Professional Documents

Culture Documents

Chapter 4 Admission of A Partner

Uploaded by

Hansika SahuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 Admission of A Partner

Uploaded by

Hansika SahuCopyright:

Available Formats

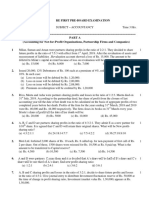

ADMISSION OF A PARTNER

1. A and B share profits and losses equally. They have Rs20,000each as capital. They admit C as equal partner and

goodwill was valued at Rs30,000. C is to bring in Rs30,000as his capital and necessary cash towards his share of

goodwill. Goodwill Account will not remain open in books. If profit on revaluation is Rs13,000,find the closing

balance of the capital accounts.

(a) Rs31,500;Rs31,500; Rs30,000 (b) Rs31,500; Rs31,500; Rs20,000

(c) Rs26,500; Rs26,500; Rs30,000 (d) Rs20,000;Rs20,000;Rs30,000

2. If, at the time of admission, the revaluation A/c shows a profit, it should be credited to :

(a) Old partners capital accounts in the old profit sharing ratio.

(b) All partners capital accounts in the new profit sharing ratio.

(c) Old partners capital accounts in the new profit sharing ratio.

(d) Old partners capital accounts in the sacrificing ratio.

3. In case of admission of a partner, the entry for unrecorded investments will be:

(a) Debit Partners Capital A/cs and Credit Investments A/c

(b) Debit Revaluation A/c and Credit Investment A/c

(c) Debit Investment A/c and Credit Revaluation A/c

(d) None of the above

4. A and B are partners of a partnership firm sharing profits in the ratio of 3 : 2 respectively. C was admitted for

1/5th share of profit. Machinery would be appreciated by 10% (book value Rs80,000) and building would be

depreciated by 20% (Rs2,00,000). Unrecorded debtors of Rs1,250would be brought into books now and a

creditor amounting to Rs2,750 died and need not pay anything on this account. What will be profit/loss on

revaluation?

(a) Loss Rs28,000 (b) Loss Rs40,000 (c) Profits Rs28,000 (d) Profits Rs40,000

5. If at the time of admission if there is some unrecorded liability, it will be ______________to____________ Account

(a) Debited, Revaluation (b) Credited, Revaluation (c)Debited, Goodwill (d) Credited, Partners’

6. Revaluation Account or Profit and Loss Adjustment A/c is a

(a) Real Account (b) Personal Account (c) Nominal Account (d) Asset Account

7. A and B are partners sharing profits in the ratio of 2 : 3. Their Balance Sheet shows Machinery at

Rs2,00,000;Stock at Rs80,000and Debtors at Rs1,60,000.C is admitted and new profit sharing ratio is agreed at 6

: 9 : 5. Machinery is revalued at Rs1,40,000 and a provision is made for doubtful debts @5%. A’s share in loss on

revaluation amount to Rs20,000. Revalued value of Stock will be :

(a) Rs62,000 (b) Rs1,00,000 (c) Rs60,000 (d) Rs98,000

8. If at the time of admission, some profit and loss account balance appears in the books, it will be transferred to:

(a) Profit & Loss Adjustment Account (b) All partners‘ Capital Accounts

(c) Old partners‘ Capital Accounts (d) Revaluation Account

9. At the time of admission of a partner, what will be the effect of the following information? Balance in Workmen

compensation reserve Rs40,000. Claim for workmen compensation Rs45,000.

(a) Rs45,000 Debited to the Partner’s capital Accounts. (b) Rs40,000Debited to Revaluation Account.

(c) Rs5,000Debited to Revaluation Account. (d) Rs5,000 Credited to Revaluation Account.

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 1

10. Angle and Circle ware partners in a firm. Their Balance Sheet showed Furniture at Rs2,00,000; Stock at

Rs1,40,000;Debtors at Rs1,62,000 and Creditors at Rs60,000. Square was admitted and new profit-sharing ratio

was agreed at 2:3:5. Stock was revalued at Rs1,00,000, Creditors of Rs15,000are not likely to be claimed, Debtors

for Rs2,000 have become irrecoverable and Provision for doubtful debts to be provided @ 10%. Angle’s share in

loss on revaluation amounted to Rs30,000. Revalued value of Furniture will be:

(a) Rs2,17,000 (b) Rs1,03,000 (c) Rs3,03,000 (d) Rs1,83,000

11. At the time of admission of new partner, the increase in the value of assets is debited to:

(a) Revaluation A/c (b) Assets A/c (c) Capital A/cs of old partners (d) None of these

12. The capitals of A and B are Rs 48,000 and Rs 32,000 respectively and their profit sharing ratio is 3:2. C is

admitted for 1/5th share. The amount of capital brought by C will be:

(a) Rs 16,000 (b) Rs 20,000 (c) Rs 64,000 (d) Rs 40,000

13. A and B are partners. C is admitted for 1/5th share. C brought Rs 1,20,000 as his share of capital. The total capital

of firm will be:

(a) Rs 1,00,000 (b) Rs 2,00,000 (c) Rs 4,00,000 (d) Rs 6,00,000

14. X and Y share profits equally. Z is admitted for 1/7th share. New profit sharing ratio will be:

(a) 1:2:3 (b) 3:3:1 (c) 1:3:3 (d) 3:2:1

15. P and Q are partners. S is admitted for 1/5th share and he brings his share of capital of 25,000. The total capital

of firm will be:

(a) Rs 75,000 (b) Rs 1,00,000 (c) Rs 1,25,000 (d) Rs 1,50,000

16. If at the time of admission, there is some unrecorded asset, it will

(a) Debited to Revaluation A/c (b) Credited to Revaluation A/c

(c) Transferred to Old Partners' Capital A/cs (d) Transferred to All Partners' Capital A/cs

17. L and M are partners in a firm sharing profits and losses in the ratio of 3: 2. Their capitals were Rs 6,40,000 and

Rs 4,00,000 respectively. N was admitted for 1/5th share in the profits of the firm. He brought Rs 4,80,000 as his

capital. The goodwill of the firm will be:

(a) Rs 8,80,000 (b) Rs 1,76,000 (c) Rs 13,60,000 (d) Rs 2,72,000

18. A and B are partners sharing profits in the ratio of 3:2. A's capital is Rs 72,000 and B's capital is Rs 48,000. C is

admitted for 1/5th share in profits. The amount of capital which C should bring:

(a) Rs 30,000 (b) Rs 24,000 (c) Rs 1,50,000 (d) Rs 96,000

19. A and B are partners in a firm with capitals of Rs 1,80,000 and 2,00,000 respectively. C was admitted for 1/3rd

share in profit and brings Rs 3,40,000 as capital. The amount of goodwill is:

(a) Rs 2,40,000 (b) Rs 1,00,000 (c) Rs 1,50,000 (d) Rs 3,00,000

20. If the incoming partner brings the amount of goodwill in cash and also a balance exists in goodwill account then

the existing Goodwill is written off among the old partners:

(a) in new profit sharing ratio (b) in old profit sharing ratio (c) in sacrificing ratio (d) in gaining ratio

21. In the Balance Sheet prepared after new partnership agreement, assets and liabilities are recorded at:

(a) original value (b) revalued figure (c) at realisable value (d) at current cost

22. In case of Workmen Compensation Reserve, if the amount claimed is more than the amount lying in WCR, then

the shortfall will be recorded in

(a) Revaluation Account (b) Partners' Capital Accounts (c) Balance Sheet (d) None of these

23. At the time of admission of a partner, what will be the effect of the following information-Balance in Workmen

Compensation Reserve Rs 40,000. Claim for Workmen Compensation Rs 45,000?

(a) Rs 45,000 Debited to the Partner's Capital Accounts (b) Rs 40,000 Debited to Revaluation Account

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 2

(c) Rs 5,000 Debited to Revaluation Account (d) Rs 5,000 Credited to Revaluation Account

24. Kalki and Kumud were partners sharing profits and losses in the ratio of 5:3. On 1st April, 2021 they admitted

Kaushtubh as a new partner and new ratio was decided as 3:2:1.

Goodwill of the firm was valued as Rs 3,60,000. Kaushtubh could not bring any amount for goodwill. Amount of

goodwill share to be credited to Kalki and Kumud Accounts will be: -

(a) Rs 37,500 and Rs 22,500 respectively (b) Rs 30,000 and Rs 30,000 respectively

(c) Rs 36,000 and Rs 24,000 respectively (d) Rs 45,000 and Rs 15,000 respectively

25. Asha and Nisha are partners sharing profits in the ratio of 2:1. Kashish was admitted for 1/4th share of which

1/8th was gifted by Asha. The remaining was contributed by Nisha. Goodwill of the firm is valued at Rs 40,000.

How much amount for goodwill will be credited to Nisha's Capital account?

(a) Rs2,500 (b) Rs 5,000 (c) Rs 20,000 (d) Rs 40,000

26. Fill in the Blanks

(i) Admission of a partner results in_____________ of the partnership firm.

(ii) PQ and Rare sharing profits and losses in the ratio of 3/8, 1/4 and 3/8 respectively. M. a new partner is given

1/4th share. Then new profit-sharing ratio will be______________

(iii) For any increase in the value of asset, the Revaluation Account is______________

(iv) The capital balances of P and Q are Rs 45,000 and Rs 25,000 respectively after making all the adjustments. If

C, the incoming partner, is to bring 1/3rd of the total capital of the firm, then his share of capital will be________

(v) If goodwill is appearing in the Balance Sheet at the time of admission of a new partner, the existing goodwill is

written off among ____________ partners in _____________ratio.

(vi) Investment Fluctuation Reserve is a reserve set aside out of profit to adjust the difference between

___________and _______________of investment.

(vii) A new partner contributes ___________. at the time of his admission to compensate the old partners

27. Tina, Sonali and Niru were partners in a firm two years ago when Sonali died. Later on, Tina and Niru had

decided to carry on the partnership amongst themselves sharing profits in the ratio of 2:1. However, in wake of

deteriorating financial position of the family of Sonali, both Tina and Niru agreed upon admitting the minor

daughter of Sonali named Mona into the firm. The mother of Mona consented to act as the legal guardian of the

child until she attained the age of maturity.

On 31st March, 2023 the Balance Sheet of Tina and Niru stood as follows:

Liabilities Amount (Rs) Assets Amount(Rs)

Tina's Capital 30,000 Freehold Property 10,000

Niru 's Capital 15,000 Furniture 3,000

General Reserve 12,000 Stock 6,000

Creditors 8,000 Debtors 40,000

Cash 6,000

65,000 65,000

Tina and Niru share profits and losses in the ratio of 2: 1. They agree to admit Mona into the firm subject to the

following terms and conditions:

(a) Mona will bring in Rs 10,500 of which Rs 4,500 will be treated as his share of goodwill to be retained in the

business.

(b) Mona will be entitled to 1/4th share of profits in the firm.

(c) A provision for bad and doubtful debts is to be created at 3% on the debtors.

(d) Furniture is to be depreciated by 5%.

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 3

(e) Stock is to be revalued at Rs 5,250

(i) Mention the provision of the Partnership Act affected by the admission of Mona and the clauses governing

this provision.

(ii) Prepare Revaluation Account, Partners' Capital Accounts and opening Balance Sheet of the new firm.

28. Amit and Bikash are partners in a firm sharing profits in the ratio of 3:2. Their Balance Sheet as at 31⁰t

December, 2022 stood as under:

Liabilities Amount (Rs) Assets Amount(Rs)

Capital A/cs Machinery 33,000

Amit 35,000 Furniture 15,000

Bikash 30,000 65,000 Investments 20,000

General Reserves 10,000 Stock 23,000

Bank Loan 9,000 Debtors 19,000

Creditors 36,000 Less: Provision for 17,000

Doubtful Debts 2,000

Cash 12,000

1,20,000 1,20,000

On that date they admitted Chiku into partnership for 1/4th share in the profit on the following terms:

(i) Chiku bring capital proportionate to his share. He brings Rs 7,000 in cash as his share of goodwill.

(ii) Debtors are all good.

(iii) Depreciate stock by 5% and furniture by 10%

(iv) An outstanding bill for repairs Rs 1,000 will be brought in books.

(v) Half of the investments were to be taken over by Amit and Bikash in their profit-sharing ratio at book value.

(vi) Bank loan is paid off.

(vii) Partners agreed to share future profits in the ratio of 3:3:2.

Prepare Revaluation Account, partners' Capital Accounts and Balance Sheet after admission of Chiku into the

partnership

29. Following is Balance Sheet of Anshul and Bharti, who had been sharing profits in proportion of 3/4th

and 1/4th as at 31st March, 2022:

Liabilities Amount (Rs) Assets Amount(Rs)

Creditors 1,50,000 Cash at Bank 90,000

General Reserve 24,000 Bills Receivable 12,000

Capital A/cs: Debtors 64,000

Anshul 1,14,000 Machinery 80,000

Bharti 62,000 1,76,000 Furniture 4,000

Land and Building 1,00,000

3,50,000 3,50,000

They agree to take Shashi into partnership for 1/5th share on 1st April, 2022.

The partners have raised the following questions:

(i) How will be the new profit sharing ratio of the partners determined?

(ii) Goodwill Account be valued at Rs 80,000. Shashi is unable to bring cash for her share of goodwill.

How will the goodwill be recorded in the books?

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 4

(iii) Machinery and Furniture be reduced by 10% and 5%. Provision for Doubtful Debts be created on

Debtors.

That Land and Building be appreciated by 20%. What is the amount of profit or loss on the revaluation?

(iv) When Shashi pays Rs 56,000 as Capital for 1/5th share in the future profit. What will be the capital

account balances of the partners in the reconstituted firm as at 1st April, 2022?

(v) State the need for treatment of goodwill on admission of a partner.

30. A, B and C were partners in a firm sharing profits in the ratio of 3:2:1. On 31st March, 2023 their

Balance Sheet was as follows:

Balance Sheet of A, B and C

as at 31st March, 2023

Liabilities Amount (Rs) Assets Amount(Rs)

Creditors 84,000 Bank 17,000

General Reserve 21,000 Debtors 23,000

Capitals: Stock 1,10,000

A 60,000 Investments 30,000

B 40,000 Furniture and Fittings 10,000

C 20,000 1,20,000 Machinery 35,000

2,25,000 2,25,000

On the above date D was admitted as a new partner and it was decided that:

(i) The new profit sharing ratio between A, B, C and D will be 2:2:1:1.

(ii) Goodwill of the firm was valued at Rs 90,000 and D brought his share of goodwill premium in cash.

(iii) The market value of investments was Rs 24,000.

(iv) Machinery will be reduced to Rs 29,000.

(v) A creditor of Rs 3,000 was not likely to claim the amount and hence to be written off.

(vi) D will bring proportionate capital so as to give him 1/6th share in the profits of the firm.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the reconstituted

firm.

31. Pinky, Qumar and Roopa are partners in a firm sharing profits and losses in the ratio of 3:2:1. Seema is

admitted as a new partner for 1/4th share in profits of the firm, which he gets 1/8th from Pinky and

1/16th each from Qumar and Roopa. The total capital of the new firm after Seema's admission will be

Rs 2,40,000. Seema is required to bring in cash equal to 1/4th of the total capital of the new firm. The

capitals of the old partners also have to be adjusted in proportion of their profit sharing ratio. The

capitals of Pinky, Qumar and Roopa after all adjustments in respect of goodwill and revaluation of

assets and liabilities have been made, are Pinky Rs 80,000. Qumar Rs 30,000 and Roopa Rs 20,000.

Calculate the capitals of all the partners and record the necessary journal entries for doing adjustments

in respect of capitals according to the agreement between the partners.

32. Sajana and Alok were partners in a firm sharing profits and losses in the ratio 3:2. On 31st March 2018

their Balance Sheet was as follows:

Balance Sheet of Sanjan and Alok as on 31-3-2018

Liabilities Amount (Rs) Assets Amount(Rs)

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 5

Creditors 60,000 Cash 1,66,000

Workmen’s 60,000 Debtors 1,46,000

Compensation fund

Capitals: Less: Provision for 1,44,000

doubtful debts 2,000

Sajana 5,00,000 Stock 1,50,000

Alok 4,00,000 Investments 2,60,000

Furniture 3,00,000

10,20,000 10,20,000

On 1st April, 2018, they admitted Nidhi as a new partner for 1/4th share in the profits on the following

terms:

(a) Goodwill of the firm was valued at Rs 4,00,000 and Nidhi brought the necessary amount in cash for

her share of goodwill premium, half of which was withdrawn by the old partners.

(b) Stock was to be increased by 20% and furniture was to be reduced to 90%.

(c) Investments were to be valued at Rs 3,00,000. Alok took over investments at this value.

(d) Nidhi brought Rs 3,00,000 as her capital and the capitals of Sanjana and Alok were adjusted in the

new profit sharing ratio.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the reconstituted firm

on Nidhi’s admission.

33. Rojita and Sandhya were partners sharing profits in the ratio of 3:2. Their Balance Sheet as at 31.3.2023

was as follows:

Liabilities Amount (Rs) Assets Amount(Rs)

Provision for Bad 1,000 Land and Building 80,000

Debts

Creditors 60,000 Machinery 20,000

Capitals A/cs Furniture 10,000

Rojita 60,000 Debtors 25,000

Sandhya 40,000 1,00,000 Cash 16,000

Profit and Loss Account 10,000

1,61,000 1,61,000

Deepika was admitted to the partnership for 1/5th share in the profits on the following terms

(a) The new profit-sharing ratio was decided as 2:2:1.

(b) Deepika will bring Rs 30,000 as his capital and Rs 15,000 for his share of goodwill,

(c) Half of goodwill amount was withdrawn by the partner who sacrificed his share of profit in favour of

Deepika.

(d) A provision of 5% for bad and doubtful debt was to be maintained.

(e) An item of Rs 500 included in sundry creditors was not likely to be paid.

(f) A provision of Rs 800 was to be made for claims for damages against the firm.

After making the above adjustments, the capital accounts of Rojita and Sandhya were to be adjusted on

the basis of Deepika 's capital. Actual cash was to be brought in or to be paid off as the case may be.

Prepare Revaluation Accounts, Partners' Capital Accounts and Balance Sheet of the new firm.

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 6

34. Charu and Harsha were partners in a firm sharing profits in the ratio of 3:2. On 1-4-2022, their Balance

Sheet was as follows:

Balance Sheet of Charu and Harsha

as at 1.04.2022

Liabilities Amount (Rs) Assets Amount(Rs)

Creditors 17,000 Cash 6,000

General Reserve 4,000 Debtors 15,000

Workmen 9,000 Investments 20,000

Compensation Fund

Investment 11,000 Plant 14,000

Fluctuation Fund

Provision for doubtful 2,000 Land and Building 38,000

debts Capitals:

Capitals:

Cahru 30,000

Harsha 20,000

93,000 93,000

On the above date, Vaishali was admitted for 1/4th share in the profits of the firm on the following

terms:

(i) Vaishali will bring Rs 20,000 for her capital and Rs 4,000 for her share of goodwill premium.

(ii) All debtors were considered good.

(iii) The market value of investments was Rs15,000.

(iv) There was a liability of Rs 6,000 for workmen compensation.

(v) Capital accounts of Charu and Harsha are to be adjusted on the basis of Vaishali's capital by opening

Current accounts.

Prepare Revaluation Account and Partners' Capital Accounts.

35. On 31st March, 2023, the Balance Sheet of Roshan and Rinku who shared profits in 3: 2 ratio was as

follows:

Liabilities Amount (Rs) Assets Amount(Rs)

Creditors 20,000 Cash 5,000

Profit and Loss 15,000 Sundry Debtors 20,000

Account

Capital Accounts: Less: Provision 700 19,300

Roshan 40,000 Stock 25,000

Rinku 30,000 70,000 Plant and Machinery 35,000

Patents 20,700

1,05,000 1,05,000

On this date, Birendra was admitted as a partner on the following conditions:

(a) ' Birendra ' will get 4/15th share of profits.

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 7

(b) ' Birendra ' had to bring Rs 30,000 as his capital to which amount other Partners' Capitals shall have

to be adjusted.

(c) He would pay cash for his share of goodwill which would be based on 2½ years' purchase of average

profits of past four years.

(d) The assets would be revalued as under:

Sundry Debtors at book value less 5% provision for bad debts, Stock at Rs 20,000, Plant and

Machinery at Rs 40,000.

(e) The profits of the firm for the years ended 31st March, 2020, 2021 and 2022 were Rs 20,000, Rs

14,000 and Rs 17,000 respectively.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the new firm.

36. Subrat and Vijay are partners in a firm sharing profits in the ratio of 3: 2. Their Balance Sheet as on 31st

March, 2022 was as follows:

Balance Sheet of Subrat and Vijay

as on 31.03.2022

Liabilities Amount (Rs) Assets Amount(Rs)

Sundry Creditors 20,000 Cash 12,000

Provision for doubtful 2,000 Debtors 18,000

debts

Outstanding Salary 3,000 Stock 20,000

General Reserve 5,000 Furniture 40,000

Subrat 60,000 Plant and Machinery 40,000

Vijay 40,000

1,30,000 1,30,000

On the above date, Sumit was admitted for 1/6th share in the profits on the following terms:

(i) Sumit will bring Rs 30,000 as his capital and Rs 10,000 for his share of goodwill premium, half of

which wil be withdrawn by Subrat and Vijay.

(ii) Debtors Rs1,500 will be written off as bad debts and a provision of 5% will be created for bad and

doubtful debts.

(iii) Outstanding salary will be paid off.

(iv) Stock will be depreciated by 10%, furniture by Rs 500 and Plant and Machinery by 8%.

(v) Investments Rs 2,500 not mentioned in the balance sheet were to be taken into account.

(vi) A creditor of Rs 2,100 not recorded in the book was to be taken into account.

Pass necessary Journal entries for the above transactions in the books of the firm on Sumit's admission

37. Ajay and Vijay were partners in a firm sharing profits in the ratio 5: 3. They admit Raju as a partner

with 1/5th contributed according to the proportionate capital. The financial position was as under:

Liabilities Amount (Rs) Assets Amount(Rs)

Creditors 19,000 Goodwill 10,000

Bills Payable 8,000 Land and Building 25,000

Capital Account Plant and Machinery 35,000

Ajay 55,000 Stock 20,000

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 8

Vijay 30,000 85,000 Debtors 25,000

General Reserve 16,000 Investment 14,000

Provision for bad and 1,500 Cash 2,400

doubtful debts

Out standing Salary 2,400 Prepaid Insurance 500

1,31,900 1,31,900

They agreed to admit Raju on the term that the capital of partners were to be adjusted in new profit

sharing 5:3:2 respectively. From the information given below, complete the postings of Revaluation

Account, Partners' Capital Account and Balance Sheet of the new firm.

Dr. Revaluation A/c Cr.

Particulars Amount (Rs) Particulars Amount (Rs)

To………………. …………………….. By …………………….. ………………….

To………………. …………………….. By …………………….. ………………….

To………………. …………………….. By …………………….. ………………….

…………………….. …………………

Dr. Partner, Capital A/c Cr.

Particulars Ajay(Rs) Vijay(Rs) Raju(Rs) Particulars Ajay(Rs) Vijay(Rs) Raju(Rs)

To Good …………… ……………… By Balance …………… ……………

will A/c b/d

To 6,250 3,750 By General …………… ……………

investment Reserve

A/c A/c

To cash A/c 2,400 By …………… ……………

Revaluation

A/c

To Balance …………… …………… By …………… ……………

of Capital Premium

c/d (after for

adjustment) Goodwill

74,250 41,550 74,250 41,550

To Ajay's …………… By Balance 61,750 31,650

Current A/c of Capital

b/d(after

adjustment)

To balance …………… …………… …………… By cash A/c ……………

c/d

By Vijay's ……………

Current

A/c

61,750 32,025 23,350 61,750 32,025 23,350

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 9

Balance Sheet of the New Firm

Liabilities Amount (Rs) Assets Amount(Rs)

Creditors 17,800 Land and Building 38,000

Bills Payable 8,000 Plant and Machinery 30,000

Capital Account Stock 20,000

Ajay …………. Debtors 25,000

Vijay ……………… Investment 4,000

Raju ………… 1,16,750 Cash 25,550

(Rs 2,400+Rs 5,200-Rs

2,400+Rs 23,350)

Outstanding Repairs 100 Prepaid Insurance 500

Provision for bad and 1,000 Vijay’s Current A/c …………….

doubtful debts

Out standing Salary 2,400

Ajay’s Current A/c ……….

1,49,425 1,49,425

THE ARROHAN CONCEPTUAL LEARNING (CHHEND, POWER HOUSE ROAD, KOELNAGAR)

Contact No-9437082693 Page 10

You might also like

- Xii Accountancy-Practice Paper-2Document16 pagesXii Accountancy-Practice Paper-2sneha muralidharanNo ratings yet

- CH 4 MCQ AccDocument23 pagesCH 4 MCQ AccLONE WOLF TECHNo ratings yet

- KV No.1 Afa Monthly Test Accountancy ProblemsDocument4 pagesKV No.1 Afa Monthly Test Accountancy Problemsramandeep kaurNo ratings yet

- 12acc03 QPDocument14 pages12acc03 QPSandesh kumar SharmaNo ratings yet

- CH 4 MCQ AccDocument21 pagesCH 4 MCQ AccAmit Gupta100% (1)

- Practice Accountancy: Time: 3 Hours. M.Mark: 80 General InstructionsDocument13 pagesPractice Accountancy: Time: 3 Hours. M.Mark: 80 General InstructionsTûshar ThakúrNo ratings yet

- 2021 QP.3 Cbse PatterDocument12 pages2021 QP.3 Cbse PatterabiNo ratings yet

- 12 Accountancy QP Prep T1 21Document9 pages12 Accountancy QP Prep T1 21mitaliNo ratings yet

- Navya and Radhey Were Partners Sharing Profits and Losses in The RatioDocument9 pagesNavya and Radhey Were Partners Sharing Profits and Losses in The RatioMohammad Tariq AnsariNo ratings yet

- FIRST TERM EXAM 2021-22 Accountancy XIIDocument18 pagesFIRST TERM EXAM 2021-22 Accountancy XIISiddhi JainNo ratings yet

- QP AccountancyDocument130 pagesQP AccountancyTûshar ThakúrNo ratings yet

- Wa0025.Document8 pagesWa0025.Pieck AckermannNo ratings yet

- Partnership - Admission of Partner - DPP 05 (Of Lecture 07) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 05 (Of Lecture 07) - (Kautilya)DevanshuNo ratings yet

- Term I - Class Xii - AccountancyDocument6 pagesTerm I - Class Xii - AccountancyPriyanshu PalNo ratings yet

- To Buy Recommended Term 1 Book Based On This CBSE Sample Paper, Click HereDocument10 pagesTo Buy Recommended Term 1 Book Based On This CBSE Sample Paper, Click Heresanskriti singhNo ratings yet

- MCQs - Partnership (All Chapters)Document6 pagesMCQs - Partnership (All Chapters)bdharshini06No ratings yet

- Acc-Sample Paper-04Document8 pagesAcc-Sample Paper-04guneet uberoiNo ratings yet

- R.E.D. Group Midterm Accountancy ExamDocument6 pagesR.E.D. Group Midterm Accountancy ExamGaurang AgarwalNo ratings yet

- 12th MCQDocument17 pages12th MCQkalpbhatia9898No ratings yet

- Accountancy QP Set-2Document15 pagesAccountancy QP Set-2ABDUL RAHMAN 11BNo ratings yet

- Accountancy Model Unit Test - 2Document7 pagesAccountancy Model Unit Test - 2Raaja YoganNo ratings yet

- XII Accts Re First Board Exam 20-21Document9 pagesXII Accts Re First Board Exam 20-21Sagar SharmaNo ratings yet

- 12th Acccounts Full TestDocument18 pages12th Acccounts Full TestCp GpNo ratings yet

- Accountancy Sample PaperDocument24 pagesAccountancy Sample PaperJutishmita SaikiaNo ratings yet

- Partnership Test YoutubeDocument14 pagesPartnership Test YoutubeRiddhi GuptaNo ratings yet

- Partnership FundamentalsDocument5 pagesPartnership Fundamentalsdiyadhannawat06No ratings yet

- Sample Paper 2Document15 pagesSample Paper 2TrostingNo ratings yet

- Wa0045.Document7 pagesWa0045.Pieck AckermannNo ratings yet

- 10065CBSE Guess Paper 2022-23Document8 pages10065CBSE Guess Paper 2022-23Dhriti KarnaniNo ratings yet

- Half Yearly XII AccDocument7 pagesHalf Yearly XII AccJahnavi GoelNo ratings yet

- Term One Accountancy 12 QP & MSDocument13 pagesTerm One Accountancy 12 QP & MSVarun HurriaNo ratings yet

- Admission of A Partner Test SPCC 23-24 Accounts - Docx (1)Document4 pagesAdmission of A Partner Test SPCC 23-24 Accounts - Docx (1)Sagar JhaNo ratings yet

- Ultimate Book of Accountancy Class 12thDocument16 pagesUltimate Book of Accountancy Class 12thTrostingNo ratings yet

- 1QP-CLASS XII ACC Common Board - 2022-23 - 230328 - 200811Document14 pages1QP-CLASS XII ACC Common Board - 2022-23 - 230328 - 200811jiya.mehra.2306No ratings yet

- FASD CLASS XII ACCOUNTANCY QPTerm I Pre Board 2021-22Document13 pagesFASD CLASS XII ACCOUNTANCY QPTerm I Pre Board 2021-22aaaaaaffffgNo ratings yet

- ACCOUNTANCY TEST-40 MARKDocument2 pagesACCOUNTANCY TEST-40 MARKCharming CuteNo ratings yet

- 12 Accountancy Pre Board 1 Set ADocument8 pages12 Accountancy Pre Board 1 Set Amcsworkshop777No ratings yet

- Xii Mid Term Exam LJ Acc LJ2021 22Document9 pagesXii Mid Term Exam LJ Acc LJ2021 22Tûshar ThakúrNo ratings yet

- Preboard - 1 Session - 2021 - 22 Grade: XIIDocument6 pagesPreboard - 1 Session - 2021 - 22 Grade: XIIVAIBHAV BADOLANo ratings yet

- PRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsDocument8 pagesPRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsKaustav DasNo ratings yet

- Worksheet AdmissionDocument3 pagesWorksheet AdmissionYogesh AdhikariNo ratings yet

- PRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsDocument12 pagesPRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsKaustav DasNo ratings yet

- ACCOUNTNCY QP Guugram RegionDocument12 pagesACCOUNTNCY QP Guugram Regionvivekdaiv55No ratings yet

- Accoutancy XII Practice Paper - 2024 (NEW)Document12 pagesAccoutancy XII Practice Paper - 2024 (NEW)Fatima IslamNo ratings yet

- Accountancy QPDocument11 pagesAccountancy QPTûshar Thakúr0% (1)

- Class Xii Accountancy Practice AssignmentDocument6 pagesClass Xii Accountancy Practice AssignmentTûshar ThakúrNo ratings yet

- Accountancy Online Test Answer KeyDocument5 pagesAccountancy Online Test Answer KeyAppan HaNo ratings yet

- TLS/XII/Accountancy/Oct_P.T_3/2021-22: Periodic Test QuestionsDocument13 pagesTLS/XII/Accountancy/Oct_P.T_3/2021-22: Periodic Test QuestionsPriyank DhadhiNo ratings yet

- Mcqs Cuet Ch-1 Acc 12Document7 pagesMcqs Cuet Ch-1 Acc 12khushisingh9972No ratings yet

- Question No. 1 To 20 1marksDocument3 pagesQuestion No. 1 To 20 1markssameeksha kosariaNo ratings yet

- Accountancy QP TEST-1Document11 pagesAccountancy QP TEST-1SomeoneNo ratings yet

- Admission Assignment NewerDocument3 pagesAdmission Assignment Newersakshamagnihotri0No ratings yet

- 12 Accounts 2020 21 Practice Paper 3Document9 pages12 Accounts 2020 21 Practice Paper 3Vijey RamalingamNo ratings yet

- 12 Acc. PB 1Document7 pages12 Acc. PB 1Chirag KapoorNo ratings yet

- Xii PB 2023 Acct QP 16112023Document9 pagesXii PB 2023 Acct QP 16112023NARESH KUMARNo ratings yet

- Pre - Board Examination - Accountancy - Class XII - (2022-23)Document12 pagesPre - Board Examination - Accountancy - Class XII - (2022-23)Shipra GumberNo ratings yet

- Accountancy MT August 2021-22 PDFDocument5 pagesAccountancy MT August 2021-22 PDFAnse RoythomasNo ratings yet

- Worksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerDocument14 pagesWorksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerRica Jane LlorenNo ratings yet

- SP Term 1 XII - AcctsDocument14 pagesSP Term 1 XII - AcctsSakshi NagotkarNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Britannia: Performance HighlightsDocument11 pagesBritannia: Performance HighlightsAngel BrokingNo ratings yet

- Vocabulary Business AdministrationDocument8 pagesVocabulary Business AdministrationAachus1282No ratings yet

- Chapter 7 The Financial EnvironmentDocument25 pagesChapter 7 The Financial EnvironmentEunice NunezNo ratings yet

- 2006 CDN Real Estate Industry 020806 REV2Document268 pages2006 CDN Real Estate Industry 020806 REV2pankaj_pandey_21No ratings yet

- Multiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationDocument15 pagesMultiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationNananananaNo ratings yet

- CIR v. RufinoDocument1 pageCIR v. RufinoChou TakahiroNo ratings yet

- Organisation Commerce Notes of H.S.C.Document176 pagesOrganisation Commerce Notes of H.S.C.Rajan Anthony Parayar78% (9)

- 3rd XFL RulesDocument15 pages3rd XFL Rulesapi-269614652No ratings yet

- Vietnam's Derivatives MarketDocument12 pagesVietnam's Derivatives MarketNguyễn Thuỳ DungNo ratings yet

- Impact of Financial Leverage On Financial Performance: Special Reference To John Keells Holdings PLC in Sri LankaDocument6 pagesImpact of Financial Leverage On Financial Performance: Special Reference To John Keells Holdings PLC in Sri Lankarobert0rojerNo ratings yet

- Josh-Tarasoff Markel InsuranceDocument25 pagesJosh-Tarasoff Markel InsuranceCanadianValue50% (2)

- TRAIN Part 4 - Documentary Stamp TaxDocument21 pagesTRAIN Part 4 - Documentary Stamp TaxGianna CantoriaNo ratings yet

- PGSF 1931 CF VoltasDocument8 pagesPGSF 1931 CF Voltasriya guptaNo ratings yet

- Tax Notes On Passive IncomeDocument4 pagesTax Notes On Passive IncomeMaria Anna M LegaspiNo ratings yet

- Shares Mag 10th FebDocument56 pagesShares Mag 10th Febsteve16635829No ratings yet

- Managing Finance - Study Material (Full Permission)Document312 pagesManaging Finance - Study Material (Full Permission)midnightblushNo ratings yet

- Invest in Debt and Equity SecuritiesDocument38 pagesInvest in Debt and Equity SecuritiesGaluh Boga KuswaraNo ratings yet

- Economy TermsDocument90 pagesEconomy TermsSabyasachi SahuNo ratings yet

- Quiz Bomb On InvestmentDocument36 pagesQuiz Bomb On InvestmentTorreus AdhikariNo ratings yet

- 2 7Document35 pages2 7Kiran VaykarNo ratings yet

- CBSE Modle Question PaperDocument21 pagesCBSE Modle Question Papergaming loverNo ratings yet

- Consulting Case Solutions:: Assignment OnDocument11 pagesConsulting Case Solutions:: Assignment OnAkash KhatriNo ratings yet

- Sample Questions Level IDocument31 pagesSample Questions Level IWong Yun Feng Marco100% (1)

- Variable - Online Mock ExamDocument11 pagesVariable - Online Mock ExamMitziRawrrNo ratings yet

- Early-Stage Valuation in The Biotechnology IndustryDocument54 pagesEarly-Stage Valuation in The Biotechnology Industrytransbunko100% (1)

- Capital Market Assignment on Functions and ImportanceDocument8 pagesCapital Market Assignment on Functions and ImportanceRazwana AishyNo ratings yet

- The World ExplainedDocument10 pagesThe World ExplainedfcamargoeNo ratings yet

- Hongkong and Shanghai Banking CorpDocument10 pagesHongkong and Shanghai Banking CorpThor D. CruzNo ratings yet

- Corporate Finance: Week 9-10 Does Debt Policy Matter?Document31 pagesCorporate Finance: Week 9-10 Does Debt Policy Matter?Pol 馬魄 MattostarNo ratings yet

- Econ 132 Problems For Chapter 1-3, and 5Document5 pagesEcon 132 Problems For Chapter 1-3, and 5jononfireNo ratings yet