Professional Documents

Culture Documents

SP2 Sep 2023 Q4

Uploaded by

Shruti GoelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SP2 Sep 2023 Q4

Uploaded by

Shruti GoelCopyright:

Available Formats

SP2

#3.

Change in assumptions with paid-up option:

1. Assumption for the option take – up rate will need to be determined.

2. Additional administrative expenses relating to the option will be added during the pricing.

3. Total expense assumption would be expected to be higher.

4. Lapse rates should be fall, since the paid-up option will provide the policyholders to cease

the premium payment and still receive benefit.

5. However, the impact on assumption for lapse would depend on the difference in the

benefits between the surrender value & paid-up option.

6. If the paid up provides higher benefit then lapse rates would reduce else, lapse rates would

increase if surrender benefit is in the money for the policyholder.

7. Impact on mortality assumption for people exercising the option.

8. Impact on mortality assumption for people not exercising the option and continuing the

policy as usual.

9. Interest rate assumption may change if the paid-up option alters the investment strategy

then discount rate used in prospecitive pricing would be impacted.

10. Company may also wish to adjust the profit margin with the addition of the paid-up option.

11. Any regulatory implications relating to paid-up policies will need to be complied with, hence

adjusting the pricing assumptions.

12. Impact on investment return? Since this is a without profits product, impact on investment

return assumption should be minimal.

13. Tax assumption may vary with respect to paid up policies and should be considered during

the pricing.

14. Reserving assumption will be updated for the policies with paid-up option and that would

impact the capital & solvency requirements. Hence, there would be an overall impact on the

reserves at company level.

15. If the policyholders deem this product to be beneficial with increased value then the

volumne of new business will be higher and there might be a change in the new business

mix.

#4.

Data anomalies that could be highlighted under each check:

1. First life age

The value of the first life age could be extreme values such as significant higher or lower age.

Policyholder age range would be expected to around the standard retirement age of 60.

Any outlier value would be highlighted.

This would highlight any data related error.

2. First life vs Second life age

For joint life policies, the ages for both lives should be aligned.

For example, spouses age would usually be expected to be within 5 – 10 years age gap.

Significant discrepancy may indicate data error or errors in underwriting.

3. Second Life annuity percentage

Any data point with extremely high or low annuity percentage would be highlighted that

could be due to data entry issue or data error.

High percentage would indicate unusual amount being paid to the policyholder that should

be checked and verified.

4. Original premium divided by annual annuitant amount

If original premium is out of proportion to annual annuitant amount, then that may help in

identifying the errors related to policy information or data issues.

The ratio should be well within an acceptable range.

5. Current annuity amount vs original annuity amount for policies with indexation

For indexed policies, annuity amount should increased based on the inflation index. If the

ratio isn’t aligned with increasing expectation then it may indicate possible issues with the

underlying policies.

With these checks, companies can identify potential frauds or systematic errors in the data

recording. Further investigation should be carried out for each of the data errors.

You might also like

- ActEd - Actuarial Practice Subject CP1 CMP 2019Document1,492 pagesActEd - Actuarial Practice Subject CP1 CMP 2019Mudit Chhabra50% (2)

- Life Insurance Specialist Principles Subject SP2 CMP 2019 - BPP ActEd PDFDocument1,120 pagesLife Insurance Specialist Principles Subject SP2 CMP 2019 - BPP ActEd PDFAakash Sharma0% (1)

- FPL Group Dividend Policy AnalysisDocument3 pagesFPL Group Dividend Policy AnalysisGovert Wessels100% (1)

- Case 3-1 Southwest AirlinesDocument2 pagesCase 3-1 Southwest AirlinesDebby Febriany86% (7)

- Minimizing Contracting Costs Under PATDocument4 pagesMinimizing Contracting Costs Under PATKrithika NaiduNo ratings yet

- Discuss The Relevance of Dividend Policy in Financial Decision MakingDocument6 pagesDiscuss The Relevance of Dividend Policy in Financial Decision MakingMichael NyamutambweNo ratings yet

- Chapter I AnswersDocument2 pagesChapter I AnswersBeverly Exaure100% (9)

- Britannia Field ReportDocument6 pagesBritannia Field Reportdaul93No ratings yet

- A Clean, Well-Lighted Place EssayDocument7 pagesA Clean, Well-Lighted Place EssayAdrianNo ratings yet

- SP2 2023Document13 pagesSP2 2023Shruti GoelNo ratings yet

- Transactions of Society of Actuaries 1985 VOL. 37: A. AdvantagesDocument42 pagesTransactions of Society of Actuaries 1985 VOL. 37: A. AdvantagesVladimir MonteroNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyToufiq AmanNo ratings yet

- Valuations 1Document26 pagesValuations 1nsnhemachenaNo ratings yet

- How Do Life Settlements Compare With Other Investments?Document5 pagesHow Do Life Settlements Compare With Other Investments?anonymouswhistleblowerNo ratings yet

- Payout Policy: Suggested Answer To Opener-in-Review QuestionDocument15 pagesPayout Policy: Suggested Answer To Opener-in-Review QuestionChoudhry TradersNo ratings yet

- 4.dividend DecisionsDocument5 pages4.dividend DecisionskingrajpkvNo ratings yet

- Dividend Theories and Empirical Evidence ExplainedDocument11 pagesDividend Theories and Empirical Evidence ExplainedAamir KhanNo ratings yet

- Uts Teori AkuntansiDocument6 pagesUts Teori AkuntansiARYA AZHARI -No ratings yet

- Review Q's Chap 14Document3 pagesReview Q's Chap 14Katrina PaquizNo ratings yet

- Whatever Dividend Policy A Company AdoptsDocument4 pagesWhatever Dividend Policy A Company Adoptsrobhanson90No ratings yet

- Chapter No. 10 Â " Dividend PolicyDocument9 pagesChapter No. 10 Â " Dividend PolicyToaster97No ratings yet

- FinmanDocument7 pagesFinmanNHEMIA ELEVENCIONADONo ratings yet

- Faq - Life Insurance Industry Revising Caps On Par PiDocument4 pagesFaq - Life Insurance Industry Revising Caps On Par PiHaNo ratings yet

- Research Paper On Determinants of Dividend PolicyDocument5 pagesResearch Paper On Determinants of Dividend Policyea1yw8dxNo ratings yet

- Dividend Policy and Earnings Management Decision GuideDocument8 pagesDividend Policy and Earnings Management Decision GuideNtege SimonNo ratings yet

- Dividend Policy AfmDocument10 pagesDividend Policy AfmPooja NagNo ratings yet

- MODULE_5_-_Issues_in_Valuing_Financial_Service_FirmsDocument3 pagesMODULE_5_-_Issues_in_Valuing_Financial_Service_Firmschristian garciaNo ratings yet

- Group Assignment 4 Earning ManagementDocument6 pagesGroup Assignment 4 Earning Managementcikyayaanosu0% (1)

- Freetrade SIPP Key Features DocumentDocument1 pageFreetrade SIPP Key Features DocumentssNo ratings yet

- Dividend Policy - Unit 4 Factors Affecting Dividend Policy of A Firm, Business and Company: External and Internal FactorsDocument4 pagesDividend Policy - Unit 4 Factors Affecting Dividend Policy of A Firm, Business and Company: External and Internal FactorsHimanshuNo ratings yet

- Ahmed Elsayad Finance Q + A's 2008 To August 2017Document20 pagesAhmed Elsayad Finance Q + A's 2008 To August 2017MoatasemMadianNo ratings yet

- ACC 225 Principles of Accounting I Module 5 Assignment ANSWERSDocument8 pagesACC 225 Principles of Accounting I Module 5 Assignment ANSWERSNdirangu DennisNo ratings yet

- ICICI Pru Assure WealthDocument2 pagesICICI Pru Assure WealthPavan Kumar RanguduNo ratings yet

- Must Ask Questions: Before Renewing Your PlanDocument3 pagesMust Ask Questions: Before Renewing Your PlanVicente TorresNo ratings yet

- Mock Exam September 2020 Attempt AFM - AnswerDocument6 pagesMock Exam September 2020 Attempt AFM - AnswerKubNo ratings yet

- Seminar 7 Suggested Solutions - BUS 421 D200Document11 pagesSeminar 7 Suggested Solutions - BUS 421 D200Dylan DeferNo ratings yet

- Dividend Policies and DecisionsDocument19 pagesDividend Policies and Decisionsdushime delphineNo ratings yet

- DividendsPolicy 23Document20 pagesDividendsPolicy 23haymanotandualem2015No ratings yet

- WP Insight HCR Impact On Rewards StrategiesDocument4 pagesWP Insight HCR Impact On Rewards StrategiesGeorge B. BuckNo ratings yet

- FSA&V Case StudyDocument10 pagesFSA&V Case StudyAl Qur'anNo ratings yet

- MM Dividend Irrelevancy Theory vs Practical InfluencesDocument5 pagesMM Dividend Irrelevancy Theory vs Practical InfluencesTaimoor AtifNo ratings yet

- Tutorial in Week 11 (Based On Week 10 Lecture) Beginning 14 May 2018 TOPIC: Executive Compensation Solutions Q1 AttachedDocument5 pagesTutorial in Week 11 (Based On Week 10 Lecture) Beginning 14 May 2018 TOPIC: Executive Compensation Solutions Q1 AttachedhabibNo ratings yet

- Chapter 05 - AnswerDocument28 pagesChapter 05 - AnswerRobles MarkNo ratings yet

- IandF ST2 201604 ExaminersReportDocument14 pagesIandF ST2 201604 ExaminersReportz_k_j_vNo ratings yet

- Interindustry Dividend Policy Determinants in The Context of An Emerging MarketDocument6 pagesInterindustry Dividend Policy Determinants in The Context of An Emerging MarketChaudhary AliNo ratings yet

- Earning Management Group AssignmentDocument7 pagesEarning Management Group AssignmentcikyayaanosuNo ratings yet

- Chapter 6: The Measurement Perspective On Decision UsefulnessDocument15 pagesChapter 6: The Measurement Perspective On Decision UsefulnessPujangga AbdillahNo ratings yet

- Insurance AccountingDocument34 pagesInsurance Accountingrcpgeneral100% (1)

- Dividend Policy": Term Paper - I On Corporate Financial ManagementDocument10 pagesDividend Policy": Term Paper - I On Corporate Financial ManagementbodhikolNo ratings yet

- Chapter 15Document11 pagesChapter 15arwa_mukadam03100% (1)

- Dividend Decision ExplainedDocument8 pagesDividend Decision ExplainedVishal TanwarNo ratings yet

- Dividend Policy: Answers To QuestionsDocument10 pagesDividend Policy: Answers To QuestionsLee JNo ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- Dividend policies and determinants explainedDocument2 pagesDividend policies and determinants explainedTafakhar HasnainNo ratings yet

- Chapter 14-1Document73 pagesChapter 14-1Naeemullah baigNo ratings yet

- Fin 4050 Term PaperDocument11 pagesFin 4050 Term PaperMark D. KaniaruNo ratings yet

- Southeastern Steel Company Dividend Policy Financial ManagementDocument24 pagesSoutheastern Steel Company Dividend Policy Financial ManagementJobiCosmeNo ratings yet

- Background On DividendsDocument3 pagesBackground On DividendsGustafaGovachefMotivati0% (1)

- FMA - Tute 10 - Dividend PolicyDocument3 pagesFMA - Tute 10 - Dividend PolicyPhuong VuongNo ratings yet

- Price - Cap and Revenu CapDocument19 pagesPrice - Cap and Revenu CapCarlitos IvanNo ratings yet

- CH 20 Designing Capital StructureDocument21 pagesCH 20 Designing Capital StructureN-aineel DesaiNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- Life Primer (Tables)Document53 pagesLife Primer (Tables)Shruti GoelNo ratings yet

- Communication GuideDocument2 pagesCommunication GuideShruti GoelNo ratings yet

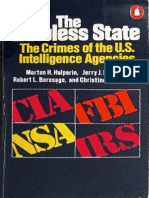

- Excerpts From The Book 'The Lawless State (The Crimes of The U.S. Intelligence Agencies) ' by Morton H. Halperin, Jerry Berman, Robert Borosage, Christine Marwick (1976)Document50 pagesExcerpts From The Book 'The Lawless State (The Crimes of The U.S. Intelligence Agencies) ' by Morton H. Halperin, Jerry Berman, Robert Borosage, Christine Marwick (1976)Anonymous yu09qxYCM100% (1)

- Pilkington case study external environment and internal analysisDocument2 pagesPilkington case study external environment and internal analysisUmair AliNo ratings yet

- Nursing Republic Acts PhilippinesDocument1 pageNursing Republic Acts PhilippinesRaisah Bint AbdullahNo ratings yet

- H900XP Study Guide R1.1Document28 pagesH900XP Study Guide R1.1Leandro Aquino Dos Santos100% (1)

- AAPP: Information Release: Nyi Nyi Aung Is Banned Family VisitDocument1 pageAAPP: Information Release: Nyi Nyi Aung Is Banned Family VisitBurma PartnershipNo ratings yet

- The World of Middle Kingdom Egypt (2000-1550 BC) : Contributions On Archaeology, Art, Religion, and Written SourcesDocument44 pagesThe World of Middle Kingdom Egypt (2000-1550 BC) : Contributions On Archaeology, Art, Religion, and Written Sourcesmai refaatNo ratings yet

- Plato Girls PDFDocument30 pagesPlato Girls PDFJohn Reigh CatipayNo ratings yet

- English Week Online for Fun and ProficiencyDocument1 pageEnglish Week Online for Fun and ProficiencypuspagobiNo ratings yet

- Government of Punjab: Walk in InterviewDocument7 pagesGovernment of Punjab: Walk in InterviewJeshiNo ratings yet

- Ge 2 - Purposive Communication: 1st Exam Mechanics & GuidelinesDocument8 pagesGe 2 - Purposive Communication: 1st Exam Mechanics & GuidelinesCarl Monte de RamosNo ratings yet

- Pahlavi Yasna and Visprad (E. B. N. Dhabhar) - TextDocument597 pagesPahlavi Yasna and Visprad (E. B. N. Dhabhar) - TextLalaylaNo ratings yet

- Introduction To The Civil Law SystemDocument2 pagesIntroduction To The Civil Law Systemlauren cNo ratings yet

- Assignment 2nd Evening Fall 2021Document2 pagesAssignment 2nd Evening Fall 2021Syeda LaibaNo ratings yet

- Contract Law For IP Lawyers: Mark Anderson, Lisa Allebone and Mario SubramaniamDocument14 pagesContract Law For IP Lawyers: Mark Anderson, Lisa Allebone and Mario SubramaniamJahn MehtaNo ratings yet

- Tfii'Llbiupptnes I Upreme Court:Fflanila: L/Epubltt ofDocument21 pagesTfii'Llbiupptnes I Upreme Court:Fflanila: L/Epubltt ofJanMikhailPanerioNo ratings yet

- BW OTSurveypt24Document32 pagesBW OTSurveypt24Luis MelendezNo ratings yet

- Address of Michael C. Ruppert For The Commonwealth Club - San Francisco Tuesday August 31, 2004Document54 pagesAddress of Michael C. Ruppert For The Commonwealth Club - San Francisco Tuesday August 31, 2004Emiliano Javier Vega LopezNo ratings yet

- Common NounDocument2 pagesCommon Nounapi-341286046100% (1)

- BibliographyDocument8 pagesBibliographyVysakh PaikkattuNo ratings yet

- Taxco Cathedral and Perugia - Two Pieces for GuitarDocument1 pageTaxco Cathedral and Perugia - Two Pieces for GuitarcapaustralNo ratings yet

- Providing Safe Water Purification Units to Schools and Communities in Dar es SalaamDocument19 pagesProviding Safe Water Purification Units to Schools and Communities in Dar es SalaamJerryemCSM100% (1)

- RTI IndonesiaDocument2 pagesRTI IndonesiaReza MappangaraNo ratings yet

- Contemporary Philippine Arts From The Region: 3 Quarter, 2Document10 pagesContemporary Philippine Arts From The Region: 3 Quarter, 2BEBERLIE GALOSNo ratings yet

- School Kills Curiosity and Promotes Bad BehaviorDocument2 pagesSchool Kills Curiosity and Promotes Bad BehaviorThư AnhNo ratings yet

- Intra-corporate Controversy DismissalDocument125 pagesIntra-corporate Controversy DismissalPearl Angeli Quisido CanadaNo ratings yet

- MKT 460 CH 1 Seh Defining Marketing For The 21st CenturyDocument56 pagesMKT 460 CH 1 Seh Defining Marketing For The 21st CenturyRifat ChowdhuryNo ratings yet

- Chakor Park DPR - 30-05-17 PDFDocument49 pagesChakor Park DPR - 30-05-17 PDFGoWaterParkNo ratings yet