Professional Documents

Culture Documents

Islamic Finance

Uploaded by

Siti AsyiqinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Islamic Finance

Uploaded by

Siti AsyiqinCopyright:

Available Formats

In the name of Allah, the Most Gracious, and the Most Merciful.

Praise be to Allah , Peace be upon the

Prophet Muhammad, his family and companions, May Allah bless them with honour and graces.

The interest on Muamalat has been growing nowadays with the successful implementation and growth

of the Islamic financial industry. As we can see,Islamic finance has developed into a global

phenomenon. The industry has a globally diverse clientele and is attracting growing interest from global

players who are increasingly playing major roles in this industry. Islamic finance is considered as an

alternative to the conventional economic and financial system and is seen as the possible solution for

the current global financial crisis. The Islamic financial industry has emerged as a competitive

component of the financial system, along with the conventional financial system, in contributing

towards the country‟s economic development. Currently, Islamic financial Institutions promoting

comprehensive Islamic financial infrastructure and the success of integrating the Islamic finance into the

financial system contributes to a more progressive domestic financial intermediation process. Islamic

finance has been on the rise for many years across markets in Africa, the Middle East and Southeast

Asia. Islamic finance now facing a lot and new challenging.

Since I have been in the Islamic Finance filed, I like to do a lot of research related to digital banking and

finance. Nowadays, we can see a new digital cryptocurrency been used in the market. Without doubt,

cryptocurrencies seem to be the most visible albeit controversial example of fintech. This further

justifies the need to clarify the l Sharī‘ah issues pertaining to such fintech applications.

As a current job required me to Conduct Shariah research and process of retail’s products such Digital

Banking and that forcing me to go very deep in conducting research for such new product. Beside, I also

performing an assessment and review exercise over the company’s business, operation and activities to

Ensure the Shari'a compliance (as manifested by the guidelines and Fatawa issued by the Shari’a Board

on a day to day basis in all its business activities, operations and transactions (by reviewing the approval

of the contracts, agreements, policies, procedures, products, process flows, transactions, reports (profit

distribution calculations), etc.

Thus, my aim is to do new research to give benefit and solutions related to latest development and grow

in Islamic finance globally.

You might also like

- Accounting, Auditing and Governance for Takaful OperationsFrom EverandAccounting, Auditing and Governance for Takaful OperationsNo ratings yet

- Principles of Islamic Finance: New Issues and Steps ForwardFrom EverandPrinciples of Islamic Finance: New Issues and Steps ForwardNo ratings yet

- The Foundations of Islamic Economics and BankingFrom EverandThe Foundations of Islamic Economics and BankingNo ratings yet

- Fintech and Islamic Finance: Digitalization, Development and DisruptionFrom EverandFintech and Islamic Finance: Digitalization, Development and DisruptionNo ratings yet

- Islamic Finance in a Nutshell: A Guide for Non-SpecialistsFrom EverandIslamic Finance in a Nutshell: A Guide for Non-SpecialistsRating: 5 out of 5 stars5/5 (1)

- Shari'ah Non-compliance Risk Management and Legal Documentations in Islamic FinanceFrom EverandShari'ah Non-compliance Risk Management and Legal Documentations in Islamic FinanceNo ratings yet

- Intan Larasati 2A English For Syariah Banking Islamic Banking and Finance ContextDocument7 pagesIntan Larasati 2A English For Syariah Banking Islamic Banking and Finance ContextMauLana IqbalNo ratings yet

- Prospects and Problems of Shariah-Compliant Finance: Executive SummaryDocument8 pagesProspects and Problems of Shariah-Compliant Finance: Executive SummarysyedtahaaliNo ratings yet

- Darwis Abd Rasak, Mohd Azhar Abdul KarimDocument21 pagesDarwis Abd Rasak, Mohd Azhar Abdul KarimCk ThamNo ratings yet

- SSRN Id1370736Document17 pagesSSRN Id1370736Mohamed MustefaNo ratings yet

- Introduction To Islamic Capital MarketsDocument5 pagesIntroduction To Islamic Capital MarketsSon Go HanNo ratings yet

- Thesis On Islamic Banking in PakistanDocument7 pagesThesis On Islamic Banking in PakistanBuyResumePaperCanada100% (2)

- Development of Islamic Finance in Malaysia A Conceptual1594Document21 pagesDevelopment of Islamic Finance in Malaysia A Conceptual1594Mohd HapiziNo ratings yet

- Fr. Marvin IFM Chapter 1Document14 pagesFr. Marvin IFM Chapter 1vishalsingh9669No ratings yet

- School of Post Graduate Studies Nasarawa State University Keffi Faculty of Administration Department of AccountingDocument22 pagesSchool of Post Graduate Studies Nasarawa State University Keffi Faculty of Administration Department of AccountingAbdullahiNo ratings yet

- A Closer Look at Islamic Finance in Sri Lanka by MM - Published CIMA-UKDocument6 pagesA Closer Look at Islamic Finance in Sri Lanka by MM - Published CIMA-UKIrum SabaNo ratings yet

- Mastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1From EverandMastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1No ratings yet

- Ethical Discourse in Finance Interdisciplinary and Diverse Perspectives Marizah Minhat Full ChapterDocument51 pagesEthical Discourse in Finance Interdisciplinary and Diverse Perspectives Marizah Minhat Full Chapterjohn.massey988100% (8)

- Ethical Discourse in Finance Interdisciplinary and Diverse Perspectives Marizah Minhat Full ChapterDocument67 pagesEthical Discourse in Finance Interdisciplinary and Diverse Perspectives Marizah Minhat Full Chapterrose.kim993No ratings yet

- The Introduction of Islamic Finance in MalaysiaDocument2 pagesThe Introduction of Islamic Finance in Malaysiaafiffarhan2100% (1)

- Islamic Financial Institution Banking Activity TDocument21 pagesIslamic Financial Institution Banking Activity TNtinginya Iddi rajabuNo ratings yet

- Somaliland: Private Sector-Led Growth and Transformation StrategyFrom EverandSomaliland: Private Sector-Led Growth and Transformation StrategyNo ratings yet

- Recommendation IFMDocument9 pagesRecommendation IFMshnurmiera100% (1)

- An Empirical SurveyDocument26 pagesAn Empirical SurveyRafiqul IslamNo ratings yet

- Corporate Governance and Islamic FinanceDocument4 pagesCorporate Governance and Islamic Financehanyfotouh100% (2)

- Islamic Finance and FinTech in MENADocument2 pagesIslamic Finance and FinTech in MENAhanoun1987No ratings yet

- International Business University of MysoreDocument14 pagesInternational Business University of MysoreViraja Guru100% (4)

- Toward Inclusive Islamic Finance GIZDocument54 pagesToward Inclusive Islamic Finance GIZceoNo ratings yet

- IntroductionDocument21 pagesIntroductionmuhammad jaffarNo ratings yet

- Innovation Versus Replication Some Notes On The Approaches in Defining Shariah Compliance in Islamic FinanceDocument24 pagesInnovation Versus Replication Some Notes On The Approaches in Defining Shariah Compliance in Islamic Financebayu pratama putraNo ratings yet

- Islamic Finance Literature ReviewDocument4 pagesIslamic Finance Literature Reviewafdtwtdsa100% (1)

- Dr. Muhammad Ashraf Imran UsmaniDocument16 pagesDr. Muhammad Ashraf Imran UsmaniMohamedNo ratings yet

- Islamic Finance Dissertation PDFDocument7 pagesIslamic Finance Dissertation PDFBuyingPapersOnlineSingapore100% (1)

- Islamic FinanceDocument4 pagesIslamic Financebharatjha1732002No ratings yet

- An Empirical Survey of Individual Consumer, Business Firm and FinDocument23 pagesAn Empirical Survey of Individual Consumer, Business Firm and FinWabisa AsifNo ratings yet

- How to Open & Operate a Financially Successful Import Export BusinessFrom EverandHow to Open & Operate a Financially Successful Import Export BusinessRating: 4.5 out of 5 stars4.5/5 (4)

- New Hope Dawns in The Pearl of AsiaDocument2 pagesNew Hope Dawns in The Pearl of AsiaMuath MubarakNo ratings yet

- Critical Issues and Success Factors For TakafulDocument6 pagesCritical Issues and Success Factors For TakafulhatimabbasmNo ratings yet

- The Function of Islamic Finance and TheDocument14 pagesThe Function of Islamic Finance and TheSayed Sharif HashimiNo ratings yet

- The Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceFrom EverandThe Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceNo ratings yet

- The Awareness and Attitude Towards Islamic Banking A Study in MalaysiaDocument26 pagesThe Awareness and Attitude Towards Islamic Banking A Study in MalaysiaJenny YeeNo ratings yet

- Dissertation Islamic FinanceDocument8 pagesDissertation Islamic FinanceCollegePaperHelpCanada100% (1)

- Implementation of FintechDocument3 pagesImplementation of FintechMuskaan Kasliwal SP JainNo ratings yet

- Press Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalDocument2 pagesPress Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- "The Business and Money Blueprint: A Guide to Building Wealth and Success"From Everand"The Business and Money Blueprint: A Guide to Building Wealth and Success"No ratings yet

- Ramadan by Ahmad JibrilDocument26 pagesRamadan by Ahmad JibrilSharifNo ratings yet

- Dubai Security Guards Induction TrainingDocument75 pagesDubai Security Guards Induction TrainingALIM AHMED62% (13)

- Political and Legal Factors Affecting The Impact of International TradeDocument13 pagesPolitical and Legal Factors Affecting The Impact of International TradeDARIUS KIMINZA0% (1)

- Islamic Constitutional Law II: SL 2102Document13 pagesIslamic Constitutional Law II: SL 2102RANDAN SADIQ100% (1)

- Arbitration and CultureDocument419 pagesArbitration and CultureMiz09No ratings yet

- Islam 1Document6 pagesIslam 1arslan05No ratings yet

- The Obligation of Seeking Refuge From Four Things From Four Things - Shaikh Al-AlbaaniDocument6 pagesThe Obligation of Seeking Refuge From Four Things From Four Things - Shaikh Al-AlbaaniMountainofknowledgeNo ratings yet

- Surah Al IqlaasDocument21 pagesSurah Al Iqlaaslalu mikeyNo ratings yet

- Ja'far Al-Sadiq: Imams of Shi'a IslamDocument8 pagesJa'far Al-Sadiq: Imams of Shi'a IslamYusuf Al-ShurNo ratings yet

- Women's Traveling PDFDocument100 pagesWomen's Traveling PDFNazmus SaquibNo ratings yet

- Ramadhan: JournalDocument14 pagesRamadhan: JournalTediNo ratings yet

- Fasting Rules From Islamic Laws - Ayatullah Sayyid Ali Al-Hussaini As-Sistani (Seestani) - XKPDocument67 pagesFasting Rules From Islamic Laws - Ayatullah Sayyid Ali Al-Hussaini As-Sistani (Seestani) - XKPIslamicMobility100% (1)

- Practicum Report Writing Guidelines - EconomicsDocument76 pagesPracticum Report Writing Guidelines - Economicsnsn sabrinaNo ratings yet

- A Guide To Performing Your Salaah PDFDocument28 pagesA Guide To Performing Your Salaah PDFZakariyahNo ratings yet

- The Rebirth of IdeologyDocument5 pagesThe Rebirth of IdeologyLIU DANNo ratings yet

- Umrah LeafletDocument1 pageUmrah LeafletFaiz KhanNo ratings yet

- Islamiat, MCQs - HassaanDocument31 pagesIslamiat, MCQs - HassaanFouzia AzizNo ratings yet

- Analisis Kecurangan Dalam Takaran Dan Timbangan Oleh Pedagang Ditinjau Dari Fiqih Riba (Studi Kasus Di Pasar Bandar Kediri) Linda Khoirun Nisak, DKKDocument21 pagesAnalisis Kecurangan Dalam Takaran Dan Timbangan Oleh Pedagang Ditinjau Dari Fiqih Riba (Studi Kasus Di Pasar Bandar Kediri) Linda Khoirun Nisak, DKKFatihatut Dirosatin N.UNo ratings yet

- How To Perform Your Salah 2Document15 pagesHow To Perform Your Salah 2omarhamzajenvey100% (1)

- Fasting in Islam: Dr. Arafat El-Ashi (Director) Muslim World League Canada OfficeDocument11 pagesFasting in Islam: Dr. Arafat El-Ashi (Director) Muslim World League Canada OfficekeithNo ratings yet

- Fasting (Sawm) 10 Mark AnswersDocument8 pagesFasting (Sawm) 10 Mark AnswersNabeel AzizNo ratings yet

- Dua After Sal atDocument26 pagesDua After Sal atMohd AzeemNo ratings yet

- Custom and Muslim Law in British IndiaDocument31 pagesCustom and Muslim Law in British IndiaSamdarsh NirankariNo ratings yet

- 2019 Duplicate Syllabus of AlimDocument3 pages2019 Duplicate Syllabus of AlimYounus AzizNo ratings yet

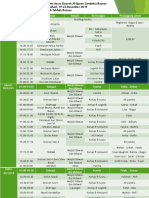

- Rundown Acara Dauroh Quran Cendekia BAZNASDocument4 pagesRundown Acara Dauroh Quran Cendekia BAZNASzabe251100% (1)

- Text, Body and Law Naked Prayer in The Commentaries of The Mukhta Ar Khalīl (Matthew Steele, 2017, Journal MENA) PUBLISHEDDocument18 pagesText, Body and Law Naked Prayer in The Commentaries of The Mukhta Ar Khalīl (Matthew Steele, 2017, Journal MENA) PUBLISHEDmsteele242185No ratings yet

- Al-Hawi Al-Kabir - Al-Imam Al-Mawardi - 20 of 26Document358 pagesAl-Hawi Al-Kabir - Al-Imam Al-Mawardi - 20 of 26papa_terakhir100% (1)

- The Closing Supplication - Dua Khatm Al-Qur'anDocument3 pagesThe Closing Supplication - Dua Khatm Al-Qur'anE-Tilawah AcademyNo ratings yet

- Penyewaan (Ijarat Al-Waqf) Tanah Wakaf Menurut Fuqaha Dan Praktis Majlis Agama Islam Dan Adat Melayu Terengganu (MAIDAM)Document18 pagesPenyewaan (Ijarat Al-Waqf) Tanah Wakaf Menurut Fuqaha Dan Praktis Majlis Agama Islam Dan Adat Melayu Terengganu (MAIDAM)FOURTH AINA100% (1)