Professional Documents

Culture Documents

FM 5

Uploaded by

gojo satoruCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM 5

Uploaded by

gojo satoruCopyright:

Available Formats

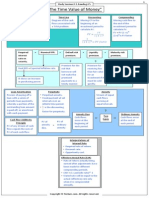

Chapter 5: ● Compound interest - interest earned on a given

deposit ad has become part of the principal at

❖ Time Value of Money - observation that it is better the end of a specified period

to receive money sooner than later

➢ Invest money now = earn positive rate of return ● Principal - amount of money on which interest is paid

= more money tomorrow FVn = PV0 x (1+r)n

➢ Money now is worth more than money in the

future FVn = future value r = annual rate of interest

❖ Timeline - horizontal line on which time zero PV0 = initial principal n= number of periods

approaches at the leftmost end and future periods

are marked from left to right ● Simple Interest - earned only on an investment’s

➢ Used to depict investment cash flows original principal and not on interest that

accumulated over time

➢ Compounding - future value technique to find ● Present value - value of today’s dollars of some future

future value of each cash flow at the end of cash flow

investment’s life and sum these values to find PV0 = FVn / (1+r)n

the future value

■ Adding interest to an investment’s ❖ Annuity - stream of equal periodic cash flow over a

principal and paying interest on the specified time period

new higher balance ➢ Can be inflows or outflows

➢ Discounting - technique to find the present ➢ Ordinary annuity - cash flow occurs at the

value at time zero and sums these value to find end of each period

the value today ➢ Annuity due - cash flow occurs at the

■ Used by investors to make investing beginning of each period

decisions

■ Inverse of compounding Future Value of an Ordinary Annuity:

❖ Computational Tools

➢ Financial Calculators - numerous

preprogrammed financial routines

➢ Electronic Spreadsheet - built-in routines that

Present Value of an Ordinary Annuity:

simplify time-value calculations

❖ Basic Pattern of Cash Flow

➢ Single amount - lump sum amount either

currently held or expected at some future date

➢ Annuity - level of periodic stream of cash flow

Future Value of an Annuity Due:

➢ Mixed-stream - not an annuity; stream of

unequal periodic cash flows that reflect no

particular pattern

SINGLE AMOUNTS: Present Value of an Annuity Due:

● Future value - value at some future date of

money you invest today

○ Terminal value, sum, the amount,

amount, accumulated amount

Always:

FV of Annuity Due > FV of Ordinary Annuity

PV of Annuity Due > Pv of Ordinary Annuity ● Effective (true) annual rate (EAR) - annual rate of

interest actually paid or earned

❖ Perpetuity - annuity with an infinite life, providing

continual annual cash flow

➢ PV0 = CF1 / r ● Annual percentage rate (APR) - nominal annual rate

➢ PV of a growing perpetuity: of interest, found by multiplying the periodic rate by

■ PV0 = CF1 / (r -g) the number of periods in one year, that must be

■ Applies only when discount rate is disclosed to consumers on credit cards and loans as

greater than the growth rate a result of “truth-in-lending laws”

■ If r ≤ g, cash flows grow so fast that PV ● Annual percentage yield (APY) - effective annual

= INFINITE rate of interest that must be disclosed to consumers

● r = interest rate; g = by banks on their savings products as a result of

growth rate “truth-in-savings laws”

❖ Mixed Stream - stream of unequal periodic cash SPECIAL APPLICATIONS OF TIME VALUE

flows that reflect no particular pattern

❖ FV of mixed stream - compute FV of each cash flow ● Determining deposits needed to accumulate a

at the specified FV and add all the individual FVs to future sum:

find the total FV

❖ PV of mixed stream - compute PV of each cash flow

and add all the individual PVs to find the total FV

COMPOUNDING INTEREST MORE FREQUENTLY THAN ● Loan amortization - determination of equal periodic

ANNUALLY loan payments necessary to provide a lender with a

specified interest return and to repay the loan

● Semiannual Compounding - compounding of interest principal over a specified period

over two periods within the year ● Loan amortization schedule - schedule of equal

● Quarterly Compounding - compounding of interest payments to repay a loan

over four periods within the year ○ Shows the allocation of each loan payment

to interest and principal

General Equation for Compounding:

To solve for payment:

● Continuous compounding - compounding of interest,

literally, all the time To solve for interest or growth rate:

○ Infinite number of times in a year

○ e=exponential function

To solve for the unknown number of periods:

● Nominal (stated) annual rate - contractual annual rate

of interest charged by a lender or promised by a

borrower

You might also like

- Time Value and MoneyDocument10 pagesTime Value and Moneymr haldarNo ratings yet

- Discounted Cash Flows and ValuationDocument31 pagesDiscounted Cash Flows and ValuationkamranNo ratings yet

- FINMAN II - Time Value of MoneyDocument3 pagesFINMAN II - Time Value of MoneyAnne LunaNo ratings yet

- Time Value of Money PracticeDocument11 pagesTime Value of Money PracticeUmer ArshadNo ratings yet

- Time Value of MoneyDocument44 pagesTime Value of MoneyJoenna Marie Morales0% (1)

- Finman TheoriesDocument4 pagesFinman TheoriesMoguriNo ratings yet

- Financial Management - Midterm NotesDocument7 pagesFinancial Management - Midterm NotesPrincess Ericka CastleNo ratings yet

- FIN202Document6 pagesFIN202Dang Ngoc Van (K17 DN)No ratings yet

- Time Value of Money (TVM)Document5 pagesTime Value of Money (TVM)Yesha Jade SaturiusNo ratings yet

- Gen. Math ReviewerFinalsDocument5 pagesGen. Math ReviewerFinalsCezter AbutinNo ratings yet

- Financial Management Lecture 2Document27 pagesFinancial Management Lecture 2Tesfaye ejetaNo ratings yet

- Time Value of MoneyDocument24 pagesTime Value of MoneyShashank100% (1)

- BCH 503 SM02Document4 pagesBCH 503 SM02sugandh bajajNo ratings yet

- Async CFin-I Annuities and Perpetuities Friday 5august2022Document35 pagesAsync CFin-I Annuities and Perpetuities Friday 5august2022SSNo ratings yet

- CH - 02 Concept of Value and ReturnDocument25 pagesCH - 02 Concept of Value and Returnpriyanshu jaiswalNo ratings yet

- Time Value of MoneyDocument23 pagesTime Value of Moneyhardika jadavNo ratings yet

- Chapter Three Time Value of MoneyDocument24 pagesChapter Three Time Value of MoneytezanaNo ratings yet

- CH - 02 Concept of Value and ReturnDocument25 pagesCH - 02 Concept of Value and ReturnMrhunt394 YTNo ratings yet

- Time Value OF MoneyDocument16 pagesTime Value OF MoneyKomal AgarwalNo ratings yet

- TOPIC 2 NOTES and LOANS PAYABLEDocument4 pagesTOPIC 2 NOTES and LOANS PAYABLEDustinEarth Buyo MontebonNo ratings yet

- NH l1sshbb 2los5Document1 pageNH l1sshbb 2los5Oliver SheringhamNo ratings yet

- 05 Fixed Income SecuritiesDocument55 pages05 Fixed Income SecuritiessukeshNo ratings yet

- The Time Value of Money: Mike Shaffer April 15, 2005Document23 pagesThe Time Value of Money: Mike Shaffer April 15, 2005Ritika SinghNo ratings yet

- Chapter 5: Introduction To Valuation: The Time Value of MoneyDocument5 pagesChapter 5: Introduction To Valuation: The Time Value of MoneyPhạm Hoàng Diệu VyNo ratings yet

- Time Value of MoneyDocument18 pagesTime Value of MoneyIIMnotesNo ratings yet

- Time Value of MoneyDocument42 pagesTime Value of MoneyCatalan MelodyNo ratings yet

- Time Value of MoneyDocument13 pagesTime Value of MoneyAulia EndiniNo ratings yet

- Unit-3 Time Value of MoneyDocument26 pagesUnit-3 Time Value of MoneySushil KharelNo ratings yet

- FE1 Chapter 4Document41 pagesFE1 Chapter 4Hùng PhanNo ratings yet

- Law On Partnership ReviewerDocument2 pagesLaw On Partnership ReviewerEMZy ChannelNo ratings yet

- Finance Reviewer: Time-Value of MoneyDocument1 pageFinance Reviewer: Time-Value of MoneyAngela ChuaNo ratings yet

- Topic 4 - TVMDocument30 pagesTopic 4 - TVMDeepika SinghNo ratings yet

- Chapter 4 Problem SetDocument3 pagesChapter 4 Problem SetNasir Ali RizviNo ratings yet

- CFA Prep Level 1: Session 1 - Ajinkya Bhat - Ankit BhargavaDocument15 pagesCFA Prep Level 1: Session 1 - Ajinkya Bhat - Ankit BhargavaPrakarsh Aren100% (1)

- AnnuitiesDocument6 pagesAnnuitiesFaith MagluyanNo ratings yet

- 2 Time Value of Money - StudDocument36 pages2 Time Value of Money - StudAshwamedhNo ratings yet

- The Time Value of MoneyDocument34 pagesThe Time Value of MoneykamranNo ratings yet

- TVMDocument38 pagesTVMbenjamin.labayenNo ratings yet

- Compounding and DiscountingDocument20 pagesCompounding and DiscountingShivansh Dwivedi100% (1)

- Time Value of Money: Topic 02Document5 pagesTime Value of Money: Topic 02ravindu 11111No ratings yet

- Chapter 3 - MeasurementDocument3 pagesChapter 3 - MeasurementCait PostNo ratings yet

- 1: Time Value of Money: Tuesday, 28 December 2021 10:18 PMDocument14 pages1: Time Value of Money: Tuesday, 28 December 2021 10:18 PMalexa ubaldoNo ratings yet

- Time Value of Money PDF Notes - Download HereDocument7 pagesTime Value of Money PDF Notes - Download HereUnni KuttanNo ratings yet

- FN 202 Chapter 4Document38 pagesFN 202 Chapter 4BablooNo ratings yet

- ENECON ReviewerDocument5 pagesENECON ReviewerJomeljames Campaner PanganibanNo ratings yet

- Concepts of Value and Return - Chapter 2Document26 pagesConcepts of Value and Return - Chapter 2RabinNo ratings yet

- FM 4Document3 pagesFM 4gojo satoruNo ratings yet

- FM I Note - Chapter Three (TVM)Document15 pagesFM I Note - Chapter Three (TVM)zewdieNo ratings yet

- Financial Management: by K Lubza NiharDocument21 pagesFinancial Management: by K Lubza NiharAashutosh MishraNo ratings yet

- TVM - Unit 4Document32 pagesTVM - Unit 4gajakesari738No ratings yet

- Reviewer PDFDocument4 pagesReviewer PDFMarian B TersonaNo ratings yet

- Time Value of Money: Concepts in ValuationDocument4 pagesTime Value of Money: Concepts in ValuationRia GayleNo ratings yet

- Bab 11 Manajemen Keuangan Dan Pembiayaan Usaha - ConceptDocument28 pagesBab 11 Manajemen Keuangan Dan Pembiayaan Usaha - ConceptMaria Dewinta AgustinNo ratings yet

- Resume Chapter 5 MKL - Fanny Noviana .J 201950352Document6 pagesResume Chapter 5 MKL - Fanny Noviana .J 201950352Fanny NovianaNo ratings yet

- Topic Two - A Review of Financial MathematicsDocument39 pagesTopic Two - A Review of Financial MathematicsPhương Anh ĐỗNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingNelhey DllgNo ratings yet

- Time Value of MoneyDocument23 pagesTime Value of Moneyvinodkothari100% (1)

- Bafs s4 Personal Finance CHDocument3 pagesBafs s4 Personal Finance CHapi-516803253No ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Financial Markets Chapter 1Document3 pagesFinancial Markets Chapter 1gojo satoruNo ratings yet

- Cash and ReceivablesDocument31 pagesCash and Receivablesgojo satoruNo ratings yet

- Financial Markets Chapter 1 - NotesDocument3 pagesFinancial Markets Chapter 1 - Notesgojo satoruNo ratings yet

- Financial Markets Chapter 2 - NotesDocument3 pagesFinancial Markets Chapter 2 - Notesgojo satoruNo ratings yet

- 1 NotesDocument1 page1 Notesgojo satoruNo ratings yet

- Evolution and History of VolleyballDocument5 pagesEvolution and History of Volleyballgojo satoruNo ratings yet

- Chapter 15 Transfer Pricing: True / False QuestionsDocument284 pagesChapter 15 Transfer Pricing: True / False Questionsgojo satoruNo ratings yet

- Business Combination MergerDocument108 pagesBusiness Combination Mergergojo satoruNo ratings yet

- Question 1Document5 pagesQuestion 1Yono SéNo ratings yet

- ENG - Ebook Kurangkan Hutang Kita!-1Document21 pagesENG - Ebook Kurangkan Hutang Kita!-1Mr DummyNo ratings yet

- Lalaine Espina - Business Finance-Interest RateDocument2 pagesLalaine Espina - Business Finance-Interest RateLalaine EspinaNo ratings yet

- AfarDocument53 pagesAfarrodell pabloNo ratings yet

- Notes On National Credit Act 34 of 2005Document9 pagesNotes On National Credit Act 34 of 2005Noxolo MotloungNo ratings yet

- Assignment in Lieu of 2nd Internal-FT-IV (E F G) - BFSDocument2 pagesAssignment in Lieu of 2nd Internal-FT-IV (E F G) - BFSSiddhesh ShahNo ratings yet

- Simple InterestDocument2 pagesSimple InterestNathan Dungog100% (2)

- Mock TestDocument26 pagesMock TestRadhika KushwahaNo ratings yet

- (Please Tick Whichever Is Applicable) : CSO/PNBHFL/Supplementary Agreement Format/ Version 9.0.0 Page 1 of 2Document2 pages(Please Tick Whichever Is Applicable) : CSO/PNBHFL/Supplementary Agreement Format/ Version 9.0.0 Page 1 of 2Rohan SakpalNo ratings yet

- Options Futures and Other Derivatives Global 9th Edition Hull Test BankDocument8 pagesOptions Futures and Other Derivatives Global 9th Edition Hull Test Bankconalkeishaywx100% (27)

- Interest and Annuity Tables For Discrete CompoundingDocument19 pagesInterest and Annuity Tables For Discrete CompoundingWan Muhd FaizNo ratings yet

- Memorandum of Deposit of Title Deeds Krishna RajaDocument4 pagesMemorandum of Deposit of Title Deeds Krishna Rajavairam88No ratings yet

- Loan Cheat Sheet by Jocelyn PredovichDocument1 pageLoan Cheat Sheet by Jocelyn PredovichJocelyn Javernick PredovichNo ratings yet

- Generating Immediate Cash From Accounts ReceivableDocument4 pagesGenerating Immediate Cash From Accounts ReceivableNylan AnyerNo ratings yet

- Chapter 2, 3 4 Financial Statements (Part 2)Document34 pagesChapter 2, 3 4 Financial Statements (Part 2)Aidil Osman17No ratings yet

- Written Assignment Unit4: XYZ Bank Balance SheetDocument4 pagesWritten Assignment Unit4: XYZ Bank Balance SheetMarcusNo ratings yet

- Revathy Assg Ratio CalculationDocument2 pagesRevathy Assg Ratio CalculationAishvini ShanNo ratings yet

- AOFM Portfolio Overview Jun 2010 v2Document6 pagesAOFM Portfolio Overview Jun 2010 v2trader_10No ratings yet

- Working Paper Egrement Ika SalinanDocument1 pageWorking Paper Egrement Ika Salinanfc BundaNo ratings yet

- HiwalahDocument17 pagesHiwalahMahyuddin KhalidNo ratings yet

- Argentina - Letter of Support For Joint ProposalDocument14 pagesArgentina - Letter of Support For Joint ProposalBAE NegociosNo ratings yet

- Insolvency Law Study Guide 2014 - UNISADocument219 pagesInsolvency Law Study Guide 2014 - UNISADawn McGowan100% (1)

- ch13 Testbank Intermediate AccountingDocument43 pagesch13 Testbank Intermediate Accountingalaa96% (53)

- Practice - Fabm1 q3 Mod3 Accountingequation Final 1 PDFDocument23 pagesPractice - Fabm1 q3 Mod3 Accountingequation Final 1 PDFJdkrkejNo ratings yet

- 20 Current LiabilitiesDocument15 pages20 Current Liabilitieserica lamsenNo ratings yet

- Bonds Exercises With AnswersDocument10 pagesBonds Exercises With AnswersDenise Jane RoqueNo ratings yet

- Business Math Week 9Document10 pagesBusiness Math Week 9황혜진No ratings yet

- Civil - Law - BarQA - 2009 2017 Pages 161 182,1 7usDocument29 pagesCivil - Law - BarQA - 2009 2017 Pages 161 182,1 7usKAREENA AMEENAH ACRAMAN BASMANNo ratings yet

- W3 Module 5 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 3Document6 pagesW3 Module 5 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 3leare ruazaNo ratings yet

- 21 XXX XXX TP Cibil - ReportDocument6 pages21 XXX XXX TP Cibil - ReportVishnu GaikwadNo ratings yet