Professional Documents

Culture Documents

(A) (B) (C) (D) Year

Uploaded by

Gonçalo AlmeidaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(A) (B) (C) (D) Year

Uploaded by

Gonçalo AlmeidaCopyright:

Available Formats

(a) (b) (c) (d)

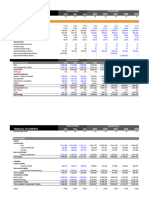

Depreciation Accumulated Residual

Year Starting Value

20% Depreciation Value

20% (a)-(b)

1 200,000 40,000 40,000 160,000

2 160,000 32,000 72,000 128,000

3 128,000 25,600 97,600 102,400

4 102,400 20,480 118,080 81,920

5 81,920 81,920 200,000 0

Variable

Sales Revenues Fixed Costs Dep. 20% EBT

Costs

20,556 25 5 350,000

0

1 20,556 513,910 102,782 350,000 40,000 21,128

2 20,556 513,910 102,782 350,000 32,000 29,128

3 20,556 513,910 102,782 350,000 25,600 35,528

4 20,556 513,910 102,782 350,000 20,480 40,648

5 20,556 513,910 102,782 350,000 81,920 -20,792

Net income Depreciation OCF Investment Net Cash flow PV Cash flow

0 -200,000 -200,000 -200,000

1 15,846 40,000 55,846 55,846 49,862

2 21,846 32,000 53,846 53,846 42,926

3 26,646 25,600 52,246 52,246 37,188

4 30,486 20,480 50,966 50,966 32,390

5 -15,594 81,920 66,326 66,326 37,635

NPV 0

Tax Net Income

25%

5,282 15,846

7,282 21,846

8,882 26,646

10,162 30,486

-5,198 -15,594

12%

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Coretech Excel - XLSX UpdatedDocument8 pagesCoretech Excel - XLSX UpdatedtahjinNo ratings yet

- (A) (B) (C) (D) Year 1 2 3 4 5Document8 pages(A) (B) (C) (D) Year 1 2 3 4 5Gonçalo AlmeidaNo ratings yet

- BoschDocument6 pagesBoschAdarsh ChavelNo ratings yet

- Project Payback & IRR AnalysisDocument5 pagesProject Payback & IRR AnalysisYashwini KomagenNo ratings yet

- Project Report 5Document27 pagesProject Report 5adwait kulkarniNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- Depreciation For ClassDocument23 pagesDepreciation For ClasscheeriosNo ratings yet

- Spicy Malunggay CookiesDocument19 pagesSpicy Malunggay CookiesChristine Margoux SiriosNo ratings yet

- Sukanya-Samriddhi-Account-Excel-calculator-downloadDocument3 pagesSukanya-Samriddhi-Account-Excel-calculator-downloadTisha AroraNo ratings yet

- Modelliing SheetDocument2 pagesModelliing Sheetpriyansharya4No ratings yet

- Diamond Energy Resources StudentDocument2 pagesDiamond Energy Resources StudentDonny BuiNo ratings yet

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelThanh NguyenNo ratings yet

- INR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.0Document7 pagesINR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.057 - Lakshita TanwaniNo ratings yet

- Fin 643 CasesDocument23 pagesFin 643 CasesMashfequl EhsanNo ratings yet

- Britannia 1Document40 pagesBritannia 1Dipesh GuptaNo ratings yet

- Demo Financial PlanDocument30 pagesDemo Financial PlanLinh Nguyễn Hoàng TúNo ratings yet

- IFS Dividends IntroductionDocument2 pagesIFS Dividends IntroductionMohamedNo ratings yet

- Main Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleDocument12 pagesMain Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleHussain ImranNo ratings yet

- Worksheet MerchandisingDocument6 pagesWorksheet MerchandisingLyca Mae CubangbangNo ratings yet

- Bajaj Finserv ReportDocument6 pagesBajaj Finserv ReportAdarsh ChavelNo ratings yet

- DCF Practice ProblemDocument4 pagesDCF Practice Problemshairel-joy marayagNo ratings yet

- Historical revenue forecast and advertising trendsDocument10 pagesHistorical revenue forecast and advertising trendsCherie Soriano AnanayoNo ratings yet

- NPV IrrDocument2 pagesNPV IrrchandanNo ratings yet

- Kid'S Bloom Projected Income Statement For The Year Ended December 31Document3 pagesKid'S Bloom Projected Income Statement For The Year Ended December 31Myrose De La PeñaNo ratings yet

- DCF Case Sample 1Document4 pagesDCF Case Sample 1Gaurav SethiNo ratings yet

- Assignment ..Document5 pagesAssignment ..Mohd Saddam Saqlaini100% (1)

- Providing Children Quality Education and Helping Them Choosing A Better FutureDocument4 pagesProviding Children Quality Education and Helping Them Choosing A Better FutureShubhamSoodNo ratings yet

- Net Present Value Practice Questions SolvedDocument6 pagesNet Present Value Practice Questions SolvedIshita KapadiaNo ratings yet

- Numeric Model MetricsDocument5 pagesNumeric Model MetricsAnkit NarulaNo ratings yet

- Trade Achievers To PublicDocument4 pagesTrade Achievers To Publictharun venkatNo ratings yet

- 3 Statements ModelDocument1 page3 Statements ModelOmar RuizNo ratings yet

- Building: Annual 2 0 2 1 / 2 2Document128 pagesBuilding: Annual 2 0 2 1 / 2 2TharushikaNo ratings yet

- CAPEX modelDocument8 pagesCAPEX modelgfraoterNo ratings yet

- Analyze investment project cash flows and valuationDocument4 pagesAnalyze investment project cash flows and valuationabeer alamNo ratings yet

- Less Clossing Stock (23,590) (15,360)Document2 pagesLess Clossing Stock (23,590) (15,360)Elvis CharendaNo ratings yet

- Cadiz-Jericho-E. Intacc2 320 Output1Document4 pagesCadiz-Jericho-E. Intacc2 320 Output1Kervin Rey JacksonNo ratings yet

- Production and consumption data for flower and coffeeDocument15 pagesProduction and consumption data for flower and coffeeAileen Mifranum IINo ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- Worksheet MerchandisingDocument3 pagesWorksheet MerchandisingLyca MaeNo ratings yet

- P and S Company consolidated financial statementsDocument2 pagesP and S Company consolidated financial statementsTasha MarieNo ratings yet

- Bantayan BountyDocument227 pagesBantayan BountybgelbolingoNo ratings yet

- The Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021Document11 pagesThe Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021ShivamNo ratings yet

- 03. DCF Model of a Venture , Exit ValueDocument2 pages03. DCF Model of a Venture , Exit Valueharshit.dwivedi320No ratings yet

- fmDocument6 pagesfmdikshapatil6789No ratings yet

- ENTI Ver 1Document72 pagesENTI Ver 1krishna chaitanyaNo ratings yet

- Class 7 - Comprehensive CaseDocument4 pagesClass 7 - Comprehensive CasePurple BeastNo ratings yet

- Monthly Profit & Loss Statement 2021 Vs 2022 Vs EXPDocument8 pagesMonthly Profit & Loss Statement 2021 Vs 2022 Vs EXPGarden View HotelNo ratings yet

- LBO TITLEDocument16 pagesLBO TITLEsingh0001No ratings yet

- Spread Sheet ModelingDocument9 pagesSpread Sheet ModelingAbhay BaraNo ratings yet

- Contoh Simple FCFFDocument5 pagesContoh Simple FCFFFANNY KRISTIANTINo ratings yet

- Case FileDocument4 pagesCase Fileabeer alamNo ratings yet

- ??? 2023 PDFDocument9 pages??? 2023 PDFnihalNo ratings yet

- Business - Valuation - Modeling - Assessment FileDocument6 pagesBusiness - Valuation - Modeling - Assessment FileGowtham VananNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Sample 4Document7 pagesSample 4Snehashis SahaNo ratings yet

- Solution ExercisesDocument7 pagesSolution Exercises280alexNo ratings yet

- DR Reddy LabsDocument6 pagesDR Reddy LabsAdarsh ChavelNo ratings yet

- Chapter 1Document18 pagesChapter 1Kenny WongNo ratings yet

- Perhitungan Materialitas: LiabilitiesDocument6 pagesPerhitungan Materialitas: LiabilitiesMaurizka ArdeaNo ratings yet

- 12 40Document10 pages12 40Gonçalo AlmeidaNo ratings yet

- Exercicios Do Capitulo 6 (Finanças Empresariais)Document2 pagesExercicios Do Capitulo 6 (Finanças Empresariais)Gonçalo AlmeidaNo ratings yet

- Exercicios Do Capitulo 4 (Finanças Empresariais)Document3 pagesExercicios Do Capitulo 4 (Finanças Empresariais)Gonçalo AlmeidaNo ratings yet

- Exercícios Capítulo 2 (II) - Demonstrações Financeiras e Fluxos de CaixaDocument3 pagesExercícios Capítulo 2 (II) - Demonstrações Financeiras e Fluxos de CaixaGonçalo AlmeidaNo ratings yet

- Information On RequisitesDocument1 pageInformation On Requisitesdina beniniNo ratings yet

- Fs SP 500 Shariah IndexDocument8 pagesFs SP 500 Shariah IndexJimot DLangapaNo ratings yet

- Foreign Income t1135Document6 pagesForeign Income t1135api-457375876No ratings yet

- Hakeem Ullah 0xutxhDocument5 pagesHakeem Ullah 0xutxhHakeem UllahNo ratings yet

- Annual Plan 2018-19 Highlights Growth Targets, CPEC ProgressDocument202 pagesAnnual Plan 2018-19 Highlights Growth Targets, CPEC ProgressTOOBABINTE ARIFNo ratings yet

- Case 11-1: Let There Be Light Lamp Shade CompanyDocument3 pagesCase 11-1: Let There Be Light Lamp Shade CompanySUKRON ARI YONONo ratings yet

- Yonas AtomsaDocument48 pagesYonas Atomsaberhanu seyoumNo ratings yet

- Case Study11Document5 pagesCase Study11Abdulaziz Saad Al BayatiNo ratings yet

- USD/PKR Forecast Blog Post Predicts Currency Rate RiseDocument79 pagesUSD/PKR Forecast Blog Post Predicts Currency Rate RiseSaira WaqasNo ratings yet

- Polymers of Styrene, in Primary FormsDocument1 pagePolymers of Styrene, in Primary FormslyesNo ratings yet

- Ican Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Document16 pagesIcan Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Sushant MaskeyNo ratings yet

- Managerial Accounting 1-4Document3 pagesManagerial Accounting 1-4Meliana WandaNo ratings yet

- Cash Disbursement JournalDocument1 pageCash Disbursement JournalRhea Mikylla ConchasNo ratings yet

- Agriculture MapDocument1 pageAgriculture MapAntonius SuhantoNo ratings yet

- CP-NS Merger AnalysisDocument12 pagesCP-NS Merger AnalysisPaul GhanimehNo ratings yet

- Introduction To Economics For WeeblyDocument21 pagesIntroduction To Economics For WeeblyDivergeNo ratings yet

- Vivekananda College,: Thakurpukur Kolkata-700063Document26 pagesVivekananda College,: Thakurpukur Kolkata-700063Paramartha BanerjeeNo ratings yet

- Strategy Execution - DiscussionDocument22 pagesStrategy Execution - DiscussionAayushya ChaturvediNo ratings yet

- 20% Rate Adjustment For Non-UP Contractual PersonnelDocument5 pages20% Rate Adjustment For Non-UP Contractual PersonnelKristine CruzNo ratings yet

- Project Management AgreementDocument6 pagesProject Management AgreementAHMADNo ratings yet

- Barangay Profile: Proposed Development in Brgy. San Isidro, Taytay RizalDocument3 pagesBarangay Profile: Proposed Development in Brgy. San Isidro, Taytay RizalAliana CondesNo ratings yet

- Tender Evaluation Example ReportDocument15 pagesTender Evaluation Example ReportNhial Panom PuotNo ratings yet

- Political Economy of International Trade Chapter - 5Document22 pagesPolitical Economy of International Trade Chapter - 5Suman BhandariNo ratings yet

- MATHS - 6 Chapter - 8 DecimalsDocument25 pagesMATHS - 6 Chapter - 8 DecimalsNirav GavitNo ratings yet

- 11.the Petty Cash Fund (Financial Accounting)Document1 page11.the Petty Cash Fund (Financial Accounting)Asjad JamshedNo ratings yet

- Notes On PrivatisationDocument64 pagesNotes On PrivatisationSwathi ShekarNo ratings yet

- Macroeconomics VII: Aggregate Supply: Gavin Cameron Lady Margaret HallDocument18 pagesMacroeconomics VII: Aggregate Supply: Gavin Cameron Lady Margaret HallTendai MatsikureNo ratings yet

- Strategic Management: Chapter Two Analyzing The External Environment of The FirmDocument30 pagesStrategic Management: Chapter Two Analyzing The External Environment of The Firmjubaida khanamNo ratings yet

- Effects of COVID-19 on Philippine Economy and IndustriesDocument4 pagesEffects of COVID-19 on Philippine Economy and IndustriesSheena SandovalNo ratings yet

- Full Download Fundamentals of Management 8th Edition Robbins Solutions ManualDocument35 pagesFull Download Fundamentals of Management 8th Edition Robbins Solutions Manualbloomaryonrush2qp6100% (22)