Professional Documents

Culture Documents

Data Patterns Income&CashFlow - 4 Years - 19052020

Uploaded by

Sundararaghavan ROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Data Patterns Income&CashFlow - 4 Years - 19052020

Uploaded by

Sundararaghavan RCopyright:

Available Formats

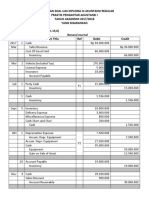

Income statement:

FY2016 FY2017 FY2018 FY2019 FY2020

Revenue

Net revenue 84.5 111.4 113.1 131.1 156.9

Other income 1.0 0.5 0.6 1.3 2.5

Total revenue 85.5 111.9 113.7 132.4 159.4

Gross margin % 57.1 58.4 64.0 67.0

Gross margin 65.4 82.5 102.6

Expenses

Cost of goods sold 31.2 48.3 47.7 48.5 54.3

Employee expenses 28.0 33.0 34.8 38.5 43.2

Selling, general & admin expenses 12.6 13.7 12.5 21.6 16.4

Total expenses 71.8 95.0 95.1 108.6 113.9

EBITDA 12.7 16.4 18.0 22.5 45.5

EBITDA (%) 15.0% 14.7% 15.9% 17.1% 29.0%

Finance cost1 8.4 8.7 9.3 10.0 12.1

Depreciation 4.2 4.1 4.0 3.6 3.8

PBT 1.1 4.1 5.4 10.2 29.6

Prior period adjustments

26% Tax @ 26% for projected years (0.2) 1.4 1.0 2.4 7.7

PAT 1.3 2.7 4.4 7.7 21.9

PAT (%) 1.5% 2.4% 3.9% 5.8% 13.8%

₹ crore

FY2021 FY2022 FY2023

221.3 268.7 307.1

1.7 1.7 2.3

223.0 270.4 309.4

62.9 63.7 64.5

137.5 169.5 195.6

83.8 99.1 111.5

56.5 62.9 72.0

18.5 20.9 23.7

158.8 182.9 207.2

62.5 85.8 99.9

28.3% 31.9% 32.5%

13.9 14.4 18.4

5.0 7.4 8.6

45.3 65.7 75.3

11.8 17.1 19.6

33.5 48.6 55.7

15.0% 18.0% 18.0%

FY2016 FY2017 FY2018 FY2019 FY2020

LIABILITIES

Equity

Share capital 1.7 1.70 1.70 1.70 1.70

Reserves and surplus 117.6 120.29 124.35 131.64 154.27

Total equity 119.3 121.99 126.05 133.34 155.97

Non-current liabilities

Long term borrowing 5.8 3.8 1.8 0.0 0.0

Deferred tax liabilities1 3.5 3.01 1.75 0.98 0.98

Long term provisions 2.6 3.26 3.69 4.78 4.78

Current liabilities

Short term borrowings 51.5 49.61 40.70 58.16 59.94

Trade payables 26.8 30.11 28.47 29.26 17.55

Advance from customers 43.76 32.67

Other current liabilities 10.8 19.90 47.89 11.85 8.78

Oow CPLTD 2.2 2.0 2.0 1.80 -

Short term provisions 0.9 1.12 2.18 2.19 11.30

Non-current+current liabilities 101.9 110.80 126.48 151.00 136.01

Total liabilities 221.2 232.79 252.53 284.33 291.98

FY2016 FY2017 FY2018 FY2019 FY2020

ASSETS

Non-current assets

Gross block 61.7 61.05 63.19 64.20 65.36

Accumulated depreciation 24.2 27.29 30.97 34.55 38.34

Net block 37.5 33.76 32.23 29.65 27.02

Long term advances 2.7 2.84 2.84 2.68 2.68

Total non-current assets 40.2 36.60 35.07 32.34 29.70

Current assets

Inventories 54.3 60.50 75.35 86.58 78.54

Trade receivables 117.0 123.01 116.20 116.37 116.06

Cash and cash equivalents - free 2.0 1.59 1.97 0.77 16.27

Cash and cash equivalents - margin money 4.5 6.00 14.81 36.24 43.72

Short term loans & advances 3.2 5.10 9.14 12.01 7.68

Total current assets 181.0 196.20 217.47 251.97 262.26

Total assets 221.2 232.80 252.54 284.31 291.96

Check (0.0) 0.0 0.0 (0.0) (0.0)

Total Debt 60 55 44 60 60

Total Equity 119 122 126 133 156

TOL 102 111 126 151 136

DE ratio 0.50 0.45 0.35 0.45 0.38

PAT 1 3 4 8 22

RoE 2% 4% 6% 15%

TOL/TNW 0.85 0.91 1.00 1.13 0.87

FY2021 FY2022 FY2023

1.70 1.70 1.70

187.78 236.40 292.13

189.48 238.10 293.83

11.7 17.50 5.84

0.98 0.98 0.98

4.78 4.78 4.78

50.00 50.00 75.00

20.95 24.78 27.87

41.95 46.85 58.67

14.61 20.44 20.44

5.83 11.66 11.66

11.77 17.08 19.58

156.71 182.42 213.16

346.19 420.52 507.00

FY2021 FY2022 FY2023

89.26 113.26 113.26

43.33 50.71 59.29

45.93 62.55 53.97

2.68 2.68 2.68

48.62 65.24 56.66

69.82 66.08 65.02

129.07 134.33 127.95

62.48 118.36 210.42

28.50 28.82 39.24

7.68 7.68 7.68

297.55 355.26 450.32

346.17 420.50 506.98

(0.0) (0.0) (0.0)

68 79 93

189 238 294

157 182 213

0.36 0.33 0.31

34 49 56

19% 23% 21%

0.83 0.77 0.73

Unit FY2016 FY2017 FY2018

Cash flow from operations

PAT ₹ crore 1.3 2.7 4.4

Add: Depreciation ₹ crore 4.2 4.1 4.0

Cash flow from operations before working capital changes ₹ crore 5.5 6.8 8.4

Less: Increase / (decrease) in working capital ₹ crore 3.9 8.9 9.7

Less: Increase / (decrease) in deferred tax liabilities ₹ crore (0.8) 0.5 1.3

Less: Increase / (decrease) in Advance from customers ₹ crore -

Less: Increase / (decrease) in long term provisions ₹ crore 0.3 0.7 (0.4)

Less: Increase / (decrease) in other current liabilities ₹ crore 2.9 (9.4) (28.0)

Less: Increase / (decrease) in short term provisions ₹ crore (1.6) 0.2 (1.1)

Less: Increase / (decrease) in short term loans & advances 4.0

Cash flow from operations after working capital changes ₹ crore 0.8 5.8 22.9

Cash flow from investing

Capital expenditure ₹ crore (0.5) (0.4) (2.8)

Cash flow from investing ₹ crore (0.5) (0.4) (2.8)

Cash flow from financing

Increase / (decrease) in working capital loans ₹ crore 5.0 (1.9) (8.9)

Drawdown from new long term loans - FY2018 & FY2019 loan ₹ crore - - -

Repayment of term loans ₹ crore (4.7) (2.4) (2.0)

₹ crore

Cash flow from financing ₹ crore 0.3 (4.3) (10.9)

Change in cash ₹ crore 0.7 1.1 9.2

Opening cash ₹ crore 5.8 2.0 1.6

Cash available before margin money ₹ crore 6.5 3.1 10.7

Total margin money required/outstanding ₹ crore 4.5 6.0 14.8

Incremental margin money required / (released) ₹ crore 4.5 1.5 8.8

Closing cash available after setting aside margin money ₹ crore 2.0 1.6 1.9

Interest on Bank deposit 0.60

INR in Crores

FY2019 FY2020 FY2021 FY2022 FY2023

7.7 21.9 33.5 48.6 55.7

3.6 3.8 5.0 7.4 8.6

11.3 25.7 38.5 56.0 64.3

10.6 3.4 0.9 (2.3) (10.5)

0.8 - - - -

(43.8) 11.1 (9.3) (4.9) (11.8)

(1.1) - - - -

35.9 1.3 0.0 0.0 -

(0.0) (9.1) (0.5) (5.3) (2.5)

2.7 (4.3) - - -

6.3 23.4 47.3 68.5 89.1

(1.0) (1.2) (23.9) (24.0) -

(1.0) (1.2) (23.9) (24.0) -

17.5 1.8 (9.9) - 25.0

- - 17.5 17.5 -

(2.0) (1.8) - (5.8) (11.7)

15.5 (0.0) 7.6 11.7 13.3

20.7 22.3 31.0 56.2 102.5

1.9 0.7 16.2 62.4 118.3

22.7 23.0 47.2 118.6 220.8

36.7 43.5 28.3 28.6 39.0

21.9 6.8 (15.2) 0.3 10.4

0.7 16.2 62.4 118.3 210.4

1.31 2.49 1.70 1.72 2.34

Summary

Particulars FY2017 FY2018 FY2019 FY2020 FY2021 FY2022

Revenue 111.9 113.7 132.4 159.4 223.0 270.4

EBITDA 16.4 18.0 22.5 45.5 62.5 85.8

PAT 2.7 4.4 7.7 21.9 33.5 48.6

Networth 122.0 126.1 133.3 156.0 189.5 238.1

Term Loan bal at the end of the year 5.8 3.8 1.8 0.0 17.5 29.2

Working capital Loan 49.6 40.7 58.2 59.9 50.0 50.0

Capex Additions #REF! #REF! #REF! #REF! #REF! #REF!

FY2023

309.4

99.9

55.7

293.8

17.5

75.0

#REF!

You might also like

- Fs ExerciseDocument6 pagesFs ExerciseDIVINE GRACE ROSALESNo ratings yet

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- RECEIVABLES Answer KeyDocument24 pagesRECEIVABLES Answer KeyInsatiable Life100% (1)

- Revenue and Cost Analysis 2007-2020Document38 pagesRevenue and Cost Analysis 2007-2020Latisha UdaniNo ratings yet

- PFRS UPDATES ON ACCOUNTING CHANGES AND ERRORSDocument11 pagesPFRS UPDATES ON ACCOUNTING CHANGES AND ERRORSMark GerwinNo ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument119 pagesChapter 16 Advanced Accounting Solution ManualShieldon Vic Senajon Pinoon100% (5)

- Illustrative ProblemDocument7 pagesIllustrative ProblemKim Patrick VictoriaNo ratings yet

- 26.8% Upside to Target Price of $12.03 per shareDocument6 pages26.8% Upside to Target Price of $12.03 per sharekunal bajajNo ratings yet

- RATIOS (Common Size Balance Sheet)Document4 pagesRATIOS (Common Size Balance Sheet)meenakshi vermaNo ratings yet

- Omaxe Ltd. Executive Summary under 40 charactersDocument2 pagesOmaxe Ltd. Executive Summary under 40 charactersShreemat PattajoshiNo ratings yet

- CC2 - The Financial Detective, 2005Document4 pagesCC2 - The Financial Detective, 2005Aldren Delina RiveraNo ratings yet

- Du Pont AnalysisDocument5 pagesDu Pont Analysisbhavani67% (3)

- Ratio Analysis of MSN LABORATARIESDocument3 pagesRatio Analysis of MSN LABORATARIESnawazNo ratings yet

- FinalDocument14 pagesFinalsakthiNo ratings yet

- Income Latest: Financials (Standalone)Document3 pagesIncome Latest: Financials (Standalone)Vishwavijay ThakurNo ratings yet

- Fsa Colgate - AssignmentDocument8 pagesFsa Colgate - AssignmentTeena ChandwaniNo ratings yet

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- Financial Forecasting: Revenue, Costs, Profits, EPSDocument54 pagesFinancial Forecasting: Revenue, Costs, Profits, EPSRonakk MoondraNo ratings yet

- LuxotticaDocument24 pagesLuxotticaValentina GaviriaNo ratings yet

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Document11 pages12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaNo ratings yet

- Balance Sheet Analysis and Financial Ratios for Munjal Auto IndustriesDocument29 pagesBalance Sheet Analysis and Financial Ratios for Munjal Auto Industriesaditya_behura4397No ratings yet

- Coca-Cola Co Financials at a Glance (2008-2017Document6 pagesCoca-Cola Co Financials at a Glance (2008-2017SibghaNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- FCFF Vs Fcfe StudentDocument5 pagesFCFF Vs Fcfe StudentKanchan GuptaNo ratings yet

- Rosetta Stone IPODocument5 pagesRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNo ratings yet

- Revenue, Costs, and Profits Over TimeDocument19 pagesRevenue, Costs, and Profits Over TimeELIF KOTADIYANo ratings yet

- Mehran Sugar Mills - Six Years Financial Review at A GlanceDocument3 pagesMehran Sugar Mills - Six Years Financial Review at A GlanceUmair ChandaNo ratings yet

- Tottenham Case PDF FreeDocument19 pagesTottenham Case PDF Freemaham nazirNo ratings yet

- DSP Merrill Lynch LTD Industry:Securities/Commodities Trading ServicesDocument8 pagesDSP Merrill Lynch LTD Industry:Securities/Commodities Trading Servicesapi-3699305No ratings yet

- JSW Energy: Horizontal Analysis Vertical AnalysisDocument15 pagesJSW Energy: Horizontal Analysis Vertical Analysissuyash gargNo ratings yet

- Financial Statements and Analysis: Income Statement Balance Sheet Cashflow Statement Financial RatiosDocument93 pagesFinancial Statements and Analysis: Income Statement Balance Sheet Cashflow Statement Financial RatiosAayushi ChandwaniNo ratings yet

- 2 - Aditya - Balaji TelefilmsDocument12 pages2 - Aditya - Balaji Telefilmsrajat_singlaNo ratings yet

- Ashok Leyland Limited: RatiosDocument6 pagesAshok Leyland Limited: RatiosAbhishek BhattacharjeeNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- Financial Ratios of Zee Entertainment Over 5 YearsDocument2 pagesFinancial Ratios of Zee Entertainment Over 5 Yearssagar naikNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Aztecsoft Financial Results Q1-09 Press ReleaseDocument5 pagesAztecsoft Financial Results Q1-09 Press ReleaseMindtree LtdNo ratings yet

- Rohit Pandey-15E-064 - FSA - EnduranceDocument6 pagesRohit Pandey-15E-064 - FSA - EnduranceROHIT PANDEYNo ratings yet

- P & L A/C Sanghicement Amt. %: IncomeDocument5 pagesP & L A/C Sanghicement Amt. %: IncomeMansi VyasNo ratings yet

- Annual Accounts 2021Document11 pagesAnnual Accounts 2021Shehzad QureshiNo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- Leveraged Buyout Valuation and AnalysisDocument5 pagesLeveraged Buyout Valuation and AnalysisfutyNo ratings yet

- Abridged Statement - Sheet1 - 2Document1 pageAbridged Statement - Sheet1 - 2KushagraNo ratings yet

- FM Varsity Main-Model Chapter-4Document8 pagesFM Varsity Main-Model Chapter-4AnasNo ratings yet

- Financial HighlightsDocument3 pagesFinancial HighlightsSalman SaeedNo ratings yet

- Analysis and interpretation: We see the Past track record and along with it the three possible forecastsDocument5 pagesAnalysis and interpretation: We see the Past track record and along with it the three possible forecastssumeetkantkaulNo ratings yet

- CEAT Financial Statement AnalysisDocument10 pagesCEAT Financial Statement AnalysisYugant NNo ratings yet

- CEAT Financial Statement AnalysisDocument10 pagesCEAT Financial Statement AnalysisClasherNo ratings yet

- Balance Sheet of Empee DistilleriesDocument4 pagesBalance Sheet of Empee DistilleriesArun PandiyanNo ratings yet

- CPIL Q3FY18 Investor PresentationDocument26 pagesCPIL Q3FY18 Investor PresentationSourav DuttaNo ratings yet

- Ratio Analysis Compares Liquidity, Efficiency, Leverage and Profitability of HUL and ITCDocument2 pagesRatio Analysis Compares Liquidity, Efficiency, Leverage and Profitability of HUL and ITCSuryakantNo ratings yet

- Investment Valuation Ratios Over 5 YearsDocument16 pagesInvestment Valuation Ratios Over 5 Yearsgaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Institute Program Year Subject Project Name Company Competitor CompanyDocument37 pagesInstitute Program Year Subject Project Name Company Competitor CompanyEashaa SaraogiNo ratings yet

- XLS EngDocument26 pagesXLS EngcellgadizNo ratings yet

- P&L Statement Analysis Mar 12-Mar 21Document16 pagesP&L Statement Analysis Mar 12-Mar 21tapasya khanijouNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangNo ratings yet

- AOFSDocument15 pagesAOFS1abd1212abdNo ratings yet

- Final Project of AnalysisDocument22 pagesFinal Project of Analysisuniversityofwah100% (1)

- P&L Statement Analysis of PI Industries LtdDocument45 pagesP&L Statement Analysis of PI Industries LtddixitBhavak DixitNo ratings yet

- Deepak Nitrite - Industry Analysis and Recommendation to BuyDocument14 pagesDeepak Nitrite - Industry Analysis and Recommendation to BuySujay SinghviNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- Devi ProjectDocument56 pagesDevi Projectdurga deviNo ratings yet

- Financial Accounting ProblemsDocument8 pagesFinancial Accounting ProblemsAkshay SawhneyNo ratings yet

- Tut 05 SolnDocument4 pagesTut 05 Soln张婧姝No ratings yet

- Advanced Accounting Chapter 16Document3 pagesAdvanced Accounting Chapter 16sutan fanandiNo ratings yet

- Model Test Paper-1Document24 pagesModel Test Paper-1dawraparul27No ratings yet

- Practice Statement of Cash FlowsDocument3 pagesPractice Statement of Cash FlowsSid NairNo ratings yet

- Accounting For Managers - FinalDocument21 pagesAccounting For Managers - FinalAnuj SharmaNo ratings yet

- Kunjaw UasDocument11 pagesKunjaw UasIvan Katibul FaiziNo ratings yet

- Fundamental Analysis of Bosch Ltd. CAGR Growth and Financial RatiosDocument6 pagesFundamental Analysis of Bosch Ltd. CAGR Growth and Financial RatiosJeffry MahiNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- ENT300 - Module 11 - FINANCIAL PLANDocument56 pagesENT300 - Module 11 - FINANCIAL PLANMuhammad Nurazin Bin RizalNo ratings yet

- Mids Excel WorkDocument2 pagesMids Excel WorkMuhammad EhtishamNo ratings yet

- 2017 DoubleDragon Properties Corp and SubsidiariesDocument86 pages2017 DoubleDragon Properties Corp and Subsidiariesbackup cmbmpNo ratings yet

- Acc406 - Q - Set 1 - Sesi 1 July 2020Document12 pagesAcc406 - Q - Set 1 - Sesi 1 July 2020NABILA NADHIRAH ROSLANNo ratings yet

- Adjusting Accounts and Preparing Financial Statements: QuestionsDocument74 pagesAdjusting Accounts and Preparing Financial Statements: QuestionsChaituNo ratings yet

- Pacoac - Acctg For Corporation, Financial Reporting - Analysis, and Intro To CostaccDocument12 pagesPacoac - Acctg For Corporation, Financial Reporting - Analysis, and Intro To CostaccJaysonNo ratings yet

- Akun Impor PT Surya SejahteraDocument4 pagesAkun Impor PT Surya SejahteraDiana FransiscaNo ratings yet

- SENA Logistics Management Profit LossDocument4 pagesSENA Logistics Management Profit LossJose Fernando SerranoNo ratings yet

- Kuis Akun No 1Document10 pagesKuis Akun No 1Daveli NatanaelNo ratings yet

- Financial Statement Analysis ExamDocument21 pagesFinancial Statement Analysis ExamKheang Sophal100% (2)

- Important Formulae for Financial ManagementDocument1 pageImportant Formulae for Financial ManagementakashNo ratings yet

- Adhi LK TW I 2018Document184 pagesAdhi LK TW I 2018Rezi auliawNo ratings yet

- Introduction to Accounting and BusinessDocument35 pagesIntroduction to Accounting and BusinessYonas N IsayasNo ratings yet

- Accounting Equation TutorialDocument2 pagesAccounting Equation TutorialNara SakuraNo ratings yet