Professional Documents

Culture Documents

Esop Disclosure Pursuant To Regulation 14 of SEBI Regulations 2021 For The Year Ended 31 - March - 2022

Uploaded by

Vikky Rawal0 ratings0% found this document useful (0 votes)

6 views5 pagesThe document provides disclosures on employee stock option plans (ESOPs) for AU Small Finance Bank for the financial year 2021-22. It includes details such as the number of options granted and exercised during the year, exercise prices, employees receiving grants, and the methodology used to estimate the fair value of options. Key information disclosed includes diluted EPS of Rs. 35.69 per share for issues under ESOP schemes and that the bank uses the intrinsic value method for accounting of ESOPs.

Original Description:

ESOP details

Original Title

esop-disclosure-pursuant-to-regulation-14-of-SEBI-regulations-2021-for-the-year-ended-31_march_2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides disclosures on employee stock option plans (ESOPs) for AU Small Finance Bank for the financial year 2021-22. It includes details such as the number of options granted and exercised during the year, exercise prices, employees receiving grants, and the methodology used to estimate the fair value of options. Key information disclosed includes diluted EPS of Rs. 35.69 per share for issues under ESOP schemes and that the bank uses the intrinsic value method for accounting of ESOPs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views5 pagesEsop Disclosure Pursuant To Regulation 14 of SEBI Regulations 2021 For The Year Ended 31 - March - 2022

Uploaded by

Vikky RawalThe document provides disclosures on employee stock option plans (ESOPs) for AU Small Finance Bank for the financial year 2021-22. It includes details such as the number of options granted and exercised during the year, exercise prices, employees receiving grants, and the methodology used to estimate the fair value of options. Key information disclosed includes diluted EPS of Rs. 35.69 per share for issues under ESOP schemes and that the bank uses the intrinsic value method for accounting of ESOPs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

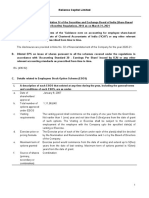

The Disclosures pursuant to Regulation 14 of the SEBI (Share Based Employee Benefits and Sweat Equity)

Regulations, 2021 on ESOP disclosures for the Financial Year 2021-22

Sl. Particulars Status of compliance

No.

A. Disclosures in terms of the accounting standards Details are covered under Point F of Schedule

prescribed by the Central Government in terms of section 17 - Notes to Accounts of the financial

133 of the Companies Act, 2013 (18 of 2013) including the statements in the Bank’s Annual Report

‘Guidance note on accounting for employee share-based 2021-22.

payments' issued in this regard from time to time.

B. Diluted EPS on issue of shares pursuant to all the schemes Rs. 35.69 per share

covered under the regulations shall be disclosed in

accordance with 'Accounting Standard 20 - Earnings Per

Share' issued by Central Government or any other

relevant accounting standards as issued from time to

time.

C. Details related to ESOS

i. A description of each ESOS that existed at any time during Details are covered under Point J. “Employee

the year, including the general terms and conditions of Stock Option Schemes” of the Board’s Report

each ESOS, including - in the Bank’s Annual Report 2021-22.

(a) Date of shareholders’ approval

(b) Total number of options approved under ESOS

(c) Vesting requirements

(d) Exercise price or pricing formula

(e) Maximum term of options granted

(f) Source of shares (primary, secondary or combination)

(g) Variation in terms of options

ii. Method used to account for ESOS - Intrinsic or fair value Intrinsic Value

iii. Where the company opts for expensing of the options Details are covered under Point No. 25 of “B.

using the intrinsic value of the options, the difference Other Disclosures” of Schedule 18 - Notes to

between the employee compensation cost so computed Accounts of the financial statements in the

and the employee compensation cost that shall have been Bank’s Annual Report 2021-22.

recognized if it had used the fair value of the options shall

be disclosed. The impact of this difference on profits and

on EPS of the company shall also be disclosed.

iv. Option movement during the year (For each ESOS) Details are covered under Point J. “Employee

Particulars Stock Option Schemes” of the Board’s Report

1. Number of options outstanding at the beginning in the Bank’s Annual Report 2021-22.

of the period

2. Number of options granted during the year

3. Number of options forfeited / lapsed during the

year

4. Number of options vested during the year

5. Number of options exercised during the year

6. Number of shares arising as a result of exercise

of options

7. Money realized by exercise of options (INR), if

scheme is implemented directly by the company

8. Loan repaid by the Trust during the year from

exercise price received

9. Number of options outstanding at the end of

the year

10. Number of options exercisable at the end of the

year

v. Weighted-average exercise prices and weighted-average Details are covered under Point J. “Employee

fair values of options shall be disclosed separately for Stock Option Schemes” of the Board’s Report

options whose exercise price either equals or exceeds or in the Bank’s Annual Report 2021-22.

is less than the market price of the stock.

vi. Employee wise details (name of employee, designation, a. Details of senior managerial personnel are

number of options granted during the year, exercise price) given in “Annexure-A”

of options granted to –

a. Senior Managerial Personnel as defined under reg. Details mentioned in point No. b. & c. are

16(d) of SEBI (Listing Obligations and Disclosure covered under Point J. “Employee Stock

Requirements) Regulation, 2015. Option Schemes” of the Board’s Report in the

b. any other employee who receives a grant in any Bank’s Annual Report 2021-22.

one year of option amounting to 5% or more of

option granted during that year; and

c. identified employees who were granted option,

during any one year, equal to or exceeding 1% of

the issued capital (excluding outstanding warrants

and conversions) of the company at the time of

grant.

vii. A description of the method and significant assumptions

used during the year to estimate the fair value of options

including the following information:

(a) the weighted-average values of share price, exercise price, Details are covered under Point No. 25 of “B.

expected volatility, expected option life, expected Other Disclosures” of Schedule 18 - Notes to

dividends, the risk-free interest rate and any other inputs Accounts of the financial statements in the

to the model; Bank’s Annual Report 2021-22.

(b) the method used and the assumptions made to incorporate Not Applicable

the effects of expected early exercise;

(c) how expected volatility was determined, including an Volatility is a measure of the amount by

explanation of the extent to which expected volatility was which a price is expected to fluctuate during

based on historical volatility; and a period based on the historic data. The Bank

got listed on stock exchange in July 2017.

Share price of the Bank from the listing day to

one day prior to date of grant is considered

for determining the volatility.

(d) whether and how any other features of the option grant The expected life of share option is based on

were incorporated into the measurement of fair value, historical data. Vesting and exercise period

such as a market condition. has been considered while calculating the life

of the Option Future market conditions are

not used for measurement of fair value.

Disclosures in respect of grants made in three years prior There were only four grants made by the

to IPO under each ESOS Nomination and Remuneration Committee

prior to the Initial Public Offer (IPO) of the

(i) Until all options granted in the three years prior to the Bank and the disclosure in respect of such

IPO have been exercised or have lapsed, disclosures of the options have been included hereinabove.

information specified above in respect of such options shall

also be made.

D. Details related to ESPS Not Applicable

E. Details related to SAR Not Applicable

F. Details related to GEBS / RBS Not Applicable

G. Details related to Trust

(i) General information on all schemes

S. Particulars Status of Compliance

No.

1. Name of the Trust AU Small Finance Bank Employees Welfare

Trust

2. Details of the Trustee(s) Mr. Manoj Tibrewal (Trustee No. 1)

Mr. Ajay Sankhla (Trustee No. 2)

3. Amount of loan disbursed by company / any NA

company in the group, during the year

4. Amount of loan outstanding (repayable to company NA

/ any company in the group) as at the end of the year

5. Amount of loan, if any, taken from any other source NA

for which company / any company in the group has

provided any security or guarantee

6. Any other contribution made to the Trust during the NA

year

(ii) Brief details of transactions in shares by the Trust

(a) Number of shares held at the beginning of the year; Not Applicable

(b) Number of shares acquired during the year through (i)

primary issuance (ii) secondary acquisition, also as a

percentage of paid up equity capital as at the end of the

previous financial year, along with information on

weighted average cost of acquisition per share;

(c) Number of shares transferred to the employees / sold

along with the purpose thereof;

(d) Number of shares held at the end of the year.

(iii) In case of secondary acquisition of shares by the Trust

Number of shares Not Applicable

Held at the beginning of the year

Acquired during the year

Sold during the year

Transferred to the employees during the year

Held at the end of the year

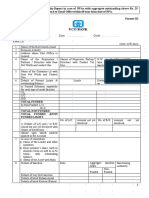

“Annexure-A”

Details of stock options granted to Senior Managerial Personnel (SMP) during the financial year

ended March 31, 2022

S. No. Name Designations No. of ESOP granted in Grand

ESOP ESOP Plan Total

Plan 2020

2016

1 Mr. Rishi Dhariwal Group Head Liability - 15796 15,796

2 Mr. Deepak Jain Chief Risk Officer - 16397 16,397

3 Mr. Bhaskar Vittal Karkera Chief of Wheels - 13877 13,877

4 Mr. Manoj Tibrewal Business Head- Merchant - 8276 8,276

Solution Group

5 Mr. Vimal Jain Chief Financial Officer - 14357 14,357

6 Mr. Yogesh Jain Chief of Staff - 20000 20,000

7 Mr. Ankur Tripathi Chief Information Officer - 25000 25,000

8 Mr. Mayank Markanday Head of Credit Card Business 10000 9458 19,458

9 Mr. Pankaj Sharma Head of Merchant Lending - 12500 12,500

10 Mr. Aalekh Vijayvargiya National Credit Manager SBL - 15000 15,000

(MSME)

11 Mr. Aditya Sharma Head of Technical & Legal - - 12500 12,500

Mortgages

12 Mr. Shantanu Prasad Head of Treasury & Wholesale - 11936 11,936

Liability

13 Mr. Chandan Singh Gehlot Head of Credit - DCM - 5523 5,523

14 Mr. Gaurav Jain President - Tech Initiatives & - 5581 5,581

Distribution Strategy

15 Mr. Sharad Goklani Chief Technology Officer - - -

16 Mr. Vivek Tripathi Head of Human Resources - 11620 11,620

17 Mr. Vivek Tripathi Head of Commercial Banking - 16000 16,000

18 Mr. Priyam Alok Head of Business Banking - 7866 7,866

19 Mr. Rajesh Gupta Head of Agri Banking - - -

20 Mr. Ranjan Agarwal National Business Manager- - 5612 5,612

NBFC & DCM

21 Mr. Ankit Ajmera National Business Manager- - 3433 3,433

REG

22 Mr. Amit Mathur Head of Credit - Commercial - - -

Banking

23 Mr. Vivek Rathi National Credit Manager - 7680 7,680

Business Banking

24 Mr. Gyaneshwar Ranjan National Credit Manager Agri - 4065 4,065

Banking

25 Mr. Deepak Goyal National Credit Manager- REG - 4073 4,073

26 Mr. Vikrant Jethi Head of Collections - 10373 10,373

27 Mr. Raj Kumar Sharma National Collection Manager - 10813 10,813

Wheels

28 Mr. Sumit Sharma National Collection Manager - 6011 6,011

SBL-HL

S. No. Name Designations No. of ESOP granted in Grand

ESOP ESOP Plan Total

Plan 2020

2016

29 Mr. Shoorveer Singh Shekhawat Head of Marketing, Video - 11865 11,865

Banking & TFx Initiatives

30 Mr. Dilip K Vidyarthy National Business Manager - 13,076 13,076

Bancassurance

31 Mr. Shatrughan Singh Bhati Head of Sales Management and - 6,253 6,253

Business Analytics - Branch

Banking

32 Mr. Avinash Sharan National Business Manager - - 7,698 7,698

Branch Banking

33 Mr. Shekhar Shukla Head of Operations - 8,856 8,856

34 Mr. Vikas Chowdhry Lead Operations - Retail Assets - 5,304 5,304

& SBL

35 Mr. Yogesh Soni Head of Branch Banking - 7,780 7,780

Operations

36 Mr. Sachin Kumar Jain National Credit Manager - 8,090 8,090

Wheels

37 Mr. Abhinav Garg National Product & - 5,348 5,348

Communication Manager

Wheels

38 Mr. Ashish Gorecha National Business Manager - 13,023 13,023

Home Loan

39 Mr. Ronak Jain National Credit Manager Home - 6,896 6,896

Loan

40 Mr. Deepak Saraswat National Legal Manager - SBL & - 4,502 4,502

HL

41 Mr. Akhil Kumar Patni National Product & - 4,638 4,638

Communication Manager SBL

42 Mr. Ashok Kumar Khandelwal Chief Compliance Officer - 7,525 7,525

43 Mr. Vinay Vaish Head of Internal Audit - 6,986 6,986

44 Mr. Manmohan Parnami Company Secretary - 3,808 3,808

45 Mr. Manish Sehgal Chief Information Security - 5,121 5,121

Officer

46 Mr. Farhan Ahmed Chief Vigilance Officer - 5,783 5,783

Grand total 10,000 4,06,299 4,16,299

Note: the exercise price for ESOP Plan 2016 was Rs. 1167 and ESOP Plan 2020 was Rs. 1121.

You might also like

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Reliance Capital LimitedDocument6 pagesReliance Capital Limitedaditya tripathiNo ratings yet

- Esop 2019-20Document2 pagesEsop 2019-20aftab khanNo ratings yet

- Esop Disclosure Fy2019 20 - 221012 - 153613Document3 pagesEsop Disclosure Fy2019 20 - 221012 - 153613Shikha JainNo ratings yet

- UC SOE Assets FormatDocument4 pagesUC SOE Assets FormatajayNo ratings yet

- RBI 202425 18 Key Facts Statement (KFS) For Loans & AdvancesDocument8 pagesRBI 202425 18 Key Facts Statement (KFS) For Loans & Advancesambarishramanuj8771No ratings yet

- Disclosure Under SEBI Regulations On ESOP 2019 20Document4 pagesDisclosure Under SEBI Regulations On ESOP 2019 20Raja BetaNo ratings yet

- Auditors Report PROJECTDocument40 pagesAuditors Report PROJECTCarol I. LoboNo ratings yet

- Basel II Disclosure For The Year Ended March2012Document15 pagesBasel II Disclosure For The Year Ended March2012kartiki1No ratings yet

- Reserve Bank of IndiaDocument8 pagesReserve Bank of IndiaVasu Ram JayanthNo ratings yet

- BAL 22 ESOPs For Web IndiDesignDocument6 pagesBAL 22 ESOPs For Web IndiDesignRishav PatwariNo ratings yet

- IRDAI Master Circular Unclaimed Amounts of Policyhol 002Document13 pagesIRDAI Master Circular Unclaimed Amounts of Policyhol 002Puran Singh LabanaNo ratings yet

- Format IIIDocument6 pagesFormat IIIAman GargNo ratings yet

- 104-Check List For Scrutiny of Credit ProposalsDocument10 pages104-Check List For Scrutiny of Credit ProposalsgayathrihariNo ratings yet

- SEBI Circ PDFDocument17 pagesSEBI Circ PDFSHYAM SINGHNo ratings yet

- Draft Guidelines DNBS (PD) - CC. No. - /03.05.002 / 2007-2008 June - , 2008Document21 pagesDraft Guidelines DNBS (PD) - CC. No. - /03.05.002 / 2007-2008 June - , 2008Bhavesh SoniNo ratings yet

- Alternative Funding InstrumentsDocument7 pagesAlternative Funding InstrumentsManasvi GuptaNo ratings yet

- Eicher Motors ESOP Statement 2021-22Document5 pagesEicher Motors ESOP Statement 2021-22Srikesav SivakumarNo ratings yet

- Share Based Payments ExercisesDocument5 pagesShare Based Payments ExercisesayhanacruzNo ratings yet

- ECB Practical ApproachDocument4 pagesECB Practical ApproachCryosave100% (1)

- 05 Acctg Ed 1 - Statement of Financial Position PDFDocument8 pages05 Acctg Ed 1 - Statement of Financial Position PDFGian Christian Magno BuenaNo ratings yet

- Applicationform PDFDocument3 pagesApplicationform PDFV. santhoshNo ratings yet

- HDFC Mutual Fund ListDocument60 pagesHDFC Mutual Fund Listhshah21No ratings yet

- Utilisation Certificate (Rs. in Lakhs) : (Please Give No. and Dates of Sanction Orders Showing The Amounts Paid)Document2 pagesUtilisation Certificate (Rs. in Lakhs) : (Please Give No. and Dates of Sanction Orders Showing The Amounts Paid)jayakrishnanNo ratings yet

- Bank Accounting PolicyDocument29 pagesBank Accounting Policykotha123No ratings yet

- Application Form For MsmesDocument8 pagesApplication Form For MsmesNitin PaliwalNo ratings yet

- Guide To Understand An Offer Document: (WWW - Sebi.gov - In)Document5 pagesGuide To Understand An Offer Document: (WWW - Sebi.gov - In)Geetika KhandelwalNo ratings yet

- Annexure A Application For MSME Loan Upto Rs.100 LakhDocument6 pagesAnnexure A Application For MSME Loan Upto Rs.100 LakhChayan MajumdarNo ratings yet

- Guidance For Preparation of Funding Documents v2Document17 pagesGuidance For Preparation of Funding Documents v2AtulNo ratings yet

- Circular For Interest PaymentDocument3 pagesCircular For Interest PaymentVibhu SinghNo ratings yet

- Housing Finance IndustryDocument18 pagesHousing Finance IndustrySiva annaNo ratings yet

- Final Circ2 2004Document6 pagesFinal Circ2 2004Gavin HenningNo ratings yet

- Updates On Revised Kisan Credit Card (KCC) SchemeDocument10 pagesUpdates On Revised Kisan Credit Card (KCC) SchemeSelvaraj VillyNo ratings yet

- Circular On Reg 32Document3 pagesCircular On Reg 32Swapnita RaneNo ratings yet

- Sid - Sbi S P Bse Sensex Index FundDocument136 pagesSid - Sbi S P Bse Sensex Index FundKrish MudaliarNo ratings yet

- NonDocument6 pagesNonb jayaNo ratings yet

- Proposed Remuneration Policy Members Executive BoardDocument10 pagesProposed Remuneration Policy Members Executive BoardMaria CristinaNo ratings yet

- XYZHL Application Form - Editable - FinalDocument5 pagesXYZHL Application Form - Editable - FinalamiteshnegiNo ratings yet

- Indian Accounting Standard (IND As) 33, IAS 33 Earnings Per Share - Taxguru - inDocument6 pagesIndian Accounting Standard (IND As) 33, IAS 33 Earnings Per Share - Taxguru - inaaosarlbNo ratings yet

- Circular On (A) Benefit Illustration and (B) Other Market Conduct AspectsDocument23 pagesCircular On (A) Benefit Illustration and (B) Other Market Conduct AspectsRoshan PednekarNo ratings yet

- Theory of AccountsDocument7 pagesTheory of AccountsralphalonzoNo ratings yet

- Bank Branch AuditDocument7 pagesBank Branch Auditjoinsandeh1301100% (2)

- HDFC Annual ReportDocument139 pagesHDFC Annual ReportDanish KhanNo ratings yet

- Government Securities Market EditedDocument32 pagesGovernment Securities Market Editedamnanraza30No ratings yet

- Asset Classification and Provisioning Regulations 2017 ENG PDFDocument4 pagesAsset Classification and Provisioning Regulations 2017 ENG PDFNelsonNo ratings yet

- Corporate Reporting II Lectures 8 & 9 (IAS 19) & SBPs IFRS2 Obligation-1Document20 pagesCorporate Reporting II Lectures 8 & 9 (IAS 19) & SBPs IFRS2 Obligation-1Letsah BrightNo ratings yet

- Supplement Executive Programme: For June, 2021 ExaminationDocument51 pagesSupplement Executive Programme: For June, 2021 ExaminationNiel JangirNo ratings yet

- 1 PF Audit ChecklistDocument8 pages1 PF Audit ChecklistAmbarish Gondhalekar75% (4)

- Reserve Bank of India: Master Direction On Issuance and Operation of Prepaid Payment InstrumentsDocument37 pagesReserve Bank of India: Master Direction On Issuance and Operation of Prepaid Payment Instrumentsprit6924No ratings yet

- ESOP Letter To EmployeesDocument5 pagesESOP Letter To EmployeesNivedita Jaiswal100% (3)

- Grant-In-Aid: A Presentation by V.R.Ramankutty, Faculty, RTC, MumbaiDocument28 pagesGrant-In-Aid: A Presentation by V.R.Ramankutty, Faculty, RTC, MumbaikunalNo ratings yet

- Government Securities Market in India 1. What Is A Bond?Document5 pagesGovernment Securities Market in India 1. What Is A Bond?Arpit GuptaNo ratings yet

- The Provisions of Chapter VI of This Operational Circular Are Applicable To All Listed Entities Who HaveDocument75 pagesThe Provisions of Chapter VI of This Operational Circular Are Applicable To All Listed Entities Who HaveArun Kumar SharmaNo ratings yet

- Customer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsDocument17 pagesCustomer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsKavya NageshNo ratings yet

- CM1BDocument3 pagesCM1BRahul IyerNo ratings yet

- Quiz SolutionsDocument4 pagesQuiz SolutionsEDELYN PoblacionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)