Professional Documents

Culture Documents

Cashflow D

Uploaded by

Jatin JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cashflow D

Uploaded by

Jatin JainCopyright:

Available Formats

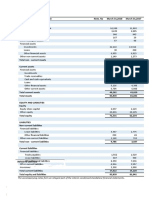

Balance Sheet

As at 31t March, 2022

in crore)

As at

Notes As at

31st March 2022 31st March 2021

Assets

Non-Current Assets

Property, Plant and Equipment 2,23,824 2,92,092

Capital Work-in-Progress 19,267 20,765

Intangible Assets 15,802 ,741

Intangible Assets Under Development 15,395 12,070

Financial Assets

Investments 3,30,493 2,52,620

Loans 41,951 64,073

Other Financial Assets 2,247 1,625

Other Non-Current Assets 7,297 4,968

Total Non-Current Assets 6,56,276 6,62,954

Current Assets

Inventories 45,923 437

Financial Assets

Investments 78,304 94,665

Trade Receivables 14,394 4,159

Cash and Cash Equivalents 21,714 5,573

Loans 161 993

Other Financial Assets 54,901 59,560

Other Current Assets 7,001 8,332

Total Current Assets 2,22,398 2,10,719

Total Assets 8,78,674 8,73,673

Equity and Liabilities

Equity 445

Equity Share capital 6,765

Other Equity 5 4,64,762 4,68,038

Total Equity 4,74,483

4,71,527

Liabilities

Non-Current Liabilities

Financial Liabilities

Borrowin9s b 1,67,231 1,60,598

Lease Liabilities 2,790 2,869

Other Financial Liabilities 3,210 1,145

Provisions 8 1,598 1,499

Deferred Tax Liabilities (Net) 30,832 30,788

Other Non-Current Liabilities 504 504

Total Non-Current Liabilities 2,06,165 1,97,40

Current Liabilities

Financial Liabilities

Borrowings 21 27,332 61,100

Lease Liabilities

Trade Payables 22

Due to:

Micro and small Enterprises 138 90

Other than Micro and Small Enterprises 1,33,867 86,909

Other Financial Liabilities 33,225 33,108

Other Curent Liabilities 24 5,438 19,563

Provisions 896 901

Total Current Liabilities 2,00,982 2,01,7

Total Liabilities 4,07,147 3,99,190

Total Equity and Liabilities 8,78,674 8,73,673

Significant Accounting Policies I to 47

See acconmpanying Notes to the Financial Statements

As per our Report of even date FOr and on behait of the Board

For DTS&Associates LLP For SRBC& COUP Alok Agarwal M.D. Ambani Chairman and

Chartered Accountants chartered Accountants Chiet Financial officer Managing Director

(Registration No

(Registration No. N.R. Meswani

142412W/ WIO0595) 324982E/E300003) Srikanth Venkatachari H.R. Meswani

Executive Directors

Joint chiet Financial officer P.M.S. Prasad

P.K. Kapil

TPOstwal Vikas Kumar Pansari Savithri Parekh Nita M. Ambani

Partner Partner Company Secretary Prof. DipakC. Jain

Dr. R.A. Mashelkar

Membership No. 030848 Membership No. 093649 Non-Executive

Adil Zainulbhai Directors

Date: May 06, 2022

Raminder Singh Gujral

Dr. shumeetsdner

Arundhati Bhattacharya

His Excellency Yasir OthmanH. Al Rumayyan

K.V. Chowdary

308 Reliance Industries Limited

Statement of Profit and Loss

For the year ended 3" March, 2022

(t in crore)

Notes 2021-22 2020-21

Income

Value of Sales 4,63,067 2,76,181

Income from Services 358 2,759

Value of Sales & Services (Revenue) 4,66,425 2,78,940

Less: GST Recovered 21,050 13,871

Revenue from operations 26 4,45,375 2,65,069

Other Income 13,872 14,818

Total Income 4,59,247 2,79,887

Expenses

Cost of Material Consumed 3,20,852 1,68,262

Purchase of Stock-in-Trade 10,691 7,301

Changes in Inventories of Finished Goods, Work-in-Progress and Stock-in-Trade 28 (7,962) 610

Excise Duty 21,672 19,402

Employee Benefits Expense 29 5,426 5,024

Finance Costs 30 9,123 16,211

Depreciation / Amortisation and Depletion Expense 276 9,199

Other Expenses 42,383 30,970

Total Expenses 4,12,461 2,56,979

Profit Before Exceptional ltem and Tax 46,786 22,908

Exceptional Item (Net of Tax) 4,304

Profit Before Tax 46,7

,786 27,212

Tax Expenses

Current Tax 787

Deferred Tax 6,915 (4,732)

Profit for the Year 39,084 31,944

Other Comprehensive Income

i.Items that will not be reclassified to Profit or Loss 27.1 241 350

l. Income tax relating to items that will not be reclassified to Profit or Loss (58) (79)

ii. tems that will be reclassified to Profit or Loss 27.2 (2,705) 2,755

iv. Income tax relating to items that will be reclassified to Profit or Loss 543

(456)

Total Other Comprehensive Income/ (Loss) for the Year (Not of Tax) (1,979) 2,570

Total Comprehensive Income for the Year 37,105 34,514

Earnings per Equity Share of Face Value of ? 10 Each

Basic (in ) - After Exceptional Item 59.24 49.66

Basic(in ) - Before Exceptional item 59.24 42.97

Diluted (in ) -After Exceptional item 33 8.49 48.90

Diluted (in ) -Before Exceptional Item 33 58.49 42.31

Significant Accounting Policies

1 to 47

See accompanying Notes to the Financial Statements

*

Profit before tax is after Exceptional Item and tax thereon. Tax expenses are excluding the Current Tax and Deferred Tax on Exceptional

Item.

As per our Report of even date For and on behaif of the Board

For DTS&Associates LLP For SRBc&coLP Alok Agarwal M.D. Ambani Chairman and

Chartered Accountants Chartered Accountants Chief Financial Officer Managing Director

(Registration No. (Registration No N.R. Meswani

142412W/ Wio0595) 324982E/E300003)

Srikanth Venkatachari H.R. Meswani

xecutive Directors

Joint Chief Financial Officer P.M.S. Prasad

K. Kapil

TPOstwa Vikas Kumar Pansari Savithri Parekh Nita DipakC.

prod M. AmbanJain

Parther rtner Company Secretary Dr.R.A. Mashelkar

Membership No. 030848 Membership No. 093649 Non-Executive

Adil Zainulbhai

Directors

Date: May 06, 2022

Raminder Singh Gujral

Dr.Shumeet Banerji

Arundhati Bhattacharya

His Excellency Yasir othman H.Al Rumayyan

K.V. Chowdary

Intograted Annual Report 2021-22 309

Statement of Changes in Equity

For the year ended 31" March, 2022

A. Equity Share Capital

incrore

Balance as at change during the Balance as at

1st April, 2020 y e a r 2020-21 Sist March, 2021

Change during

the year 2021-22

Balance as at

31st March, 2022

6,339 106 6,445 320 ,765

B. Other Equity

(incrore)

n c e

otal Transte Transtfer Balance

at Ist to (tolfrom E m p l o y

1s at 31st

April, Incomefor the Dividends from General Rightsmp others March,

2021 Year etained Reserve Issue options 2022

Earnings

As at 31" March, 2022

Share Call Money Account 39,843 (39,843)

ReservesandSurplus

Capital Reserve 403 403

Securities Premium 59,442 39,447 841 99,730

Debenture

Redemption Reserve

5,965 (1,795) 4,170

Share Based

Payments Reserve

419 (386) 3

General Reserve 2,58,4 (34,348) 2,24,062

Retained Earnings 41,893 39,0844,297) (4,135) 72,545

Special Economic Zone

Reinvestment Reserve

4,975 4,135 9,110

Other Comprehensive Income 56,688 (1,979) 4 ,709

Total 4,68,038 37,105 (4,297) (36,143)(396) 455 4,64,762

Refer Note 14.9

Includes transfer of R 36,143 crore to statement of profit and loss (Refer Note 32(a) & 43.1).

Considers Special Economic Zone Reinvestment Reserve created during the year of R 5,040 crore.

310 Reliance Industries Limited

Corporate Management Governance Financial

Overview Review statements

ndelons

(incrore)

Total Transfer Balance

Balanc nsfer

to) at 3lst

aa

2020 t

Dividendspetoined om Employee others as

March,

eneral ssue options

ear Earnings eserve 2021

As at 31 March, 2021

Share Application Money (0

Pending Allotment

Share Call Money Account 39,843 39,843

Reserves and Surplus

Capital Reserve 403 403

Securities Premium 46,329 13,104 59,442

Debenture Redemption Reserve 9,375 (3,410) 5,965

Share Based Payments Reserve 4 415 19

General Reserve 2,55,000 3,410 2,58,410

Retained Earnings 14,146 31,944 (3,921) (32,692)" 32,416 41,893

Special Economic Zone

Reinvestment Reserve 5,500 525) 4,975

other Comprehensive Income

54,118 2,570 56,688

Total 3,84,876 34,514 (3,921) (33,217) 52,947 423 32,416 4,68,038

Refer Note 14.9

Refer Note 32 (0)

Net of Special Economic Zone Reinvestment Reserve created during the year of t 3,303 crore.

As per our Report of even date For and on behalf of the Board

For DTS & Associates LUP For

SRBc&coUP Alok Agarwal M.D. Ambani Chairman and

Chartered Accountants Chartered Accountants Chiet Financial Officer Managing Direc irector

(Registration No. (Registration No.

N.R. Meswani

142412W/ wo0595) 324982E/E300003)

Srikanth Venkatachar H.R. MesWan

Executive Directors

Joint Chief Financial officer PM.S.Prasad

P.K.Kapil

TPOstwal Vikas Kumar Pansari Savithri Parekh Nita M. Ambani

Prof. Dipak C. Jain

Partner Partner Company Secretary

Membership No. 030848 Membership No. 093649 Dr.R.A. Mashelkar Non-Executive

Adil zain C Directors

Date: May 06, 2022 Dr. Shumeer

Arundhati Bhattacharya

His Excellency Yasir Othman H.AIRumayyan

K.V. Chowdary

Integrated Annual Report 2021-22 311

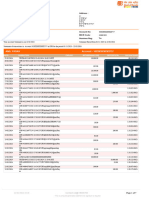

Statement of Cash Flow

For the year ended 31 March, 2022

( in crore)

2021-22 2020-21

A. Cash Flow from operating Activities

Net Profit Before

Tax as per Statement of Profit and Loss (After Exceptional item

and Tax thereon) 46,786 27,212

Adjusted for:

Premium on buy back of debentures 380 94

Provision for Impairment in value of investment (Net) (16)

Profit)/ Loss on Sale / Discard of Property, Plant and Equipment (Net) 80

Depreciation/ Amortisation and Depletion Expense 10,276 9,199

Effect of Exchange Rate 1,920 (1,238)

Change

Net Gain on Financial Assets "

(765) (2,866)

Exceptional Item (Net of taxes) (4,304)

Dividend Income (276) (141)

Interest Income (12,390) (1,065)

Finance costs 9,123 211

operating Profit before Working Capital Changes 55,134 33,186

Adjusted fo

Trade and Other Receivables (12,639) 2,781

inventories (9,337) 1,365

Trade and Other Payables

35,796 (36,154)

Cash Generated from operations 68,954 1,178

Taxes Paid (Net) (1,463) (1,690)

Net Cash

Flow from / (Used in) Operating Activities 67,491 (512)

B. Cash Flow from Investing Activities

Expenditure on Property, Plant and Equipment and Intangible Assets (18,149) (21,755)

Repayment of Capex Liabilities transferred from RJIL 5) (27,743)

Proceeds from disposal of Property, Plant and Equipment and Intangible Assets 30 1,147

Investments in Subsidiaries (37,574) (16,147)

Disposal of Investments in Subsidiaries 956 1,33,647

Purchase of Other Investments (5,21,980) (4,32,4

Proceeds from Sale of Financial Assets 5,02,224 4,34,074

Loans (given) / repaid (net) -Subsidiaries,Associates, Joint Ventures and Others 22,952 (7,321)

Interest Income 5,955 10,706

Dividend Income from Subsidiaries/ Associates 75 41

Dividend from

income others

Net Cash Flow (Used in) / from Investing Activities (45,315) 74,257

C. Cash Flow from Financing Activities

Proceeds from issue of Equity Share Capital

Net Proceeds from Rights Issue 39,76 13,210

Payment of Lease Liabilities (109) (53)

Proceeds from Borrowings - Non-Current (including current m a t u r i t i e s

29,916 32,765

Repayment of Borrowings- Non-Current (including current maturities) (36,539) (86,291)

Borrowings - Current (Net)

,754) 3,078)

Dividends Paid (4,297) (3,921)

Interest Paid (11,019) 14,294)

Net Cash Flow (Used in) Financing Activities (6,035) (76,657)

Not increase/(Decre ase) in Cash and Cash Equivalents 16,141 (2,912)

Opening Balance of Cash and Cash Equivalents 5,573 8,485

Closing Balance of Cash and Cash Equivalents (Refer Note No. 9) 21,714 5,573

"other than Financial

Services

segnmen

*Includes amount spent in cash towards Corporate Social Responsibility of t 813 crore (Previous Year t 922 crore).

312 Reliance Industries limited

Corporate Management Governance Financial

Overview Review statements

Standalone

Change in Liability Aris ing from Financing Activities

(in crore)

1st April, 2021 Foreign exchange

Cash floW movement/otne 31st March, 2022

Borrowing-Non-Current (including

maturities) (Refer Note 16)

current

1,88,546 (6,623) 3,242 1,85,165

Borrowing-Current (Refer Note 21) 33,152 (23,754) 9,398

2,21,698 (30,377) 3,242 1,94,563

( in crore)

1st April, 2020 Cash flow oreign exchange 31st March, 2021

movement/ others

BorrowingNon-Current(including current

maturities) (Refer Note 16)

2,38,700 (53,526) 3,372 1,88,546

Borrowing- Current (Refer Note 21) 59,899 (18,078) 3,669) 33,152

2,98,599 (71,604) (5,297) 2,21,698

Others includes short-term loans of t 10,707 crore, refinanced into Long Term Loan.

As per our Report of even date For and on behalf of the Board

For DTS&Associates LLP For S RBC&cOUP Alok Agarwal M.D. Ambani Chairman and

Chartered Accountants Chartered Accountants Chief Financial Officer Managing Director

(Registration No. (Registration No.

324982E/E300003) N.R. Meswani

142412W/ WiOO595) H.R.Meswani

Srikanth Venkatachari

P.M.S. Prasad Executive Directors

Joint Chief Financial Officer

K..Kapil

TP Ostwal Vikas Kunmar Pansari Savithri Parekh Nita M.Ambani

Partner rorther Company Secretary Prot. DipakC. Jain

Membership No. 030848 Membership No. 093649 Dr.R.A. Mashelkar

Adil Zainulbhai Non-Executive

Raminder Singh Gural Directors

Date: May 06, 2022 Dr. Shumeet Banerji

Arundhati Bhattacharya

His Excellency Yasir Othman H. Al Rumayyan

K.V. Chowdary

Integrated Annual Report 2021-22 313

You might also like

- Case Study: Alex Sharpe’s Risky Stock PortfolioDocument3 pagesCase Study: Alex Sharpe’s Risky Stock PortfolioBilal Rafaqat TanoliNo ratings yet

- Environmental Problems and Sustainability Chapter SummaryDocument41 pagesEnvironmental Problems and Sustainability Chapter SummaryTim Weaver75% (4)

- OM - J&G Distributors SolutionDocument8 pagesOM - J&G Distributors SolutionSiddharth JoshiNo ratings yet

- PLCR TutorialDocument2 pagesPLCR TutorialSyed Muhammad Ali SadiqNo ratings yet

- Consolidated Balance SheetDocument1 pageConsolidated Balance SheetSukhmanNo ratings yet

- Particulars 2Document2 pagesParticulars 2AshwinNo ratings yet

- RIL Integrated Annual Report 2022 23 PagesDocument2 pagesRIL Integrated Annual Report 2022 23 Pagesobroymanas0No ratings yet

- Ind As Financials Standalone q1 Fy 22Document41 pagesInd As Financials Standalone q1 Fy 22Tuhin SenNo ratings yet

- VedantaDocument2 pagesVedantaOnkar ShindeNo ratings yet

- Balance Sheet: ASAT31 MARCH, 2017Document2 pagesBalance Sheet: ASAT31 MARCH, 2017Mandeep BatraNo ratings yet

- Ifrs Consolidated Financials q3 Fy22Document37 pagesIfrs Consolidated Financials q3 Fy22Bharath Gowda VNo ratings yet

- Ind As Financials Consol q4 Fy 21Document42 pagesInd As Financials Consol q4 Fy 21asdasdNo ratings yet

- Balance Sheet: in CroreDocument8 pagesBalance Sheet: in CroreAshwin MurthyNo ratings yet

- Annual Report of INFOSYS LimitedDocument16 pagesAnnual Report of INFOSYS LimitedAman SinghNo ratings yet

- Mindtree SA IndAS 1Q21Document41 pagesMindtree SA IndAS 1Q21sh_chandraNo ratings yet

- Coca ColaDocument10 pagesCoca ColaJelyn JagolinoNo ratings yet

- 2022 - Consolidated Financial StatementsDocument7 pages2022 - Consolidated Financial StatementscaarunjiNo ratings yet

- Balance SheetDocument2 pagesBalance Sheetobroymanas0No ratings yet

- RPL Ind AS Consol Dec-23Document19 pagesRPL Ind AS Consol Dec-23venkyniyerNo ratings yet

- Standalone Balance Sheet As at March 31, 2021Document4 pagesStandalone Balance Sheet As at March 31, 2021Tuhin SenNo ratings yet

- Consolidated Balance Sheet Highlights for March 2019Document1 pageConsolidated Balance Sheet Highlights for March 2019jadgugNo ratings yet

- BFS Consolidated Balance SheetDocument1 pageBFS Consolidated Balance SheetNishaujjwalNo ratings yet

- Wipro Limited Interim Condensed Consolidated Financial Statements for Q1 FY22Document33 pagesWipro Limited Interim Condensed Consolidated Financial Statements for Q1 FY22Prasad RohitNo ratings yet

- Fin Stat - 2020-21Document3 pagesFin Stat - 2020-21Aman Khosla A-manNo ratings yet

- IMperial Mines 2018.Q2 FSDocument30 pagesIMperial Mines 2018.Q2 FSKevin GullufsenNo ratings yet

- Standalone Balance SheetDocument1 pageStandalone Balance SheetPrerna ChavanNo ratings yet

- CompleteDocument17 pagesCompletesanket patilNo ratings yet

- Bharti Airtel Limited Standalone Financial Statements 2018-19Document2 pagesBharti Airtel Limited Standalone Financial Statements 2018-19Ankit ViraNo ratings yet

- CAMSAnnualReport 2021 2022-208-211Document4 pagesCAMSAnnualReport 2021 2022-208-211Radhika GoelNo ratings yet

- KRR FS Q1 2023 15-May-2023Document19 pagesKRR FS Q1 2023 15-May-2023prenges prengesNo ratings yet

- AR Financial Statements ExtractedDocument4 pagesAR Financial Statements ExtractedISHA AGGARWALNo ratings yet

- Balance Sheet: As at March 31, 2022Document32 pagesBalance Sheet: As at March 31, 2022Ahire Ganesh Ravindra bs20b004No ratings yet

- Annual Report 2021 22 182 187Document6 pagesAnnual Report 2021 22 182 187Radhika GoelNo ratings yet

- Asian Paints ProjectDocument3 pagesAsian Paints ProjectRahul SinghNo ratings yet

- Wipro Limited Interim Condensed Consolidated Financial Statements for Q1 FY23Document35 pagesWipro Limited Interim Condensed Consolidated Financial Statements for Q1 FY23Midhun ManoharNo ratings yet

- Bal SheetDocument1 pageBal Sheetfakeking1412No ratings yet

- ACC ProjectDocument2 pagesACC ProjectShrey DardaNo ratings yet

- Spreadsheet 9M21Document14 pagesSpreadsheet 9M21Salah HusseinNo ratings yet

- FINANCIAL POSITION AND PROFITDocument2 pagesFINANCIAL POSITION AND PROFITMuhammad Noman MehboobNo ratings yet

- Wipro Limited and SubsidiariesDocument34 pagesWipro Limited and SubsidiariesLyca SorianoNo ratings yet

- ADIB Consalidated Condensed Dec 2022Document109 pagesADIB Consalidated Condensed Dec 2022Youssef NabilNo ratings yet

- Liquidity RatioDocument2 pagesLiquidity RatioRahul PrasadNo ratings yet

- Financial Report 30 09 2019 ENDocument38 pagesFinancial Report 30 09 2019 ENVenture ConsultancyNo ratings yet

- Balance Sheet VW Ar18Document1 pageBalance Sheet VW Ar18Sneha SinghNo ratings yet

- Financials 1620828-23.03.25Document6 pagesFinancials 1620828-23.03.25Levin OliverNo ratings yet

- Pak Elektron Limited: Condensed Interim Consolidated Balance Sheet AS AT MARCH 31, 2017Document9 pagesPak Elektron Limited: Condensed Interim Consolidated Balance Sheet AS AT MARCH 31, 2017Imran Abdul AzizNo ratings yet

- Balance Sheet For The Year Ended March 31, 2021Document43 pagesBalance Sheet For The Year Ended March 31, 2021parika khannaNo ratings yet

- FA AssignmentDocument21 pagesFA AssignmentMuzammil khanNo ratings yet

- 2 NGCI BalanceSheet 07032022 8Document2 pages2 NGCI BalanceSheet 07032022 8Hussna Al-Habsi حُسنى الحبسيNo ratings yet

- Shell PLC Annual Report and Accounts 2021: AssetsDocument1 pageShell PLC Annual Report and Accounts 2021: AssetsSonia CrystalNo ratings yet

- PJSC Lukoil: 31 December 2020Document53 pagesPJSC Lukoil: 31 December 2020Vincze EugeneNo ratings yet

- 6 Supplementary Accounting StatementDocument11 pages6 Supplementary Accounting StatementNithinMannepalliNo ratings yet

- Nicole Irvin - ProjectDocument4 pagesNicole Irvin - Projectapi-581024555No ratings yet

- GovernmentalDocument25 pagesGovernmentalshajiNo ratings yet

- Consolidated Balance Sheet As at June 30, 2021: AssetsDocument2 pagesConsolidated Balance Sheet As at June 30, 2021: Assetsshannia dcostaNo ratings yet

- Consolidated Balance Sheet: Asat31 March, 2021Document4 pagesConsolidated Balance Sheet: Asat31 March, 2021Joel DsouzaNo ratings yet

- CIB Separate Financial Statements Mar 2022 EnglishDocument29 pagesCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechNo ratings yet

- 1.2 Maliyye Hesabatlari Eng III Rub 2022Document2 pages1.2 Maliyye Hesabatlari Eng III Rub 2022Zakir KhalilovNo ratings yet

- Balance Sheet For The Year Ended March 31, 2021Document45 pagesBalance Sheet For The Year Ended March 31, 2021parika khannaNo ratings yet

- Balance Sheet - The Coca-Cola Company (KO)Document1 pageBalance Sheet - The Coca-Cola Company (KO)vijayNo ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedvijayNo ratings yet

- Annual Report Financial Year 2021 2022Document1 pageAnnual Report Financial Year 2021 2022anjaliNo ratings yet

- American Airlines Group IncDocument5 pagesAmerican Airlines Group IncMyka Mabs MagbanuaNo ratings yet

- Module 1 Engineering EconomicsDocument34 pagesModule 1 Engineering EconomicsSINGIAN, Alcein D.No ratings yet

- Appointment Letter: Teamlease Services Limited., Cin No. L74140Ka2000Plc118395Document4 pagesAppointment Letter: Teamlease Services Limited., Cin No. L74140Ka2000Plc118395amrit barmanNo ratings yet

- Business Chapter 2 BUSINESS STRUCTUREDocument7 pagesBusiness Chapter 2 BUSINESS STRUCTUREJosue MushagalusaNo ratings yet

- OpTransactionHistoryUX522 02 2024Document7 pagesOpTransactionHistoryUX522 02 2024Praveen SainiNo ratings yet

- BBA - Recruitment Process Followed by ICICI Bank PDFDocument108 pagesBBA - Recruitment Process Followed by ICICI Bank PDFSahil MavkarNo ratings yet

- Operations Management: Processes and Supply Chains Supplement A & Chapter 6 Selected Problems SolutionDocument7 pagesOperations Management: Processes and Supply Chains Supplement A & Chapter 6 Selected Problems SolutionQuynhLeMaiNo ratings yet

- Nuss Company ProfileDocument3 pagesNuss Company ProfiletelecomstuffsNo ratings yet

- Philippine Financial SystemDocument2 pagesPhilippine Financial SystemKurt Lubim Alaiza-Anggoto Meltrelez-LibertadNo ratings yet

- Unit III - Application of Theory of ProductionDocument16 pagesUnit III - Application of Theory of ProductionPushpavalli MohanNo ratings yet

- Logistics SsDocument18 pagesLogistics SsCarla Flor LosiñadaNo ratings yet

- GST Question Bank Nov 22Document750 pagesGST Question Bank Nov 22mercydavizNo ratings yet

- Thanos Industries Case StudyDocument48 pagesThanos Industries Case StudyWJ TanoNo ratings yet

- Opportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatDocument8 pagesOpportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatUmbertoNo ratings yet

- Answer SheetDocument49 pagesAnswer SheetMaryamKhalilahNo ratings yet

- Zerodha TDDocument22 pagesZerodha TDNitinNo ratings yet

- ASSG CargillsDocument3 pagesASSG Cargillslakmal_795738846No ratings yet

- 02 Activity 2Document1 page02 Activity 2Nica GalandeNo ratings yet

- DLL ENTREP Week 9Document6 pagesDLL ENTREP Week 9KATHERINE JOY ZARANo ratings yet

- Snake LTD - Class WorkingsDocument2 pagesSnake LTD - Class Workingsmusa morinNo ratings yet

- Sample Test Paper Sample Test Paper Sample Test Paper: Part-ADocument8 pagesSample Test Paper Sample Test Paper Sample Test Paper: Part-AMUHAMMED SHAMMASNo ratings yet

- Assignment BRDocument7 pagesAssignment BRprerana sharmaNo ratings yet

- Term Paper IN Theories and Practices of Ecological TourismDocument2 pagesTerm Paper IN Theories and Practices of Ecological Tourismkristel jadeNo ratings yet

- Translate-BSG Quiz 1Document2 pagesTranslate-BSG Quiz 1franky mNo ratings yet

- Describe The Balanced Scorecard Concept and Explain The Reasoning Behind ItDocument2 pagesDescribe The Balanced Scorecard Concept and Explain The Reasoning Behind ItRamm Raven CastilloNo ratings yet

- SmeDocument68 pagesSmevictorNo ratings yet

- LE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIDocument20 pagesLE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIАвишек СенNo ratings yet