Professional Documents

Culture Documents

Head of Department of Shariah and Economics

Uploaded by

Nur AfiqahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Head of Department of Shariah and Economics

Uploaded by

Nur AfiqahCopyright:

Available Formats

Head of Department of Shariah and Economics, Academy of

Islamic Studies, University of Malaya, explain some of the other things that xoppress and harm the

borrower. According to him, the pawn dealers charge on receipt of charges. Actually, the mortgagee

may be the receipt for free when applying for a deferment. However, there are bold traders take

advantage of pawn charge 50 cents for each copy of the receipt of the nextcharge.

The Act does not require the provision of receipts for pawned goods unless the holder want to

surrender the pawn ticket. It also does not require the dealer to show clearly on the receipts the

interest rates charged or explain to the borrowers who are illiterate. Simply

because the pawn business is not closely monitor. In fact the Act does not set the controls or

regulations on the auction event for unredeemed pledge or pawned item .Furthermore, the pamned

item to be auctioned is not displayed for public review.

Furthermore, six months is a very short period to redeem the

pledge item if the amount borrowed is huge. The Act also limits the pawn dealer to provide the

maximum loan to borrower to RM5,000. Any amount above that, the pawn dealer need to be a

licensed moneylender. The contract does not expire or become invalid mortgage even if the

borrower dies. Successors will replace them. If the heirs are still young or going abroad, the

beneficiary can

sell the property with the consent of the mortgagee charge. It can be used to settle debts of the

deceased.

In addition, the lenders also exposed to other risks. In Klang recently, a pawn shop was raided and

jewelry worth RM50,000 were seized by the local authorities due to illegal pawn shop operation. The

syndicate was believed to have bought at a higher rate than the market but also impose a higher

interest rate that is 5 % instead of 2 % per month. The borrowers will receive a receipt that says his

name and date of the transaction, without other important information such as the identity card

number and phone number. The redemption period is only 3 months. Failure to redeem, the items

will be auction without the owners' knowledge. This activity is definitely illegal. Unfortunately, the

local authorities cannot take action since there are not many information about this type of

pawnshop owners.

Other than that, the pawnshops do not accept payment in installments. The borrower must pay the

full amount of RM1,000 plus interest within a specified period. Failure to pay means loss of

collateral. How do pawnshops make a profit? Assuming the actual charge is RM1,500 but valued

RM800, pawnshops may give loans RM300. If the borrower fails to redeem, the oss of RM1,500 -

RM336 = RM1,164 . Pawnshops profit from high interest rates and extra

fees charged on transactions with borrowers.

Fortunately, under the Islamic system, Islamic pawn broking business (murtahin) do not charge

interest (usury/riba). The gain obtained is of the fees keep the assets pledged. For example, if the

charge is RM1,000 or less, the fee charged is safe (RM1,000 / 100 ) x 40

cents, or RM4 per month. Typically, about half of the value of the security given to the borrower

(rahin) as a loan without interest. Thus, a loan of RM500 payable within 6 months will be charged a

fee of RM4 x 6 = RM24.

To redeem, murtahin rahin have to pay RM524. Rahin may seek an extension of the repayment

period but have to pay additional storage fees. If rahin still fails to pay, the right to auction off

murtahin pledged assets. Murtahin will claim what is due to the remaining ceded

to rahin. If rahin cannot be located, the remainder will be given to the treasury. Rahin can claim their

rights of the treasury in the future.

Murtahin rahin cannot sell assets for investment purposes and profit alone. Murtahin can earn

revenue from asset store not profit from the use of the asset. If this happens without the knowledge

or consent of rahin and if it is a loss, murtahin must take responsibility for the loss.

You might also like

- Act4122 - DoneDocument20 pagesAct4122 - DoneNor HafizaNo ratings yet

- Issues of Ar RahnuDocument6 pagesIssues of Ar RahnuNass AzwadiNo ratings yet

- Islamic PawnbrokingDocument10 pagesIslamic PawnbrokingAwatif RamliNo ratings yet

- Law Assignment - Prangan Roy Rudra - 2011473630Document4 pagesLaw Assignment - Prangan Roy Rudra - 2011473630Prangan Roy RudraNo ratings yet

- Modes of FinancingDocument3 pagesModes of FinancingagzohaNo ratings yet

- Tue Class (Retail Banking)Document16 pagesTue Class (Retail Banking)Harendra Singh BhadauriaNo ratings yet

- Personal Loans Made Easy, how to borrow money and avoid being blacklisted.From EverandPersonal Loans Made Easy, how to borrow money and avoid being blacklisted.No ratings yet

- Full Assignment IslamicDocument12 pagesFull Assignment IslamicJoelene Chew100% (1)

- Islamic Law Assingmnet 2Document8 pagesIslamic Law Assingmnet 2Mahnoor KhanNo ratings yet

- Mortgage Confidential: What You Need to Know That Your Lender Won't Tell YouFrom EverandMortgage Confidential: What You Need to Know That Your Lender Won't Tell YouRating: 4 out of 5 stars4/5 (1)

- PawnbrokingDocument5 pagesPawnbrokingAida SyazwinNo ratings yet

- Escape the System: A Guide to Running a Black Market BusinessFrom EverandEscape the System: A Guide to Running a Black Market BusinessRating: 1 out of 5 stars1/5 (1)

- English TranslationDocument5 pagesEnglish TranslationsaadNo ratings yet

- Uts Bhs Inggris Riyan Ashari Silalahi PS-3ADocument11 pagesUts Bhs Inggris Riyan Ashari Silalahi PS-3ARiyan Azhari SilalahiNo ratings yet

- Tax Liens: How To Generate Income From Property Tax Lien CertificatesFrom EverandTax Liens: How To Generate Income From Property Tax Lien CertificatesNo ratings yet

- Forex Scheme Woes: Investors Fall For Plans That Promise Up To 250% Returns, Raising Questions About Their SustainabilityDocument13 pagesForex Scheme Woes: Investors Fall For Plans That Promise Up To 250% Returns, Raising Questions About Their SustainabilitymuthukjNo ratings yet

- Islamic FinanceDocument5 pagesIslamic Financeahsand123No ratings yet

- CTL InfoPack EngDocument10 pagesCTL InfoPack Englesbleus10No ratings yet

- BLAW01 - Maceda Law ScriptDocument7 pagesBLAW01 - Maceda Law ScriptJulienne UntalascoNo ratings yet

- Meezan Bank LTDDocument53 pagesMeezan Bank LTDim.abid1No ratings yet

- Final Assessment Fin546 (Template Answer)Document6 pagesFinal Assessment Fin546 (Template Answer)NOR IZZATI BINTI SAZALI100% (1)

- Hand Out On Liability ProductsDocument18 pagesHand Out On Liability Productsవేణుఎస్No ratings yet

- How Safe Is My Money With Kapil Chit FundsDocument4 pagesHow Safe Is My Money With Kapil Chit FundskgsbppNo ratings yet

- A Secure Electronic Murabaha Transaction: 16 Bled Ecommerce Conference EtransformationDocument13 pagesA Secure Electronic Murabaha Transaction: 16 Bled Ecommerce Conference EtransformationVasanthan SubramaniamNo ratings yet

- SPB Monetary Policy AnalysisDocument5 pagesSPB Monetary Policy AnalysisSeema KhanNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Marketing of Financial Services Fin 6023 Semester: Fall 2009 Brokerage HousesDocument11 pagesMarketing of Financial Services Fin 6023 Semester: Fall 2009 Brokerage HousesMohsin MahmoodNo ratings yet

- Xpress Cash Financing-IDocument15 pagesXpress Cash Financing-ISyirah Che AzizNo ratings yet

- Syahrini Back IssueDocument7 pagesSyahrini Back IssueAnnisa SophiaNo ratings yet

- AccountingDocument5 pagesAccountingmokoenadinny99No ratings yet

- Lecture Murahaba Bba8Document35 pagesLecture Murahaba Bba8UmairSadiq100% (1)

- IslamDocument7 pagesIslamRyan JeeNo ratings yet

- Bank Al HabibDocument4 pagesBank Al HabibSeema KhanNo ratings yet

- Comparison Between MaidamDocument3 pagesComparison Between MaidamMarriessia Rimbo DanielNo ratings yet

- Are All Forms of Interest Prohibited?: Islamic Economics Research Center King Abdul Aziz University, Jeddah, Saudi ArabiaDocument5 pagesAre All Forms of Interest Prohibited?: Islamic Economics Research Center King Abdul Aziz University, Jeddah, Saudi ArabiaAdhiyanto PLNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- Banking On Sharia Principles: Islamic Banking and The Financial IndustryDocument3 pagesBanking On Sharia Principles: Islamic Banking and The Financial IndustryNaffay HussainNo ratings yet

- Banking (AutoRecovered) 1Document17 pagesBanking (AutoRecovered) 1Fatema TahaNo ratings yet

- Name: Perah Shaikh Roll No: 2K19/Bba/139 Class: Bba Part 2 (Morning) Subject: Money and Banking. Topic: Islamic Banking Submit To: Mam Paras ChannarDocument11 pagesName: Perah Shaikh Roll No: 2K19/Bba/139 Class: Bba Part 2 (Morning) Subject: Money and Banking. Topic: Islamic Banking Submit To: Mam Paras ChannarCafe MusicNo ratings yet

- Banks and Financial InstituionDocument2 pagesBanks and Financial InstituionMubarak MohamoudNo ratings yet

- Banking AssDocument12 pagesBanking AssHibo AnwarNo ratings yet

- If Islamic Banks Do Not Charge Interest Rates, How Do They Make Profits ?Document2 pagesIf Islamic Banks Do Not Charge Interest Rates, How Do They Make Profits ?Gregoire MollierNo ratings yet

- Islamic Banking: By: Soukaina Ikbal & Chaimae BenyahyaDocument10 pagesIslamic Banking: By: Soukaina Ikbal & Chaimae BenyahyaKenza HazzazNo ratings yet

- AKPK Power - Chapter 3 - Wise Usage of Credit CardDocument20 pagesAKPK Power - Chapter 3 - Wise Usage of Credit CardEncik AnifNo ratings yet

- Final Exam Law200Document6 pagesFinal Exam Law200Md. Sabbir Sarker 1611386630100% (1)

- Chit FundsDocument5 pagesChit FundsscribdbodasNo ratings yet

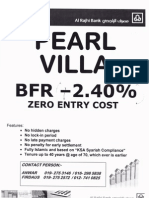

- Al Rajhi BankDocument4 pagesAl Rajhi BankSimon LeeNo ratings yet

- MONEY & CREDIT - Class Notes - Foundation Mind-MapDocument49 pagesMONEY & CREDIT - Class Notes - Foundation Mind-Mapnimit jaiswalNo ratings yet

- Islamic Banking Thesis TopicsDocument8 pagesIslamic Banking Thesis Topicslizbrowncapecoral100% (2)

- What Is A Pawn Shop?Document9 pagesWhat Is A Pawn Shop?Shane AguinaldoNo ratings yet

- Concept of Various Islamic Modes of Financing: 2.1.1 Mudarabah As A Mode of FinanceDocument3 pagesConcept of Various Islamic Modes of Financing: 2.1.1 Mudarabah As A Mode of FinancehudaNo ratings yet

- Preethi Rao: Chit Funds - A Boon To The Small EnterprisesDocument19 pagesPreethi Rao: Chit Funds - A Boon To The Small EnterprisesNisha UchilNo ratings yet

- Rotating Saving and Credit Association (Rosca)Document4 pagesRotating Saving and Credit Association (Rosca)Misheck D BandaNo ratings yet

- Rotating Saving and Credit Association (Rosca)Document4 pagesRotating Saving and Credit Association (Rosca)Misheck D BandaNo ratings yet

- International Financial Management Notes Unit-1Document15 pagesInternational Financial Management Notes Unit-1Geetha aptdcNo ratings yet

- Bispap 113Document343 pagesBispap 113aksharNo ratings yet

- Lesson 2 Bank Discount and Promissory NoteDocument3 pagesLesson 2 Bank Discount and Promissory NoteSERALDYN SAMSONNo ratings yet

- Lahore School of Economics Financial Management I Bonds and Their Valuation - 1 Assignment 7Document1 pageLahore School of Economics Financial Management I Bonds and Their Valuation - 1 Assignment 7octaviaNo ratings yet

- Exchange Rates in The Short RunDocument29 pagesExchange Rates in The Short RunChi VũNo ratings yet

- CAIIB Syllabus - Advanced Bank ManagementDocument19 pagesCAIIB Syllabus - Advanced Bank ManagementAshwin KGNo ratings yet

- Derivatives 3 MFIN Forward and Futures Pricing and UseDocument47 pagesDerivatives 3 MFIN Forward and Futures Pricing and UsecccNo ratings yet

- Finance Test PaperDocument5 pagesFinance Test PaperSuryansh Srivastava FitnessNo ratings yet

- Assignno3 Incometax-LiwagjaicelberniceDocument3 pagesAssignno3 Incometax-LiwagjaicelberniceShane KimNo ratings yet

- 8.managing Risk - Off The Balance Sheet With Loan Sales and SecuritizationDocument38 pages8.managing Risk - Off The Balance Sheet With Loan Sales and SecuritizationChristine Joy AguilaNo ratings yet

- Acc 308 - Week4-4-2 Homework - Chapter 13Document6 pagesAcc 308 - Week4-4-2 Homework - Chapter 13Lilian L100% (1)

- FNCE 623 Formulae For Mid Term ExamDocument3 pagesFNCE 623 Formulae For Mid Term Examleili fallahNo ratings yet

- SMI SHAS4542 n9 - Engineering Economy - Basic Project Financing 1023Document69 pagesSMI SHAS4542 n9 - Engineering Economy - Basic Project Financing 1023farhatulNo ratings yet

- Lec 2 - FM3Document14 pagesLec 2 - FM3con guevarraNo ratings yet

- An Analysis of Financial Position and VaDocument11 pagesAn Analysis of Financial Position and VaMani PNo ratings yet

- Chapter 29-The Monetary SystemDocument47 pagesChapter 29-The Monetary SystemHuy TranNo ratings yet

- Mid-Term Exam. 2022Document3 pagesMid-Term Exam. 2022Trâm AnhNo ratings yet

- Why Are Demand Deposits Considered As MoneyDocument7 pagesWhy Are Demand Deposits Considered As Moneytown BoyNo ratings yet

- Financial Instrument v.03Document49 pagesFinancial Instrument v.03ashaheen2704No ratings yet

- Overnight Indexed SwapDocument2 pagesOvernight Indexed Swaptimothy454No ratings yet

- Ecos Plastics CompanyDocument2 pagesEcos Plastics CompanyRAJUNo ratings yet

- ACI Dealing Certificate New Version Syllabus 27 Jul 2020Document15 pagesACI Dealing Certificate New Version Syllabus 27 Jul 2020Oluwatobiloba OlayinkaNo ratings yet

- Unit 7 Management of Marketable Securities: StructureDocument25 pagesUnit 7 Management of Marketable Securities: StructureGemechu AlemuNo ratings yet

- Babaran, Rojean C. FM 6Document2 pagesBabaran, Rojean C. FM 6catherine geronimoNo ratings yet

- Kami Export - Copy of Managing Credit SC-5.1 Student Activity PacketDocument4 pagesKami Export - Copy of Managing Credit SC-5.1 Student Activity PacketILse Reynoso-MartinezNo ratings yet

- CSE Awareness On Savings and Investment For The StudentsDocument33 pagesCSE Awareness On Savings and Investment For The StudentsAlexander FloresNo ratings yet

- Third Year Comprehensive Examination (TYCE) Handout Page 1 of 33Document33 pagesThird Year Comprehensive Examination (TYCE) Handout Page 1 of 33Ken MateyowNo ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Stephen Ross PDF ScribdDocument41 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Stephen Ross PDF Scribdwalter.herbert733100% (44)

- Lecture 1-Macro Frame - Fin Prog - Overview - 2017-RevisedDocument64 pagesLecture 1-Macro Frame - Fin Prog - Overview - 2017-RevisedMark EllyneNo ratings yet

- Chapter 09 - Short-Term DebtDocument15 pagesChapter 09 - Short-Term DebtKhang Tran DuyNo ratings yet