Professional Documents

Culture Documents

2023 Commercial and Taxation Law Syllabus Based eREVIEWER v2.01

Uploaded by

Shelvin EchoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023 Commercial and Taxation Law Syllabus Based eREVIEWER v2.01

Uploaded by

Shelvin EchoCopyright:

Available Formats

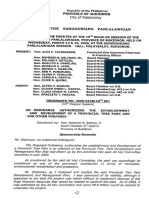

Commercial and Tax Law

Syllabus-based eReviewer for the 2023 Bar

Version 2 with Bar Chair Case Digests

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

Table of Contents

National Taxation 139 3. Dissolution and Winding Up

Business Organizations 2 Income Tax 141 4. Limited Partnership

Partnerships 2 Value-Added Tax 183 1 General Provisions

Corporations 14 Tax Remedies Under the NIRC 200 a) De nition, Elements, and Characteristics

Banking Laws 55 Local Taxation 218 Definition

New Central Bank Act 55 Local Government Taxation 218 By the contract of partnership

1. two or more persons bind themselves

General Banking Law of 2000 58 Real Property Taxation 228 2. to contribute money, property, or industry

Secrecy of Bank Deposits 64 Judicial Remedies 234 3. to a common fund,

4. with the intention of dividing the pro ts among themselves.

Anti-Money Laundering Act 66

Commercial Law Characteristic Elements

Insurance Law 72 1) Consensual — perfected by mere consent;

Transportation Law 87 I Business Organizations 2) Nominate — has a special name in law;

3) Bilateral — entered into by 2 or more persons with

Intellectual Property Code 94 Partnerships reciprocal rights and obligations;

4) Onerous — parties aspire to gain some bene t;

Electronic Commerce Act 119 Corporations

5) Commutative — the undertaking of each of the partners is

Foreign Investments Act 120 considered as the equivalent of that of the others;

A Partnerships

6) Principal — does not depend upon some other contracts;

Public Service Act 123 1. General Provisions 7) Preparatory — a means to an end.

General Principles in Taxation Law 125 2. Rights and Obligations of Partnership and Partners Essential Features

1) There must be a valid contract;

eCodal+Pro by RGL 2 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

2) The parties have legal capacity to enter into the contract; e) Consideration for the sale of a goodwill of a business i) no time is speci ed and is not formed for a particular

or other property by installments or otherwise. undertaking and which may be terminated anytime

3) There must be a mutual contribution of money, property or

by mutual agreement of the partners or by the will of

industry to a common fund; Incidents of a partnership

one of them; OR

4) The object must be lawful; and 1) Partners share in pro ts and losses. There is community of

ii) one for a xed term or particular undertaking that is

interest; (1767, 1797, 1798)

5) The primary purpose is to carry on a business for pro ts and continued after the termination of such term or

to divide the same among the parties. 2) They have equal rights in the management and conduct of the particular undertaking without any express agreement

business; (1803)

b) Rules to Determine Existence b) With a xed term — one in which the term is xed or

3) Every partner is an agent of the partnership who binds the agreed upon or formed for a particular undertaking, and

others for his acts for the purpose of its business; (1818) upon expiration of the term or completion of the

1) Persons who are not partners as to each other are not partners

as to third persons except as provided by Article 1825 on 4) All partners are personally liable for the debts of the undertaking, the partnership is dissolved, unless

partnership by estoppel; partnership with their separate property (1816, 1822-1824) continued by the partners.

exc limited partners; (1843)

2) Co-ownership or co-possession does not of itself establish a d) Partnership by Estoppel

partnership, whether such co-owners or co-possessors do or do 5) The books shall be kept at the principal place of business;

not share any pro ts made by the use of the property; (1805)

When does partnership liability result?

3) The sharing of gross returns does not of itself establish a 6) A duciary relation exists between partners; (1807)

Partnership by estoppel results if ALL the actual partners

partnership, whether or not the persons sharing them have a 7) A capitalist partner cannot carry on a competing business consented to the representation.

joint or common right or interest in any property from which unless expressly allowed (1808), while an industrial partner is

the returns are derived; When is liability pro rata?

absolutely prohibited from engaging in any other business;

4) The receipt by a person of a share of the pro ts of a (1789) a) When there is NO existing partnership, and all those

business is prima facie evidence that he is a partner in the represented as partners consented; or

8) The partnership is not terminated upon dissolution, but

business, except if such pro ts were received in payment as: continues until the winding up is completed. (1828) b) When there is an existing partnership, and not all of the

a) Debt by installments or otherwise; partners consented.

c) Partnership Term

b) Wages of an employee or rent to a landlord; When is liability separate?

c) Annuity to a widow or representative of a deceased a) When there is NO existing partnership, and only some of

1) There is no time limit for the existence of the partnership as

partner; those represented consented; or

this depends on the agreement of the parties.

d) Interest on a loan, though the amount of payment b) When there is an existing partnership, and none of the

2) A partnership may be formed

vary with the pro ts of the business; partners consented.

a) At will —

eCodal+Pro by RGL 3 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

Elements to establish liability as a partner on ground of estoppel c) Even if a co-venturer transfers his interest to another, A partnership for the practice of law, constituted in accordance with

the transferee does not become a co-venturer together the Civil Code provisions on partnership, acquires juridical

1) Proof by plainti that he was individually aware of the

with the others in the joint venture unless all the other personality by operation of law. Having a juridical personality

defendant’s representations;

co-venturers consent. This is in consonance with the distinct and separate from its partners, such partnership is the real

2) Reliance on such representation by the plainti ; and principle of delectus personarum. party-in-interest in a suit brought in connection with a contract

3) Lack of any denial or refutation of the statements by the entered into in its name and by a person authorized to act on its

d) Generally, the co-venturers acting on behalf of the

defendant. behalf.

joint venturers are agents thereof with capacity to

bind the joint venture.

e) Partnership as Distinguished from Joint Venture g) Management

e) Death, retirement, insolvency, civil interdiction or

dissolution of any co-venturer dissolves the joint

1) A joint venture is an association of persons or companies 1) If ONE is appointed manager

venture. [Cesar L. Villanueva, Philippine Corporate

jointly undertaking some commercial enterprise; generally,

Law] May execute all acts of administration despite the opposition

a) all contribute assets and share risks which requires a of his partners, unless he should act in bad faith;

community of interest in the performance of the Primelink Properties v. Lazatin-Magat If appointed in articles of partnership, his power is irrevocable

subject matter,

As a general rule, the relation of the parties in joint ventures is without just or lawful cause. Thus, removal may be had

b) a right to direct and govern the policy in connection only

governed by their agreement. When the agreement is silent on any

therewith, and

particular issue, the general principles of partnership may be resorted a) For lawful cause of if there is bad faith; AND

c) a duty, which may be altered by agreement to share to.

b) Through the votes of the partners representing the

both in pro t and losses.

An important distinction between these two business forms is that controlling interest.

2) Under Philippine law, a joint venture is a form of partnership although a corporation cannot enter into a partnership contract, it

If appointed after the partnership has been constituted, his

and should thus be governed by the law of partnerships. may, however, engage in a joint venture with others.

power may be revoked at any time by the vote of the partners

3) Since a joint venture is a particular partnership, it would have citing Aurbach v. Sanitary Wares Manufacturing Corporation representing the controlling interest.

the following characteristics:

2) If TWO OR MORE are appointed managers

a) It would have a juridical personality separate and f ) Professional Partnership

a) without speci cation of their respective duties, or

distinct from that of each of the joint venturers.

General professional partnership. Two or more persons may also b) without a stipulation that one of them shall not act

b) Each of the co-venturers would be liable with their

form a partnership for the exercise of a profession. without the consent of all the others,

private property to the creditors of the joint venture

beyond their contributions to the joint venture.

Saludo, Jr. v. PNB 2018

eCodal+Pro by RGL 4 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

each one may separately execute all acts of administration, a) Rights and Obligations of the Partnership Unless expressly allowed, not merely by toleration. The

but if any of them should oppose the acts of the others, the remedies of the other partners would be

decision of the majority of the managers shall prevail.

1) Refund amounts disbursed by the partner in behalf of the a) To exclude the erring industrial partner from the

In case of a tie, the matter shall be decided by the partners partnership plus the corresponding interest from the time the rm; or

owning the controlling interest. expenses are made; b) To avail themselves of the bene ts which he may

In case UNANIMITY OF ACTION is stipulated, the 2) Answer for the obligations the partner may have contracted in have obtained;

CONCURRENCE OF ALL shall be necessary for the good faith in the interest of the business; and c) Plus right to damages in either case.

validity of the acts.

3) Answer for risks in consequence of its management. 2) Capitalist partner — Relative prohibition, only to any

The absence or disability of any one of them cannot be alleged, business of the same kind, unless there is a stipulation to the

unless there is imminent danger of grave or irreparable b) Obligations of Partners Among Themselves

contrary. Sanctions for violating the prohibition include:

injury to the partnership.

a) Bringing to the common funds any pro ts from the

3) When the manner of management has NOT been agreed When does a partnership commence?

other business; and

upon, the following rules shall be observed: GR: From the moment of the execution of the contract.

b) Personally bearing the losses.

a) ALL the partners shall be considered agents and EXC: Unless otherwise stipulated.

whatever any one of them may do alone shall bind the When is a capitalist partner obliged to sell his interest to others?

partnership. Obligations of partners with respect 1) There is an imminent loss of the partnership business;

to contribution of property

b) UNANIMOUS CONSENT is required in making 2) The majority of the capitalist partners are of the opinion

1) To contribute at the beginning of the partnership or at the

any important alteration in the immovable that an additional contribution to the common fund would

stipulated time the money, property, or industry which he may

property of the partnership, even if it may be useful to save the business;

have promised to contribute;

the partnership. 3) The capitalist partner refuses deliberately to contribute an

2) To answer for eviction in case the partnership is deprived of

But if the refusal of consent by the other partners is additional share to the capital; and

the determinate property contributed;

manifestly prejudicial to the interest of the partnership, 4) There is no agreement that even in case of an imminent loss of

the court's intervention may be sought. 3) To answer for the fruits of the property the contribution of

the business, the partners are not obliged to contribute.

which he delayed, from the date they should have been

GR: Partner NOT entitled to compensation. Here, an industrial partner is exempt from contributing an additional

contributed up to the time of actual delivery.

EXC: The law may imply a contract for compensation. share. He has already contributed his entire industry.

Prohibition against engaging in business

Obligation of managing partner who collects debt

Rights and Obligations of Partnership and 1) Industrial partner — Absolutely prohibited, regardless of

2 the nature of the business whether of the same kind or not. Where

Partners

eCodal+Pro by RGL 5 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

1) There exists at least 2 debts, one where the collecting partner is EXC: If through the partner's extraordinary e orts in other i) The share of the capitalist partner is in proportion to

creditor, and the other, the partnership is the creditor; activities of the partnership, unusual pro ts have been his capital contribution.

2) Both debts are demandable; and realized, the courts may equitably lessen this ii) The industrial partner shall receive such share as may

responsibility. be just and equitable, which must be satis ed rst

3) The collecting partner is authorized to manage and actually

before the capitalist partners shall divide the pro ts.

manages the partnership, the RULE is as follows: Risk of loss of things contributed

Who bears loss? This means the least amount that a capitalist partner

GR: The sum received is to be applied to the 2 credits in

gets.

proportion to their amounts.

Speci c and determinate things, which are not

Partner 3) Losses

EXC: If received, for the account of the partnership, shall be applied fungible where only use is contributed

to the partnership credit only. a) According to agreement;

Speci c and determinate things the ownership

EXC to EXC: Partnership b) If no agreement, but the contract provides for a

of which is transferred to the partnership

pro t-sharing scheme, the losses shall be in accordance

If credit to the collecting partner is more onerous, the debtor

Fungibles or things which cannot be kept with that scheme.

is given the right to prefer payment to the former.

without deteriorating even if contributed only Partnership c) If there is also no pro t-sharing stipulated, then losses

Obligation of partner who receives for use shall be borne in proportion to capital contribution.

share of partnership credit

Things contributed to be sold Partnership In any case, the purely industrial partner shall not be

A partner shall be obliged to bring to the partnership capital what

liable for the losses.

he received even though he may have given receipt for his share only, Things brought and appraised in the inventory Partnership

IF Can a third person be designated to determine share in profits

or losses?

1) He has received, in whole or in part, his share of a partnership Rules for distribution of profits and losses

credit; 1) Capital YES. If the partners have agreed to intrust to a third person.

2) The other partners have not collected theirs; AND a) According to agreement; Such designation may be impugned only when it is manifestly

inequitable. In no case may a partner complain of such decision if

3) The partnership debtor has become insolvent. b) If no agreement, the share shall be equal;

he

Obligations of partner for damages to partnership c) In case of imminent loss of the business, additional shares

1. Has begun to execute the decision of the third person, or

may be determined by the majority.

GR: The damages caused by a partner to the partnership

2. Has not impugned the same within a period of three

CANNOT be o set by the pro ts or bene ts which he may 2) Pro ts months from the time he had knowledge thereof,

have earned for the partnership by his industry.

a) According to agreement; The designation of losses and pro ts cannot be intrusted to one of

b) If no agreement the partners.

eCodal+Pro by RGL 6 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

A stipulation which excludes one or more partners from any share A partner is co-owner with his partners. Original capital Aggregate of the

in the pro ts or losses is VOID. contribution + All individual contributions

a) Equal right to possess for partnership purposes,

Assets property subsequently made in establishing or

Subpartnership but not for any other purpose without the consent of

included acquired + Partnership continuing the

the other partners;

Every partner may associate another person with him in his share, name + Goodwill partnership

but the associate shall NOT be admitted into the partnership b) NOT assignable except in connection with the

without the consent of ALL the other partners, even if the assignment of rights of all the partners in the same

Assignment of partner’s whole interest

partner having an associate should be a manager. property;

This is permitted without causing dissolution. However, such

c) NOT subject to attachment or execution except

Right of partner to a formal account assignment does NOT grant the assignee the right to:

on a claim against the partnership;

GR: During the existence of the partnership, a partner is NOT a) Interfere in the management;

entitled to a formal account of partnership a airs since his When partnership property is attached for a

partnership debt the partners, or any of them, or the b) Require any information or account; or

right to know are amply protected with regard to access to

partnership books. representatives of a deceased partner, cannot claim c) Inspect partnership books.

any right under the homestead or exemption

EXC: Action for accounting. Any partner shall have the right to a The only rights of the assignee are:

laws.

formal account as to partnership a airs: 1) To receive the pro ts accruing to the assigning partner;

d) NOT subject to legal support.

1) If he is wrongfully excluded from the partnership business or 2) To avail of usual remedies in the event of fraud in the

possession of its property by his co-partners; 2) His interest in the partnership;

management;

2) If the right exists under the terms of any agreement; Refers to his share of the pro ts and surplus. These may be

3) To receive assignor’s interest in case of dissolution;

assigned.

3) As provided by Article 1807 — Every partner must account to 4) To require an account of partnership a airs, but only in case

the partnership for any bene t, and hold as trustee for it any A partner shall NOT be deprived of his right, if any, under the

of dissolution.

pro ts derived by him without the consent of the other exemption laws, as regards his interest in the partnership.

Remedies of separate judgment creditor of a partner

partners from any transaction connected with the formation, 3) His right to participate in the management.

conduct, or liquidation of the partnership or from any use by 1) Application for a charging order after securing judgment

Partnership Property Partnership Capital

him of its property. on his credit. However, claims of partnership creditors

must be satis ed rst.

4) Whenever other circumstances render it just and reasonable. Changes VARIES CONSTANT

e.g. a partner has been assigned abroad for a long time. in value 2) Other remedies may include

Property Rights of a Partner a) Receivership;

1) His rights in speci c partnership property; b) Sale of interest.

eCodal+Pro by RGL 7 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

The interest charged may be redeemed. A stipulation among partners contrary to the pro rata and 4) Confess a judgment;

subsidiary liability expressly imposed is VOID and of no e ect as

5) Enter into a compromise concerning a partnership

c) Obligations of Partnership/Partners to Third to third persons.

Persons claim or liability;

Such stipulation however is VALID and enforceable among the

6) Submit a partnership claim or liability to arbitration;

partners.

Liability for inclusion of name in firm name 7) Renounce a claim of the partnership.

Partners by estoppel. Persons who, being not partners, include Liability of partnership for acts of partners

3) Acts in contravention of a restriction on authority

their names in the rm name 1) Acts for apparently carrying out the usual way of

business of the partnership a.k.a. Acts of administration GR: Partnership is NOT liable to third persons having

1. DO NOT acquire the rights of a partner, actual or presumptive knowledge of the restrictions.

GR: Every partner is an agent and may execute such acts

2. but they shall be SUBJECT to the liability of a partner EXC: Such persons not having such notice have a right to

with binding e ect.

insofar as third persons without notice are concerned.

assume that the authority of a partner is co-extensive

Liability for contractual obligations of the partnership EXC: If the partner so acting with the business transacted by his rm.

The general rule is that a partner, who had actual or apparent a) Has in fact no authority; AND

Conveyance of real property owned by partnership

authority, has the right to make all partners liable for the b) The third person KNOWS. Title in Conveyance

contracts he makes for the partnership in the name and for the EFFECT

2) Acts of strict dominion or ownership name of in name of

account of the partnership.

GR: NOT binding; Passes title, but partnership can

The individual liability of partners to creditors is pro rata and

subsidiary. EXC: Unless authorized by the other partners. recover if

a) Conveyance was not in usual

1) Pro rata — based on the number of partners, and not on the Except when authorized by the other partners or

Partnership Partnership way of business; or

amount of contribution. unless they have abandoned the business, one or

b) Buyer had knowledge that

2) Subsidiary or secondary — only after all the partnership more but less than all the partners have no authority

the partner-seller had no

assets have been exhausted. to:

authority.

Industrial partners, although not liable for losses, are 1) Assign the partnership property in trust for creditors

or on the assignee's promise to pay the debts of the Buyer gets equitable interest of the

personally liable for liabilities of the partnership to third

partnership; partnership except if

persons. Partner’s

Partnership a) Partnership is not engaged in

2) Dispose of the goodwill of the business; name

Losses = settlement of partnership a airs among partners; buying and selling of lands;

3) Do any other act which would make it impossible to or

Liabilities = to third persons.

carry on the ordinary business of a partnership;

Stipulation against liability

eCodal+Pro by RGL 8 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

b) Buyer had knowledge that 3. who reasonably could and should have communicated it to the Liability of incoming partner for partnership obligations

the partner-seller had no acting partner,

1) Limited to his share in the partnership property for

authority.

operate as notice to or knowledge of the partnership. existing obligations.

Partner/s in EXC: in the case of fraud on the partnership, committed by or with GR: Not personally liable for existing partnership

One or

whose name the consent of that partner. obligations.

more Passes title, same as (1)

the title

partners NB: Notice to any partner, under certain circumstances, operates as EXC: Unless there is a stipulation to the contrary.

stands

notice to or knowledge to the partnership only. Evidently, it

2) Extends to his separate property for subsequent obligations.

One or does not provide for the reverse situation, or that notice to the

more or all partnership is notice to the partners. (Guy v. Gacott 2016)

3 Dissolution and Winding Up

partners or

Partnership Buyer gets equitable interest of the Liability arising from partner’s wrongful

a third act, omission, or breach of trust Three stages of ending a partnership:

or partner partnership, same as (2)

person in

The partners and partnership are SOLIDARILY liable for: 1) Dissolution — is the change in the relation of the partners

trust for

caused by any partner ceasing to be associated in the carrying

partnership 1) Loss or injury caused to third persons — Requisites for

on of the business.

liability

All 2) Winding up — is the actual process of settling the business

All partners Passes title. a) Partner must be guilty of a wrongful act or omission;

partners or partnership a airs after dissolution, involving

AND

Admission by a partner a) The collection and distribution of partnership assets,

b) He must be acting in the ordinary course of business,

An admission or representation made by any partner concerning or with the authority of his co-partners even if the act b) Payment of debts, and

partnership a airs within the scope of his authority is evidence is unconnected with the business. c) Determination of the value of each partner’s interest in

against the partnership. 2) Loss where one partner acting within the scope of his the partnership.

Notice to, or knowledge of, a partner apparent authority receives money or property of a third 3) Termination — point in time when all partnership a airs are

person and misapplies it; completely wound up and nally settled. It signi es the end of

GR: Notice to any partner of any matter relating to partnership

a airs, and the knowledge of the partner acting in the 3) Loss where the partnership in the course of its business the partnership life.

particular matter, receives money or property of a third person and the money or

property so received is misapplied by any partner while it is in

Causes of Dissolution

1. acquired while a partner or the custody of the partnership. 1) Act of parties NOT in violation of their agreement —

2. then present to his mind, and a) Termination of the de nite term or particular

the knowledge of any other partner undertaking speci ed in the agreement;

eCodal+Pro by RGL 9 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

b) Express will of any partner, who must act in good faith, e) The business of the partnership can only be carried GR: Each partner is liable to his co-partners for his

when no de nite term or particular is speci ed; on at a loss; share of any liability created by any partner acting

c) Express will of ALL the partners who have not assigned f) Other circumstances render a dissolution equitable. for the partnership as if the partnership had not

their interests or suffered them to be charged for their been dissolved

i) Abandonment of the business;

separate debts, either before or after the termination of any EXC: Unless the partner acting for the partnership had

speci ed term or particular undertaking; ii) Fraud in the management of the business;

a) knowledge of the dissolution caused by act of

d) Expulsion of any partner from the business bona de in iii) Refusal without justi able cause to render accounting

any partner; OR

accordance with such a power conferred by the agreement of partnership a airs, etc.

b) knowledge or notice of the death or

between the partners; On the application of the purchaser of a partner's interest:

insolvency.

2) Act of parties in violation of their agreement; a) After the termination of the speci ed term or particular

b) With respect to third persons —

3) Operation of law — undertaking;

i) As to prior or former dealers — persons who extended

a) Any event which makes it unlawful for the business of b) At any time if the partnership was a partnership at will

credit to partnership prior to dissolution — must have

the partnership to be carried on or for the members to when the interest was assigned or when the charging

knowledge or actual notice of the dissolution to relieve

carry it on in partnership; order was issued.

partnership from liability;

b) Loss of speci c thing — When a speci c thing which a E ect of dissolution on authority of partner ii) As to persons who had known of partnership’s existence

partner had promised to contribute to the partnership, GR: Upon dissolution, a partnership ceases to be a going concern — publication;

perishes before the delivery; and the partner’s power of representation is con ned only to In both instances, the liability of a partner shall be satis ed

c) Death of any partner; 1. acts incident to winding up or out of partnership assets alone when such partner had

d) Insolvency of any partner or of the partnership; been prior to dissolution:

2. completing transactions begun but not nished.

e) Civil interdiction of any partner; 1) Unknown as a partner to the person with whom the

This rule is subject to quali cations.

contract is made; and

4) Court decree — On application by or for a partner the a) With respect to partners themselves —

2) So far unknown and inactive in partnership a airs

court shall decree a dissolution due to:

i) If the dissolution is NOT caused by the act, insolvency that the business reputation of the partnership could

a) Insanity; or death of a partner, the authority of any partner to bind not be said to have been to any degree due to his

b) Incapacity; the partnership by a new contract is IMMEDIATELY connection with it.

terminated.

c) Misconduct; iii) The partnership is in NO case bound by any act of a

ii) Otherwise, termination of authority depends upon WON partner after dissolution:

d) Persistent breach of partnership agreement;

the partner had knowledge or notice of the dissolution —

eCodal+Pro by RGL 10 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

1) Unlawful to carry on the business, unless the act is 1) If dissolution NOT in contravention of agreement — 1) To have the value of his interest in the partnership

appropriate for winding up partnership a airs; Partners have the right to have at the time of dissolution, less damages

ascertained and paid in cash or secured by bond

2) Insolvency of partner; a) The partnership property applied to discharge the

approved by the court; and

liabilities of the partnership; AND

3) Partner has no authority to wind up partnership

2) To be released from all existing and future

a airs; except by a transaction with one who — b) The surplus, if any, applied to pay in cash the net amount

liabilities of the partnership.

owing to respective partners.

a) Is a former dealer and had no knowledge or

In ascertaining the value of the partner's interest

notice of his want of authority; or NO partner is liable for any loss sustained as a result of

the value of the goodwill of the business shall

dissolution.

b) Is not a former dealer, and, having no knowledge NOT be considered.

or notice of his want of authority, the fact of his 2) If dissolution in contravention of agreement — The

Rights of injured partner where partnership contract rescinded

want of authority has not been duly published. rights of a partner vary depending on his innocence.

a) If innocent — 1) Right of a lien on, or retention of, the surplus of partnership

Winding up; manner, persons authorized

property after satisfying partnership liabilities for any sum of

Winding up may be done judicially or extrajudicially by i) To have partnership property applied for the money paid or contributed by him;

payment of its liabilities and to receive in cash his

1) The partners designated by the agreement; 2) Right to subrogation in place of partnership creditors after

share of the surplus;

2) In the absence of such agreement, by all partners who have not payment of partnership liabilities; and

ii) To be indemni ed for damages caused by the guilty

wrongfully dissolved the partnership; OR 3) Right of indemni cation by the guilty partner against all

partner;

3) The legal representative of the last surviving partner, not debts and liabilities of the partnership.

iii) To continue the business in the same name during

insolvent; OR Rules in settling accounts between partners

the agreed term, by themselves or jointly with others;

4) A court-appointed receiver. and 1) Assets of the partnership. —

Right of partner to application of partnership property on iv) To possess partnership property should they a) Partnership property + Goodwill; AND

dissolution decide to continue the business.

b) Contributions of the partners necessary for the payment

“Partner’s lien” is the right of every partner, on a dissolution, b) If guilty of wrongfully causing the dissolution — of all liabilities.

against the other partners and persons claiming through them in i) If the business is NOT continued — To have 2) Order of application of the assets. —

respect of their interests as partners, to have the partnership partnership property applied for the payment of its

property applied to discharge partnership liabilities and the surplus liabilities and to receive in cash his share of the surplus a) Those owing to partnership creditors;

assets, if any, distributed in cash to the respective partners, after less damages. b) Those owing to partners other than for capital and pro ts,

deducting what may be due to the rm from them as partners.

ii) If the business is continued such as loans given by partners or advances for business

expenses;

eCodal+Pro by RGL 11 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

c) Return of capital contribution of partners; Rights of creditors of dissolved partnership which is continued De nition and Requirements

d) Pro ts. 1) Equal rights of dissolved and new partnership creditors. A limited partnership is one formed by two or more persons,

3) Right of a partner where assets insu cient. — The 2) Liability of persons continuing the business. — shall be having as members

following shall have the right to enforce the contributions satis ed out of the partnership property only, unless there 1. one or more general partners AND

is a stipulation to the contrary.

a) Any partner or his legal representative, to the extent of the 2. one or more limited partners.

amount which he has paid in excess of his share of the 3) Prior right of dissolved partnership creditors as against

liability; purchaser. — When a retiring or deceased partner has sold his The limited partners as such shall not be bound by the obligations

interest without a nal settlement with partnership creditors, of the partnership.

b) An assignee for the bene t of creditors; or

such creditors have an equitable lien on the consideration As to General Limited

c) Any person appointed by the court paid to the retiring or deceased partner by the purchaser.

Extends only to capital

4) Liability of deceased partner’s individual property. — The lien comes ahead of the separate creditors of said partner. Liability Personally liable

contribution

shall be liable for his share of the contributions necessary to

satisfy the liabilities incurred while he was a partner. Rights of retiring, or of estate of deceased, partner

Management ✔ ✘

5) Priority to payment of partnership creditors/ partners’ when business is continued

creditors. — When partnership property and the individual Money, property or

1) To have the value of the interest of the retiring or deceased Contribution At least money or property

properties of the partners are in possession of a court for industry

partner in the partnership ascertained as of the date of

distribution retirement or death; AND NO unless also a general

a) partnership creditors shall have priority on 2) To receive thereafter, as an ordinary creditor, an amount To proceedings by partner, or where the object

partnership property; and Proper Party or against the is to enforce his right

a) equal to the value of his share in the dissolved

partnership against, or liability to, the

b) separate creditors on individual property. partnership

partnership.

This is otherwise known as the doctrine of the b) with interest,

marshalling of assets. Does not make

c) or, at his option, in lieu of interest, the pro ts

Assignment of assignee new partner

6) Distribution of property of insolvent partner. — his attributable to the use of his right. Freely assignable

interest without consent of

individual property shall be distributed as follows:

others.

a) To those owing separate creditors;

4 Limited Partnership

Name in firm ✔ ✘

b) To those owing to partnership creditors; and

c) To those owing to partners by way of contribution. Absolutely or

Other business No prohibition

relatively prohibited

eCodal+Pro by RGL 12 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

Retirement, death, insanity, 6) To receive a share of the pro ts or other compensation by way a) Receive or hold as collateral security any partnership

Dissolution ✔ insolvency DOES NOT of income; property; or

dissolve

7) To receive the return of his contribution provided there is a b) Receive payment, conveyance or release from liability if it

surplus. will prejudice the right of third persons.

Statutory requirements

1) Sign and swear to a certi cate;

GR: Unless he is a general partner, a limited partner is NOT a IF at the time the assets of the partnership are not

proper party to proceedings by or against a partnership su cient to discharge partnership liabilities to persons

2) File for record the certi cate in the O ce of the SEC. not claiming as general or limited partners.

EXC: Where the object is to enforce a limited partner's right against

A limited partnership is formed if there has been substantial or liability to the partnership. Any violation of the prohibition will give rise to the

compliance in good faith with the foregoing requirements. presumption that it has been made to defraud

Status of person erroneously believing

partnership creditors.

If there is no substantial compliance, the partnership becomes a himself to be a limited partner

general partnership as far as third persons are concerned, in A person who has contributed to a partnership erroneously believing Return of contribution

which ALL members are liable as general partners. that he has become a limited partner, is NOT personally liable as a GR: A limited partner only has the right to demand and receive

When does a limited partner become liable as a general general partner, provided: CASH for his contribution, whether he contributed money or

partner? a) On ascertaining the mistake he promptly renounces his property.

1. If his surname appears in rm name; interest in the pro ts of the business, or other compensation EXC: When there is stipulation to the contrary in the certi cate; or

by way of income;

2. If he takes part in the control of the business. Where ALL partners consent to the return other than in form

b) His surname does NOT appear in the partnership name; and of cash.

Limited partner; speci c rights

c) He does NOT participate in the management of the business. When may a limited partner have the partnership dissolved?

1) To require that the partnership books be kept at the principal

place of business; Transactions of limited partner with the partnership Upon petition with the court:

2) To inspect and copy at a reasonable hour partnership books 1) Allowable transactions.— a) When his demand for the return of his contribution is

or any of them; a) Grant loans to the partnership; denied although he has a right to such return; or

3) To demand true and full information of all things a ecting b) Transacting other business with it; and b) When his contribution is not paid because the other

the partnership; liabilities of the partnership have not been paid or the

c) Receiving a pro rata share of the partnership assets with

partnership property is insu cient for their payment.

4) To demand a formal account of partnership a airs whenever general creditors if he is not also a general partner.

circumstances render it just and reasonable; Before seeking judicial redress, he may rst ask the other partners to

2) Prohibited transactions. —

have the partnership dissolved.

5) To ask for dissolution and winding up by decree of court;

eCodal+Pro by RGL 13 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

Limited partner; liabilities 1) Is made with unanimous consent; and GR: A substituted limited partner is liable for all the liabilities of his

2) Does not prejudice partnership creditors who extended assignor;

1) To the partnership —

credit or whose claims arose before the cancellation or EXC: Those of which he was ignorant at the time he became a

a) For the di erence between his contribution as actually

amendment of the certi cate. limited partner and which could not be ascertained from the

made and that stated in the certi cate as having been

certi cate.

made, and Limited partner; assignee to substituted

b) For any unpaid contribution which he agreed in the A substituted limited partner is a person admitted to all the Limited Partnership; Dissolution

certi cate to make in the future at the time and on the rights of a limited partner who has died or has assigned his interest The partnership liabilities shall be settled in the following order:

conditions stated in the certi cate. in a partnership.

1) Those due to creditors, including limited partners,

2) To partnership creditors and other partners — becomes An assignee, who does NOT become a substituted limited partner, has

except those on account of their contributions, in the order of

liable for partnership obligations when

1. NO right to priority as provided by law;

a) He contributes services, instead of only money or

a. require any information or 2) Those to limited partners

property;

b. account of the partnership transactions or a) in respect to their share of the pro ts and other

b) He allows his surname to appear in the rm name;

c. to inspect the partnership books; compensation by way of income on their contributions;

c) He fails to have a false statement in the certi cate

2. He is only entitled to b) in respect to the capital of their contributions;

corrected, knowing it to be false;

a. receive the share of the pro ts or other compensation by 3) Those to general partners

d) He takes part in the control of the business;

way of income, or a) other than for capital and pro ts;

e) He receive partnership property as collateral security,

payment, conveyance, or release in fraud of partnership b. the return of his contribution, to which his assignor b) in respect to pro ts;

creditors; and would otherwise be entitled.

c) in respect to capital. (NB: in general partnership, capital

f) There is failure to substantially comply with the legal What are the requisites for an assignee to enjoys preference over pro ts)

become a substituted limited partner?

requirements governing the formation of limited

partnerships. 1) Unanimous consent of all members; or if the limited partner Corporations

is empowered by the certi cate, must give the assignee the right B

3) To separate creditors — Charging order — The interest Revised Corporation Code of the Philippines

to become a limited partner;

may be redeemed with the separate property of any

general partner, but may NOT be redeemed with 2) The certi cate must be amended; and

De nition of Corporation

partnership property. 3) The amended certi cate must be registered in the SEC.

Classes of Corporations

The liabilities may be waived or compromised,

provided the waiver or compromise:

eCodal+Pro by RGL 14 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

Nationality of Corporations b) Participation in Management l) Responsibility for Crimes

Corporate Juridical Entity c) Proprietary Rights m) Special Fact Doctrine

Capital Structure d) Remedial Rights n) Inside Information

Incorporation and Organization e) Obligations of a Stockholder o) Contracts

a) Promoter f) Meetings 10. Capital A airs

b) Subscription Contract 9. Board of Directors and Trustees a) Certi cate of Stock

c) Pre-Incorporation Subscription Agreements a) Repository of Corporate Powers b) Watered Stocks

d) Consideration for Stocks b) Tenure, Quali cations, and Disquali cations of c) Payment of Balance of Subscription

Directors

e) Articles of Incorporation d) Sale of Delinquent Shares

c) Requirement of Independent Directors

f) Corporate Name and Limitations on its Use e) Alienation of Shares

d) Elections

g) Registration, Incorporation, and Commencement of f) Corporate Books and Records

Corporate Existence e) Removal

11. Dissolution and Liquidation

h) Election of Directors or Trustees f) Filling of Vacancies

a) Modes of Dissolution

i) Adoption of By-Laws g) Compensation

b) Methods of Liquidation

j) E ects of Non-Use of Corporate Charter h) Disloyalty

12. Other Corporations

7. Corporate Powers i) Business Judgment Rule

a) Close Corporations

8. Stockholders and Members j) Solidary Liabilities for Damages

b) Non-Stock Corporations

a) Fundamental Rights of a Stockholder k) Personal Liabilities

c) Educational Corporations

eCodal+Pro by RGL 15 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

applies when persons assume to form a corporation and

d) Religious Corporations Moreover, a corporation which has failed to le its by-laws within

exercise corporate functions and enter into business relations

with third persons. the prescribed period does not ipso facto lose its powers as such.

e) One Person Corporations

All persons who assume to act as a corporation knowing it to

f) Foreign Corporations

be without authority to do so shall be liable as general

Seventh Day Adventist Conference Church of Southern

13. Merger and Consolidation partners for all debts, liabilities and damages incurred or

Phil. Inc. v. Northeastern Mindanao Mission of Seventh

arising as a result thereof. (§20) Day Adventist, Inc.

1 De nition of Corporation 2. De facto Corporation. There are stringent requirements

The alleged donation to petitioners was void. The donation could

before one can qualify as a de facto corporation:

not have been made in favor of an entity yet inexistent at the time it

A corporation is

a. the existence of a valid law under which it may be was made. Nor could it have been accepted as there was yet no one

1. an arti cial being incorporated; to accept it.

2. created by operation of law, b. an attempt in good faith to incorporate; and There are stringent requirements before one can qualify as a de

facto corporation. The ling of articles of incorporation and the

3. having the right of succession and c. assumption of corporate powers.

issuance of the certi cate of incorporation are essential for the

4. the powers, attributes, and properties expressly authorized The due incorporation of any corporation claiming in good existence of a de facto corporation.

by law or incidental to its existence. faith to be a corporation, and its right to exercise corporate

Corporate existence begins only from the moment a certi cate of

powers, shall not be inquired into collaterally in any

incorporation is issued. No such certi cate was ever issued to

2 Classes of Corporations private suit to which such corporation may be a party. Such

petitioners or their supposed predecessor-in-interest at the time of

inquiry may be made by the Solicitor General in a quo

1. Stock corporations are those the donation. Petitioners obviously could not have claimed

warranto proceeding. (§19)

succession to an entity that never came to exist. Neither could the

a. which have capital stock

principle of separate juridical personality apply since there was never

Sawadjaan v. CA

b. divided into shares and any corporation to speak of.

c. are authorized to distribute to the holders of such WON AIIBP had NO legal personality to dismiss Sawadjaan since it

shares, dividends, or allotments of the surplus pro ts failed to file its by-laws within the designated 60 days from the

on the basis of the shares held. effectivity of Rep. Act No. 6848. Lozano v. De los Santos

2. All other corporations are nonstock corporations. NO. At the very least, by its failure to submit its by-laws on time, The doctrine of corporation by estoppel advanced by Anda cannot

the AIIBP may be considered a de facto corporation whose right to override jurisdictional requirements. Jurisdiction is xed by law and

Other Classifications

exercise corporate powers may not be inquired into collaterally in is not subject to the agreement of the parties. It cannot be acquired

1. Corporation by estoppel. Founded on principles of any private suit to which such corporations may be a party. through or waived, enlarged or diminished by any act or omission of

equity and is designed to prevent injustice and unfairness. It

eCodal+Pro by RGL 16 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

required. (Gamboa v. Teves 2011 En Banc)

the parties, neither can it be conferred by the acquiescence of the SEC issued the corresponding Certi cate of Incorporation only on

court. August 31, two (2) days after Puri cacion executed a Deed of 2. Both the Voting Control Test and the Bene cial

Donation on August 29. Clearly, at the time the donation was Ownership Test must be applied to determine whether a

Corporation by estoppel is founded on principles of equity and is

made, the Petitioner cannot be considered a corporation de facto. corporation is a “Philippine national.”

designed to prevent injustice and unfairness. It applies when persons

assume to form a corporation and exercise corporate functions and Rather, a review of the attendant circumstances reveals that it calls The 60-40 ownership requirement in favor of Filipino

enter into business relations with third persons. Where there is no for the application of the doctrine of corporation by estoppel. citizens must apply separately to each class of shares,

third person involved and the conflict arises only among those whether common, preferred non-voting, preferred

Jurisprudence dictates that the doctrine of corporation by estoppel

assuming the form of a corporation, who therefore know that it has not voting or any other class of shares. (Heirs of Gamboa v.

applies for as long as there is no fraud and when the existence of the

been registered, there is no corporation by estoppel. Teves 2012 En Banc Resolution)

association is attacked for causes attendant at the time the contract

or dealing sought to be enforced was entered into, and not 3. The SEC suggested applying the Grandfather Rule on

thereafter.

a. two (2) levels of corporate relations for

Macasaet v. Co, Jr. 2013

Here, Puri cacion dealt with the petitioner as if it were a

i. publicly-held corporations or

Abante Tonite is a corporation by estoppel as the result of its corporation. This is evident from the fact that Puri cacion executed

having represented itself to the reading public as a corporation two (2) documents conveying her properties in favor of the ii. where the shares are traded in the stock

despite its not being incorporated. petitioner. exchanges, and to

The non-incorporation of Abante Tonite with the SEC was of no Further, the subsequent act by Puri cacion of re-conveying the b. three (3) levels for

consequence, for, otherwise, whoever of the public who would property in favor of the petitioner is a ratification by conduct of i. closely held corporations or

su er any damage from the publication of articles in the pages of its the otherwise defective donation.

ii. the shares of which are not traded in the

tabloids would be left without recourse.

stock exchanges. (Narra Nickel Mining v.

Redmont Consolidated Mines 2015

3 Nationality of Corporations Resolution)

Missionary Sisters of Our Lady of Fatima v. Alzona 2018

1. The term "capital" in Section 11, Article XII of the 4. If the Filipino has

WON petitioner has the legal capacity to accept the donation of Constitution refers only to shares of stock entitled to vote a. Political Rights — the voting power of the

Purificacion. in the election of directors, and thus, refers ONLY TO "speci c stock", i.e., he can vote the stock or direct

YES, not in the capacity as a de facto corporation but as a COMMON SHARES, and NOT to the total outstanding another to vote for him, or

corporation by estoppel. It is the act of registration with SEC capital stock comprising both common and non-voting

preferred shares. b. Economic Rights — the investment power over the

through the issuance of a certi cate of incorporation that marks the

"speci c stock", i.e., he can dispose of the stock or

beginning of an entity's corporate existence. Full bene cial ownership of 60% of the outstanding direct another to dispose of it for him, or

Petitioner led its AOI and by-laws on August 28. However, the capital stock, coupled with 60% of the voting rights, is

eCodal+Pro by RGL 17 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

Grandfather Rule is necessary if doubt exists as to the locus of the

c. both, i.e., he can vote and dispose of that "speci c 3. Limited Liability Rule — A stockholder is personally liable

“bene cial ownership” and “control.”

stock" or direct another to vote or dispose it for him, for the nancial obligations of the corporation to the extent of

“Doubt” refers to various indicia that the “bene cial ownership” his unpaid subscription.

then such Filipino is the "bene cial owner" of that "speci c

and “control” of the corporation do not in fact reside in Filipino Liability for tort and crimes

stock." (Roy III v. Herbosa 2017 En Banc Resolution)

shareholders but in foreign stakeholders. These indicators are:

The corporation should alone be liable for its own corporate acts

a) Control Test a. That the foreign investors provide practically all the and liabilities entered into by its authorized o cers.

funds for the joint investment undertaken by these

Recovery of damages

Control Test nds initial application and "must govern in Filipino businessmen and their foreign partner;

reckoning foreign equity ownership in corporations engaged in b. That the foreign investors undertake to provide GR: A corporation is not entitled to moral damages because, not

nationalized economic activities." practically all the technological support for the joint being a natural person, it cannot experience physical su ering

Where a corporation and its non-Filipino stockholders own stocks venture; or sentiments like wounded feelings, serious anxiety, mental

in a SEC registered enterprise, anguish and moral shock.

c. That the foreign investors, while being minority

a. at least 60% of the capital stock outstanding and stockholders, manage the company and prepare all EXC: A juridical person can validly claim for libel or any other form

entitled to vote of each of both corporations must be economic viability studies. (Narra Nickel Mining v. of defamation and claim moral damages.

owned and held by citizens of the Philippines; AND Redmont Consolidated Mines 2015 Resolution) Article 2219(7) of the Civil Code expressly authorizes the

b. at least 60% of the members of the Board of Directors of 4 Corporate Juridical Entity recovery of moral damages in cases of libel, slander or any

each of both corporations must be citizens of the other form of defamation. Article 2219(7) does not qualify

Philippines, a) Doctrine of Separate Juridical Personality whether the plaintiff is a natural or juridical person.

in order that the corporation shall be considered a Philippine

Silverio Jr. v. Filipino Business Consultants Inc.

national. A corporation has a personality separate and distinct from that of

its stockholders or members composing it, as well as from the WON FBCI's acquisition of the "substantial and controlling shares of

b) Grandfather Rule directors, trustees and o cers who act on its behalf. stocks" of Esses and Tri-Star entitles it to the possession of the property

Consequences owned by the latter.

The Grandfather Rule may be used as a supplement to the

1. The property of the corporation is not the property of its NO. Esses and Tri-Star, just like FBCI, are corporations. A

Control Test, that is, as a further check to ensure that control and

stockholders or members. corporation has a personality distinct from that of its

bene cial ownership of a corporation is in fact lodged in Filipinos.

stockholders. Thus, FBCI's alleged controlling shareholdings in

2. A corporation can incur obligations which should not be

The Grandfather Rule is the method by which the percentage of Esses and Tri-Star merely represent a proportionate or aliquot

attributed to its stockholders, directors and o cers.

Filipino equity in a corporation engaged in nationalized and/or interest in the properties of the two corporations. Such controlling

partly nationalized areas of activities is computed. A resort to the shareholdings do not vest FBCI with any legal right or title to any of

eCodal+Pro by RGL 18 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

Esses and Tri-Star's corporate properties. 3) Alter ego cases, where a corporation is merely a farce since it is ction is used as a vehicle for the evasion of an

a mere alter ego or business conduit of a person, or where the existing obligation;

b) Doctrine of Piercing the Corporate Veil corporation is so organized and controlled and its a airs are so

2.2. in fraud cases, or when the corporate entity is used

conducted as to make it merely an instrumentality, agency,

to justify a wrong, protect a fraud, or defend a

Under the doctrine of "piercing the veil of corporate fiction," conduit or adjunct of another corporation.

crime; or

the court looks at the corporation as a mere collection of Case law lays down a three-pronged test to determine the application

2.3. is used in alter ego cases, i.e., where a corporation is

individuals or an aggregation of persons undertaking business as a of the alter ego theory, which is also known as the instrumentality

essentially a farce, since it is a mere alter ego or

group, disregarding the separate juridical personality of the theory, namely:

business conduit of a person, or where the

corporation unifying the group.

1) Instrumentality or Control Test — Control, not mere corporation is so organized and controlled and its

The procedure for the doctrine to be properly applied: majority or complete stock control, but complete a airs conducted as to make it merely an

1) The court must first acquire jurisdiction over the domination, not only of nances but of policy and business instrumentality, agency, conduit or adjunct of

corporation or corporations involved before its or their practice in respect to the transaction attacked so that the another corporation.

separate personalities are disregarded; and corporate entity as to this transaction had at the time no

3. Here, the application of the doctrine of piercing the

separate mind, will or existence of its own;

2) The doctrine can only be raised during a full-blown trial over a corporate veil is unwarranted.

cause of action duly commenced involving parties duly 2) Fraud Test — Such control must have been used by the

3.1. no evidence was presented to prove that CyberOne

brought under the authority of the court by way of service of defendant to commit fraud or wrong; and

PH was organized for the purpose of defeating

summons or what passes as such service. (Kukan International 3) Harm Test — The aforesaid control and breach of duty must public convenience or evading an existing

v. Reyes 2010) have proximately caused the injury or unjust loss obligation;

Stockholders of a corporation are liable for the debts of the corporation complained of. (DBP v. Hydro Resources Contractors 2013)

3.2. petitioners failed to allege any fraudulent acts

up to the extent of their unpaid subscriptions. They cannot invoke committed by CyberOne PH in order to justify a

the veil of corporate identity as a shield from liability, because the veil Gesolgon v. CyberOne PH 14 Oct 2020 wrong, protect a fraud, or defend a crime;

may be lifted to avoid defrauding corporate creditors. (Halley v. 1. While it is true that CyberOne AU owns majority of the 3.3. the mere fact that CyberOne PH's major

Printwell 2011) shares of CyberOne PH, this, nonetheless, does not stockholders are CyberOne AU and respondent

The doctrine of piercing the corporate veil applies only in three (3) warrant the conclusion that CyberOne PH is a mere Mikrut does not prove that CyberOne PH was

basic areas, namely: conduit of CyberOne AU. organized and controlled and its a airs conducted

1) Defeat of public convenience as when the corporate ction 2. The doctrine of piercing the corporate veil applies only in a manner that made it merely an

is used as a vehicle for the evasion of an existing obligation; in three basic instances, namely: instrumentality, agency, conduit or adjunct of

CyberOne AU.

2) Fraud cases or when the corporate entity is used to justify a 2.1. when the separate distinct corporate personality

wrong, protect fraud, or defend a crime; or defeats public convenience, as when the corporate See Labor Law Case Digest No. 48

eCodal+Pro by RGL 19 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

Survey of Cases Trading, Inc. the capital stocks of a corporation is

Apply v. Labayen not by itself a su cient ground to

Parayday v. Shogun Shipping Co. 06 Jul 2020

Case Circumstance 2014 disregard the separate corporate

Piercing

1. Other than their bare allegations, petitioners could have personality. The wrongdoing must

presented before the labor tribunals Oceanview's amended A corporation not impleaded in a be clearly and convincingly

Kukan

Articles of Incorporation indicating that it changed its suit cannot be subject to the court's established.

name to Shogun Ships.

International

process of piercing the veil of its

✘

v. Reyes 2010 Rosales v. New

2. The doctrine of piercing the veil of corporate entity can corporate ction. The sale of the assets of New ANJH

A.N.J.H.

only be raised during a full-blown trial over a cause of Enterprises

to NH Oil was a circumvention of ✔

The prevailing rule is that a

action duly commenced involving parties duly brought the employees' security of tenure.

Halley v. stockholder is personally liable for 2015

under the authority of the court by way of service of

Printwell, Inc. the nancial obligations of the ✔

summons or what passes as such service. International Santos used I/AME as a means to

2011 corporation to the extent of his

2.1. Here, Oceanview was never impleaded as a party Academy of defeat judicial processes and to evade

unpaid subscription.

respondent and was never validly served with Management his obligation to Litton. ✔

summons. Goldkey was merely an adjunct of & Economics Outsider reverse veil-piercing is

Heirs of Tan

Hammer and, as such, the legal v. Litton 2017 applicable in the instant case.

Uy v.

See Labor Law Case Digest No. 55 ction that it has a separate

International

personality from that of Hammer

✔ G Holdings-being the majority and

Reverse Piercing of the Corporate Veil Exchange Maricalum controlling stockholder-had been

should be brushed aside as they are,

Bank 2013 Mining Corp. exercising signi cant control over

The plainti seeks to reach the assets of a corporation to satisfy undeniably, one and the same.

v. Florentino Maricalum Mining.

✘

claims against a corporate insider. It has two (2) types:

While ownership by one corporation 2018 However, the fraud and harm tests

Outsider reverse piercing occurs when a party with a claim of all or a great majority of stocks of were not satis ed.

against an individual or corporation attempts to be repaid with DBP v. Hydro

another corporation and their

assets of a corporation owned or substantially controlled by the Resources

interlocking directorates may serve as

defendant. Contractors

indicia of control, by themselves and

✘ 5 Capital Structure

Corporation

In contrast, in insider reverse piercing, the controlling members without more, however, these

2013

will attempt to ignore the corporate ction in order to take circumstances are insu cient to a) Number and Quali cations of Incorporators

advantage of a bene t available to the corporation, such as an establish an alter ego relationship.

interest in a lawsuit or protection of personal assets. (International Incorporators are those stockholders or members mentioned in the

WPM The mere ownership by a single

Academy of Management & Economics v. Litton 2017)

International stockholder of even all or nearly all of

✘ AOI as originally forming and composing the corporation and who are

signatories thereof.

eCodal+Pro by RGL 20 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

1. Any person, partnership, association or corporation, bu er fund against In other words, at least 6.25% of the increase has been paid up.

corporate losses.

2. Singly or jointly with others; c) Corporate Term

3. Not more than fteen (15) in number; The amount of The PUC is the reference

capital which the point of the extent of GR: Perpetual existence, including those already existing during

4. Incorporators who are natural persons must be of legal age;

corporation already corporate earnings that the the e ectivity of the RCC.

5. Each incorporator of a stock corporation must own or be a received from its board may retain for use of

subscriber to at least one (1) share of the capital stock. Paid-up EXC: Unless the AOI of newly established corporations provide

subscribers the corporation.

Capital otherwise.

Changes from BP 68 (represents the paid Whenever a corporation

portion of the SCS) proposes to increase its The existing corporation, upon a vote of its stockholders

6. No more prescribed minimum number of incorporators; (PUC)

and the value of assets ACS, it must establish that representing a MAJORITY of its outstanding capital stock,

7. Majority need not be PH residents. that are available to it has received additional noti es the SEC that it elects to retain its speci c corporate

the corporation for its PUC of at least 6.25% of term pursuant to its AOI.

b) Subscription Requirements use. the proposed increase.

Corporations with a limited term may extend or shorten its term by

Type What It Is Practical Purpose The aggregate amending its AOI within 3 years prior to the expiration of the term.

amount of premium 1. An extension may be made earlier than the three (3) year

The APIC also forms part

Information about the ACS arising from capital period only for justi able reasons.

The minimum of the corporate trust

permits government stock subscriptions,

amount of capital Additional fund; thus, it may not be 2. Such extension of the corporate term shall take e ect only on

Authorized regulators and major donations received,

which the Paid-in declared as dividend not be the day following the original or subsequent expiry date.

Capital corporate creditors to assess and shareholders’

corporation will Capital reclassi ed to absorb

Stock the ability of the additional capital 3. In case of extension of corporate term, a dissenting

receive when it issues de ciency except through

corporation to raise their infusion without stockholder may exercise the right of appraisal.

all its shares. (APIC) an organizational

(ACS) prescribed capital without corresponding shares

ACS = No. of Shares restructuring approved by Corporations with expired terms may apply for a revival of its

further approval from the of stock to wipe out

x Par Value the SEC. corporate existence. The GR and EXC apply.

SEC and its stockholders. the corporation

de cit. Action Taken Voting Required

The committed The amount of SCS

Subscribed

amount of capital represents the value of Stock corporations shall NOT BE REQUIRED to have a minimum

Capital Opting out from the default Stockholders representing

which the assets that are considered as capital stock, except as otherwise speci cally provided by special law.

Stock regime of Perpetual Existence MAJORITY of OCS

corporation will corporate trust fund.

However, if the corporation intends to increase its capital stock, at

receive from its Prospective creditors may Extending or Shortening the Majority of Board +

(SCS) least 25% of the increase in capital stock shall have been subscribed and

existing subscribers. rely on this amount as their Corporate Term Stockholders representing 2/3

that at least 25% of the amount subscribed shall have been paid.

eCodal+Pro by RGL 21 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

of OCS Preferred except as otherwise provided in the stock certi cate, the redemption

rests entirely with the corporation and the stockholder is without

One which entitles the holder thereof to certain preferences over

d) Classi cation of Shares the holders of common stock. The preferences are designed to

right to either compel or refuse the redemption of its stock.

induce persons to subscribe for shares of a corporation. Preferred

Common

Scope of voting rights subject to classification shares take a multiplicity of forms. The most common forms may

be classi ed into two: Shares with no preferences. Holders of these shares are regarded as

Common shareholders, as residual owners, have full voting

residual owners, who assume all the risks but reap all the bene ts

rights. Holders of other shares have similar rights, except when 1. preferred shares as to assets;

in the a airs of the corporation. They may only receive dividends

denied by the corporation’s charter or in compliance with the

gives the holder thereof preference in the distribution of the and/or assets upon liquidation following the satisfaction of the

provisions of the constitution or the law.

assets of the corporation in case of liquidation. stipulated returns to other funders of the corporation, such as

Non-voting shares are merely prevented from electing directors creditors or preferred shareholders.

2. preferred shares as to dividends.

and other matters presented to the shareholders in general for

Founder's

approval. the holder of which is entitled to receive dividends on said

share to the extent agreed upon before any dividends at all are Where the exclusive right to vote and be voted for in the

Holders of nonvoting shares shall nevertheless be entitled to vote on

paid to the holders of common stock. There is no guaranty, election of directors is granted, it must be for a limited period not

the following matters:

however, that the share will receive any dividends. to exceed ve (5) years from the date of incorporation.

a) Amendment of the AOI;

Such exclusive right shall not be allowed if its exercise will violate

b) Adoption and amendment of bylaws; Republic Planters Bank v. Agana, Sr.

1. the “Anti-Dummy Law”;

c) Sale, lease, exchange, mortgage, pledge, or other disposition WON petitioner can be compelled to redeem the preferred shares

2. the “Foreign Investments Act of 1991”; and

of all or substantially all of the corporate property; issued to the private respondent.

3. other pertinent laws.

d) Incurring, creating, or increasing bonded indebtedness; NO. Preferences granted to preferred stockholders do not give

them a lien upon the property of the corporation nor make them Redeemable

e) Increase or decrease of ACS;

creditors of the corporation, the right of the former being always Shares usually preferred, which by their terms are redeemable

f) Merger or consolidation of the corporation with another subordinate to the latter. Dividends are thus payable only when

corporation or other corporations; 1. at a xed date, or

there are pro ts earned by the corporation and as a general rule, even

g) Investment of corporate funds in another corporation or if there are existing pro ts, the BOD has the discretion to 2. at the option of either issuing corporation, or the

business; and determine whether or not dividends are to be declared. stockholder, or both

h) Dissolution of the corporation. In this case, while the stock certi cate does allow redemption, the at a certain redemption price. A redemption by the corporation of

option to do so was clearly vested in the petitioner bank. The its stock is, in a sense, a repurchase of it for cancellation.

redemption therefore is clearly the type known as "optional". Thus, Redemption of shares is allowed even if there are no

eCodal+Pro by RGL 22 of 239

Commercial and Taxation Law v2 Syllabus-based Reviewer for the 2023 Bar with Bar Chair Case Digests

unrestricted retained earnings on the books of the corporation. bonus plan for management and employees or for acquiring agreement was expressly made subject to such approval or

It in e ect quali es the general rule that the corporation cannot another company. It may be held inde nitely, resold or retired. rati cation.

purchase its own shares except out of current retained earnings. While held in the company's treasury, the stock earns no

2) The promoter should remit to the corporation pro ts that he

dividends and has no vote in company a airs.