Professional Documents

Culture Documents

Tutorial 5 Solutions

Uploaded by

merita homasiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 5 Solutions

Uploaded by

merita homasiCopyright:

Available Formats

Tutorial 5 (Week 6) Solutions

Ch03 – Ross et al.

Solutions

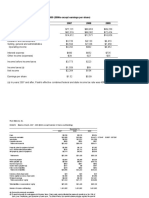

35. Here, we need to calculate several ratios given the financial statements. The ratios are:

Short-term solvency ratios:

Current ratio = Current assets / Current liabilities

Current ratio2016 = $28 666 / $6319

Current ratio2016 = 4.54 times

Current ratio2017 = $32 409 / $7427

Current ratio2017 = 4.36 times

Quick ratio = (Current assets – Inventory) / Current liabilities

Quick ratio2016 = ($28 666 – 17 357) / $6319

Quick ratio2016 = 1.79 times

Quick ratio2017 = ($32 409 – 19 350) / $7 427

Quick ratio2017 = 1.76 times

Cash ratio = Cash / Current liabilities

Cash ratio2016 = $4607 / $6319

Cash ratio2016 = 0.73 times

Cash ratio2017 = $4910 / $7427

Cash ratio2017 = 0.66 times

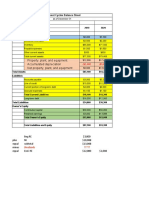

Asset utilization ratios:

Total asset turnover = Sales / Total assets

Total asset turnover = $205 227 / $109 219

Total asset turnover = 1.88 times

Inventory turnover = COGS / Inventory

Inventory turnover = $138 383 / $19 350

Inventory turnover = 7.15 times

Receivables turnover = Sales / Receivables

Receivables turnover = $205 227 / $8149

Receivables turnover = 25.18 times

Long-term solvency ratios:

Total debt ratio = (Current liabilities + Long-term debt) / Total assets

Total debt ratio2016 = ($6319 + 22 500) / $87 354

Total debt ratio2016 = 0.33 times

Total debt ratio2017 = ($7427 + 19 000) / $109 219

Total debt ratio2017 = 0.24 times

Debt–equity ratio = (Current liabilities + Long-term debt) / Total equity

Debt–equity ratio2016 = ($6319 + 22 500) / $58 535

Debt–equity ratio2016 = 0.49 times

Debt–equity ratio2017 = ($7427 + 19 000) / $82 792

Debt–equity ratio2017 = 0.32 times

Equity multiplier = 1 + D/E ratio

Equity multiplier2016 = 1 + 0.49

Equity multiplier2016 = 1.49 times

Equity multiplier2017 = 1 + 0.32

Equity multiplier2017 = 1.32 times

Times interest earned = EBIT / Interest

Times interest earned = $60 934 / $1617

Times interest earned = 37.68 times

Cash coverage ratio = (EBIT + Depreciation) / Interest

Cash coverage ratio = ($60 934 + 5910) / $1617

Cash coverage ratio = 41.34 times

Profitability ratios:

Profit margin = Net income / Sales

Profit margin = $38 557 / $205 227

Profit margin = 0.1879, or 18.79%

Return on assets = Net income / Total assets

Return on assets = $38 557 / $109 219

Return on assets = 0.3530, or 35.30%

Return on equity = Net income / Total equity

Return on equity = $38 557 / $82 792

Return on equity = 0.4657, or 46.57%

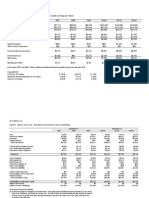

36. The Du Pont identity is:

ROE = (PM)(Total asset turnover)(Equity multiplier)

ROE = (Net income / Sales)(Sales / Total assets)(Total assets / Total equity)

ROE = ($38 557 / $205 227)($205 227 / $109 219)($109 219 / $82 792)

ROE = 0.4657, or 46.57%

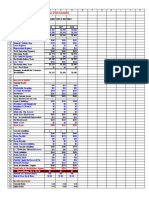

46. Return on

equity

19.31%

Return on multiplied Equity

assets By multiplier

8.47% 2.28

Profit margin multiplied by Total asset turnover

3.53% 2.40

Net income divided by Sales Sales divided by Total assets

$2146 $60 868 $60 868 $25 337

subtracted from

Total costs Sales Fixed assets plus Current assets

$58 722 $60 868 $17 676 $7661

Cash

Cost of goods sold Depreciation $1333

$41 180 $598

Accounts rec. Inventory

Other expenses Interest $584 $4872

$15 732 $282

Other

$872

Taxes

$930

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisTheicon420No ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Current Assets: Liabilities and Stockholders' EquityDocument9 pagesCurrent Assets: Liabilities and Stockholders' EquityIrakli SaliaNo ratings yet

- 11.0 Enager Industries, Inc. - DataDocument3 pages11.0 Enager Industries, Inc. - DataAliza RizviNo ratings yet

- Recipe Unlimited Corporation: Condensed Consolidated Interim Financial Statements (Unaudited)Document46 pagesRecipe Unlimited Corporation: Condensed Consolidated Interim Financial Statements (Unaudited)polodeNo ratings yet

- Home Depot OriDocument21 pagesHome Depot OriBrayan PerezNo ratings yet

- Flash Memory Case SolutionDocument10 pagesFlash Memory Case SolutionsahilkuNo ratings yet

- P&G 3 Statement ModelDocument20 pagesP&G 3 Statement ModelRabia HashimNo ratings yet

- Chapter 7 Problem 7Document3 pagesChapter 7 Problem 7Pamela PerezNo ratings yet

- Flash MemoryDocument14 pagesFlash MemoryPranav TatavarthiNo ratings yet

- 20190312220046BN001184625Document10 pages20190312220046BN001184625Roifah AmeliaNo ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- Anthem IncDocument28 pagesAnthem IncHans WeirlNo ratings yet

- Week-2-Chapter-3-Financial-Build-A-Mode LDocument7 pagesWeek-2-Chapter-3-Financial-Build-A-Mode LCrusty GirlNo ratings yet

- Eaton Corporation WaccDocument21 pagesEaton Corporation WaccDee-Annee Dottin0% (2)

- Problem Solving Chapter 7Document3 pagesProblem Solving Chapter 7Kevin TW SalesNo ratings yet

- McGraw Hill Connect Question Bank Assignment 2Document2 pagesMcGraw Hill Connect Question Bank Assignment 2Jayann Danielle MadrazoNo ratings yet

- Financial Management Assignment 1Document3 pagesFinancial Management Assignment 12K22DMBA67 kushankNo ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Ind - Ass.CF I ProblemsDocument3 pagesInd - Ass.CF I ProblemsNop SopheaNo ratings yet

- Financial Planning and ForecastingDocument20 pagesFinancial Planning and ForecastingSyedMaazNo ratings yet

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- Financial Management Week 4Document5 pagesFinancial Management Week 4giezel francoNo ratings yet

- Analysis and Interpretation of Profitability: Operating ExpensesDocument2 pagesAnalysis and Interpretation of Profitability: Operating ExpensesDavid Rolando García OpazoNo ratings yet

- This Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementDocument74 pagesThis Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementRikhabh DasNo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- 1 - Week 6 Final Case Project Workbook - Abc Company - Spring 2019Document8 pages1 - Week 6 Final Case Project Workbook - Abc Company - Spring 2019Minh Van NguyenNo ratings yet

- PG 2021 Financial StatementsDocument6 pagesPG 2021 Financial StatementsCamille E. CamtuganNo ratings yet

- Ümmüşnur Özcan - CartwrightlumberworksheetDocument7 pagesÜmmüşnur Özcan - CartwrightlumberworksheetUMMUSNUR OZCANNo ratings yet

- The Balance Sheet and Income StatementDocument3 pagesThe Balance Sheet and Income Statementdhanya1995No ratings yet

- Lecture 2 PDFDocument62 pagesLecture 2 PDFsyingNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Assignment 01 2018 Financial Analysis HotelDocument6 pagesAssignment 01 2018 Financial Analysis HotelEllie NguyenNo ratings yet

- Tugas Kelompok Ke-2 (Minggu 5/ Sesi 7) Financial Modelling LaboratoryDocument13 pagesTugas Kelompok Ke-2 (Minggu 5/ Sesi 7) Financial Modelling LaboratoryRexy HannerNo ratings yet

- Chap 2 Market Value RatiosDocument22 pagesChap 2 Market Value Ratiosyemsrachhailu8No ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- BD21060 Aman Assignment5Document6 pagesBD21060 Aman Assignment5Aman KundraBD21060No ratings yet

- Carley NDocument11 pagesCarley NaliNo ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- HW 2 - Ch03 P15 Build A Model - HrncarDocument2 pagesHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaNo ratings yet

- Experiential Exercise 4A: Performing A Financial Ratio Analysis For Walt Disney CompanyDocument9 pagesExperiential Exercise 4A: Performing A Financial Ratio Analysis For Walt Disney CompanyPang Pang CarolNo ratings yet

- Flash Memory ExcelDocument4 pagesFlash Memory ExcelHarshita SethiyaNo ratings yet

- Amazon Financial Statements 2005-2019 - AMZNDocument2 pagesAmazon Financial Statements 2005-2019 - AMZNVinita AgrawalNo ratings yet

- 1993 at The End of The Year 1994Document10 pages1993 at The End of The Year 1994Joan MaduNo ratings yet

- Textbook Materials - ch3Document40 pagesTextbook Materials - ch3OZZYMANNo ratings yet

- Your Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / KyanDocument6 pagesYour Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / Kyanmohitgaba19No ratings yet

- Dupont Analysis: P. V. Viswanath (With Permission)Document22 pagesDupont Analysis: P. V. Viswanath (With Permission)Ashish SharmaNo ratings yet

- 2.5. Case 5Document26 pages2.5. Case 5HetviNo ratings yet

- Colgate 2020 AR Excel Financials For AR Web Site HSDocument6 pagesColgate 2020 AR Excel Financials For AR Web Site HSMohammad ameen Ur rahmanNo ratings yet

- ACF5950-Assignment-2801656-kaidi ZhangDocument13 pagesACF5950-Assignment-2801656-kaidi ZhangkietNo ratings yet

- Income Statement: Dec-16 Dec-17Document14 pagesIncome Statement: Dec-16 Dec-17HetviNo ratings yet

- Financial Analysis Model: Income StatementDocument3 pagesFinancial Analysis Model: Income StatementAdrian PetcuNo ratings yet

- Financial Briefing: Turning Gears, Inc. Consolidated Statement of OperationsDocument2 pagesFinancial Briefing: Turning Gears, Inc. Consolidated Statement of OperationsishuNo ratings yet

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Consolidated Statements of IncomeDocument52 pagesConsolidated Statements of IncomeTinatini BakashviliNo ratings yet

- FE Format GuideDocument1 pageFE Format Guidemerita homasiNo ratings yet

- Tutorial 4 SolutionsDocument3 pagesTutorial 4 Solutionsmerita homasiNo ratings yet

- Tutorial 7 SolutionsDocument2 pagesTutorial 7 Solutionsmerita homasiNo ratings yet

- Tutorial 6 SolutionsDocument4 pagesTutorial 6 Solutionsmerita homasiNo ratings yet

- Tutorial 2 SolutionsDocument5 pagesTutorial 2 Solutionsmerita homasiNo ratings yet

- Introduction To SCILABDocument14 pagesIntroduction To SCILABMertwysef DevrajNo ratings yet

- MBridgeDocument50 pagesMBridgeTsila SimpleNo ratings yet

- Scope: Manufacture of High Precision and CloseDocument1 pageScope: Manufacture of High Precision and CloseAnuranjanNo ratings yet

- Appointments & Other Personnel Actions Submission, Approval/Disapproval of AppointmentDocument7 pagesAppointments & Other Personnel Actions Submission, Approval/Disapproval of AppointmentZiiee BudionganNo ratings yet

- ACLU Letter of ConcernDocument5 pagesACLU Letter of ConcernRyan FinnertyNo ratings yet

- Hr-Analytics (Case Study)Document3 pagesHr-Analytics (Case Study)Jeeshan IdrisiNo ratings yet

- Boat, Time Speed and DistanceDocument5 pagesBoat, Time Speed and DistanceAnmol AswalNo ratings yet

- Secondary Laboratory Proposal OnlyDocument5 pagesSecondary Laboratory Proposal Onlylaboratory.databaseNo ratings yet

- MyLabX8 160000166 V02 LowRes PDFDocument8 pagesMyLabX8 160000166 V02 LowRes PDFhery_targerNo ratings yet

- Communication To Offer-ContractsDocument20 pagesCommunication To Offer-ContractsAarif Mohammad BilgramiNo ratings yet

- Ex Covid Shift ADocument1 pageEx Covid Shift ADetri Yoga AdhiNo ratings yet

- Journal of Air Transport Management: Tim HazledineDocument3 pagesJournal of Air Transport Management: Tim HazledineRumaisa HamidNo ratings yet

- Evaporative Cooling Design Spreadsheet 2014 - MetricDocument1 pageEvaporative Cooling Design Spreadsheet 2014 - MetricCristian MoratayaNo ratings yet

- 21S18052 - Joshua Partogi Hutauruk - Review BUSNOV - Umbrella - WarsDocument5 pages21S18052 - Joshua Partogi Hutauruk - Review BUSNOV - Umbrella - WarsJoshua HutaurukNo ratings yet

- NDT Technician TrainingDocument6 pagesNDT Technician TraininglarsonndeservicesNo ratings yet

- Literature Review On Climate Change in NigeriaDocument9 pagesLiterature Review On Climate Change in Nigeriac5rn3sbr100% (1)

- Internet Phone Services Simplified (VoIP)Document176 pagesInternet Phone Services Simplified (VoIP)sumanth83137No ratings yet

- Allison at 500, at 1500 Series Parts Catalog: 2 1 See Section 10Document7 pagesAllison at 500, at 1500 Series Parts Catalog: 2 1 See Section 10amin chaabenNo ratings yet

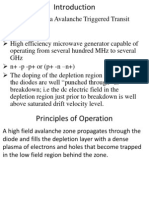

- Trapatt ModeDocument30 pagesTrapatt Modebchaitanya_555100% (1)

- Kumara SwamiyamDocument21 pagesKumara SwamiyamVijey KumarNo ratings yet

- 14.quality of Life in Patients With Recurrent AphthousDocument7 pages14.quality of Life in Patients With Recurrent AphthousCoste Iulia RoxanaNo ratings yet

- Indiabulls PILDocument64 pagesIndiabulls PILPGurus100% (1)

- Warman Slurry Correction Factors HR and ER Pump Power: MPC H S S L Q PDocument2 pagesWarman Slurry Correction Factors HR and ER Pump Power: MPC H S S L Q Pyoel cueva arquinigoNo ratings yet

- LivePerson Chat ReportsDocument23 pagesLivePerson Chat ReportsEdenEtfNo ratings yet

- Type DG Mod 320 Part No. 952 013: Figure Without ObligationDocument1 pageType DG Mod 320 Part No. 952 013: Figure Without Obligationsherub wangdiNo ratings yet

- 17 Farley Fulache Vs ABS-CBN G.R. No. 183810Document7 pages17 Farley Fulache Vs ABS-CBN G.R. No. 183810SDN HelplineNo ratings yet

- C&DS Lab Manual UpdatedDocument182 pagesC&DS Lab Manual UpdatedJesmin MostafaNo ratings yet

- Ashik KP - Windows Engineer - 6 00 - Yrs - Bangalore LocationDocument4 pagesAshik KP - Windows Engineer - 6 00 - Yrs - Bangalore LocationmanitejaNo ratings yet

- Hullabaloo (TV Series)Document3 pagesHullabaloo (TV Series)ozNo ratings yet

- Civil Procedure Flash CardsDocument48 pagesCivil Procedure Flash CardsNick Ashjian100% (1)