Professional Documents

Culture Documents

Research Thesis

Uploaded by

RAPHAEL0 ratings0% found this document useful (0 votes)

10 views40 pagesMBA FINANCE

THE UNIVERSITY OF ZAMBIA

Original Title

RESEARCH THESIS

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMBA FINANCE

THE UNIVERSITY OF ZAMBIA

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views40 pagesResearch Thesis

Uploaded by

RAPHAELMBA FINANCE

THE UNIVERSITY OF ZAMBIA

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 40

Investigating the major financial factor affecting SME farmers based on the Copper Province

when accessing Finance from financial institutions: A case study of Agriculture sector in

Copperbelt Province in Zambia,

Student Name: Victor Tangawarima

Student Number: GSB901914

University Of Zambia

Date: January 23rd 2022

RESEARCH ABSTRACT

‘The paper outlines the challenges and opportunities which when understood better by the

small and medium-

ized enterprises (SMEs) to farming economy, their access to financing can

be better. Financial institutions have common values and the same values if understood well by

the farmers in the enterprise industry can better bridge the gap between the two sectors.

The research was conducted on the Copperbelt province. SME s there actually experience

challenges in accessing finance. It’s sad that most the previous research mostly talks about the

challenges which small and medium enterprises face. However, this research took another angle

to look at the challenges which the financial institutions face with this small and medium

enterprises in the region of the Copperbelt, in Zambia,

T

e qualitative research employed surveys, interviews, and questionnaires based on the

views and opinions of representatives of financial institutions. A sample of 40 representatives of

financial institutions was used to form themes and statistical graphs to develop meaning from

data.

‘The findings revealed that though collateral is a significant factor, market value of the

SMEs product is the most i

portant because, it realizes value. Market value of farm produce has

‘more value than loan collateral. When farmers invest in highly valuable items, which can highly

be converted into a revenue, both the farmer and the financial institution realize value. When

Grabbing collateral is not the primary objective, but value addition,

CONTENTS

1.0 Research abstract

1.1 Research Background

1.2Problem statement

1.3 Purpose of Study.

1.4 Aims of Study .

1.5 Significance of Study.

1.6 Research Objectives

1.7 Research Questions

1.8 Scope of Study

1.9 Research Proposal Budget ..

2.2 Study limitations

2.3Ethical Issu

3.0 Literature Review

3.1 Introduction

3.1 Theoretical

3.2 Empirical

3.3 Conceptual framework

4.0 Research Methodology .

4.1 Sampling Techniques

4.2 Research procedures

4.3 Sample size

4.4 Justification For the Sample Size.

4.5 Questionnaires

4.6 Data Triangulation

4.7 Data Analysis

4.8 Ethical reviews

5.0 Research Analysis and interpretations

5. Investigating value of attitudes on financial access.

5.2 investigating value of Experience on financial access ..

5.3investigating value of collateral

5.4 Investing the value of market demand

5.5 Investigating the value of research proposal

5.6 Investigating the most significant value

6.0 Discussions and findings

6.1 Conclusions on Findings

6.2 Recommendations

6.3 Suggestions for further research

6.4 References

6.5 Appendix

CHAPTER ONE

1.0 BACKGROUND

‘The problem regarding SME access to finance in Copperbelt is urgent. The devaluation

of the reduced resource potential of financial sector is one of the key factors curbing SME access

to finance, Factors that hamper SMEs in accessing finance are high interest rates for all business,

heavy lending terms, and lack of lending institutions’ interest in providing finance to regions.

‘The importance of increasing financial inclusivity and financial literacy has recently become

urgent in farmers on Copperbelt. The levels of accessibility for the country’s population and

entrepreneurs, including SMEs, to services offered by financial institutions are not desirable.

The agricultural sector in Zambia plays a key role in providing livelihoods for the

country’s population. It continues to be the biggest employer in the informal sector and provides,

the highest proportion of formal employment opportunities across all economic sectors in the

country.

Microfinance can be an effective way of extending financial services— including

deposits, loans, payment services, money transfers, and insurance—to low-income farmers and

micro and smaller enterprises. State-funded agricultural development banks or other state-funded

programs are a common source of credit for farms, microenterprises, and SMEs that cannot

access sufficient credit, either from friends and family or from commercial banks. Agricultural

development banks also frequently provide finance to other financial institutions that serve the

agriculture sector, such as rural banks and MFIs. Agricultural banks may provide support to

build the capacity of microenterprises and SMEs so that they are eligible for credit from private

financial institutions.

Due to trade liberalization, Zambia has exposed local producers to tough competition

from imports. The power outages being experienced in the country have put a lot of uncertainty

in irrigated agriculture and in production of high value agricultural products.

Despite Zambia being endowed with vast land, fertile soils, plenty of water and a

favorable weather pattern that can support agricultural production and hence stimulate rural

development this potential is never realized. For instance, market reforms have been made in

‘Zambia to stimulate private sector participation without addressing major constraints that hinder

agricultural and rural development. These constraints include poor service delivery particularly

for small scale farmers, marketing constraints especially in outlying areas as a result of poor

infrastructure such as feeder roads, a void in agricultural finance and credit, unfavorable world

and regional markets and poor accessibility and administration of land.

Credit is believed to be the binding constraint in many cases related to agriculture project

objectives, leading to the incorrect assumption that rural finance and agricultural credit are the

same, Instead, rural finance encompasses the full range of financial services demanded by rural

households, including loans, savings, payment and money transfer services, and risk

management (¢.g., insurance, hedging, and guarantees).

1.2 PROBLEM STATEMENT

Financial institutions have experienced challenges with access to finance. A lot has been head

from farmers but little had been head from financial instructions. This research discovered new findings.

Despite the crucial role of credit in agricultural production and development, farmers still have limited

access to farm credit. The problem is statement is to understand the real issue with financial institutions

towards SME farmers .Awoke (2004), noted that its acquisition and repayment are fraught with several

problems especially in the small holder farming. Most of the defaults arose from poor management

procedures, loan diversion and unwillingness to repay loans. According to Saleem and Janm (2014)

various researchers have put forward the benefits, problems, access and role of credit for increased

productivity. But prompt repayment of credit is necessary for good credit worthiness.

In order to shift from subsistence to commercial agricultural production, access to finance

is

crit

cal. Access to finance will enable the growth of the agricultural sector (The International

Institute for Sustainable Development, (2015). Agriculture is a very important sector which not

only plays a major role in poverty reduction and food security but also the creation of

employment. However, the challenge in Zambia lies in working as a small-holder farmer

(Ministry of Agriculture, 2020),

Both in industrialized and non-industrialized countries, SMEs have been found to have

less access to external finance and therefore struggle in their operation and growth,

1.3 PURPOSE OF STUDY

The purpose of study was to investigate the main challenges financial institutions

experience when they offer loans to farmers in the SME sector. Much of the research has been

head from the farmers problems but the less has been head from the financial institutes. The

main challenge was identified, and it will help to narrow the gap between the financial

institutions and the farmers in the SME sector. Most of the SME farmers do not have the access

to finance and the financial institutions have not given the opportunity to give farmers in the

SME sector loans credit to support their business, That is , there is a challenge or difficult is a

fact, but what is that challenge which if known, the farmers will work on it and can help prosper

their business forward. And if Zambian farmers on the Copperbelt region can access financial

support and their livelihood, provincial development can be enhanced. The development of the

Towns can adjust to urbanization and contribute the national development by sustaining their

lives without government support.

1.4 AIMS OF

STUDY

The aim of the study was to extract the main reason why the farmers on the Copperbelt

have had challenges when accessing the finance from the institutions that provide capital and

other financial services to other business. The main aim was to investigate why financial

institutions, favor other business ventures other than that of famers in the small and medium,

enterprises sector. To operate profitably, financial institutions need a clear, reliable environment.

Studying why SMEs in Zambia have difficulty in accessing credit or funding from financial

institutions, perspective of the operators of these SMEs is crucial since it would present the

problem from the perspec

of the SMEs thereby making it a base line study for policy

interventions by state agencies, development partners and non-governmental organisation with

missions to develop the SME sector.

1.5 SIGNIFICANCE OF THE STUDY

The study has now simplified the understanding of the challenges SME farmers

experience when making efforts to access the finance. The actual factor which is so significant,

among the financial institutions is now understood. SME farmers on the Copperbelt are able to

‘work together in order to provide financial institutions with what really matters to them and not

just making efforts which have no value to the financial institutions.

‘The benefits of this research included increased productivity of Copperbelt based

agriculture, reduced rural poverty rates in the region, increased regional food security, crop

diversification, improved agricultural markets, less pressure on the Treasury stemming from.

agricultural subsidies and Copperbelt emerging as a leading regional provider of agricultural

products. The primary beneficiaries are the Copperbelt SME farm dwellers because of the

location.

1.6 RESEARCH OBJECTIVES

The objective was to investigate the main challenges which financial institutions

experience when offering financial products among the following factors ;collateral , farmers

attitudes , value of the farmers experience , market value of the f

m produce , soundness or

effectiveness of the business plan

1.7 RESEARCH QUESTIONS

‘What is the major factor that values most to financial institutions when providing finance

to agricultural SMEs in the Copperbelt region? ‘There are a lot of possible factors such as the

market demand for agricultural products, soundness of the business proposal, the performance of

agricultural product

erience of the SME farmers, availability of collateral among others.

Among the above mentioned the research explored and discovered the most valuable factor to

the financial institution .

1.8 SCOPE OF STUDY

‘The study was conducted on the Copperbelt region among the financial institutes as

targets sources of information to showcase challenges their have experienced with the famers

under the

‘egory of SMEs. The province has five districts, and two cities and it is expected that

most of them have had experience with the farmers. Among the information provided was the

performance of their products, the negative outcome, which previously was not their

expectations.

‘The main districts are Chililabombwe, Kitwe, Luanshya, Masaiti, Ndola, Mpongwe,

Lufwanyama, Kalulushi and Mufulira districts. Ndola and Kitwe are the provineial districts

headquarters and most of the financial institutions are based here,

‘The list of the financial institutions in the region are in the table below.

NAME OF FINANCIAL INSTITUTION [No. OFBRANCHES | TARGET SECTOR

‘Zambia National Commercia Bank 16 ‘Agriculture Poultry

Stanbie Bank Zambia limited 12 Agriculture general

First National Bank 10 ‘Agriculture poultry

‘ABSA Barclays Bank of Zambia 3 Agriculture poultry

National Savings and Credit Bank 10 ‘Agriculture poultry

Tnvest Trust Bank Limited 3 Agriculture general

Caymont Bank 4 Agriculture Poultry

Farmers union 7 ‘Agriculture general

Farmers and cooperative society limited [5 ‘Agriculture Poultry

1.9 BUDGET

‘The budget catered for the transportation between cities and districts, at low prices. This

involved only using public transportation. The was no much significant variance between the

budgeted expenses and the budgeted results.

2.0 STUDY LIMITATIONS

The study was conducted on the Copperbelt region, and it is only a province. As such it

cannot represent the national or global perspective. Financial institutions behavior and the general

economy are somehow related, When the Gross domestic product for the country improves, the

circulation of money in the economy grows and that reduces the risk and demand for finance. The

research was time sensitive as the future may be more technological and government policies may

influence the market of poultry through subsidies, interest rates and embargoes. The research only

concentrated on the financial institutions and not the SME farmers in the poultry sector. Some

respondents did not have financial and agricultural backgrounds as the SME business sectors were

not part of their products.

2.1 ETHICAL ISSUES

This research was conducted in an ethical manner. I understand that most financial

institution are privy with the information they hold, As such maximum integrity and

confidentiality was implemented. The information that the institutions provided was only used

for the purpose of this research and shall not be used for any other purpose. The research did

request for names of institutions and other personal details of respondents managing the

intuitions, The information and data only obtained from the willing participants who permitted

me to conduct the research. The data and information collected was obtained in an objective

‘manner with questions customized to research questions only. The permission letter will disclose

10

my stance on accountability of the information that I used where I acknowledged personal

liability for data leakages in a case that the information shared is found with an unauthorized

party .

1

3.0 CHAPTER TWO: LITERATURE REVIEW

This chapter reviews literature on agricultural efficiency and highlights the importance of

ial institutions. It reflects the contributions

agricultural efficiency regarding values of the finan

of the findings in other in Zambia, outside Zambia but within Africa and beyond. It defines the

SME concepts in the poultry farming and various relevant types of variables; among them value

of the business plan, importance of the SMEs experience, value of collateral and the significance

of the market demand. Finally, it looks at related past studies on what matters most to value of

financial institutions

3.1 Theoretical Framework

Microfinance can be broadly defined as financial service provision to poor people in

urban and rural areas. Microfinance only partly overlaps with rural finance, given that most

microfinan

sustomers are in urban areas. SME finance is the funding of small and medium

enterprises. As outlined in the IFC (2022) SM

Finance stocktaking report, the term “SM

typically encompasses a broad spectrum of definitions across countries and regions. Agricultural

microfinance refers to the provision of financial services to small farmers and poor rural

households for agricultural production, marketing and proc:

ing. The most requested items for

accessing are provision of finance were as follows.

Stanbic bank (2022) needs the following to finance agricultural project, busines

financial statements, personal statements of assets and liabilities of all the partners, a 12-month

cash flow forecast, the amount of own contribution, and the source of the funds, Schedule of

debtors and creditors, past three months’ bank statements, members or directors, sales and

2

purchases budgets, A projected income and expenditure statement. Financial institutions need

similar documents and it’s considered an industry practice.

Foundation for National community assistance (2022) demands the following from the

SME farmers who request for loans, The bank statements

business plan, community, or

personal asserts, to securer the loan, Personal statements of assets and liabilities of all the

partners. A projected income and expenditure statement. Financial institutions need similar

documents and its considered an industry practice

National farmers union (2022) needs the following to finance agricultural project,

collateral, business plan, A 10 -month cash flow forecast, the amount of own contribution, and

the source of the funds, bank statements, members or directors, sales and purchases budgets.

3.2 Empirical Framework

Ministry of finance (2022), Providing financial access to the poor has always been a

challenge due to various reasons. It is a known fact that most poor transact in small amounts,

lack collateral, lack credit history and live in areas that are difficult to serve, mostly rural. On the

other hand, the financial illiteracy of rural clients evidently restricts their decisions to use

structure which can enable

financial service providers to deliver their services and products to rural clients at a minimal cost

is limited. Additionally, most low-income people work in the informal sector with high

susceptibility to shocks and have irregular income. As such the level of risk on farming for

financial intuitions may be too much to bear.

Financial literacy may be a factor but skills alone without experience would also be an

issue with the financial institutions. Financial institutions also need to do follow ups on SMEs

3

however the challenge is that most of the SME farmers are rural based and may not be credible

when providing finance. It’ is called the fungibility behavior which is explained by lack of

follow-up services, such as training in financial management, savings and improved credit

servicing (Mago and Costa, 2018).

According to Provident & Zacharia (2008), investigated critical look at the role of

microfinance banks in poverty reduction in Tanzania, the study based on questionnaires, semi

structured interviews, observations and documentary reviews. The main findings of their study

showed that majority of the poor do not access microfinance services loans because they lack

‘guarantors, assets, businesses, salaried employment, savings account in banks, ability to make

pre-loan weekly deposit on Special Savings Account which are required as collaterals. The key

factor was guarantee, either coming from an asset, as collateral or from salary. In Zambia, most

of the SMEs do not have formal jobs, and this leaves collateral as a key source of guarantee,

however its relevance to financial institutions in Zambia, and deserves to be investigated.

Microfinance gives access to financial and nonfinancial services to low-income people,

who wish to access money for starting or developing an income generation activity (Ojo, 2009)

Olagunju and Adeyemo (2007) studied factors that determine loan repayment deci

mn among

farmers in Southwestern Nigeria during 2005.Data from 180 respondents were collected through

multistage sampling technique. His results showed farming experience, farm location, cost of

obtaining loan, visitation, borrowing frequency and education as important factors in

determining loan repayment.

Oladeebo et al (2008) examined socio-economic factors such as a mount of loan repaid,

amount of loan collected and spent on agricultural production, annual net farm income, age, farm

14

size cultivated, farming experience with credit use, and level of education influencing loan

repayment among small-scale farmers in Ogbomosho agricultural zone of Oyo State of Nigeria

Among them amount of loan obtained by farmers, years of farming experience with credit use

and level of education were the major factors that positively and significantly influenced loan

repayment. Most Zambians are educated and they are able to understand basic arithmetics ,

interest payments , and other areas that may be used to assess literacy and this leaves farming

experience an area that would require investigation as farming in Nigeria and Zambia may be

slightly different in that Nigeria has different cultures and vegetation is not the same as Zambia ,

and the research di not specify the specific area of farming , when the proposal is specifically in

poultry,

Kohansal at al (2009) studied the factors influencing on repayment performance of

farmers in Khorasan-Razavi province of Iran during 2008, Results showed that farmer's

experience, income, received loan size and collateral value have positive effect on loan

repayment. In Zambia, demand for the product is also relevant. An experienced farmer, with

expensive collateral, who intends to in farming products that do not have market would not likely

make a sale in the Copperbelt because the produce may be demand less. This research will also

investigate the value of product demand on financial institutions when providing finance to SME

poultry farmers,

Koopahi and Bakhshi (2002) Identified defaulter farmers from no defaulters of

agricultural bank recipients in Iran by using a discriminate analysis. They found use of

machinery, length of repayment period, bank supervision on the use of loan had significant and

positive effect on the agricultural credit repayment performance. The research was trying to

15

explore the reasons why farmers default, acknowledging the fact that its serious issue that affect,

financial institutions. However, our local SMEs in Zambia, on the Copperbelt region, default on

Joans and barely have machinery. Financial institutions would probably use that machinery as

collateral in Zambia.

Eze and Ibekwe (2007) studied determinants of loan repayment under the Indigenous

Financial System in Southeast, Nigeria During (2005). 180 respondents were selected randomly.

for primary data collection, Data were collected by means of questionnaire and observation,

Descriptive statistics and multiple regression techniques were used for analysis, The research

acknowledged that experience of the small and medium enterprise can affect loan repayment. In

this research, value of on financial institutions experience with that of SMEs was be explored.

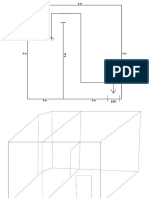

3.3 Conceptual framework

Among the variables, the adequate business proposal, the power of collateral, market

‘demand for the SMEs farm product, experience of the farmers matters most to the financial

institution , as key items to for look out and should be able to guarantee or warrant business

profit.

eer el

Laake

alias

Perce

DC eau autocad

aE UTar ly

16

One of the above factors should be able to be the priority to financial institutions and when SME

farmers do the math, they will know values most and can well be guided to obtain finance, The

most important factor t the financial product, is basically any product that can be profitable.

7

4.0 CHAPTER FOUR: METHODOLOGY

This chapter provides the detailed research methodology that was adopted in the study

It addressed the research design, population and sampling design used in the study. The chapter

further discussed the data collection methods, research procedures and data analysis methods that

were be implemented.

4,1 Sampling Technique

‘Though the invitation letters were sent to all parts of the districts and the two cities,

‘Ndola and Kitwe, the method of convenience sampling was employed in arriving at the 40

SMEs, which the researchers believe helped the confidence relevant for this study and who have

sufficient time and were willing to participate. This technique, convenience sampling, involves

obtaining responses within the sample frame from willing respondents and their availability for

the study. The advantage here is that respondents participated on their own volition and not

selected against their will. This technique was chosen to boost response rate because respondents

in this sector are reluctant in giving out information, because they worry information about their

businesses may leak through to competitors and potentially exposed them to tax authorities.

4.2 Procedures

After deciding on the target population, a list of SMEs was selected. The various SMEs

that agreed to be part were subsequently contacted and given a brief about what the study seek to

achieve through the means of telephone. After getting the required number for the study, the

questionnaires were dispatched. The respondents were given two weeks to complete the

questionnaires, before live interviews were conducted so as to give them ample time in giving

out the right responses.

18

4.3 Justification of the sample size

Because the emphasis of this research is on quality rather than quantity, the objective is

to maximize numbers but to become “saturated” with information on the topic. The aim was to

capture depth and richness rather than representativeness. The interviews ware complemented

with secondary information to assure the adequacy of the data. The reason to conduct 40

interviews on the demand-side includes a limited budget, accessibility to the financial

institutions, the willingness of participants to speak freely with the interviewer and data

saturation.

‘The participants were given informed consent, forms to read, ask any questions related to

the study and sign the forms before the researcher could commence with the interview. All the

questions were translated into the language the interviewee was willing to choose. The

interviewing was performed in the interviewees’ places of work, or locations they will deem

appropriate, The interviews were both written down on notes, with the agreement of the

interviewees, then transcribed for analysis and the anonymity of the participants were

maximized

4.4 Questionnaires

Qualitative data are those collected, analyzed, interpreted by observing what people do

and say (Ngechu, 2006). A questionnaire is a carefully designed instrument for collecting data in

accordance with the specifications of the research questions and hypotheses. It elicits written

responses from the subjects of the research through a series of question/statements put tighter

with specific aims in mind. The questionnaire may be used to ascertain facts, opinions, beliefs,

attitudes, and practices. As such the questionnaires was distributed coupled with live interviews.

‘A questionnaire was used to explore the key research question.

19

4.5 Data Analysis Techniques

Data gathered from this research was analyzed using tables and graphs.

4.6 Reli

ity and Validity (triangulation)

Qualitative credibility is achieved through practices including thick description,

triangulation crystallization, multivocality and partiality. This study provided a thick

description of the data and will be used for triangulation methods to ensure its validity.

For construct, validity, multiple sources of evidence, namely interviews, secondary data and

document, analysis, was to be used. The secondary data provided the necessary information to

make cross-references for the inferences from primary data. Triangulation facilitates validation

ion from more than two sources. It tests the consisten:

of data through cross verifi of findings

obtained through different instruments and increases the chance to control, or at least assess,

some of the threats or multiple causes influencing our results.

4.7 Ethical considerations

Highly ethical standards were applied by making sure that information obtained was

confidential where needed and procedures of getting data will done in a professional manner in

order to avoid plagiarism and protect intellectual property rights; bias were avoided.

20

5.0 CHAPTER FIVE: ANALYSIS AND INTERPRETATIONS,

5.1 Investigating Attitudes of Financial Institutions on SME Farmers

The research assessed the attitudes of the financial institutions on SME poultry farmers.

‘The findings revealed that most financial institutions feel that most of the times, collateral of the

farmers will be grabbed because they are more likely to default on the loan. 75% of respondents

felt that collateral can be grabbed. 70% of respondents felt that most farmers would cancel their

loans or finances because they lack adequate plans. Regarding fulfilling the financial obligations

of the finance most respondents said only 10% would fulfil the obligations of finance. Before a

loan is acquired by the famer, the probability that they do not default is 20%. Based on the past,

most enterprises said 15% would come with financial plan and the risk endowed with the product

is 85%. Most of the respondents said that products aimed at SME poultry farmers would yield a

low profit and the loan would not be paid on time. 70% feel that the loan has low profits and

70% feels that the loan would not pay on time. This concludes that the financial institutions are

negative about SME farmers based on the time and activities they have experienced with them.

Source (2022)

21

‘The research further explored the satisfaction on the financial institutions regarding their

SME poultry farmers. 70% of the respondents said they would remove the products owing to low

profitability. Only 30% described the financial products aimed at future to bear about 30%

confidence in the future performance of the products. To describe the experience of their

relationship with SME farmers, 70% described the experience to be poor in that product

performance, failure to professionally communicate, in comparison with other customers.

Regarding recommendation, 20% said they would recommend while the other 80% said they

would not. The level of satisfaction in terms of business proposals investments and collateral

behavior, including court cases, spell that most financial institutions are not pleased with the

behavior of SME poultry farmers. Below is the table that summaries the findings of the research,

then tabulated in to the charts

SATISFACTION

CoML a oaay

GEA

EXPERIENCE WITH FARMERS

a

Cag eon

rare eZ

Source data (2022)

2

5.2 Investigating The Effect of Experience On accessing Finance

With regard to the literature, on farming, experience of the SME in farming business spell

that experience is a significant factor. Most of the financial institutions agreed that experience is

significant, and this was represented with 70%. However, respondents complained that most

emerging SMEs are not experienced. Only 40 % have experience and its difficulty to justify. On

the other hand, financial institutions showcased some confidence in the combination of

experience and loan defaulting saying that the chances of loan defaulting by an SME enterprise it

at least two years of experience, was 50% meaning that the score was shared, among the

respondents. How they interpreted the score on risk from an experienced SME poultry farmer,

and that the loan would not be defaulted at was at 30%. This spells that the confidence on

experience is low. Below is the chart to reveal the findings the chart

Source data (2022)

23

5.3 Investigating the Effect Of Collateral

Collateral was also investigated in relation to the research question. the number of

respondents that believed collateral is important were 70%. They said and appreciated the value

of collateral on the security of the financial product. The frequency of times farmers opts to offer

collateral or secure their finance with collateral, implying that 70% are no willing would resist to

secure the loan o financial product. The adequate or evaluation of collateral is an issue in that the

value which SME s attach to their property and the value which financial institutions place on

their property is unequal in most cases. The financial institutions normally place the value lower

than the customers perspective because they include the challenge to put the assets in liquid or

cash form as the finance product is. Sufficiency of the collateral would spell the direct value of

the. According to the financial institutions, only 20% would provide the collateral that is

adequate and only 25% offered collateral that was sufficient. When rating how significant

collateral is to the financial institution, 70 % rated financial institution to be very important,

especially with medium and small and enterprises.

24

Source data (2022)

5.4 Investigating The Effect of Market Demand on Financial Access

‘The research also investigated effect of market demand on the ability of the financial

institution to offer finance. If the financial product has very high chances of being sold and

formal documents are present such as a salary , Then it becomes reliable for the financial

institutions to offer the finance. If market demand for the product is low, the risk of business

becomes high inspite of the collateral available. The purpose of providing an SME in poultry

farming is to promote a business. The research investigated the challenges which would affect

the marketing of the poultry products. It was found that the need for license as a requirement to

manage a business was minimal; only 10%. The strength of the monitors to ensure that

regulations are followed was 20%. The other respondents (80%) said the regulation is weak.

70% provided key feedback on the time and agreed that the time to sale poultry stock is minimal.

‘The cost of establishing the market was also found to be very minimal. It was found to represent

20% of the cost . 80% of respondents agreed that demand is high.

25

NEED FOR A LICENCE

STRENGTH OF REGULATION

TIME TO REPLENISH

ESTABLISHING MARKET

(COST OF MARKETING

DEMAND FOR PRODUCT

o%

MARKET DEMAND

(EN 10%

LL 7.

«x

10% 20% 30% 40% 50% «GOK 70K BOK «90H,

Source data (2022)

5.5 Investigation on The Value of The Business /Proposal When Accessing Finance

The value of business proposals was also assessed, and the findings were as follows. The

number of times when financial institutions were presented with business plans was on average

70% said they had not been presented with any business plan by the respondents. 50%

Said they had assisted the customers with the development of the business plan. This spells that

inspite of bearing a business plan, half of them need assistance. However, the importance of the

business, plan or proposal is that that it guides the financial institution on the ability and success

of the potenti

business, and this would secure their loan or finance. 80% said it’s a valuable

item, The chart below summarized the findings of the study the value of the business proposal

26

Source data (2022)

5.6 Investigating the Most Significant Factor When Accessing Finance

This part of this research presented the most significant factor that values to financial

institution when providing finance to SME poultry farmers. The respondents revealed that the

‘most challenging issue is the market demand which matters most, When they assess the market,

for livestock and related poultry products, they can judge the performance of the business plan

the formulation of business plans which was given the value of 10% could be prepared by any

with possible falsification, Even if the business plan or proposal is excellent, the economic forces

‘would still command the value. These forces are the demand for the product. A farmer might

have the experience of 100 years, but the economic forces would command the price and

demand. The respondents, financial institutions, was represented by 50% of those who agreed

‘that market demand for the product was the most important of all. Experience of SME poultry

7

farmers and their collateral was level in terms of value with 20%. The chart below summarized

the findings.

Source data (2022)

6.0 Discussions on the findings

The most valuable factor for the financial institution s was compared between collateral

and product demand. the financial institutions favored product demand and said collateral is not

the essence of business but the market value of the SMEs product demand on the market.

Collateral only acts as security and most SMEs do not have so much valuable assets to offer. As

such financial institutions on the copper belt use economic estimates to predicate the behavior of

the market in terms of demand and supply of livestock and related poultry products. When

interviewed most of them aid product market value matters most tis security. Remove collateral,

the business will likely fail if the offering has less demand, As such market demand is the most

28

challenging factor for the financial institutions which they face with SME enterprises in the

poultry industry.

70%

30%

6.1 Conclusion on the Findings

Source data (2022)

In conclusion of this research, one should be able to tell the value of the product market.

Itrelates to the value of the products on the open market. Financial institutions conduct what

they call feasibility studies on the market to test whether the product which the enterprise wants

to bring on the market can sell or as high demand such that will approach to the market it can

attract a lot of customers and again it can bring value to the business owner. On the other hand,

collateral is equally important however it is not as important as product market. The reason is,

that the motivation of financial institutions is not to grab the property of SME farmers but to

develop value from what they have on the market at large. The main interest of financial

29

institutions when they provide finance is that the business of an enterprise that is seeking a loan

or finance should prosper and not to grab the collateral that itis able to provide. The main aim of

the collateral is just to provide a security or insurance for the loan or for the finance which has

been accessed by the customer or in this case is small and medium enterprises in the poultry

farming on the Copperbelt.

6.2 Recommendation on the study

1. This study was only conducted on the probability among the poultry farmers under the

category of small and medium enterprises how have ideas recommended that similar

research can be conducted in another province especially southern where go to keeping

and a lot of enterprises are based with challenges to reach financial institutions.

2. The sample size for the research was only 40 respondents in a region as such I can

recommend that a larger sample size is conducted in different areas and countries to

investigate if the results can be there similar.

6.3 Suggestions for Further Research

T can also recommend that this study can be conducted in a country or developed countries

as you may know the situation for Zambia with a low gross domestic product in comparison to

other countries. In developed countries where are systems processes are well established the

value of collateral, most likely can be very low because all the advanced systems processes

availability of technology in other countries.

30

REFERENCES

Awoke, M.U, (2004) . Factors Affecting Loan Acquisitioned Repayment Patterns of

Smallholder.

Ezeh, C. 1, & Anyiro, C. ©. (2013). The impact of micro financing on poverty levels of rural

women farm households in Abia State, Nigeria. Implication for policy interventions,

Journal of Central European Agriculture, 14(2), 168-180

Eze and Ibekwe (2007) economics and micro finance: Department of Agriculture Economics,

University of Nigeria Nsukka,

F.1 Olagunju and R.Adeyemo (2007). “ Determinants of loan repayment decision among small

holders farmers in Southwestern Nigeria.” Pakistan journal of social sciences 4(5): 677-

686

Koopahi, M. and Bakhshi, M.R.(2002). Factors affecting agricultural credit repayment

performance: (case study in Birjand district). Iranian journal of agricultural sciences.

Kumar, R. (2005), Research Methodology-A Step-by-Step Guide for Beginners, (2nd.ed.),

Singapore, Pearson Education.

MR kohansal M.Gharbane and H.M Ansoori (2008) “Effect of credit accessibility of farmers an

agricultural investment and investigation of policy options in Kohansal. Razavi province

journal of applied scabies 8(23): 455-4459, 2008.

Ministry of agriculture (2020), The credit and finance .Role of Credit on Small and Medium

Enterprise in Zambia . bttps://wwwagriculture.gov.zm/ Accessed (2022).

31

Oladeebo, O.E. (2003). Socio-Economic Factors, Influencing Loan Repayment Among Small

Scale Farmers in Ogbomoso Agricultural Zone of Oyo State, Nigeria,

Saunders, M., Lewis, P. and Thomill, A. (2003) Research Methods for Business Students Third

Edition, Prentice Hall, England,

Saunders, M., P. Lewis, et al. (2007). Research Methods for Business Students. Fourth Harlow,

England, FT Prentice Hall, Pearson Education.

Stephen Mago, Costa Hofix,( 2018) Microfinance as a pathway for smallholder farming in

Zimbabwe, Environmental economics Journal, Zimbabwe.

32

Student Name: Victor Tangawarima RESEARCH QUESIONNARE

Student Number: GSB901914 FORTHE PROPOSAL MBA

Negative =Between 40 and above , Moderate=Between 30 and 39, Positive =Between (21 and 29), Very positive =Less than 30

pe. 1

Student Name: Victor Tangawarima

Student Number: GSB901914 aS

RESEARCH QUESIONNARE

FOR THE PROPOSAL MBA

Impressed =41 and 50 , Satisfied =Between 31 and 40, Somehow Disappointed =Between (21 and 30) , Disappointed =Less than 10 and 20

INVESTIGATING THE SATISFACTION OF THE 5 a 3 2 7

PERFORMANCE

1 | How satisfied are you with loan products from SMEs poultry | Very Fair Neither | Disappointing | Very

farmers? Disappointing

oS eS Ss S o

2_| How likely are you to recommend loan products from SMEs? | Very Likely _| Mostly | Neither _ | Unlikely Never

eS cI o a oI

3_| How do you rate farming loan products among other products? [Excellent | Good __| Fair Poor Bad

i] = oS i= o

4 | On your product line, how do you rank SME poultry farming? | Very Important | Moderate | Not important | Useless

important

oa eS SS So So

5_| rate the experience with SME farmers on loan repayment? Excellent | Good _| Fair Poor Bad

oO Oo So SI o

6_| How likely are you to continue Serving farmers with finance | Definitely __| sure No. Maybe Never

oo ao a oa oa

7_| Do you consider eliminating them from your product line Never Maybe | NO. Sure Definitely

o o eS i] o

8_| How do you rank them with other products Very High [higher Average _| Low Very Low

o a oa So oa

9 | Do they waste your time No Kind of __| Somehow | Yes Big time

o o oS o

70 | in future would they perform better or improve Yes Maybe | Somehow | Not sure Unlikely

= o S Sa o

pe. 2

Student Number: GSB901914 FOR THE PROPOSAL MBA

Student Name: Victor Tangawarima &S RESEARCH QUESIONNARE

How do you value the experience of the SME poultry business

owners?

®

‘Owners of the farmers hold at least two experiences in the Occasionally Sometimes

related?

How do you rate experience in the poultry farming? Very Important Not

Important

2 2)

How do you classify most of the farmers, seeking investment | Experts masters novices

in the farming?

@, & e

How likely i it that when a SME poultry farmer defaults, he | Very-Rarely Neutral” Likely”

has experience?

® ®

How likely is that when an SME poultry farmer defaults, he Neutral unlikely

has no experience?

@

Experienced farmers unlikely default Strongly agree neuat

®

Experienced farmers are less risk Strongly agree neuttal

2)

Unexperienced farmers are risky ‘Very unusual Sometimes

a

Experienced farmers are more realistic and optimistic frequently neither

e y

Impressed =41 and 50,, Satisfied =Between 31 and 40, Somehow Disappointed =Between (21 and 30) , Disappointed =Less than 10 and 20

pe. 3

Student Name: Victor Tangawarima

Student Number: GSB901914

RESEARCH QUESIONNARE

FOR THE PROPOSAL MBA

Impressed =41 and 50 , Satisfied =Between 31 and 40, Somehow Disappointed =Between (21 and 30) , Disappointed =Less than 10 and 20

INVESTIGATING THE VALUE OF ADEQUATE BUSINESS PLANS | 5 4 3 2 T

T_| Whats the value ofthe professional business plan ofan SME poultry __| Very important |Somehow | Not useless

farmer? important important _| important

© © © O

Z_[ Do most ofthe poultry farmers develop adequate business plans? Mostly [regularly [occasionally | irregularly | rarely

Oo © © oe ©

3 _| How frequent do farmers produce adequate business before accessing | Very Quite offen | Usually, | unusual Very

finance? often unusual

e © © © 2

“@_| How satisfied are you with Business plans by farmers they mostly Very Moderately | Ordinarily | Disappointed | Very

produce? satisfied satisfied poor

oe © ° © e

5__| Do you consider business plans by poultry farmerstobeinadequate? | No ‘Alittle bit__[ Not sure Maybe | Yes

es e O ° ©

6 _| How often do you assist farmers in developing business plans or them to | Very Quite often | Occasionally | usually, Very

access finance? often unusual

2 s O 2, 2

7 _| What isthe value ofthe professional business plant ofan SME poultry | Very important [Somehow | Not useless

farmer? important important _| important

s U 2 O e)

@ | Do most of the poultry farmers hold develop adequate business plans? | Very Quite often. | Occasionally | usually, Very

often ‘unusual

2 s 2 © Oo

'9_| How frequent do farmers produce business plans when accessing Very Quite often | Occasionally | usually, Very

finance? often unusual

© © © O oe

0 _| How satisfied are you with business plans by farmers they mostly Very Moderately | Ordinarily | Disappointed | Very

produce? satisfied satisfied poor

e © 2 ° ©

pe. 4

Student Name: Victor Tangawarima

Student Number: GSB901914

RESEARCH QUESIONNARE

FOR THE PROPOSAL MBA

Impressed =41 and 50 , Satisfied =Between 31 and 40, Somehow Disappointed =Between (21 and 30) , Disappointed =Less than 10 and 20

INVESTIGATING THE EFFECT OF COLLATERAL 5 a 3 z z

1_| Do you require back up when SME poultry farmersneed finance? | Mostly _| regularly ___| occasionally _| irregularly | rarely

2 | What is the value of collateral when a customer is securing a loan? | Very important Somehow | Not Useless

important important _| important

3_| Do SME poultry farmers come with sufficient collateral? Frequently | Occasionally | Rarely Never _[ Never

@_| Do SME farmers secure their loans with collateral? Mostly | regularly | occasionally _| irregularly | rarely

5 | What do you value do you attach to collateral by SME poultry very important [Somehow | Not Useless

farmers? important important _| important

6 | isthe collateral attached used by SME poultry farmers adequate? | Mostly [regularly | occasionally _| irregularly | rarely

7_| Do most of the farmers meet the standard of required collateral? _| Mostly regularly, ‘occasionally _| irregularly | rarely

8_| Do you require back up when SME poultry farmers need finance? | Always | regularly __| Occasionally_| irregularly | rarely

3. | What's the value of collateral when a customer is securing aloan? | Verv High | High Moderate | Low Very Low

10 | How frequent do you need collateral? Always | Occasionally | Rarely Never | Never

pe. 5

Student Name: Victor Tangawarima

Student Number: GSB901914

>

RESEARCH QUESIONNARE

FOR THE PROPOSAL MBA

‘THE EFFECT OF MARKET DEMAND 5 4 3 2 1

T_| How is the demand for poultry farming products in this _| Very High | High Moderate | Low Very Low

region?

2_ | How easy do poultry farmers find market for their farm | Very Easy | Quite Easy | Fairly Tough | Very Hard

produce? Eas,

3 | All things normal, do poultry standard products at, Never | Rarely Neutral | Sometimes | Mostly

common price last on the market?

4 | Compared to other goods, how quick are poultry Very Nonmal ‘Average | Slow Very Slow

products sold?

3 | Do poultry products require heavy marketing to be sold _| Rare Occasionally | Quite Often Very Often

in this region? Often

6 | How easy is it to establish a poultry market fora SME | Very Easy | Quite Easy | Fairly Tough | Very Hard

farmer? Easy

7_ | How strong are the regulations on the poultry products _ | Very Quite Fairly Weak Very Weak

on this region?

8_ | How often are practising licences checked by regulators? [Never | Rarel Neutral [Likely | Very Likel

9 | How is the demand for poultry farming products in this | Very High | High Moderate | Low Very Low

region?

10 | How is the cost of marketing in this region for poultry | Marginal _| Low Fair High Expensive

products

Impressed =41 and 50 , Satisfied =Between 31 and 40, Somehow Disappointed =Between (21 and 30) , Disappointed =Less than 10 and 20,

pe. 6

Student Name: Victor Tangawarima RESEARCH QUESIONNARE

Student Number: GSB901914 FOR THE PROPOSAL MBA

MAJOR FACTORS AFFECTING FINANCIAL INSTITUTIONS

1. Given that the demand for poultry is high, would you consider collateral to be important?

2. Given that market demand is low would you consider collateral to be important?

. Given that the SME poultry famer does not have an adequate business plan, but market demand is high, would you provide

finance?

4, Given the SME poultry famer, is inexperienced but demand is high, would you provide the finance?

5. Given that the SME poultry farmer does not have, an adequate business plan, but with collateral, would you provide finance?

6. Ifthe SME poultry farmer has an adequate business plan, with collateral but without experience, would you provide finance?

7. In order of importance rank the following variables on the SME poultry business. Experience, business plan, collateral, market

demand.

8. Given that the farmer has sufficient experience, adequate business plan, and the demand for product is high, but without

collateral, would you provide finance?

9. Which of the variables would you eliminate last among following, Experience, business plan, collateral, market demand?

10, From the SME poultry farmer, is product profitability your main objective?

11. Given that loan product has high profit potential, would you sacrifice collateral?

12, In what circumstance would you sacrifice collateral?

13, In what circumstance would you neglect experience and adequacy of the business plan?

14, Between collateral and market demand market demand, which one can you do away with?

15. What is the major factor that you the financial institution face with the SME farmers?

pe. 7

Student Name: Victor Tangawarima

Student Number: GSB901914

RESEARCH QUESIONNARE

FOR THE PROPOSAL MBA

pe. 8

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Workforce Planning Guide - tcm18 42735 PDFDocument40 pagesWorkforce Planning Guide - tcm18 42735 PDFDante ArinezNo ratings yet

- Tech-Supportive Human ResourceDocument14 pagesTech-Supportive Human ResourceRAPHAELNo ratings yet

- Managerial Effectiveness AsignmentDocument11 pagesManagerial Effectiveness AsignmentRAPHAELNo ratings yet

- Managerial EffectivenessDocument10 pagesManagerial EffectivenessRAPHAELNo ratings yet

- ConstructionDocument2 pagesConstructionRAPHAELNo ratings yet

- Change ManagementDocument13 pagesChange ManagementRAPHAELNo ratings yet

- Global CultureDocument21 pagesGlobal CultureRAPHAELNo ratings yet

- Strategic Human Resource Management: Back To The Future?: A Literature ReviewDocument50 pagesStrategic Human Resource Management: Back To The Future?: A Literature ReviewgerhanaoldschoolNo ratings yet

- Strategic Human Resource Management: Back To The Future?: A Literature ReviewDocument50 pagesStrategic Human Resource Management: Back To The Future?: A Literature ReviewgerhanaoldschoolNo ratings yet

- Social Media MarketingDocument90 pagesSocial Media MarketingPatrick Turner100% (2)

- Horska Et Al 2014 MiniDocument312 pagesHorska Et Al 2014 Minipratiraval100% (1)

- 02 Chapter 2Document60 pages02 Chapter 2swapnshriNo ratings yet

- Strategic Human Resource Management: Back To The Future?: A Literature ReviewDocument50 pagesStrategic Human Resource Management: Back To The Future?: A Literature ReviewgerhanaoldschoolNo ratings yet

- Global MarketingDocument64 pagesGlobal MarketingRAPHAELNo ratings yet

- Global MKTDocument62 pagesGlobal MKTRAPHAELNo ratings yet

- GouldDocument474 pagesGouldLabinot MusliuNo ratings yet

- Glocal Strategy of Global BrandsDocument10 pagesGlocal Strategy of Global BrandsDonna Lynn BonielNo ratings yet

- Global MARKETINGDocument6 pagesGlobal MARKETINGRAPHAELNo ratings yet

- Global MARKETINGDocument132 pagesGlobal MARKETINGRAPHAELNo ratings yet

- International MarketingDocument12 pagesInternational MarketingRAPHAELNo ratings yet

- Glocal Strategy of Global BrandsDocument10 pagesGlocal Strategy of Global BrandsDonna Lynn BonielNo ratings yet

- Global and International MarketingDocument15 pagesGlobal and International MarketingRAPHAELNo ratings yet

- ML13 349Document7 pagesML13 349worldontopNo ratings yet

- Global MarketingDocument275 pagesGlobal MarketingReiki Channel Anuj BhargavaNo ratings yet

- Consumer BehaviorDocument63 pagesConsumer BehaviorRAPHAELNo ratings yet

- Fulltext01 4Document56 pagesFulltext01 4Recca DamayantiNo ratings yet

- Situation Ecommerce Europe Parlement EuropeenDocument134 pagesSituation Ecommerce Europe Parlement EuropeenSerge Esteves100% (1)

- Vainikka Bianca PDFDocument46 pagesVainikka Bianca PDFVickRam RaViNo ratings yet

- Eao201302 05Document18 pagesEao201302 05IndrajitNo ratings yet