Professional Documents

Culture Documents

QBO Cert Exam Module 5 - 6

Uploaded by

John AnthonyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QBO Cert Exam Module 5 - 6

Uploaded by

John AnthonyCopyright:

Available Formats

QuickBooks

Online Certification

Preparation

Module 5 Supporting Your Small Business Clients

Module 6 Reporting

Presenter: Heather D. Satterley

Intuit Confidential and Proprietary

Heather D. Satterley

Intuit Advanced Certified ProAdvisor

2017 & 2019 Top QuickBooks Categorical ProAdvisor

Top 100 ProAdvisor 2014 - 2019

Member of the Intuit Trainer / Writer Network

Co-host of The QB ‘Appy Hour with Liz and Heather

Inaugural member of The Accounting Salon

Member – 2019 ADP Accountant Advisory Board

www.satterleyconsulting.com

Intuit Confidential and Proprietary 2 2

CPE Process

In order to receive CPE credit:

This course is eligible for up to 1.5 hours of CPE.

CPE certificates are emailed directly to you within 3 weeks of the training date

to the email address you used to register.

Intuit Confidential and Proprietary 3

Prepare for Today

Sign up for the free QuickBooks ProAdvisor Program:

Go to: bitly.com/pap_join or quickbooks.com and click on Accountants menu

Additional Resources

Accountant QuickBooks Training: Firm of the Future Blog: QuickBooks Online Blog:

qbtrainingevents.com firmofthefuture.com quickbooks.intuit.com/blog

Intuit Confidential and Proprietary 5

Prepare for today

Sign up for the free QuickBooks ProAdvisor Program:

In order to take your exam, you must be enrolled in the QuickBooks ProAdvisor

Program, which is free! Go to:

http://bitly.com/pap_join Or QuickBooks.com/ProAdvisor

Intuit Confidential and Proprietary 6

QuickBooks Online Certification

• 8 Sections

• Multiple choice, submit each section, then submit all sections for

grading; 80% or better each section to pass

• Only need to re-take sections not passed

• 3 Attempts to pass; 60-day lockout after 3 successive not pass

attempts

Intuit Confidential and Proprietary 7

Accessing the exam

Intuit Confidential and Proprietary 8

Accessing the exam

Intuit Confidential and Proprietary 9

New to QuickBooks Online?

Sign up for the Introduction to QuickBooks Online Accountant course at

www.qbtrainingevents.com to learn the basics of QuickBooks Online.

• Recognize how to navigate QuickBooks Online Accountant to manage clients and

practice all in one place

• Learn how to extend QuickBooks Online’s functionality through apps and the ecosystem

• Perform basic money in transactions in your client’s QuickBooks Online company

• Perform basic money out transactions in your client’s QuickBooks Online company

• Describe the benefits of using bank feeds to clients

Intuit Confidential and Proprietary 10

Agenda - Track 1 QuickBooks Online Certification

Session 1: Module 1: QuickBooks Solutions for Clients

Session 2: Module 2: Client Onboarding

Session 3: Module 3: Special Client Onboarding Tasks

Module 4: Managing Your Client Work

Session 4: Module 5: Supporting Your Small Business Clients

Module 6: Reporting

Session 5: Module 7: Banking and Tools

Module 8: Preparing Clients’ books

Intuit Confidential and Proprietary 11

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 1:

Refresh Your Skills: Customer & Vendor

workflows

Intuit Confidential and Proprietary

Refresh Your Skills: Customer & Vendor workflows

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Identify best practice customer and vendor workflows

Intuit Confidential and Proprietary 13

The Sales Workflow

PAYMENT AT TIME OF SALE

Step 1 Step 2

Sales Receipt Deposit

Record sale and Group multiple

payment in a payments to a

single step single bank

deposit

Tools and slide deck: http://bit.ly/tour_qbo_intro Intuit Confidential and Proprietary 14

The Sales Workflow

PAYMENT ON ACCOUNT (A/R)

Step 1 Step 2 Step 3

Invoice Payment Deposit

Invoice from Apply payments Group multiple

estimates or to open invoices payments to a

create from manually or single bank

scratch automatically deposit

Intuit Confidential and Proprietary 15

Expense & Vendor Workflows

PAYMENT AT TIME OF PURCHASE

Option 1 Option 2 Option 3

Expense Check Bank Feed

Record Record purchases Code expenses

purchases with and write/print with bank

debit or credit paper checks downloads

cards

Tools and slide deck: http://bit.ly/tour_qbo_intro Intuit Confidential and Proprietary 16

Expense & Vendor Workflows

PAY BILLS LATER (A/P)

Step 1 Step 2

Bill Payment

Enter bill from Apply payments

Purchase Order to open bills with

or create from debit/credit cards

scratch or check

Tools and slide deck: http://bit.ly/tour_qbo_intro Intuit Confidential and Proprietary 17

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 2:

Undeposited Funds

Intuit Confidential and Proprietary

Undeposited Funds

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize how to utilize the features of Undeposited

funds

Intuit Confidential and Proprietary 19

Undeposited Funds

Payment

“UNDEPOSITED”

Deposit

Tools and slide deck: http://bit.ly/tour_qbo_intro Intuit Confidential and Proprietary 20

Record a Receive Payment

Intuit Confidential and Proprietary 21

Create a Deposit

Intuit Confidential and Proprietary 22

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 3:

Best practice workflows

Intuit Confidential and Proprietary

Best practice workflows

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize the importance of workflows

Identify common client errors caused by poor workflow

List tools that help track activity in a client's

QuickBooks Online Company

Intuit Confidential and Proprietary 24

What makes a great workflow?

QuickBooks Online is a super-flexible product and

there are several workflows that can get something

done.

Clients can also see the same information from

different angles

So, what’s the problem?

The way data is recorded in QuickBooks Online

affects the usefulness of reports

Intuit Confidential and Proprietary 25

When workflows go bad…terminology

The case of the mis-posted

check

Client received a check from his

customer

To record the deposit, he clicks on

Check in the Vendor column

Intuit Confidential and Proprietary 26

When workflows go bad…terminology

The case of the mis-posted

check

Effect on QuickBooks

• Bank account is decreased

• Payee field defaults to vendors

• Income will be debited

(reduced)

Intuit Confidential and Proprietary 27

How can we help?

Teach your client to use the proper

customer and vendor workflows!

• Gear – settings and tools

• Create – transaction screens

• Centers – best practice

workflows!

Intuit Confidential and Proprietary 28

When workflows go bad…not using form screens

The case of the transaction

entered via the bank register

Client always entered deposits

and checks into her register in her

old accounting program

She records a check to record a

sales tax payment in the register

Intuit Confidential and Proprietary 29

When workflows go bad…not using form screens

The case of the transaction

entered via the bank register

Effect on QuickBooks

• Sales tax payment not applied

to correct month

• Sales tax center is wrong

• Sales tax reports are wrong

Intuit Confidential and Proprietary 30

How can we help?

Teach client to use the proper

transaction screens in

QuickBooks, not the register!

• Gear – settings and tools

• Create – transaction screens

• Centers – best practice

workflows!

Intuit Confidential and Proprietary 31

When workflows go bad…uncompleted workflow

The case of the uncompleted

accounts payable workflow

Client entered a Bill for an expense

He then created check transactions

for each Bill categorized to an

expense account

Intuit Confidential and Proprietary 32

When workflows go bad…uncompleted workflow

The case of the uncompleted

accounts payable workflow

Effect on QuickBooks:

• Accounts payable is overstated

• Expenses are overstated

(duplicated)

Intuit Confidential and Proprietary 33

How can we help?

Teach client to use Pay Bills!

• Gear – settings and tools

• Create – transaction screens

• Centers – best practice

workflows!

Intuit Confidential and Proprietary 34

Tips on coaching best practice workflows

• Encourage them to use the centers in the Left Nav bar

• Teach them correct terminology

• Keep it simple

• Keep checking back in

Intuit Confidential and Proprietary 35

Using QuickBooks tools and reports to identify issues

The Transaction Journal

• Displays the debits and credits behind each transaction

• Can help identify mis-postings and mapping errors

The Audit Log / Voided/Deleted Transactions tool

• A filtered version of the Audit log

• Available only to Accountant users via the Accountant /Toolbox.

Intuit Confidential and Proprietary 36

Transaction Journal

Intuit Confidential and Proprietary 37

Voided/Deleted Transactions / Audit log

Intuit Confidential and Proprietary 38

DEMO

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 4:

Estimates & Purchase Orders

Intuit Confidential and Proprietary

Estimates & Purchase Orders

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize how to utilize estimates

Recognize how to convert an Estimate to a Purchase

Order

Intuit Confidential and Proprietary 41

Estimate/Purchase Order Workflow

Intuit Confidential and Proprietary 42

Creating an Estimate

Intuit Confidential and Proprietary 43

Using an Estimate to Create a Purchase Order

Intuit Confidential and Proprietary 44

Add a Purchase Order to an Expense transaction

Intuit Confidential and Proprietary 45

Converting an Estimate to an Invoice

Intuit Confidential and Proprietary 46

DEMO

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 5:

Credit Memos & Customer Statements

Intuit Confidential and Proprietary

Credit Memos & Customer Statements

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize how to utilize Credit memos

Intuit Confidential and Proprietary 49

Why use Credit Memos

Why use a credit memo instead of just editing the transaction?

This can cause confusion and isn’t great recordkeeping.

If the Invoice is in a prior period, it will change prior period amounts.

Why not just bill for less on the next invoice?

It is important to create a new transaction for each exchange between the supplier and the customer.

Inventory quantities on hand can become out of sync for a period.

Why not just refund in cash? And not record?

It’s important to capture all transactions, paid in cash or not, to ensure clients’ records are complete.

Intuit Confidential and Proprietary 50

Credit memo settings

Intuit Confidential and Proprietary 51

Create a Credit Memo

Intuit Confidential and Proprietary 52

Manually apply a Credit Memo to an Invoice

Intuit Confidential and Proprietary 53

Refund Receipts

Intuit Confidential and Proprietary 54

DEMO

Customer Statement Types

Statement Type Description

This customer statement type shows a list of invoices and

BALANCE payments with opening and ending balance, for date range

FORWARD selected.

This customer statement type shows a list of all open and/or

OPEN ITEM unpaid invoices.

This customer statement type shows a list of transactions

TRANSACTION

between two set dates.

Intuit Confidential and Proprietary 56

Customer Statements

Intuit Confidential and Proprietary 57

Customer Statements

Intuit Confidential and Proprietary 58

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 6:

Vendor Credits

Intuit Confidential and Proprietary

Vendor Credits

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize how to utilize Vendor Credits

Intuit Confidential and Proprietary 60

Vendor Credit Workflow

• Decreases Accounts Payable balances

• Can be applied to an existing open bill

• Can be held to apply to a future bill

• Can be automatically applied if setting

is selected (similar to Credit Memo)

Intuit Confidential and Proprietary 61

Create a Vendor Credit

Intuit Confidential and Proprietary 62

Apply a Bill Credit to a Bill

Intuit Confidential and Proprietary 63

DEMO

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 7:

Deposit transactions

Intuit Confidential and Proprietary

Deposit transactions

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize how to use and view deposit transactions

Intuit Confidential and Proprietary 66

When to use Add Other Funds on the Deposit screen

When a company receives funds from:

✓ Loan proceeds or contributions from owners

✓ A vendor refund posted directly to an expense account

✓ A customer and they don’t record income using the sales transaction screens

✓ An employee who reimburses the company for an employee loan receivable

✓ A tax refund. This screen is where you record it to the Tax Refunds account

Intuit Confidential and Proprietary 67

Create a Deposit to record proceeds from a loan

Intuit Confidential and Proprietary 68

DEMO

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 8:

QuickBooks Online Payments

Intuit Confidential and Proprietary

QuickBooks Online Payments

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize how to utilize the features of Online

Payments

Intuit Confidential and Proprietary 72

Payments via Invoices and Sales Receipts

Intuit Confidential and Proprietary 73

How QuickBooks Online Payments work

Intuit Confidential and Proprietary 74

Invoice status is updated in the Invoices tab

Intuit Confidential and Proprietary 75

Customer can enter their payment details and pay electronically

Intuit Confidential and Proprietary 76

Payment notification and updates

Intuit Confidential and Proprietary 77

Recurring Payments

Intuit Confidential and Proprietary 78

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 9:

Journal Entries

Intuit Confidential and Proprietary

Journal Entries

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize how to utilize Journal Entries

Intuit Confidential and Proprietary 80

When to use Journal entries

Journal Entry Rules

• Total debits must equal total credits in order to save the journal

entry

• You cannot use Products and Services items in a journal entry

• When posting to Accounts Receivable, you must specify a

customer

• When posting to Accounts Payable you must specify a vendor

• You may use multiple Accounts Receivable and/or Accounts

Payable accounts on the same journal entry

• You can’t mark an amount as billable to a customer

Intuit Confidential and Proprietary 81

When to use an Adjusting Journal entry

Common scenarios where journal entries are usually marked as adjusting

• Accrued expenses

• Deferred expenses

• Accrued revenues

• Deferred revenues

• Non-cash transactions

Intuit Confidential and Proprietary 82

Record an adjusting Journal entry

Intuit Confidential and Proprietary 83

DEMO

QuickBooks Online

Certification Training

MODULE 5:

Supporting Your Small Business Clients

LESSON 10:

Transfers

Intuit Confidential and Proprietary

Transfers

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize when and how to use transfers

Intuit Confidential and Proprietary 86

What is a Transfer

Summary of the transfer functionality:

• The transfer screen is used to move funds between two balance sheet accounts

• The transfer screen is not used to record income or expense

• There are no customers, vendors, employees, or Products and Services items

involved. These fields are not available on the transfer screen

• You don’t use the Transfer feature to transfer from your bank account to your

vendor’s bank account

Intuit Confidential and Proprietary 87

Create a Transfer

Intuit Confidential and Proprietary 88

DEMO

QuickBooks Online

Certification Training

MODULE 6:

Reporting

LESSON 1:

Refresh Your Skills: Basic Reports

Intuit Confidential and Proprietary

Refresh Your Skills: Basic Reports

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Recognize how to navigate the Reports Center and

run basic reports

Recognize the difference between cash-basis and

accrual-basis reporting

Intuit Confidential and Proprietary 91

The Benefits of Creating Reports

Your clients need to have a clear snapshot of how they are doing.

QuickBooks Online reports provide valuable insights into:

The financial position of a business

The results of operations for a specific time period

Statistical information such as the best-selling item or gross profit margin

Information about customers, vendors, and employees

Intuit Confidential and Proprietary 92

Cash and Accrual Reporting

Cash basis reports – displays income when cash is received

Displays income as of the date a customer payment is received

Displays expenses as of the date a vendor is paid

Accrual basis reports – displays income when it is earned

Displays income as of the date of the invoice

Displays expenses as of the date of the bill

Intuit Confidential and Proprietary 93

Reports Center

Tools and slide deck: http://bit.ly/tour_qbo_intro Intuit Confidential and Proprietary 94

Reports Center

Tools and slide deck: http://bit.ly/tour_qbo_intro Intuit Confidential and Proprietary 95

Reporting restrictions

Why some reports may be missing:

Edit and review the user’s permissions.

Verify the feature is available in the client’s

QBO subscription.

Check to see if the feature is turned on in

Account and Settings.

Tools and slide deck: http://bit.ly/tour_qbo_intro Intuit Confidential and Proprietary 96

DEMO

Running an A/R Aging Summary report

Accounts Receivable (or A/R) reports in QuickBooks Online allow you or your clients

to see who owes the business money and how much they owe.

The A/R Aging Summary report lists each customer with an open balance

Intuit Confidential and Proprietary 98

Running an A/R Aging Summary report

Intuit Confidential and Proprietary 99

Accounts Payable reports

Accounts Payable (or A/P) reports in QuickBooks Online allow you and your clients

to see what the business owes and when the payments are due.

The A/P Aging Summary

This report summarizes the status of unpaid bills and unapplied vendor credits. It serves

as a quick glance at which vendors are most overdue.

Intuit Confidential and Proprietary 100

Running an A/P Aging Summary report

Intuit Confidential and Proprietary 101

Profit & Loss and Balance Sheet reports

Intuit Confidential and Proprietary 102

Profit & Loss and Balance Sheet reports

Intuit Confidential and Proprietary 103

QuickBooks Online

Certification Training

MODULE 6:

Reporting

LESSON 2:

The value of reports

Intuit Confidential and Proprietary

The value of reports

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

Describe the value of the reports to clients

Intuit Confidential and Proprietary 105

Analyzing the Profit and Loss Report

Intuit Confidential and Proprietary 106

Analyzing the Profit and Loss – Key Metrics to Consider

Income:

Does their total income look about right?

Which income streams brought in more revenue?

Is all their income categorized?

Expenses:

Are there any expense items in Ask my Accountant?

Point out expenses that were different than prior

periods and ask why

Review key areas like revenue, gross profit and net

profit

Intuit Confidential and Proprietary 107

Analyzing the Balance Sheet

Intuit Confidential and Proprietary 108

Analyzing the Balance Sheet – Key Metrics to Consider

When analyzing the Balance Sheet, the key

areas to focus on are:

Has each account been reconciled?

Review Accounts Receivable (compare to revenue)

Review any new asset purchases

Review any prepaids or accruals and confirm they were

accurately categorized

Review owner transactions in the equity section

Does Opening Balance Equity have a balance?

Verify that Net Income from the P & L matches the Balance

Sheet

Verify that prior year Net Income matches current year Retained

Earnings

Intuit Confidential and Proprietary 109

Validating the Balance Sheet

Balance Sheet Account Subsidiary Report that “proves” to balance

Cash, checking Bank Reconciliation report

Accounts Receivable A/R Aging or Open Invoices

Inventory Asset Inventory Valuation Summary (or Detail)

Fixed Assets Transaction Detail Report filtered for Account

Other Assets Transaction Detail Report or Reconciliation report

Accounts Payable A/P Aging or Open Bills

Credit card accounts Reconciliation report

Liability accounts Transaction Detail Report or Reconciliation report

Sales tax payable Sales tax liability report

Payroll taxes payable Payroll tax liability report

Equity Transaction Detail Report or Reconciliation report

Intuit Confidential and Proprietary 110

QuickBooks Online

Certification Training

MODULE 6:

Reporting

LESSON 3:

Creating reports to answer common

business questions

Intuit Confidential and Proprietary

Creating reports to answer common business questions

LEARNING OUTCOMES

Upon completion of this topic, you should

be able to:

State the impact of best practice workflows on reports

List reports that answer client’s common business

questions

Describe the value of sales and expense reports and

how to run them

Intuit Confidential and Proprietary 112

Start with the end in mind – transactions determine reporting options

Income Expense Purchase

Sales Reports

Reports Reports Reports

• Invoice • Invoice • Bills* • Bills

• Sales • Sales • Checks* • Checks

Receipt Receipt • Expenses* • Expenses

• Credit Memo • Credit Memo

• Refund • Refund

Receipt Receipt

• Deposit*

*Income and Expense reports may show amounts from sales and purchase transactions, but sales and purchase

reports will only show amounts from sales and expense transactions that use product/service items.

Intuit Confidential and Proprietary 113

Answering Common Client Questions with Reports

Intuit Confidential and Proprietary 114

Customizing Reports

Intuit Confidential and Proprietary 115

DEMO

Next Steps

Intuit Confidential and Proprietary

QuickBooks Online Certification

• 8 Sections

• Multiple choice; submit each section then

submit all sections for grading

• 80% to pass each section

Only need to re-take sections not passed

3 Attempts to pass (each section)

60-day lockout

Intuit Confidential and Proprietary 118

Accessing the exam

Intuit Confidential and Proprietary 119

Accessing the exam

Intuit Confidential and Proprietary 120

After You Pass Your Exam

• Download your new Certified ProAdvisor Badge from the same

button you clicked to take the exam.

• Use your badge on for your website, biz cards, etc.

• Create or Update your ProAdvisor Profile in the Find-a-ProAdvisor

Referral Database. Best Practices:

― Include a picture not your logo

― Include a short bio about the services you offer

― Select the certifications you have complete

Intuit Confidential and Proprietary 121

Recertification and leveling up

• Once certified, you can also continue your journey with a range of additional courses

that will add to your knowledge and impress clients.

― ProAdvisor additional courses: Visit www.qbtrainingevents.com

― ProAdvisor certification badges

• Recertify every year between March to July 31 on what’s new in QuickBooks Online

to maintain certification status for another year.

― Certified between March 1, 2019 to February 28, 2020 – recertify in 2020

Intuit Confidential and Proprietary 122

You might also like

- QBO Cert Exam Module 1Document68 pagesQBO Cert Exam Module 1Nikka ella LaraNo ratings yet

- QBO Cert Exam Module 7 - 8Document114 pagesQBO Cert Exam Module 7 - 8John AnthonyNo ratings yet

- Introduction To QBOA - Part 2 - PresentationDocument93 pagesIntroduction To QBOA - Part 2 - PresentationherrajohnNo ratings yet

- QBO Cert Exam Module 2Document77 pagesQBO Cert Exam Module 2Nikka ella LaraNo ratings yet

- QBO Cert Exam Module 3 - 4Document121 pagesQBO Cert Exam Module 3 - 4Nikka ella LaraNo ratings yet

- QuickBooks Online Core Certification Workbook V22.4.1Document47 pagesQuickBooks Online Core Certification Workbook V22.4.1Shirshah LashkariNo ratings yet

- 08 QuickBooks Online Certification Part 1-2 Training Instructor-Gisele DoucetDocument99 pages08 QuickBooks Online Certification Part 1-2 Training Instructor-Gisele DoucetReazoen Kabir Romel100% (1)

- QBO ProAdvisor Certification Part 1 SlidesDocument175 pagesQBO ProAdvisor Certification Part 1 SlidesMichael GaoNo ratings yet

- QBOAV - in Action - HandoutDocument61 pagesQBOAV - in Action - HandoutNIKUNJ PATELNo ratings yet

- QBO ProAdvisor Certification Part 2 SlidesDocument157 pagesQBO ProAdvisor Certification Part 2 SlidesMichael GaoNo ratings yet

- Quickbooks Online Certification:: How It Works Leave ExamDocument3 pagesQuickbooks Online Certification:: How It Works Leave ExamJanine Lerum100% (1)

- QB Certification Section 1Document3 pagesQB Certification Section 1Jimmy JamesNo ratings yet

- 2017 Cert Prep Webinar - EM.062617 - Attendee PDFDocument272 pages2017 Cert Prep Webinar - EM.062617 - Attendee PDFSrabonBarua100% (1)

- QuickBooks Online 2024 ProAdvisor Certification ReviewerDocument226 pagesQuickBooks Online 2024 ProAdvisor Certification ReviewerRonald Nadon100% (1)

- Supporting Your Small Business ClientsDocument13 pagesSupporting Your Small Business ClientsRichard Rhamil Carganillo Garcia Jr.No ratings yet

- UntitledDocument17 pagesUntitledpink burger60% (5)

- Introduction To QuickBooks For FarmersDocument93 pagesIntroduction To QuickBooks For Farmerspetitmar1No ratings yet

- Quick Guide to the QuickBooks Desktop Conversion ToolDocument35 pagesQuick Guide to the QuickBooks Desktop Conversion ToolLouiseCuentoNo ratings yet

- Supplemental Guide: Module 4: Reporting & TroubleshootingDocument75 pagesSupplemental Guide: Module 4: Reporting & TroubleshootingEdward DubeNo ratings yet

- 63ea52fcc0dcd Quickbooks Online Exams AnsDocument149 pages63ea52fcc0dcd Quickbooks Online Exams AnsCarlo Cariaso0% (1)

- QB Pro ExamDocument6 pagesQB Pro ExamRamij BabuNo ratings yet

- Exam Preparation QuickbooksDocument29 pagesExam Preparation QuickbooksSyed ShafanNo ratings yet

- 638d8a3f738df Qbo ExamDocument70 pages638d8a3f738df Qbo Exammaobangbang21No ratings yet

- QuickBooks - ReviewerDocument41 pagesQuickBooks - ReviewerSeverus HadesNo ratings yet

- New Microsoft Word DocumentDocument12 pagesNew Microsoft Word DocumentRamij BabuNo ratings yet

- QBO Core Cert Glossary 2024Document17 pagesQBO Core Cert Glossary 2024antoniomuscanti00No ratings yet

- Quickbooks Online Certification Section 1Document5 pagesQuickbooks Online Certification Section 1Shahid Mirza0% (2)

- Pro Advisor Section 2Document1 pagePro Advisor Section 2ENIDNo ratings yet

- QBO Certification - Modules 1 - 8 - Website - Rev090121Document331 pagesQBO Certification - Modules 1 - 8 - Website - Rev090121herrajohnNo ratings yet

- QBO Certification Training Guide - v031122Document308 pagesQBO Certification Training Guide - v031122Jonhmark AniñonNo ratings yet

- 2022 QB ProDocument31 pages2022 QB ProJen Adviento0% (1)

- Quickbooks ExamDocument15 pagesQuickbooks ExamRobelyn LacorteNo ratings yet

- Review Answers to Improve Client Accounting SkillsDocument5 pagesReview Answers to Improve Client Accounting SkillsDennis lugodNo ratings yet

- QBO Certification 1st PartDocument17 pagesQBO Certification 1st PartRa MenaceNo ratings yet

- Sample QuickBooks Online Certification Exam Answers Questions 1 1Document25 pagesSample QuickBooks Online Certification Exam Answers Questions 1 1Bhargav Patel0% (1)

- Become A QuickBooks ProAdvisorDocument6 pagesBecome A QuickBooks ProAdvisorpriyanshu saraswat0% (1)

- Quickbooks Payroll Qs Section 3Document7 pagesQuickbooks Payroll Qs Section 3Noorullah0% (1)

- QuickBooks Online Setup GuideDocument327 pagesQuickBooks Online Setup Guiderbreddy74No ratings yet

- Section 1 Review Answers: Edit AnsweDocument10 pagesSection 1 Review Answers: Edit AnsweCamille SalasNo ratings yet

- QBO Student Guide US PDFDocument110 pagesQBO Student Guide US PDFXyz 123100% (1)

- Qbo 2018 TBDocument20 pagesQbo 2018 TBWilson CarlosNo ratings yet

- QuickBooks Small Business User Guide PDFDocument95 pagesQuickBooks Small Business User Guide PDFEhsan AlimNo ratings yet

- Qbo TBDocument19 pagesQbo TBWilson Carlos100% (2)

- 63ea52fcc0dcd Quickbooks Online Exams AnsDocument149 pages63ea52fcc0dcd Quickbooks Online Exams AnsCarlo CariasoNo ratings yet

- Review Answers: Quickbooks Online CertificationDocument1 pageReview Answers: Quickbooks Online Certificationsmn123456No ratings yet

- Supplemental Guide: Module 1: Advanced CategorizationDocument69 pagesSupplemental Guide: Module 1: Advanced CategorizationCracker OatsNo ratings yet

- Studentbook QuickbookDocument378 pagesStudentbook Quickbookamirhdl100% (3)

- Quick Books Questions & AnswersDocument3 pagesQuick Books Questions & Answersmohan_bioinfoNo ratings yet

- Quick BooksDocument22 pagesQuick BooksENIDNo ratings yet

- Test Bank For QuickBooks Pro 2013 A Complete Course 14E 14th EditionDocument6 pagesTest Bank For QuickBooks Pro 2013 A Complete Course 14E 14th EditionMohammed Khouli100% (1)

- Quick BooksDocument6 pagesQuick BooksENIDNo ratings yet

- QuickBooks 2014 Payroll User GuideDocument32 pagesQuickBooks 2014 Payroll User GuideHaplucky100% (1)

- QB Mae 1Document27 pagesQB Mae 1Janine Lerum100% (2)

- Section 2 CompiledDocument54 pagesSection 2 CompiledCamille SalasNo ratings yet

- Advising Clients Q1Document8 pagesAdvising Clients Q1Mandela EscaladaNo ratings yet

- Quickbooks Certification Training (Module 1)Document89 pagesQuickbooks Certification Training (Module 1)Riza LNo ratings yet

- QBO Advanced Certificaton - Modules 1 - 9 - WebsiteDocument455 pagesQBO Advanced Certificaton - Modules 1 - 9 - WebsiteMichael GaoNo ratings yet

- Work effectively in the accounting and bookkeeping industryDocument10 pagesWork effectively in the accounting and bookkeeping industryHarsh KSNo ratings yet

- Region IX, Zamboanga Peninsula Burgos ST., Molave, Zamboanga Del Sur 7023 Tel No. (062) 2251 507/ School ID No. 303797Document7 pagesRegion IX, Zamboanga Peninsula Burgos ST., Molave, Zamboanga Del Sur 7023 Tel No. (062) 2251 507/ School ID No. 303797Charlyn CastroNo ratings yet

- Fa ProjectDocument16 pagesFa Projecttapas_kbNo ratings yet

- Audit ProceduresDocument36 pagesAudit ProceduresRoshaan AhmadNo ratings yet

- Accounting Chapter 5: Internal Control, Cash and Receivables 1. Accounts & Notes ReveivableDocument7 pagesAccounting Chapter 5: Internal Control, Cash and Receivables 1. Accounts & Notes ReveivableMarine De CocquéauNo ratings yet

- Chapter 14 Business CombinationDocument5 pagesChapter 14 Business CombinationAshNor Randy0% (1)

- Exam Working CapitalDocument4 pagesExam Working CapitalBereket K.ChubetaNo ratings yet

- PCAB Requirements: A. LegalDocument6 pagesPCAB Requirements: A. LegalGilianne Kathryn Layco Gantuangco-CabilingNo ratings yet

- Problem set on partnership liquidation and distribution of assetsDocument5 pagesProblem set on partnership liquidation and distribution of assetsHoney OrdoñoNo ratings yet

- Ch13 4es - InvestmentDocument27 pagesCh13 4es - InvestmentK59 Nguyen Dang Vy KhanhNo ratings yet

- AcumaticaERP OrganizationStructureDocument44 pagesAcumaticaERP OrganizationStructurecrudbugNo ratings yet

- Sale of Equity Shares PDFDocument2 pagesSale of Equity Shares PDFBen TenNo ratings yet

- Travel Agent Feasibility StudyDocument30 pagesTravel Agent Feasibility StudyZohaib AzharNo ratings yet

- Exercises-Source of FinancingDocument3 pagesExercises-Source of Financingmusa_scorpionNo ratings yet

- Introduction To Financial Accounting-Unit 1-1Document57 pagesIntroduction To Financial Accounting-Unit 1-1B-ton LimbeNo ratings yet

- PT JayatamaDocument67 pagesPT JayatamaAminadap. SIL.TNo ratings yet

- Corporate ReportingDocument20 pagesCorporate Reportingay nnNo ratings yet

- PRTC FAR-1stPB 5.22Document9 pagesPRTC FAR-1stPB 5.22Ciatto SpotifyNo ratings yet

- LiquidationDocument18 pagesLiquidationSamaica MontemayorNo ratings yet

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137No ratings yet

- Business MathDocument41 pagesBusiness MathJayson Alvarez MagnayeNo ratings yet

- Financial Accounting 17th Edition by Williams ISBN Solution ManualDocument90 pagesFinancial Accounting 17th Edition by Williams ISBN Solution Manualjames100% (24)

- Adjusting Entries Sample ProblemsDocument2 pagesAdjusting Entries Sample ProblemsReese KimNo ratings yet

- In The Calculation of Return On Shareholders Investments The Referred Investment Deals WithDocument20 pagesIn The Calculation of Return On Shareholders Investments The Referred Investment Deals WithAnilKumarNo ratings yet

- NN5 Chap 5Document41 pagesNN5 Chap 5Nguyet NguyenNo ratings yet

- p1 52Document52 pagesp1 52Xeniya Morozova Kurmayeva67% (3)

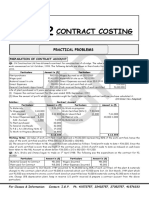

- Contract Costing: Practical ProblemsDocument28 pagesContract Costing: Practical ProblemsHarshit Aggarwal79% (14)

- Week 3 Asset Based Valuation Part 2 MG3Document26 pagesWeek 3 Asset Based Valuation Part 2 MG3VENICE MARIE ARROYONo ratings yet

- CFAS Chapter40 IFRIC Interpretations (Gutierrez-Ingat)Document19 pagesCFAS Chapter40 IFRIC Interpretations (Gutierrez-Ingat)Fran GutierrezNo ratings yet

- Amalgamation and Absorption of CompaniesDocument89 pagesAmalgamation and Absorption of CompaniesHarshit Kumar GuptaNo ratings yet

- Accounting Policies and StandardsDocument31 pagesAccounting Policies and StandardsAbhishek Kr Paul50% (2)