Professional Documents

Culture Documents

Natwarlal and Company A.y.20.21

Natwarlal and Company A.y.20.21

Uploaded by

sunil jadhav0 ratings0% found this document useful (0 votes)

25 views26 pagesOriginal Title

Natwarlal and Company a.Y.20.21

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views26 pagesNatwarlal and Company A.y.20.21

Natwarlal and Company A.y.20.21

Uploaded by

sunil jadhavCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 26

enggeeeeHiiited

EEE ELLE eT LEE

ie IINLILELLELELD

gown WOW

Gi, uly EEE,

yy ALUM ALLTEL

44) j

444 j

44) j

44% ;

LAG q

1G) i

49% y

4G A

(4) ii

14) if

14 iy

G, u

14% iy

44% gf

44% iy

444 WY

14) iy

iY 4G

444 iG

444 ZY

444 GG}

(Yi iy:

iY) iy

244 GB?

4B Z Gi

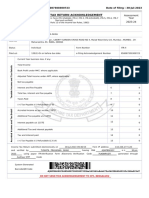

7 M/S. NATAWARLAL & CO. Gi

1G) 4Z%

434 Wy

1G PAN: AKPPR7390P G j

1G ee We

445 14)

1G) 1 Wy

yy _ASST. YR - 2020-2021 Yi

“GE 2G

1G; Wy

2G) AUDITED BY: ae

AUDITED BY: ;

1G) MANISH SHUKLA & CO. 4 Z Z

; Y ; CHARTERED ACCOUNTANTS, Z Z Z

4 Z Z OFFICE NO.201,28°FLOOR. ; Z ;

744 13/21SETH VIRCHAND UMARSI 6G

Wy BUILDING, 3"” PANJARAPOLE, 44%

444 LANE MUMBAI ~ 400 004. 4 Z Z

1G) “PEL : 022-66157019/ 9967892177 4 4;

1G j Mail: camanishshukla@gmail.com 4G),

Yi iy

Yi 1G)

Yi Y;

1G; 44)

GGG 44:

14) 14)

G1 LL, 4

veeerruauusua ae III

ULLLTTL LET)

_>

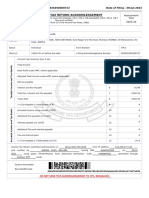

7 INDIANINCOME TAX Ri TURN ACKNOWL

[Where the dats of the Reta

of facome in Form ITR1 (SAIAJ), ITR2,ITR3,

Assessment Year

/ WWe-SUCAND, ERS 14 TTR nd vert 2020-21

{ (Pease eRe 12 ofthe lsat Res, 1962)

Fran |axorrea90p >

NATWARLAL JESARAMJI RAWAL

51/89. Shop No. 2,2nd Floor, Nagdeui Street, Nagdevi, Mumbai, AAAiTARASHTTRA, 400008

Adtress

Status Individual Form Number a

Filed wis |139(1)-On or before due date if Acknowledgement Number | 227960361260121

«a | Sarent Year business los, itany 1 °

3 [Tustincone 7 721360

% | Book Profit under MAT, where apileatie 2 0

= |Adusted Tota Income wader AMT where appliance 7), i 3 721360

fg [Nettax payable i 4 59043

| Interest and Fee Payable : m [3 1254

]_ [Totattas, interest and Fee payable 6 wT

2 | TaxesPaia 7 0300

© [eorex rayatte(onetondatie = = 0

vy _ [Dividend Tax Payable i re 9 9}

| interest Payable BO Pi 0 ehh 10 o

2 [rot pividen ax and ners py ieee 1 a

5 [taxes Paia wersntioe 12 o

| cotac rayabte (Re! B ai

% | Accreted Income as per sect 4 ol

é E

@ —['Aaditional Tax payable wis STD 15 ol

: 7 °

E [interest payable wis 11STE. as) |

zz 51-Tax and fnterest payable a .

BE | aditional Tax and interest payable aH

ge [a cS 5 ni

[Pax and interest pa |

iE ei » {|

g Fax Payable f-)Retondable (17

2 [eta raya et a veritedby |)

2601-2001 2153249 from IP address 180.107.6286 _

Income Tax Return submitted electronically on 26-01-2021 21:32:49 _ H

NATWARLAL, JESARAML RAWAL = wing {|

from IP $50,107. 166.396 \

“AKrPRT3900 26-01-2021 21:32:49 from IP ares

having PAN

on

igital Signature Certificate (DSC).

me 1S608MSCN=e-Madhrs Sub CA for Class

sumer Serves ted

2 Haka 2014,0U=Certying AnheriyOmeMuara Cat

DSC details:

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

AY. 2020-2021

Name :NATWARLAL JESARAMJI RAWAL

Father's Name : JESARAMJI RAWAL

Address 357/59,

Shop No. 2, 2nd Floor,

Nagdevi Street,

Nagdevi,, Mumbai - 400 003,

PLY, :2013.2020

PAN, :AKPPR 7390 P

D.O.B. : 29-May-1980

Status: Individual

Resident ‘Aadhaae 8227 8185 4364

Statomont of Income

- Senne 7 Re Re

1 Profits and gains of Business or Profession

Business-1: M/s, Natwartal J. Rawal

Not Profit Before Tax as per P & L ale 831,931

‘Add: Inadmissible expenses & Income not included

Depreciation debited to P&L afc 11,754

Adjusted Profit of Business-1 — 843.685

Total income of Business and Profession 8,43,685

| Less: Depreciation as per IT Act 6 11,754

| Income chargeable under the head “Business and 8,31,931

| Profession”

| @ Income from other sources

| Interest income 1 2,651

Dividends 2 poem

| Income chargeable under the head ‘other sources 2,681

& Gross Total Income 634,582

Deductions under Chapter VI-A

2651

BOTTA: Interest on Saving ale

Investment u/s 80C, CCC, CCD

Life insurance premium

Tuition fees

Deduction subject to coiling u/s B0CCE

Deduction in respect of payments from 01-Apr-20 to

31-Jul-20 (For Sch.DI)

= Total Income

Tax on total income

Add: Cess.

Tax with cess

Net Tax.

‘Advance Tax

Total prepaid taxes

Balance Tax

Interest wis 2348

Interest uls 234C

4 50,000

ete wee

NATWARLAL JESARAMJI RaWaL

Net tax Payable

Self-assessment tax paid

Balance tax payable

Schedule 1

interest income (other than NSC/KVP interest)

Name of the Bank and Account No,

Interest on Savings afc (20TTA)

Bassein Catholic Co Op Bank Ltd - $8/27489 m2

Excellent Co Op Bank Ltd - 003100001/20435 1,879

Total

Interest

Schedule 2

Paniculars Amount

Dividends exempt w/s 10/94) or toxable ws 1158804 a

Wise 131

Dividends exempt ufs 10(34) Ta

Schedule 3

‘Schedule 4

Advance tax paid

Union Bank of India-0280183 16-Sep-2019 0008

Union Bank of India-0290153 13-Dec-2019 (00036

Total tax

Schedule 5

Self Assessment tax paid

Name of the Bank and BSR Code Date of deposit _Challan Sno.

Union Bank of India - 0280153 16-Jan-2021 0008

Income with full exemption

Income Section Amount

Dividend income 10(34) 13

Total exempt income 134

|

Bank A/e: Union Bank of India 315301010036146 IFSC: UBINOS31537

Date: 26-Jan-2021

Asstyear: 2020-2021

10257

10,300

a

_

28,000

25,000

= __50,000

Amount paid

10,300

Va EB

VvVvy

\

\

Place: Mumbai (NATWARLAL JESARAMMI RAWAL

anrenes itpssprtaincometaxnsiaefiinggouine-ling MyAccountipinFoemAck him!

EBs e-Filing mynernnne

SOE, eon Tv Dn Gove as

ACKNOWLEDGEMENT OF RECEL

OF FORM (Other Than ITR)

NATWARLAL JESARAMIL

Name RAWAL PAN AKPPR73900

ne . Assessment

Form N cB Wee 2020-21

Filing Acknowledgement 985237551010121 Date of e-Filing 01/01/2021

Number

For end on behalf of

e-Filing Administrator

(This is a computer generated Acknowledgment Receipt and needs no signature)

(Grekiepantine Resear] [ik hereto Clow ie window

riipriniFormck th

haps partalincometaxinciaetin: govinle Fling yAccounls

uw

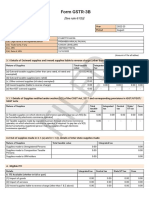

FORM NO. 3CB

[See rule 6G(1)(b)]

ler scetion 44A1 of the Income-tax Act, 1961 in the case of a person referred to in

clause (b) of sub-rule (1) of rate 6G

report

ine! the Baan sheet a6 at SIst March 2020 an he Profitandfssagcoun for the perio Beginning fom

asAO12 to ending on 3403/2020 attached herewith, of NATWARLAL JESARAMJI RAWAL $759, SHOP.NO.O2 IND

OOR, NAGDEVISTREET, MUMBAL MAHARASHTRA, 400003 AKPPR7000,

2.We certily that the balance sheet and the Profit andl toss ageount tre in green with t

the head office at MLOT.NO 88/87,OFFICE NO 203,2ND FLOOR,TRIVENI CO:

HAL-soumg,, and @ branches,

+ books of aeeount maintained at

MSG, SUC. LD, NAGDEVI STREET, MUM

3. @) We report the following ubservations/commentsdise

AS PER SCHEDULE "I" OF BALANCE SUI

icies/inconsistencies; if any;

(b) Subject to above.

(A) Ws have obtained all the information and explanations which, 10 the best of Our knowledge and belief, were necessary

For the purposes af the audit,

UHI OVE wpsnon,

Hho Quy bach

(C1 Qar opmowen ane te the best of Our unformation anal secortng to the esphinations geen tw Us the suid accounts, ead

‘with notes thereon, iTany, yive tre and fae view

(i) in the case of the balance shect, of the state ofthe affbirs of the assessce as at 31st March, 2020 and

(Gipin the case of the Profit and loss account ofthe Pevft ofthe assessee for the year ended on that date,

aren

‘oom have Been kept hy the heal ellie anal branches af ie assesses Bir as appears

su Ueliel vote nes esa forthe eatin ot Bah

4. The statement of particulars required to be furnished under section 44AB is annexed herewith in Forin No, 3CD.

5.ln Our opinion and tothe best of Our information and according to explanations given to Us the particulars given in the said

Form No. 3CD and the Annexure thereto are true and correct subject to following observations/qualifiestons, if any:-

ST] Qualification Type nero uaifcaions

IN

Pace ummat Nan ume ANISH JAGiISH SHU

te aauzane Membership Number 292

Das FRN (Frm Registetion Numbcr) 129581”

: Akos OFFICE No. 201,20 FLORASAI SETH

VIRCHAND UMARSLBUILDING, 1D.

PASJARAPOLE LANE, MUMUAL MAIL

{ASHTRA, 400004

FORM NO. 3cD

“cee {See rule 66(2)]

Statement of particulars required tobe furnished under section 44A.B ofthe Inco

tay Act, 1961

1] Name AEE

NATWARLAT, JESARANIT RAWAL

2 | Ades ss

5089, SHOP NODEIND FLOOR, N

| P . NAGDEVISTRERT

3" |Permanent Aeeount Nmbar (PAN — [nar —~

| Wheter eases Table to pay HUTRATEN TRS wi

‘duty, service tax, sales tax, goods and services tax,customs| *

{duty.ete. ifyes, please furnish the egistation number o,GST

number oF any other identification number alloted for the

IS [one

7 Regisation Number

-{_ ocean Seva WATIRRRSTITNA TAKRPRTIPTAW

nm lida

[6_|Previons year fom

creer sorry a STATE

7 Sass Yea 20021

nate the relevant clase of section ATA under which te audit has been Snte

IST Relevant clause of section 44A1 under which the audit has been conducted

|e

é a TETRA

ete ie sss as oid fr tao ron TSUAT TSUAATTSBAB I

Secon unr wih opin cere T

B”J> [lin oc Asocniono Persons inion anes oT FRENTE

oCAOM, wher share of mente are indseminaoruiowa? nn ne OOS SH

Nae

a ag Ta

7 eo

FT ya RSW NEST WO TT HT a

stingy hepa th han Bee re Hetig ne He Bele]

ie fangs ane af Puen ge pai New — em

ge Jaen pt

bea ei

co

Tf] Ra air aS a a Da PN TT Bg PTF

every bane or fei

Sear Sas

vo LESALE AND RETATE- TRADE ino Ta ir

TUE eh any Seng ea ORG oT TET pao TT Re

ise Tse [secon [ea

Tf Rr ooo SST ROTTS TETON AU, YER EEREST— TN

Baas peed

a aT Rea TTR Ta TS TOT WC OE TERT TTP STOO THE

Tie

are maintained ins computer system, mention the books of aceuunt generated by such computer system. Ifthe books of

accounts ere not kept atone location, plese Furnish the addresses of locations along withthe details of books of accounts

maintained at each location.) Same as 11(2) above

[Books mnainained Taddress LineT Adress ne? Oyo Town oF

Disece

|exSH BOOK BANK BOO |S, ROOM NOTOT |NAGDEVI STREET, | MUBAT

PURCHASE REGISTER | 2ND FLOOR,TRIVE | MUMBAI-00003

| SALES REGISTER, LED [NI CO-OP 11SG.SOC

|GER, JOURNAL REGISTE | LTD

Rk

Tife [bist oF books oF account and

Sais [PCa

I MARARA 0005

Isivra

UT oF Tle vant Gosia xanined. Same a5 11D) SOOWE

Examined ~

apg ANCA HACSTN, SES ESSER LEDC TOT Ty

and gains aisesable on presumptive bass yes. mnie

Shatner he profitandTossagepunt includes any profisand puns ass aes a

FE UaD, AT, tA, 440, A, ADD, Caner GS

lorany other relevant section). eee maa

Section er

~ 7 arcane nga

Fala of acourag cnptoed ne peo os

Whether there has Been any chan

the immediately preceding previous yea.

lf anor ob above sin the afimatve ve deals oT aN eange an ie SES eee on

ounling employed vis-a-vis the method employed in] No

or oss

Paniculars

T3]d-_] ether ay adjustment voquTed Tobe made To The POT oF Tes for eompying Wi te pavions¢

No

nen computation and disclosure standans notified under section 145(2), l

[Ineréase in profs) [Deeease in promis i

|

[ie iF answer o (above sn the aimative, give dats of sich djsiments

cbs _ crease in profi(Rs) [Decrease profi@Ra) [Net eee) |

ota

T3[t_ [Disclose as perICDS. |

Ics Disctosure 1

Metfod of valuation of Closing soak played a Te previous yea [FOOT |

Tab [in ease oF dovion rom the method of

raluoton preserbed under section 145A, and the effet therea? on]No

the profit or las, please furnish

Pariculars

Tnerease Th promi(Re) [Decrease m peoTi(Ray

[Give the following parletars ofthe capita asl converted To sock-invirade

[@) Description of capital asset () Date off) Cost off) Amount at

quisition acquisition which the asso

is converted into

| stocks rade

Ni : =

18) Anat ot eee oe prov and ose aecna DAE

Ic]s ~ [Teens ing within the wpe of econ 2k

Deseinion

i

Tey |The proforma sed, raw backs aToRT oF Uy of aon rear RETIRE x Funda TET OTST

tax, where such ee, dnwbacis or ofund ar admit as ducky te authors conemed

[Amount

rau

TG[E — [Escalation cn seoqed Sng Ue previo year

Deseipion Teun

iu

Tela [any oer tem of eae

Dessripson neat

Ii >

ale —|capiarecepe aay =

essipion [aroun

I

77

here aay Tand or building oF both Te wanaTeved during Ue provious yer Tor a consideration Tes tan value adopied or

assessed or assessable by any authority ofa Sate Government referred in section 43CA SOC, please Furnish

See aco Un [aaaes Unchy tat ae aoa oan a

omy ; fecied erase

baa Jaccrued assessable

RSIS ONE PT TY BT HPT HT

oy fe

a “ag oa

Pe escalate |p OD: [engl SaBTIGT—Jemte [on [Down

fo ahdeween Ey NB" [wits 8A [intaciGem [vue off favo [ae o

pe pte) as [dwn [ess fa) (et exfa)[Pweb fl

es ojo rr ce

ses lo Ka _

Ba

| ee la

Pini &]40% 001 | ke] 0 je lo je o J aor Gi

oti .

00% paar |e EP :

cine

ie ai Fae Ate En oe Page

TTD RE Do TT

[Amounts admissible wider sections ¢

mount Bed i

Se ee ot 1 gee sao fll the condons any seid

fr tncomestax Act, 1961 of Income Rul

circular, et issued in tid bell,

ST STRAT FOOT

TE oe ey oe Fer the eer aprovisions|

es,1962 or any oter guidelines

accoun

[hay sum paTd To a eraployee ax bonus or Commission for senices rendered, where such sum was otherwise payable

to his pfs evident (Seton 360) ners aya

| a = [amount i

iso ean bu Tons Feeived Tam onployeos Tor various Funds ak ened wo Taseton 36(1 Ka

| tcsived payment amount paid for paymeot

io the cones

onployers I autores

a zi

PleaeTaishthe

advenisement expenditure ete

if Tas oun, alng i The nature oF capt, person

Capit

Pacculars Timon

Fesonal expands

To [Panic [Roan Re

7 [Adverse expenainetrany soni Drodrs pam o he Tike published by a poliiea pan

To Pranieuais [Amount in Rs

pene sare a Gus eg anes een we |

Tanta I noun Re)

Expense a Bs 1 ES TT

Trae ano ae}

pn By way Toe Ws Tr aan oy TT Te Te Dag Tres

_[rantiontar SS no f

expends by way oT my oer paally oe Tne vol coves aD i

rarest Tainan a «

Espen urs ToT any rp WT a TENGE oT WH PONT Hy aw

Tiaras Tarount in a

{amounts nadie under mevON ART

[lias payment to non-resident refered 1 in sub-clause G) x

(A) Dati of pyt on whieh ana dtd

Dae of] Arnownt of Natre —offNane of he] PAN ol]Addeas —]Adiras —]Ciiy or Pncode

amet "permet [perme i fhe pevesfunet [timea frown of :

— = Seen eae District FE

papa OW WHE aU UTE Bt Ta bs pT BGT VIOUS VST TT he TRUER FE

before the expiry of time prescribed under sction200(1) Gommanemie estes =

Date off AMOUNT of Nate affine —oT]FAN YAGER [AGUen Cy —w]Faeste |Anom]}

even" fpaymen” [payment fhepayee lite inet |tine2 [Town on] [or ux

rset Distt edu

L vali

| i sept eT ota Ta

AY Deaf payer ones ux Tn dee = E

Dae ofjArmar Notre] Nome fie PAN Sl] ASU Une TAGGRS [Cyr Tow ncade i

ymca fot payment fpayee fhe Lie? for Die i

paymen aye é

vale

By Disa OT payne ov wax Tak Bre deduced ut Fak nak bon pad oF Beare We Oe te wpeTHET r

sub seten (1) of etion 139. +

Hee apart [Nate of Name OFAN Ol[AGaraw [Aden [Oy —oTPinede AnounT Aout cue] |

poynent fot lrayment [he payee |Line [tine [Town or lor wxfot (V0

joeet “faaycsit Disie esdute|ecpsited, i

lavaliable [any i

[iyas payment fered tom sobeTouse

Tay Det of payment on whic levy 1 nt dedi

ie a None ofhe|PAN —OI]Address Line T]Adaress ily or Town Pncode

[Dae onpAmoun|Natue 0

payment fot [payment |rayes the bie sda

payne vit : t

eB Das pp on wh Ty as Ds Seite a wale pe Ta ee ATT

ube section (1) of estion 139 Wey : —_

sub section (! = = 4

Line

[Date of[ Amount Nature off Name offPAN of]

aye ot {payment ine ayer he

| . payment

| Payee. | | { deposited, iff

avaliable | f

_ 1 L jany

[Gere Donat ox nor bass) oo

(0) weal ax under suesTause a)

ie ete a acer al

(vi royally, Toense fe sr

fe under sub-clause (Wb)

ibs payabte outside Tao a non reside without TDS ce under sab Tawa OT

[Date of Ainount of Name of the|PAN off Address Line 1 Address] Ciy Fincode—]]

. avaliable | | L|

(Cp paynen ww FF Pherae under wasn Cy

(Vax pad by enplyer or arquies wider sub-cnse

lc) Amounts debited to profit and loss aecount being, Terex, Sa

{a saiorneTisaneT ene mle se AOAC

ign A) and eenputation ther

Parvulars Section FAinouat debied Amount ]amount Jems

toPLAIC [Admissible __fmadmissiblo

(A) On the basis of the examination of books of wecount

expenditure covered under section 4UA(3) read with ule GDD were made by aecount payee cheque drawn ona bank

ik olher relevant docamienividence, whcthor the] Ves]

_Joe aout payee bank dat I nt pease mish the dels:

“[Date Or Payment [Nature OfJAmounin Rs [Name oF We payee Permanent Reso

Payer INamber ‘of the payee, if

nila

[Gay On te bass oT the examination of baoks oTseooanr and ater evant JoeumentsTevidence, whether the payment] Ves

referred to in section 40A(3A) read wit rule GOD were made by aesount payee cheque drawn on a bank or account

payee bank draft IF not, please furnish the details of amount deemed to be the profits and gains of business er]

[profession under section 40AGA)

[Date OF Payment JNawre_——Of]Amoantim Rs] Name ofthe payee Permanent Aesoun

Payment Number of the payee, if

available

(Poison Tor payment of goal no allowable under senion OAC

[@ Any sum ps by te essessee as an employer not lowable under seaion UA)

(@)Panicunes of any Tay oF contingent ator

[Nato OF bing [amount To Re

[ay Amount of deduction ini ems of Seon TAA Ta espa Tie expeditare ineue6U FINO To TREE WHT

does nt fem par of he oa inom

[Rate OF Labi Taam

(@rArmount nile under te provio wo sean SATCHD

2Anmoun of flretiadavantble under setion 23 of he Mico Siva ad Maton Unarpass Developmen Re

b006

13] anelas oT any payment made vo pecs apt under seo SORT, :

Name of Rested Person JPAN of Rest Pawson [Relion Nature of Payment Mado)

aa AVERETT EROTHER SALARY ea

[Ams UeoTE0 Tbe ris and gains under Seton JPAC or BAD oF AG or UAC OrSTADA,

Sesion [Descripon Tamount

0

ls] Any amon af aT chargeable To a under sno and computation ewor

|" [Namie of Person TAmount arincome [Section [Descriptor ot Transaction [Computation rany

i :

| [epee Fay Su VTE enue OE) (ONT) oT econ 40 we Tay Tor WHT

Fe Gok freed on eT dy te prevou es bu was re aliowed nthe samen’ of any preceding EVO Vm

ad was :

d Pa ring the previous ear

fe es : [Rare aT [eon ——]

i

og) Ho paid dng We revs year =

aA — — a

t ee ~ cian TUF SS

[25] | was Tneurved Tn the previous year an SS aT A THT)

re] BN) ‘on or before the duc dae Tor Tunishing he eur earn

elroy —_[Psifonoree ane TTAB nae

Seaton i i |

Frau Coes ee aa =

Tore Te afore ate i

BNO) [not paid on arbor Te wo -

1 Dons, como oF FEMnERATON Tass wad]

mt

(Te!

I

crt

Section

Ni

(Stare whether safes tax,

ay, exes

servive Tax, customs] No

duty or any other indireet tax, fevy, exss,

impost, ete. is passed through the profit and loss

recount)

27]

BI

year an

Wits treatment in profit and loss account and treatment of outstanding Central Value Added Tas Credits

a al

[Amount ef Central Value Added Tex Creda? laput Tax Credi(ITC) avalled of or utilised during ihe previous] No

Input Tax Credit(ITC) in accounts |

Nawwre of ability [Amount

CENVATATC [Amount

Loss/Accounts

Treatment in Profit and|

[Opening Balance

[Croat

Credit

Availed

Uilized

Ciosing/Outstanding

Balance

Panels of come Or eapanditare of por period ended or GeDTed To he prot and oss aoc

[Tyre Pariclas Amount Prior period owe

[ise ters

yyformat)

Ra

[Whether diving the previous year he aussie Tas eine any propery, big sare oT Com

company in Whi

refered tin seton 562i)

‘ot being a

tn dhe public are substantially interested, without consideration or for inadequate consideration as

[Name of the|PAN_of The]Nans oP We[ CIN oft company [No.of Share| Amount — ol] Fair Marky

person fram|pertan,ifeompany fom Recsived [consideration flue of the

which shares|svailable which shares sid stares

rescived "| recived

st

[29] Whetiner daring te provious year io assesice received any consideration for asus of shares which exceeds the Fi]

market value ofthe shares as referred to in seetion $6(2) vib). If yes, please Furnish the duals ofthe same

ferredtoin

[Name of the person from whom] PAN ofthe peton,l]No. of Shares [Amount of] Fair — Marke

|consderaton received for issue offavailable consideration value of the

shares received shares

IN

[Ala) | Whether any amount f to be included as Tacore chargeable wider the ead Income Trom oll sources aa]No

referred tin clause (x) of sub-section (2) of section 56? (b) If yes, please Furnish the fllowing details

STN. [Nature of nome TAmount

ni

B(aj | Whether any amount fo Be TeToded as come chargeable under the head Tneome fom other roureat ae]No

se (1) of subsection 2) of section 562(VexNo)(b) yes, lente fr

following deta

4

IN

IsTNe. [Nature oF aeome: TAmount

[30] Betis oT any amount Narrowed on Randi Or any amount dus Theron (neha Th

an Te GTA BOTOWED|NG

ri

4)

No, fuse of subi|Rs) offs a hs [income on such exes of money

the associated money

n (1). offprimary

: ey Which has not]

bee enterprise | is{been repatriated] money: Wh Be

ston P2CE este red vote these eal Ahi

a repatriated 10 Inia preserved tine. [he prese

AI

ie

tay

2s per te provisions]

of sub-section (2) of

section 921

made ?

‘cr ‘

Nr

UhcTer seas Ta TUTE expe ang ie previous ear y Way

execolng one ere rupees refered to in sub-section (of eton 9B,

\(b) iFyes, please furnish the following details

‘oF interest or of Similar nature]No

ISINo, [Amount (in Rs}][Eamings before|Amount (in Rs)_of]Deta

fexpenditureby|interest, tax,fexpenditme by way offexpen

of similar nature) amortization

incurred (EBITDA) during| which exceeds 30% of] 24B.

way oF interest r| depreciation andlinterest-or of similar|forward as pet sub-/forward as per sub-

ature as per (i) above] section (4) of section} section (4) of section|

the previous year|EBITDA as pee (ii)/Assewivent]Amount Assessment] Amount]

ins above year tins.) [Year [in Rs)

a a

rue broughtfexpenditure catid

4B:

Si

Ray Whee SSS Ts ee To apoE ve aaNgETEE

during the previous year(This Clause is kept in abeyance till 3st Mareb, 2021)

No

ia renvod To section 96,

cb) IT yes, please Furth the Following details

[SINe ature of he mipemnissbIe voTiance arangonent — [Amuunt (iv Rs} of tx bevel ind

previous year arising, in sggregat, to

ll the parties tothe arrangement

Nt

aang

«Gala OT ech Ton or dapont in an amount exGseTng the Tit specified a section

TOTES Taken FEES

the previous year =

[SNo [Name of We]Adaress

fender —orlthe Tender or|Acsount

depositor |dcpositor | Number(

avatable_|eeposit| depes

aT Permaneat Arvoun] Whee] Maxaman

ot Toan|thefamount

vith theftaken as fany ime du

jassesee) [or

far the|sccepretun year

lender or uring

ine tne

lscposivor reson

yeer

for [loan orfoutstanding in] was

ie account atfor sesapted|accepted — by|

Mpaved{the previous} or bork deaf draft whether the

Frater —theyin ease te]

oanordeposi|ioan or deposit

Taken|was taken |

wring|by cheque|eheque or bank

for use offsame was taken

for accepted by

electronic

Jlesring an account payee

leytem cheque or an]

Nivowgh account payee|

sank account bank dal

ala oF aah speed wu ha TOUT ence eT HE

ken oF aepied Ga

saan 2

ihe previous yeor=

ee Reams oT The] Adres af he person Fam] Pamanant Amount

person omwom specified sum is|Accomt of

whom spesitid| received Number (fspesie

un is recived

with the) or

eae ae

he person

Fro who

specified

recived

ailable. [sv when] aecoprodby[by cheque or bok]

Shae then ease

specified sum) specified sum w35

xb [as taken o-|tken or acepted

cheque or benk| deal, whether he

15 fératt or vselsame was taken

lof eletonior_ accepted |

clearing system|an sezount ye]

Though 9 bankleheque or a

account (account payer

banker

a Fa Government company, a bankir

company a8 CpaTaTON CHINA]

co aa VRE TTT

se or Priel AG) ”

Ln op wana eT

i eto sg asin on esol

a sym we sc ee EE

system through a bank aceount

3 rensacions relating

rasaton BOOST, ag

than by # cheque or bank draft

[Nata ff Amount

Fama penon

to ong event oF oczasicn from a pe

‘ease of eestroic clearing

Hae OT EPL

eRe [Name of thease oT he Faye

Payer“

available

vith the

the Payer

ansatin eeipt

BRI

(Té1

ine Tit speeTied Tn section 2

sf aia oF seep a a ou exe Tv aggrgate Fo paso

Jaday orn spect of singe trsicton in espet nf sation, refuting to one event or occasion from a person,|

Reo an not Benn agen payee ee a a eeu page bank af, dng the

|pwevious year

S.No. [Name ofthe Payer Permanent Aesount] Amount of receipt

Number (if availabe with

he assessoe ofthe Payer

dross of the Payer

frp | Paxiiculars of ah payment made Tn an amount execeding a section TOOST. Toa pen

ranger rapeet oa single ansacton ot respec of tansation lating oon event of acai (0 paso,

Wat gue of lode clering ste tough a bank acount during he previous

otherwise than by a cheque ur ba

|| tex

sation Payment

\ a

\\ |. | Be _|

Sg eT pe aon 20UST. Th aBBTRATE a person 3]

relating to one event or occasion to person, made

gecount payee bank deaf during the previous year

STS | Panicle of each payment tn an amount ex

day o in espost of a single transaetion orn expect of wansactions

by cheque or bank drafl, no being an asount payee cheque 0” a

pie fe orieP eres oTiie ayse [Permanent Account] Amount of Payment

Number (if avilable with

\ | the asesse) ofthe Payee

the ese a recip by or payment to a Government company,

vn he ens of transactions referred. in sction 26955

ated Sr July, 2007)"

“vanae in an amvoun execeding We Timi speeifie|

atiulrs st oa (bb) (be) and ba) weed note ven

(Dunkin Company. pot ec savings bank,» cooperative Bank

Jr thc eae of persons referred tin Notion No, $0, 2068

Pareto of each cpayment of Teun or depositor any speciied

si

avesdon 2607 ade during the revs ya

NO aa ale ne ihe ease Te pO

Ree eee Ypccoan fot tejamou (repayment vas made by eho

esboriferaympecutandng. ifwas made[tank df, wheter te

Natea [Tine scuun ay cheqe[same was repaid by 25

ran the|_lanytimeduringlor bank acount payer cheque of

atasret [ine pevou rat or uselanaeeount payee bank

ftenee| (yr J lector

cerng

sem

firoh

| et

nr

SST ano Sapa ory SpE wR na HOUT ENCE Ti speeTed nse

{alas oT repay en ot oan or depos ova speed oavance

Pardue thn by a cheque or bank df a te feecni cling ye though aban aco

during the previous year: —

ISNeName of the Tender]

or depositor or person

fom whom specifies

advance is received

ideas OTe Tender, Permanent Assount Nomber (7pAmount of repayment

depsior or person fromfovaiable wits the assessezof thelof Taan or depos oy

Mito specified advance lender, oc depositor ot person|any specified advance

is received * {from whom specified advance is|eesived otherwise then

received lby 2 cheque or bank

raft or use of eestonie|

clorng sytem trough

bank account during the)

previous year

Trnapoefcd insect

Ni

a ary ETT vanes TORT ee

alto 7 yee bank dat dig th]

er eenom specified whom spied. vere] oti cB

whom &

advance is received {isreceived fen eI

pao oT er

Ja toan oc deposit or

Ny specified advance

rete terse tha

Pa cheque of bank

draft or use of electronic

clearing system through 3

bank account during the!

previous year

Pati

taken or accepted from Goverament, Government company, banking compan

corey inity, banking company oa eorpaation established by @ Cental, Sit|

7]a [Deals of brought Torwaed Tot oF deprecion owas ihe Toowing manner to exten avaTale

S.No Assessmen| Nature aFToswalfowanoe [Amount [AI [Amount TAmeun] Ordec

Year las ose’ fas fas’ [uns

retuned [allowanchsdjusted [assessedand

not [by Date

lowed [withdrawl

of

ulition

113A] depeci}on

sueount

under

taxation

under

M1sBAayto

be fled

info

INT

ab | Wether ange ih Sarcholding oT Uh company has ak place Ta he previous year due fo which Not AppIicable

the losses incured prior tothe previous year eannat be allowed tobe carried forward in terms of]

secon 9.

FE] Wheto the esses fas Tne? ay specTaTon Tess eTeed To eeion 73 Goring the previo %

Tr yes, pee fra he

repo a

re g entity 1s Table to furnish the report as referred] No

5] ro Fe TEETER HTD TTS HOTT

ion 2 of sion 2

Ho in sub-section @)of parent entiy [Name ot alternate Date of Torniahng]

Sr [Whether report has] Name oF Jreponing, entity (ilfofrepon i

he eae aes z

{parent entity er an ey

‘Gtemate reporting &

Jensity a

a Tae oF Tornsing he repo — mach kp abeyance]

FA [Break-up of tal expendiure oF en — a ie

j ‘il yeh, 2021) ites registered under tating entities}

i Si ea son GETTIN Sy aca mcs |

t ae iat pods|Relating | entities |registered entities |not i

| jaf Espen el Hingio Mesenttes falling episod entie easergeniies [Ce 7

rare ig ete 7

i tbe year eer Jeomposition

scheme 7

} Na 7

|

Place MUMAt Name MANISH_ JAGDISH. SHUK!

(ANISH_JA HULA

Date rue Membership Number 129947

FRN (tim Registration Number} 1295810

Address OFFICE NO.201,2ND FLOR,1¥21 SETH

VIRCHAND UMARSLBUILQING-ARD

PANJARAPOLE LANE,MUMMAL MAI

: ARASITRA, 400104,

Filing Details

Revisiow Original Diiginal

Tia tT Fat ND

SessipToN —ASTNODate oT] pur 1ofAount Talat on aeeant of [Toa Art

Block of Assets Purchase fuse AODVAT Exchange [SOBIV

ate (Gram

cha

Fane

Machinery @ 40%

Total of Plant & Machinery @ 40% eae zi _ a

ie “S[l—_[uaaons AEA [—— BRT ae ae Ty

Machinery @ 15%

Haiarat Mant & Maeno © Ta

Daauatan Deira PaIRTNE TD

Description of Block of Assets S{ Rane of Soe ce [AAT

Taare Machinery @ a%

SO a EL

7 +

Plant & Machinery @ 15%

|Toutor Plant & Machinery @ 15%

“Grady HANSHIAGOSHSHUKEA having PAN ADHESOSIOE rom IP Access

o.

This form has been digitally si

4.23,249.48 on 2024-01-01 24:12:00.0 —

se SI No and [ssuer 1766ss37cNeeudtes Sub CA for Class 2 Individual 2014,0UsCertiving

|auinorty.OseMusa Consumer Selene CIN

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Lalit Ji March 20Document6 pagesLalit Ji March 20sunil jadhavNo ratings yet

- LJ 22-23Document1 pageLJ 22-23sunil jadhavNo ratings yet

- LJ 21-22Document1 pageLJ 21-22sunil jadhavNo ratings yet

- KK Salary SlipDocument3 pagesKK Salary Slipsunil jadhavNo ratings yet

- Natwarlal & CoDocument2 pagesNatwarlal & Cosunil jadhavNo ratings yet

- 23073000507649RBIS ChallanReceiptDocument2 pages23073000507649RBIS ChallanReceiptsunil jadhavNo ratings yet

- NJ 20-21Document1 pageNJ 20-21sunil jadhavNo ratings yet

- PDF 149005520310723Document1 pagePDF 149005520310723sunil jadhavNo ratings yet

- RJ FinancialDocument9 pagesRJ Financialsunil jadhavNo ratings yet

- PDF 856087300300723Document1 pagePDF 856087300300723sunil jadhavNo ratings yet

- Lalit Ji Huf 22Document6 pagesLalit Ji Huf 22sunil jadhavNo ratings yet

- LJ 20-21Document1 pageLJ 20-21sunil jadhavNo ratings yet

- Chintan Shah JUN 2023 PayslipDocument1 pageChintan Shah JUN 2023 Payslipsunil jadhavNo ratings yet

- LJ Huf FinancialDocument21 pagesLJ Huf Financialsunil jadhavNo ratings yet

- Chintan Shah MAR 2023 PayslipDocument1 pageChintan Shah MAR 2023 Payslipsunil jadhavNo ratings yet

- PDF Scan 28-07-2023 13.3Document1 pagePDF Scan 28-07-2023 13.3sunil jadhavNo ratings yet

- KK Pan CardDocument1 pageKK Pan Cardsunil jadhavNo ratings yet

- 23073000035439KKBK ChallanReceiptDocument2 pages23073000035439KKBK ChallanReceiptsunil jadhavNo ratings yet

- Bajaj Natwarlal Repayment ScheduleDocument3 pagesBajaj Natwarlal Repayment Schedulesunil jadhavNo ratings yet

- 23073000665832ICIC ChallanReceiptDocument2 pages23073000665832ICIC ChallanReceiptsunil jadhavNo ratings yet

- Form PDF 149005520310723Document10 pagesForm PDF 149005520310723sunil jadhavNo ratings yet

- 1 Itr List 2023-241Document12 pages1 Itr List 2023-241sunil jadhavNo ratings yet

- PDF 855926390300723Document1 pagePDF 855926390300723sunil jadhavNo ratings yet

- GSTR3B 27aiepp7316g1z6 082022Document3 pagesGSTR3B 27aiepp7316g1z6 082022sunil jadhavNo ratings yet