Professional Documents

Culture Documents

Itr-V Dompp4989c 2023-24 116486580310723

Itr-V Dompp4989c 2023-24 116486580310723

Uploaded by

SHANTANU VERMAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr-V Dompp4989c 2023-24 116486580310723

Itr-V Dompp4989c 2023-24 116486580310723

Uploaded by

SHANTANU VERMACopyright:

Available Formats

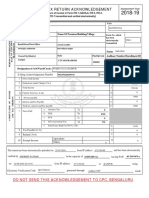

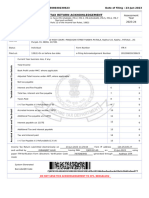

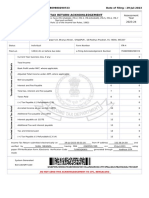

Acknowledgement Number: 116486580310723 Date of filing: 31-Jul-2023

INDIAN INCOME TAX RETURN VERIFICATION FORM

Assessment

FORM [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, Year

ITR-V ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically] 2023-24

(Please see Rule 12 of the Income-tax Rules, 1962)

Name POONAM

PAN DOMPP4989C Form Number ITR-4

e-Filing Acknowledgement

Filed u/s 139(1)-On or before due date 116486580310723

Number

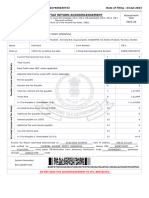

VERIFICATION

I, POONAM son/ daughter of CHANDER BHAN , solemnly declare that to the best of my knowledge and belief, the information

given in the return which has been submitted by me vide acknowledgement number 116486580310723 is correct and

complete and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am making this return in

my capacity as Self and I am also competent to make this return and verify it. I am holding permanent account number

DOMPP4989C

Signature >

Date of

31-Jul-2023 Source IP address 10.128.4.1

submission

System Generated

Barcode / QR Code

DOMPP4989C041164865803107231ab0315dcc091bd97098e159324a27cd819f593

a

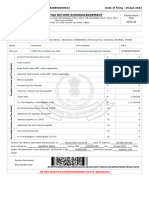

Instructions:

1. Please send the duly signed (preferably in blue ink) Form ITR-V to "Centralized Processing Centre, Income Tax Department,

Bengaluru 560500", by SPEED POST ONLY. Alternately, you may e-verify the electronic transmitted return data using

Aadhaar OTP or Login to e-Filing account through Net-Banking login or EVC generated using Pre-Validated Bank

Account/Demat Account or EVC generated through Bank ATM.

2. Form ITR-V shall not be received in any other office of the Income Tax Department or in any other manner. The confirmation

of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail Id registered in the e-Filing account.

3. On successful verification, the return filing acknowledgement can be downloaded from e-Filing portal as a proof of

completion of process of filing the return of Income.

4. Please sign only in the box provided for signature. Signature anywhere else other than the box provided can render the ITR

V invalid.

5. For any queries, please contact 1800 103 0025, 1800 419 0025. For International callers +91-80-46122000, +91-80-

61464700.

The ITR V should be received at Central Processing Centre, Bengaluru - 560500 within 30 days from the date of successful

transmission of the return data. (Please note the change in time available for verifying the return, i.e from 120 days to 30

days).

"Please note that if the ITR-V is received beyond 30 days of uploading the return data, the date of receipt of

ITR-V will be taken as the date of filing of return and all provisions of the act will apply accordingly."

You might also like

- To Whomsoever It May Concern: Wipro LogoDocument1 pageTo Whomsoever It May Concern: Wipro LogoParvishMarmatNo ratings yet

- PDF - 933662320220722.pdf ITR 22-23Document1 pagePDF - 933662320220722.pdf ITR 22-23smpNo ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- Government of Telangana: PAYSLIP:-DEC-2020Document2 pagesGovernment of Telangana: PAYSLIP:-DEC-2020Raghavendra BiduruNo ratings yet

- MR Harpreet Singh Punjab India 9592923392Document1 pageMR Harpreet Singh Punjab India 9592923392Neno MiqavaNo ratings yet

- BM0519004030 PDFDocument1 pageBM0519004030 PDFGauri Jamdar.No ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- Itr 2022-23Document1 pageItr 2022-23digitalworldnangalNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- PDF 139527500310723Document1 pagePDF 139527500310723NithinNo ratings yet

- Nishar ItrDocument1 pageNishar ItrE-Ticket 40 RTNo ratings yet

- ACK131773880020523Document1 pageACK131773880020523Ritu RajNo ratings yet

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSUDHEESH KUMARNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- ACK302828890260623Document1 pageACK302828890260623Jaswanth KumarNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- Umesh ITR A.Y. 2023-2024Document1 pageUmesh ITR A.Y. 2023-2024swatigrv2004No ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- ACK544968000190723Document1 pageACK544968000190723hp agencyNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurumahesh bhorNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep NegiNo ratings yet

- Paramjeet Kaur 2023-2024Document1 pageParamjeet Kaur 2023-2024thinkpadt480tNo ratings yet

- Ack Cdhpa3843f 2022-23 220950670290722Document1 pageAck Cdhpa3843f 2022-23 220950670290722rtaxhelp helpNo ratings yet

- Ack. AY 2022-23 RambirDocument1 pageAck. AY 2022-23 Rambirkdsss pNo ratings yet

- AcknowledgmentDocument1 pageAcknowledgmentSatyam MaramNo ratings yet

- Itr 22 23Document1 pageItr 22 23biswa chakrabortyNo ratings yet

- Ganesh Payslip JanDocument1 pageGanesh Payslip JanBADI APPALARAJUNo ratings yet

- Payslip - 2023 06 28Document1 pagePayslip - 2023 06 28ttamilpNo ratings yet

- PDF 691846850250723Document1 pagePDF 691846850250723Anish MishraNo ratings yet

- ZHR RVPN 111500Document69 pagesZHR RVPN 111500vinodk33506No ratings yet

- Ack 504547400170723Document1 pageAck 504547400170723varsha sardesaiNo ratings yet

- Ack Aalcs4258c 2022-23 448872891271023Document1 pageAck Aalcs4258c 2022-23 448872891271023deepakNo ratings yet

- Sunil MewadaDocument1 pageSunil MewadaSteve BurnsNo ratings yet

- India Payslip January 2023 PDFDocument1 pageIndia Payslip January 2023 PDFN RamPrasad100% (1)

- Ack 137988180310723Document1 pageAck 137988180310723Lakesh kumar padhyNo ratings yet

- MRMRT16330450000010851 NewDocument4 pagesMRMRT16330450000010851 NewGirish kumar kushwahaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAbhinaba SahaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNANDAN SALESNo ratings yet

- Madan PayslipDocument1 pageMadan PayslipBADI APPALARAJUNo ratings yet

- JunDocument1 pageJunkallinath nrNo ratings yet

- Rutansh Final Itr 2022-23 - 2Document1 pageRutansh Final Itr 2022-23 - 2Rutansh JagtapNo ratings yet

- PDF - 878651410190722. SubhashDocument1 pagePDF - 878651410190722. SubhashYUVRAJ BhardwajNo ratings yet

- Ack Ejaps7559m 2022-23 763168490080722Document1 pageAck Ejaps7559m 2022-23 763168490080722Rashi SrivastavaNo ratings yet

- DILBAGH SINGH ITR 2023-2024 - UnlockedDocument1 pageDILBAGH SINGH ITR 2023-2024 - UnlockedmohitNo ratings yet

- 2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFDocument1 page2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFVasanth Kumar AllaNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Mohammad AliNo ratings yet

- PDF To WordDocument1 pagePDF To WordThe Great Indian TipsNo ratings yet

- Form 16Document9 pagesForm 16KOKILA VIJAYAKUMARNo ratings yet

- 2122 ItrDocument1 page2122 ItrAjay PratapNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMithlesh SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- PDF 990850220061221Document1 pagePDF 990850220061221Olympia FitnessNo ratings yet

- Chotte Lal 2023 24Document1 pageChotte Lal 2023 24ajay singhNo ratings yet

- Itr 2021.2022Document1 pageItr 2021.2022MoghAKaranNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedsaisindhuNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- 2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFDocument1 page2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFmaxNo ratings yet

- PDF 147397690310723Document1 pagePDF 147397690310723Rashi SrivastavaNo ratings yet

- Math Summative TestDocument4 pagesMath Summative TestBryan QuiboNo ratings yet

- Non Filing Letter Sample Templates Updated 11.09.2020Document2 pagesNon Filing Letter Sample Templates Updated 11.09.2020SophieNo ratings yet

- TATA 1mg Healthcare Solutions Private Limited: Barmer, Barmer, 344702, INDocument1 pageTATA 1mg Healthcare Solutions Private Limited: Barmer, Barmer, 344702, INNehru LalNo ratings yet

- Au Tax Refund Tut Part 1 - ProfxDocument22 pagesAu Tax Refund Tut Part 1 - Profxryanrburton09No ratings yet

- Humidifier InvoiceDocument2 pagesHumidifier InvoicebhagatnairitaNo ratings yet

- Double Tax Avoidance Treaty: Presented By: Syed Husain Akbar Sunny Sharma Mrinal Jain Dushyant PoswalDocument16 pagesDouble Tax Avoidance Treaty: Presented By: Syed Husain Akbar Sunny Sharma Mrinal Jain Dushyant Poswalsyedakbar89No ratings yet

- FAR04-13 - Income TaxesDocument6 pagesFAR04-13 - Income TaxesAi NatangcopNo ratings yet

- Basic Terms MCQDocument40 pagesBasic Terms MCQSarvar PathanNo ratings yet

- 084 CIR v. Citytrust (Potian)Document3 pages084 CIR v. Citytrust (Potian)Erika Potian100% (1)

- Guideline in The Transfer of Titles of Real PropertyDocument4 pagesGuideline in The Transfer of Titles of Real PropertyLeolaida AragonNo ratings yet

- Chapter 6 Exclusions From Gross Income PDFDocument12 pagesChapter 6 Exclusions From Gross Income PDFkimberly tenebroNo ratings yet

- TS IT FY 2023-24 Full Version 1.0Document16 pagesTS IT FY 2023-24 Full Version 1.0varshithvarma051No ratings yet

- Answers To Concepts Review and Critical Thinking Questions 1Document7 pagesAnswers To Concepts Review and Critical Thinking Questions 1Waheed BalochNo ratings yet

- GST PresentationDocument66 pagesGST PresentationkapuNo ratings yet

- CPDprogram ACCOUNTANCY-101518 PDFDocument610 pagesCPDprogram ACCOUNTANCY-101518 PDFPRC BoardNo ratings yet

- 2013 - Form 990Document30 pages2013 - Form 990Fred MednickNo ratings yet

- Prentice Halls Federal Taxation 2015 Corporations Partnerships Estates and Trusts 28th Edition Pope Solutions ManualDocument44 pagesPrentice Halls Federal Taxation 2015 Corporations Partnerships Estates and Trusts 28th Edition Pope Solutions Manualkarinawarrenpkmgsxdfrc100% (32)

- Rohm Apollo Semiconductor Phil Vs CirDocument3 pagesRohm Apollo Semiconductor Phil Vs CirHoven MacasinagNo ratings yet

- 5 Mushak 6.3Document1 page5 Mushak 6.3MD Hasan Ali AliNo ratings yet

- Total Amount PayableDocument3 pagesTotal Amount PayableAMIT0% (1)

- Metropolitan Zoo: No. of Dependents Hourly Wage Hours Worked Overtime Pay Federal Withholding TaxDocument1 pageMetropolitan Zoo: No. of Dependents Hourly Wage Hours Worked Overtime Pay Federal Withholding TaxalmaNo ratings yet

- Chapter 7 Equilibrium Input and OutputDocument40 pagesChapter 7 Equilibrium Input and OutputhakkudadaNo ratings yet

- GST SettlementDocument32 pagesGST SettlementSrinivas KovvurNo ratings yet

- Olive Inc A Canadian Company Whose Functional Currency Is Canadian PDFDocument1 pageOlive Inc A Canadian Company Whose Functional Currency Is Canadian PDFTaimour HassanNo ratings yet

- Endterm FinmaDocument10 pagesEndterm FinmaMarian Augelio PolancoNo ratings yet

- Invoice - HeadsetDocument1 pageInvoice - Headsetjyotsna jhaNo ratings yet

- Document 12Document1 pageDocument 12selbal0% (1)

- SRW2223 B1 00086Document1 pageSRW2223 B1 00086Anthony Mathew S ANo ratings yet

- QTG Inv Ae 2022 020117Document2 pagesQTG Inv Ae 2022 020117İnsömnia ÇöğNo ratings yet