Professional Documents

Culture Documents

Cfa 1 - Mock Exam Notes

Cfa 1 - Mock Exam Notes

Uploaded by

alexa ubaldoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cfa 1 - Mock Exam Notes

Cfa 1 - Mock Exam Notes

Uploaded by

alexa ubaldoCopyright:

Available Formats

Corporate issuers

- Historical equity risk premium approach gives a good indicator of the expected equity

risk premium. Limitations include i.) the level of risk of the stock index may change over

time ii.) resulting estimates are sensitive to the estimations method

- Flotation costs are a cash outflow. It is a one-time cash outflow that occurs at the

initiation of a project

Alternative investments

- Trading NAV: NAV for a hedge fund that reflects liquidity discounts

Reporting NAV: NAV for quoted market prices

- Inefficiency of alternative investments exists in the form of illiquidity versus traditional

asset classes -> will not reflect new information as quickly, leading to a form of market

inefficiency called informational inefficiency

- REIT - trade at prices which differs from its NAV per share (at a discount or premium)

- Hedge fund activist strategy focuses on the purchase of sufficient equity in order to

influence company’s policies or direction

- Commodity indexes, to be transparent, investable and replicable will use the prices of

the futures contracts on the commodities in the index.

Derivates

- Derivative contracts have a definitive life span and expire on a specified date outlined in

the contract itself

- The value of a European put option is inversely related to the risk-free rate

-

You might also like

- 6473 LectureDocument13 pages6473 Lectureapi-3699305No ratings yet

- Mutual Funds: Presented To:-! ! ! ! Presented ByDocument24 pagesMutual Funds: Presented To:-! ! ! ! Presented ByAnoop Raj SrivastvaNo ratings yet

- Mutual Fund: Presented To:-Presented ByDocument24 pagesMutual Fund: Presented To:-Presented ByInder_Joshi_8243No ratings yet

- Introduction To Alternative InvestmentDocument7 pagesIntroduction To Alternative InvestmentSimran SangwanNo ratings yet

- CFA Alternatives L3Document12 pagesCFA Alternatives L3adham.abdelatyNo ratings yet

- Optimal Design: of Volatility-Driven Algo-Alpha Trading StrategiesDocument1 pageOptimal Design: of Volatility-Driven Algo-Alpha Trading StrategiesDwight ThothNo ratings yet

- Chap 11 Equity StrategiesDocument72 pagesChap 11 Equity StrategiesYibeltal AssefaNo ratings yet

- Session 1Document10 pagesSession 1rafat.jalladNo ratings yet

- What Are DerivativesDocument16 pagesWhat Are DerivativesfelixprabuNo ratings yet

- Personal Finance AssignmentDocument18 pagesPersonal Finance AssignmentVivek DaultaNo ratings yet

- Uti Baf Nfo FlyerDocument2 pagesUti Baf Nfo FlyerAnanthNo ratings yet

- Upload SapmDocument20 pagesUpload SapmQurath ul ainNo ratings yet

- Lecture8 Chap13Document15 pagesLecture8 Chap13Jerónimo BedoyaNo ratings yet

- Introduction To Bond Portfolio Management: by Frank J. FabozziDocument18 pagesIntroduction To Bond Portfolio Management: by Frank J. Fabozzisiddis316No ratings yet

- Capital Market Line and The Efficient FrontierDocument6 pagesCapital Market Line and The Efficient FrontierPushpa BaruaNo ratings yet

- What Is A Mutual Fund?Document8 pagesWhat Is A Mutual Fund?Devansh Jignesh ShahNo ratings yet

- Investment Analysis & Portfolio ManagementDocument26 pagesInvestment Analysis & Portfolio Managementluvkush1No ratings yet

- Role of Capital Market in Economic DevelopmentDocument5 pagesRole of Capital Market in Economic DevelopmentRucha KamatNo ratings yet

- Cost and Availability of Capital 3QJ8RLNo7zDocument33 pagesCost and Availability of Capital 3QJ8RLNo7zNikitha NithyanandhamNo ratings yet

- Hedge Fund StrategiesDocument3 pagesHedge Fund StrategiesBob PanjabiNo ratings yet

- Security Market IndicesDocument5 pagesSecurity Market IndicesNga NguyễnNo ratings yet

- Mutual FundsDocument5 pagesMutual FundsParthNo ratings yet

- Portfolio MGTDocument98 pagesPortfolio MGTNishantNo ratings yet

- Module 5 - Portfolio ManagementDocument7 pagesModule 5 - Portfolio ManagementAyush kashyapNo ratings yet

- 5.derivative ProjectDocument82 pages5.derivative Projectkware215No ratings yet

- Bond Portfolio Management StrategiesDocument23 pagesBond Portfolio Management Strategiesashudadhich100% (2)

- CAPMDocument2 pagesCAPMdantesdrechgioNo ratings yet

- Presenting: Equity ManagementDocument44 pagesPresenting: Equity ManagementMohamed HammadNo ratings yet

- Passive Equity InvestingDocument2 pagesPassive Equity InvestingkypvikasNo ratings yet

- BBA Unit 5Document4 pagesBBA Unit 5gorang GehaniNo ratings yet

- SAPM Ist UnitDocument13 pagesSAPM Ist UnitJaideep SharmaNo ratings yet

- The Global Cost of CapitalDocument31 pagesThe Global Cost of CapitalMai LiênNo ratings yet

- CAIA Part I Intro To Alpha and Beta DriversDocument8 pagesCAIA Part I Intro To Alpha and Beta DriversJiaxi_Chen_996No ratings yet

- Chapter 12 - Derivative MarketsDocument28 pagesChapter 12 - Derivative MarketsFrancis GumawaNo ratings yet

- DerivativesDocument77 pagesDerivativesDr.P. Siva Ramakrishna100% (2)

- Issues in Business ValuationDocument32 pagesIssues in Business Valuationmeesumit1583No ratings yet

- 9 Shceme SelectionDocument18 pages9 Shceme SelectionashitNo ratings yet

- Chapter-1: "Mutual Fund Is A Common Pool of Money in Which Investor Place TheirDocument53 pagesChapter-1: "Mutual Fund Is A Common Pool of Money in Which Investor Place TheirSunanda MathuriaNo ratings yet

- Important Questions Related To Any Investment?Document19 pagesImportant Questions Related To Any Investment?Muskan ChawlaNo ratings yet

- 14-15 ImDocument25 pages14-15 ImpratapNo ratings yet

- Regulation of Securities IntermediariesDocument50 pagesRegulation of Securities IntermediariesKYLE HOGEBOOMNo ratings yet

- Securities Analysis & Portfolio Management IntroDocument50 pagesSecurities Analysis & Portfolio Management IntrogirishNo ratings yet

- Mutual Fund Prot and DivDocument13 pagesMutual Fund Prot and Divbharatt25No ratings yet

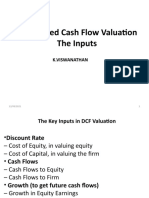

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDocument47 pagesDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarNo ratings yet

- NISM VIII Equity Derivative Short NotesDocument23 pagesNISM VIII Equity Derivative Short NotesvinaykbrNo ratings yet

- R58 Alternative InvestmentsDocument97 pagesR58 Alternative Investmentsrishikajha1243No ratings yet

- Unit 5 Iapm CapmDocument11 pagesUnit 5 Iapm Capmshubham JaiswalNo ratings yet

- SAPMDocument5 pagesSAPMgowrishajoshiNo ratings yet

- Case Study Summary HFDocument16 pagesCase Study Summary HFMai SuwanchaiyongNo ratings yet

- Vangaurd ETFDocument12 pagesVangaurd ETFdelossantos5542No ratings yet

- Introduction To Derivative Instruments Part1Document49 pagesIntroduction To Derivative Instruments Part1Marco PoloNo ratings yet

- Summary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoFrom EverandSummary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoNo ratings yet

- Chapter 3Document18 pagesChapter 3JapaPrashanthNo ratings yet

- Presentation 14791 Content Document 20240103101324AMDocument21 pagesPresentation 14791 Content Document 20240103101324AMytmandar29No ratings yet

- Formulation of Portfolio Strategy - IMDocument9 pagesFormulation of Portfolio Strategy - IMKhyati Khokhara100% (1)

- Formulation of Portfolio Strategy - IMDocument9 pagesFormulation of Portfolio Strategy - IMKhyati KhokharaNo ratings yet

- Is Derivative Market Beneficial For AllDocument23 pagesIs Derivative Market Beneficial For AllgangwanisNo ratings yet

- P7-Exchange Risk-Managing and ProtectionDocument31 pagesP7-Exchange Risk-Managing and Protectionenacengic99No ratings yet

- Kim - Sbi Equity Hybrid FundDocument24 pagesKim - Sbi Equity Hybrid FundbbaalluuNo ratings yet

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingFrom EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingNo ratings yet

- ResumeDocument2 pagesResumealexa ubaldoNo ratings yet

- Organizing, Visualizing and Describing DataDocument1 pageOrganizing, Visualizing and Describing Dataalexa ubaldoNo ratings yet

- Wharton Business Analytics Coursera QuizDocument155 pagesWharton Business Analytics Coursera Quizalexa ubaldo100% (2)

- 1: Time Value of Money: Tuesday, 28 December 2021 10:18 PMDocument14 pages1: Time Value of Money: Tuesday, 28 December 2021 10:18 PMalexa ubaldoNo ratings yet