 1 yr

AUSS.OB -27.8

Fig 14: Declining Volume, down 24% in 5 years

In the past five years, Average Daily Volume of Trading (ADVT)

has decreased 24.0% to 241,348 shares.

Avg. Daily Volume Traded 12 months ended Jul 31, thousand

shares

Year ADVT

2023 241.3

2022 200.7

2021 228.5

2020 271.8

2019 317.7

Fig 15: Declining VWAP, down 9% in 5 years

In the past five years Volume Weighted Average Price (VWAP)

has decreased by 8.8% to NOK81.93. Based on a dynamic start

date of five years ago, there have been declines in VWAP in 2

out of 5 years.

Past five years, 12 months ended Jul 31 (NOK)

Year High Price VWAP Low Price

2023 116.15 81.93 61.94

2022 137.51 110.22 87.5

2021 109.43 82.1 56.23

2020 83.67 71.91 55.65

2019 115.42 89.79 29.06

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 9

Norway Edition Monday, July 31, 2023

Fig 16: Declining share turnover, down 31% in 5 years

In the past five years, average daily share turnover has

decreased 30.7% to NOK19.7 million ($1.9 million). This suggests

decreased liquidity.

Past five years, 12 months ended Jul 31 (NOK million)

Year Average Daily Turnover

2023 19.7

2022 21.6

2021 18.7

2020 19.5

2019 28.4

Fig 17: Lagging Relative Strength

The relative strength for 180 days, 90 days and 30 days has been Quotes from Legends: Relative Strength

consistently under a benchmark of 70 percentile; indicating it is

lagging the better-performing stocks in the Norwegian market.

Fig 18: % Change (Tr. 12 Mo): Stock (-31.9%) v Index (-0.7%)

In the past 12 months Austevollafood has underperformed the Oslobors Benchmark Index by 31.2%.

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 10

Norway Edition Monday, July 31, 2023

Fig 19: Price < Moving Avg Price

In the last 30 days the 200-day Moving Avg Price has exceeded Quotes from Legends: Moving Average Price

the share price on 22/22 days; a bearish signal.

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 11

Norway Edition Monday, July 31, 2023

Fig 20: Global Rank [out of 46,572 stocks]

Description Value Rank Quartile

MCap ($ B) 1.5 6,822 Top

Total Assets ($ B) 4.7 4,738 Top

Revenue ($ B) 3.1 3,593 Top

Net Profit ($ M) 244.8 3,569 Top

Return on Equity % 15.2 7,826 Top

Net Profit Margin % 13.7 9,001 Top

Price to Book 0.7 7,343 Top

Price Earnings 6.1 3,144 Top

Yield % 7.3 2,998 Top

PV$1000 (1Year) $* 692 34,567 Third

$* Change (1Year) % -35.0 35,506 Bottom

Rel Strength 6 Mo ($) 25 34,838 Third

* 1 year ago USD 1 = NOK 9.66; Jul 31, 2023: USD 1 = NOK 10.2

Bullish Signals

Fig 21: PAST MONTH: WEAK MOMENTUM UP - AUSS increases 2.6% on

volume 0.7 times average

[up NOK1.90]

Austevollafood underperformed the Oslobors Benchmark Index on 12 days and outperformed it on

9 days. The price ranged between a high of NOK76.15 on Monday, 31 Jul and a low of NOK71.65

on Friday, 7 Jul.

Day Headline Price Chang Momentum Comment

[NOK] e%

Jul 31 Lifts 1.6%, hits 46-day high 76.15 1.6 Price rise on rising relative strength

Jul 28 Offers dividend yield of 7.3%, hits 42-day 74.95 -1.0 Price rise on rising relative strength

high

Jul 27 Offers dividend yield of 7.3% 75.7 3.0 Top Rise;RPC = 2.3%

Jul 26 Drops 1.3% 73.5 -1.3 Price/MAP200 below 1 and falling

Jul 25 Offers dividend yield of 7.4% 74.45 0.1 Price rise on rising relative strength

Jul 24 Drops on increasing volatility 74.35 -0.6 RPC= -1.1%

Jul 21 Offers dividend yield of 7.3%, hits 30-day 74.8 0.3 Price rise on rising relative strength

high

Jul 20 Accelerates rise, up 3.1% in 2 days 74.6 1.8 Price rise on rising relative strength

Jul 19 In 2nd consecutive rise 73.3 1.3 Price rise on rising relative strength

Jul 18 Offers dividend yield of 7.6% 72.35 0.3 RPC= -1.03%

Jul 17 Accelerates decline, down 3.1% in 2 days 72.15 -1.6 Price/MAP200 below 1 and falling

Jul 14 Drops 1.5% 73.3 -1.5 Price/MAP50 below 1 and falling

Jul 13 Offers dividend yield of 7.4% 74.45 -0.1 Price rise on rising relative strength

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 12

Norway Edition Monday, July 31, 2023

Jul 12 Accelerates rise, up 3.5% in 2 days 74.5 2.6 RPC= 1.7%

Jul 11 In 2nd consecutive rise 72.6 0.8 Price rise on rising relative strength

Jul 10 Offers dividend yield of 7.6% 72.0 0.5

Jul 07 Drops to eight-month low on firm volume 71.65 -1.1 VI*=1.2;RPC = -1.2%

Jul 06 Offers dividend yield of 7.6% 72.45 -1.9 Steepest Fall

Jul 05 Loses NOK152 million ($14 million) (1.0%) in 73.85 -1.0 VI*=1.1

MCap, steepest heavyweight fall in Food

products sector

Jul 04 Offers dividend yield of 7.4% 74.6 0.4 VI*=1.4

Jul 03 Increases on average volume 74.3 0.2 Oversold: close to 14-day low

* RPC - Relative Price Change is % price change of stock less % change of the Oslobors Benchmark Index.

VI= Volume Index, 1 is avg.

Price/Earnings of 6.2 < Food Products sector (of 14 stocks) avg of 13.9:

• The price-to-earnings ratio of 6.2 indicates undervaluation compared with sector average of 13.9 and market average of 19.1.

Price/Earnings/Growth of 0.24 < Food Products sector (of 14 stocks) avg of 1.6:

• Price/Earnings/Growth of 0.24 (based on the year-on-year growth in trailing 12 months EPS of 25.7%) versus sector average of

1.6 and market average of 1.7.

Price to Book of 0.7 < Food Products sector (of 14 stocks) average of 3.9:

• The Price to Book of 0.7 indicates undervaluation compared with sector average of 3.9 for the Food Products sector.

Relative Value Indicators: Undervaluation compared with Index averages

and bond yield

• Earnings yield of 16.2% is more attractive compared with the

Norwegian average earning yield of 5.2%.

• The earnings yield of 16.2% is 4.3 times the 10-year bond yield

of 3.8%.

(All figures in %)

Earnings Yield 16.2

Norwegian avg 5.2

Dividend Yield 7.2

Bond Yield 3.8

Dividend Yield > Bond Yield of 3.78%:

The dividend yield of 7.22% is 1.91 times the triple-A bond yield of

3.78%. The times factor of 1.91 is above the benchmark factor of

0.67 times set by Benjamin Graham.

(All figures in %)

Dividend Yield 7.22

Bond Yield 3.78

Spread 3.44

3-DAY: WEAK MOMENTUM UP

AUSS increases 3.6% on below average volume 0.9 times average. Compared with the Oslobors Benchmark Index which rose 13.9

points (or 1.1%) in the 3-days, the relative price increase was 2.5%.

Austevollafood (AUSS) outperformed the Oslobors Benchmark Index in 2 out of 3 days. The price ranged between a high of

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 13

Norway Edition Monday, July 31, 2023

NOK76.15 on Monday Jul 31 and a low of NOK74.95 on Friday Jul 28.

Jul Austevollafood Close [NOK] Change % Comment

Mon 31 Lifts 1.6%, hits 46-day high 76.15 1.6 Price rise on rising relative strength

Fri 28 Offers dividend yield of 7.3%, hits 42- 74.95 -1.0 Steepest Fall

day high

Thu 27 Offers dividend yield of 7.3% 75.7 3.0 Top Rise; RPC=2.3%

* RPC - Relative Price Change is % price change of stock less % change of the Oslobors Benchmark Index.

Fig 22: Rank in the top 24% by Relative Valuation in the Norwegian market

Description Value Rank

Price to Sales 0.5 In Top 16%

P/E * P/NTA 4.2 In Top 18%

Price to Book Value 0.7 In Top 24%

Uptrend

Past Quarter:

The Best 3 weeks in the past quarter

The past month witnessed the best 2 weeks in the past quarter. In the past quarter the week beginning Monday May 08 saw the

highest weekly rise of 4.2% for a relative price increase of 3.5%.

Mon-Fri Change % Oslobors Benchmark Index Change % Vol Ind [1 is avg]

May 08-12 4.2 0.7 1

Jul 10-14 2.3 0.2 0.6

Jul 17-21 2 2.5 0.6

Other Bullish Signals

• Return on Equity of 15.2% versus sector average of 11.2% and market average of 7.2%.

• Return on Assets of 8.9% versus sector average of 5.9% and market average of 2.3%.

• Return on Capital Employed of 13.5% versus sector average of 11.3% and market average of 0.7%.

MCap/Total Assets:

• Tobin's Q Ratio, defined as MCap divided by Total Assets, is 0.3. Compared with the rest of the market the stock is undervalued

and ranks in the top quartile of stocks by value of Q Ratio.

• Net profit margin has averaged 10.1% in the last 3 years. This is better than the sector average of 9.8% and suggests a high

margin of safety.

• As per the Du Pont analysis, Return on Equity of 15.2% is better than sector average of 11.2%. This is computed as net profit

margin of 13.7% times asset turnover [sales/assets] of 0.65 times leverage factor [total assets/shareholders' equity] of 1.7.

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 14

Norway Edition Monday, July 31, 2023

Ongoing Bullish Parameters

Fig 23: Growth in annual dividends per share and earnings per share

• Austevollafood sees dividend rise for a third consecutive year

Austevollafood reported dividends per share of NOK5.50 in the past year, up 22.2% from the previous year. This is the third

consecutive dividend increase. In the past 3 years average annual compound growth rate of dividends was 30.1%.

- EPS growth [FY2022 vs FY2021] of 25.7%:

FY EPS (NOK) Growth %

2022 12.34 25.7

2021 9.82 115.8

Fig 24: Rank in the top 16% by Size in the Norwegian market

Description Value Rank

Annual Revenue NOK31.2 billion ($3.1 billion) In Top 7%

MCap $2 billion In Top 14%

Ave daily Turnover NOK15.7 million ($1.5 million) In Top 16%

Fig 25: Present Value of NOK1000 Invested in the Past 3 Years; The Best

Period with PVNOK1000 > 1,238

PVNOK1,000 3 yrs ago

AUSS.OB NOK1,239

Food Products sector NOK18,415

Oslobors Benchmark Index NOK1,507

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 15

Norway Edition Monday, July 31, 2023

Fig 26: Annualised Period-based Total Shareholder Returns [TSR %]: The

Best Periods with TSR > 7.2%

TSR % 3 yrs 10 yrs

AUSS.OB 7.3 16.1

Fig 27: P/E/G < 1

The price earnings ratio of 6.2 divided by trailing twelve months Quotes from Legends: P/E/G < 1

eps growth of 25.7% corresponds to an attractive P/E/G of 0.2

times; being less than the value benchmark of 1.0.

EPS Growth (%) 25.66

P/E/G 0.24

P/E 6.17

Fig 28: Improved EBIT Margins

EBIT margin is positive and has increased from 16.5% to 17.4% in Quotes from Legends: EBIT Margin

the past year.

FY EBIT Margins (%)

2022 17.4

2021 16.5

2020 4.6

2019 11.8

2018 18.7

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 16

Norway Edition Monday, July 31, 2023

Fig 29: Low Debt to Equity (%) and Reducing

The debt to equity ratio of 37.9% is under a safe benchmark Quotes from Legends: Debt to Equity

figure of 50%. Moreover, it has improved from 41.2% a year ago.

Years Debt to Equity (%)

Dec 2022 37.86

Dec 2021 41.23

Dec 2020 38.38

Dec 2019 35.15

Fig 30: Satisfies six criteria of Benjamin Graham

• The P/E of 6.2 multiplied by the P/NTA of 0.7 is 4.2. Being less than the Benjamin Graham benchmark of 22.5 the stock appears

undervalued.

• "An earnings-to-price yield of at least twice the triple-A bond"; the stock's earning yield of 16.2% is 4.3 times the triple-A bond

yield of 3.8%.

• The P/E of 6.2 is 0.1 times the highest average P/E of 44.9 in the last five years. This is a value criterion, according to Benjamin

Graham who described as a value criterion "A P/E ratio down to less than four-tenth of the highest average P/E ratio the stock

attained in the most recent five years".

• "A dividend yield of at least two-thirds the triple-A bond yield"; the stock's dividend yield is 1.9 times the triple-A bond yield of

3.8%.

• "Total debt less than tangible book value"; total debt of NOK10.7 billion (US$1.1 billion) is less than tangible book value of

NOK22.6 billion (US$2.3 billion).-"Current ratio of two or more"; current assets are 2.4 times current liabilities.

• "Total debt equal or less than twice the net quick liquidation value"; total debt of NOK10.7 billion (US$1.1 billion) is 1.3 times the

net liquidation value of NOK8.27 billion (US$844.7 million).-"Stability of growth in earnings over the last 5 years, defined as no

more than two declines of 5% or greater in year-end earnings";there have been 2 declines in earnings in the last 5 years.

Fig 31: Satisfies 7 out of 9 criteria of Joseph Piotroski [pass mark 5]

• Positive net income.

• Positive operating cashflow.

• Return on Assets improvement [from 7.9% to 8.9%].

• Good quality of earnings [operating cashflow exceeds net income].

• Total shares on issue unchanged.

• Improvement in gross margin [from 46.9% to 47.7%].

• Improvement in asset turnover [growth in revenue of 14.4% exceeded growth in assets of 9.8%].

But does not meet the following 2 criteria of Joseph Piotroski:

• Improvement in long-term debt to total assets.

• Improvement in current ratio.

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 17

Norway Edition Monday, July 31, 2023

Fig 32: Year-over-year (%) Change in Dividend

Final dividend for FY 2022 was NOK5.50. The year-on-year change

was up 22.2% from NOK4.50 in the previous year FY 2021.

Final FY 2021 FY 2022

Dividend (NOK) 4.5 5.5

Fig 33: Turnover Period Above Average

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 18

Norway Edition Monday, July 31, 2023

Corporate Profile

Fig 34: Contact Details

Website http://www.auss.no

Physical Address Alfabygget, Storebo 5392

Phone 4756181000

Email info@auss.no

Fig 35: Industry & Sector [of 25 stocks]

Classification Level Name of Sector

Business Sector Food & Beverages

Economic Sector Consumer Non-Cyclicals

Financials FY 2022

Fig 36: Financials, FY 2022 [year-ended 31 December 2022 ]

Austevollafood EPS Growth slows to 26%

Release Date: May 02, 2023

Austevollafood (OB:AUSS), announced EPS of NOK12.34 ($1.26) for the year-ended 31 December 2022 [FY2022], up 26% from

NOK9.82 ($1.11) in the previous year-ended 31 December 2021 [FY2021]. EPS growth from the year-ended 31 December 2020

[FY2020] to the year-ended 31 December 2021 [FY2021] was 116%.

Fig 37: Annual growth in Revenue, Net Profit and EPS

31 December 31 December

Year-ended

[FY/2022] [FY/2021]

Revenue, NOK Billion 31.2 26.6

Revenue, $ Billion 3.2 2.7

Growth in Revenue % 17.3 18.4

Net Profit, NOK Billion 2.5 2.0

Net Profit, $ Million 254 203

Growth in Net Profit % 25.6 301.1

EPS, NOK 12.34 9.82

Growth in EPS % 25.7 115.8

Major changes compared with previous year (FY2022 vs FY2021):

Favourable Changes:

• Net profit up 25.6% from NOK2.0b ($224.8m) to NOK2.5b ($254.4m)

• Sales revenue up 17.3% from NOK26.6b ($3.0b) to NOK31.2b ($3.2b)

• EPS up 25.7% from NOK9.82 ($1.11) to NOK12.34 ($1.26)

• EBIT Margin up from 16.5% to 17.4%

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Source: Annual/Quarterly Report Page 19

Norway Edition Monday, July 31, 2023

• EBIT to total assets up from 10.0% to 11.3%

Unfavourable Changes:

• Current ratio down 13% from 2.8 to 2.4

• Working capital to total assets down from 24.0% to 23.0%

• Total non-current assets to Total Assets down from 62.4% to 60.6%

• Other non-current assets to Total Assets down from 21.5% to 19.8%

• Total Liabilities to EBITDA of 5.4 compares unfavourably with the Joseph Piotroski benchmark of <5. However, it has improved by

19.1% from the previous year's ratio of 6.7.

Fig 38: Year-on-year comparison of Performance Ratios [FY2022 vs FY2021]

December 31 FY2022 FY2021 Change (%)

Return on Equity (%) 15.2 13.6 Up 11.8

Return on Assets (%) 8.9 7.9 Up 12.7

Total debt to net tangible assets (%) 47.1 52.3 Down 9.9

Debt/Equity (Down 7.3% from 0.41 to 0.38) 0.4 0.4 Down 7.3

Common Size Ratios by Assets %

Current Debtors to Total Assets 7.6 6.9 Up 9.5

Long-term investments to Total Assets 7.1 7.0 Up 1.9

Non-current debtors to Total Assets 0.5 0.4 Up 30.3

Future income tax benefit to Total Assets 0.3 0.2 Up 90.4

Currency Conversion (December 31, 2022): $1 = NOK9.79

Currency Conversion (December 31, 2021): $1 = NOK8.82

Five-year record of growth and performance:

In the last 5 years Total Revenue averaged NOK25.3B, EBITDA averaged NOK3.9B and Net Profit averaged NOK3B. Compound

Annual Growth Rate (CAGR) averaged 8.4% for Total Revenue, 19.8% for Net Profit and -4.9% for EBITDA.

5-year Avg (NOK

Description Annual (NOK B) 5-year CAGR %

B)

Total Revenue 31.2 25.3 8.4

EBITDA 3.7 3.9 (4.9)

Operating Profit 5.4 3.6 19.8

Net Profit 2.5 3 19.8

Five-year record of EBITDA, Operating Profit, Net Profit, ROE, ROA and ROCE

In 2022 Net Profit Margin of 13.7% was above its 5-year Avg of 11.7% (All Figures in %)

Description 2022 5-year Avg

EBITDA Margin 11.9 15.8

Operating Profit Margin 17.4 13.8

Net Profit Margin 13.7 11.7

Return on Equity 15.2 10.5

Return on Assets 8.9 7.1

Return on Capital Employed 13.5 9.5

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Source: Annual/Quarterly Report Page 20

Norway Edition Monday, July 31, 2023

Dividend

Fig 39: Dividend History

Fig 40: Annual Dividends - Past 4

In the past 5 years annual dividends have increased by NOK2.0

years (NOK)

from NOK3.5 to NOK5.5. Based on a start date of 5 years ago,

there has been one decline in dividends over the last 5 years. Quotes from Legends: Dividends Trailing Twelve Months

Value

Date Type

(NOK)

26 May 2023 5.5 Final

Tr 12 Months 5.5

2021 - 2022 4.5

2020 - 2021 3.5

2019 - 2020 2.5

2018 - 2019 3.5

Top Management and Board of Directors

Fig 41: Top Management

Top Management [Three top executives with tenure > 13 yrs]

Name Designation Since Appointment

Helge Singelstad Chairman 13 Yrs, 7 Mos

Britt Kathrine Drivenes Chief Financial Officer 27 Yrs, 7 Mos

Arne Mogster Chief Executive Officer, President

Fig 42: Board Of Directors

Board Of Directors

Name Designation

Helge Mogster Director

Lill Maren Mogster Director

Siren Merete Gronhaug Independent Director

Hege Charlotte Bakken Independent Director

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 21

Norway Edition Monday, July 31, 2023

Financials as Reported FY 2022, Past 7 Years

Fig 43: Financials as reported (FY 2022 [year-ended 31 December 2022 ])

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

(In NOK Million, except per share data and shares outstanding)

Fig 44: INCOME STATEMENT AS REPORTED

Description NOK Million NOK Million

Dec 31 2022 2021 Change %

Revenue 31,169 26,571 Up 17.3

Other gains and losses -20 62 Deterioration

Cost of goods sold -16,294 -14,109 Deterioration 15.5

Wages and salaries -4,519 -4,064 Deterioration 11.2

Other operating expenses -4,556 -3,651 Deterioration 24.8

Operating profit before depreciation amortisation impairment 5,782 4,810 Up 20.2

and fair value adjustment of biological assets

Depreciation of fixed assets -1,038 -968 Deterioration 7.2

Depreciation of right-of-use assets -613 -566 Deterioration 8.3

Amortisation of intangible assets -81 -45 Deterioration 80.0

Impairment/reversal of impairment 1 -13 Recovery

Operating profit before fair value adjustment of biological 4,051 3,218 Up 25.9

assets

Fair value adjustment of biological assets 1,189 1,114 Up 6.7

Operating profit 5,240 4,332 Up 21.0

Income from equity-accounted investments 494 394 Up 25.4

Financial income 848 394 Up 115.2

Financial expenses -1,155 -744 Deterioration 55.2

Profit before tax 5,428 4,376 Up 24.0

-1,142 -939 Deterioration 21.6

Profit for the year 4,285 3,437 Up 24.7

Attributable to non-controlling interests 1,795 1,455 Up 23.4

Attributable to shareholders in Austevoll Seafood ASA 2,490 1,982 Up 25.6

Earnings per share/diluted earnings per share (NOK) NOK12.34 NOK9.82 Up 25.7

Proposed dividend per share (NOK) 5.5 4.5 Up 22.2

Average no. of outstanding shares 201,824,074 201,824,074 Steady

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Source: Annual/Quarterly Report Page 22

Norway Edition Monday, July 31, 2023

Fig 45: BALANCE SHEET AS REPORTED

Description NOK Million NOK Million

Dec 31 2022 2021 Change %

Assets

Goodwill 2,279 2,217 Up 2.8

Deferred tax asset 160 69 Up 131.9

Licences 9,518 9,412 Up 1.1

Trademarks 50 50 Steady

Vessels 2,628 2,385 Up 10.2

Land buildings and equipment 7,629 6,896 Up 10.6

Right-of-use assets 3,222 3,064 Up 5.2

Investments in associates and joint ventures 3,382 3,002 Up 12.7

Investments in other companies 43 47 Down 8.5

Other non-current receivables 223 168 Up 32.7

Total non-current assets 29,134 27,310 Up 6.7

Inventories 2,956 1,932 Up 53.0

Biological assets 7,972 6,173 Up 29.1

Trade receivables 2,909 2,321 Up 25.3

Other receivables 751 717 Up 4.7

Cash & cash equivalents 4,340 5,329 Down 18.6

Total current assets 18,928 16,471 Up 14.9

Total assets 48,062 43,781 Up 9.8

Equity and liabilities

Share capital 101 101 Steady

Treasury shares -18 -18 Steady

Share premium 3,714 3,714 Steady

Retained earnings 11,525 9,575 Up 20.4

Non-controlling interests 12,841 11,815 Up 8.7

Total equity 28,162 25,187 Up 11.8

Deferred tax 3,581 3,512 Up 2.0

Pension liabilities and other liabilities 13 11 Up 18.2

Borrowings 5,968 6,663 Down 10.4

Lease liabilities to credit institutions 903 1,025 Down 11.9

Lease liabilities other than to credit institutions 1,527 1,382 Up 10.5

Other long-term liabilities 30 30 Steady

Total non-current liabilities 12,021 12,623 Down 4.8

Borrowings 2,263 1,315 Up 72.1

Short-term lease liabilities to credit institutions 345 265 Up 30.2

Short-term lease liabilities other than to credit institutions 323 277 Up 16.6

Trade payables 2,380 1,921 Up 23.9

Tax payable 1,023 686 Up 49.1

Other current liabilities 1,543 1,507 Up 2.4

Total current liabilities 7,879 5,971 Up 32.0

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Source: Annual/Quarterly Report Page 23

Norway Edition Monday, July 31, 2023

Total liabilities 19,900 18,594 Up 7.0

Total equity and liabilities 48,062 43,781 Up 9.8

Fig 46: CASH FLOW AS REPORTED

Description NOK Million NOK Million

Dec 31 2022 2021 Change %

Profit before tax 5,428 4,376 Up 24.0

Taxes paid -775 -447 Deterioration 73.4

Depreciation and amortisation 1,732 1,580 Up 9.6

Impairment/reversal of impairment -1 13 Deterioration

Gain/loss on sale of land buildings and equipment -8 -62 Improved 87.1

Unrealised foreign exchange gains/losses -32 -45 Improved 28.9

Share of profit from joint ventures and associates -494 -394 Deterioration 25.4

Interest expense 431 322 Up 33.9

Interest income -79 -39 Deterioration 102.6

Fair value adjustment of biological assets -1,189 -1,114 Deterioration 6.7

Change in inventories -1,634 -87 Deterioration 1,778.2

Change in trade receivables and other receivables -523 -15 Deterioration 3,386.7

Change in trade payables 459 443 Up 3.6

Change in net pension liabilities 2 2 Steady

Change in other accruals -22 102 Deterioration

Net cash flow from operating activities 3,195 4,635 Down 31.1

Proceeds from sale of fixed assets 54 43 Up 25.6

Proceeds from sale of shares and other equity instruments 2

Purchase of intangible assets and fixed assets -1,834 -1,338 Deterioration 37.1

Purchase of shares and holdings in other companies -59 -505 Improved 88.3

Dividends received 131 114 Up 14.9

Interest received 79 39 Up 102.6

Change in other non-current receivables -55 -4 Deterioration 1,275.0

Exchange differences on invested capital 9

Net cash flow from investing activities -1,675 -1,650 Deterioration 1.5

Proceeds from new long-term interest-bearing debt 292 2,394 Down 87.8

Repayment of long-term interest-bearing debt -1,288 -2,467 Improved 47.8

Change in short-term interest-bearing debt 570 -410 Recovery

Interest paid -441 -326 Deterioration 35.3

Dividends paid -908 -706 Deterioration 28.6

Dividend paid to non-controlling interests -844 -634 Deterioration 33.1

Exchange differences on financing activities 72 21 Up 242.9

Net cash flow from financing activities -2,547 -2,128 Deterioration 19.7

Change in cash and cash equivalents -1,027 856 Deterioration

Liquid assets at 01.01. 5,329 4,463 Up 19.4

Exchange rate changes on cash and cash equivalents 38 9 Up 322.2

Liquid assets at 31.12. 4,340 5,329 Down 18.6

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Source: Annual/Quarterly Report Page 24

Norway Edition Monday, July 31, 2023

Fig 47: Download AUSTEVOLLAFOOD Financials Past 7 Years

Description (December 31) 2022 2021 2020 2019 2018 2017 2016

Income Statement

Revenue per share 154.44 131.65 93.86

EBITDA (B) 3.7 2.8 3.7 4.1 5.2 4.7 3.8

Depreciation (1.7 B) (1.6 B) 1.5 B 1.3 B 960.1 M 919.4 M (845 M)

Tax (1.1 B) (939 M) (204.6 M) (558.5 M) (369.1 M) 975 M

Net profit 2.5 B 2B 494.1 M 1.3 B 4.2 B 1B 1.6 B

EPS 12.34 9.82 4.55 6.89 9.79 8.62 8.17

Balance Sheet

Equity Share Capital (B) 15.3 13.4 12.1 12.3 19.2 18.2

Retained Earnings (B) 11.5 9.6 8.3 8.5 6 5.5

Total Debt (B) 10.7 10.4 8.8 8.2 8.7 9.2

Total Assets (B) 48.1 43.8 39.7 39.8 38 35.3 35

Current Asset (B) 18.9 16.5 14 14.9 15.2 13.7 14.7

Fixed Asset (B) 7.6 6.9 6.3 6.3 8.9 5.6 4.7

Working Capital (B) 11 10.5 8.4 9.5 15.2 8.5 9.1

Cash Flow

Operating Cash Flow (B) 3.2 4.6 2.9 3.2 3.2 4.2 3.3

Investing Cash Flow (B) (1.7) (1.6) (1.4) (1.1) (1.6) (1.6) (3.9)

Financing Cash Flow (B) (2.5) (2.1) (1.3) (2.3) (2.3) (1.3) 1.8

Net Cash Flow (1 B) 857 M 215.4 M (143.2 M) (696.7 M) 1.3 B 1.3 B

Peer Comparison & Ranking of AUSS

Fig 48: GLOBAL PEER COMPARISON: AUSS - SIZE (all figures in $)

In its Global Peer Group of 9 companies AUSS is ranked AUSS is ranked first (1) by Net Profit, second (2) by Revenue, Total Assets and

fifth (5) by MCap.

Total

Name (Code) MCap Revenue Net Profit

Assets

Rank of AUSS 5 2 1 2

Austevollafood (AUSS) 1.5B 3.1B 244.8M 4.7B

Great Wall Enterprise (1210) 1.6B 3.6B 69.9M 2B

Tecon Biology - A Share (002100) 1.6B 2.3B 42.2M 2.7B

Visionox Technology Inc. (002387) 1.5B 1B (289.8M) 5.6B

Shenzhen Kingkey Smart Agriculture Times (000048) 1.5B 839.6M 108.3M 2.5B

Corticeira Amorim (COR) 1.5B 910.8M 98.6M 1.2B

Ultrajaya Milk (ULTJ) 1.5B 505.3M 63.4M 486.8M

Vitasoy International (00345) 1.4B 833.8M (20.4M) 873M

Zhejiang Guyuelongshan Shaoxing Wine- A Share (600059) 1.4B 226.8M 28.3M 883.2M

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Source: Annual/Quarterly Report Page 25

Norway Edition Monday, July 31, 2023

GLOBAL PEER COMPARISON: AUSS - RELATIVE VALUE INDICATORS

In value terms, comparing relative value of its shares, AUSS is ranked

+ 1 out of 9 by Dividend Yield (%) [7.3]

+ 1 out of 9 by Price/Earnings per share [6.1]

+ 2 out of 9 by Price/Sales per share [0.5]

Curre

Last Div Yld P/Boo

Name (Code) ncy P/E P/S

Price (%) k

Code

Rank of AUSS by value 1 1 2

Austevollafood (AUSS) NOK 76.2 7.3 6.1 0.5

Great Wall Enterprise (1210) TWD 59.8 2.5 22.9 0.4 1.9

Tecon Biology - A Share (002100) CNY 8.4 2.6 35.1 0.7 1.5

Visionox Technology Inc. (002387) CNY 8 1.5 1.1

Shenzhen Kingkey Smart Agriculture Times (000048) CNY 20.8 4.8 12.8 0.9 4.2

Corticeira Amorim (COR) EUR 10.3 2.8

Ultrajaya Milk (ULTJ) IDR 1,925 2.9 20.3 2.9 3.9

Vitasoy International (00345) HKD 10.3 0.1 1.6 3.3

Zhejiang Guyuelongshan Shaoxing Wine- A Share (600059) CNY 11.1 0.7 50.5 6.2 1.9

USD 1=

Fig 49: 10.197508 Norwegian Krone (NOK); 0.908 Euro (EUR)Global Peer

Group - Price Performance

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 26

Norway Edition Monday, July 31, 2023

Fig 50: Global Peer Group - Total Shareholder Returns [TSR in $]

Fig 51: BUYSELLSIGNALS FUNDAMENTALS VALUATION RANKING

Austevollafood vs Norwegian Market

Out of 318 stocks in the Norwegian Market, Austevollafood is ranked eighth(8) by P/Earnings/ Growth, thirteenth(13) by P/Sales,

fourteenth(14) by Revenue and Twenty-sixth(26) by Net Profit $.

Norwegian

AUSS AUSS Rank

Avg

P/Earnings/ Growth 1.7x 0.2x 8

P/Sales 2.1x 0.5x 13

Revenue $ 1B 3.1 B 14

Net Profit $ 104.8 M 244.2 M 26

P/Earnings 19.1x 6.2x 32

Price/Net Tangible Assets 1.3x 0.7x 36

Yield (%) 7.9 7.2 40

Market Cap $ 1.2 B 1.5 B 43

ROA (%) 2.3 8.9 51

ROE (%) 7.2 15.2 67

EBITDA Margin% 18.4 11.9 84

Discount to 52-Wk High (%) 11.1 34.4 100

Premium to 52-Wk Low (%) 8.3 22.9 117

Total Debt/Equity (the lower the better) 0.6x 0.4x 122

Negative values are shown in brackets.

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 27

Norway Edition Monday, July 31, 2023

Fig 52: MARKET SHARE

Austevollafood vs Food Products sector [Food Products sector Total in Brackets]

Revenue of NOK31.2 billion ($3.1 billion)[21.5% of aggregate sector revenue of NOK156.6 billion; down from 22.0% in the previous

year.]

Net Profit of NOK2.5 billion ($244.2 million) [16.7% of aggregate sector net profit of NOK16.3 billion; up from 14.8% in the previous

year.]

EBIT of NOK5.4 billion ($532.3 million) [23.2% of aggregate sector EBIT of NOK25 billion; down from 23.3% in the previous year.]

Fig 53: GLOBAL RANK [out of 46,573 stocks] AND RANK OF

AUSTEVOLLAFOOD IN THE EUROPE REGION [out of 7,400 stocks]

Description Value Global Rank In Eur Region

MCap ($) 1.5B 6,822 1,147

Total Assets ($) 4.7B 4,738 870

Revenue ($) 3.1B 3,593 654

Net Profit ($) 244.8M 3,569 687

Return on Equity % 15.2 7,826 1,510

Net Profit Margin % 13.7 9,001 1,442

Price to Book 0.7 7,343 965

Price/Earnings 6.1 3,144 581

Yield % 7.3 2,998 628

PV1000 (1Year) $* 692 34,567 5,425

$* Change (1Year) % -35.0 35,506 5,527

* 1 year ago $1 = NOK 9.66

Jul 31, 2023: $ 1 equals NOK 10.2

Fig 54: RANK OF AUSTEVOLLAFOOD IN THE NORWEGIAN MARKET [out of 326

stocks] AND IN THE FOOD PRODUCTS SECTOR [out of 11 stocks]

Description Value In Norwegian Market In Food products sector

MCap (NOK) 15.4B 41 5

Total Assets (NOK) 48.1B 29 3

Revenue (NOK) 31.2B 20 2

Net Profit (NOK) 2.5B 26 4

Return on Equity % 15.2 67 2

Net Profit Margin % 13.7 71 5

Price to Book 0.7 47 1

Price/Earnings 6.2 40 1

Yield % 7.2 45 2

PV1000 (1Year) NOK 722 225 8

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 28

Norway Edition Monday, July 31, 2023

Currency Synopsis: Norwegian Krone (NOK)

Fig 55: % Change of NOK vs Currency Basket Period-Based

In the past year the Norwegian Krone fell 4.3% against the US Dollars; in the past three years the Norwegian Krone fell 11.0% against

the US Dollars.

1-week

Last Country 1-day % 1-Year % 3-Yrs %

%

NOK1=0.098USD United States Of America -1.4 -4.3 -11.0

NOK1=0.701CNY China -1.1 1.1 -9.1

NOK1=13.585JPY Japan -2.3 -2.4 17.2

NOK1=0.089EUR European Union -0.3 -11.3 -4.8

NOK1=125.295KRW South Korea -1.0 -6.3 -5.0

NOK1=0.13SGD Singapore -0.8 -8.2 -14.1

NOK1=0.159NZD New Zealand 0.2 -2.9 -3.4

NOK1=0.077GBP United Kingdom -9.3 -10.4

NOK1=0.147AUD Australia 0.9 0.2 -4.5

NOK1=0.764HKD Hong Kong -1.3 -5.2 -10.4

NOK1=0.085CHF Switzerland -0.4 -13.6 -16.2

NOK1=0.13CAD Canada -0.9 -1.6 -11.9

NOK1=1.031SEK Sweden 0.1 -1.8 7.1

NOK1=1.0NOK Norway 0.0

NOK1=1.653MXN Mexico -1.1 -21.1 -32.3

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 29

Norway Edition Monday, July 31, 2023

OTHER LISTINGS AND STOCK IDENTIFIERS

Fig 56: Primary Exchange and Other Listings: Trading Currency and

Volume

Exchange Ticker Currency Last ADVT Vol % of Total Today's VI

Oslobors AUSS NOK 76.15 254,439 96.0 0.8

Frankfurt Z85 EUR 6.74 1,326 4.0 6.6

Total 100.00

1 NOK [Norwegian Krone]= 0.089 EUR

ADVT= Avg. Daily Volume of Trading; VI= Volume Index (1 is avg)

Fig 57: Stock Identifiers

ISIN: NO0010073489

PermID: 4295885416

CUSIP: R0814U100

RIC: AUSS.OL

Historical Perspective

Year-on-Year Comparison USD/NOK (Trailing year - ended 28 Jul)

In the past 5 years, the USD/NOK has jumped 23.9% from 8.19 to 10.15, an average compound annual appreciation of the USD by

4.4%.

2023 2022 2021 2020 2019 2018

Close 10.15 9.74 8.81 9.13 8.72 8.19

% Change 4.2 10.6 -3.5 4.7 6.5

USD1 buys NOK 10.15 today: Appreciation of USD from 7.35 v/s NOK thirty years ago

Last 5 Yrs ago 10 Yrs ago 15 Yrs ago 20 Yrs ago 25 Yrs ago 30 Yrs ago

USD/NOK 10.15 8.19 6.11 5.15 7.15 7.53 7.35

Present Value of NOK1000 Invested in USD 30 years ago is NOK1,380

PVNOK1,000 5 yrs ago 10 yrs ago 20 yrs ago 30 yrs ago

USD/NOK NOK1,240 NOK1,661 NOK1,419 NOK1,380

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 30

Norway Edition Monday, July 31, 2023

Credit Rating Summary: NORWAY

Rating Foreign

Long Term Description

Agency Currency

Moody's Aaa

Fitch AAA

S&P AAA Extremely strong capacity to meet financial commitments. Highest Rating.

FITCH AAA Highest credit quality: 'AAA' ratings denote the lowest expectation of default risk. This

capacity is highly unlikely to be adversely affected by foreseeable events.

DAGONG AAA Highest Credit Quality: "AAA" ratings denote the lowest expectation of default risk. It

indicates that the issuer has exceptionally strong capacity for payment of financial

commitments. Although the AAA debt protection factors may change, this capacity is

highly unlikely to be adversely affected by any foreseeable event. 'AAA' is the highest

issuer credit rating assigned by Dagong.

INDEX (Click tab for direct access)

Section 1 Austevollafood (AUSS) 1

Fig 3: AUSTEVOLLAFOOD (AUSS) Stock Dashboard [traded in Norwegian Krone, NOK] End-of-Day 2

Fig 4: Past Quarter Snapshot 2

Fig 5: LONG-TERM FUNDAMENTAL RANKING: 4 OUT OF 5 [5 is best] 3

Section 2 The Past Quarter: Financials 3

Fig 6: AUSS Financials Summary: EPS up 25.7% to NOK12.34 in FY2022 [ y.e. 31 Dec 2022] 3

Section 3 The Past Quarter: Press Releases and Corporate Wire 4

Fig 7: Press Releases and Corporate Wire 4

Section 4 Bearish Signals 7

Fig 8: Rank in the bottom 21% by Price Performance in the Norwegian market 7

Downtrend 7

Other Bearish Signals 7

Overbought/Bearish Signals 7

Section 5 Ongoing Bearish Parameters 7

Fig 9: Rank in the bottom 24% by Growth in the Norwegian market 7

Fig 10: Present Value of NOK1000 Invested in the Past [3 Mo, 1 Yr]; The Worst Periods with PVNOK1000 < 866 8

Fig 11: The Worst Periods [3 Mo, 1 Yr] with Price Change % < -18.3 8

Fig 12: Moving Annual Return of -27.0% in the past year 8

Fig 13: Annualised Period-based Total Shareholder Returns [TSR %]: The Worst Period with TSR < -27.7% 9

Fig 14: Declining Volume, down 24% in 5 years 9

Fig 15: Declining VWAP, down 9% in 5 years 9

Fig 16: Declining share turnover, down 31% in 5 years 10

Fig 17: Lagging Relative Strength 10

Fig 18: % Change (Tr. 12 Mo): Stock (-31.9%) v Index (-0.7%) 10

Fig 19: Price < Moving Avg Price 11

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 31

Norway Edition Monday, July 31, 2023

Fig 20: Global Rank [out of 46,572 stocks] 12

Section 6 Bullish Signals 12

Fig 21: PAST MONTH: WEAK MOMENTUM UP - AUSS increases 2.6% on volume 0.7 times average 12

Relative Value Indicators: Undervaluation compared with Index averages and bond yield 13

3-DAY: WEAK MOMENTUM UP 13

Fig 22: Rank in the top 24% by Relative Valuation in the Norwegian market 14

Uptrend 14

Other Bullish Signals 14

Section 7 Ongoing Bullish Parameters 15

Fig 23: Growth in annual dividends per share and earnings per share 15

Fig 24: Rank in the top 16% by Size in the Norwegian market 15

Fig 25: Present Value of NOK1000 Invested in the Past 3 Years; The Best Period with PVNOK1000 > 1,238 15

Fig 26: Annualised Period-based Total Shareholder Returns [TSR %]: The Best Periods with TSR > 7.2% 16

Fig 27: P/E/G < 1 16

Fig 28: Improved EBIT Margins 16

Fig 29: Low Debt to Equity (%) and Reducing 17

Fig 30: Satisfies six criteria of Benjamin Graham 17

Fig 31: Satisfies 7 out of 9 criteria of Joseph Piotroski [pass mark 5] 17

Fig 32: Year-over-year (%) Change in Dividend 18

Fig 33: Turnover Period Above Average 18

Section 8 Corporate Profile 19

Fig 34: Contact Details 19

Fig 35: Industry & Sector [of 25 stocks] 19

Section 9 Financials FY 2022 19

Fig 36: Financials, FY 2022 [year-ended 31 December 2022 ] 19

Fig 37: Annual growth in Revenue, Net Profit and EPS 19

Fig 38: Year-on-year comparison of Performance Ratios [FY2022 vs FY2021] 20

Section 10 Dividend 21

Fig 39: Dividend History 21

Fig 40: Annual Dividends - Past 4 years (NOK) 21

Section 11 Top Management and Board of Directors 21

Fig 41: Top Management 21

Fig 42: Board Of Directors 21

Section 12 Financials as Reported FY 2022, Past 7 Years 22

Fig 43: Financials as reported (FY 2022 [year-ended 31 December 2022 ]) 22

Fig 44: INCOME STATEMENT AS REPORTED 22

Fig 45: BALANCE SHEET AS REPORTED 23

Fig 46: CASH FLOW AS REPORTED 24

Fig 47: Download AUSTEVOLLAFOOD Financials Past 7 Years 25

Section 13 Peer Comparison & Ranking of AUSS 25

Fig 48: GLOBAL PEER COMPARISON: AUSS - SIZE (all figures in $) 25

Fig 49: 10.197508 Norwegian Krone (NOK); 0.908 Euro (EUR)Global Peer Group - Price Performance 26

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 32

Norway Edition Monday, July 31, 2023

Fig 50: Global Peer Group - Total Shareholder Returns [TSR in $] 27

Fig 51: BUYSELLSIGNALS FUNDAMENTALS VALUATION RANKING 27

Fig 52: MARKET SHARE 28

Fig 53: GLOBAL RANK [out of 46,573 stocks] AND RANK OF AUSTEVOLLAFOOD IN THE EUROPE REGION [out of 7,400

stocks] 28

Fig 54: RANK OF AUSTEVOLLAFOOD IN THE NORWEGIAN MARKET [out of 326 stocks] AND IN THE FOOD PRODUCTS

SECTOR [out of 11 stocks] 28

Section 14 Currency Synopsis: Norwegian Krone (NOK) 29

Fig 55: % Change of NOK vs Currency Basket Period-Based 29

Section 15 OTHER LISTINGS AND STOCK IDENTIFIERS 30

Fig 56: Primary Exchange and Other Listings: Trading Currency and Volume 30

Fig 57: Stock Identifiers 30

Section 16 Historical Perspective 30

Section 17 Credit Rating Summary: NORWAY 31

Glossary

Annual Return (Fig 12): Relative Price Change [RPC]:

Dividends Paid In a 12-Month Period/Price at the Beginning of the Period Relative price change is price change of stock with respect to

+ Capital Gain or Loss over 1 Year/Price 1 Year Ago (%) Benchmark Index

Current Ratio: Relative Strength (n-th Period) (Fig 17, 8, 20):

Current Assets/Current Liabilities (times) Price close today/Price close 'n' periods ago, then ranked by percentile

Debt/Equity (Fig 29): within the entire market.

Net Debt/Net Assets % Return on Assets (Fig 38):

Dividend Yield (Fig 21): Net Profit/Total Assets (%)

Dividend Per Share/Share Price (%) Return on Equity (Shareholders' Funds) (Fig 20, 38, 53, 54):

EBIT Margin (Fig 28): Net Profit/Net Assets (%)

Earnings Before Interest and Tax/Revenue (%) TSR (Fig 13, 26):

Income during the n years (3/2/1) (Fig 39): Total Shareholder Returns is expressed as an annualized rate of return for

Dividends received during the Period shareholders after allowing for capital appreciation and dividend

PVNOK1000 (Fig 53, 54, 10, 25, 57): TTM:

Present value of NOK1000 invested 1 year/'n' years ago Trailing 12 Months

Price/Earnings (Fig 53, 54, 22, 27, 51, 20): Turnover Period (Fig 33):

Share Price/Earnings Per Share (times) Time Period required for trading all Outstanding Shares

Price/NTA (Fig 20, 22, 53, 54): Turnover Rate (Fig 33):

Closing Share Price/Net Tangible Assets Per Share (times) Norwegian Krone value of annual trading volume as a percentage of

Price/Sales (Fig 51): market capitalisation

Share Price/Sales Per Share (times) Volume Weighted Average Price (VWAP) (Fig 15):

The Volume Weighted Average Price (VWAP) is the summation of

turnover divided by total volume in the same period.

Momentum Up Price increase fuelled by above average Volume

Weak Momentum Up Price increase on below average Volume

Momentum Down Price decrease fuelled by above average Volume

Weak Momentum Down Price decrease on below average Volume

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

www.BuySellSignals.com . . @selltipsdotcom Page 33

Norway Edition Monday, July 31, 2023

BuySellSignals Financial Research provides equity research on over 48,000 companies listed in

more than 90 countries and 120 markets across the world. BuySellSignals believes that every stock

has a story to tell and that this story changes every day. To capture this story, BuySellSignals offers

the latest pertinent and comprehensive information so that investors can make well-informed

investment decisions.

For further details on definitions and quotations from investing legends, Click here

For any enquiries, please email: feedback@buysellsignals.com

Disclaimer: While this document is based on information sources which are considered reliable, it has been prepared without consideration of your

specific investment objectives, financial situation or needs, so you should carry out your own analysis or seek professional investment advice before

an investment decision is made. The document contains unbiased, independent equities data from BuySellSignals (AFS Licence 222756), who

provide round the clock analysis on every stock, every sector, every market, every day. BuySellSignals is not a broker, and does not have an

executing, corporate advisory or investment banking function. BuySellSignals, its directors, employees and consultants do not represent, warrant or

guarantee, expressly or impliedly, that the information contained in this document is complete or accurate.

Data for the BuySellSignals algorithms is sourced from annual reports and company releases and may not be fully up to date. It should be used as a

guide only.

"Your content offering is consistently in the top 10 of accessed publications." .... Refinitiv

BuySellSignals Daily Stock Research Report - PDF: Every stock, Every market, Every day

Bullish and bearish signals and parameters use algorithms based on application of investment wisdom from legends.

Click on the links provided in Page 1 to export data.

For samples of Product Suite visit www.bstfund.com For enquiries, please email: feedback@buysellsignals.com

www.BuySellSignals.com . . @selltipsdotcom Page 34

You might also like

- Following the Trend: Diversified Managed Futures TradingFrom EverandFollowing the Trend: Diversified Managed Futures TradingRating: 3.5 out of 5 stars3.5/5 (2)

- Syd Uni Project - BluescopeSteelbslAu-RiskGreaterThanEpsMomentum20211001Document10 pagesSyd Uni Project - BluescopeSteelbslAu-RiskGreaterThanEpsMomentum20211001hongyu zhangNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- HSBC STG IB League 2021 Case StudyDocument12 pagesHSBC STG IB League 2021 Case StudyvaibhavNo ratings yet

- WKR 0006Document38 pagesWKR 0006Walentyna RomanowiczNo ratings yet

- CAP Stock AnalysisDocument39 pagesCAP Stock Analysisruh cinNo ratings yet

- Northern Lights: in This IssueDocument18 pagesNorthern Lights: in This IssuejainantoNo ratings yet

- Dipawali ReportDocument16 pagesDipawali ReportKeval ShahNo ratings yet

- O/W: "Foot Traffic Is Up": Universal Store (UNI)Document6 pagesO/W: "Foot Traffic Is Up": Universal Store (UNI)Muhammad ImranNo ratings yet

- DNBMarkets BALDER-AGoodDealButNoPromises Jun 27 2016Document45 pagesDNBMarkets BALDER-AGoodDealButNoPromises Jun 27 2016Christian?97No ratings yet

- U/W: Investing To Fortify BTM Growth: Polynovo (PNV)Document7 pagesU/W: Investing To Fortify BTM Growth: Polynovo (PNV)Muhammad ImranNo ratings yet

- Interim Report: January 1-March 31, 2021Document18 pagesInterim Report: January 1-March 31, 2021Michael ZhangNo ratings yet

- LIVE-PGT-7th Oct, 2022 Global & Domestic News LetterDocument1 pageLIVE-PGT-7th Oct, 2022 Global & Domestic News LetterANKUR KIMTANINo ratings yet

- Accell Group: Time To AccelerateDocument52 pagesAccell Group: Time To AccelerateAndi WangNo ratings yet

- Stove Kraft-Company Update 25 September 2021 - Nirmal Bang (Inst.)Document14 pagesStove Kraft-Company Update 25 September 2021 - Nirmal Bang (Inst.)Raghu KuchiNo ratings yet

- Morning - India 20210831 Mosl Mi PG010Document10 pagesMorning - India 20210831 Mosl Mi PG010vikalp123123No ratings yet

- Mirae Asset Sekuritas Indonesia UNVR 3 Q22 5a7e62f034Document11 pagesMirae Asset Sekuritas Indonesia UNVR 3 Q22 5a7e62f034reza.macanNo ratings yet

- Hlag H1 2022 EngDocument54 pagesHlag H1 2022 EngEric LopesNo ratings yet

- 2925 EngDocument18 pages2925 EngBalasubramaniam4890No ratings yet

- Bawag Company ProfileDocument13 pagesBawag Company ProfileAdam KecskemétiNo ratings yet

- GMK Norilskiy Nikel Pao Adr (Nkelyq)Document2 pagesGMK Norilskiy Nikel Pao Adr (Nkelyq)Carlos FrancoNo ratings yet

- Equity Research: Earnings For 4Q13 in Line With ExpectationDocument4 pagesEquity Research: Earnings For 4Q13 in Line With ExpectationSittidath PrasertrungruangNo ratings yet

- Environmental Support: BYD (1211 HK)Document9 pagesEnvironmental Support: BYD (1211 HK)Man Ho LiNo ratings yet

- DNBMarkets NORTHERNLIGHTS-28June2016 Jun 28 2016Document14 pagesDNBMarkets NORTHERNLIGHTS-28June2016 Jun 28 2016Christian?97No ratings yet

- Otovo 0821 Update - V06Document18 pagesOtovo 0821 Update - V06Petter UlsetNo ratings yet

- Bir NaDocument8 pagesBir NaForexliveNo ratings yet

- Comvita 26feb2019 DBDocument13 pagesComvita 26feb2019 DBGeorge WongNo ratings yet

- Resources FundDocument2 pagesResources Fundb1OSphereNo ratings yet

- Morning Brief - September 07, 2022Document1 pageMorning Brief - September 07, 2022ANKUR KIMTANINo ratings yet

- Stove Kraft-1QFY22 Result Update - 01 August 2021Document7 pagesStove Kraft-1QFY22 Result Update - 01 August 2021Raghu KuchiNo ratings yet

- PPFCF PPFAS Monthly Portfolio Report December 31 2021Document15 pagesPPFCF PPFAS Monthly Portfolio Report December 31 2021Owners EstateNo ratings yet

- Billerud Interim Report Q1 2011Document20 pagesBillerud Interim Report Q1 2011BillerudNo ratings yet

- The Case of Missing Sales Growth: Zydus WellnessDocument5 pagesThe Case of Missing Sales Growth: Zydus WellnessasdasdNo ratings yet

- No Va Land Investment (NVL) VND117,000.0: Fig 3: NVL Stock Dashboard (Traded in Vietnamese Dong, VND)Document27 pagesNo Va Land Investment (NVL) VND117,000.0: Fig 3: NVL Stock Dashboard (Traded in Vietnamese Dong, VND)DIDINo ratings yet

- Financial Statement Analisys Chapter 17Document37 pagesFinancial Statement Analisys Chapter 17titinNo ratings yet

- Financial AnalysisDocument14 pagesFinancial Analysismuzaffarovh271No ratings yet

- EMBRAC.B - RedEyeDocument16 pagesEMBRAC.B - RedEyeJacksonNo ratings yet

- JPMorgan Global Growth & Income PLC (GB - EN) (25 - 05 - 2022)Document3 pagesJPMorgan Global Growth & Income PLC (GB - EN) (25 - 05 - 2022)George StevensonNo ratings yet

- Mirae Asset Sekuritas Indonesia UNVR 4 Q22 6b0dcd62d7Document6 pagesMirae Asset Sekuritas Indonesia UNVR 4 Q22 6b0dcd62d7reza.macanNo ratings yet

- October 1, 2022 To December 31, 2022Document9 pagesOctober 1, 2022 To December 31, 2022Stephen LeMercierNo ratings yet

- Patel Brijeshkumar MukeshbhaiDocument23 pagesPatel Brijeshkumar MukeshbhaiBhaskar NapteNo ratings yet

- United Breweries LimitedDocument9 pagesUnited Breweries LimitedMorningLight100% (7)

- Cocoland 20100727 - CUDocument2 pagesCocoland 20100727 - CUlimml63No ratings yet

- Bonesupport q4 Uncalled Share Drop Gives Attractive Entry Points 2024-02-16Document17 pagesBonesupport q4 Uncalled Share Drop Gives Attractive Entry Points 2024-02-16Antonio Rodríguez de la TorreNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument54 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- OECD Interim Economic Outlook Strengthening The Recovery: The Need For SpeedDocument21 pagesOECD Interim Economic Outlook Strengthening The Recovery: The Need For SpeedTram TranNo ratings yet

- Q4 2016 PresentationDocument38 pagesQ4 2016 PresentationhzulqadadarNo ratings yet

- Wipro, Ltd. WIT Azim H. Premji 119,491 AD Development, Infrastructure Outsourcing and Business Consulting ServicesDocument4 pagesWipro, Ltd. WIT Azim H. Premji 119,491 AD Development, Infrastructure Outsourcing and Business Consulting ServicespalsarajNo ratings yet

- 2007 01 17 CannacordAdamsDocument11 pages2007 01 17 CannacordAdamsanon-495257No ratings yet

- Raport Anual SWECODocument27 pagesRaport Anual SWECOGabriel AvacariteiNo ratings yet

- KBSV REE 1Q23 EngDocument8 pagesKBSV REE 1Q23 Engsurananamita99No ratings yet

- O/W: More Gains For The Grains: Clinuvel Pharmaceuticals (CUV)Document8 pagesO/W: More Gains For The Grains: Clinuvel Pharmaceuticals (CUV)Muhammad ImranNo ratings yet

- Glaxosmithkline PLC (GSK) : Price, Consensus & SurpriseDocument11 pagesGlaxosmithkline PLC (GSK) : Price, Consensus & SurpriseRedNo ratings yet

- Mayberry Jamaican Equities Ltd. Q1 March 2021 Results JMDDocument14 pagesMayberry Jamaican Equities Ltd. Q1 March 2021 Results JMDdelrose delgadoNo ratings yet

- Granules - India BP - Wealth 151121Document7 pagesGranules - India BP - Wealth 151121Lakshay SainiNo ratings yet

- Xvivo Report On Operations 2021Document29 pagesXvivo Report On Operations 2021Pengais HarahapNo ratings yet

- Mayberry Jamaican Equities Ltd. Q1 March 2021 Results USDDocument14 pagesMayberry Jamaican Equities Ltd. Q1 March 2021 Results USDdelrose delgadoNo ratings yet

- GSK PharmaDocument10 pagesGSK PharmaSasidharan Sajeev ChathathuNo ratings yet

- Fund Managers' Report - Conventional - Nov 2022Document15 pagesFund Managers' Report - Conventional - Nov 2022Aniqa AsgharNo ratings yet

- Letter To Bse For Investors Presetation September 2021Document39 pagesLetter To Bse For Investors Presetation September 2021Chirag khandelwalNo ratings yet

- Moises MarRojo NiñosGrandesDocument2 pagesMoises MarRojo NiñosGrandesCésar Eliazar Romero AlvarezNo ratings yet

- 2023-05-10-BAKKA - OL-Arctic Securities-Arctic Bakkafrost - CMD in June Next Catalyst-101908123Document19 pages2023-05-10-BAKKA - OL-Arctic Securities-Arctic Bakkafrost - CMD in June Next Catalyst-101908123César Eliazar Romero AlvarezNo ratings yet

- 2023-06-07-AUSS - OL-Nordea Markets-Austevoll Seafood Good Things Come To Those Who Bait-102309674Document22 pages2023-06-07-AUSS - OL-Nordea Markets-Austevoll Seafood Good Things Come To Those Who Bait-102309674César Eliazar Romero AlvarezNo ratings yet

- 2023-05-26-AUSS - OL-DNB Markets-Austevoll Seafood (Buy, TP NOK117.00) - Resource Tax To Be ... - 102140971Document18 pages2023-05-26-AUSS - OL-DNB Markets-Austevoll Seafood (Buy, TP NOK117.00) - Resource Tax To Be ... - 102140971César Eliazar Romero AlvarezNo ratings yet