Professional Documents

Culture Documents

28 Insurance Law Notes BLAW300

Uploaded by

Petra Biljan0 ratings0% found this document useful (0 votes)

5 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pages28 Insurance Law Notes BLAW300

Uploaded by

Petra BiljanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Course: Business Law

Insurance Law Lecture Notes

Material: Textbook chapter 28

Chapter 28: Insurance

-introduction

-insurance is a cornerstone of effective risk management

-but insurance can be expensive and may not be available at all

-example: certain houses in Calgary are built on floodplain and cannot get flood insurance at all

or if they can it is at an exhorbitant price

-legislation

-requires certain terms be in insurance contracts

-regulates the insurance industry

-monitors insurance companies for compliance with legislation

-purpose: protecting the public from unscrupulous, financially unstable, or otherwise

troublesome insurance providers

-three basic kinds of insurance

-life and disability insurance

-property insurance

-liability insurance

-deductible

-an amount the insured must pay before insurance will provide benefits

-example: $500 deductible on car insurance

-insurer must pay the first $500

-insurance company pays amount over $500

-the insurance contract

-duty to disclose

-insured has a duty to disclose to the insurer all information relevant to the risk

-failure to disclose = insurer may not honour policy and deny coverage

-even if loss has nothing to do with undisclosed information

-reason: insurer must be able to adequately assess the risk they are taking on

-duty to disclose does not include things not personal to the applicant

-insurable interest

-cannot obtain insurance for something in which you have no interest

-insurable interest = something that would prejudice or damage the insured if it were

lost, damaged, or destroyed

-hence why you cannot obtain insurance on your neighbour's house

-you have no interest in that

-a lender has an interest in the ability of the borrower to pay back the loan

-and so anything that reasonably enables the borrower to pay back the loan or any

security is something that the lender has an insurable interest in

-indemnity

-insurance contracts are contracts of indemnity

-meaning: insured not supposed to profit from coverage

-except for life insurance contracts

-subrogation

-insurer has right of subrogation

-meaning, the insurer gives up any right to sue any wrongdoer

-the insurer gets his money from the insurance company

-insurance company assumes the right to sue any wrongdoer

-right of subrogation only occurs when insurer has paid the full extent of the loss

-not just part of it

-the policy

-exclusion clauses

-situations where insurer will not provide coverage

-example: no coverage of building if building left unoccupied for more than 30

consecutive days

-commonly include

-damage caused by

-wear and tear

-mould

-vandalism

-malicious acts of the insured

-rider

-a way to add or change the standard coverage that is included in the original contract

-essentially is a way to amend the contract later on

-endorsement

-alteration made after contract already in force

-insurance products

-types of insurance that may be obtained by business

-injury and proerty damage re business' operations

-personal injury to people the business employes/interacts with

-financial loss and injury caused by defected product/services

-financial loss and injury caused by employees

-injury and property damage caused by fire or other disaster

-loss of profit due to fire or other cause of business shut down

-environmental damage caused by the business

-death of a person vital to the business' operations

-occupier's liability insurance

-insurance if business held liable for failing to ensure premises are safe

-comprehensive general liability insurance

-covers liabilities incurred during the course of business

-very broad

-errors and omissions insurance

-applies more to professionals

-covers liabilities incurred due to an error or omission on the part of the insured

-property insurance

-insures property (land, buildings, equipment, etc)

-business interruption insurance

-insures a business against losses incurred because of a specified reason

-fire, flood, strike, etc

-environmental impairment insurance

-businesses that breach environmental regulations may face substantial fines and bear the costs

to cleanup any contaminated site

-general insurance policies usually exclude this type of damage because clean up is usually very

expensive

-you usually have to obtain a separate, and more expensive, insurance policy to cover

this type of damage

-key-person life insurance

-sometimes, there are a few people who are key to a business' operations

-their lives can be insured so if they die then the business will be compensated

-remedies of the insured

-against the insurer

-if insured makes a claim, an insurance adjuster will likely investigate and evaluate the loss

-the adjuster will recommend an amount to the insurer and the insurer will offer to settle the

claim

-but, the amount the insurer offers and the amount the insured thinks they are entitled to can

differ

-may result in breach of contract and the insured suing the insurer

-insurers have duty of good faith

-if insurer breaches duty of good faith and fails to provide the insurer with adequate

compensation under their policy, the court may impose punitive damages

-Whiten v Pilot Insurance Co 2002

-W's family home burnt down in the middle of the night

-fire destroyed all their possessions and pets

-family was in poor financial state

-Pilot gave them a single $5000 payment for living expenses

-Pilot alleged W had burned his own house down

-even though adjuster and fire chief said it was accidental

-Pilot got a new adjuster and pressured him into giving an opinion that

supported Pilot's claim that W had burnt his own house down

-even gave new adjuster misleading information

-W got damages + $1 million in punitive damages

-punitive damages reduced to $100,000 on appeal

You might also like

- Letter of Agreement For Public Relations ServicesDocument2 pagesLetter of Agreement For Public Relations Servicesapi-28322363883% (6)

- GR 157584 Garcia V Exec. SecDocument3 pagesGR 157584 Garcia V Exec. SecVergelGerona100% (1)

- Startup Founders AgreementDocument13 pagesStartup Founders AgreementAmal Mulia100% (2)

- Property & Casualty InsuranceDocument22 pagesProperty & Casualty Insurancejpsyntel100% (1)

- Fundamental Principles of InsuranceDocument2 pagesFundamental Principles of InsuranceRaja Thangavelu33% (3)

- Patents Act 1970 2020 Edition BiColour Version Updated With 2019 Amendments PDFDocument104 pagesPatents Act 1970 2020 Edition BiColour Version Updated With 2019 Amendments PDFUMANG0% (1)

- Criminal Justice Masterworks A History oDocument1 pageCriminal Justice Masterworks A History oAugustus KiokoNo ratings yet

- Notice of Hearing, Motion To Extend Discovery, Brief in SupportDocument6 pagesNotice of Hearing, Motion To Extend Discovery, Brief in SupportusacanadalegalNo ratings yet

- Reviewer QEDocument183 pagesReviewer QERosa Mae TiburcioNo ratings yet

- 4.2. InsuranceDocument11 pages4.2. InsuranceThobo PeterNo ratings yet

- Fire, Casualty, Surety and LifeDocument7 pagesFire, Casualty, Surety and LifeZyra C.No ratings yet

- Chapter 4-6 SummaryDocument10 pagesChapter 4-6 SummaryalessiamenNo ratings yet

- Insurance Law in IndiaDocument44 pagesInsurance Law in IndiaVaibhav AhujaNo ratings yet

- Introduction To InsuranceDocument29 pagesIntroduction To InsurancenazmulNo ratings yet

- Lesson Law of InsuranceDocument6 pagesLesson Law of Insurancegaurav94163No ratings yet

- Insurance NotesDocument59 pagesInsurance NotesLukhanyo NdaleniNo ratings yet

- History of Insurance: England in The 1600s Ships and Cargoes Owners and Merchants Lloyds of London Common LawDocument29 pagesHistory of Insurance: England in The 1600s Ships and Cargoes Owners and Merchants Lloyds of London Common LawAman GuptaNo ratings yet

- BỘ CÂU HỎI BẢO HIỂMDocument26 pagesBỘ CÂU HỎI BẢO HIỂMEli LiNo ratings yet

- Insurance and Assurance 5Document34 pagesInsurance and Assurance 5nrv2hcm25cNo ratings yet

- Fire InsuranceDocument20 pagesFire InsuranceAnkush Sharma100% (1)

- CH 1 Insurance and RiskDocument23 pagesCH 1 Insurance and Riskxingren010808No ratings yet

- 00000477-Law of InsuranceDocument24 pages00000477-Law of Insuranceakshay yadavNo ratings yet

- Special Doctrines Under Fire Insurance Law: Submitted To:-Mrs. Dipender Gill (Assistant Professor of Law)Document11 pagesSpecial Doctrines Under Fire Insurance Law: Submitted To:-Mrs. Dipender Gill (Assistant Professor of Law)RashmiPandeyNo ratings yet

- Business LawDocument2 pagesBusiness LawMarrNo ratings yet

- Untitled DocumentDocument4 pagesUntitled DocumentSiladitta PalNo ratings yet

- INSURANCEDocument11 pagesINSURANCESashNo ratings yet

- Fire InsuranceDocument3 pagesFire Insuranceprithviraj yadavNo ratings yet

- Insurance Law SummariesDocument44 pagesInsurance Law SummariescindyNo ratings yet

- Principles of Insurance - Pham HaDocument157 pagesPrinciples of Insurance - Pham HaanonymousninjatNo ratings yet

- Bảo Hiểm FinalDocument51 pagesBảo Hiểm FinalHuyền Khánh HoàngNo ratings yet

- Insurance 1Document9 pagesInsurance 1ellengaoneNo ratings yet

- Vấn đáp bảo hiểmDocument35 pagesVấn đáp bảo hiểmKhuê Minh NguyễnNo ratings yet

- file học vấn đápDocument34 pagesfile học vấn đápHoang NguyenNo ratings yet

- InsuranceDocument23 pagesInsurancetafarihusbands14No ratings yet

- Insurance - 2013Document25 pagesInsurance - 2013Crazy KamaNo ratings yet

- Lecture 7 - Common Issues in Contract and TortDocument17 pagesLecture 7 - Common Issues in Contract and TortMyke BarnetsonNo ratings yet

- Insurance ManagementDocument27 pagesInsurance Managementzaks69No ratings yet

- Private Liability Insurance InformationsDocument2 pagesPrivate Liability Insurance InformationsHelmi Murad EbrahimNo ratings yet

- Vấn đáp Bảo hiểm CLCDocument22 pagesVấn đáp Bảo hiểm CLCMai Nguyen Tuyet KieuNo ratings yet

- Fire InsuranceDocument27 pagesFire Insurancedevashish_bajajNo ratings yet

- Basics of Insurance: Course Instructor: Nusrat FarzanaDocument16 pagesBasics of Insurance: Course Instructor: Nusrat FarzanamjrNo ratings yet

- Wa0058 PDFDocument5 pagesWa0058 PDFamir rabieNo ratings yet

- Insurance Law ProjectDocument6 pagesInsurance Law ProjectMagrothiya SatakshiNo ratings yet

- Chapter Seven: Law of InsuranceDocument37 pagesChapter Seven: Law of InsuranceSirbela KedirNo ratings yet

- Insurance ReviewerDocument16 pagesInsurance ReviewerIya TungolNo ratings yet

- Chapter 07 RMIDocument20 pagesChapter 07 RMISudipta BaruaNo ratings yet

- Protecting Your PropertyDocument35 pagesProtecting Your PropertyAbigail ConstantinoNo ratings yet

- Fire Insurance Definition - Docx New - Docx NavnathDocument13 pagesFire Insurance Definition - Docx New - Docx Navnathnavnath50% (2)

- Types of Insurance ContractsDocument1 pageTypes of Insurance ContractsAMIT BHATIANo ratings yet

- Presentation ON Fire InsuranceDocument20 pagesPresentation ON Fire InsuranceS. M. Faysal 172-11-5575No ratings yet

- Asuransi CH.6Document33 pagesAsuransi CH.6Tessa Kusuma DewiNo ratings yet

- Chapter 12 Notes InsuranceDocument3 pagesChapter 12 Notes Insuranceapi-168415683No ratings yet

- Fire InsuranceDocument5 pagesFire Insurancerahulhaldankar0% (1)

- Insurance Law - FINALS: Intentional Acts Are Not CoveredDocument1 pageInsurance Law - FINALS: Intentional Acts Are Not CoveredJuliefer Ann GonzalesNo ratings yet

- Insurance & Risk ManagementDocument43 pagesInsurance & Risk Managementsibananda patra100% (1)

- Fire Insurance (Chapter 07)Document9 pagesFire Insurance (Chapter 07)Abu Muhammad Hatem TohaNo ratings yet

- Fire InsuranceDocument4 pagesFire Insuranceজাহিদ হৃদয়No ratings yet

- Home InsuranceDocument16 pagesHome InsuranceShashank TiwariNo ratings yet

- Fire InsuranceDocument5 pagesFire InsuranceTanvi SadekarNo ratings yet

- Property Insurance Checklist of Terms: Homeowners & RentersDocument3 pagesProperty Insurance Checklist of Terms: Homeowners & Rentersabracadabra33No ratings yet

- Fire InsuranceDocument4 pagesFire InsurancesanyassandhuNo ratings yet

- Seven Principles of Insurance With ExamplesDocument7 pagesSeven Principles of Insurance With Examplessagar111033No ratings yet

- Basics of InsuranceDocument26 pagesBasics of Insurancedranita@yahoo.comNo ratings yet

- United India Insurance Co REPORT 22.07.19Document53 pagesUnited India Insurance Co REPORT 22.07.19Trilok SamtaniNo ratings yet

- Report 22.07.19Document53 pagesReport 22.07.19Trilok SamtaniNo ratings yet

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!From EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Rating: 5 out of 5 stars5/5 (1)

- CASE #106 Sps. Elvira and Edwin Alcantara vs. Sps. Zenaida and Florante Belen, Et. Al G.R. No. 200204 Dated April 25,2017 FactsDocument2 pagesCASE #106 Sps. Elvira and Edwin Alcantara vs. Sps. Zenaida and Florante Belen, Et. Al G.R. No. 200204 Dated April 25,2017 FactsHarleneNo ratings yet

- IMFTE CharterDocument7 pagesIMFTE Charternoah4lmaltNo ratings yet

- People V Catantan DigestDocument2 pagesPeople V Catantan Digestjoyeduardo100% (1)

- Transcripts KATHERINE JACKSON V AEG LIVE September 9th.2013Document72 pagesTranscripts KATHERINE JACKSON V AEG LIVE September 9th.2013TeamMichaelNo ratings yet

- Jose Jinggoy E. Estrada, Petitioner, vs. Sandiganbayan (Third Division), People of The Philippines and Office of The OMBUDSMAN, Respondents. DecisionDocument19 pagesJose Jinggoy E. Estrada, Petitioner, vs. Sandiganbayan (Third Division), People of The Philippines and Office of The OMBUDSMAN, Respondents. DecisionUnsolicited CommentNo ratings yet

- General vs. ClaravallDocument1 pageGeneral vs. ClaravallKenneth Ray TagleNo ratings yet

- Magallanes Vs Palmer AsiaDocument8 pagesMagallanes Vs Palmer AsiabogoldoyNo ratings yet

- CLU PIL Prepare Request For Service Overseas OutgoingDocument8 pagesCLU PIL Prepare Request For Service Overseas Outgoingmarcus_aurelius97No ratings yet

- (Insurance) Peza v. AlikpalaDocument2 pages(Insurance) Peza v. AlikpalaJechel TBNo ratings yet

- Sample Bequest ClausesDocument1 pageSample Bequest ClausesAlanNo ratings yet

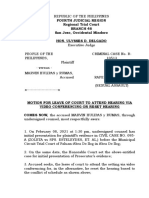

- Fourth Judicial Region Regional Trial Court Branch 46 San Jose, Occidental Mindoro Hon. Ulysses D. DelgadoDocument3 pagesFourth Judicial Region Regional Trial Court Branch 46 San Jose, Occidental Mindoro Hon. Ulysses D. DelgadoVILLAMAR LAW OFFICENo ratings yet

- Pantaleon Vs American Express InternationalDocument3 pagesPantaleon Vs American Express InternationalJia VillarinNo ratings yet

- People of The Philippines VS. Bryan Rumbaoa: Violation of Sec. 5 & 11 of R.A. 9165 & Sec. 3 of R.A. 9516Document128 pagesPeople of The Philippines VS. Bryan Rumbaoa: Violation of Sec. 5 & 11 of R.A. 9165 & Sec. 3 of R.A. 9516Knicky FranciscoNo ratings yet

- Jamero Vs MelicorDocument1 pageJamero Vs MelicorMari DesNo ratings yet

- Double Jeopardy & CitizenshipDocument62 pagesDouble Jeopardy & CitizenshipKayeCie RLNo ratings yet

- United States v. Barber, 4th Cir. (2009)Document3 pagesUnited States v. Barber, 4th Cir. (2009)Scribd Government DocsNo ratings yet

- Proclamation of Sale: Public AuctionDocument13 pagesProclamation of Sale: Public Auctionchek86351No ratings yet

- 11-PAL Vs NLRCDocument6 pages11-PAL Vs NLRCZannyRyanQuirozNo ratings yet

- Pod Copy: No Cash Collection Upon DeliveryDocument2 pagesPod Copy: No Cash Collection Upon DeliveryAgnesReaM.AlanzalonNo ratings yet

- 10 Trade and Investment Devt Corp v. CSCDocument2 pages10 Trade and Investment Devt Corp v. CSCZepht BadillaNo ratings yet

- Ipc Project PDFDocument18 pagesIpc Project PDFHURI BABANo ratings yet

- Agustin - Revival of JudgmentDocument8 pagesAgustin - Revival of JudgmentMarilou AgustinNo ratings yet

- 2015 SCMR 1544Document11 pages2015 SCMR 1544Abdul Majeed NisarNo ratings yet