Professional Documents

Culture Documents

URA Factsheet

Uploaded by

Alex MilarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

URA Factsheet

Uploaded by

Alex MilarCopyright:

Available Formats

ETF Category: Commodities

URA

Global X Uranium ETF

As of 04/30/2023

REASONS TO CONSIDER KEY INFORMATION

Inception Date 11/04/2010(2)

Solactive Global Uranium &

Targeted Exposure

Underlying Index Nuclear Components Total

URA is a targeted play on uranium mining and the production of nuclear components.

Return Index

Number of Holdings 48

Assets Under Management $1,364.44 mil

Total Expense Ratio 0.69%

Distribution Frequency Semi-Annually

Emerging Energy Opportunity

Nuclear power emits zero direct emissions during operations.(1) As governments pledge to reduce

fossil fuel reliance, nuclear could be a viable bridge while more renewable capacity is built. TRADING DETAILS

Ticker URA

CUSIP 37954Y871

Exchange NYSE Arca

ETF Efficiency Bloomberg IOPV Ticker URAIV

In a single trade, URA delivers efficient access to a basket of companies involved in mining uranium Index Ticker SOLURANT

and producing nuclear components.

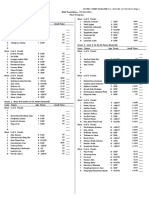

PERFORMANCE (%) TOP 10 HOLDINGS (%) Holdings Subject to Change

Since

1M YTD 1Y 3Y 5Y 10Y

Inception Cameco Corp 23.07% Uranium Energy Corp 3.30%

NAV 0.30% -0.50% -14.14% 26.67% 10.85% -2.54% -9.95% Sprott Physical 9.92% Denison Mines Corp 3.12%

Market Nac Kazatog-regs 6.12% Energy Fuels Inc 3.05%

0.35% -0.40% -13.07% 26.49% 10.82% -2.55% -9.97%

Price

Nexgen Energy Ltd 5.45% Yellow Cake Plc 3.01%

Hybrid

0.33% -0.33% -13.74% 27.62% 12.03% -1.69% -9.39% Paladin Energy Ltd 3.93% Itochu Corp 2.37%

Index(3)

The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an

investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. High short-

term performance, when observed, is unusual and investors should not expect such performance to be repeated. Returns for periods greater than one year are annualized.

Click here for standard performance as of the most recent quarter-end.

COUNTRY BREAKDOWN (%)

Canada 47.63%

South Korea 13.47%

Australia 13.11%

Kazakhstan 7.10%

United States 7.05%

Japan 5.12%

Britain 3.33%

South Africa 1.92%

Hong Kong 0.88%

Spain 0.39%

605 THIRD AVENUE 1 (888) 493-8631

43RD FLOOR GLOBALXETFS.COM

NEW YORK, NY 10158 @GLOBALXETFS

URA Global X Uranium ETF As of 04/30/2023

DEFINITIONS

Solactive Global Uranium & Nuclear The Solactive Global Uranium & Nuclear Components Total Return Index tracks the price movements in shares of companies which are (or

Components Total Return Index are expected to be in the near future) active in the uranium industry. This particularly includes uranium mining, exploration, uranium

investments and technologies related to the uranium industry. The Index will include a minimum of 20 components at every rebalancing.

(1) Energy Information Administration, Dec 2021

(2) The Fund’s investment objective and investment strategies changed effective May 01, 2018 and again on August 01, 2018.

(3) The Hybrid Solactive Uranium Index reflects the performance of the Solactive Global Uranium Total Return Index through April 30, 2018, the Solactive Global Uranium & Nuclear Components Transition TR Index through July 31, 2018 and the

Solactive Global Uranium & Nuclear Components Total Return Index going forward.

Investing involves risk, including the possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences

in generally accepted accounting principles, or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as

increased volatility and lower trading volume. Narrowly focused investments may be subject to higher volatility. There are additional risks associated with investing in Uranium and the

Uranium mining industry. URA is non-diversified. The information provided is not intended for trading purposes, and should not be considered investment advice.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Fund’s full or

summary prospectus, which may be obtained by calling 1.888.493.8631, or by visiting globalxetfs.com. Please read the prospectus carefully before investing.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Beginning October 15,

2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national

best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to October 15, 2020, market price returns were based on the midpoint between the Bid and Ask price.

NAVs are calculated using prices as of 4:00 PM Eastern Time. The returns shown do not represent the returns you would receive if you traded shares at other times. Indices are

unmanaged and do not include the effect of fees, expenses or sales charges. One cannot invest directly in an index.

Global X Management Company LLC serves as an advisor to the Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO, 1 Freedom Valley Drive, Oaks, PA,

19456), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments. Global X Funds are not sponsored, endorsed, issued, sold or promoted by

Solactive AG, nor does Solactive AG make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO, Global X nor Mirae Asset Global Investments

are affiliated with Solactive AG.

605 THIRD AVENUE 1 (888) 493-8631

43RD FLOOR GLOBALXETFS.COM

NEW YORK, NY 10158 @GLOBALXETFS

You might also like

- Renewable Power Generation Costs in 2020From EverandRenewable Power Generation Costs in 2020No ratings yet

- Fact Sheet-IXCDocument2 pagesFact Sheet-IXCTe-yu OuNo ratings yet

- Energy SPDR Fact SheetDocument4 pagesEnergy SPDR Fact Sheetjbyjw5g6jhNo ratings yet

- Medco Energi Public Expose Highlights Strong Financial and Operational PerformanceDocument66 pagesMedco Energi Public Expose Highlights Strong Financial and Operational Performancebrahm DuttNo ratings yet

- DSP World EnergyDocument12 pagesDSP World EnergyArmstrong CapitalNo ratings yet

- LIT FactsheetDocument2 pagesLIT FactsheetAlex MilarNo ratings yet

- PAK FactsheetDocument2 pagesPAK Factsheetfaisall.msqNo ratings yet

- Daily News 2012 11 13Document5 pagesDaily News 2012 11 13te_gantengNo ratings yet

- Barron 39 S 01 June 2020 PDFDocument80 pagesBarron 39 S 01 June 2020 PDFastarini EndahNo ratings yet

- Iaea CN 246 Ks 8 SekimuraDocument41 pagesIaea CN 246 Ks 8 SekimuragdsgNo ratings yet

- EPO IRENA Offshore Wind Patent Insight Report 2023Document59 pagesEPO IRENA Offshore Wind Patent Insight Report 2023altieric92No ratings yet

- Thai Solar Energy ProfileDocument27 pagesThai Solar Energy Profilemiguelrobertosales337No ratings yet

- SPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkDocument2 pagesSPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkmuaadhNo ratings yet

- JNUG Factsheet PDFDocument2 pagesJNUG Factsheet PDFCho CuteNo ratings yet

- Amwatch: Stock Focus of The DayDocument4 pagesAmwatch: Stock Focus of The DayBrian StanleyNo ratings yet

- Ishares Msci Global Gold Miners Etf: Fact Sheet As of 09/30/2021Document3 pagesIshares Msci Global Gold Miners Etf: Fact Sheet As of 09/30/2021Tuğçe Gazi Osman ÖzNo ratings yet

- Ishares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021Document3 pagesIshares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021hkm_gmat4849No ratings yet

- 21WXSCO13 fliLeZysDocument49 pages21WXSCO13 fliLeZysAbdoulaye DialloNo ratings yet

- Ind Nifty CommoditiesDocument2 pagesInd Nifty CommoditiesPrabhakar DalviNo ratings yet

- The Role of GOvernment To Develop Solar Energy Industry in Indonesia - Ministry of IndustryDocument18 pagesThe Role of GOvernment To Develop Solar Energy Industry in Indonesia - Ministry of IndustryBambangNo ratings yet

- Tanzania AnalysisReport BriquetteMarkets FinalDocument88 pagesTanzania AnalysisReport BriquetteMarkets FinalMartti Marttinen100% (1)

- Dangote CPPDocument161 pagesDangote CPPSarah Frazier100% (1)

- SMH Fact SheetDocument2 pagesSMH Fact Sheetwijeesf797No ratings yet

- Medco 8Document37 pagesMedco 8prima100% (1)

- APEX 2008 - S1P1 Lasse Holopainen Presentation - Philippines - WESMDocument29 pagesAPEX 2008 - S1P1 Lasse Holopainen Presentation - Philippines - WESMAlvin BosqueNo ratings yet

- 1Q11 Investors ' Update: PT Medco Energi Internasional TBKDocument32 pages1Q11 Investors ' Update: PT Medco Energi Internasional TBKprimaNo ratings yet

- ValuEngine Weekly Newsletter February 25, 2011Document11 pagesValuEngine Weekly Newsletter February 25, 2011ValuEngine.comNo ratings yet

- Mudajaya 20100809 CIMBDocument10 pagesMudajaya 20100809 CIMBlimml63No ratings yet

- Indices Other Stories:: FRI 23 DEC 2016Document3 pagesIndices Other Stories:: FRI 23 DEC 2016JajahinaNo ratings yet

- BGF World Technology Fund A2 USD - Fund Fact SheetDocument4 pagesBGF World Technology Fund A2 USD - Fund Fact SheetAmit KumarNo ratings yet

- Wa0007.Document19 pagesWa0007.Anu SinghNo ratings yet

- Nifty Low VolatilityDocument2 pagesNifty Low VolatilityRajesh KumarNo ratings yet

- Energy Opportunities 1Q 2022Document3 pagesEnergy Opportunities 1Q 2022ag rNo ratings yet

- The Build-Own-Operate (BOO) Approach: Advantages and ChallengesDocument21 pagesThe Build-Own-Operate (BOO) Approach: Advantages and Challengesai_sanzNo ratings yet

- Company DetailsDocument30 pagesCompany DetailssudehelyRNo ratings yet

- Sbi Life Pure Fund PerformanceDocument1 pageSbi Life Pure Fund PerformanceVishal Vijay SoniNo ratings yet

- Company HighlightsDocument16 pagesCompany HighlightsbelutpuakaNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument12 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter March 25, 2011Document11 pagesValuEngine Weekly Newsletter March 25, 2011ValuEngine.comNo ratings yet

- SBI-Small-and-Mid-Cap-Fund-Factsheet-Document1 pageSBI-Small-and-Mid-Cap-Fund-Factsheet-final bossuNo ratings yet

- Amundi Equity Global Disruptive Opportunities - UsdDocument2 pagesAmundi Equity Global Disruptive Opportunities - UsdEng Hau QuaNo ratings yet

- Ind Nifty MidSmallcap 400Document2 pagesInd Nifty MidSmallcap 400GovindarajanVaradachariNo ratings yet

- Nifty FactsheetDocument2 pagesNifty FactsheetTudou patelNo ratings yet

- Adani Energy Solutions Ltd - 12th March 2024_638458334042002673Document33 pagesAdani Energy Solutions Ltd - 12th March 2024_638458334042002673Haardik GandhiNo ratings yet

- Ind Nifty EnergyDocument2 pagesInd Nifty EnergyTHE OPTIONS DESKNo ratings yet

- Ind Nifty EnergyDocument2 pagesInd Nifty EnergySudarshan AgnihotriNo ratings yet

- CREM June 2020Document9 pagesCREM June 2020kamijou08No ratings yet

- Crem September 2020Document11 pagesCrem September 2020kamijou08No ratings yet

- Energy Efficiency Improvements for Syria's Cement SectorDocument161 pagesEnergy Efficiency Improvements for Syria's Cement SectorBenNo ratings yet

- Fpso Contractors Guidebook Caa 22 JanPSZ7VxSghsKSe4mjNbahRutM6ri124ahreJi1X7QDocument35 pagesFpso Contractors Guidebook Caa 22 JanPSZ7VxSghsKSe4mjNbahRutM6ri124ahreJi1X7Qart_5No ratings yet

- APCW TadipatriDocument25 pagesAPCW TadipatriChanna BasavaNo ratings yet

- Torrent Power 20190319 Mosl Ic Pg034Document34 pagesTorrent Power 20190319 Mosl Ic Pg034Poonam AggarwalNo ratings yet

- APAR IND. Ltd Initiating CoverageDocument16 pagesAPAR IND. Ltd Initiating CoverageDev PurohitNo ratings yet

- Ind Nifty MetalDocument2 pagesInd Nifty MetalNitin KumarNo ratings yet

- Northland Power Pitch: Impressive Growth and Stable Cash FlowsDocument9 pagesNorthland Power Pitch: Impressive Growth and Stable Cash Flows/jncjdncjdnNo ratings yet

- 1H08 Presentation: PT Medco Energi Internasional TBKDocument47 pages1H08 Presentation: PT Medco Energi Internasional TBKRachmat HidayatullahNo ratings yet

- Global Trends in Solar Power: July 2023Document56 pagesGlobal Trends in Solar Power: July 2023Samarth KhatorNo ratings yet

- Price Performance (Sep'20 100) : RationaleDocument6 pagesPrice Performance (Sep'20 100) : RationaleRUCHITANo ratings yet

- ADRO Financial Analysis - FBPDocument32 pagesADRO Financial Analysis - FBPFranklyn BerrisNo ratings yet

- Fpso Contractor GuidebookDocument25 pagesFpso Contractor GuidebookSashang BalaNo ratings yet

- Acr Aqualink PLB Usd465Document2 pagesAcr Aqualink PLB Usd465Alex MilarNo ratings yet

- HomePro - No.1 Home Improvement Center in ThailandDocument2 pagesHomePro - No.1 Home Improvement Center in ThailandAlex MilarNo ratings yet

- Abyc Standards For Fuel-System Hose ClampsDocument3 pagesAbyc Standards For Fuel-System Hose ClampsAlex MilarNo ratings yet

- Sea Trial ProgramDocument2 pagesSea Trial ProgramAlex MilarNo ratings yet

- TYR90 OrderbookDocument15 pagesTYR90 OrderbookAlex MilarNo ratings yet

- Nikonians FAQs - What TripodDocument3 pagesNikonians FAQs - What TripodAlex MilarNo ratings yet

- SIGMA Lens EnglishDocument13 pagesSIGMA Lens EnglishAlex MilarNo ratings yet

- Do Boats Go Faster in Cold Water - Boating ValleyDocument8 pagesDo Boats Go Faster in Cold Water - Boating ValleyAlex MilarNo ratings yet

- Sigma 70 300macroDocument2 pagesSigma 70 300macroAlex MilarNo ratings yet

- Nikonians FAQs - What TripodDocument3 pagesNikonians FAQs - What TripodAlex MilarNo ratings yet

- PE Coursework Guidelines BookletDocument200 pagesPE Coursework Guidelines BookletNambiNo ratings yet

- BISP Flying Fish Results for Butterfly EventsDocument14 pagesBISP Flying Fish Results for Butterfly EventsAlex MilarNo ratings yet

- Record BrokenDocument4 pagesRecord BrokenAlex MilarNo ratings yet

- Nikonians FAQs - What TripodDocument3 pagesNikonians FAQs - What TripodAlex MilarNo ratings yet

- Sessions ReportDocument2 pagesSessions ReportAlex MilarNo ratings yet

- BISP Flying Fish Meet ProgramDocument18 pagesBISP Flying Fish Meet ProgramAlex MilarNo ratings yet

- SDA Junior-Swimmer WebDocument23 pagesSDA Junior-Swimmer WebAlex MilarNo ratings yet

- Aba 012811Document12 pagesAba 012811doh22No ratings yet

- Ias 16Document48 pagesIas 16Khalid AzizNo ratings yet

- Keynesian Consumption and Investment PDFDocument17 pagesKeynesian Consumption and Investment PDFGayle AbayaNo ratings yet

- Founder Employment AgreementDocument7 pagesFounder Employment AgreementRichard HuaNo ratings yet

- SC-no-4-Vol-39 - 2015Document48 pagesSC-no-4-Vol-39 - 2015leua_690001837No ratings yet

- CT8 Pu 15Document18 pagesCT8 Pu 15Flarita ChatterjeeNo ratings yet

- Credit Card NumbersDocument3 pagesCredit Card NumbersAnonymous 4LxqXiX67% (3)

- Basic Everyday Journal Entries PDFDocument2 pagesBasic Everyday Journal Entries PDFsivasivasapNo ratings yet

- Transfer PricingDocument17 pagesTransfer PricingsharadkulloliNo ratings yet

- Fi32rk14 LR PDFDocument44 pagesFi32rk14 LR PDFGina JamesNo ratings yet

- Land Law AssignmentDocument7 pagesLand Law AssignmentMohd Irfan Rusyaidi ShahidanNo ratings yet

- JPIA 1st Tutorial Basic AccountingDocument6 pagesJPIA 1st Tutorial Basic AccountingZee SantisasNo ratings yet

- EVA Financial Management at Godrej Consumer Products LTDDocument28 pagesEVA Financial Management at Godrej Consumer Products LTDRahul SaraogiNo ratings yet

- Business English 2 Finance 2 Test SolutionsDocument6 pagesBusiness English 2 Finance 2 Test SolutionscvetanovicmarjanNo ratings yet

- Management Accounting SCDLDocument7 pagesManagement Accounting SCDLJeet Kathuria100% (1)

- Fa1 PilotDocument14 pagesFa1 PilotMuhammad Yousuf100% (3)

- Essay LUMSDocument3 pagesEssay LUMSIsfandyar JunaidNo ratings yet

- Bond Pricing Agency - MalaysiaDocument29 pagesBond Pricing Agency - MalaysiaBenett MomoryNo ratings yet

- 2013 Fall: Day R Thurs S Sat Time RoomDocument5 pages2013 Fall: Day R Thurs S Sat Time Roommail2raksNo ratings yet

- TCS Company HistoryDocument22 pagesTCS Company HistoryManiraj Vignesh RNo ratings yet

- Project Review & Administrative AspectsDocument7 pagesProject Review & Administrative AspectsPriyanka Gaur100% (1)

- Cebu Pacific Air SWOT AnalysisDocument2 pagesCebu Pacific Air SWOT AnalysisMark Lester Navarro90% (21)

- Constituents of The Financial System DD Intro NewDocument17 pagesConstituents of The Financial System DD Intro NewAnonymous bf1cFDuepPNo ratings yet

- Swot of Construction Chemical IndustryDocument13 pagesSwot of Construction Chemical IndustryAnant DhingraNo ratings yet

- Model Notes Fin StatDocument54 pagesModel Notes Fin StatSerban VasiliuNo ratings yet

- Decentralization and BureacratizationDocument23 pagesDecentralization and BureacratizationClare JavierNo ratings yet

- GBP USD PersonalityDocument13 pagesGBP USD PersonalityRieyz ZalNo ratings yet

- CPL StructureDocument42 pagesCPL StructureUma NNo ratings yet

- FDI in India Case Study WalmartDocument32 pagesFDI in India Case Study WalmartDhawal Khandelwal33% (3)

- Global Premium Hotels' FY 2012 Revenue Grew 13.2% Yoy To $60.2 MillionDocument4 pagesGlobal Premium Hotels' FY 2012 Revenue Grew 13.2% Yoy To $60.2 MillionphuawlNo ratings yet