Professional Documents

Culture Documents

Chapter 1 - Exercises Part A

Uploaded by

HECTOR ORTEGACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 - Exercises Part A

Uploaded by

HECTOR ORTEGACopyright:

Available Formats

CHAPTER 1

INTRODUCTION

PART A - EXERCISES

Professor: María

María José García López

mariajose.garcia@urjc.es

Introduction Page 15 Chapter 1

ACTIVITY 1 THE FOUR FINANCIAL STATEMENTS

Purpose: • Identify the four financial statements

• Understand the basic information provided by each financial statement

BALANCE SHEET

Assets Liabilities

Stockholders’ equity

The Balance Sheet (B/S) provides a snapshot of a company’s financial position as of a certain date. It

reports assets, items of value such as inventory and equipment, and whether the assets are financed with

liabilities (debt) or stockholders’ equity (equity).

INCOME STATEMENT

Revenues

(Expenses)

Net income

The Income Statement (I/S) reports the company’s profitability during an accounting period. It reports

revenues, amounts received from customers for products sold or services provided, and expenses, the

costs incurred to produce revenues. The difference is net income.

STATEMENT OF STOCKHOLDERS’ EQUITY

Retained earnings, beginning Contributed capital, beginning

+ Net income + Issuance of shares

(Dividends) (Repurchase to retire shares)

Retained earnings, ending Contributed capital, ending

The Statement of Stockholders’ Equity (S/E) reports if the earnings (net income) of this accounting period

are distributed as dividends or retained in the business as retained earnings. It also reports amounts paid

(contributed) by stockholders to purchase common stock and preferred stock.

STATEMENT OF CASH FLOWS

Cash inflows

(Cash outflows)

Change in the cash account

The Statement of Cash Flows (C/F) reports cash inflows and cash outflows during an accounting period.

Q1 Which financial statement reports…

a. whether the company was profitable or not? (BS / IS / SE / CF)

b. whether assets are primarily financed with debt or equity? (BS / IS / SE / CF)

c. dividends declared by the board of directors for shareholders? (BS / IS / SE / CF)

d. cash received from customers during the accounting period? (BS / IS / SE / CF)

e. the revenues of a corporation? (BS / IS / SE / CF)

f. the liabilities of a corporation? (BS / IS / SE / CF)

g. retained earnings at the beginning of the accounting period? (BS / IS / SE / CF)

Introduction Page 16 Chapter 1

ACTIVITY 2 BALANCE SHEET

Purpose: • Understand the information provided by the balance sheet

• Identify asset, liability, and stockholders’ equity accounts reported on the

balance sheet

• Understand the accounting equation

PEPSICO (PEP*) 12/27/2008 BALANCE SHEET ($ in millions)

ASSETS LIABILITIES

Cash and cash equivalents $ 2,064 Accounts payable $ 2,846

Short-term investments 213 Short-term debt 369

Accounts receivable, net 4,683 Other current liabilities 5,572

Inventories 2,522 Long-term debt 7,858

Other current assets 1,324 Other noncurrent liabilities 7,243

Property, plant, and equipment, net 11,663

Goodwill 5,124 STOCKHOLDERS' EQUITY

Other intangible assets 1,860 Contributed capital 381

Long-term investments 3,883 Retained earnings 30,638

Other noncurrent assets 2,658 Treasury stock and other equity (18,913)

Total Assets $35,994 Total L & SE $35,994

The balance sheet reports assets and the amount of financing from liabilities and stockholders’ equity as

of a certain date. The accounting equation is:

Assets = Liabilities + Stockholders’ Equity

Assets are items of value that a corporation owns or has a right to use. Typical asset accounts include

cash, accounts receivable, inventory, equipment, buildings, and land. Accounts receivable are amounts to

be received in the future from customers.

Liabilities are amounts owed to creditors; the amount of debt owed to third parties. Typical liability

accounts include accounts payable, wages payable, notes payable, and bonds payable. The key word

found in many liability accounts is payable. Accounts payable are amounts to be paid in the future to

suppliers.

Stockholders’ Equity is the portion of assets the owners own free and clear. Stockholders’ equity may also

be referred to as shareholders’ equity or owners’ equity. Typical stockholders’ equity accounts include:

Contributed Capital – Amounts paid (contributed) by stockholders to purchase common stock and

preferred stock.

Retained Earnings – Net income earned by the company since its incorporation and not yet distributed

as dividends.

Q1 Identify the accounting equation amounts for PepsiCo Corporation using the information above.

Assets _______ million = Liabilities ______million + Stockholders’ Equity ________million

Q2 Will the accounting equation hold true for every corporation? (Yes / No / Can’t tell) Why?

Q3 Assets can either be financed with _________or _________________.

* Stock market symbols are shown in parentheses.

Introduction Page 17 Chapter 1

Q4 How is this company financed? Primarily with (liabilities / stockholders’ equity). How can you tell?

Q5 Circle whether the account is classified as an (A)sset, (L)iability, or part of Stockholders' Equity (SE)

on the balance sheet.

a. Cash (A / L / SE)

b. Accounts receivable (A / L / SE)

c. Accounts payable (A / L / SE)

d. Common stock (A / L / SE)

f. Equipment (A / L / SE)

e. Notes payable (A / L / SE)

g. Building (A / L / SE)

h. Retained earnings (A / L / SE)

i. Inventory (A / L / SE)

j. Mortgage payable (A / L / SE)

k. Bonds payable (A / L / SE)

l. Land (A / L / SE)

Q6 Use PepsiCo’s balance sheet on the previous page to answer the following questions:

a. What amount of cash does this company expect to receive from customers within the next

few months? _________million

b. The title of the largest asset account is _______________________________reporting

_________ million.

What types of asset costs are included in this account?

c. How much does this company currently owe suppliers? ________million

d. Since the company started business, what is the total amount shareholders have paid for

their shares of stock? ________ million

e. Since the company started business, how much net income was earned and not yet

distributed as dividends? ___________ million

Introduction Page 18 Chapter 1

ACTIVITY 3 INCOME STATEMENT

Purpose: • Understand the information reported on the income statement

• Identify revenue and expense accounts reported on the income statement

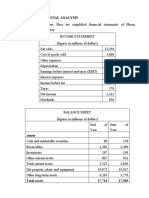

PEPSICO (PEP) 2008 INCOME STATEMENT ($ in millions)

Sales revenue $ 43,251

Cost of goods sold 20,351

Gross profit 22,900

Selling, general and administrative (SGA) expense 15,901

Depreciation and amortization expense 64

Nonoperating revenues (86)

Income before income tax 7,021

Provision for income tax 1,879

Net income $ 5,142

The income statement reports the company’s profitability during an accounting period.

Revenues are amounts received from customers for products sold and services provided. Sales revenue

and service revenue are amounts earned engaging in the primary business activity.

Expenses are the costs incurred to produce revenues. Expenses are recorded in the accounting period

they benefit (if a cause and effect relationship exists) or are incurred (if there is no cause and effect

relationship). Cost of goods sold expense reports the wholesale costs of inventory sold during the

accounting period.

Net income is the difference between revenues and expenses. Net income is also referred to as profit

(loss), earnings, or the bottom line.

Revenues – Expenses = Net income

Q1 Circle whether the account is classified as a (Rev)enue, (Exp)ense, or (Not) reported on the income

statement.

a. Wage expense (Rev / Exp / Not) d. Building (Rev / Exp / Not)

b. Inventory (Rev / Exp / Not) e. Rent expense (Rev / Exp / Not)

c. Cost of goods sold (Rev / Exp / Not) f. Service revenue (Rev / Exp / Not)

Q2 Review PepsiCo’s 2008 income statement above and answer the following questions:

a. This company reports (2 / 3 / 4 / 5) revenue accounts and (2 / 3 / 4 / 5) expense accounts.

b. Beverages and snacks were sold to customers for ______million that cost the company

________million to produce.

c. The title of the largest expense account is __________________reporting ________million,

which is typically the largest expense account for a company within the (retail / service)

industry.

What specific types of costs would be included in this account for PepsiCo?

d. Was PepsiCo profitable? (Yes / No) How much profit was reported? ________million

Q3 Net income can also be referred to as (revenues / expenses / common stock / earnings).

Introduction Page 19 Chapter 1

ACTIVITY 4 STATEMENT OF STOCKHOLDERS’ EQUITY

Purpose: • Understand information provided by the Statement of Stockholders’ Equity

• Understand changes within contributed capital and retained earnings

• Identify relationships between the IS, RE, and the BS

PEPSICO (PEP) 2008 STATEMENT OF STOCKHOLDERS’ EQUITY ($ in millions)

Total

Contributed Retained Other

Stockholders

Capital Earnings Equity

Equity

Beginning balance $ 480 $ 28,184 $ (11,430) $ 17,234

Issuance of shares 0 0

Net income 5,142 5,142

Dividends (2,599) (2,599)

Other transactions (99) (89) (7,483) (7,671)

Ending balance $ 381 $ 30,638 $(18,913) $ 12,106

The statement of stockholders’ equity reports changes within the contributed capital, retained earnings,

and other equity accounts during an accounting period. Contributed capital (CC) is increased when

additional shares of stock are issued and decreased when those shares are retired. Retained earnings (RE)

is increased by net income (earnings) of the accounting period and decreased when earnings are

distributed as dividends to the stockholders. Earnings not distributed as dividends are reported as

retained earnings.

Q1 Earnings is another word for (revenue / receivables / net income).

Earnings of a corporation belong to the (managers / stockholders).

Earnings can either be distributed to the stockholders as (dividends / expenses / retained earnings)

or kept in the business as (dividends / expenses / retained earnings).

Q2 Income Statement: Revenues - Expenses = __________

Balance Sheet: Assets = _________+ __________________

Stockholders’ Equity = Contributed Capital + ______________+Other Equity

Statement of SE: Beg Retained Earnings + __________- Dividends = ____________________

Q3 Net income is computed on the (IS / SE / BS) and then transferred to the Statement of

Stockholders’ Equity to increase (CC / RE / Other SE). Ending retained earnings is reported on the

Statement of Stockholders’ Equity and then transferred to the (IS / SE / BS).

Q4 Circle whether the account is reported on the Income Statement (IS), Statement of Stockholders’

Equity (SE), or the Balance Sheet (BS). Note: Some amounts are reported on two statements.

a. Contributed capital (IS / SE / BS) e. Sales revenue (IS / SE / BS)

b. Net income (IS / SE / BS) f. Accounts receivable (IS / SE / BS)

c. Dividends (IS / SE / BS) g. Wage expense (IS / SE / BS)

d. Retained earnings (IS / SE / BS) h. Bonds payable (IS / SE / BS)

Q5 Use PepsiCo’s 2008 statement of stockholders’ equity above to answer the following questions:

a. Contributed capital reported at the end of the accounting period is ______million, which is

the amount shareholders paid for (net income / dividends / issued shares).

b. Retained earnings increased by (net income / dividends / issued shares) of _______million

and decreased by (net income / dividends / issued shares) of _________million.

c. When the company issues shares of stock, total stockholders’ equity (increases / decreases).

When the company buys back shares of stock, total stockholders’ equity (increases /

decreases).

Introduction Page 20 Chapter 1

ACTIVITY 5 STATEMENT OF CASH FLOWS

Purpose: • Understand information provided by the Statement of Cash Flows

• Understand that cash flows are organized as operating, investing, and financing

activities

The statement of cash flows organizes cash inflows and cash outflows as operating activities, investing

activities, and financing activities.

PEPSICO (PEP) 2008 STATEMENT OF CASH FLOWS ($ in millions)

Net cash received from operating activities (NCOA) $ 6,999

Net cash paid for investing activities (NCIA) (2,667)

Net cash paid for financing activities (NCFA) (3,025)

Effect of exchange rate changes (153)

Change in cash 1,154

+ Cash, beginning of the period 910

= Cash, end of the period $ 2,064

Business activities can be classified into three distinct categories: operating, investing, and financing.

Operating Activities relate to a company's main business of selling products or services to earn net

income. Investing Activities relate to the need for investing in property, plant, and equipment or

expanding by making investments in other companies. Financing Activities relate to how a company

finances its assets -- with debt or stockholders' equity. The Statement of Cash Flows describes a

company's cash inflows and outflows for each of these three areas.

Q1 Use PepsiCo’s 2008 statement of cash flows above to answer the following questions:

a. PepsiCo generated cash inflows of ________million from (operating / investing / financing)

activities.

b. PepsiCo purchased property, plant, and equipment, which resulted in a cash (inflow /

outflow) of ________million from (operating / investing / financing) activities.

c. PepsiCo repurchased shares of stock and paid dividends, which resulted in a cash (inflow /

outflow) of ________million from (operating / investing / financing) activities.

d. At the beginning of 2008, cash was _______million. During the year, cash (increased /

decreased) by _________ million, resulting in an ending cash balance of ________ million.

e. Cash at the end of 2008 is the (same as / different than) cash at the beginning of 2009.

Q2 Circle whether the account is reported on the Income Statement (IS), the Balance Sheet (BS), or the

Statement of Cash Flows (C/F). Note: Some amounts may be reported on two statements.

a. Cash (IS / BS / CF) f. Sales revenue (IS / BS / CF)

b. Rent expense (IS / BS / CF) g. Accounts receivable (IS / BS / CF)

c. Rent payable (IS / BS / CF) h. Cash received from customers (IS / BS / CF)

d. Cash paid for rent (IS / BS / CF) i. Cash used for capital expenditures (IS / BS / CF)

e. Retained earnings (IS / BS / CF) j. Cash from issuing shares of stock (IS / BS / CF)

Introduction Page 21 Chapter 1

ACTIVITY 6 GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP)

Purpose: • Understand that GAAP (Generally Accepted Accounting Principles) are the rules

of financial accounting

• Apply the historical cost principle

GAAP (Generally Accepted Accounting Principles) are the rules that management must follow when

preparing financial statements.

• The SEC (Securities and Exchange Commission) has legislative authority to set the reporting rules

for accounting information of the publicly held corporations it regulates. It has designated GAAP to

be the official rules. The SEC provides oversight and enforcement authority over the Financial

Accounting Standards Board (FASB) and the Public Company Accounting Oversight Board (PCAOB).

• The seven full-time voting members of the FASB (Financial Accounting Standards Board) set

accounting reporting standards and formulate GAAP.

• Audits attest to whether a company’s financial statements comply with GAAP. Only CPAs (Certified

Public Accountants), licensed by the state, can conduct the audits.

• Ethical behavior is defined by the AICPA’s (American Institute of CPA’s) Code of Professional

Conduct. This code holds CPAs accountable for serving the public interest.

• The five full-time members of the PCAOB (Public Company Accounting Oversight Board) establish

auditing standards and conduct inspections of the public accounting firms that perform audits.

Q1 (FASB / SEC / GAAP / AICPA) are the rules that must be followed when preparing the financial

statements for external use.

Q2 GAAP stands for ___________________________.

Q3 (CPAs / Management / Corporate accountants) conduct audits that attest to whether a company’s

financial statements comply with GAAP.

HISTORICAL COST PRINCIPLE

GAAP #1: The Historical Cost Principle states that assets and services should be recorded at their

acquisition cost, thus using verifiable information that is the most reliable information.

Q4 An auto has a sticker price of $20,000. A company purchases the auto, but negotiates with the sales

person and pays a price of only $18,000. On the balance sheet, ($18,000 / $20,000) will be reported

for the auto. Thirty years ago land was purchased for $2,000, which now has a current market

value of $100,000. On the balance sheet, ($2,000 / $100,000) will be reported for the land.

Q5 When the financial statements are prepared according to GAAP, assets and services are reported at

their (acquisition cost / current market value).

Q6 THINK ABOUT IT: Is knowledge of an asset’s current market value ever useful? (Yes / No)

If so, when?

.

INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS)

Q7 There (are / are not) differences among the accounting standards of different countries. IFRS are

global accounting standards that U.S. GAAP is (converging toward / in full compliance with).

Introduction Page 22 Chapter 1

Introduction Page 23 Chapter 1

You might also like

- Ohada Accounting PlanDocument72 pagesOhada Accounting PlanNchendeh Christian100% (3)

- Advanced Accounting Chapter 1Document11 pagesAdvanced Accounting Chapter 1Nellie Panedy80% (15)

- Government Accounting TheoriesDocument6 pagesGovernment Accounting TheoriesHazel Jumaquio100% (7)

- Ch4 SolutionsDocument23 pagesCh4 SolutionsFahad Batavia100% (1)

- CH 4Document12 pagesCH 4Miftahudin Miftahudin0% (1)

- Imperial Administrative Records, Part IDocument323 pagesImperial Administrative Records, Part IHECTOR ORTEGANo ratings yet

- Adam Ltd Financial AnalysisDocument3 pagesAdam Ltd Financial AnalysisRegina AtkinsNo ratings yet

- Accounts Financial Ratios of KFCDocument20 pagesAccounts Financial Ratios of KFCMalathi Sundrasaigaran91% (11)

- Chapter 1 - Excercises Solutions Part ADocument8 pagesChapter 1 - Excercises Solutions Part AHECTOR ORTEGANo ratings yet

- Dev Financial Analysis-2Document8 pagesDev Financial Analysis-2Adam BelmekkiNo ratings yet

- CH 1 - End of Chapter Exercises SolutionsDocument37 pagesCH 1 - End of Chapter Exercises SolutionssaraNo ratings yet

- Financial ReportsDocument36 pagesFinancial ReportsbehanzinlufrancheNo ratings yet

- Accounting..... All Questions & Answer.Document13 pagesAccounting..... All Questions & Answer.MehediNo ratings yet

- FABM2 Module 5 Cash Flow StatementDocument12 pagesFABM2 Module 5 Cash Flow StatementLoriely De GuzmanNo ratings yet

- Financial Statements: An OverviewDocument34 pagesFinancial Statements: An OverviewMUSTAFA KAMAL BIN ABD MUTALIP / BURSAR100% (1)

- Chapters 1 and 2Document36 pagesChapters 1 and 2Qing ShiNo ratings yet

- Chapter 1 Lecture Notes: I. Forms of Business OrganizationDocument8 pagesChapter 1 Lecture Notes: I. Forms of Business OrganizationvirtualtadNo ratings yet

- jp02 Financial-Statements - BWDocument2 pagesjp02 Financial-Statements - BWJinwon KimNo ratings yet

- 2024 - Week 3 - Comm 217 Notes - Ch03Student 1to UploadDocument13 pages2024 - Week 3 - Comm 217 Notes - Ch03Student 1to Uploadsamuelrodriguezch12No ratings yet

- Mod4 Part 1 Essence of Financial StatementsDocument16 pagesMod4 Part 1 Essence of Financial StatementsAngeline de SagunNo ratings yet

- AccountingDocument34 pagesAccountingdr.a.youssryNo ratings yet

- CHAPTER 11 - AnswerDocument16 pagesCHAPTER 11 - Answernash100% (1)

- Module 2 - Assessing Financial Health of The Firm - Week 2 4Document14 pagesModule 2 - Assessing Financial Health of The Firm - Week 2 4maelyn calindongNo ratings yet

- Income Statement To The NetDocument26 pagesIncome Statement To The NetOman SherNo ratings yet

- Chapter IXDocument3 pagesChapter IXCleo IlaoNo ratings yet

- Topic 4rev StudentsDocument31 pagesTopic 4rev StudentsNemalai VitalNo ratings yet

- Topic 4rev (Students)Document30 pagesTopic 4rev (Students)RomziNo ratings yet

- Chapter IXDocument3 pagesChapter IXCleo IlaoNo ratings yet

- Fabm 2Document7 pagesFabm 2Akaashi KeijiNo ratings yet

- Interpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions ManualDocument36 pagesInterpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions Manualbobsilvaka0el100% (24)

- Supplementary Exercises Chapter 1-3Document4 pagesSupplementary Exercises Chapter 1-3Smey MNo ratings yet

- Financial Statements: An OverviewDocument41 pagesFinancial Statements: An OverviewGaluh Boga Kuswara100% (1)

- CF Lecture 0 Working With FS v1Document51 pagesCF Lecture 0 Working With FS v1Tâm NhưNo ratings yet

- Learn key financial statementsDocument36 pagesLearn key financial statementsNemalai VitalNo ratings yet

- Wealth Managment 1Document73 pagesWealth Managment 1dashashutosh87No ratings yet

- Understanding Financial Statements For Non-AccountantsDocument5 pagesUnderstanding Financial Statements For Non-AccountantsAngella RiveraNo ratings yet

- Week 2 Lesson in Business Finance.2Document36 pagesWeek 2 Lesson in Business Finance.2jane caranguianNo ratings yet

- Chapter 11 Capital N SurplusDocument12 pagesChapter 11 Capital N SurplusCiciNo ratings yet

- Unit 2 Uderstanding Financial StatementsDocument23 pagesUnit 2 Uderstanding Financial StatementsSG dNo ratings yet

- Chapter 9 - BookDocument6 pagesChapter 9 - BookCheskaNo ratings yet

- Balance SheetDocument32 pagesBalance SheetJanine padronesNo ratings yet

- Chapter 5Document8 pagesChapter 5Jimmy LojaNo ratings yet

- Outcome. 3Document24 pagesOutcome. 3Sohel MemonNo ratings yet

- Important Points 1. 2. 3. 4. 5. 6. 7Document15 pagesImportant Points 1. 2. 3. 4. 5. 6. 7RAVI KUMARNo ratings yet

- Bus 103 AccountingDocument3 pagesBus 103 AccountingDyne Morte0% (1)

- accounting(分享版)Document7 pagesaccounting(分享版)Siyang QuNo ratings yet

- Dwnload Full Interpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions Manual PDFDocument36 pagesDwnload Full Interpreting and Analyzing Financial Statements 6th Edition Schoenebeck Solutions Manual PDFphumilorlyna100% (12)

- ch1 HandoutDocument6 pagesch1 HandoutPaolo TipoNo ratings yet

- Exercises For Chapter 23 EFA2Document13 pagesExercises For Chapter 23 EFA2tuananh leNo ratings yet

- FM Testbank Ch03Document18 pagesFM Testbank Ch03David LarryNo ratings yet

- ACCOUNTING PROCESS and CLASSIFICATIONDocument26 pagesACCOUNTING PROCESS and CLASSIFICATIONvdhanyamrajuNo ratings yet

- 7 The Accounting Equation (4 Pages)Document4 pages7 The Accounting Equation (4 Pages)Danica MamontayaoNo ratings yet

- Q- CHAPTER 2Document11 pagesQ- CHAPTER 2phuonganh020804No ratings yet

- Acct CH1Document10 pagesAcct CH1j8noelNo ratings yet

- Funds Flow Theory PDFDocument7 pagesFunds Flow Theory PDFLalrinfela RalteNo ratings yet

- The Five Financial Statements Based On IFRSDocument12 pagesThe Five Financial Statements Based On IFRSAngel GraceNo ratings yet

- Exercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotDocument15 pagesExercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotCherry Doong CuantiosoNo ratings yet

- Chapter 2 Basic Financial StatementsDocument34 pagesChapter 2 Basic Financial StatementsZemene HailuNo ratings yet

- Understanding Balance SheetsDocument26 pagesUnderstanding Balance SheetsAli AhmedNo ratings yet

- Chapter 1 Introduction To FSADocument11 pagesChapter 1 Introduction To FSALuu Nhat MinhNo ratings yet

- 12TH CH-7 Not For Profit Organisation - 123Document55 pages12TH CH-7 Not For Profit Organisation - 123LalitKukrejaNo ratings yet

- Exercises For Chapter 23 EFA2Document16 pagesExercises For Chapter 23 EFA2Thu LoanNo ratings yet

- Cfs - Lecture Notes - Updated 2023Document49 pagesCfs - Lecture Notes - Updated 2023Thanh Uyên100% (1)

- Unit 4 Understanding Financial Statements: StructureDocument32 pagesUnit 4 Understanding Financial Statements: StructureTushar SharmaNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Small Change in Hellenistic Roman GalileDocument18 pagesSmall Change in Hellenistic Roman GalileHECTOR ORTEGANo ratings yet

- MALIK The Corrections of Codex Sinaiticus and The Textual Transmission of Revelation Josef Schmid Revisited RevisedDocument27 pagesMALIK The Corrections of Codex Sinaiticus and The Textual Transmission of Revelation Josef Schmid Revisited RevisedHECTOR ORTEGANo ratings yet

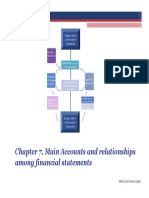

- 6 ELE Chapter 7. Relationships Among Financial StatementsDocument39 pages6 ELE Chapter 7. Relationships Among Financial StatementsHECTOR ORTEGANo ratings yet

- 4 ELE Chapter 6 y 4. Profitability and Return Ratios (B)Document28 pages4 ELE Chapter 6 y 4. Profitability and Return Ratios (B)HECTOR ORTEGANo ratings yet

- Chapter 1 - Exercises Part BDocument7 pagesChapter 1 - Exercises Part BHECTOR ORTEGANo ratings yet

- The Jewish People Jesus ChristDocument312 pagesThe Jewish People Jesus ChristHECTOR ORTEGA100% (1)

- 1 Timothy 4, Photo Companion BiblePlacesDocument67 pages1 Timothy 4, Photo Companion BiblePlacesHECTOR ORTEGANo ratings yet

- Paul's Teachings on Spiritual PowersDocument201 pagesPaul's Teachings on Spiritual PowersHECTOR ORTEGA100% (3)

- Textual Resarch On The Bible (Pruebas de Investigación Sobre La Biblia) PDFDocument32 pagesTextual Resarch On The Bible (Pruebas de Investigación Sobre La Biblia) PDFIng. Bendryx BelloNo ratings yet

- History of the Babylonians and AssyriansDocument242 pagesHistory of the Babylonians and AssyriansHECTOR ORTEGANo ratings yet

- 369441-Text de L'article-532360-1-10-20200602Document40 pages369441-Text de L'article-532360-1-10-20200602HECTOR ORTEGANo ratings yet

- 2018 The Nude at The Entrance ContextualDocument23 pages2018 The Nude at The Entrance ContextualHECTOR ORTEGANo ratings yet

- 279 The Use of The Earliest Greek ScriptDocument20 pages279 The Use of The Earliest Greek ScriptHECTOR ORTEGANo ratings yet

- Greek Biblical Manuscripts from the Judean Desert CavesDocument28 pagesGreek Biblical Manuscripts from the Judean Desert CavesHECTOR ORTEGANo ratings yet

- The Correspondence of Sargon II, Part IIDocument319 pagesThe Correspondence of Sargon II, Part IIHECTOR ORTEGANo ratings yet

- Harry: Parallels,&dquo Religious UniversityDocument1 pageHarry: Parallels,&dquo Religious UniversityHECTOR ORTEGANo ratings yet

- Kosher Fat: Mony Almalech (NBU)Document47 pagesKosher Fat: Mony Almalech (NBU)HECTOR ORTEGANo ratings yet

- First Paperback!: Must' For Christian Alike. - Tin: York Times Celebration The Stories, Traditions, LegendsDocument548 pagesFirst Paperback!: Must' For Christian Alike. - Tin: York Times Celebration The Stories, Traditions, LegendsHECTOR ORTEGANo ratings yet

- S ChaserDocument329 pagesS ChaserHECTOR ORTEGANo ratings yet

- BM Finance Notes PDFDocument10 pagesBM Finance Notes PDFApurva SunejaNo ratings yet

- 1 CombinedDocument405 pages1 CombinedMansi aggarwal 171050No ratings yet

- EC029 - A - Fixed Assets Setup & Common Data - v11.00Document14 pagesEC029 - A - Fixed Assets Setup & Common Data - v11.00Ariel SpallettiNo ratings yet

- Afar ReviewDocument7 pagesAfar Reviewhos hiNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- Cash To Accrual ProblemsDocument10 pagesCash To Accrual ProblemsAmethystNo ratings yet

- Financial Analysis of Hòa Phát Group Joint Stock CompanyDocument36 pagesFinancial Analysis of Hòa Phát Group Joint Stock CompanySang NguyễnNo ratings yet

- Financial analysis of Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCLDocument13 pagesFinancial analysis of Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCLSiddharth Rohilla (M22MS074)No ratings yet

- L5 DipBM - Assignment Briefs - September 2021Document24 pagesL5 DipBM - Assignment Briefs - September 2021Umar AliNo ratings yet

- Horton Building Supplies: Final ProjectDocument11 pagesHorton Building Supplies: Final ProjectIbrah YusalNo ratings yet

- BCIBF-103 Financial AccountingDocument423 pagesBCIBF-103 Financial AccountingS.M Documents SolutionsNo ratings yet

- Marketing PlanDocument15 pagesMarketing PlanMichael HardingNo ratings yet

- Financial Analysis Spreadsheet From The Kaplan GroupDocument4 pagesFinancial Analysis Spreadsheet From The Kaplan GroupPrince AdyNo ratings yet

- Topic 1 Introduction To Corporate FinanceDocument26 pagesTopic 1 Introduction To Corporate FinancelelouchNo ratings yet

- Chapter 5Document47 pagesChapter 5Aira Nhaira MecateNo ratings yet

- Difference Between Capital Expenditure and Revenue ExpenditureDocument6 pagesDifference Between Capital Expenditure and Revenue ExpenditureRoopkishore SharmaNo ratings yet

- Parle GDocument112 pagesParle Gdeepak Gupta100% (1)

- Morgan Marie Leasing Company Signs An Agreement On January 1Document1 pageMorgan Marie Leasing Company Signs An Agreement On January 1M Bilal SaleemNo ratings yet

- Balance Sheet of State Bank of IndiaDocument8 pagesBalance Sheet of State Bank of IndiaJyoti VijayNo ratings yet

- J.Karthik Receivables ManagementDocument93 pagesJ.Karthik Receivables Managementpeter sumanthNo ratings yet

- On GoodwillDocument23 pagesOn GoodwillNabanita GhoshNo ratings yet

- Trial Balance Home Office DR (CR) Branch Office DR (CR)Document2 pagesTrial Balance Home Office DR (CR) Branch Office DR (CR)Adriana CarinanNo ratings yet

- IBM's capital structure and financing policiesDocument17 pagesIBM's capital structure and financing policiesJenny Zulay SUAREZ SOLANONo ratings yet

- CH 11 Practice MCQ - S Financial Management by BrighamDocument49 pagesCH 11 Practice MCQ - S Financial Management by BrighamShahmir AliNo ratings yet

- 17 Answers To All ProblemsDocument25 pages17 Answers To All ProblemsRaşitÖnerNo ratings yet