Professional Documents

Culture Documents

Learning Unit 3 - Quiz 2 - 4 January Transaction

Learning Unit 3 - Quiz 2 - 4 January Transaction

Uploaded by

Maluleke BlessingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Learning Unit 3 - Quiz 2 - 4 January Transaction

Learning Unit 3 - Quiz 2 - 4 January Transaction

Uploaded by

Maluleke BlessingCopyright:

Available Formats

Learning unit 3: Quiz 2

Transaction 4 January 2022

The first step when dealing with a transaction is to identify the affected accounts. The transaction on

4 January relates to the purchase of stationery (inventory) on credit. The first affected account is

therefore inventory. The inventory was purchased on credit. The second account affected is therefore

accounts payable. NB: The inventory account is used because the business uses the perpetual

inventory system.

The inventory account will increase with the amount paid. On the other hand, the accounts payable

account will increase because the business will now owe the supplier the purchase price of the

stationery.

Accounts payable is classified as a liability. The rule for liabilities is that these accounts increase on

the credit side and decrease on the debit side. In our example the Accounts payables account will

therefor increase on the credit side. Inventory is classified as an asset. The rule for assets is that these

accounts increase on the debit side and decrease on the credit side. Therefore, the inventory account

will be debited.

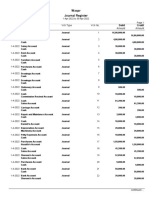

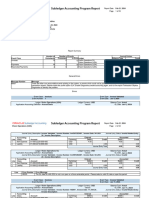

Dr Inventory Cr

2022

Jan 4 Accounts payables 5 000 00

Dr Accounts payables Cr

2022

5 000 00

Jan 4 Inventory

You might also like

- 2023 Grade 11 Written Report QPDocument5 pages2023 Grade 11 Written Report QPfiercestallionofficialNo ratings yet

- Learning Unit 3 - Quiz 2 - 10 January TransactionDocument1 pageLearning Unit 3 - Quiz 2 - 10 January TransactionMaluleke BlessingNo ratings yet

- 100 Journal TrancationsDocument5 pages100 Journal TrancationsWAQAR FAYAZNo ratings yet

- Share JournalizingDocument15 pagesShare JournalizingPrincess BenzonNo ratings yet

- Group Assignment (Student's Copy) EditedDocument7 pagesGroup Assignment (Student's Copy) EditedNUR HAIFFAHH BINTI JOHNNY MoeNo ratings yet

- Mike's Bikes Exercise: O) May 30, 2022 Accounts Receivable 375 Service Revenue 375Document4 pagesMike's Bikes Exercise: O) May 30, 2022 Accounts Receivable 375 Service Revenue 375manpreetNo ratings yet

- Creditreport 2555930042Document60 pagesCreditreport 2555930042nischal.khatri07No ratings yet

- JournalizingDocument27 pagesJournalizingMelody LiwanagNo ratings yet

- Acc 2021 GR 10 T 1 Week 6 CJ Caj EngDocument8 pagesAcc 2021 GR 10 T 1 Week 6 CJ Caj EngLinda DladlaNo ratings yet

- 3 CH3 Accounting For Receivable PART 1Document17 pages3 CH3 Accounting For Receivable PART 1smofias12006No ratings yet

- Sonai Gramin Bigarsheti Sahakari Patsanstha Maryadit: Loan Account Statement Date 27/04/2022 To 28/07/2022Document2 pagesSonai Gramin Bigarsheti Sahakari Patsanstha Maryadit: Loan Account Statement Date 27/04/2022 To 28/07/2022Bandopant KapaseNo ratings yet

- Collection LetterDocument1 pageCollection LetterRaffy Monencillo LafuenteNo ratings yet

- Financial and Management Accounting: BITS PilaniDocument21 pagesFinancial and Management Accounting: BITS Pilanirani rinoNo ratings yet

- Item Sales Per Customer ptmjp2018 220624093726Document3 pagesItem Sales Per Customer ptmjp2018 220624093726sari ike lestariNo ratings yet

- Accounting BooksDocument14 pagesAccounting BooksJamie ApostolNo ratings yet

- Dac1102 Past Examination Paper 11.04.2023 1Document10 pagesDac1102 Past Examination Paper 11.04.2023 1marumoduberemofilwerethabilevaNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- BANOShenieLynn IA3 CD1 Assignment5Document6 pagesBANOShenieLynn IA3 CD1 Assignment5Shenie Lynn BanoNo ratings yet

- ACREV 426 - AP 02 ReceivablesDocument5 pagesACREV 426 - AP 02 ReceivablesEve Jennie Rose MagnificoNo ratings yet

- GR 11 Acc T1 Week 2 Cred Recon ENGDocument6 pagesGR 11 Acc T1 Week 2 Cred Recon ENGethanmaistryNo ratings yet

- Sonai Gramin Bigarsheti Sahakari Patsanstha Maryadit: Loan Account Statement Date 02/05/2022 To 28/07/2022Document2 pagesSonai Gramin Bigarsheti Sahakari Patsanstha Maryadit: Loan Account Statement Date 02/05/2022 To 28/07/2022Bandopant KapaseNo ratings yet

- MODULE 1 Auditing A C Applications 1 Cash To Accrual Basis PDFDocument3 pagesMODULE 1 Auditing A C Applications 1 Cash To Accrual Basis PDFNOVIE JOY F. SABANDONo ratings yet

- Auditing Problems Test Banks - LIABILITIES Part 2Document6 pagesAuditing Problems Test Banks - LIABILITIES Part 2Alliah Mae ArbastoNo ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- ICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andDocument6 pagesICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andArpit GuptaNo ratings yet

- Template - Assignment - Audit of ReceivablesDocument6 pagesTemplate - Assignment - Audit of ReceivablesEdemson NavalesNo ratings yet

- Accounting Concepts and PrinciplesDocument30 pagesAccounting Concepts and PrinciplesKristine Lei Del MundoNo ratings yet

- Chapter 02-Acc 111-KuDocument5 pagesChapter 02-Acc 111-KushiieeNo ratings yet

- Acc102 W6Document41 pagesAcc102 W6Moheb RefaatNo ratings yet

- M7B Adjusting Process Overview and Accrued IncomeDocument3 pagesM7B Adjusting Process Overview and Accrued IncomeCharles Eli AlejandroNo ratings yet

- Keeluruhan Jurnal CVDocument1 pageKeeluruhan Jurnal CVKanaya FerreraNo ratings yet

- Create Accounting 251220Document3 pagesCreate Accounting 251220Linh Dang Thi ThuyNo ratings yet

- Gr9EMST2L2 SlidesDocument16 pagesGr9EMST2L2 SlidesadoliveiraNo ratings yet

- Diy-Problems (Questionnaires)Document6 pagesDiy-Problems (Questionnaires)May RamosNo ratings yet

- 06.1 - Liabilities PDFDocument5 pages06.1 - Liabilities PDFDonna AbogadoNo ratings yet

- Unit 2: Ledgers: Learning OutcomesDocument12 pagesUnit 2: Ledgers: Learning OutcomesTanya100% (1)

- Ida Ayu Koamang Sumi Antari (21021013) Tugas Bahasa Inggris 14Document9 pagesIda Ayu Koamang Sumi Antari (21021013) Tugas Bahasa Inggris 14Ida ayu Komang Sumi AntariNo ratings yet

- Audit of LiabilitiesDocument4 pagesAudit of LiabilitiesJhaybie San BuenaventuraNo ratings yet

- JOURNALDocument19 pagesJOURNALitzy midzyNo ratings yet

- Invoice Report For Cooley Law FirmDocument1 pageInvoice Report For Cooley Law FirminforumdocsNo ratings yet

- Diy-Problems (Questionnaires)Document11 pagesDiy-Problems (Questionnaires)May Ramos100% (1)

- Recording Business Transactions: Student Name Student ID Course ID DateDocument8 pagesRecording Business Transactions: Student Name Student ID Course ID DateSami Ur RehmanNo ratings yet

- Week 6 Topic Tutorial Solutions CB2100 - 1920ADocument6 pagesWeek 6 Topic Tutorial Solutions CB2100 - 1920ALily TsengNo ratings yet

- ClassificationTable-Journal - Ledger-TB-BSDocument70 pagesClassificationTable-Journal - Ledger-TB-BSAvani PatilNo ratings yet

- Pertemuan K14-1Document9 pagesPertemuan K14-1Ida ayu Komang Sumi AntariNo ratings yet

- Control Accounts A4Document8 pagesControl Accounts A4Sir YusufiNo ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- Jurnal Praktikum SoftwareDocument1 pageJurnal Praktikum SoftwareTry ElisaNo ratings yet

- VU Accounting Lesson 27Document5 pagesVU Accounting Lesson 27ranawaseemNo ratings yet

- Create Accounting 210224Document23 pagesCreate Accounting 210224nghazalyNo ratings yet

- 74607bos60479 FND cp2 U2Document111 pages74607bos60479 FND cp2 U2adityatiwari122006No ratings yet

- Accounts Receivable MaterialDocument4 pagesAccounts Receivable Materialkookie bunnyNo ratings yet

- Dealing With Bad DebtsDocument13 pagesDealing With Bad DebtsSarthak ShahNo ratings yet

- Financial Accounting: Adjusting The AccountsDocument33 pagesFinancial Accounting: Adjusting The AccountsGiang PhungNo ratings yet

- Test Sheet-Accounts v1Document6 pagesTest Sheet-Accounts v1Minaketan DasNo ratings yet

- SSAccExams ErrataPages2019 PDFDocument11 pagesSSAccExams ErrataPages2019 PDFDanielle WatsonNo ratings yet

- Accounting Unit 3 Notes - ATARNotesDocument22 pagesAccounting Unit 3 Notes - ATARNotesAnonymous rP0DTw58XNo ratings yet

- Learning Unit 3 - Quiz 2 - 10 January TransactionDocument1 pageLearning Unit 3 - Quiz 2 - 10 January TransactionMaluleke BlessingNo ratings yet

- Via Afrika Agricultural Sciences: Study GuideDocument186 pagesVia Afrika Agricultural Sciences: Study GuideMaluleke BlessingNo ratings yet

- 2021 ATP GR 11 Agric SciDocument6 pages2021 ATP GR 11 Agric SciMaluleke BlessingNo ratings yet

- 1.380 ATP 2023 24 GR 11 Agric Sci FinalDocument4 pages1.380 ATP 2023 24 GR 11 Agric Sci FinalMaluleke BlessingNo ratings yet