Professional Documents

Culture Documents

Petrol Rates 2020.10

Petrol Rates 2020.10

Uploaded by

Akhona PezaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Petrol Rates 2020.10

Petrol Rates 2020.10

Uploaded by

Akhona PezaCopyright:

Available Formats

THE DEPARTMENT OF TRANSPORT

Enquiries: Andries Schoeman, Tel: 012 309 3117/3697

Email: schoemaA@dot.gov.za,/mhlopeT@dot.gov.za

Reference: T118

1 October 2020

TO: All heads of departments

Accounting officers

TARIFFS FOR THE USE OF MOTOR TRANSPORT

1. Amendment No 10 of 2020 of the Annexure to Transport Circular No 1

of 1977 (Transport Handbook on Tariffs for the use of Motor Transport

as amended; and Private)

2. Amendment of Annexure B of the instructions with regard to the new

Subsidized Motor Scheme (Subsidized Scheme A and C).

As a result of the fluctuation of the fuel price on 7 October 2020, the

following tariffs are consequently amended from 1 October 2020.

Please note:

❑ Private rates include fuel, maintenance, capital, insurance and

depreciation.

These rates are to be used by all individuals making use of their own

motor vehicle transport, including individuals whom structured for car

allowances and all officials partaking in Scheme B of the Subsidized

Motor Transport scheme.

❑ Subsidized Scheme A rates are only inclusive of fuel.

There rates are to be used by all officials taking part in Scheme A of

the Subsidized Motor Transport scheme where government

contributes towards the capital, insurance and maintenance of the

vehicle.

❑ Subsidized Scheme C rates are only inclusive of maintenance.

These rates are to be used by all officials taking part in Scheme C of

the Subsidized Motor Transport scheme. This rate needs to be added

to the rate in Scheme A to determine the rate of reimbursement in

cents per kilometre.

Andries Schoeman

For DIRECTOR-GENERAL: TRANSPORT

Tariffs for the Use of Motor Transport – October 2020

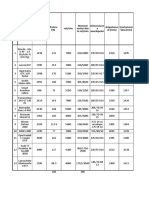

Category A: Sedans October-2020

Station Wagons

PETROL

Persal Ref Sub Scheme Sub Scheme

Engine Category Private

no. A C

Up to 1250 CC SE1250P 262.8 76.1 44.7

1251 - 1550 SE1550P 331.6 88.9 51.8

1551-1750 SE1750P 357.5 100.7 49.8

1751-1950 SE1950P 410.8 98.4 63.4

1951-2150 SE2150P 442.8 114.9 78.9

2151-2500 SE2500P 501.6 128.3 81.3

2501-3500 SE3500P 631.0 129.3 108.7

Greater than 3500 SE3501P 736.5 173.0 127.5

DIESEL

Persal Ref Sub Scheme Sub Scheme

Engine Category Private

no. A C

Up to 1250 SE1250D 246.8 62.7 42.1

1251-1550 SE1550D 302.7 66.6 45.1

1551-1750 SE1750D 330.5 75.0 48.5

1751-1950 SE1950D 342.7 72.1 63.6

1951-2150 SE2150D 406.7 77.6 80.1

2151-2500 SE2500D 470.3 87.1 91.2

Greater than 2500 SE2501D 597.4 95.6 108.8

Light Delivery

Category B: Vehicles October-2020

Single Cab 4x2

Extended Cab 4x2

PETROL

Persal Ref Sub Scheme Sub Scheme

Engine Category Private

no. A C

Up to 1250 LD1250P 221.9 86.4 41.5

1251-1550 LD1550P 292.4 106.5 43.9

1551-1750 LD1750P 322.5 135.4 45.1

1751-1950 LD1950P 375.7 134.4 50.4

1951-2150 LD2150P 385.6 141.1 53.5

2151-2500 LD2500P 410.0 160.0 59.0

2501-3500 LD3500P 440.2 169.2 64.0

Greater than 3500 LD3501P 498.8 171.0 78.7

DIESEL

Persal Ref Sub Scheme Sub Scheme

Engine Category Private

no. A C

Up to 1250 LD1250D 259.0 78.1 38.9

1251-1550 LD1550D 350.0 99.0 60.0

1551-1750 LD1750D 356.6 106.2 59.3

1751-1950 LD1950D 374.9 118.5 65.4

1951-2150 LD2150D 377.3 118.6 67.7

2151-2500 LD2500D 395.0 122.6 65.5

2501-3500 LD3500D 409.7 133.0 69.7

Greater than 3500 LD3501D 537.8 167.8 78.0

Tariffs for the Use of Motor Transport – October 2020

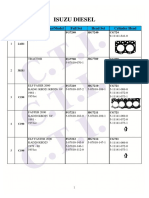

Category C: All Double Cabs October-2020

4x4 Light Delivery Vehicles

4x4 Single/ Extended Cabs

PETROL

Persal Ref Sub Scheme Sub Scheme

Engine Category Private

no. A C

Up to 2000 LV2000P 362.3 128.1 43.2

2001 to 2500 LV2500P 441.8 183.6 51.2

2501-3500 LV3500P 522.0 218.4 54.6

Greater than 3500 LV3501P 586.6 226.6 68.0

DIESEL

Persal Ref Sub Scheme Sub Scheme

Engine Category Private

no. A C

Up to 2000 LV2000D 389.4 132.9 65.5

2001 to 2500 LV2500D 458.7 142.8 66.9

2501-3500 LV3500D 511.4 146.3 73.2

Greater than 3500 LV3501D 610.7 198.8 119.8

Multi Purpose

Category D: Vehicles October-2020

Sports Utility Vehicles

Crossover vehicles

PETROL

Persal Ref Sub Scheme Sub Scheme

Engine Category Private

no. A C

Up to 1550 MP1550P 343.4 92.7 59.6

1550-1950 MP1950P 368.0 102.4 58.6

1951-2150 MP2150P 430.1 113.8 67.2

2151-2500 MP2500P 489.1 126.7 70.4

2501-3500 MP3500P 632.3 153.0 86.4

Greater than 3500 MP3501P 722.0 191.1 94.9

DIESEL

Persal Ref Sub Scheme Sub Scheme

Engine Category Private

no. A C

Up to 2150 MP2150D 459.7 85.0 82.7

2151-2500 MP2500D 569.5 108.8 80.6

2501-3500 MP3500D 601.3 113.6 94.7

Greater than 3500 MP3501D 700.0 148.1 115.9

Category F: Motor Cycle October-2020

Scooter

Persal Ref Sub Scheme Sub Scheme

Engine Category Private

no. A C

Up to 250 MC0250P 135.4 N/a N/a

Over 250 MC0251P 160.0 N/a N/a

Tariffs for the Use of Motor Transport – October 2020

You might also like

- STD 5 - 8 Ses Q & A (Masese) - 1Document40 pagesSTD 5 - 8 Ses Q & A (Masese) - 1Malack Chagwa83% (23)

- 6cta8 3-D (M)Document2 pages6cta8 3-D (M)Ahmad Shahrul MohamedNo ratings yet

- BMW 5 & 6 Series E12 - E24 - E28 -E34 Restoration Tips and TechniquesFrom EverandBMW 5 & 6 Series E12 - E24 - E28 -E34 Restoration Tips and TechniquesNo ratings yet

- ZF 2000 Series: Product DetailsDocument4 pagesZF 2000 Series: Product DetailsJhonAlexRiveroNo ratings yet

- Petrol Rates 2020.11Document3 pagesPetrol Rates 2020.11Akhona PezaNo ratings yet

- Petrol Rates 2020.12Document3 pagesPetrol Rates 2020.12Akhona PezaNo ratings yet

- Petrol Rates 2020.08Document3 pagesPetrol Rates 2020.08Akhona PezaNo ratings yet

- Petrol Rates 2020.09Document3 pagesPetrol Rates 2020.09Akhona PezaNo ratings yet

- August 2023Document3 pagesAugust 2023Ninja Thomas MakaringeNo ratings yet

- Fuel Tariff Rates For June 2022Document3 pagesFuel Tariff Rates For June 2022NicolasNo ratings yet

- Popular Product ListDocument46 pagesPopular Product ListMark Mai0% (1)

- Cadic Catalogue 2018 PDFDocument27 pagesCadic Catalogue 2018 PDFChiito Vidal100% (1)

- Arco-ШАТУНЫ-2018 01 03Document51 pagesArco-ШАТУНЫ-2018 01 03Алексей Тозик0% (1)

- Cat Marine Engine ProgramDocument4 pagesCat Marine Engine ProgramRobert BeddingfieldNo ratings yet

- Pricelist Price-ListDocument3 pagesPricelist Price-ListAkash ChoudharyNo ratings yet

- What Car Which TyreDocument17 pagesWhat Car Which TyreShrivatsa G100% (1)

- Cck-Lea031 E4 Ed8Document4 pagesCck-Lea031 E4 Ed8Cong VietNo ratings yet

- Filter CatalogDocument6 pagesFilter CatalogAhmed Mostafa100% (1)

- Excel 7 CarsDocument6 pagesExcel 7 CarsCristina FlorinaNo ratings yet

- Kits Árboles de Levas Marzo 12 2024Document3 pagesKits Árboles de Levas Marzo 12 2024Antonio UgartecheaNo ratings yet

- Tất cả xe tại kho Long ThànhDocument8 pagesTất cả xe tại kho Long Thànhmt thanh nguyenNo ratings yet

- Capacitación en Reparación de Inyectores Diésel para Siemens VDO - Toni TaoDocument61 pagesCapacitación en Reparación de Inyectores Diésel para Siemens VDO - Toni TaoFranciscoMartelRosas100% (1)

- Listado Vendedores: Precios Sujetos A Cambio Sin Previo AvisoDocument56 pagesListado Vendedores: Precios Sujetos A Cambio Sin Previo AvisoNereida GuerreroNo ratings yet

- Hasel ForkliftDocument6 pagesHasel ForkliftDerya ErdoğanNo ratings yet

- Presentation On Auto Industry Development Plan-Ii (FY 2012-13 2016-17)Document82 pagesPresentation On Auto Industry Development Plan-Ii (FY 2012-13 2016-17)areebNo ratings yet

- Kirloskar Brothers LP Motors W e F 1 March 2014Document13 pagesKirloskar Brothers LP Motors W e F 1 March 2014durgaNo ratings yet

- Oil & Gas Plant: 5 MW Continuos Operation (Desert Environment)Document2 pagesOil & Gas Plant: 5 MW Continuos Operation (Desert Environment)Elisio MarquesNo ratings yet

- FSFSCVDocument2 pagesFSFSCVEzany EzNo ratings yet

- New Parts Numbers in 2022Document16 pagesNew Parts Numbers in 2022ernestoNo ratings yet

- Volvo V40 PricelistDocument16 pagesVolvo V40 PricelistNathan GabbottNo ratings yet

- Tabelle ACI 2023 Auto Termiche Bifuel Benzina GPL e Metano Fuori ProduzioneDocument3 pagesTabelle ACI 2023 Auto Termiche Bifuel Benzina GPL e Metano Fuori ProduzioneIl DanielNo ratings yet

- 롱탄 차량 현황 (20230108)Document7 pages롱탄 차량 현황 (20230108)mt thanh nguyenNo ratings yet

- DD Series Guide Rod Diesel Pile Hammer D Series Diesel Pile HammerDocument7 pagesDD Series Guide Rod Diesel Pile Hammer D Series Diesel Pile HammerMuqorobinNo ratings yet

- Low Voltage Motors - Price ListDocument32 pagesLow Voltage Motors - Price ListsamuraivickyNo ratings yet

- CAT Engine PDFDocument28 pagesCAT Engine PDFroy fadliNo ratings yet

- Isuzu DieselDocument25 pagesIsuzu DieselJulian Arcila ValenciaNo ratings yet

- Engine VolvoDocument360 pagesEngine Volvojbouza100% (2)

- Yumak Catalog (Clutch Servo and Valve Catalogue) 2023Document616 pagesYumak Catalog (Clutch Servo and Valve Catalogue) 2023201903743kevinvaldezNo ratings yet

- Tabelle ACI 2022 - AUTOVEICOLI A BENZINA GPL E BENZINA METANO IN PRODUZIONE PDFDocument1 pageTabelle ACI 2022 - AUTOVEICOLI A BENZINA GPL E BENZINA METANO IN PRODUZIONE PDFNico NapolitanoNo ratings yet

- CAT C7 C9 HEUI CatalogueDocument24 pagesCAT C7 C9 HEUI CatalogueDodik Cahyono100% (2)

- SetrabApplicationSuggestions PDFDocument1 pageSetrabApplicationSuggestions PDFChristian Gil MagaldiNo ratings yet

- Dita Catalogo 2023Document259 pagesDita Catalogo 2023Leonardo MartinsNo ratings yet

- Vehicule Util KubotaDocument11 pagesVehicule Util KubotaDerrien EnzoNo ratings yet

- ZF 320 Series: Product DetailsDocument4 pagesZF 320 Series: Product Detailsrhandalf100% (1)

- Cars Radiator Banco PricelistDocument42 pagesCars Radiator Banco PricelistMM SparesNo ratings yet

- Diesel Engines Series 4000 R04: For Push-Pull Trains and Locomotives Eu Stage IiibDocument2 pagesDiesel Engines Series 4000 R04: For Push-Pull Trains and Locomotives Eu Stage IiibJavier Quintero100% (1)

- Full Line Brochure 7-2021Document32 pagesFull Line Brochure 7-2021PrudzNo ratings yet

- Product Bulletin: ADB11591 - Brake Pad Set, Disc BrakeDocument8 pagesProduct Bulletin: ADB11591 - Brake Pad Set, Disc BrakeDEEPENDRA KUMARNo ratings yet

- Engine Fuel ConsumptionDocument1 pageEngine Fuel Consumptionsheblm359No ratings yet

- Siemens Motor Price List 10th May 2021Document31 pagesSiemens Motor Price List 10th May 2021Sukhvinder SinghNo ratings yet

- 13-Cranktrain-2020 07 16 PDFDocument152 pages13-Cranktrain-2020 07 16 PDFSilver LocalNo ratings yet

- 5555555555555Document46 pages5555555555555Tommy CamposNo ratings yet

- Referência Ref. Técnica Aplicação: Tel: TelDocument11 pagesReferência Ref. Técnica Aplicação: Tel: TelFabricio TavaresNo ratings yet

- 2 DJDocument60 pages2 DJYeltsin Ore100% (1)

- ZF 400 Series: Product DetailsDocument4 pagesZF 400 Series: Product DetailsNEIKER 3001No ratings yet

- Marine SiteContent en Binary Asset Attachments Products Auxiliary 6C Peformance Curves FR90724 181 1800 PCDocument3 pagesMarine SiteContent en Binary Asset Attachments Products Auxiliary 6C Peformance Curves FR90724 181 1800 PCaldhanyNo ratings yet

- 220Document1 page220fahmi wibowoNo ratings yet

- NissensNews 413 January 2023Document3 pagesNissensNews 413 January 2023Nowy NowyNo ratings yet

- Allison Transmissions: How to Rebuild & Modify: How to Rebuild & ModifyFrom EverandAllison Transmissions: How to Rebuild & Modify: How to Rebuild & ModifyRating: 5 out of 5 stars5/5 (1)

- Mercedes Benz & Dodge Sprinter CDI 2000-2006 Owners Workshop ManualFrom EverandMercedes Benz & Dodge Sprinter CDI 2000-2006 Owners Workshop ManualRating: 3.5 out of 5 stars3.5/5 (2)

- Terms of ReferenceDocument3 pagesTerms of ReferenceAkhona PezaNo ratings yet

- Petrol Rates 2020.09Document3 pagesPetrol Rates 2020.09Akhona PezaNo ratings yet

- ImprovingStaffMoralethroughAuthenticAppreciation FINAL - ResDocument3 pagesImprovingStaffMoralethroughAuthenticAppreciation FINAL - ResAkhona PezaNo ratings yet

- Instructor Letter - 4 July 2023Document1 pageInstructor Letter - 4 July 2023Akhona PezaNo ratings yet

- SQL HR ConsultasDocument6 pagesSQL HR Consultasrsernesto-1No ratings yet

- Gentics Lab 5Document12 pagesGentics Lab 5Time NextNo ratings yet

- 2BHK Type1 PDFDocument1 page2BHK Type1 PDFBaluvu JagadishNo ratings yet

- Student Guide 2015Document13 pagesStudent Guide 2015api-295463484No ratings yet

- Diagram Alir Dan Deskripsi Proses: Tugas 4Document11 pagesDiagram Alir Dan Deskripsi Proses: Tugas 4FevitaNo ratings yet

- Dev Tools GuideDocument91 pagesDev Tools GuidescriNo ratings yet

- Aashirvaad AttaDocument8 pagesAashirvaad AttaPulkit AggarwalNo ratings yet

- SF Will Animerge 0Document3 pagesSF Will Animerge 0spazzowackoNo ratings yet

- Fin 254 - Chapter 5 CorrectedDocument61 pagesFin 254 - Chapter 5 CorrectedsajedulNo ratings yet

- Ramesh PTE PreperationDocument6 pagesRamesh PTE Preperationdarpan.groverNo ratings yet

- 5 Protein Purification Characterization TechniquesDocument22 pages5 Protein Purification Characterization TechniquesKelly SisonNo ratings yet

- ProximyDocument87 pagesProximyMarielba BernottyNo ratings yet

- Fry and Pop Final Na TalagaDocument22 pagesFry and Pop Final Na TalagaMicole LimNo ratings yet

- Claraboias DesenfumagemDocument2 pagesClaraboias DesenfumagemPaulo CostaNo ratings yet

- Quality Control of Construction Testing of Concrete CubesDocument20 pagesQuality Control of Construction Testing of Concrete Cubesgaurav522chdNo ratings yet

- Kez CondensadorasDocument40 pagesKez CondensadorasGerman RomeroNo ratings yet

- Joint Option Form For EpsDocument4 pagesJoint Option Form For Epsvijay2990No ratings yet

- Volmary Catalogue 2024Document398 pagesVolmary Catalogue 2024Vikash TrivediNo ratings yet

- Interim SampleDocument63 pagesInterim SampleLoku BappaNo ratings yet

- Ghana Research PaperDocument4 pagesGhana Research Paperscongnvhf100% (1)

- Preview of Tyre Retreading PDFDocument20 pagesPreview of Tyre Retreading PDFLucky TraderNo ratings yet

- TLP560J Datasheet en 20170710Document6 pagesTLP560J Datasheet en 20170710ronald contrerasNo ratings yet

- Oct 2023 Ent530 GuidelineDocument19 pagesOct 2023 Ent530 Guideline2023189791100% (1)

- 1) IntroductionDocument62 pages1) IntroductionSanjay RagupathyNo ratings yet

- 导出页面自 0. FLEXCON HDPE Company Profile 2019Document5 pages导出页面自 0. FLEXCON HDPE Company Profile 2019Ge DanielNo ratings yet

- Data Sheet - Bateria - Everexceed - ST-12120Document2 pagesData Sheet - Bateria - Everexceed - ST-12120JAIRO LOPEZNo ratings yet

- Absolute Judgement: IE-311 Ergonomics 2Document19 pagesAbsolute Judgement: IE-311 Ergonomics 2Lucky Gem AsibuqueNo ratings yet

- Concise Clinical Embryology An Integrated Case Based Approach Mar 18 2021 - 0323696155 - Elsevier 1St Edition Torchia MSC PHD Full ChapterDocument68 pagesConcise Clinical Embryology An Integrated Case Based Approach Mar 18 2021 - 0323696155 - Elsevier 1St Edition Torchia MSC PHD Full Chapterraymond.flores626100% (7)

- DNV Accident Statistics For Fixed Offshore Units On The UK Continental Shelf 1980 - 2001Document103 pagesDNV Accident Statistics For Fixed Offshore Units On The UK Continental Shelf 1980 - 2001Mohammed Samy DarwishNo ratings yet